Managing expenses isn’t just about recording outgoing transactions; it’s also about ensuring that those expenses are actually used to support business goals. This is especially true if your business frequently experiences tight cash flow.

Without efficient and well-managed expense management, cash flow often suffers, operational costs balloon without you realizing it, and margins dwindle, making it difficult for companies to make business decisions and potentially missing business growth opportunities.

Therefore, companies must manage expenses thoroughly, record them, and manage them effectively to avoid unwanted incidents. This article will discuss expense management in detail, including its definition, process, types, best practices, challenges, recommendations, and review of expense management software that you can use to streamline expense management. Learn more here!

- Expense management refers to how a company monitors, controls, and improves its spending, especially costs submitted by employees, such as travel or office supplies.

- Types of expense management: operating expenses (OpEx), travel and entertainment (T&E), employee expenses, capital expenditure (CapEx), COGS, SG&A, and financial expenses

- Best practices for expense management involve clear policies, automated reporting, regular audits, and employee engagement to improve financial control.

- Top 5 expense management software, including: ScaleOcean, Expensity, Concur Expense, Brex, and Zoho Expense

- ScaleOcean Expense Management Software uses AI to automate expense management, optimize reporting, and provide real-time financial insights.

What Is Expense Management?

Expense management refers to how a company monitors, controls, and improves its spending, especially costs submitted by employees, such as travel or office supplies. It includes setting clear policies, using tools to submit and approve expense claims, and handling reimbursements while staying aligned with internal rules and regulations.

Today, many companies rely on dedicated software to automate steps of expense management, minimise mistakes, and gain clearer insight into their overall spending. You can use ScaleOcean ERP-based expenses software that can optimize and integrate all expense processes and recording.

Why does Expense Management Matter?

Effective expense management matters because it directly impacts cash flow, profitability, and long-term sustainability. By tracking and controlling spending properly, businesses can spot waste, prevent fraud, and avoid budget overruns.

Companies should also understand that opportunity cost allows businesses to evaluate the trade-offs of spending decisions, ensuring that resources are allocated to the most profitable areas.

Clear policies and automated systems also help keep employees compliant, speed up reimbursements, and give finance teams better visibility to make smarter, data-driven decisions.

Key Component of Expense Management

Effective expense management relies on several core components that work together to control spending, streamline workflows, and maintain compliance. By understanding these elements, businesses can build a structured system that supports efficient processing, accurate reporting, and stronger financial oversight.

1. Expense Tracking and Categorization

Expense tracking and categorization involve recording every cost and assigning it to the correct category, project, or department. This ensures all spending is documented, easy to review, and aligned with budgets. Proper categorization also helps businesses identify trends, reduce unnecessary costs, and improve financial planning.

2. Policy Creation and Enforcement

Policy creation and enforcement define the rules employees must follow when spending company money. Clear guidelines on allowable expenses, limits, and required documentation prevent misuse and ensure compliance. Automated checks in expense software help enforce policies consistently and reduce errors or violations across teams.

3. Reimbursement Process

The reimbursement process ensures employees are paid back quickly and accurately for approved business expenses. A structured system speeds up submissions, reduces manual work, and eliminates delays. Fast, transparent reimbursement builds employee trust, improves motivation, and helps maintain clear financial records for audits.

4. Expense Approval Workflows

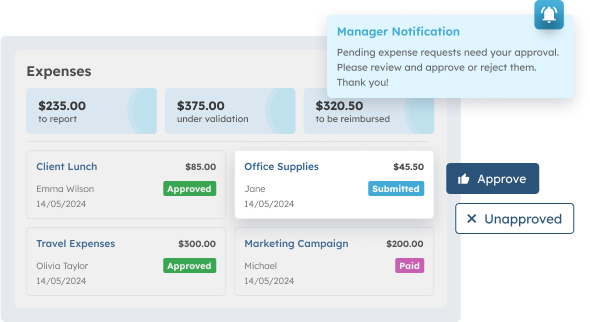

Expense approval workflows outline how claims move through managers or finance teams before being reimbursed. Automated workflows route submissions to the right reviewer, apply policy rules, and reduce bottlenecks. This creates consistency, prevents overspending, and ensures all expenses are vetted properly before payment.

5. Expense Reporting and Insights

Expense reporting and insights compile spending data into dashboards and reports that highlight trends, patterns, and anomalies. These insights help companies understand cost drivers, compare departments, and evaluate budget performance. With real-time visibility, decision-makers can take action to improve cost control and financial efficiency.

6. Integration with Accounting and Financial Systems

Integration with accounting and financial systems ensures all expense data flows directly into the company’s ERP or accounting software. This eliminates duplicate entries, improves accuracy, and keeps financial records up to date. Seamless integration supports faster month-end closing and provides a unified view of overall financial health.

7 Types of Expense Management

Business expenses come in different forms, and understanding each type helps companies manage budgets more effectively. By grouping costs into clear categories, finance teams can track spending, improve planning, and decide where to cut or increase investment to support growth.

1. Operating Expenses (OpEx)

Operating expenses are the recurring costs required to keep the business running, such as rent, utilities, software subscriptions, salaries, and maintenance. These expenses support daily operations and must be managed carefully because they directly impact profitability, cash flow, and expense ratio over time.

2. Travel and Entertainment (T&E) Expenses

Travel and entertainment (T&E) expenses cover business trips, client meetings, conferences, and hospitality activities designed to support sales or partnerships. They include flights, accommodation, meals, local transport, and event tickets.

Clear policies, spending limits, and digital tools help control T&E costs, prevent misuse, and ensure employees can travel and host clients responsibly.

3. Employee Expenses

Employee expenses are costs incurred by staff while performing their roles, such as mileage, training, professional certifications, home office equipment, or small project purchases.

A structured process for submitting claims, approving them, and reimbursing employees promptly keeps staff supported, improves morale, and maintains transparency, control, and budget discipline across the organisation.

4. Capital Expenditure (CapEx)

Capital expenditure involves long-term investments in assets like machinery, vehicles, property, or equipment. These purchases help businesses expand capabilities or improve efficiency.

Because Capital Expenditure (CapEx) affects future depreciation and financial planning, companies must evaluate these decisions carefully to ensure sustainable growth.

5. Cost of Goods Sold (COGS)

COGS includes all direct costs involved in producing or delivering goods, such as raw materials, manufacturing labour, and production overhead. Managing COGS effectively helps businesses maintain healthy margins, price products competitively, and better understand the true cost structure behind their offerings.

6. Selling, General, and Administrative Expenses (SG&A)

SG&A covers non-production costs such as marketing, sales, office administration, HR, customer service, and executive functions. These expenses support business operations but do not directly generate products. Monitoring SG&A helps companies avoid overspending and maintain efficient organisational structures.

7. Financial Expenses (Cost of Capital)

Financial expenses include interest payments, loan charges, banking fees, and other costs related to financing business activities. Managing these expenses is crucial for maintaining a healthy cash flow, reducing borrowing costs, and ensuring the company can fund operations and investments sustainably.

The Process of Expense Management

The expense management process follows a clear flow from the moment costs occur until they are recorded in the books. Understanding each step helps companies design smoother workflows, reduce errors, and make sure employee claims are handled fairly, consistently, and in line with policy and budget.

1. Expense creation and capture

The process starts when an employee incurs a business-related cost, such as travel, meals, or supplies. They capture the expense by saving receipts, taking photos, or using a mobile app. Modern tools often use OCR to read receipt details automatically, reducing manual entry and ensuring accurate, timely data capture.

2. Expense report submission

Next, employees group their expenses into a report and submit it through an expense management system. They add descriptions, choose categories, attach receipts, and link costs to projects or clients. Clear forms and templates help staff provide complete information, which speeds up review and reduces back-and-forth clarification.

3. Review and approval

Managers or finance teams then review the submitted report to check accuracy, policy compliance, and budget impact. They may approve, reject, or request clarification on specific items. Automated workflows apply company rules, flag unusual claims, and route reports to the right approver, helping minimise delays and manual errors.

4. Reimbursement and payment

Once approved, the finance team processes reimbursement, ensuring employees are paid back accurately and on time. Payments may be sent via payroll, bank transfer, or integrated payment systems. A fast and transparent reimbursement stage improves employee trust, reduces frustration, and keeps everyone motivated to follow the process.

5. Recording and reporting

Finally, all expense data is recorded in the accounting or ERP system and included in financial reports. Categorised, up-to-date records make it easier to analyse spending, prepare budgets, and support audits. Regular reporting helps management identify trends, manage cost-benefit analysis, and make better strategic decisions based on real numbers.

Common Challenges in Expense Management

Managing expenses can be complex, especially as a company grows and spending increases across teams. Without clear processes and the right tools, businesses often face inefficiencies, hidden costs, and compliance issues.

Understanding these challenges helps companies improve control, strengthen accountability, and create a smoother, more accurate expense workflow.

1. Data Entry Errors

Manual data entry increases the risk of incorrect amounts, missing receipts, duplicate claims, or misclassified expenses. These mistakes disrupt financial accuracy, slow down approvals, and create compliance issues. Automated tools with OCR and built-in validations help reduce errors and keep data consistent.

2. Inefficiencies in Processing

According to Singapore Business Review, a third of local employees (33%) still submit expenses manually by filling out forms and enclosing physical receipts. This time-consuming process not only delays reimbursements but also increases the administrative burden, further weakening employee morale and participation in business operations.

Slow, manual workflows make it difficult for employees to submit reports and for managers to review them quickly. Paper forms, spreadsheets, and email threads create bottlenecks. Streamlined digital processes cut unnecessary steps, reduce waiting time, and keep expense management running efficiently.

3. Lack of Transparency

When financial data is scattered across multiple systems or departments, it becomes hard to track where money goes. This lack of visibility leads to overspending, policy violations, and poor forecasting. Centralised expense data helps teams monitor trends and enforce policies more effectively.

4. Delayed Reimbursements

Slow approvals and manual verification often delay employee reimbursements, which affects morale and productivity. Delays also complicate accounting records. Automated workflows ensure faster processing, clearer communication, and timely payments, creating a better employee experience.

5. Increased Administrative Costs

Handling expenses manually requires significant effort from finance teams, from checking receipts to managing approvals. This adds unnecessary labour costs and reduces operational efficiency.

By implementing automated systems, companies can streamline processes, reduce admin workloads, and allow finance teams to focus on more strategic tasks, such as capital budgeting. This shift not only enhances productivity but also supports more informed decision-making for long-term growth.

6. Impact on Business Performance

Poor expense control can inflate budgets, reduce profitability, and hurt strategic planning. Without accurate insights, leaders struggle to make informed decisions. Effective expense management supports healthier margins, better forecasting, and stronger overall business performance.

7. Shifting to Expense Management Software

Transitioning to software-based systems can be challenging due to training needs, resistance to change, or integration requirements. However, digital tools bring long-term gains such as automation, real-time visibility, and improved compliance. Successful adoption requires clear communication and proper onboarding.

According to Hybrid Analytica Consulting, by integrating BPO with accounting and expense management, companies gain access to real-time dashboards and reports, enabling faster, more informed decisions.

A company can choose the best expense software that can be an automated solution, which also helps to ensure compliance with expense policies. This allows businesses to manage spending more efficiently, reduce manual errors, and maintain stronger financial control across every department.

You can use ScaleOcean expense software to streamline submissions, simplify approvals, and gain real-time visibility into spending. It also integrates seamlessly with accounting systems, helping finance teams maintain accurate records and make better decisions. Take a request demo now to get this solution.

Best Practices for Expense Management

Effective expense management requires businesses to adopt strategies that streamline processes, enhance financial control, and ensure compliance. By implementing these best practices, companies can optimize spending, maintain transparency, and improve efficiency.

Below are the key practices for effective expense management:

1. Implement Automated Expense Tools

Using Singapore expense management software simplifies the expense reporting process by automating operations such as receipt scanning and approval processing. This increases speed and accuracy while reducing manual data entry errors.

Automation also saves time for staff by speeding up reimbursements and guaranteeing more accurate records. Integrating expense software Singapore with expense management tools helps streamline financial processes, ensuring smooth data flow between reporting and accounting.

2. Create Clear Expense Policies

Clear expense procedures are critical for managing employee spending. Define reimbursable expenses, establish appropriate spending limitations, and make rules easy to access and comprehend. Regular communication of these regulations keeps employees aware, lowering the risk of overspending or policy infractions.

3. Streamline Approval Workflows

Simplified approval workflows reduce bottlenecks and keep reimbursement processes moving quickly. Automated routing ensures each claim goes to the right approver, while built-in policy checks minimise errors. Streamlined workflows also enhance transparency and allow finance teams to maintain accurate, timely records.

4. Leverage Data and Analytics

Using analytics helps businesses understand spending patterns, identify high-cost areas, and detect unusual or non-compliant expenses. For example, tracking prepaid expenses ensures that payments made in advance are properly recorded and allocated over the appropriate period.

Real-time insights support better budgeting and forecasting, enabling leaders to make data-driven decisions. Strong analytical tools also help prevent overspending and improve long-term financial planning.

5. Regular Audits and Monitoring

Regular audits are required to ensure that all spending follows corporate regulations and to discover inconsistencies. Businesses can use analytics technologies to track spending patterns, detect fraud, and identify cost-saving options. Routine checks aid in financial management and prevent wasteful spending.

6. Employee Training and Engagement

Training employees on spending regulations encourages adherence to guidelines and promotes compliance. Businesses that develop a culture of transparency and accountability encourage their staff to honestly report expenses. Proper engagement promotes efficient cost reporting and improves overall financial management.

Top 5 Expense Management Tools and Software

Choosing the right expense management software is important to streamline spending approval, enforce policy compliance, reduce errors, and deliver real‑time insights into business costs.

Below are the top 5 tools with concise explanations to help you compare functionality, benefits, limitations, and ideal use cases so you can select the best fit for your company, including:

1. ScaleOcean Expense Management Software

ScaleOcean Expense Software is a strategic solution for companies in Singapore looking to optimize expense management efficiently, transparently, integratedly, and comprehensively.

ScaleOcean is also supporting CTC grants by helping businesses leverage these financial incentives for upgrading their ERP systems. You can do a free demo and consult with the Scaleocean team to get a system solution that suits your business needs.

Key Features:

- Expense Tracking: Powered by AI and OCR technology to record all types of expenses, including reimbursements, travel, entertainment, procurement, and more, and supports uploading evidence, both receipts and invoices, directly to the system.

- AI Fraud Detection: ScaleOcean uses AI to detect fraudulent activities and financial discrepancies, ensuring accurate reporting.

- Budget Control: Set budget limits and expense categories according to company policy and ensure expenses remain within budget allocations.

- Mobile App and Multi-Device Access: Upload invoices, submit claims, and monitor their status at any time.

- Real-Time Reporting & Analytics: Real-time expense dashboard for budget monitoring, automatic report generation by division, project, location, and employee, and analytics capabilities to identify patterns, anomalies, and savings opportunities.

| Pros | Cons |

|---|---|

|

|

Best For: Scaleocean is perfect for mid-to-large enterprise companies that have many business processes and require customized solutions at a flat price.

2. Expensity

Expensity is a modern expense management platform that simplifies capturing receipts, automating expense categorization, enabling real‑time approvals, and syncing data with accounting systems to reduce manual work and improve financial visibility across teams.

Key Features

- Automated receipt capture via mobile camera and email

- Policy enforcement and spending limits

- Integration with accounting platforms

- Real‑time reporting dashboards

| Pros | Cons |

|---|---|

|

|

Best For: Growing companies seeking an intuitive, mobile‑friendly expense solution with strong automation and accounting integration for improved spend control.

3. Concur Expense

Concur Expense, part of SAP Concur, is a comprehensive enterprise‑grade expense management system that automates travel and expense reporting, enforces policy compliance, integrates travel bookings, and delivers deep analytics for large organizations.

Key Features:

- Automated expense reporting

- Travel booking and itinerary sync

- Policy compliance engine

- Advanced spend analytics

| Pros | Cons |

|---|---|

|

|

Best For: Large enterprises needing tight travel and expense integration, extensive policy controls, and advanced reporting for global operations.

4. Brex Expense

Brex Expense is a corporate expense management platform tied to Brex corporate cards that automates spend tracking, receipt matching, control policies, and integrates with accounting tools to reduce reconciliation work and improve spend visibility.

Key Features:

- Native Brex card integration

- Automated receipt and transaction matching

- Custom spend controls per card

- Real‑time spend dashboards

| Pros | Cons |

|---|---|

|

|

Best For: Startups and fast‑growing companies that already use or plan to use Brex corporate cards and want tightly integrated expense tracking and control.

5. Zoho Expense

Zoho Expense is a cost‑effective, feature‑rich expense management tool that automates receipt scanning, enforces policies, supports multi‑currency expenses, and integrates smoothly with the Zoho suite and external accounting systems.

Key Features:

- Smart receipt scanning

- Policy and approval workflows

- Multi‑currency expense handling

- Spend analytics and custom reports

| Pros | Cons |

|---|---|

|

|

Best For: Small to mid‑sized businesses wanting an affordable, easy‑to‑use solution with solid automation and integration, especially within the Zoho ecosystem.

Benefits of Expense Management Software

An expense management system provides businesses with powerful tools to streamline operations, reduce costs, and enhance financial oversight. From automating data entry to improving spend control, here are key benefits that will help optimize your company’s expense processes and drive efficiency.

1. Saves Time

Expense management systems automate the data entry process, reducing the need for employees to manually input expense reports or create spreadsheets. This automation cuts down on time spent on administrative tasks, enabling employees to focus on more strategic activities.

With real‑time data syncing and easy submission of receipts via mobile apps, businesses save valuable hours each week, streamlining workflows and improving productivity.

2. Reduces Errors

By automating expense tracking and approval workflows, expense management systems significantly reduce the risk of human error. Manual data entry often leads to inaccuracies, such as duplicate entries or incorrect amounts, which can affect financial reporting.

Automated systems ensure that expenses are recorded accurately, ensuring consistency, compliance, and reducing costly errors that might otherwise require time‑consuming corrections.

3. Better Control

Expense management systems provide robust tools to enforce spending policies and ensure compliance. Customizable controls can be set for each department or employee to limit spending according to predefined budgets and policies.

The system offers real‑time visibility into all expenses, allowing managers to monitor spending trends, spot irregularities, and take corrective action immediately, ensuring that spending aligns with organizational goals.

4. Faster Closures

With automated data capture and integration with accounting systems, expense management platforms accelerate the financial reconciliation process. This means that all transactions are recorded and categorized quickly and accurately, allowing for faster month‑end closures.

Businesses can close their books in less time, freeing up the finance team to focus on other critical tasks and ensuring financial reports are always up‑to‑date.

5. Cost Control

Effective expense management strengthens financial discipline by making it easier to monitor spending patterns, identify unnecessary costs, and set clear limits for employee claims.

One useful tool in this process is standard costing, which allows businesses to set cost benchmarks and identify variances between actual and expected expenses. With better control, businesses can reduce waste, optimise budgets, and allocate resources more strategically to support long-term financial stability.

6. Easier Compliance

Strong expense management ensures every claim aligns with internal rules, tax guidelines, and audit requirements. Automated policy checks and complete digital records reduce the risk of errors or fraud, making compliance easier for employees and finance teams while improving transparency during internal or external audits.

7. Better Visibility

Centralised expense data gives finance teams a clearer picture of company spending in real time. With dashboards and detailed reports, businesses can track trends, analyse categories, and understand cost drivers. This visibility supports data-driven decisions, smarter forecasting, and improved control over overall financial performance.

What to Look For in an Expense Management Application

Choosing the right expense management application is crucial for optimizing financial operations. The best tools streamline processes, provide key insights, and integrate with your current systems. Here are key factors to consider when selecting an expense management application for your business.

1. User-Friendliness

The user interface (UI) of an expense management application should be intuitive and easy to navigate. A user-friendly application allows employees to quickly submit expenses and review reports without requiring extensive training.

Look for platforms that feature drag-and-drop functionalities, mobile-friendly designs, and minimal setup, ensuring smooth adoption across teams without disrupting daily workflows.

2. Integration with Accounting Software

A robust expense management application should integrate seamlessly with your existing accounting software or ERP system. This integration ensures that expense data is automatically synced across platforms, eliminating the need for manual data entry and reducing the chance of errors.

Real-time syncing enhances data accuracy and streamlines financial reporting, saving your finance team time and effort.

3. Customizable Approval Workflows

Every company has its own unique approval process for expenses. The right application should allow for customizable approval workflows that align with your company’s policies.

Features such as multi-level approval, automatic routing, and policy-based triggers ensure that each expense request is thoroughly vetted before approval. This customization ensures compliance and improves spending control across departments.

4. Real-Time Expense Tracking

Look for an expense management application that provides real-time tracking of expenses. This feature offers immediate visibility into what’s being spent across departments and helps managers track budgets against actual expenses.

By having up-to-the-minute data on spending, businesses can make quick adjustments, identify potential overspending, and ensure financial discipline throughout the company.

5. Reporting and Analytics

An effective expense management application should offer robust reporting and analytics capabilities. The ability to generate custom reports on spending trends, cost centers, and budget performance helps businesses make data-driven decisions.

Insights into historical and current expenses enable finance teams to forecast future spending, optimize budgets, and identify areas for cost savings, driving long-term financial efficiency.

Future Trends of Expense Management Tools

The future of expense management is shaped by rapid advancements in digital technology. As organisations demand greater accuracy, faster processing, and deeper financial insights, new tools and innovations are transforming how expenses are captured, reviewed, and analysed.

These trends will help businesses stay efficient, compliant, and competitive, including:

1. Intelligent Automation with AI and ML

AI and Machine Learning (ML) are becoming central to expense management, moving beyond simple Optical Character Recognition (OCR) for receipt scanning. It also automatically and accurately categorizes expenses, detects complex patterns indicative of fraud or non-compliance in real-time based on historical data.

This advanced automation frees finance professionals from tedious, repetitive tasks, allowing them to focus on strategic analysis, policy enforcement, and identifying cost-saving opportunities. This shift is crucial for efficiency and audit readiness.

2. Real-Time Spend Visibility and Control

The industry is rapidly shifting from reactive, post-spending expense reporting to proactive, real-time spend management. This is facilitated by the widespread adoption of integrated corporate cards, virtual cards, and centralized payment platforms that instantly capture transaction data.

3. Mobile Expense Capabilities

Mobile-based expense tools allow employees to record receipts, submit claims, and monitor approval status from anywhere. Real-time notifications and app-based workflows create a faster, more convenient experience. Mobility ensures accurate, timely submissions and eliminates delays often caused by traditional manual systems.

4. Global Compliance and Multi-Currency

Support As businesses expand their international and remote operations, the complexity of managing global expenses, multiple tax jurisdictions (like VAT/GST), and various local compliance rules is escalating.

Future platforms are being built with robust, embedded global capabilities, automatically handling complex multi-currency conversions, applying country-specific tax rules, and maintaining a verifiable, compliant audit trail across all territories.

5. Blockchain Integration

Blockchain provides secure, tamper-resistant records that boost transparency and trust in expense data. While still emerging, it offers potential benefits for validating transactions, reducing fraud, and simplifying audits. As adoption grows, blockchain may strengthen data integrity across the entire expense management cycle.

6. Predictive Analytics and Budget Forecasting

Predictive analytics uses historical data to anticipate future spending patterns and highlight potential cost issues. These insights help businesses build stronger budgets, monitor financial trends, and make proactive decisions. With forecasting tools, companies can improve planning accuracy and maintain tighter control over expenses.

Conclusion

Effective expense management is essential for maintaining financial control, improving transparency, and supporting better decision-making across the organisation. As businesses grow and expenses become more complex, having a reliable, automated system is no longer optional.

This is where ScaleOcean Expense Software becomes the ideal solution. With automated workflows, real-time tracking, policy enforcement, and seamless integration with accounting systems, ScaleOcean helps companies manage spending with accuracy and confidence.

It streamlines the entire process, reduces manual work, and gives finance teams clear visibility into every transaction. For businesses looking to strengthen financial discipline and operate more efficiently, ScaleOcean offers a powerful, scalable, and future-ready platform. Take a free demo now to get the best solution for your specific needs.

FAQ:

1. What is the best way to manage expenses?

1. Understand your income and monthly expenses.

2. Organize your spending into categories.

3. Regularly review recurring costs to identify savings.

4. Avoid making impulse purchases.

5. Reduce interest payments wherever possible.

6. Monitor your budget regularly to stay on track.

2. What is the difference between spend management and expense management?

Expense management is concerned with tracking and reimbursing employee expenses, whereas spend management takes a more comprehensive, proactive approach to optimizing overall company spending. It includes managing suppliers, contracts, and inventory to ensure every dollar aligns with the company’s strategic objectives.

3. What is the 7-day rule of expenses?

The 7-day rule involves a “cooling-off” period before making any unplanned purchase. If you want to buy something outside your budget, wait for seven days to consider whether it’s truly necessary and if it’s worth breaking your budget for the purchase.

4. What is the role of an expense manager?

An expense manager oversees the company’s expense policies and procedures. They review and recommend updates to these policies, manage the employee audit list by adding or removing individuals, and can add reasons for audits or extend the audit period as needed.

PTE LTD..png)

.png)

.png)

.png)

.png)