The Profit and Loss (P&L) statement is essential for understanding a company’s financial health by summarizing its revenues, costs, and expenses over a set period. For businesses in Singapore, where market conditions can change rapidly, mastering the P&L is key to making informed decisions and improving profitability.

This article will explore the importance of the P&L statement, covering its key components such as revenue, gross profit, and operating income. It will highlight how regular analysis of these figures can enhance financial management, helping business owners make better decisions, streamline operations, and support growth in a competitive market.

- A Profit and Loss (P&L) statement is a crucial financial document that summarizes a company’s revenues, costs, and profits over a given period, providing insights into its financial health.

- Key components of the P&L statement, such as revenue, COGS, gross profit, and operating expenses, help businesses evaluate their financial performance and identify areas for improvement.

- The types of P&L statements, including single-step and multi-step formats, offer different levels of detail to suit the complexity of a business’s financial needs.

- ScaleOcean’s accounting software simplifies P&L analysis by automating data recording, offering real-time insights, and streamlining financial reporting, which enhances decision-making and operational efficiency.

Understanding the Profit and Loss (P&L) Statement

A Profit and Loss Statement, also known as an income statement, is an important financial document that summarizes a company’s revenues, expenditures, and spending during a given time period. This statement provides significant information about how well a company produces profit by increasing sales, lowering costs, or both. It simply provides a snapshot of a company’s financial performance, usually across a fiscal quarter or a year.

Businesses, investors, and stakeholders in Singapore rely on the profit and loss (P&L) statement to assess financial health and efficiency. In industries like manufacturing and retail, the P&L provides vital transparency, helping businesses make informed decisions in a competitive market. As the Singapore economy evolves, understanding the P&L is crucial for managing costs and driving profitability, enabling strategic decision-making.

Key Components of a P&L Statement

The primary components of a Profit and Loss (P&L) Statement provide a detailed insight of a company’s financial performance by separating revenues, costs, and profits. Understanding these components is critical for determining how successfully a company manages its financial operations, from revenue generation to cost control. Similarly, a quotation letter helps businesses outline the costs and terms of a transaction, providing clarity on pricing and expectations. These aspects aid in identifying areas where a business can improve its profitability or operational efficiency. The following sections will outline each essential component of a profit and loss statement:

1. Revenue (Sales)

Revenue is the total amount of money a firm gets by selling goods or services over a given period, before expenses are deducted. It is the primary indicator of a company’s ability to create cash flow statements and represents demand for its products. This indicator is critical in determining a company’s financial health. Income types include:

a. Gross Revenue

Gross revenue is the total amount of money a firm makes by selling its products or services, excluding any deductions for returns, allowances, or discounts. It indicates the total money earned by business activity before any factors that may affect the total amount received. Gross revenue provides a comprehensive view of a company’s sales performance and serves as a starting point for further financial research.

b. Net Revenue

Net revenue is the amount remaining after deducting refunds, allowances, and discounts from gross revenue. This figure represents the actual revenue that a company anticipates to collect after accounting for client returns or price reductions. Net revenue gives a more realistic picture of a company’s revenues from its primary business activities and is an important metric for assessing its financial success.

2. Cost of Goods Sold (COGS)

Cost of Goods Sold (COGS) represents the direct costs involved in producing goods or services a company sells. These costs are directly linked to the manufacturing process and are essential for creating products. COGS helps determine gross profit by showing production-related costs, excluding unrelated overhead or operating expenses. The key components of COGS include:

a. Raw Materials

Raw materials are the basic ingredients or components utilized in the manufacturing of commodities. These are the major inputs needed to produce completed goods. Depending on the type of business, raw materials might comprise anything from metals to polymers and fabrics. Raw material costs are an important component of COGS since they have a direct impact on a company’s production costs and profitability.

b. Direct Labor

Direct labor refers to the pay and benefits paid to employees who are directly involved in the production process. This comprises workers who operate machinery, assemble products, or undertake other duties directly associated with the production of commodities or services. Direct labor expenditures are included in COGS because they are required to create the product and contribute to the total cost of production.

c. Manufacturing Overhead

Manufacturing overhead comprises all indirect costs connected with production that cannot be traced back to a single product. These expenses could include utilities, plant upkeep, equipment depreciation, and supervisor wages. Although these costs are required for production, they are not directly related to any specific product but rather support the entire manufacturing process.

3. Gross Profit

Gross profit is a key financial metric that reflects the profitability of a company’s core operations by measuring the difference between revenue and the direct costs associated with producing goods or services. It provides insight into how efficiently a company is managing its production costs in relation to its revenue. To calculate gross profit, you subtract the cost of goods sold (COGS) from total revenue, as shown in the formula:

Gross Profit = Revenue – COGS

Gross profit is important because it demonstrates how efficiently a company manufactures and sells its products. A higher gross profit indicates that the company is effectively controlling production costs, whereas a lower gross profit may imply inefficiencies or increased costs that could impact total profitability. It serves as the foundation for evaluating a company’s overall financial performance and profitability.

4. Operating Expenses

Operating expenses are the costs that a business must incur on a daily basis but are unrelated to productivity. These expenses fund activities such as management, sales, and marketing and are required to keep the business going. Although necessary for operations, they do not immediately contribute to the production of goods or services. The primary categories of operating expenses are:

a. Selling, General, and Administrative Expenses (SG&A)

SG&A refers to the costs associated with the general operation of a business, excluding manufacturing costs. These expenses include salary and compensation for non-production personnel, office space rent, utilities like energy and water, and marketing and advertising charges to promote the firm and attract clients. SG&A expenses are necessary to support overall corporate operations but are not directly related to the production of goods or services.

b. Depreciation and Amortization

Depreciation and amortization involve allocating the cost of tangible and intangible assets over their useful lives. Physical assets, such as machinery and equipment, are subject to depreciation, while intangible assets like patents or software are amortized. These processes help businesses account for the decreasing value of their assets over time. Businesses recognize these expenses gradually over time, allowing them to account for asset wear and tear and how to calculate depreciation.

5. Operating Income (EBIT)

Operating income, commonly known as Earnings Before Interest and Taxes (EBIT), is an important financial term that assesses a company’s profitability based on its core operations. To compute it, you deduct operational expenses from gross profit to determine how successfully a company earns profit from its regular business activities. The formula for calculating operating income is as follows:

Operating Income = Gross Profit – Operating Expenses

Operating income is important because it represents a company’s profitability from core operations, eliminating interest and taxes. It reveals how efficiently the company runs day-to-day operations. A higher operational income indicates greater profitability from core activities, whereas a lower operating income may imply inefficiencies or growing operating costs.

6. Other Income and Expenses

Other income and expenses refer to financial items not directly tied to a company’s core operations but still affecting its profitability. These include income or costs from non-operating activities. Analyzing these items helps businesses understand how external factors impact financial results, offering a fuller picture of overall performance. The key categories of other income and expenses include:

a. Interest Income and Expenses

Interest income refers to the earnings a company generates from its cash holdings or investments, such as savings accounts or bonds. Conversely, interest expenses represent the costs a company incurs from borrowing funds, such as loans or credit interest. These items can significantly impact profitability, with interest income boosting earnings and interest expenses increasing costs.

b. Gains or Losses from Investments

Investment gains and losses occur when a corporation buys or sells financial assets such as stocks, bonds, or real estate. If the value of an investment rises, the corporation reports a profit; if it falls, a loss is recognized. These changes have an impact on overall financial performance and are critical for evaluating a company’s investment strategy and risk management, as well as understanding its financial leverage definition to assess how debt influences investment outcomes.

c. Foreign Exchange Gains or Losses

Foreign exchange profits or losses occur when a corporation conducts transactions in multiple currencies, and exchange rates fluctuate. A gain occurs when the value of the foreign currency rises, while a loss occurs when it falls. These gains or losses are especially relevant for multinational businesses because currency fluctuations can have a major impact on profitability.

7. Earnings Before Tax (EBT)

Earnings Before Tax (EBT) is a financial indicator that measures a company’s profitability prior to paying for income taxes. It gives information on a company’s potential to profit from its core operations, as well as any additional income or expenses incurred outside of its regular commercial activities. To calculate EBT, you add other income and subtract other expenses from operating income, as shown in the formula:

EBT = Operating Income + Other Income – Other Expenses

EBT is crucial because it shows a company’s profitability before taxation, giving a more accurate picture of its operational and financial success. By removing taxes, EBT enables businesses and investors to measure how successfully a company generates earnings, regardless of tax methods or liabilities. This makes it an effective indicator for comparing performance across firms or time periods.

8. Income Tax Expense

Income tax expense is the amount a firm owes based on its taxable income. According to EMERHUB, Singapore applies a 17% corporate tax rate on businesses’ chargeable income, regardless of whether they are local or foreign. Starting January 1, 2025, a new minimum effective tax rate will apply to large multinational enterprises (MNEs). This tax is calculated using the applicable rates and deductions, reflecting the company’s tax liability for profits earned.

9. Net Income (Net Profit or Loss)

Net income, commonly known as the bottom line, is an important financial term that measures a company’s overall profitability after all expenses, including taxes, have been removed. It is computed by subtracting income tax expenses from earnings before taxes (EBT), as stated in the formula:

Net Income = EBT – Income Tax Expense

Net income is important since it reflects the company’s overall profitability during a certain period. It is an important indicator of a company’s financial success since it reflects the net effect of all revenues, costs, and taxes. A positive net income implies profitability, whereas a negative net income represents a loss. This indicator is critical to assessing a company’s long-term viability and success.

Types of P&L Statements

The Profit and Loss (P&L) statement can be presented in different formats, depending on the complexity of the business’s financials and the level of detail required. These formats help businesses present their financial data in a way that aligns with their operational needs. Understanding the types of P&L statements is important for choosing the right one for your business. The main types of P&L statements include the following:

1. Single-Step Income Statement

The single-step income statement uses a simpler structure that groups all earnings and expenses. The calculation of net income is straightforward: remove total expenses from total receipts. This structure makes it simple to understand at a glance.

This style is excellent for modest firms with simple finances. Because it does not differentiate operating and non-operating income or expenses, it is ideal for organizations that do not require precise financial breakdowns. It provides a concise and straightforward overview of the financial performance.

2. Multi-Step Income Statement

The multi-step income statement contains more information, separating operating revenues and expenses from non-operating elements. This structure provides a more complete picture of a company’s operational effectiveness by differentiating core business operations from other income streams and costs, especially when using the accrual accounting process.

Larger firms or those with more complicated financial operations tend to favor the multi-step structure. It is more suited for firms that require a more in-depth review of their financial performance, as it provides useful insights into both operational and non-operating income and expenses.

Importance of the P&L Statement

The Profit and Loss (P&L) Statement is an important financial tool that provides an overview of a company’s financial condition. It enables firms, investors, and stakeholders to evaluate profitability, operational efficiency, and overall financial performance. The profit and loss statement is critical in driving strategic decisions because it provides a clear view of sales, expenses, and profits. The significance of the P&L statement can be observed in the following areas:

1. Financial Performance Assessment

The P&L statement is critical for determining a company’s profitability and operational efficiency. By analyzing revenues and costs, a firm may determine whether it is making enough money to cover its expenses and continue to grow.

Understanding the difference between bookkeeping and accounting also helps ensure that the data feeding into the P&L is accurate and properly categorized. A well-managed profit and loss statement helps identify areas where a company can cut costs or boost income, making it an important tool for performance evaluation.

2. Decision-Making Tool

The profit and loss statement is an important tool for management to use when making decisions. It offers the necessary information for budgeting, forecasting, and strategic planning. By examining financial data, managers can alter their strategy to increase profitability, better allocate resources, and develop more accurate financial forecasts for the future.

3. Investor Relations

The profit and loss statement provides transparency for investors and stakeholders, allowing them to assess a company’s financial health. By providing a detailed record of revenue and expenses, investors can analyze the risk and potential return on their investment. A well-maintained P&L fosters trust, which is critical for recruiting and maintaining investors.

4. Compliance and Reporting

Financial reporting and regulatory compliance are critical components of the P&L statement. Companies in Singapore must prepare their P&L to meet tax reporting requirements and adhere to regulatory norms. According to IRAS, sole proprietors are required to use either a 2-Line or 4-Line Statement to report their income, with the 4-Line Statement required if revenue exceeds $200,000. Accurate and timely P&L reports ensure compliance and help businesses avoid penalties, maintaining trust with authorities and stakeholders.

Limitations of the P&L Statement

While the Profit and Loss (P&L) statement is an important financial tool, it has limitations that must be considered when assessing a company’s financial health. These constraints stem from the fact that the P&L is solely concerned with operational success and profitability, with no regard for other critical financial aspects. Understanding these limits is critical for doing a thorough study of a company’s financial situation. The fundamental constraints of the profit and loss statement include the following:

1. Non-Cash Items

The P&L statement does not include cash flow, which is critical for determining a company’s liquidity. It shows profitability but does not reflect actual cash available, because non-cash items such as depreciation or changes in working capital can affect profit but not cash flow. Cash flow statements should also be studied to get a full picture of the finances.

2. Historical Data

The profit and loss statement represents previous performance but does not necessarily predict future results. It does not account for changes in market conditions or corporate initiatives that could impact profitability. While valuable for assessing previous performance, it should be supplemented with forward-looking financial data to ensure more accurate future planning.

3. Excludes Non-Operating Factors

The profit and loss statement focuses solely on revenues and expenses, excluding non-operating items like assets, liabilities, and equity. This reduces its capacity to provide a comprehensive picture of a company’s financial situation. A more in-depth analysis should include a review of the balance sheet and cash flow statement.

Analyzing a P&L Statement

Analyzing a profit and loss (P&L) statement is critical for understanding a company’s financial performance and making sound decisions. By carefully reviewing important metrics and comparing data over time, firms and investors can analyze profitability, detect trends, and find areas for improvement. A thorough examination of the P&L statement provides important insights into both present performance and potential future results. The key factors of examining a profit and loss statement include the following:

1. Key Metrics

Key metrics from the profit and loss statement provide a clear and succinct approach to assessing a company’s profitability and financial efficiency. These indicators assist in determining how successfully a business generates profit from its revenue and manages costs at various phases of its operations.

By assessing these measurements, organizations and investors can acquire a better understanding of their financial performance. The essential KPIs to focus on are as follows:

a. Gross Profit Margin

The gross profit margin is an important indicator for determining how effectively a company produces and sells its products in relation to its revenue. It focuses on the direct costs of production, such as raw materials and labor, to assess how much income is available to cover additional expenses. The formula to calculate gross profit margin is:

Gross Profit Margin = Gross Profit / Revenue

This method determines the percentage of revenue that surpasses the cost of goods sold (COGS), demonstrating how effectively a company manages its production expenses. A higher gross profit margin suggests that the organization is effectively controlling manufacturing costs while retaining more income for additional commercial activities.

b. Operating Profit Margin

The operating profit margin measures a company’s capacity to profit from its core business activities after accounting for running expenses such as workers, rent, and utilities. It removes non-operating income and expenses, such as interest and taxes, to provide a more accurate view of operating efficiency. Understanding the operating margin for a business is crucial as it shows how effectively a company turns revenue into operating profit. The formula for determining the operating profit margin is:

Operating Profit Margin = Operating Income / Revenue

This formula calculates the proportion of income that remains after operating expenses are deducted. A greater operational profit margin suggests that the company is more efficient in turning revenue to operating profit.

c. Net Profit Margin

The net profit margin is a key metric that reflects a company’s overall profitability after deducting all expenses such as operating costs, interest, taxes, and non-operating items. It offers a clear image of the company’s ability to earn profit once all obligations are met. The formula to calculate net profit margin is:

Net Profit Margin = Net Income / Revenue

This formula determines the percentage of income that converts to actual profit after all expenses. A larger net profit margin shows that the company is efficiently transforming revenue into profit, indicating good financial health.

2. Trend Analysis

Trend analysis examines profit and loss statements over many time periods to detect patterns in revenue, expenses, and profitability.

By using accurate data produced through double-entry accounting, firms can identify patterns, estimate future performance, and address issues such as rising expenses or dropping sales, allowing for better-informed decision-making.

3. Industry Comparison

Industry comparison is comparing a company’s performance to industry norms or competitors. This helps measure how well a company performs in comparison to others, providing insights into competitive positioning and emphasizing areas where improvements are required to remain competitive.

P&L Management

P&L management entails overseeing and optimizing the many components of a Profit and Loss statement to increase a company’s profitability. This technique enables firms to successfully manage revenues and costs, ensuring that financial objectives are reached. An example of cost control in this context is regularly evaluating and modifying profit and loss statements to ensure that expenditures are aligned with business goals. Businesses can improve their overall financial performance by regularly evaluating and modifying profit and loss statements. The major strategies for effective profit and loss management include the following:

1. Cost Control

Cost control entails putting in place ways to reduce wasteful expenses and make better use of resources. This includes analyzing operational expenses through the general ledger, removing inefficiencies, and identifying areas where spending can be cut without sacrificing product or service quality.

Effective cost control increases profitability by ensuring that the company spends wisely and only on important tasks.

2. Revenue Enhancement

Revenue improvement entails recognizing and capitalizing on possibilities to boost sales and profitability. This could include entering new markets, launching new products or services, or adjusting pricing methods. Businesses that investigate ways to increase income can enhance their financial situation and provide more prospects for growth and profitability.

3. Efficiency Improvements

Efficiency improvements entail simplifying operations to increase production and save expenses. This includes automating procedures, streamlining workflows, and removing bottlenecks in production and service delivery. Companies can raise profit margins by improving operational efficiency, allowing for higher profitability without increasing sales.

P&L in the Singapore Context

In Singapore, the profit and loss (P&L) statement is an important part of the financial reporting process for firms. It is a critical document for determining a company’s profitability, and its preparation is mandated by law for regulatory and tax purposes. Companies must adhere to strict rules to ensure accurate and compliant reporting. The key characteristics of profit and loss in the Singapore context include the following:

1. Regulatory Requirements

Companies in Singapore must prepare financial statements, including P&L accounts, as part of their annual reporting obligations. This ensures transparency and allows stakeholders to assess the company’s financial health. These statements must be filed with ACRA and IRAS, and a financial audit is typically conducted to verify compliance with regulations.

2. Tax Implications

The P&L statement calculates a company’s net profit or loss, which helps determine its taxable income in Singapore. Accurate reporting of revenue and expenses is critical for computing corporate taxes and complying with tax legislation, ensuring that businesses avoid penalties for inaccurate reporting. Additionally, understanding corporate deductions and expenses is essential to minimizing tax liabilities while maintaining compliance.

3. Compliance Standards

Companies in Singapore must prepare their profit and loss accounts in accordance with the Singapore Financial Reporting Standards (SFRS). The SFRS guarantees uniformity and openness in financial reporting by establishing norms for revenue recognition, expense reporting, and presentation that satisfy regulatory and best practice requirements.

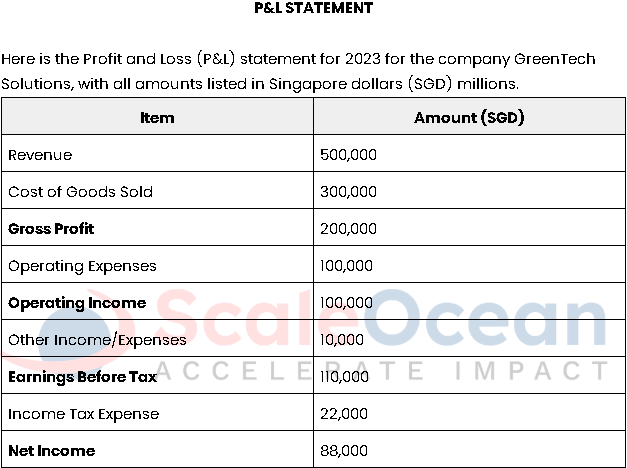

Practical Application: P&L Statement Example

The table presents the 2023 Profit and Loss (P&L) statement for GreenTech Solutions, with figures in SGD millions. The company earned SGD 500,000 in revenue, with COGS of SGD 300,000, resulting in a gross profit of SGD 200,000. After operating expenses of SGD 100,000, the operating income was SGD 100,000.

Other income/expenses of SGD 10,000 brought earnings before tax (EBT) to SGD 110,000. After an income tax expense of SGD 22,000, the net income for the year was SGD 88,000. Below is an example of a simplified P&L statement:

Streamline Your P&L Analysis with ScaleOcean’s Accounting Software

ScaleOcean’s accounting software in Singapore enables firms to streamline financial operations by offering real-time insights and seamless connectivity across sales, procurement, inventory, and asset management. It automates duties like transaction recording and reporting, resulting in accurate and up-to-date financial data. This integration increases productivity, lowers errors, and improves decision-making in developing firms.

If you want to discover how ScaleOcean can improve your financial processes, we provide a free demo of the program so you may see its possibilities firsthand. Furthermore, firms may be eligible for the CTC grant, which assists with the cost of integrating digital solutions such as ScaleOcean. The following are the key features of ScaleOcean’s accounting software:

- End-to-End Financial Integration, ScaleOcean’s accounting integrates with sales, procurement, inventory, and asset management for real-time financial tracking.

- Comprehensive Financial Reporting, Provides customizable Profit & Loss, balance sheets, and cash flow reports for quick financial insights.

- Automated Transaction Recording, Automatically records transactions like sales, purchases, and inventory adjustments, reducing errors.

- Real-Time Budget Comparison, Compares actual P&L figures with budgeted ones in real-time for better financial oversight.

- Seamless Integration Across Modules, Accounting integrates smoothly with other ScaleOcean modules like sales, inventory, and procurement.

Conclusion

The profit and loss (P&L) statement is an important financial record that provides useful information about a company’s profitability and operational efficiency. By summarizing a company’s revenues, costs, and expenses, it paints a clear picture of financial performance, allowing firms to assess their progress and identify opportunities for growth.

Regular creation and analysis of the profit and loss statement is essential for good financial management, allowing organizations to track profitability and improve operational efficiency. With ScaleOcean’s accounting software, this process is automated, resulting in accurate and timely results. Businesses that streamline financial management can make better decisions, utilize their resources, and stay on pace to meet their financial objectives.

FAQ:

1. What is in a profit and loss statement?

A Profit and Loss (P&L) statement, or income statement, is a financial report that outlines a company’s revenues, costs, and expenses over a certain period. It generally includes sections for total revenue, cost of goods sold (COGS), gross profit, operating expenses (like SG&A), operating income, other income and expenses, earnings before tax (EBT), income tax expense, and net income.

2. How do you calculate the statement of profit and loss?

To calculate a Profit and Loss statement, begin with total revenue, subtract the cost of goods sold (COGS) to find the gross profit, then deduct operating expenses to arrive at the operating income. After factoring in other income and expenses, subtract income tax to get the net income. The formula is:

Net Income = (Revenue – COGS – Operating Expenses) + Other Income – Income Tax

3. How to explain P&L in an interview?

In an interview, explain the P&L statement as a key tool for understanding a company’s profitability and financial health. Describe how it shows a business’s ability to generate revenue, manage costs, and control expenses. Highlight the importance of sections such as revenue, gross profit, operating income, and net income, and how they aid in decision-making, growth analysis, and financial assessment.

4. How to create a profit or loss statement?

1. Collect revenue data: Gather all income generated from sales or services during the period.

2. Determine cost of goods sold (COGS): Calculate the direct costs associated with producing goods or services.

3. Calculate gross profit: Subtract COGS from total revenue to get gross profit.

4. Account for operating expenses: Include costs such as salaries, rent, utilities, and marketing.

5. Calculate operating income: Subtract operating expenses from gross profit to determine operating income.

6. Factor in other income/expenses: Add or subtract non-operating income or costs like investment gains or losses.

7. Subtract income tax: Calculate and subtract income tax to find the net income.

8. Organize the data: Use accounting software or a spreadsheet to display the information in an organized, clear manner.

PTE LTD..png)

.png)

.png)

.png)

.png)