Effective financial management is an essential skill that can shape the future of both individuals and businesses. However, many people face challenges like managing a budget, dealing with unexpected expenses, and making the right investment choices. Tackling these issues early on can lead to long-term financial success.

For younger generations, mastering financial management is becoming even more important. In fact, according to the CIMB, 60% of respondents under the age of 30 aim to achieve financial independence before turning 40.

What’s even more promising is that 54% of them feel confident in their financial management skills. This shows a growing understanding of how crucial financial planning is for achieving future goals.

Understanding the major components of financial management is critical for organizations seeking to succeed in today’s competitive environment. So, in this article, let’s look at what financial management is, why it’s important, and what best practices businesses should follow.

- Financial management is a method of strategically planning, arranging, and monitoring financial activities and resources to fulfill organizational objectives.

- Financial management goals are focused on maximizing profit, enhancing shareholder value, ensuring liquidity, managing risks, and more.

- Types of financial management include capital structure & planning, capital budgeting, financial decision-making, and working capital management.

- ScaleOcean ERP helps businesses streamline financial processes, automate reporting, and provide real-time data, enhancing accuracy, decision-making, and operational efficiency.

What is Financial Management?

Financial management is a method of strategically planning, arranging, and monitoring financial activities and resources to fulfill organizational objectives that will ensure all departments stay on track.

Key components include budgeting and forecasting, which assist in estimating future financial demands, cash flow management, which ensures liquidity for everyday operations, and financial reporting and compliance, which provide transparency and regulatory conformance.

Effective financial management is important to long-term success, allowing firms to deploy resources efficiently while remaining compliant with local rules such as GST and IRAS standards. Companies that take a balanced approach to these issues can overcome financial obstacles and develop sustainable success.

Tactical vs. Strategic Financial Management

Tactical financial management is all about focusing on short-term goals and making sure daily operations run smoothly. It involves managing cash flow, solving immediate financial issues, and ensuring resources are used efficiently to meet the company’s current needs.

Strategic financial management, however, takes a longer-term view. It’s about aligning financial decisions with the company’s overall vision, planning for future growth, and making smart investment choices to help the business succeed over time.

The Importance of Financial Management

Effective financial management is crucial for the smooth functioning and growth of a business. It enables companies to deploy resources more efficiently, promotes strategic decision-making, and assures regulatory compliance.

NPV plays a key role in this by helping businesses assess the profitability of investments and prioritize projects that offer the highest returns, all of which contribute to long-term success and stability, as explained in the scope of financial management below:

1. Strategic Planning

Financial management starts with understanding what steps need to be taken to hit both short-term and long-term goals. By aligning financial strategies with business objectives, leaders can ensure that resources are used wisely to foster growth.

Leaders need to have clear insights into the company’s performance to make the best plans for the future. Knowing how things are going now helps in planning for potential obstacles and opportunities, keeping the business on a steady path.

2. Economic Stability

Careful financial management ensures that resources are allocated efficiently, which contributes to a company’s overall economic stability.

By focusing on financial metrics management, Businesses may stay resilient in the face of economic fluctuations by maximizing cash flow, lowering costs, and planning for future expansion.

3. Informed Decision-Making

Financial management provides businesses with essential data and insights, empowering them to make informed strategic decisions.

Accurate financial reporting, budgeting forecasts, and cash flow tracking help guide leaders towards profitable investments and sustainable business practices. You can also learn how to calculate profitability ratios to improve financial decision-making and strategy.

4. Regulatory Compliance

Effective financial management assures compliance with financial regulations and standards, thereby protecting the business’s reputation and legal status.

Compliance with legislation such as GST and IRAS minimizes costly penalties and fosters trust among stakeholders, investors, and authorities. If you use e-tax software, the software will help businesses stay compliant efficiently, ensuring accurate reporting and avoiding penalties.

5. Risk Management

A good financial management system can help companies detect and mitigate financial risks. By regularly conducting a financial audit, businesses can ensure that their financial data is accurate and reliable.

This helps businesses handle economic uncertainty and ensure their future operations by projecting prospective obstacles and managing assets, liabilities, and cash flow.

6. Financial Oversight

Good financial management ensures that every department is focused on the company’s larger vision. Staying within budget and working efficiently helps departments contribute to the bigger picture and supports the company’s goals.

Oversight ensures that robust financial control is maintained so that resources aren’t wasted and that every part of the business is aligned with the financial goals. Proper financial management helps all areas work together smoothly, leading to better overall performance and stability.

7. Operational Procedures

Operational procedures are essential in financial management as they establish the framework for day-to-day activities. These procedures ensure consistency, compliance, and efficiency in financial transactions, minimizing errors and promoting smooth operations across departments.

Having clear operational procedures also helps businesses track and control their financial resources. By defining processes for budgeting, reporting, and auditing, companies can maintain transparency, reduce financial risks, and ensure better decision-making in achieving financial goals.

The Components of Financial Management

A systematic process, financial management ensures the efficient use of resources to meet company goals. It includes the following essential components that collaborate to promote financial stability and long-term growth.

1. Financial Planning

Financial planning involves creating strategies to meet future financial needs. It includes budgeting, forecasting, and setting financial goals, ensuring the organization is prepared for both short-term obligations and long-term objectives.

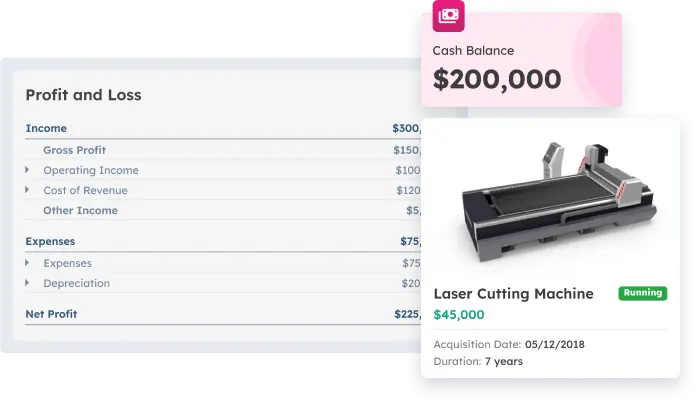

ERP for financial accounting plays a crucial role in this process by providing real-time financial data, enabling accurate forecasting, and streamlining budget management to support informed decision-making.

2. Investment Decisions

This component focuses on determining where to distribute resources for the best results. It entails reviewing investment opportunities, assessing risks, and choosing projects that are consistent with the business’s growth and profitability goals.

For instance, a proforma invoice example can be used to estimate financial needs before investing in large-scale projects, providing a clearer understanding of expected costs.

3. Financing Decisions

Financing decisions are made by determining the best combination of debt and equity. This balance ensures that the company can support its operations and investments while remaining financially stable and cost-effective.

To maintain financial stability, businesses can use accounts payable automation tools to optimize cash flow management, improve payment accuracy, and ensure timely settlement of debts.

4. Dividend Decisions

Dividend decisions involve determining the right balance between distributing profits to shareholders and retaining earnings for future investments. This decision directly impacts shareholder satisfaction as it determines their returns from the company.

At the same time, how much profit a company chooses to reinvest affects its ability to fund future growth initiatives. The decision can influence the company’s long-term development and its strategic goals moving forward.

Incorporating ScaleOcean ERP into your financial management strategy can streamline key processes like financial planning, investment, and financing decisions. With real-time data and automated tools, ScaleOcean ERP empowers businesses to make informed choices, ensuring long-term growth and stability.

Types of Financial Management

Financial management encompasses a wide range of actions aimed at managing resources, ensuring liquidity, and meeting long-term financial goals. This impacts a business’s financial health and strategic direction, as highlighted in the following sections.

1. Capital Structure & Planning

The optimal mix of debt and equity financing is crucial for supporting operations and driving growth, forming the foundation of effective capital structure and planning.

A well-balanced capital structure helps minimize costs, reduce risks, and strengthen the organization’s financial stability.

2. Capital Budgeting

Capital budgeting focuses on evaluating investment opportunities to ensure they align with the organization’s financial goals. It involves analyzing potential projects, assessing risks, and prioritizing those that offer the highest returns.

A key part of this process is understanding the impact of inventory accounting, as accurate inventory valuation helps determine the financial health of the business and supports sound investment decisions.

Effective capital expenditure (CAPEX) management is crucial in this process, as it helps businesses make informed decisions on long-term investments that drive growth.

3. Financial Decision-Making

Financial decision-making involves evaluating numerous funding sources and investment opportunities to maximize returns. It guarantees that resources are distributed efficiently to achieve the organization’s growth and profitability goals, aligning with the broader financial goals for business and enterprises.

4. Working Capital Management

Working capital management guarantees that the company has enough liquidity to satisfy its short-term obligations. It involves managing cash flow, inventory, and receivables to maintain operational efficiency and financial stability.

To ensure the accuracy of cash flow reporting, businesses can also implement a regular bank reconciliation process to align their records with the bank’s statements, ensuring consistency and preventing discrepancies. Referring to a cash flow statement format can help visualize how cash is tracked and reported effectively.

Financial Management Goals

Financial management goals are essential for steering a business toward long-term growth and stability. These objectives ensure effective resource allocation, risk mitigation, and value creation for stakeholders.

Proper analysis of financial figures like net sales allows businesses to focus on maximizing profit and managing costs effectively, ensuring sustainable profitability. Here are the main objectives of financial management:

1. Profit Maximization

Profit maximization focuses on increasing the organization’s overall profitability. By optimizing revenue streams and minimizing costs, businesses can achieve higher earnings, ensuring long-term financial sustainability and competitive advantage.

By focusing on profit maximization, businesses can make informed decisions that increase overall revenue. Streamlining processes, investing in high-return opportunities, and controlling unnecessary expenses are key strategies for improving profitability.

2. Wealth Maximization

Wealth maximization aims to enhance the company’s value for its shareholders. This involves making strategic decisions that increase share prices and dividends, ultimately delivering greater returns to investors. Effective use of financial instruments can also play a key role in achieving these goals.

To achieve wealth maximization, companies must prioritize long-term growth, focusing on sustainable strategies that increase shareholder value. This involves balancing dividend payouts with reinvestment to ensure a steady rise in the company’s market value.

3. Liquidity Management

Liquidity management guarantees that the firm has enough cash flow to cover its short-term financial obligations. Effective liquidity management eliminates operational disruptions and promotes confidence in creditors and investors.

Effective liquidity management involves continuously monitoring cash flow to prevent shortfalls. According to Irwin Insolvency, from the Zippia report, 82% of firms fail due to poor cash flow management.

By maintaining a healthy cash reserve, businesses can manage day-to-day operations without worry, ensuring they have enough funds for both routine and unexpected needs.

4. Risk Management

Risk management involves identifying and addressing financial risks to protect the company’s resources. By implementing strategies to mitigate uncertainties and utilizingaccounting software, businesses can safeguard assets and ensure steady growth.

Risk management is critical for financial stability. By regularly assessing risks and adjusting strategies accordingly, businesses can minimize potential losses. Utilizing financial tools like hedging and insurance ensures that the company stays resilient amid uncertainties.

5. Scenario Planning for Financial Forecasts

Scenario planning plays a crucial role in financial management by helping businesses anticipate various market conditions. By considering a range of possible outcomes, companies can prepare for uncertainties and adapt their strategies to stay financially secure.

Developing multiple financial scenarios enables businesses to assess potential risks and opportunities. This proactive approach helps leaders make informed decisions, ensuring financial goals are set realistically while staying aligned with long-term business objectives.

6. Managing Investor and Board Relationships

Building strong relationships with investors and the board is essential for achieving financial goals. Clear communication and regular updates on financial performance create trust, which is key to maintaining their support and securing future funding.

Understanding the needs and concerns of investors and the board helps businesses align their financial strategies with stakeholder expectations. This collaborative approach ensures financial goals are met while keeping strong, positive relationships with key decision-makers.

Challenges in Financial Management for Singaporean Businesses

Singaporean businesses face unique financial management challenges, from high operational costs to regulatory complexities. Overcoming these challenges is important for maintaining competitiveness and ensuring long-term success, as explored in the following sections.

1. Rising Operational Expenses

High operating costs can hurt profitability. To overcome this, companies can optimize expenses through accurate planning and cost-control procedures, ensuring that resources are distributed economically while maintaining quality.

2. Navigating Regulatory Complexity

The strict Singapore accounting standards, including GST and PDPA, can be challenging. Using compliance software enables businesses to meet regulations, avoid penalties, and simplify reporting procedures.

3. Talent Shortages in Finance

A lack of skilled financial professionals can hinder growth. Using government initiatives such as SkillsFuture to upskill finance staff ensures access to the knowledge required for effective financial management.

4. Inefficient Manual Processes

Manual financial tasks, such as utilizing a bookkeeping spreadsheet, are prone to errors and inefficiencies. Automating processes such as using invoicing software in Singapore, payroll, and reporting improves accuracy, saves time, and enhances overall productivity.

Streamline your Financial Management for Business with ScaleOcean

In today’s fast-paced business world, staying organized and efficient is important. ScaleOcean accounting software allows companies to easily streamline processes, decrease complexity, and increase productivity.

ScaleOcean automates essential operations to keep you in control of your business, allowing you to focus on growth and innovation. You can also try afree demo to experience firsthand how it can simplify and optimize your operations through our key features below.

- Automated financial reporting and compliance: Ensure accurate financial statements and compliance without manual effort.

- Real-time cash flow tracking and forecasting: Make informed decisions with up-to-date cash flow visibility and forecasts.

- User-friendly interface for seamless adoption: Simplified design ensures that teams can start using it with minimal training.

ScaleOcean provides a powerful ERP system backed by a dedicated support team in Singapore, offering real-time assistance to minimize operational delays. With affordable pricing and government subsidies, it is accessible to businesses of all sizes.

As demonstrated by real-world success stories from businesses that have implemented the system, ScaleOcean’s impact extends beyond its features. A retail company in Singapore experienced a 30% reduction in manual errors after adopting ScaleOcean ERP.

Conclusion

Mastering financial management is essential for businesses seeking sustainable growth and long-term success. By focusing on budgeting, cash flow, compliance, and risk management, businesses can boost profitability and ensure stability.

Effective financial management can increase profitability by up to 25%, enhancing decision-making, economic resilience, and resource allocation. With the rise of digital solutions like ScaleOcean’s top accounting software, businesses can streamline financial operations and maintain better control over their financial health.

Discover how ScaleOcean’s comprehensive financial tools can help your business make smarter financial decisions and drive growth. Strong financial management practices, which can lead to a 25% profitability boost, are vital for thriving in today’s competitive landscape.

FAQ:

1. What are the 4 C’s of financial management?

The 4 C’s are key financial indicators that determine your financial health: cash flow, credit, customers, and collateral. Improving these areas helps you access better funding options. Cash flow is the most critical as it impacts your ability to keep the business running. Managing expenses and maintaining cash in the business is crucial.

2. What are the 7 principles of financial management?

1. Consistency in financial systems and policies over time

2. Accountability to explain how funds and resources are used to stakeholders

3. Transparency in work plans, activities, and financial reporting

4. Prudence in financial decisions

5. Sustainability to ensure long-term viability

6. Profitability by ensuring resources are utilized efficiently

7. Liquidity to meet short-term obligations and ensure operational continuity

3. What are the 4 R’s in finance?

The 4 Rs process involves Recognize, Reflect, Reframe, and Respond. The Reflect step is especially important as it helps you tap into your emotional intelligence. This approach allows you to better understand and manage your financial decisions for smarter action.

4. What are the four pillars of finance?

Many financial experts agree that financial health relies on four key pillars: Spend, Save, Borrow, and Plan. Actively working on improving each of these areas is essential. If you’re not satisfied with your financial health, here are some helpful tips to strengthen each pillar.

PTE LTD..png)

.png)

.png)

.png)

.png)