When it comes to managing business finances, many companies still struggle to manage various financial control processes. This is especially true for medium-sized and large companies, which often have a large amount of scattered financial data that is still managed locally. This usually involves manual processes that increase the risk of human error and are time-consuming.

As businesses grow, companies can utilize cloud accounting, which provides real-time access to financial data from anywhere and at any time, accurately manages finances, and ensures all data is properly protected.

This article will provide comprehensive information on cloud accounting, its benefits, comprehensive features, and examples of the best cloud accounting applications, such as Scaleocean, as well as comprehensive reviews to help you choose the right cloud accounting system for your needs. Learn more here!

- Cloud accounting utilizes internet-based software for financial management, providing real-time access, collaboration, and storage on remote servers instead of local devices.

- The benefits of cloud accounting are improving business efficiency by offering real-time access, cost-efficiency, enhanced security, scalability, and better collaboration across teams and locations.

- Features of cloud accounting systems include automating tasks, providing real-time analytics, integrating AI for financial predictions, and allowing seamless collaboration, improving accuracy, and saving time.

- Popular cloud accounting software like ScaleOcean, QuickBooks, FreshBooks, Sage, and Zoho Books

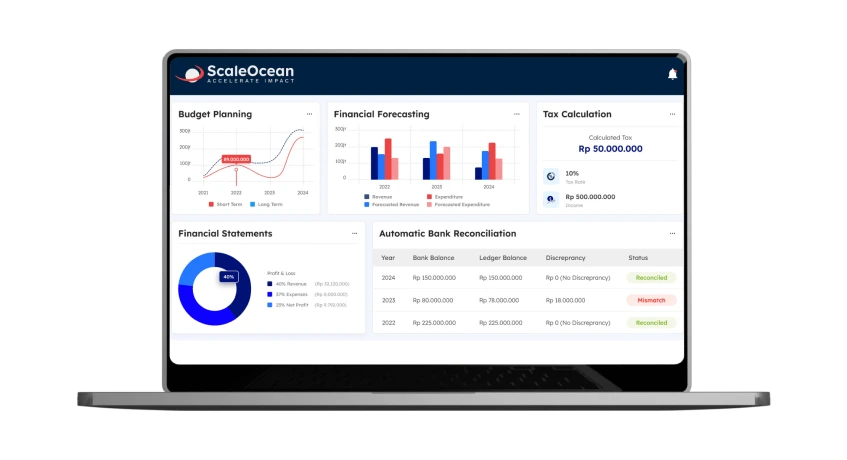

- ScaleOcean’s comprehensive solution of cloud accounting software, with seamless integration, provides an ideal solution for businesses looking to streamline financial management securely and efficiently.

What is Cloud Accounting?

Cloud accounting utilizes internet-based software for financial management, providing real-time access, collaboration, and storage on remote servers instead of local devices.

It offers advantages such as automatic updates, enhanced security, scalability, and cost-efficiency via subscription plans, making it perfect for remote teams and businesses requiring flexible, centralized financial control.

What’s the Difference between Cloud Accounting vs. On-premises Accounting?

When it comes to managing finances, businesses have two main options: cloud accounting and on-premises accounting. While both offer solutions for tracking and managing financial data, their approaches and benefits differ.

Understanding the key differences can help businesses make informed decisions based on their needs, size, and growth potential. Cloud accounting relies on internet-hosted software, enabling real-time access and collaboration from any location, with data stored on remote servers.

On-premises accounting, on the other hand, involves software installed on local devices, with data stored on-site. Cloud accounting offers flexibility, automatic updates, and lower upfront costs through subscription models, while on-premises solutions provide more control over data security but require higher initial investment and ongoing maintenance.

| Differences | Cloud | On-Premises |

|---|---|---|

| Where is the system installed? | Hosted on remote servers and accessed via the internet | Installed on local servers or individual computers |

| How to access? | Accessible from anywhere with an internet connection | Accessed from within the company’s network or local computers |

| How to pay? | Subscription-based, usually with lower initial costs | On-time upfront payment with additional maintenance fees |

| How are the securities? | High-level security with data encryption and backups provided by the provider | Greater control over data security, but requires its own security measures and infrastructure |

| How does data back-up & recovery? | Automatic data backups and disaster recovery are included | Requires manual backup procedures and dedicated systems for recovery |

| How to add a user? | Users can be added through the cloud provider’s admin portal, allowing easy access and setup through the web interface. | Users must be manually added on the local server, often requiring administrator-level access |

| How to integrate? | Easily integrates with other cloud-based tools and services | Integration may require custom solutions and more complex setups |

How Cloud Accounting Works?

Cloud accounting works by using internet-based software to manage financial data, hosted on remote servers instead of local computers. Businesses can access their financial records in real-time from anywhere with an internet connection.

The software automatically updates and stores data securely, ensuring accurate, up-to-date information. Cloud accounting systems integrate various features such as invoicing, payroll, and financial reporting, allowing teams to collaborate seamlessly.

With subscription-based pricing, cloud accounting offers scalability and flexibility for businesses of all sizes, eliminating the need for complex hardware or manual backups.

Benefits of Cloud Accounting

Cloud accounting offers numerous advantages for businesses looking to streamline their financial processes. With its ability to enhance efficiency, security, and scalability, cloud accounting is becoming increasingly popular among organizations of all sizes.

Here are some key benefits of adopting cloud accounting for your business, including:

Real-Time Access to Financial Data: Cloud accounting allows business owners and accountants to access financial data anytime, anywhere, with just an internet connection. This real-time access ensures that decision-makers are always up to date with their financial situation, enabling quicker responses to any issues or opportunities.

Cost Efficiency: With cloud accounting, businesses can reduce the costs associated with maintaining on-premise software and hardware. The subscription-based pricing model means there are no upfront investments, and automatic updates eliminate the need for costly system upgrades or technical support, making it a more affordable option for businesses of all sizes.

Enhanced Security: Cloud accounting platforms typically offer advanced encryption and secure backup systems, ensuring that sensitive financial data is protected. Unlike traditional systems that may be vulnerable to physical theft or system failures, cloud-based solutions offer automatic data backups and disaster recovery features, enhancing data security and reducing the risk of data loss.

Scalability and Flexibility: Cloud accounting systems are highly scalable, meaning they can grow with your business. As your needs expand, you can easily add new users, access more features, or integrate with other software. This flexibility allows businesses to customize their accounting solutions without the need for significant IT infrastructure changes or new hardware investments.

Improved Collaboration: Cloud accounting makes it easy for teams to collaborate in real-time, no matter where they are located. Multiple users can access and work on the same financial data simultaneously, improving communication between departments and streamlining processes. This collaboration ensures that everyone stays on the same page and can make more informed decisions quickly.

Challenges of the Traditional Accounting System

Traditional accounting systems, while effective in the past, face several challenges in today’s fast-paced business environment. Many businesses are still relying on outdated methods, which can lead to inefficiencies, errors, and higher operational costs.

Understanding the challenges of traditional accounting systems helps businesses recognize the need for more advanced solutions. Here are some common difficulties faced when using traditional accounting systems.

Limited Accessibility: Traditional accounting systems are typically installed on local servers or desktop computers, restricting access to authorized users only within the office. For example, if a business owner needs to review the financial status of the company while traveling, they may be unable to access key financial documents.

Long Upgrades: Upgrading traditional accounting systems often requires significant time and effort. Businesses must schedule downtimes, plan for manual data migration, and ensure compatibility with existing infrastructure. This long process disrupts daily operations and can result in expensive downtime.

End of Life (EOL): Traditional accounting systems eventually reach their End of Life (EOL), meaning the software is no longer supported or updated. Once EOL is reached, businesses face risks of using outdated software, including security vulnerabilities and lack of new features, making it difficult to stay competitive.

High Operational Costs: Maintaining a traditional accounting system can be costly due to the need for dedicated hardware, software licenses, and IT support. For example, small businesses often find themselves spending money on server maintenance, software updates, and hiring IT specialists to manage the system.

Data Security Risks: With traditional accounting systems, the responsibility for data security falls on the business itself. Local servers can be vulnerable to theft, natural disasters, or cyberattacks, leading to potential data loss or breaches.

For instance, if a company’s financial data is stored on an in-house server without proper security measures, it becomes an easy target for hackers. Additionally, manual backups may not be performed regularly, putting valuable financial information at risk and making recovery difficult.

Limited Integration and Automation: Traditional accounting systems often operate in isolation, meaning they cannot easily integrate with other business systems like payroll, inventory, or CRM tools.

For example, a business that uses a separate accounting and inventory system may find it cumbersome to reconcile financial data with inventory records. Without automation, processes such as invoicing, tax calculations, or report generation are time-consuming, leading to inefficiencies and missed opportunities for optimizing business workflows.

Core Features of Cloud Accounting Systems

Cloud accounting systems are equipped with powerful features that significantly improve the efficiency, accuracy, and accessibility of financial management. These features can streamline routine tasks, provide valuable insights, and support scalability as businesses grow.

Below are some of the key features that set cloud accounting apart.

- Automation Capabilities: Cloud accounting systems automate routine tasks such as invoicing, bill payments, and bank reconciliation. This reduces the need for manual data entry, saving time and minimizing errors. The best accounting software can recurring invoices can be automatically generated, and expenses can be tracked without manual input, improving overall efficiency and accuracy.

- Real-Time Analytics and Financial Data: Cloud accounting provides real-time access to financial data, allowing businesses to monitor cash flow, profitability, and financial health instantly. With real-time analytics, businesses can generate up-to-date reports, allowing for timely decision-making and the ability to respond quickly to changes in the market or operations.

- AI Accounting: AI-driven cloud accounting systems leverage machine learning to analyze financial data, predict trends, and automate complex processes. For example, AI can identify patterns in transaction data, helping businesses forecast cash flow, detect anomalies, and automate tasks like categorizing expenses. This reduces human intervention while improving accuracy.

- Collaboration Tools: Cloud accounting systems facilitate seamless collaboration among team members, accountants, and business owners. Multiple users can access and edit the same financial data simultaneously, no matter their location. This improves communication and ensures that everyone involved in financial decisions has access to the same up-to-date information.

- Mobile App Access: Cloud accounting systems often offer mobile applications that allow business owners and accountants to manage finances on the go. Whether checking the latest reports, approving expenses, or generating invoices, mobile access ensures that financial data is always within reach, offering flexibility for remote teams and traveling executives.

- Tax and Compliance Management: Cloud accounting systems help businesses manage taxes and ensure compliance with regulations by automatically calculating tax obligations and keeping track of deadlines. Features like automatic tax updates ensure that businesses remain compliant with local, regional, and international tax laws, reducing the risk of penalties for non-compliance.

- Integrating Capabilities: Cloud accounting platforms easily integrate with other software tools like CRM, inventory management, payroll, and e-commerce platforms. This integration streamlines workflows by ensuring that financial data flows seamlessly between systems, reducing the risk of data duplication or errors and improving operational efficiency.

- Automate Reporting and Dashboards: Cloud accounting systems allow businesses to automate the generation of financial reports and dashboards. Customizable templates can automatically generate balance sheets, income statements, and cash flow reports. Dashboards provide visual insights into key financial metrics, allowing businesses to track their financial health at a glance.

- User Access Controls: Cloud accounting systems allow businesses to set granular user access controls, ensuring that sensitive financial data is only accessible to authorized personnel. For example, business owners can assign specific roles and permissions to employees, limiting access to certain features or data based on their role within the company. This enhances security and ensures compliance with internal policies.

When Should a Company Use Cloud Accounting?

A company should consider using cloud accounting when it seeks greater flexibility, scalability, and real-time financial visibility. For businesses with remote teams, cloud accounting offers the ability to access financial data from anywhere, facilitating collaboration and decision-making.

It’s ideal for companies experiencing growth, as it can easily scale to accommodate more users, transactions, and integrated tools without the need for additional infrastructure.

Cloud accounting is also beneficial for businesses looking to reduce IT costs, as it eliminates the need for expensive hardware, manual updates, and on-site maintenance.

Additionally, if a business wants to streamline operations, automate routine tasks, and stay compliant with tax regulations, cloud accounting systems offer features that simplify these processes, making them a valuable solution for businesses aiming for efficiency and cost-effectiveness.

Reasons to Use Cloud Accounting Software

Cloud accounting software offers a wide range of advantages for businesses, helping streamline financial management and improve decision-making. Its ability to enhance efficiency, security, and flexibility makes it an essential tool for modern businesses. Here are some key reasons why companies should consider using cloud accounting software.

1. Cost-Effective Solution

Cloud accounting software eliminates the need for expensive hardware and IT infrastructure. With subscription-based pricing, businesses can access powerful accounting tools without high upfront costs.

This makes it an affordable option, especially for small to medium-sized businesses. Furthermore, businesses save on IT staff costs since updates and maintenance are managed by the software provider, reducing overall operational expenses.

2. Real-Time Financial Insights

Cloud accounting systems provide real-time access to financial data, allowing businesses to monitor cash flow, track expenses, and generate reports instantly.

Business owners and managers can make informed decisions based on up-to-date financial information, improving the accuracy of forecasts and enabling proactive adjustments to business strategies.

3. Automatic Updates and Security

Cloud accounting platforms offer automatic software updates, ensuring that businesses always use the latest features and comply with any regulatory changes.

Security is also a top priority, as cloud providers implement advanced encryption, multi-factor authentication, and regular data backups to protect sensitive financial information from breaches and data loss.

4. Scalability for Growing Businesses

As businesses expand, their financial needs evolve. Cloud accounting software offers scalability to grow with your business, whether you need to add more users, integrate with other business tools, or handle increased transaction volumes.

This flexibility ensures that the accounting system remains aligned with the company’s needs, without requiring significant investments in new software or infrastructure.

5. Improved Collaboration

Cloud accounting facilitates collaboration between multiple users in different locations. Teams can access and work on the same financial data simultaneously, which is especially beneficial for businesses with remote teams or multiple departments.

With real-time collaboration, everyone involved in financial decision-making can stay on the same page, improving efficiency and reducing the risk of errors.

6. Enhanced Compliance and Tax Management

Cloud accounting software helps businesses stay compliant with changing tax laws and financial regulations by automating calculations and generating accurate tax reports. It also ensures that deadlines are met by providing reminders and managing tax filing processes.

This reduces the risk of penalties due to missed deadlines or incorrect filings, making tax management more efficient and accurate.

7. Integration with Other Business Systems

Cloud accounting software easily integrates with other business systems, such as payroll, inventory management, and CRM platforms.

This integration allows for seamless data flow between different departments, reducing the need for manual data entry and minimizing the chances of errors. It also enhances overall business efficiency by streamlining processes across various functions.

Top 5 Cloud Accounting Software in Singapore

Every company must use the right cloud accounting application for its needs to ensure the system’s implementation results in optimal and efficient financial management. In this article, we also outline information and reviews of cloud accounting software you might consider for your business, including:

1. ScaleOcean

Scaleocean, a system designed for medium-to-large enterprises, supports companies in utilizing the CTC Grant and provides a customizable solution that allows you to tailor the system to the specific needs of your business’s financial processes.

Furthermore, this system provides all-in-one solutions, with comprehensive and seamless integration with various business functions, from expenses and CRM to payroll and inventory management systems, so you can easily manage all financial data across various business processes on a single cloud platform.

To help businesses experience its benefits firsthand, ScaleOcean offers a free demo, providing a hands-on opportunity to explore its features and functionality.

2. QuickBooks

QuickBooks is an accounting software tailored to help small and medium-sized businesses streamline financial operations efficiently. It includes features like invoicing, expense tracking, payroll management, and financial reporting, all through an intuitive interface.

Renowned for its capabilities and cross-industry adaptability, QuickBooks’ cloud-based platform enables real-time collaboration, granting access to financial data from any location. Furthermore, it integrates smoothly with various third-party tools, ensuring flexibility to suit diverse business requirements.

3. FreshBooks

FreshBooks is a cloud-based accounting software designed for small business owners, freelancers, and sole proprietors. It streamlines financial tasks with features like invoicing, expense tracking, time tracking, and financial reporting through a simple, user-friendly interface.

Its intuitive design is suitable for users without accounting expertise, helping entrepreneurs focus on business growth. With comprehensive tools and affordable pricing, FreshBooks is a budget-friendly choice for small businesses.

4. Sage

Sage Business Cloud Accounting is a cloud-based financial management solution tailored to simplify accounting for small and medium-sized businesses. It provides features like invoicing, expense tracking, cash flow monitoring, and financial reporting through an easy-to-use interface.

Known for its scalability, Sage is ideal for growing businesses. Its intuitive design streamlines financial processes, enabling business owners to prioritize operations. Furthermore, it integrates effortlessly with third-party applications, offering flexibility to accommodate diverse business requirements.

5. Zoho Books

Zoho Books is a cloud-based accounting software designed for small and medium-sized businesses to streamline financial management. It includes features like invoicing, expense tracking, project management, and financial reporting, all through an easy-to-use interface.

Known for its extensive capabilities, Zoho Books can be the choice for Singaporean businesses seeking a cost-effective solution. Its smooth integration with other Zoho tools creates a unified platform for efficient business operations.

Trend and Future of Cloud Accounting

The future of cloud accounting is poised for significant transformation, driven by advancements in technology. As businesses continue to embrace digital solutions, cloud accounting systems will evolve to offer even more sophisticated features, improving efficiency, accuracy, and security.

Below are some key technological trends shaping the future of cloud accounting.

1. Artificial Intelligence (AI) and Machine Learning

AI and machine learning are set to play a crucial role in the future of cloud accounting by automating complex tasks like data entry, transaction categorization, and financial forecasting. AI-powered algorithms will be able to detect anomalies in financial data, flagging potential fraud or errors in real-time.

Machine learning models will also learn from past data, improving the accuracy of financial predictions and helping businesses make data-driven decisions. As AI advances, cloud accounting systems will become even smarter, enabling businesses to focus more on strategy and less on manual tasks.

2. Blockchain Integration

Blockchain technology, known for its secure and transparent ledger system, has the potential to revolutionize cloud accounting by ensuring the integrity and security of financial data.

In the future, cloud accounting software could leverage blockchain for secure transactions, reducing fraud and errors in financial reporting. Smart contracts could also automate payments and compliance checks, improving the efficiency of accounting processes and enhancing trust among stakeholders.

Blockchain’s ability to offer a transparent, immutable record will likely become a key feature in cloud accounting systems.

3. Robotic Process Automation (RPA)

Robotic Process Automation (RPA) will further streamline repetitive tasks in cloud accounting, such as invoicing, reconciliations, and payroll processing. Future cloud accounting systems will integrate RPA to handle routine tasks with minimal human intervention, increasing efficiency and reducing errors.

For example, RPA could automatically match purchase orders with invoices, ensuring consistency without the need for manual checks. As a result, businesses will experience faster, more accurate financial processing, allowing accountants to focus on strategic work rather than administrative tasks.

4. Autonomous Finance

Autonomous finance refers to the use of AI and machine learning to automate and optimize financial decision-making processes without human intervention. It encompasses systems that manage investments, savings, budgeting, and financial transactions automatically based on pre-defined rules, algorithms, or goals.

Autonomous finance systems continuously analyze financial data, learn from market trends, and adjust strategies in real-time. This can lead to more efficient financial management, quicker responses to market changes, and the ability to optimize financial outcomes without constant oversight.

Conclusion

Cloud accounting transforms financial management by boosting efficiency, accessibility, and real-time insights. Popular platforms like QuickBooks, FreshBooks, Sage Business Cloud Accounting, and Zoho Books offer robust features to help businesses in Singapore automate tasks, maintain data security, and make informed decisions.

Yet, integration challenges, cost considerations, and cybersecurity must be managed to fully leverage cloud accounting. ScaleOcean accounting software offers real-time inventory tracking, automated reports, and smooth integration for businesses needing a tailored solution, ensuring flexibility and security.

To simplify adoption, ScaleOcean offers a free demo and consultation, letting businesses explore its features risk-free and helping them achieve business goals.

FAQ:

1. Is cloud accounting the future?

Cloud accounting is not just a passing trend. It’s becoming the standard for small businesses in South Africa. It provides real-time insights, enhances compliance, and offers the flexibility to manage your business from anywhere.

2. What does a cloud accountant do?

A Cloud Accountant is a financial expert who utilizes cloud-based accounting software to manage and analyze a company’s financial information. They oversee tasks such as bookkeeping, payroll, tax compliance, and financial reporting remotely, enabling real-time collaboration with clients.

3. Is cloud accounting more expensive?

Traditional accounting methods can be expensive, time-consuming, and prone to errors. In contrast, cloud accounting is a more cost-effective solution that provides numerous advantages.

4. What are the disadvantages of cloud accounting?

While many cloud accounting providers implement strong security measures, the rise in cyber-attacks has led to frequent data breaches, causing unauthorized transactions and financial losses.

PTE LTD..png)

.png)

.png)

.png)

.png)