Running a business without proper financial reporting is like navigating without a map, and you might move forward, but you won’t know if you’re heading in the right direction. Financial reporting provides businesses with a clear picture of their financial health, ensuring informed decision-making and regulatory compliance.

In Singapore, the Accounting and Corporate Regulatory Authority (ACRA) enforces strict financial reporting standards through its Financial Reporting Surveillance Program, ensuring companies maintain transparency and accountability.

Understanding the role and significance of financial reporting is important for companies seeking to comply with regulations, attract investors, and drive long-term growth.

In a competitive business environment, maintaining accurate and timely financial reports allows companies to make better strategic decisions, optimize resources, and strengthen stakeholder trust.

- Financial reporting is essentially how a company shares its performance and health story. By using clear statements, like the balance sheet and cash flow.

- Key components of financial reporting include balance sheets, income statements, cash flow statements, equity changes, explanatory notes, MD&A, and SEC filings.

- Common mistakes in financial reporting include errors in data entry, inconsistent practices, delays in reporting, and failure to meet compliance standards, impacting accuracy and trust.

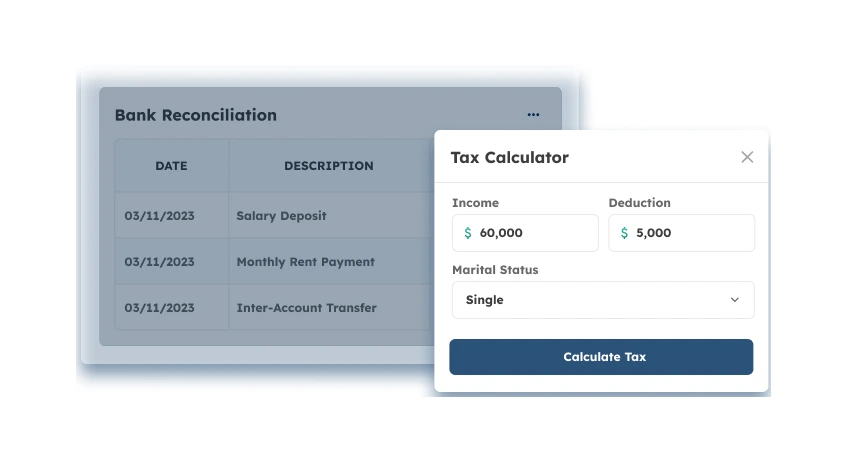

- ScaleOcean accounting software helps businesses to optimize financial management by automating data collection, providing customizable reporting, and offering scalable solutions.

What is Financial Reporting?

Financial reporting is essentially how a company shares its performance and health story. By using clear statements like the balance sheet and cash flow, it keeps everyone, from teams to investors, truly informed about revenue and assets.

By following standards like GAAP or IFRS, this process ensures total transparency. It helps stakeholders make smart moves, using cash flow tracking and projections to check a company’s actual performance and overall health.

These reports are vital for seeing how a company grows over time. They offer a clear look at financial health, helping everyone evaluate profitability and liquidity while guiding big strategic decisions and future planning.

Why Financial Reporting Matters?

Financial reporting is vital for showing a clear picture of a company’s health. It drives better decisions and transparency, ensuring businesses meet stakeholder expectations. Let’s dive into why it truly matters:

1. Securing Capital

Financial reports are vital for any company seeking funding. Investors and lenders rely on accurate statements to judge risks and returns. This level of transparency builds the trust needed to attract serious capital providers.

Good reporting highlights a business’s stability and growth potential. By showing sound financial management and steady profits over time, well-documented data helps you secure loans and keep investors confident in your future.

2. Adhering to Legal Standards

Financial reporting keeps things legal by following standards like GAAP and IFRS. These rules ensure that reporting stays fair and consistent across different industries, helping businesses avoid unnecessary legal risks. Also, using the best tax software further ensures compliance with these standards.

Staying compliant through accurate reporting helps you avoid penalties or disputes. It keeps companies accountable and builds real trust with regulators and investors, which is key for long-term, sustainable growth.

3. Analyzing Financial Performance

Financial reporting lets businesses dive deep into their performance. It helps everyone evaluate profitability and efficiency, which are absolutely vital when making big strategic moves and checking financial health.

These reports also highlight exactly where a business can improve. By spotting trends, companies can optimize how they work, move resources where they’re needed most, and refine their strategy to keep growing steadily.

4. Building Confidence

Accurate financial reporting gives investors real peace of mind by proving a company’s health. It shows the business is well-managed, which builds strong confidence in both its current and long-term strategic plans.

These statements reassure stakeholders that the company stays ethical and compliant. This transparency is key to keeping investor trust, ensuring they stay supportive of the company’s ongoing growth and stability.

5. Informed Decision Making

Financial reporting is key for guiding stakeholder decisions. It helps investors decide on shares, lets lenders assess loan risks, and gives managers the solid data they need for effective, long-term business planning.

By offering a clear financial snapshot, these reports help everyone make smart choices. Without accurate data, decision-makers would just be guessing, which leads to much higher risks and missed opportunities for growth.

Key Components of Financial Reporting

Financial reporting is made up of several key components that provide a clear picture of a company’s financial health. These reports assist stakeholders in assessing performance, tracking financial position, and ensuring compliance with accounting standards.

1. Balance Sheet Overview

Think of a balance sheet as a financial snapshot, showing exactly what a company owns and owes at any given time. It lists assets, liabilities, and equity to give a clear picture of its current standing.

It helps everyone check for stability and liquidity by weighing assets against debts. It’s also great for spotting a financial leverage example, giving deeper insights into how well a company can meet its obligations.

2. Income Statement Analysis

The income statement outlines a company’s revenues, expenses, and net profit over a financial period. It provides insights into profitability, operational efficiency, and financial performance, helping stakeholders analyze income sources, cost structures, and overall business success.

The operating profit margin is a key metric derived from the income statement, indicating how efficiently a company is managing its core operations and generating profits from sales.

3. Cash Flow Statement Insights

A cash flow statement tracks exactly how money moves in and out, giving you a clear, detailed look at your company’s liquidity. It’s essential to know your actual spending power.

It shows how cash comes from operations, investments, and financing. This helps businesses ensure they always have enough on hand to meet both short-term bills and long-term financial commitments without any stress.

4. Equity Changes Report

The statement of changes in equity highlights how a company’s ownership structure shifts over time. It provides a clear look at the movement within equity accounts during a specific period.

It breaks down retained earnings, shares, and dividends. This helps investors see how financial decisions affect ownership value, making it easier to understand the real impact on shareholder equity.

5. Explanatory Notes to Financial Statements

Notes to financial statements are key to giving a deeper context to your main reports. They detail accounting policies and major events, helping stakeholders get a much clearer and more complete picture of a company’s position.

These notes ensure transparency so everyone understands how the data is derived. Without them, it’s easy to misread results. They play a vital role in explaining complex data and offering truly valuable extra insights.

6. Management Discussion and Analysis

The MD&A section is a vital part of financial reporting, giving us management’s take on the company’s results. It adds necessary context to the raw numbers and highlights the key factors that actually drive performance.

This section helps investors and analysts look ahead at risks and prospects. By understanding management’s view on trends and strategies, stakeholders can make smarter calls about a company’s long-term growth and viability.

7. SEC Filings

SEC filings are reports sent to regulators like the U.S. Securities and Exchange Commission. They offer deep dives into a firm’s finances, including public documents like the 10-K annual report and the 10-Q quarterly update.

These filings are key for transparency, giving investors and analysts the data they need to stay informed. They act as a trusted resource for smart decision-making, ensuring companies remain fully compliant and open.

Key Advantages of Financial Reporting

Financial reporting gives businesses real insights into their health, helping with smart decisions and building trust. It lets stakeholders check performance and find ways to grow. Here are the main benefits:

1. Spotting Trends

Financial reporting lets businesses track performance over time, spotting trends in revenue and costs. These insights help teams pivot strategies and stay ahead of market shifts, ensuring long-term success and stability.

By analyzing financial patterns, companies can make proactive moves and find growth opportunities. This forward-thinking approach ensures businesses are much better prepared for any market changes or economic shifts ahead.

2. Initiating Budget Plans and Forecasts

Accurate financial reporting is key to building realistic budgets and forecasts. By looking at past and current data, companies can set reachable targets and allocate resources effectively to hit their future goals.

Financial reports also help compare your expected results with what actually happened. This makes it easy to spot where to adjust, ensuring your budget stays aligned with real-time financial needs and priorities.

3. Strengthening Business Partnerships

Being open with financial reports really builds trust with partners, investors, and customers. By showing your stability and efficiency, you’re giving them the confidence they need for a solid, long-term collaboration.

Accurate reporting also helps you negotiate better terms and strengthen key relationships. When your data is clear, partners feel much more secure, leading to better deals and alliances that benefit everyone involved.

4. Optimizing Working Capital Management

Financial reports give a clear look at working capital, which is vital for daily operations. By checking cash flow and inventory, businesses can stay liquid enough to easily handle their short-term bills and obligations.

Tracking working capital trends helps companies run much more efficiently. By improving collections and managing payables, teams can cut costs and make the most of their resources, boosting their overall financial health.

Requirement of Financial Reporting

Financial reporting must meet specific requirements to ensure accuracy, consistency, and compliance with accounting standards. These requirements help businesses maintain financial transparency, facilitate decision-making, and build trust with stakeholders.

1. Organized Chart of Accounts

A chart of accounts is a list of all the financial accounts in a company’s general ledger that is organized methodically. It classifies assets, liabilities, equity, income, and expenses, guaranteeing proper classification and accurate financial reporting for analytical and compliance purposes.

2. Defined Accounting Policies

Accounting policies define how companies record financial transactions, ensuring consistency, comparability, and regulatory compliance. Accrual accounting, a common approach, records revenues and expenses when incurred, offering a more accurate financial picture.

3. Effective Internal Controls

Internal controls are mechanisms designed to safeguard financial data, prevent fraud, and ensure reporting accuracy. These controls include authorization procedures, reconciliations, and audits, helping businesses detect errors, mitigate risks, and maintain compliance with financial regulations.

To enhance these controls, businesses can implement accounts payable software that automates invoice processing and ensures all financial transactions are accurate and compliant.

4. Adherence to Reporting Standards

Compliance with financial accounting standards in Singapore for reporting ensures that financial statements are prepared in line with national and international regulations. Meeting these requirements enhances credibility, facilitates cross-border financial analysis, and ensures uniformity in reporting practices.

Common Mistakes in Financial Reporting

Financial reporting errors can impact a company’s credibility, decision-making, and regulatory compliance. Avoiding common mistakes is important to ensure accurate financial statements, maintain transparency, and prevent financial or legal consequences.

1. Errors in Data Entry

Mistakes in manual data entry can lead to miscalculations, inaccurate financial statements, and compliance issues. Small errors, such as incorrect figures or misplaced decimal points, can distort financial reports, affecting business decisions and stakeholder trust. Implementing automation and regular audits helps minimize these risks.

2. Inconsistent Reporting Practices

A lack of standardization in financial reporting leads to discrepancies and confusion. Using inconsistent formats, terminology, or classification methods makes it difficult to compare financial data over time.

To ensure consistency and clarity, businesses can use the invoicing system to standardize invoicing formats, making financial reporting more accurate and easier to manage. Establishing uniform reporting procedures ensures clarity, accuracy, and compliance with regulatory expectations.

3. Delays in Financial Reports

Late financial reporting may hinder decision-making and put companies at risk of failing to meet regulatory deadlines. Businesses rely on accurate financial data to monitor performance, recognize trends, and make strategic decisions.

Implementing efficient reporting methods, such as double-entry accounting methods, and establishing clear deadlines contribute to timely and accurate financial accounts.

4. Failure to Meet Compliance Standards

Non-compliance with financial reporting standards can result in penalties, reputational damage, and legal issues. Adhering to established accounting principles ensures transparency, enhances credibility, and facilitates easier financial analysis for investors, auditors, and regulatory authorities.

Internal Reporting vs. External Reporting

Internal reporting is all about giving your team the data they need to thrive. It helps managers and executives make smart daily choices, track performance, and keep everyone aligned with the company’s goals for better efficiency.

External reporting is tailored for those outside the company, like investors and regulators. Reports like balance sheets offer a clear, honest look at financial health to help with big decisions and meet official requirements.

Also, here are the tables for differences in various aspects:

| Aspect | Internal Reporting | External Reporting |

|---|---|---|

| Audience | Internal stakeholders (managers, department heads, executives) | External stakeholders (investors, regulators, creditors) |

| Purpose | Helps with day-to-day decision-making and performance monitoring | Provides transparency and supports external decision-making |

| Scope | Focuses on internal operations and performance | Focuses on the company’s financial health and compliance |

| Frequency | Often frequent (weekly, monthly, or ad-hoc) | Typically, quarterly or annually |

| Content | Detailed operational and financial data | Standardized financial statements (e.g., Balance Sheet, Income Statement) |

Enhancing Efficiency with Accounting Software

Accounting software in Singapore enhances efficiency by automating tasks, providing real-time insights, and ensuring compliance. It minimizes errors, streamlines reporting, and reduces costs, allowing finance teams to focus on strategic growth instead of manual bookkeeping.

1. Automating Accounting Tasks

Accounting software eliminates manual data entry and automates financial metrics, report generation, minimizes errors, and saves valuable time.

By integrating automated calculations, transaction tracking, and reconciliation processes, businesses can enhance accuracy, reduce administrative workload, and improve financial efficiency.

2. Accessing Real-Time Financial Data

Real-time data access enables companies to instantly evaluate their financial health, allowing for faster and more informed decision-making. With up-to-date information on profit and loss statements, cash flow, revenue, and expenses, management can respond quickly to financial changes and enhance overall business strategy.

3. Enhancing Accuracy and Regulatory Compliance

Advanced accounting software ensures financial reports adhere to industry standards and regulatory requirements. By reducing human errors, applying consistent accounting policies, and integrating compliance checks, businesses can produce reliable financial statements and avoid legal or financial penalties.

4. Optimizing Costs and Time Efficiency

By streamlining financial processes, financial and accounting ERP software reduces operational costs and frees up valuable time. Automating repetitive tasks enables businesses to allocate resources effectively, allowing finance teams to focus on strategic planning and business growth instead of manual bookkeeping.

Effective expense management in business becomes much easier with the integration of automated accounting solutions, leading to improved efficiency and cost-saving opportunities.

Examples of Financial Reporting Applications in Various Industries

Financial reporting applications are essential across industries, helping businesses track performance, ensure compliance, and optimize financial management. Different sectors leverage these tools to meet specific needs, from monitoring sales and expenses to managing revenue cycles and regulatory reporting, as uncovered below.

1. Financial Reporting in Retail

Retail businesses use financial reporting software to track sales, inventory levels, cash flows, and business expenses, ensuring profitability. By analyzing revenue trends, managing stock efficiently, and optimizing pricing strategies, retailers can improve operational efficiency, minimize losses, and enhance financial decision-making for sustainable growth.

2. Accounting Solutions for Service Providers

Service-based businesses rely on financial reporting to manage billing cycles, revenue recognition, and client payments. Automated invoicing, expense tracking, and profitability analysis help service providers streamline cash flow management, ensure accurate financial statements, and maintain transparency with clients and stakeholders.

3. Non-Profit Financial Management

Nonprofit organizations use financial reporting to keep track of donations, grants, and program expenses. Good practices in bookkeeping and accounting support accurate tracking of these funds.

Transparent reporting encourages accountability, helps in regulatory compliance, and provides stakeholders with clear information about resource distribution, financial sustainability, and the impact of philanthropic activities.

Optimizing Financial Reporting with ScaleOcean Accounting Software

Businesses can use the right accounting software to streamline financial management and gain a better understanding of their financial health. ScaleOcean Accounting Software provides advanced features that go beyond basic bookkeeping to ensure accuracy, efficiency, and adaptability.

This solution, which includes automated financial data collection, customizable reporting, and advanced financial analysis, is built to scale with your business. Moreover, you can experience it firsthand with a free demo and see how it simplifies your accounting operations.

Here are the key features for ScaleOcean software:

- Automated Financial Data Collection: ScaleOcean automates financial data collection from various departments, ensuring accuracy and consistency in financial reports.

- Customizable Financial Reporting: ScaleOcean enables businesses to tailor financial reports to their specific needs.

- Enhanced Financial Analysis: This software is equipped with advanced financial analysis tools that help businesses identify trends, measure performance, and develop better financial strategies.

- Scalability and Flexibility: Designed to grow with businesses, ScaleOcean offers flexibility through modular customization and cross-department integration.

Conclusion

Financial reporting is important for transparency, compliance, and strategic decision-making. Accurate reports help businesses track performance, manage risks, and maintain investor trust.

However, common mistakes like data errors, inconsistent reporting, and non-compliance can lead to financial mismanagement. Using the right accounting software streamlines processes, enhances accuracy, and provides real-time insights for better financial control.

ScaleOcean Accounting Software simplifies financial reporting with automation, customizable reports, and advanced analytics. Its scalability ensures efficiency for businesses of all sizes, optimizing compliance and decision-making. Ready to enhance your financial management? Try a free demo of ScaleOcean today and experience seamless, automated reporting.

FAQ:

1. What are the 5 steps of financial reporting?

1. Gather and record financial data

2. Document financial transactions

3. Transfer to ledger and check balances

4. Create financial statements

5. Conduct audits or reviews, and share with stakeholders

2. What is 5 4 4 financial reporting?

The 5-4-4 financial reporting model divides a year into four-week periods for most months, with one month having five weeks. This system is commonly used in retail to compare seasonal financial data across standardized reporting periods.

3. What is GAAP and IFRS?

GAAP (Generally Accepted Accounting Principles) and IFRS (International Financial Reporting Standards) are guidelines for companies to follow when recording and reporting their financial information. These standards ensure consistency, transparency, and ease of comparison in financial statements.

4. What are the five elements of financial reporting?

The five key components of financial reporting are assets, liabilities, equity, income, and expenses. These elements are critical for understanding a company’s financial situation, performance, and its potential for future cash generation.

PTE LTD..png)

.png)

.png)

.png)

.png)