A financial audit is a critical process for businesses, ensuring that financial statements are accurate, compliant with regulations, and reliable for stakeholders. Companies depend on audits to verify financial integrity, detect errors or fraud, and maintain transparency in their operations.

Whether conducted internally or by external auditors, a financial audit provides an objective review of records, accounting policies, and financial transactions to assess compliance and financial stability.

Understanding the audit process and best practices can help businesses strengthen financial controls, mitigate risks, and improve decision-making.

In this article, we will break down the key aspects of financial audits, their significance in business operations, and how to conduct them effectively. By the end, you’ll have a clear strategy for maintaining compliance and ensuring financial accountability.

- A financial audit is an independent examination of a company’s financial statements to ensure accuracy, transparency, and compliance with accounting standards.

- The financial audit process involves planning, fieldwork, reporting, and follow-up stages to identify discrepancies and strengthen financial stability.

- Financial audits help businesses detect errors, prevent fraud, and increase trust among stakeholders, contributing to better decision-making.

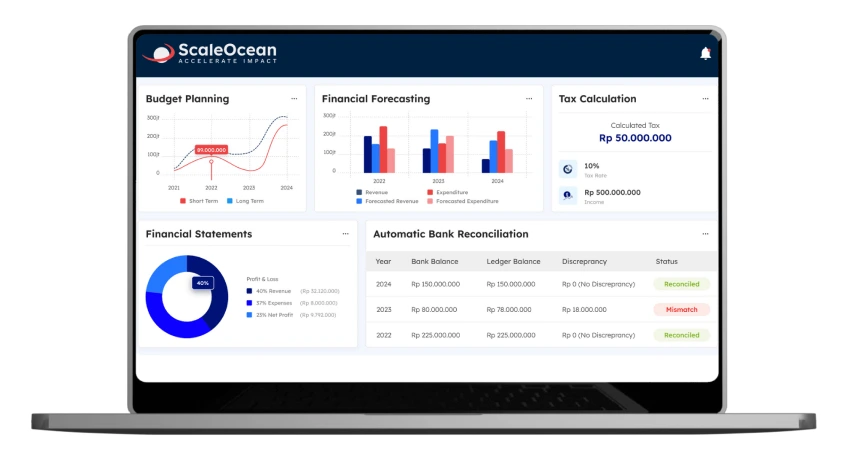

- ScaleOcean accounting software streamlines financial audits with automation, real-time tracking, and seamless integration.

What is a Financial Audit?

A financial audit is an independent examination of a company’s financial statements and records to ensure accuracy, reliability, and compliance with relevant laws and accounting standards. It helps businesses verify that their financial information is free from material misstatements, whether due to errors or fraud.

Conducted by internal or external auditors, the process involves reviewing transactions, financial reports, and internal controls. A financial audit improves transparency, boosts stakeholder confidence, and ensures regulatory compliance, making it critical for businesses that want to maintain credibility and make sound financial decisions.

The Importance of Financial Audits for Businesses

Financial audits play a vital role in understanding a business’s financial health. By conducting a thorough review of financial statements, businesses can uncover any discrepancies and ensure that everything is transparent. This builds trust with stakeholders and helps make informed decisions.

Below are the key points highlighting the importance of financial audits for businesses:

- Precision and Trustworthiness: Financial audits ensure that a business’s financial information is both accurate and reliable. This precise reporting creates confidence among stakeholders, enabling businesses to make smarter decisions based on solid data, which strengthens their position in the marketplace.

- Fraud Mitigation: A financial audit helps detect and prevent fraudulent activities by thoroughly reviewing records for inconsistencies or schemes that could harm the business. It also serves as a deterrent, reducing the likelihood of fraud by ensuring financial activities are closely monitored.

- Compliance with Regulations: Financial audits help businesses stay compliant with laws and regulations, avoiding fines, penalties, and legal issues. Compliance builds trust with authorities and stakeholders, while also showing a commitment to ethical business practices.

- Assurance for Stakeholders: Stakeholders such as investors, creditors, and employees rely on financial audits to confirm that a business is managing its finances responsibly. Successful audits provide assurance that the company is financially stable and effectively managing its resources.

- Enhancing Operational Efficiency: Financial audits offer valuable insights that help businesses identify inefficiencies in their operations. By highlighting areas for improvement in budgeting and resource allocation, audits enable businesses to make smarter decisions, enhancing overall operational performance.

Types of Financial Audits

The three primary types of financial audits are explained below:

External Audits

External audits are conducted by independent auditors to provide an objective assessment of an organization’s financial statements.

These audits ensure that Singapore accounting standards and regulatory obligations are met, providing confidence to investors, lenders, and regulatory agencies. External audits improve openness and stakeholder confidence by ensuring financial accuracy and detecting irregularities.

Internal Audits

Internal audits are performed by a business’s financial controller to assess its financial controls, risk management, and governance processes. Unlike external audits, these are ongoing assessments aimed at improving operational efficiency and preventing fraud.

Internal audits help businesses identify weaknesses, enhance internal controls, and ensure that financial practices align with organizational goals and regulatory requirements.

Forensic Audits

Forensic audits investigate financial discrepancies, fraud, or legal violations within an organization. These audits include a thorough financial study to detect wrongdoing such as embezzlement, asset misappropriation, or financial statement fraud.

Often used in legal proceedings, forensic audits help businesses uncover financial irregularities and strengthen fraud prevention measures.

Internal Revenue Service (IRS) Audits

An IRS audit is a detailed review of a business’s financial records to ensure it is following tax laws properly. The audit checks that income, deductions, and credits are accurately reported, helping to ensure the business is paying the right amount of taxes.

IRS audits can happen if there are inconsistencies in tax filings, unusually high deductions, or any other red flags that catch the IRS’s attention. Going through an IRS audit helps businesses avoid penalties, stay on track with taxes, and maintain transparency in their finances.

Standards and Regulations of Financial Audit

Financial audits need to follow specific standards and regulations to ensure the results are both accurate and reliable. These guidelines help keep things transparent, minimize risks, and build trust with stakeholders. Sticking to these standards is essential for any business to succeed.

Below are the key standards and regulations for financial audits:

GAAS (Generally Accepted Auditing Standards)

GAAS provides a set of rules for conducting audits consistently and reliably. These standards ensure that auditors evaluate financial statements objectively and with integrity, giving businesses a true and clear picture of their financial health.

By following GAAS, auditors can make sure that financial statements truly represent a business’s performance. This boosts stakeholder confidence, helps with better decision-making, and ensures a company remains credible in the marketplace.

PCAOB (Public Company Accounting Oversight Board)

The PCAOB oversees auditors of public companies to ensure they stick to high-quality auditing practices. Their guidelines focus on making sure audits are thorough and transparent, ultimately protecting investors and ensuring financial reports are trustworthy.

When companies follow PCAOB standards, they show a commitment to top-notch auditing practices. This regulation ensures consistency among public companies and guarantees that investors and stakeholders get reliable and accurate financial information.

ISA (International Standards on Auditing)

ISA establishes global auditing standards to create consistency in audits worldwide. These standards guide auditors in reviewing financial statements based on best practices, giving businesses internationally accepted evaluations of their finances.

By adhering to ISA, businesses can operate confidently across international markets. These standards promote trust and transparency, helping companies navigate the global financial landscape with assurance.

Stages of a Business Financial Audit Process

In businesses, the financial audit process is divided into several stages, each to ensure financial reporting accuracy, compliance, and transparency. These stages assist auditors in systematically evaluating financial statements, identifying risks, and making recommendations for improvement.

A financial audit consists of four main stages as follows:

1. Planning

The planning stage involves defining the audit scope, objectives, and methodology. Auditors review financial records, assess risk areas, and establish a structured approach for the audit.

This stage ensures that auditors focus on key financial aspects, including financial instruments, and comply with regulatory standards, and that they create an efficient audit plan tailored to the organization’s needs.

2. Fieldwork

During fieldwork, auditors gather and analyze financial data, test internal controls, and identify potential discrepancies. This phase includes examining transactions, verifying financial records, and interviewing key personnel.

Fieldwork is crucial for detecting errors, fraud, or inefficiencies, ensuring that financial statements reflect an accurate and fair representation of the organization’s financial health.

3. Reporting

The reporting stage involves documenting audit findings, conclusions, and recommendations in an official audit report. Auditors summarize their observations, highlight compliance issues, and provide actionable insights.

To ensure accuracy and efficiency, auditors can also rely on tools like bank reconciliation within ERP software to streamline the process of aligning bank statements with internal records.

4. Follow-up

The follow-up stage ensures that corrective actions are implemented based on audit findings. Auditors review whether management has addressed identified issues and strengthened internal controls. Additionally, auditors’ opinions on the effectiveness of these corrective measures play a crucial role in ensuring transparency and accuracy.

This step is essential for continuous improvement, regulatory compliance, and reducing future financial risks, helping organizations maintain long-term financial integrity and accountability. By incorporating auditors’ feedback, businesses can proactively address potential vulnerabilities and stay on track with industry standards.

Below are the types of auditors’ opinions that businesses may encounter:

- Clean Opinion: A clean opinion, also known as an unqualified opinion, indicates that the financial statements are accurate and comply with all accounting standards. This is the best possible outcome of an audit, reassuring stakeholders that the company’s financial health is well-managed.

- Conditional Opinion: A conditional opinion, or qualified opinion, is given when auditors find that most of the financial statements are accurate, but there are some exceptions. These exceptions could be related to specific issues like accounting policies or estimations that don’t fully align with standards.

- Adverse Opinion: An adverse opinion is issued when auditors determine that the financial statements do not present a true and fair view of the company’s financial position. This opinion usually results from significant discrepancies or non-compliance with accounting principles that affect the financial statements.

- Withheld Opinion: A withheld opinion occurs when auditors are unable to express an opinion on the financial statements due to insufficient evidence or limitations in the scope of the audit. This often happens when auditors cannot access all the necessary information to form a definitive conclusion.

Key Components of a Financial Audit

A financial audit is a thorough process that evaluates an organization’s financial statements and practices. Key components of a financial audit ensure accuracy, transparency, and compliance while identifying potential risks and inefficiencies.

These components include audit planning, risk assessment, internal control evaluation, and substantive testing. For a practical illustration of these concepts, you can refer to a profit and loss statement example to see how financial data is typically structured and audited.

Here are the main components of a financial audit:

Audit Plan

The audit plan serves as a roadmap, outlining the audit’s objectives, scope, and procedures. It provides auditors with a structured approach, ensuring that all areas of financial reporting are covered.

The plan also includes timelines, resources, and the roles of the audit team to ensure a smooth process.

Risk Assessment

Risk assessment involves identifying areas of financial statements that have a higher likelihood of material misstatement.

This step helps auditors focus their efforts on critical areas, considering factors like complexity, industry regulations, and previous audit findings. It guides the audit process and prioritizes areas that need more scrutiny.

Internal Control Evaluation

Internal control evaluation is a critical step in ensuring the integrity of a company’s financial reporting. Auditors assess the effectiveness of policies and procedures designed to prevent errors or fraud.

They focus on internal controls over financial reporting and review how well the organization follows its established practices.

Substantive Testing

Substantive testing involves verifying the accuracy of financial information by performing detailed tests on transactions and balances.

This stage helps auditors gather evidence to confirm the validity of financial statements. Substantive testing can include checking documentation, reviewing accounts, and sampling transactions to ensure the financial data’s integrity.

How to Conduct a Financial Audit

Conducting a financial audit involves a structured approach to ensure accuracy, compliance, and transparency in financial reporting. Each step plays an important role in identifying risks, verifying financial data, and improving internal controls.

Using the best financial accounting software in Singapore can streamline this process, making it more efficient. The key steps in conducting a financial audit include:

1. Preparation

The preparation stage involves gathering necessary financial documents, understanding the organization’s operations, and setting audit objectives.

Auditors examine financial accounts, inventory accounting, procedures, and previous audits to develop a clear audit strategy. Proper preparation enables a seamless audit process, allowing auditors to concentrate on critical financial areas and any compliance concerns.

2. Risk Assessment

Auditors use risk assessment to identify areas that are most vulnerable to errors, fraud, or misstatements. This step entails analyzing financial data, auditing internal controls, and determining regulatory compliance.

By identifying high-risk areas, auditors can focus their efforts and create effective audit procedures to ensure financial integrity and reduce potential discrepancies.

3. Testing

During the testing phase, auditors perform detailed examinations of financial transactions and internal controls. This includes verifying account balances, reviewing supporting documentation, and conducting analytical procedures.

Testing ensures that financial data is accurate, complete, and compliant with accounting standards, helping organizations detect potential errors or fraudulent activities.

4. Reporting

The reporting phase entails compiling audit findings into a comprehensive audit report. This report includes key observations, compliance concerns, and suggestions for improvement.

It is an invaluable resource for management and stakeholders, providing insights into financial goals and performance, operational risks, and areas that need to be addressed.

5. Follow-up

Follow-up is the last step in ensuring that recommended changes and corrective actions are carried out correctly. Auditors determine whether management has addressed identified weaknesses and improved financial controls.

Regular follow-ups help organizations improve compliance, increase financial accountability, and avoid recurring problems in future audits.

Limitations of Financial Audits

While financial audits are necessary to ensure accuracy and compliance, they have some limitations that can reduce their effectiveness. These limitations are caused by time constraints, reliance on management, and the possibility of undetected fraud.

Understanding the following challenges allows businesses to take additional steps to improve financial oversight.

Scope Constraints

Auditors may not examine every transaction due to time and resource limitations. Instead, they use sampling methods and risk-based approaches to focus on key financial areas.

While this makes audits more efficient, it also means some errors or irregularities may go unnoticed if they fall outside the reviewed sample.

Inherent Limitations

Some misstatements may not be detected, especially if fraud involves collusion among employees or management. Even with rigorous audit procedures, certain financial manipulations can be difficult to uncover.

Auditors assess financial data based on available records, but hidden transactions or intentionally falsified documents can evade detection.

Dependence on Management

Auditors rely on the accuracy and completeness of information provided by management. If management withholds key documents or presents misleading data, the audit’s findings may not fully reflect the organization’s true financial position.

This dependency highlights the importance of ethical corporate governance and strong internal controls.

To overcome these limitations, businesses can rely on ScaleOcean ERP, which offers real-time data tracking, robust internal controls, and automation. With this solution, companies can enhance financial accuracy, reduce risks, and improve overall transparency, ensuring better financial oversight.

Accountants Role in Financial Audits

Accountants play an important role in financial audits because they ensure the accuracy of financial data, assist auditors, and drive necessary improvements. Their involvement streamlines the auditing process, improves compliance, and promotes financial transparency.

Accountants’ primary responsibilities during financial audits include preparation, collaboration, and implementation. Here are the detailed explanation of the accountants’ primary responsibilities:

Preparation

Before the audit begins, accountants ensure that all financial records are accurate, complete, and well-organized. Account reconciliation, financial statement review, and ensuring accounting standards compliance are all part of this process.

Proper preparation reduces audit discrepancies, accelerates the auditing process, and allows auditors to analyze financial data more efficiently.

Collaboration

During the audit, accountants collaborate closely with auditors to provide documents, explanations, and clarifications. They assist auditors with understanding financial transactions, internal controls, and any unusual entries.

Effective collaboration ensures that the audit process runs smoothly, reduces misinterpretations, and improves audit findings.

Implementation

After the audit, accountants are responsible for applying audit recommendations to improve financial practices. This may include strengthening internal controls, updating accounting policies, or addressing compliance gaps.

Implementing audit recommendations helps organizations enhance financial accuracy, reduce risks, and improve overall financial management.

Manage Your Financial Statements with ScaleOcean

Managing financial statements is crucial for informed business decisions, but without the right tools, tracking income, expenses, and cash flow can be tedious and error-prone. ScaleOcean Accounting Software streamlines financial management with automation and real-time tracking, ensuring accuracy and efficiency. Businesses can request a free demo to see how it optimizes financial processes.

With its user-friendly system, ScaleOcean simplifies revenue tracking, expense management, tax handling, and financial reporting. Additionally, ScaleOcean is eligible for CTC grants, providing financial support to businesses in Singapore to implement ERP solutions and enhance operational efficiency.

What sets ScaleOcean apart is its cost-effective, all-in-one solution with unlimited users at no extra cost, ideal for growing businesses. Offering 200+ industry-specific modules, advanced customization, and transparent pricing, it ensures seamless multi-branch integration, AI-driven analytics, and robust security for smarter decision-making.

Key Features:

- Accounts Receivable & Payable: Keep track of customer invoices and supplier payments efficiently to ensure smooth cash flow management.

- Cash Flow Forecasting: Monitor and predict financial trends by analyzing real-time cash flow.

- Budget Planning: Set financial limits and control expenses to prevent overspending.

- Bank Reconciliation: Automatically match bank transactions with company records, reducing discrepancies.

- Comprehensive Financial Reporting: Generate financial reports such as balance sheets, income statements, and profit and loss statements with ease.

Utilizing advanced financial management software can streamline the audit process by automating data collection, enhancing accuracy, and ensuring compliance with accounting standards. Implementing such solutions can lead to more efficient audits and better financial oversight.

With ScaleOcean Accounting Software, businesses can reduce human errors, speed up financial reporting, and gain real-time visibility into their financial health. This enables organizations to focus on strategic growth while maintaining strong financial control.

Conclusion

Financial audits play a big role in ensuring transparency, regulatory compliance, and building stakeholder confidence. They help businesses verify financial accuracy, detect irregularities, and strengthen internal controls.

By understanding the audit process, companies can conduct thorough financial reviews, address potential risks, and improve decision-making.

While audits have limitations, companies can mitigate these challenges by adopting best practices, enhancing internal oversight, and utilizing reliable accounting tools such as ScaleOcean accounting software.

A well-executed audit not only safeguards financial integrity but also boosts operational efficiency, ensuring long-term business stability.

FAQ:

1. What are the 4 types of financial reports?

The four main financial reports include the balance sheet, income statement, cash flow statement, and statement of shareholders’ equity. Together, these documents give a complete overview of a company’s financial health, performance, and changes over time.

2. What are the 7 audit procedures?

The seven essential audit procedures are inspection, physical examination, observation, external confirmation, inquiry, recalculation, and reperformance. These procedures are crucial in conducting thorough and reliable audits that ensure accurate financial reporting.

3. What are the 7 principles of auditing?

Key Principles of Auditing:

1. Integrity, Independence, and Objectivity

2. Confidentiality

3. Skill and Competence

4. Work Performed by Others

5. Documentation

6. Planning

7. Audit Evidence

4. Who performs a financial audit?

Financial audits are generally conducted by accounting firms that specialize in financial reporting. These firms provide assurance services, including audits, to ensure the accuracy and reliability of a company’s financial statements.

PTE LTD..png)

.png)

.png)

.png)

.png)