In Singapore’s competitive business environment, corporations are constantly under pressure to control rising operational costs while remaining profitable. Effective cost control is critical for long-term sustainability, allowing organizations to optimize resources, cut wasteful costs, and remain competitive.

The Monetary Authority of Singapore (MAS) understands this requirement, and on February 21, 2025, the Stock Market Review Group outlined ways to improve Singapore’s stock market competitiveness, ensuring firms prosper in the face of adversities.

This article explores numerous cost-cutting measures that firms can use to improve financial efficiency. We will look at classic tactics like cost breakdown analysis and renegotiating vendor contracts, as well as newer approaches like using technology and tools like cost control software and integrated ERP systems. Understanding and implementing these techniques can help firms manage costs and achieve long-term success.

- Cost control is the practice of pinpointing, cutting, or completely eliminating unnecessary business expenses in order to increase profits.

- Effective cost control boosts profitability by managing fixed and variable costs. The formula for this is: Target Net Income = Revenue – Fixed Costs – Variable Costs.

- Households can use cost control by sticking to a budget, comparing prices, and opting for sales or second-hand items, which helps reduce unnecessary spending and boosts savings.

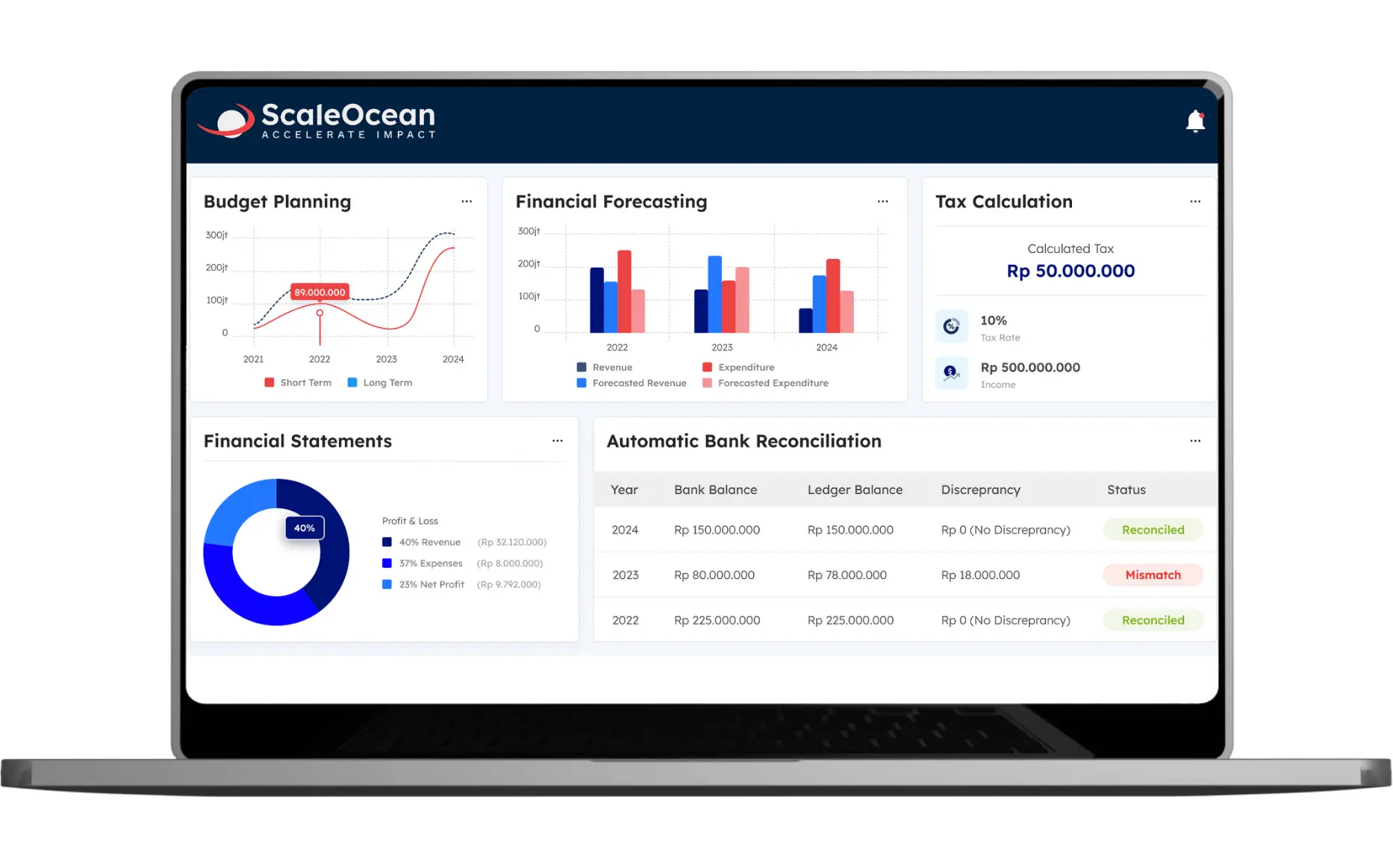

- ScaleOcean accounting software automates cost control by integrating financial management functions, providing real-time data, and simplifying cost forecasting, helping businesses track spending and make informed decisions.

What Is Cost Control?

Cost control is the practice of pinpointing, cutting, or completely eliminating unnecessary business expenses in order to increase profits. By thoroughly evaluating spending trends, companies can minimize waste and prioritize efficient resource allocation, which is key to truly boosting profitability.

This essential method helps businesses maintain strong financial health by ensuring that every single cost directly aligns with the company’s objectives. Proper cost control enhances budget oversight, optimizes operations, and truly contributes to long-term financial success.

The Importance of Cost Control for Businesses

In Singapore, where operational expenses are high, effective cost control is crucial for maintaining profit margins and financial stability. By managing spending efficiently, businesses can allocate resources to key growth areas.

IRAS also supports cost management by allowing tax deductions for Research and Development (R&D) expenses, capped at $300,000 every 3 years. This provides businesses with a clear framework to optimize spending while benefiting from tax incentives.

Cost containment is critical for small and medium-sized businesses (SMEs) to achieve long-term success. Efficient cost control can help SMEs increase profits, allowing them to reinvest in their firm. As a result, cost management promotes not only short-term survival but also long-term viability in competitive marketplaces.

Types of Costs in Business

Costs are an important consideration in corporate planning and decision-making. These costs can be classified in several ways based on their nature or behavior. Understanding the various sorts of costs allows firms to manage spending more effectively and increase overall efficiency.

1. By Nature

Understanding the various sorts of costs is critical for good cost management. Costs can be generally classified based on their type, as they indicate how resources are used during the production process. These classifications help firms track and manage their expenses more efficiently, resulting in better resource allocation decisions. The two main categories are as follows:

a. Direct Costs

Direct costs are expenses directly related to the production of goods or services. This comprises raw materials, labor expenditures, and any other expenses directly related to the production process. These expenses vary depending on the volume of manufacturing and are easily traceable to specific products.

b. Indirect Costs

Indirect costs, also known as overhead, are expenses that are not directly related to the manufacturing process but are required to manage a business. This includes expenses such as rent, utilities, and managerial wages. These costs are often fixed and must be spread over multiple products or services based on usage or other criteria.

2. By Behavior

Cost behavior relates to how costs change in response to business activity levels, such as production volume. Understanding these patterns enables organizations to forecast and manage their expenses more effectively. The three basic types of costs classified by behavior are fixed, variable, and semi-variable costs:

a. Fixed Costs

Fixed costs stay constant regardless of how much or little a company generates. These expenses do not vary with production volume, making them predictable. Rent, salary, and insurance premiums are common examples of expenses that must be paid regardless of whether goods or services are generated. Effective management of fixed expenses ensures that organizations have a steady cost base.

b. Variable Costs

Variable expenses are directly related to production output and rise as volume increases. These costs vary according to the volume of goods or services produced. Raw resources, direct labor, and scalable utilities are some examples. Efficiently managing variable costs allows firms to streamline manufacturing processes and increase profitability as demand fluctuates.

c. Semi-variable Costs

Semi-variable expenses include both fixed and variable parts. These costs include a fixed base cost that must be paid, as well as variable costs based on usage or production. For example, power bills may include a fixed monthly payment as well as additional charges based on consumption. Understanding these expenses allows firms to balance predictability and flexibility in their operations.

Stages of Cost Management

Effective cost management is essential for ensuring financial stability, optimizing resources, and boosting profitability. By managing costs systematically, organizations can prevent overspending and allocate their budget efficiently. This process includes several key stages:

1. Planning for Resource Allocation

Resource planning involves identifying necessary project resources and allocating them effectively. This includes determining the right mix of labor, equipment, and materials needed to meet your project objectives. Proper planning is essential to ensure projects stay on track and within budget.

A detailed resource plan also helps you forecast any potential resource shortages or constraints. By aligning resources with clear project goals, businesses can easily avoid delays and ensure smooth project execution, ultimately leading to more efficient operations and cost savings.

To enhance decision-making, businesses can apply opportunity cost management to evaluate the trade-offs between various resource allocation options, ensuring that the best use of resources contributes to the project’s overall success.

2. Estimating Project Expenses

Estimating project expenses means forecasting all costs needed to complete a project. This involves evaluating direct costs (like labor and materials) and indirect costs (like overheads). Accurate expense estimation truly helps businesses set realistic financial expectations.

By leveraging historical data, industry benchmarks, and expert input, companies can create far more precise cost estimates. This step ensures projects are financially viable and helps secure funds, leading to better decision-making and minimizing the risk of budget overruns.

To support this process, businesses can utilize techniques like standard costing, which allows them to set predefined cost benchmarks and compare actual expenses against these standards to stay on track financially.

3. Setting a Budget for Costs

Setting a cost budget is crucial for establishing clear financial boundaries for any project. This involves allocating resources and estimating costs for each activity. A well-defined budget prevents overspending and ensures funds are wisely allocated to the most critical areas.

Effective budgeting requires fully understanding both fixed and variable costs. Businesses must prioritize expenses based on needs and financial capacity, ensuring the budget remains flexible enough to accommodate unforeseen changes while still staying within the defined limits.

4. Managing and Controlling Expenses

Managing and controlling expenses is a continuous process of tracking costs to ensure they align perfectly with the budget. This involves monitoring daily expenditures and identifying areas where costs can realistically be reduced. Effective expense management framework significantly contributes to the overall success of any project.

Businesses can leverage cost control tools and software to track spending in real time, compare actual costs against estimates, and make needed adjustments. Regular monitoring allows teams to spot potential overspending early, enabling quick corrective action to keep the project on budget.

5. Assessing Costs After Project Completion

After project completion, assessing costs is crucial for evaluating financial performance. This means comparing actual costs against initial estimates to find discrepancies. By doing this, businesses can pinpoint inefficient areas and greatly improve cost-benefit analysis management.

Post-project cost assessment offers valuable insights into how well resources were truly allocated and managed. It provides a strong basis for refining your budgeting and estimating techniques, helping your business make smarter financial decisions for all future projects.

How Managing Costs Enhances Profitability

Cost control plays a truly vital role in boosting profitability by minimizing unnecessary expenses. By carefully evaluating and cutting both fixed and variable costs, businesses can easily improve financial performance and achieve their desired net income. Here’s a revised formula to demonstrate how cost control enhances profitability:

Target Net Income = Revenue – Fixed Costs – Variable Costs

Imagine a company targeting $12,000 net income from $120,000 in sales. To hit this goal, they must focus on cutting both fixed and variable costs. Fixed costs (like rent) can be reviewed, while variable costs (like labor/materials) can be reduced via better sourcing or efficiency.

For example, cutting production material costs by $3,000 through a better supply chain strategy would bring the company closer to its net income target. Effective cost control truly ensures optimal resource use, which is what ultimately drives higher profitability.

Key Elements of Cost Control

Cost control involves several essential components, including cost estimating, budgeting, and monitoring. A strong focus on financial management is vital for businesses to track and control these elements effectively.

By implementing sound financial management practices, companies can ensure that their cost control measures are aligned with their overall financial goals, ultimately improving resource allocation and maintaining a stable cost base. The following are the key components of cost control:

1. Cost Estimating

Cost estimating is the process of forecasting future expenses for certain activities or projects. It entails estimating probable costs based on past data, industry benchmarks, or comparable projects. Accurate cost assessment helps firms plan properly and avoid unanticipated financial challenges, while bank reconciliation ensures that the cost estimates align with actual financial balances and available resources.

2. Budgeting

Budgeting is the process of constructing a financial plan, including expected income and expenses for a given time period. It establishes a framework for efficiently allocating resources and tracking expenses. Businesses that have defined financial goals can ensure that they stay within their financial boundaries and maximize profitability.

A solid capital budgeting strategy can further enhance this process by guiding businesses in making informed investment decisions that align with long-term objectives and resource constraints, ensuring sustainable growth and financial stability.

3. Cost Baselines

Cost baselines are the predetermined cost numbers against which actual performance is measured. They serve as benchmarks for monitoring the progress of a project or commercial operations. When real expenses depart from the baseline, organizations can take corrective measures to stay on track financially.

4. Monitoring & Variance Analysis

Monitoring and variance analysis entail routinely comparing actual and anticipated expenditures to guarantee alignment. If there are disparities between the two, businesses must study the variance to determine the source and take corrective action. This stage is critical for keeping financial management and making good use of resources.

How Households Can Use Cost Control

While cost control is often a business concept, households can really benefit from these same strategies. Creating and sticking to a budget is essential for managing personal finances, as it helps keep spending in check and boosts savings significantly over time.

Additionally, comparing prices across different stores and opting for sales or second-hand items can drastically reduce expenses. By making smarter purchasing decisions, individuals can stretch their budgets further and easily avoid overspending on things they don’t truly need.

Challenges in Cost Control

Cost control is crucial for business success, but many companies face challenges when trying to implement effective cost management systems. High operating costs, especially for small and medium-sized enterprises (SMEs), can be a significant hurdle. The initial investment in software, training, and infrastructure may seem daunting.

However, with the right tools and strategies, businesses can better manage these costs and ensure long-term financial health. The following are some of the primary issues firms encounter when attempting to adopt efficient cost management systems:

1. High Implementation Costs

Implementing cost control systems can be costly, particularly for small and medium-sized businesses (SMEs). The initial investment in software, training, and infrastructure may be financially challenging.

Although the long-term benefits of cost control might be significant, the initial expenses may discourage smaller businesses from using such systems.

To mitigate these costs, businesses can apply a prepaid expenses technique to manage upfront payments for services over time, helping to balance cash flow and reduce the financial burden of implementing cost control systems.

2. Complexity of Systems

Cost control systems can be difficult to set up and administer, necessitating specialized knowledge and skills. Businesses may need to invest in highly skilled individuals to manage and optimize these systems. Inadequate system management can lead to underutilized resources and inefficiency, reducing the potential benefits of cost control.

3. Need for Accurate Data

Accurate and up-to-date data is required for successful cost control. Collecting and keeping this data can be resource-intensive, especially if organizations do not have automated cost-tracking systems. Inaccurate or outdated data can lead to poor decision-making and impede the effectiveness of any cost-cutting measures.

4. Short-Term Focus

A significant emphasis on short-term cost savings may cause organizations to compromise on quality or innovation. This can have an impact on long-term growth and customer satisfaction because cost-cutting measures in specific areas may impede product or service enhancement. While cost savings are crucial, firms must strike a balance between them and the need to invest in quality and innovation.

5. Risk of Overlooking Strategic Investments

Companies that prioritize cost reductions may neglect critical strategic investments in research, development, or personnel training. Such oversights may eventually hinder the company’s growth potential and competitiveness.

Neglecting these efforts can have long-term negative consequences for a company’s capacity to respond to market changes and maintain long-term success.

To avoid this, businesses should balance cost control with capital expenditure strategy investments to ensure resources are allocated to areas that drive long-term growth, innovation, and market adaptability.

Cost Control Strategies

Implementing efficient cost-cutting initiatives is critical for firms seeking to increase profitability and operational efficiency. Companies can achieve long-term growth by focusing on both traditional and creative solutions. Combining tried-and-true tactics with cutting-edge technology allows businesses to address rising costs and streamline operations. Here are some important cost-cutting methods to consider:

1. Traditional & Process-Focused Strategies

In order to save money, firms frequently adopt traditional and process-oriented tactics to optimize operations. These tactics focus on optimizing procedures, minimizing wasteful expenses, and improving overall financial performance. Companies can increase profitability and remain competitive by focusing on essential processes. Several ways might assist firms in accomplishing cost control and improving operational efficiency:

a. Cost Breakdown Analysis

Companies can better understand their cost structure by doing a complete analysis of operational costs such as labor, materials, and logistics. This deep dive allows firms to find inefficiencies and possible areas for optimization, resulting in better decision-making and cost-saving measures. By implementing a cost breakdown structure, businesses can more clearly allocate and track expenses, ensuring that every cost is accounted for in a manageable way.

b. Renegotiating Vendor Contracts

Reviewing and renegotiating vendor contracts can help businesses get more competitive pricing or conditions that better fit their changing needs. This method not only lowers procurement costs but also improves overall cost efficiency by negotiating better bargains on critical services and supplies.

c. Process Automation

Implementing technology to automate previously manual operations enables firms to reduce human error while increasing operational efficiency. Automation simplifies operations, saves personnel costs, and enhances accuracy, resulting in cheaper long-term operational expenses.

d. Outsourcing

Outsourcing certain corporate services, such as customer service or manufacturing, to third-party suppliers can help businesses save money while maintaining quality. Businesses can focus on core activities while lowering fixed expenses in non-essential areas by leveraging external providers’ expertise and cost advantages. For example, outsourcing administrative tasks like purchase requisition processes can help companies avoid unnecessary costs and optimize purchasing activities.

e. Employee Expense Control

Empowering employees to manage and control their departmental spending raises overall cost awareness throughout the firm. This strategy promotes accountability and guarantees that spending is closely managed, lowering the possibility of unnecessary spending.

f. Implementing Activity-Based Costing (ABC)

Using the Activity-Based Costing (ABC) method allows businesses to more correctly allocate indirect expenses based on the activities that generate them. This method provides a clearer view of where resources are being used and shows areas where improvements or cost savings might be implemented. With accurate data, a company can understand its profit loss statement more deeply and adjust operations accordingly to optimize profitability.

2. Leveraging Technology & Tools

In today’s fast-paced corporate climate, employing technology and tools is critical to efficient cost containment. Companies can increase their overall efficiency by adopting innovative software solutions. These technologies provide significant insights that assist firms in making data-driven decisions to improve cost management. Here are some significant techniques to use technology and tools for cost control:

a. Optimize Your Cost Control with ScaleOcean Expense Software

ScaleOcean’s best expense management system is an integrated solution that simplifies financial management for organizations. It allows businesses to track actual spending against budgets, improve cost forecasting, and make better decisions by delivering real-time financial data.

Accounting, inventory management, procurement, and project cost tracking are among the modules integrated within the software, which provides a full view of your business’s finances.

ScaleOcean provides a free demo to help organizations understand how the software helps optimize cost control and financial efficiency. Additionally, ScaleOcean is qualified for the CTC grant, which assists businesses in implementing technology solutions. This makes it much easier for firms to improve their financial management systems. The following are the main features of ScaleOcean software:

- Accounting & Financial Management, Monitor actual expenses against budgets to ensure financial stability.

- Budgeting & Forecasting, Set cost projections and control deviations for better financial planning.

- Inventory Management, Reduce storage costs and prevent over-purchasing.

- Procurement, Ensure purchases align with needs and secure the best prices.

- Project Cost Tracking, Track costs per project or activity for enhanced budgeting accuracy.

b. Integrated ERP Implementation

Implementing an integrated ERP system allows real-time data access, promoting efficiency across departments. This system enhances visibility into financial processes and helps streamline operations, resulting in better cost management and reduced inefficiencies. Additionally, it enables quicker decision-making by providing accurate, up-to-date information.

Conclusion

With significant cost constraints in Singapore, efficient cost control, from estimation to monitoring, is critical for business sustainability and competitive advantage. Companies may stay ahead of the competition by keeping a tight eye on costs and constantly optimizing spending.

A mix of organized methods and smart technology, particularly software such as ScaleOcean’s expense system, converts cost control from a burden to a strategic advantage for growth. Businesses may use the correct tools to manage costs while simultaneously driving innovation and profitability.

FAQ:

1. What is an example of cost control?

An example of cost control is renegotiating supplier contracts to obtain better rates. By securing discounts or adjusting terms, businesses can reduce procurement costs, ensuring they maximize resources while maintaining product or service quality.

2. What are the four basic steps in cost control?

The four essential steps in cost control include:

1. Planning: Setting a budget and defining financial objectives.

2. Monitoring: Continuously tracking expenses and comparing them to the budget.

3. Analyzing: Identifying any discrepancies or areas of inefficiency.

4. Correcting: Making necessary adjustments to stay within budget and improve cost management.

3. What are the 4 types of cost?

The four main types of costs are:

1. Fixed Costs: These costs remain the same regardless of production levels, such as rent.

2. Variable Costs: Costs that fluctuate depending on production, like raw materials.

3. Semi-variable Costs: Costs that have both fixed and variable elements, like utility bills.

4. Direct Costs: Expenses directly linked to production, such as wages or materials.

4. What are the 5 rules of cost control?

The five key rules for effective cost control are:

1. Establish a clear budget: Set well-defined financial targets.

2. Track expenses regularly: Monitor costs to ensure they align with the budget.

3. Spot inefficiencies: Identify areas where spending can be reduced.

4. Negotiate better deals: Work with suppliers to secure cost-effective agreements.

5. Streamline processes: Improve efficiency by automating tasks and refining workflows to save money.

PTE LTD..png)

.png)

.png)

.png)

.png)