Opportunity cost is a key concept in economics and business decision-making, representing the value of the next best alternative forgone. In Singapore’s competitive market, understanding trade-offs is essential for resource optimization and growth. According to MTI Singapore, the US and China are major trading partners, with some local businesses in Singapore impacted by shifting trade dynamics. As businesses adapt, recognizing opportunity costs becomes crucial for making informed decisions and boosting profitability.

This article investigates how opportunity costs influence business decisions in a variety of industries, offering practical insights on how businesses might improve resource allocation choices. We’ll go over the significance of assessing opportunity cost, the tools available for assessment, and real-world instances of how it affects strategic decisions.

- Opportunity cost refers to the value of the next best alternative that is sacrificed when making a decision.

- Opportunity costs calculated by formula: Opportunity Cost = RMPIC − RICP

- The importance of opportunity cost is: it helps optimize resource allocation, aids in evaluating risks and rewards, improves long-term strategic planning, and enhances financial decision-making

- Opportunities cost tells businesses about the weighting of opportunity costs, explicit costs, and implicit costs

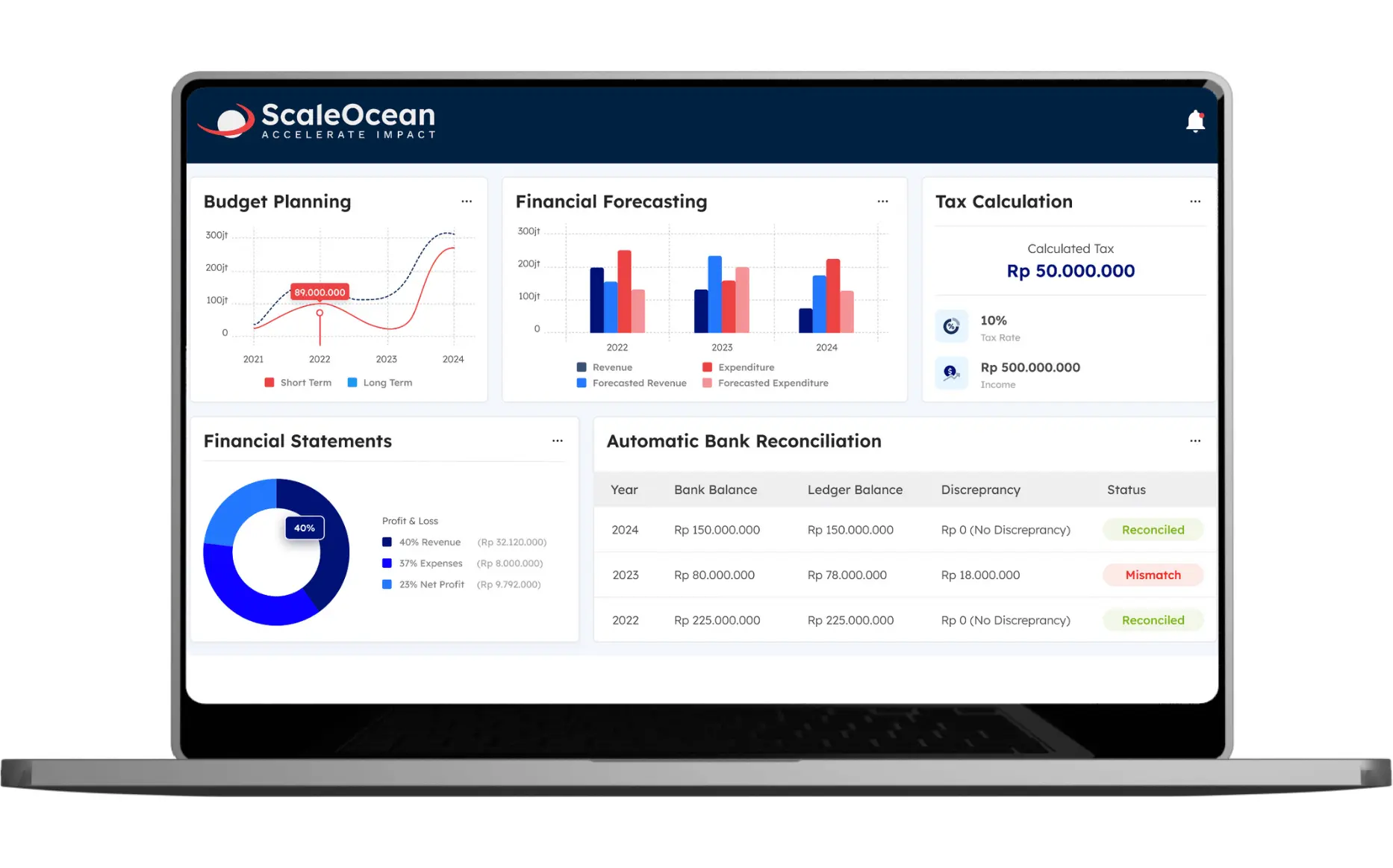

- ScaleOcean’s Expense Software automates opportunity cost calculations, providing insights into trade-offs and financial data to support strategic decision-making and growth.

What is Opportunity Cost?

Opportunity cost refers to the value of the next best alternative that is sacrificed when making a decision. It reflects what is given up to choose another option and is a key concept in decision-making, as limited resources often require trade-offs.

For instance, if a company invests in Product A, the opportunity cost is the potential profit it could have earned from Product B, assuming Product B was the next best choice. It shows the worth of the option you did not select, indicating the trade-offs associated with each selection. Simply put, it’s what you give up to choose one option over another.

For example, if you choose to spend your weekend working on a side project rather than taking a vacation, the opportunity cost could be the relaxation and satisfaction you would have had while traveling.

Similarly, in business, if a corporation decides to develop a new product, the cost may be the revenue lost by not improving its present items.

Why is Opportunity Cost Important?

Understanding opportunity cost is essential in decision-making as it helps individuals and businesses evaluate the trade-offs involved in their choices. Recognizing what is sacrificed when selecting one option over another enables more informed, efficient decisions. Below are some key reasons why opportunity cost is important:

1. Helps Optimize Resource Allocation

Opportunity cost is crucial for maximizing the use of limited resources. By understanding the potential gains from alternative options, individuals and businesses can make better choices about where to allocate their time, money, and effort.

This ensures that resources are directed toward the highest-value opportunities, leading to more effective decision-making.

2. Aids in Evaluating Risks and Rewards

By considering opportunity costs, decision-makers can better assess the potential risks and rewards of each option. It allows them to weigh the benefits of the chosen option against what is given up, providing a clearer picture of the trade-offs. This helps businesses make more strategic decisions by understanding the full scope of potential outcomes.

3. Improves Long-Term Strategic Planning

Incorporating opportunity cost into long-term planning helps businesses and individuals align their choices with their goals. Understanding the value of alternatives fosters more strategic thinking and long-term sustainability. By consistently evaluating opportunity costs, companies can make decisions that contribute to their future growth and success.

For example, managing financial items like prepaid expenses method can free up resources, allowing businesses to better allocate funds toward more profitable opportunities, further supporting their growth strategy.

4. Enhances Financial Decision-Making

Opportunity cost plays a critical role in financial decision-making. Whether it’s investing in a project or choosing between different financial opportunities, understanding what is being sacrificed helps determine which option will offer the best financial return. This leads to better budgeting and investment choices, supporting financial health in the long run.

A useful approach to managing these decisions is reviewing an expense management example, which helps businesses track and optimize their expenditures to ensure that resources are allocated effectively and that potential opportunity costs are minimized.

How to Calculate Opportunity Cost

Understanding the formula for opportunity cost is critical for making informed business decisions. Companies can assess the potential trade-offs between various options by estimating them. The formula for determining opportunity cost is simple but effective:

Opportunity Cost = RMPIC − RICP

- RMPIC=Return on the most profitable investment choice

- RICP=Return on investment chosen to pursue

Put simply, it compares the projected return from the next best option against the return from the option selected. This enables firms to decide whether they are making the best decision.

For example, if a company decides to invest in a new product line with the expectation of a $100,000 return, but the best alternative (enhancing an existing product) could have yielded $150,000, the opportunity cost is $50,000—the potential gain from not selecting the better option.

Opportunity Cost Structure

Opportunity cost has an impact on many aspects of a company, including resource allocation and long-term strategy. Understanding how it affects various elements of operations allows organizations to make more educated decisions. Opportunity cost is important in many areas, including cash, time, and personnel. Here’s a more detailed look at its structure across various areas:

1. Components

Opportunity cost includes a variety of factors like time, capital, and personnel, all of which influence decision-making. Time spent on one endeavor reduces the potential to pursue others. Capital allocated to one program may have been used elsewhere. Manpower allocation is also a factor in obtaining peak efficiency.

2. Types of Decisions

Opportunity cost influences various business decisions, such as investment and staffing. When evaluating investments, the potential returns must be considered, and a profit and loss statement helps assess the financial impact.

Staffing decisions often involve choosing between hiring more people and automating. In production, it affects whether to develop new products or enhance existing ones.

3. Multi-Dimensional

It is more than just money; it includes non-monetary variables like time and reputation. Time spent on one endeavor may result in missed opportunities for networking or forming collaborations.

Focusing on short-term profitability can have an impact on the company’s reputation. These non-financial business expenses are critical for making strategic company decisions.

What Opportunity Cost Tells Businesses

Opportunity cost provides valuable insights for businesses by helping them understand the trade-offs involved in decision-making. It highlights the potential benefits a company sacrifices when choosing one option over another.

By evaluating both explicit and implicit costs, businesses can make more informed and strategic choices that drive long-term success.

1. Weighing Opportunity Cost

Weighing opportunity cost helps businesses evaluate the value of different options by considering both the benefits and the sacrifices involved.

When making decisions, businesses should assess the potential returns from all alternatives to ensure resources are allocated to the most profitable course of action. This analysis leads to more efficient resource use.

Similarly, implementing the standard costing technique can provide a clear framework for evaluating costs and performance, enabling businesses to identify areas where resources can be optimized for maximum profitability.

2. Explicit Costs

Explicit costs refer to the direct, out-of-pocket expenses a business incurs when choosing a particular option. These costs are easy to measure, such as payments for raw materials, salaries, or rent.

By understanding explicit costs, businesses can accurately assess the financial impact of decisions and compare them to the expected returns.

3. Implicit Costs

Implicit costs, on the other hand, represent the value of opportunities foregone that do not involve direct financial payments. These can include the loss of potential income or personal time when choosing one investment over another. Recognizing implicit costs ensures businesses consider all factors, not just the tangible ones, when making decisions.

4. Explicit vs. Implicit Costs

While explicit costs are tangible and easy to quantify, implicit costs are intangible and harder to measure. Both types of cost control processes contribute to the total opportunity cost, influencing business decisions.

By comparing explicit and implicit costs, businesses can get a full picture of what they gain and lose with each choice, leading to more balanced and effective strategies.

How Do You Predict Opportunity Cost?

Predicting opportunity cost involves evaluating the potential benefits and risks of each alternative before making a decision. Businesses can use data analysis, market research, and historical performance metrics to forecast outcomes.

By considering both tangible and intangible factors, such as future revenue, market trends, and resource allocation, companies can make informed predictions about what they might lose by choosing one option over another.

To further enhance this decision-making process, businesses can implement capital budgeting strategies, which help in evaluating and prioritizing investments based on their potential return, ensuring that resources are allocated effectively for maximum profitability. This approach helps minimize risks and maximize returns in decision-making.

How to Measure Opportunity Cost with Tools and Techniques

Businesses use financial models and decision-making frameworks to determine opportunity costs. Companies can use tools like Net Present Value (NPV) and Cost-Benefit Analysis (CBA) to assess the prospective returns on their investments.

These models are critical for evaluating alternatives and making strategic decisions. By taking into account cost-benefit analysis, businesses can prevent inefficient allocations. NPV, for example, computes the present value of future cash flows while accounting for costs.

Many businesses use cloud accounting software to track these financial metrics in real time, ensuring seamless access to critical data from anywhere. It enables organizations to estimate the profitability of various investments.

In contrast, cost-benefit analysis examines the costs and benefits of alternative decisions. This strategy takes into account what may be lost by selecting one choice over another.

Example of Opportunity Cost in Business

Opportunity cost plays a key role in business decisions, affecting profitability and growth. Economic shifts, like changes in the Consumer Price Index (CPI), can influence cost structures and strategic choices.

According to DOS Singapore, the base period for CPI is 2024, requiring businesses to consider inflation’s impact on purchasing power. Understanding these trade-offs is essential for informed decision-making. Here are two examples of opportunity costs for a business and an individual:

For a Business

For a business, opportunity cost occurs when a company chooses one project or investment over another, potentially more profitable option. For instance, a business might allocate its budget to marketing campaigns rather than investing in new product development.

The opportunity cost here is the potential revenue or market share the company could have gained from the new product, which may not be realized if marketing efforts do not yield the expected results.

In making such decisions, companies need to consider their capital expenditure technique options, as investing in long-term assets like new products can provide greater returns over time compared to short-term initiatives.

For an Individual

For an individual, opportunity cost can arise in various personal decisions. For example, choosing to spend money on a vacation instead of investing in a retirement fund means the opportunity cost is the potential growth of wealth over time.

Similarly, spending time on a hobby instead of pursuing further education may result in missed opportunities for career advancement or higher income in the future.

Opportunity Cost vs. Sunk Cost

Opportunity cost and sunk cost are two distinct concepts in decision-making. Opportunity cost refers to the potential benefits lost when choosing one option over another, while sunk cost refers to money or resources already spent that cannot be recovered.

The key difference is that opportunity cost is forward-looking, focusing on future gains, while sunk cost is backward-looking and should not influence future decisions. Rational decision-making requires businesses to ignore sunk costs and focus on opportunity costs to avoid inefficient choices.

Opportunity Cost vs. Risk

Opportunity cost and risk are both critical considerations in business decisions, but differ in their nature. Opportunity cost is the potential value lost from forgoing one option, while risk refers to the uncertainty or potential for loss associated with a decision.

While opportunity cost evaluates missed opportunities, risk assesses the likelihood and magnitude of undesirable outcomes. Understanding both allows businesses to balance the pursuit of new opportunities with the need to manage uncertainty and potential losses.

Opportunity Cost vs. Opportunity Benefit

Opportunity cost and opportunity benefit are two sides of the same decision-making coin. Opportunity cost is the value of what is sacrificed when choosing one option over another, while opportunity benefit is the value gained from selecting a particular course of action.

A business must weigh both aspects to determine whether the benefits of a choice outweigh the costs. By comparing opportunity costs with opportunity benefits, companies can ensure that their decisions contribute to overall success and long-term growth.

The Risks of Ignoring Opportunity Cost

Failure to evaluate the opportunity cost can result in poor business decisions and missed opportunities. For example, a firm may invest in a profitable project when resources could have been better spent on a more rewarding opportunity.

When firms neglect the relevance of this concept, they risk overcommitting resources or losing out on possible rewards from alternative channels. For example, choosing a less profitable project may impede expansion, whereas ignoring automation may result in greater long-term operational costs.

Leverage Opportunity Cost in Your Strategy with ScaleOcean Expense Software

ScaleOcean’s Expense software, with an ERP-based can help businesses calculate opportunity costs by integrating financial data and comparing alternative investments or strategies. This automation provides valuable insights into trade-offs, cash flow, and resource allocation.

With ScaleOcean, businesses can make more informed decisions, optimizing their profitability. It ensures a strategic approach to financial planning and growth. Use our free demo to learn more about how ScaleOcean may help you optimize your company strategy.

The CTC grant makes ScaleOcean more accessible to firms seeking to improve their financial management systems. Learn firsthand how it may simplify operations and improve decision-making. Here are the main characteristics of ScaleOcean software:

- Expense Tracking: Enables automatic, real-time expense tracking.

- Automated Reimbursement: Speeds up the employee reimbursement process with automation.

- Approval Management: An automated and transparent approval system speeds up expense decisions.

- Real-Time Reporting: With comprehensive, real-time, accessible expense reports, management can immediately see whether expenses are on track and within budget.

- Budget Control: This software allows companies to monitor expenses approaching budget limits.

- Automatic Notifications: Sends notifications to relevant parties when an expense request needs to be approved or rejected.

With the integration and automation of these features, ScaleOcean’s Expense Management software helps companies manage expenses more efficiently, reducing opportunity costs that may arise from waste, delays, or errors in the expense management process.

Conclusion

Businesses must consider opportunity costs while making decisions in order to maximize resources and increase profitability. Companies can make better decisions by considering trade-offs, resulting in more efficient use of time, capital, and labor. This method guarantees that organizations focus on the most important prospects.

Businesses in Singapore can use ScaleOcean’s Expense Software to better examine their alternatives and calculate opportunity costs. Companies that make data-driven decisions can increase their profits and improve their overall strategy.

Use ScaleOcean to improve decision-making and profitability. Request a free demo to get this solution for your business.

FAQ:

1. What is opportunity cost, and its an example?

Opportunity cost refers to the value of the alternative that is not chosen when a decision is made. For instance, if you decide to use your savings for a vacation instead of investing in the stock market, the opportunity cost would be the potential gains you could have earned from that investment.

2. What is the short meaning of opportunity cost?

Opportunity cost is the value of the best alternative that is given up when making a decision. It helps measure what is lost by choosing one option over another, guiding better decision-making by comparing the possible benefits of different choices.

3. How do you calculate opportunity cost?

To calculate opportunity cost, subtract the return from the selected option from the return of the next best alternative. The formula is:

Opportunity Cost = Return on Best Foregone Option – Return on Chosen Option

This method helps quantify the sacrifice involved in making a choice.

4. What is the opportunity cost in A-level economics?

In A-level economics, opportunity cost is the value of what is given up when a choice is made. It emphasizes the trade-offs involved in decision-making, helping students understand how limited resources force individuals, businesses, and governments to make choices based on alternative costs.

PTE LTD..png)

.png)

.png)

.png)

.png)