Singapore’s business environment is noted for its rapid growth and strong economic conditions. The country’s effective regulatory system and geographical location position it as a global corporate hub. To secure long-term success in such a competitive market, organizations must first comprehend the complexities of spending management.

Understanding business expenses is crucial for both employees and companies in Singapore. Proper expense management ensures financial stability and compliance with tax regulations. With Singapore’s corporate tax rate at 17%, businesses can also take advantage of various tax incentives available to reduce their overall tax burden.

- A business expense refers to the costs a company incurs while operating to generate income. These expenses are deducted from the total revenue to calculate net profit and lower the taxable income.

- Types of business expenses are direct costs, indirect costs, and interest expenses

- Examples of business expenses are location cost, utilities, telephone and internet, business insurance, office equipment, employee salary and benefits, marketing expenses, and more

- Best practices of business expense are to use reliable expense software, review expenses regularly, ensure compliance with tax regulations, leverage technology, and monitor expenses wisely

- ScaleOcean’s Expense Management Software provides an automated and integrated solution to improve visibility and control costs, and ensure that every expense is recorded correctly and on time.

What Are Business Expenses?

A business expense refers to the costs a company incurs while operating to generate income. These expenses are deducted from the total revenue to calculate net profit and lower the taxable income.

Business expenses are critical to any company’s daily operations. Simply expressed, these are the expenses incurred by a firm in order to continue operating its business. From paying salaries to covering utility bills, these expenses help firms stay on track and fulfill their objectives.

It’s critical to recognize that corporate expenses are not the same as personal spending. There is also a clear distinction between employee-related costs and those directly related to corporate operations. Employee costs are focused on people, whereas company expenses are concerned with operations.

20 Business Expenses Categories and Examples

Business expenses are essential costs that organizations incur to maintain operations and generate revenue. Properly tracking and categorizing these expenses can help ensure accurate financial reporting, tax deductions, and long-term profitability. Here are 20 common business expense categories that you should be aware of:

1. Employee-Related Expenses

Employee-related expenses make up a significant portion of corporate costs. This comprises monthly salary and wages, which are the foundation of employee motivation and productivity.

Additionally, firms must cover employee perks such as CPF contributions, insurance, and health care as part of their responsibilities. Companies in Singapore frequently invest in training and development programs, which help employees enhance their abilities and contribute more effectively to the firm.

Furthermore, business travel and accommodation charges are typical. Whether for international conferences or client meetings, these are regarded as employee business expenses and obligations.

2. Company-Related Expenses

Aside from employee-related costs, business expenses include the company’s operating requirements. These include rent for office space, utilities, and office supplies required for everyday operations.

Capital expenditures include larger investments such as machinery purchases and office improvements. According to ACRA, company-related fees also include a $300 registration fee for transactions such as incorporation, annual filing, and change of particulars.

These costs include marketing operations such as digital commercials, social media promotions, and public relations efforts. For organizations that prioritize innovation, research and development can account for a large amount of their budget. These categories are critical for efficiently managing expenditure management operations.

3. Location Costs

Location costs refer to the expenses associated with operating from a physical location, such as rent or mortgage payments, property taxes, and maintenance fees.

These expenses are critical as they directly affect the business’s operational viability, especially for brick-and-mortar establishments. They can vary based on location, size, lease terms, and real estate market conditions.

4. Utilities

Utilities encompass services like electricity, water, heating, air conditioning, and waste disposal. These expenses are necessary for daily business operations, and their cost can fluctuate depending on usage, the size of the business premises, and local utility rates. Businesses often look for ways to minimize utility costs through energy-efficient solutions.

5. Telephone and Internet

Telephone and internet expenses are vital for communication and connectivity. This category includes the costs of mobile phones, landlines, internet service, and related business communication tools.

These expenses ensure that employees can stay connected with clients, vendors, and other stakeholders, facilitating seamless operations.

6. Business Insurance

Business insurance is essential for protecting the company against potential risks such as property damage, liability claims, or employee-related incidents.

This category includes premiums for general liability insurance, property insurance, workers’ compensation, and other policies. Insurance helps safeguard the business’s assets and financial stability.

7. Office Equipment

Office equipment expenses cover the costs of purchasing and maintaining essential tools such as computers, printers, fax machines, and furniture.

This category is important for setting up a functional work environment, and companies often allocate a budget for replacing outdated or damaged equipment to keep operations running smoothly.

8. Employee Salary and Benefits

Salaries and benefits make up a significant portion of business expenses. This category includes employee wages, bonuses, health insurance, retirement contributions, and other employee perks.

Competitive salary and benefits packages help attract and retain talent, and accurate tracking of these costs is crucial for budget management.

9. Marketing Expenses

Marketing expenses cover the costs of promoting and advertising the business, such as digital marketing campaigns, print ads, public relations, and social media management.

These expenses are key to generating brand awareness, attracting new customers, and driving sales growth. Marketing spend is often seen as an investment in business expansion.

10. Taxes

Taxes are a mandatory cost for businesses, encompassing various forms such as income tax, sales tax, and payroll tax. This category also includes tax preparation fees and penalties for late payments.

Effective tax management is essential for reducing liabilities and complying with government regulations, which is why accurate record-keeping is crucial.

11. Business Fees

Business fees refer to costs associated with maintaining legal and operational status, including licenses, permits, and registration fees. These fees can vary depending on industry, location, and business size.

Effective management of these expenses, along with strategic financial planning, is crucial for sustainable growth. One way businesses can plan for high costs is through capital budgeting, which helps in evaluating large investments and expenditures to ensure profitability and long-term financial health.

Compliance with local regulations is necessary to avoid penalties or disruption of operations, making these fees a recurring business expense.

12. Business Meals

Business meals are expenses related to dining out for business purposes, such as client meetings or team-building lunches.

These costs are often tax-deductible within certain limits, but businesses must keep detailed records to justify the expense. Business meals help foster relationships and facilitate networking opportunities.

13. Employee Gifts

Employee gifts include expenses for giving employees tokens of appreciation, such as holiday gifts, performance bonuses, or company-branded merchandise. While not always a regular expense, these gifts help boost employee morale and foster loyalty. Some gifts can also be tax-deductible, depending on the value and occasion.

14. Business Travel

Business travel expenses cover costs related to employee travel for work purposes, including flights, accommodation, meals, and transportation. These expenses are necessary for meeting clients, attending conferences, and expanding the business.

Companies often set policies for travel expenses to ensure cost control and efficiency and compliance with budgets.

15. Education

Education expenses include costs related to employee training, workshops, courses, or certifications that enhance their skills and knowledge.

These expenses contribute to the growth of the workforce and can improve business performance. Investing in employee education also helps foster a culture of continuous learning and development.

16. Legal and Professional Fees

Legal and professional fees encompass costs for hiring lawyers, accountants, consultants, or other specialists to provide expert advice and services.

These expenses can arise from contract negotiations, legal disputes, or financial audits. Hiring professionals ensures that businesses are compliant with laws and regulations, helping to minimize risk.

17. Home Office

For businesses that allow employees to work from home, home office expenses can include a portion of rent, utilities, internet, and office equipment.

These costs are typically reimbursed by the company and can vary based on the employee’s location and work setup. Home office expenses have become more common with the rise of remote work.

18. Loan Repayment and Interest Payment

Loan repayment and interest payments are expenses associated with servicing debt. This category includes monthly loan installments, interest charges, and any penalties for late payments.

Proper management of loan payments is critical for maintaining cash flow and ensuring financial stability, especially for businesses with large debts.

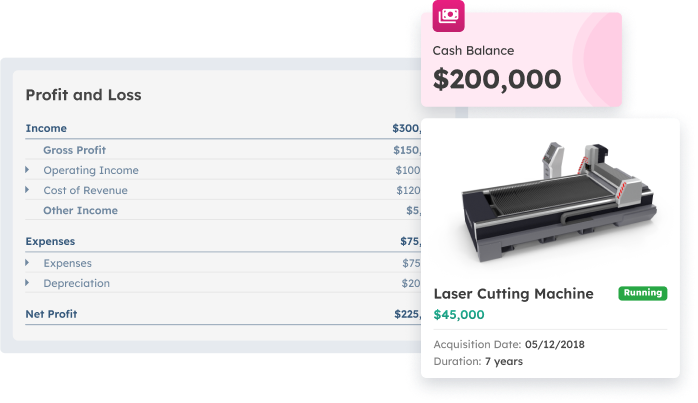

19. Depreciation

Depreciation refers to the gradual reduction in the value of business assets, such as machinery, vehicles, or office equipment, due to wear and tear or obsolescence.

This expense is recorded over time and can be deducted from taxable income, helping to reduce the overall tax burden for businesses. Prepaid expenses are also important to consider when managing financial strategies.

20. Maintenance and Other Fees

Maintenance and other fees are costs related to the upkeep of business assets, such as equipment repairs, software subscriptions, and building maintenance.

Regular maintenance is crucial for ensuring the longevity of equipment and facilities. These expenses also help prevent costly breakdowns and interruptions to business operations.

Types of Business Expenses: How Are They Recorded

Understanding how expenses are recorded is vital for accurate financial reporting and compliance. Proper categorization ensures businesses can track expenditures effectively, make informed decisions, and prepare accurate financial statements. Below are the different types of expenses and how they are recorded:

1. Direct Costs

Direct costs are expenses that can be directly attributed to the production of goods or services. These include materials, labor, and manufacturing costs.

In accounting, direct costs are recorded as part of the cost of goods sold (COGS) on the income statement. Tracking these expenses is essential for determining product profitability and managing production budgets.

2. Indirect Costs

Indirect costs, or overhead costs, are expenses that cannot be directly tied to the production process. These include utilities, rent, office supplies, and administrative salaries. Indirect costs are recorded separately from direct costs and are typically allocated across different departments or products.

These expenses are also recorded on the income statement but are categorized as operating expenses.

3. Interest Expenses

Interest expenses represent the cost of borrowing funds, including interest paid on loans and credit lines. These expenses are recorded on the income statement and deducted from the company’s revenue to calculate net profit.

Interest payments vary depending on the terms of the loan, and businesses must track them carefully for financial management and tax purposes.

Personal vs. Business Expenses

Personal expenses are costs that individuals incur for their personal use and are not related to business activities. These may include personal groceries, household bills, or entertainment. On the other hand, business expenses are costs incurred for the purpose of operating a business, such as office supplies, employee wages, or business travel.

It is crucial to clearly distinguish between personal and business expenses for accurate financial reporting and tax purposes. Mixing the two can lead to issues with tax deductions and compliance, potentially resulting in fines or audits.

Properly categorizing and documenting business expenses ensures businesses can take full advantage of allowable deductions while maintaining transparency in financial records.

What Is an Ordinary and Necessary Business Expense?

An ordinary and necessary business expense is a cost that is common, accepted, and essential for the operation of a business. According to tax laws, to be deductible, an expense must be both ordinary, meaning it is customary in the industry, and necessary, meaning it is essential for the business to function.

In decision-making, businesses must also consider the opportunity cost

of allocating resources to certain expenses, as this helps evaluate whether spending in one area may limit potential gains in another.

For example, office supplies, employee wages, and utilities are typically considered ordinary and necessary expenses. Proper documentation and justification are key to ensuring that these expenses are eligible for tax deductions.

Tax Deductibility of Business Expenses in Singapore

In Singapore, businesses must understand how their expenses are taxed. To be deductible, expenses must be incurred solely for the purpose of generating income. This criterion adheres to Singapore accounting standards, ensuring fairness and accuracy in reporting.

Understanding these standards allows organizations to manage costs more effectively while remaining compliant. Accounting fees, administrative expenditures, advertising, bad debts, and bank charges are examples of common permitted business expenses recognized by the IRAS.

Other deductible expenses include bookkeeping services, borrowing fees, and commissions that directly contribute to income-generating activities. Meanwhile, non-deductible expenses include personal expenses, capital expenditures (capex), and some mandatory payments. Staying current helps to avoid errors in financial reporting.

How Do Business Expenses Impact or Reduce Taxes?

Business expenses play a crucial role in reducing a company’s tax liability. By deducting eligible expenses from their total revenue, businesses lower their taxable income, which in turn reduces the amount of taxes owed.

These deductions help to offset operational costs, such as rent, salaries, and utilities, making the tax burden more manageable. Properly tracking and categorizing expenses ensures that businesses maximize their tax deductions while staying compliant with tax laws.

As a result, business expenses not only improve cash flow but also provide a valuable tax-saving strategy.

What Are Examples of Deductible Business Expenses?

Deductible business expenses are costs that can be subtracted from a business’s total income to reduce taxable income. Examples include salaries and wages, rent, utilities, office supplies, insurance premiums, and business travel expenses.

Businesses can also apply the standard costing method to allocate and manage costs more efficiently, ensuring accurate expense tracking and improving financial planning.

These expenses must be directly related to business operations and properly documented. Tax deductions for these expenses help lower the amount of tax a business must pay, improving cash flow and profitability.

What Are Examples of Non-Deductible Business Expenses?

Non-deductible business expenses are costs that cannot be subtracted from a business’s income to reduce its tax liability. These typically include personal expenses, fines, political contributions, and costs associated with entertainment that do not directly relate to business purposes.

Non-deductible expenses do not qualify for tax deductions, so businesses must carefully separate personal and business expenses to avoid issues during tax filing.

Best Practices for Managing Business Expenses

Managing business spending entails more than just keeping track of numbers; it also entails creating a structure that promotes long-term financial health. Good practices help businesses avoid excessive expenses and keep their finances under control.

This technique also promotes regulatory compliance and financial transparency. The following are some of the most effective techniques to manage expenses:

1. Use Reliable Expenses Software

A robust accounting system is the foundation for managing business spending. Using expense software in Singapore makes it easier to track and categorize each transaction. This contributes to accurate reports for decision-making. Reliable tools minimize human mistakes and increase efficiency.

2. Review and Categorize Expenses Regularly

Reviewing spending regularly helps discover areas where the organization may overpay. Proper categorization allows for more accurate analysis of financial reports.

Using a cost-benefit analysis template can help identify areas where spending does not align with the expected benefits, enabling more effective budgeting and future planning. Clear records are also important for tax purposes.

3. Ensure Compliance with Tax Regulations

Following the guidelines for business deductions helps to avoid legal risks and penalties. Compliance guarantees that you take full advantage of potential tax relief options. It also maintains your financial records clear and transparent. Staying up to date decreases the likelihood of reporting errors.

4. Leverage Technology for Tracking and Reporting

Technology simplifies spending management by providing tools for real-time monitoring. Automated reports help firms remain efficient and organized. Digital solutions reduce the danger of costs that are neglected. They also provide clearer insights into financial planning.

5. Monitor Business Entertainment Expenses Wisely

Monitoring workplace entertainment expenses helps maintain spending within appropriate levels. Proper documentation aids in compliance with business policies. Clear guidelines keep these costs from impacting profitability. Tracking promotes responsibility across departments.

Leveraging Technology for Efficient Expense Management

In today’s fast-paced business climate, using technology to handle expenses efficiently is more crucial than ever. Modern software solutions can help firms streamline their financial processes by providing real-time data and decreasing manual errors.

These technologies not only save time but also improve accuracy when tracking and reporting spending. Let’s look at how technology can improve the way firms handle their expenses:

1. Software Solutions for Expense Management

Software built for expense management provides a consolidated platform for managing all business spending. These systems automate processes, minimize human error, and generate detailed reports. They assist firms in being organized and in compliance with tax requirements, as well as in making better financial decisions.

2. Benefits of Expense Automation

Automating expense management saves time by removing human data entry and processing. It offers real-time tracking, allowing firms to make informed financial decisions.

According to Gov Insider, the majority of users reported that it took at most three days to complete a trip-based expense report. Automation also improves accuracy, reduces the likelihood of errors, and simplifies financial documentation, making it easier to analyze expenditure patterns.

3. ScaleOcean’s Expense Software for Streamlined Expense Management

ScaleOcean Expense Software simplifies financial management by combining critical activities such as spending monitoring, invoicing, and reporting on a single platform. Automation improves efficiency, accuracy, and transparency.

Businesses benefit from increased spending control, fewer errors, and greater financial insight, which leads to better decision-making and cash flow management. ScaleOcean provides a free demo for enterprises interested in exploring the full possibilities of its product.

Additionally, ScaleOcean offers the CTC grant to assist firms in their digital transformation path, guaranteeing that they can leverage the value of this ERP solution. The ScaleOcean program has several essential characteristics, which are listed below:

- Expense Tracking: Enables automatic, real-time tracking of business expenses, minimizing manual errors and providing full cost visibility.

- Automated Reimbursement: Automates the employee reimbursement process, speeding up expense submissions and approvals, making them more efficient.

- Receipt Capture: Enables digital uploads of transaction receipts, ensuring complete and easily accessible expense records.

- Approval Management: Simplifies the expense approval process with automation, speeding up and ensuring a more transparent approval process.

- Email Notifications: Provides automatic notifications to relevant parties regarding expense submissions and approvals to ensure nothing is missed.

- Expense Reports: Generate comprehensive, detailed expense reports for better analysis and decision-making.

- Budget Control: Enables companies to monitor expenses approaching budget limits, preventing wasteful spending.

By using ScaleOcean’s Expense Management Software, companies can improve visibility and control costs more efficiently, reduce manual errors, and ensure that every expense is recorded correctly and on time.

Conclusion

Effectively managing business expenses is crucial for maintaining financial health and maximizing profitability. Companies that streamline their expense tracking, approval processes, and reporting can gain better control over their budgets and identify opportunities for cost-saving.

With ScaleOcean’s Expense Management Software, businesses can automate and optimize their expense processes, ensuring accuracy, transparency, and efficiency.

By offering features like real-time expense tracking, automated reimbursements, and comprehensive reporting, ScaleOcean provides a seamless solution to help businesses minimize waste and maximize savings.

Embrace ScaleOcean today for a smarter, more efficient approach to managing your business expenses and driving sustainable growth. Request a free demo to get this solution to optimize your business expenses.

FAQ:

1. How many business expenses can I claim?

Generally, an LLC can deduct all ordinary and necessary business expenses without a specific dollar cap. However, some categories, such as vehicle and meal expenses, have specific percentage limits or conditions set by the IRS.

2. What business expenses are 50% deductible?

Meal expenses that are 50% deductible include those related to business meetings involving employees, stockholders, agents, and directors, as well as office and partner meetings. Meals with clients, customers, and vendors that serve the business’s interests also qualify for this deduction.

3. How to prove something is a business expense?

To verify a business expense, supporting documents such as sales slips, paid bills, invoices, receipts, deposit slips, and canceled checks are required. These documents must clearly display the amount paid and the purpose of the expense.

4. Which of the following is not a business expense?

Dividends, paid from the company’s net income, are not considered a business expense. However, advertising costs, salaries, and depreciation are eligible expenses.

PTE LTD..png)

.png)

.png)

.png)

.png)