In business financial management, two functions are often considered similar but have fundamental differences: bookkeeping and accounting. Both play a crucial role in maintaining a company’s financial health, but each has a distinct focus and methodology.

According to IRAS.GOV, accurate financial management records can ensure businesses easily comply with IRAS tax regulations, including GST filing and corporate tax reporting, thereby avoiding the risk of fines.

Therefore, understanding the differences between bookkeeping and accounting, as well as the preparation of both, is crucial for companies to manage financial reports appropriately and in accordance with applicable regulations.

In this article, we will explain in full what the differences are between bookkeeping and accounting, as well as how to understand and prepare them. Understand more here.

- Bookkeeping is the systematic process of recording and organizing a company’s financial transactions daily.

- Accounting is the process of analyzing, interpreting, and summarizing financial data to create comprehensive financial statements

- Bookkeeping vs. Accounting: Bookkeeping refers to the act of documenting daily financial transactions, whereas accounting involves reviewing and interpreting this data to produce financial statements and offer strategic insights.

- ScaleOcean accounting software provides the best solution to simplify bookkeeping and accounting in an integrated, accurate, and highly efficient manner in managing company finances.

Bookkeeping vs. Accounting: An Overview

Bookkeeping refers to the act of documenting daily financial transactions, whereas accounting involves reviewing and interpreting this data to produce financial statements and offer strategic insights.

Bookkeeping serves as the groundwork, concentrating on accuracy and transaction records, while accounting builds on this foundation to deliver comprehensive financial summaries, analysis, and planning.

Definition of Bookkeeping

Bookkeeping is the systematic process of recording and organizing a company’s financial transactions daily. This involves documenting all incoming and outgoing transactions, including sales, purchases, receipts, and payments.

The primary goal of bookkeeping is to ensure that all financial data is accurately recorded and maintained, providing a clear and up-to-date picture of a company’s financial status.

Definition of Accounting

Accounting is the process of analyzing, interpreting, and summarizing financial data to create comprehensive financial statements, such as balance sheets, general ledgers, income statements, and cash flow statements.

It goes beyond simple record-keeping by providing insights into a company’s financial health, performance, and future potential. Accounting involves making sense of the raw data collected through bookkeeping, ensuring that it adheres to established accounting principles and standards.

The Function of Bookkeeping, and How It Fits into Accounting

Bookkeeping serves as the foundation of the accounting process by ensuring that all financial data is properly documented and categorized. Without proper bookkeeping, accounting would not have reliable data to analyze.

Once the transactions are recorded, accountants can use this information to prepare financial statements, conduct financial analysis, and make informed decisions. In essence, bookkeeping provides the necessary data for accounting to interpret and evaluate a company’s financial health.

The Main Function of Accounting

The function of accounting is to analyze, interpret, and summarize the financial data recorded through bookkeeping. Using the accrual accounting method, accountants create financial statements that provide an overview of a company’s financial performance and position.

Beyond creating these reports, accounting also involves forecasting, budgeting, and advising on financial strategy. It helps businesses assess their profitability, manage costs, and plan for the future.

Accounting ensures compliance with regulatory standards, such as tax laws, and provides vital information to stakeholders, including investors, management, and government authorities.

The Difference Between Bookkeeping and Accounting

While both bookkeeping and accounting are essential for managing a company’s finances, they serve distinct roles. Understanding these differences is crucial for businesses to effectively manage their financial operations, assess their financial leverage, and plan for future growth.

Bookkeeping focuses on accurately recording daily transactions, providing the foundational data for accounting. Accounting, on the other hand, analyzes this data to assess financial health and guide strategic decisions.

Bookkeepers handle data entry, while accountants manage analysis and compliance. Accounting typically requires more education and certifications, offering greater career growth and higher earning potential compared to bookkeeping.

Here are some points of difference between bookkeeping and accounting that are easy and important to understand, including:

| Aspect | Bookkeeping | Accounting |

|---|---|---|

| Primary Focus | Recording and organizing daily financial transactions | Analyzing, interpreting, and summarizing financial data to create a report |

| Tasks | Involves tracking sales, purchases, payments, and receipts | Involves preparing financial statements, financial analysis, budgeting, cash flow statements, and forecasting |

| Scope | Has a narrower scope, dealing mainly with accurate transaction records | Has a broader scope, involving interpreting, reporting, and financial strategy |

| Process | A systematic process of data entry and organization | More complex process of analyzing, summarizing, and presenting financial data |

| Timing | Occurs continuously on a daily or weekly basis | Occurs periodically, typically monthly, quarterly, or annually |

| Stage | The initial stage in financial management | Comes after bookkeeping, using the recorded data to generate financial insight |

| Output | Financial records and general ledgers | Financial statements, reports, and analysis |

| Decision Making | Provides the raw data needed for decision-making | Provides actionable insights and recommendations for business decisions |

| Skills | Requires attention to detail and basic knowledge of accounting principles | Requires analytical skills, expertise in financial reporting, and a deeper understanding of financial strategy and regulations |

Choosing the Right Professional: Bookkeeper or Accountant?

When deciding between a bookkeeper and an accountant, it’s important to consider your business’s needs. If your primary requirement is accurate and organized record-keeping of daily transactions, a bookkeeper is the right choice.

They typically rely on double-entry accounting to ensure every transaction is recorded correctly and stays balanced. Bookkeepers ensure that all financial data is properly entered and maintained, setting the stage for effective financial management.

However, if your business requires in-depth financial analysis, tax planning, and strategic advice, an accountant is the better fit. Accountants interpret the data recorded by bookkeepers, provide financial insights, and help guide long-term decision-making.

Ultimately, businesses with complex financial needs may benefit from both professionals working together to ensure smooth operations and sound financial strategy.

Effective Bookkeeping and Accounting Strategies for Businesses

Implementing strong bookkeeping and accounting strategies is crucial for any business aiming to achieve financial stability and growth. These strategies ensure an accurate financial reporting process, also provide valuable insights that guide decision-making, tax planning, and long-term planning.

Here are the strategies for effective bookkeeping and accounting that you can use for businesses, including:

1. Foundational Bookkeeping Strategies

- Separate Business and Personal Finances: It’s crucial to keep personal and business finances separate. Use dedicated business accounts and credit cards to avoid confusion, simplify tracking, and prepare for taxes or audits. Pay yourself a salary to manage personal expenses.

- Record Every Transaction Carefully: Every income and expense should be recorded in the profit and loss statement report, no matter how small. Implement a reliable system to ensure nothing is overlooked.

- Implement a Reliable System & Automate: Shift from manual bookkeeping to cloud-based accounting software like ScaleOcean to automate data entry, track expenses, and minimize errors. This provides real-time financial data and streamlines invoicing and payroll.

- Establish Internal Controls: Divide financial responsibilities among different individuals (e.g., one person approves expenses, another records them) to reduce the risk of fraud or mistakes.

- Organize and Store Records: Keep a well-organized filing system for receipts, invoices, and financial documents. Store digital copies securely and centrally for easy access and as a backup during audits.

2. Strategic Accounting and Financial Management

- Choose the Right Accounting Method: Decide between cash basis (records transactions when cash is exchanged) or accrual basis (records transactions when they occur, regardless of cash flow). Accrual accounting offers a more accurate long-term financial picture.

- Regularly Reconcile Accounts: At least monthly, compare internal records with bank and credit card statements to ensure accuracy, detect errors, and prevent fraud.

- Monitor Cash Flow Closely: Use cash flow statements to track incoming and outgoing funds. This is critical to avoid liquidity problems and ensure there are enough funds for operations and growth.

- Analyze Financial Reports: Regularly review financial reports such as the income statement (P&L), balance sheet, and cash flow statement to assess performance and guide decision-making.

- Plan for Taxes in Advance: Stay on top of tax obligations and deadlines. Tracking deductible expenses throughout the year can simplify tax filing and reduce your tax burden.

- Budget and Forecast: Create budgets and forecasts to plan for future expenses, seasonal changes, and performance targets, comparing actual results to projections.

- Seek Professional Expertise: If bookkeeping and accounting become too complex, consider hiring a professional. Their expertise ensures compliance, offers valuable advice, and frees up your time to focus on running the business.

Manage Bookkeeping and Accounting in One Integrated Access with ScaleOcean

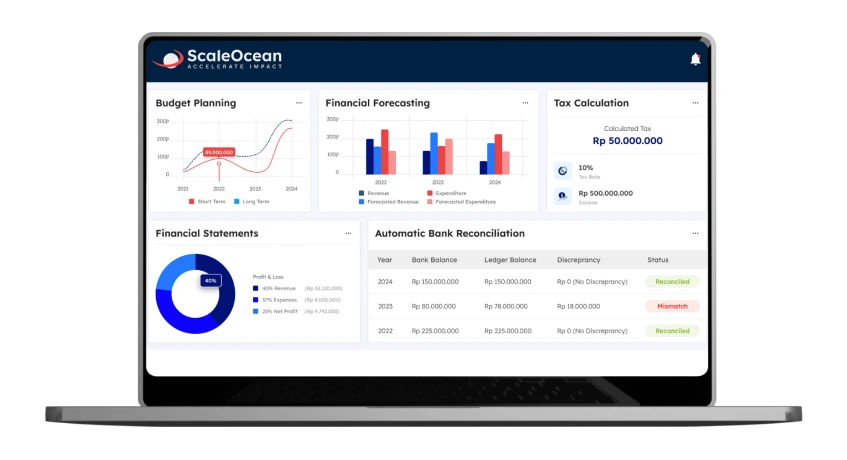

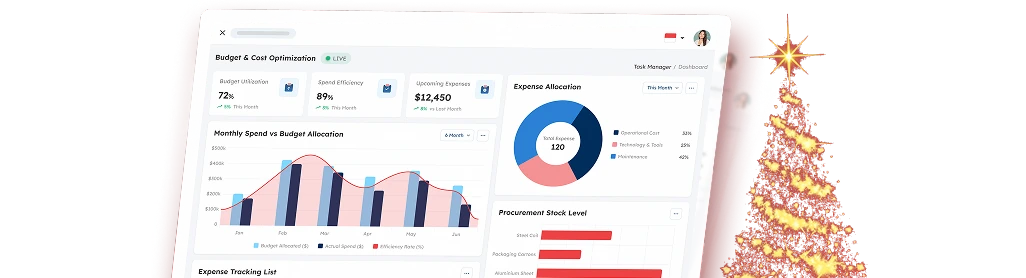

ScaleOcean accounting software, with its comprehensive and flexible ERP solution, offers an integrated approach to managing bookkeeping and accounting. Through customizable modules, ScaleOcean automates various financial processes, from recording daily transactions to accurate financial reporting.

ScaleOcean also provides seamless integration between financial functions, from sales to inventory, making it easy for you to gain real-time visibility into financial data without worrying about additional per-user costs.

Furthermore, ScaleOcean provides comprehensive customer service from start to finish, starting with free demos and consultations with a professional team, as well as after-sales service that ensures responsive ongoing support and resolves client issues quickly and efficiently.

ScaleOcean’s accounting software also offers several features specifically designed to optimize bookkeeping and accounting in your business, including:

- Automation of financial processes, such as recording financial transactions, tax calculations, and bank reconciliations, reduces the time required for manual tasks.

- Accurate financial reporting, such as balance sheets, profit and loss statements, and cash flow statements, aligns with IFRS financial standards and helps companies meet tax and other regulatory obligations.

- Real-time financial visibility, where all financial transactions are recorded and updated in real time, giving companies instant access to comprehensive financial information.

- Budget and expense control, where you can monitor and ensure expenses remain in line with established budget plans.

With these features, ScaleOcean Accounting Software can simplify bookkeeping and accounting processes, also ensure accuracy, efficiency, and compliance in managing company finances.

Conclusion

In conclusion, while bookkeeping and accounting serve distinct yet interconnected roles, both are essential for maintaining a business’s financial health and driving long-term success.

Bookkeeping ensures that transactions are recorded accurately, providing the foundation for accounting, which analyzes this data to make strategic decisions. For businesses looking to streamline both processes and ensure efficiency, using a robust ScaleOcean accounting software offers a seamless solution.

With its automated features, real-time data access, and comprehensive financial tools, ScaleOcean empowers businesses to manage their finances with ease, ensuring accuracy, compliance, and smarter decision-making. Do a free demo to get this solution for your business.

FAQ:

1. Which is better, bookkeeping or accounting?

Accountants typically have higher salary prospects and greater opportunities for career growth compared to bookkeepers. To enhance earning potential and ensure long-term job security, pursuing a career in accounting is a valuable choice.

2. Can a bookkeeper be called an accountant?

In larger companies, bookkeepers are commonly referred to as “accounting clerks,” and their roles may be specialized based on the types of data they handle, such as accounts receivable or accounts payable. Typically, a qualified accountant holds a BA degree in accounting or a business-related field with a minor in accounting.

3. What are the three types of bookkeeping?

These services encompass single-entry, double-entry, and virtual bookkeeping, with each method providing distinct benefits that can be customized to suit the size and complexity of a company’s financial activities.

4. Which comes first, bookkeeping or accounting?

Bookkeeping is the initial step in the accounting process, which is why the roles of a bookkeeper and an accountant frequently overlap. Bookkeeping involves recording and organizing financial data, whereas accounting focuses on analyzing and presenting that data.

PTE LTD..png)

.png)

.png)

.png)

.png)