The Inland Revenue Authority of Singapore (IRAS) is the principal government agency responsible for administering Singapore’s tax and collection system. IRAS Singapore is a global financial center that relies on a strong and efficient tax system to fund its infrastructure and public services.

IRAS is critical to maintaining this system by assuring compliance while encouraging economic competitiveness and innovation. The agency’s efforts not only ensure equal tax collection but also promote a business-friendly atmosphere that encourages international investment.

What is IRAS?

The Inland Revenue Authority of Singapore (IRAS) is a government authority and acts as an agent in managing tax administration. It also represents Singapore in international tax matters. IRAS Singapore functions to enforce taxes and ensure that companies meet their tax obligations efficiently.

The organization is responsible for collecting various types of taxes, including income tax, corporate tax, goods and services tax (GST), and property tax, ensuring that these tax laws are followed. As an important financial institution, IRAS plays a crucial role in funding public services and infrastructure by effectively managing tax revenue.

History of IRAS Singapore

IRAS Singapore tax was established as a statutory board under the Ministry of Finance on September 1, 1992. Prior to its formation, tax collection in Singapore was managed by the Inland Revenue Department (IRD), which had been in operation since 1947 during British colonial rule.

The transition from the Inland Revenue Department (IRD) to the Inland Revenue Authority of Singapore (IRAS) was aimed at enhancing the efficiency of tax administration, modernizing operations, and improving service delivery to taxpayers.

Over the years, IRAS has played a vital role in shaping Singapore’s tax policies, implementing digital tax services, and promoting international tax cooperation. Today, it is recognized as a leading tax authority, known for its fair, transparent, and technology-driven approach to taxation.

Core Functions and Authority of IRAS Singapore

In Singapore, IRAS plays a key role in ensuring a fair and efficient tax system. As the government’s tax administrator, IRAS also acts as the domestic tax authority, and represents Singapore in international tax matters, strengthening the country’s position in the global financial landscape.

Following are some of the Core Functions and Authorities of IRAS Singapore, include:

1. Collection Role

The Inland Revenue Authority of Singapore (IRAS) plays a crucial role in collecting various taxes. These include income tax for individuals and companies, Goods and Services Tax (GST), property tax, and taxes related to clubs, casinos, and associations. Additionally, IRAS oversees the Estate and Private Lotteries Duty, as well as taxes for trusts and charities.

IRAS ensures tax compliance through audits, enforcement actions, and taxpayer education initiatives. By adopting a risk-based approach, the authority minimizes tax evasion while encouraging voluntary compliance. It also supports businesses and individuals by offering digital tax services and simplified filing procedures. The role of this Collection has two parts, namely:

Tax Exclusions

Not all income is taxable in Singapore. The Inland Revenue Authority of Singapore (IRAS) offers tax exclusions to support businesses and individuals, such as exemptions for foreign-sourced income and capital gains, including those from selling shares and properties.

Certain government grants, allowances, and relief schemes are also exempt from tax. By managing these exclusions, IRAS maintains a competitive environment that encourages investment and economic growth.

Territorial Taxation

Singapore employs a territorial taxation system, meaning only income earned or received within the country is taxable. The Inland Revenue Authority of Singapore (IRAS) enforces this to prevent double taxation and attract international businesses.

Certain foreign-sourced income, like dividends and branch profits, may qualify for tax exemptions under specific conditions. This approach ensures clarity and fairness in tax administration, allowing businesses to operate confidently in Singapore’s strategic financial and trade hub.

2. Advisory Function

IRAS not only collects taxes but also plays a key advisory role by collaborating with the Ministry of Finance to enhance Singapore’s tax policies. It conducts research, policy reviews, and stakeholder engagements to keep the tax system competitive.

Additionally, IRAS supports businesses and individuals through tax rulings, public consultations, and educational programs. By ensuring transparency and offering guidance, it helps taxpayers understand their obligations while fostering economic stability and growth in the tax environment.

Roles and Responsibilities of IRAS Singapore

IRAS Singapore plays a vital role in ensuring that the tax structure functions efficiently, and ensuring that the country’s tax structure operates efficiently. IRAS’s numerous tax operations have a major role and responsibility in Singapore’s rise to become a global trading hub as a whole.

IRAS, which is based on Global Link Consulting, works with more than 120 software suppliers to develop products like InvoiceNow and One-Stop Payroll that streamline business tax compliance and increase operational effectiveness. Its main duties include the following:

1. Tax Collection

IRAS manages a variety of taxes, including income tax, goods and services tax (GST), property tax, and stamp duty, to ensure precise and effective revenue collection. This method provides funding for important public services such as healthcare, education, and infrastructure.

IRAS has expedited tax collection by deploying modern digital solutions that reduce errors and improve the taxpayer experience. Its efforts ensure that all taxpayers contribute equally to Singapore’s development.

2. Taxpayer Services

IRAS provides full support to taxpayers, including information, resources, and tools to help them comply with tax requirements. This includes services such as tax preparation assistance, hotlines, and online resources that address frequent questions.

IRAS encourages taxpayers to comply voluntarily by promoting openness and confidence. These services not only boost taxpayer confidence, but they also increase overall tax administration efficiency.

3. Policy Development

IRAS works with the government to create and modify tax policies that are consistent with Singapore’s economic objectives and global competitiveness. This involves ensuring that the tax system can adapt to new trends and challenges, such as digitalization and globalization.

By regularly examining and strengthening tax regulations, IRAS contributes to Singapore’s position as an appealing business destination. Its proactive approach guarantees that tax policies are relevant, egalitarian, and growth-oriented

Latest IRAS Singapore Filing Calendar 2025

Keeping track of tax deadlines is essential for both businesses and individuals to avoid penalties and ensure smooth compliance. The IRAS tax has published its filing calendar for 2025, which highlights important dates for income tax, GST, property tax, and corporate tax submissions In Singapore.

Whether you’re an entrepreneur, a corporate taxpayer, or an individual filer, knowing these deadlines ensures you stay compliant while maximizing available tax benefits.

| Date | Stages |

|---|---|

| 31 January 2025 |

|

| 1 March 2025 |

|

| 31 March 2025 |

|

| 18 April 2025 |

|

| 30 April 2025 |

|

| 31 May 2025 |

|

| 30 June 2025 |

|

| 31 July 2025 |

|

| 30 Sept 2025 |

|

| 31 Oct 2025 |

|

| 30 Nov 2025 |

|

| 31 Dec 2025 |

|

Importance of IRAS for Businesses

In order to promote an open and equitable business climate, IRAS is essential for Singaporean companies. By guaranteeing adherence to Singapore’s IRAS tax laws, IRAS assists companies in running efficiently and preserving their reputation. Its rules encourage moral behavior in addition to lowering the possibility of financial punishment. IRAS also promotes Singapore’s economic stability, which helps the country’s corporate community.

1. Tax Compliance

IRAS guarantees that firms follow IRAS tax Singapore legislation, promoting a level playing field and avoiding unwarranted penalties. Compliance with these standards enables firms to create confidence with stakeholders such as investors and customers.

Businesses that adhere to IRAS rules can also streamline their financial procedures, minimizing errors and inefficiencies. Finally, continual compliance with tax regulations protects the reputation and longevity of any Singapore-based firm.

2. Economic Contribution

IRAS generates cash to support public services and infrastructure development, benefiting both enterprises and citizens. The monies collected by IRAS are critical for developing and maintaining Singapore’s world-class infrastructure, which fosters corporate growth.

Furthermore, this cash supports social initiatives that improve the quality of life for workers, resulting in a more productive and inventive economy. Businesses contribute to the nation’s development, ensuring long-term sustainability and prosperity for everybody.

Staying Compliant with IRAS in Singapore

Compliance with Singapore’s IRAS tax laws is a critical component of a company’s operations in Singapore. Businesses that keep proper records, meet tax deadlines, and use the right tools can avoid penalties and ensure smooth and efficient tax reporting. Here are the requirements to comply with:

1. Record-Keeping

Maintaining accurate and up-to-date financial records is required for IRAS online tax payment and reporting. These records, including details on prorated salary, provide a comprehensive picture of financial activity, making it easier to spot anomalies and remedy errors.

Regular audits of financial records, particularly the general ledger, guarantee that the information supplied to IRAS is accurate and by tax requirements. Effective record-keeping assists firms in preparing for prospective tax audits, lowering the risk of penalties and disputes.

2. Timely Filings

Adhering to tax filing dates allows firms to avoid penalties and preserve a good status with the IRS. Late filings might incur fines and interest charges, affecting cash flow and business efficiency.

Setting reminders and utilizing digital tools can assist guarantee that deadlines are met consistently. Businesses that file their taxes on time demonstrate dependability and trustworthiness to IRAS and other stakeholders.

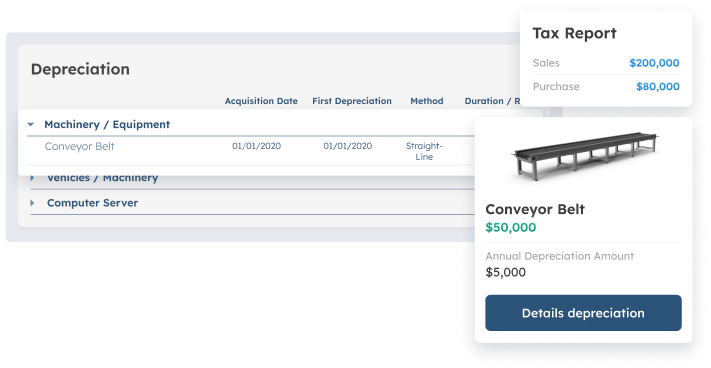

3. Utilizing Approved Accounting Software

Using IRAS-approved accounting software streamlines tax reporting and ensures accuracy, making compliance easier and more efficient. These technologies are intended to integrate seamlessly with IRAS systems, minimizing manual effort and errors.

Automated features enable businesses to track costs, generate reports, and submit taxes more effectively. Companies that employ certified software linked into an ERP system can remain ahead of regulatory changes while also streamlining their overall tax administration procedures.

Recommended Accounting Software for IRAS Compliance

Leveraging IRAS-approved accounting software streamlines compliance by allowing for seamless connectivity with IRAS systems. These technologies assist firms in avoiding manual errors, improving tax filing efficiency, and maintaining compliance with Singapore’s Inland Revenue Authority standards.

Companies that use the correct accounting software in Singapore can focus on core activities while reducing the difficulties of tax management.

1. Benefits

Adopting IRAS-approved accounting software provides many benefits that go beyond compliance. These solutions assist firms in optimizing financial administration, increasing productivity, and ensuring accurate tax reporting. The following are the primary features that make these solutions vital for Singapore-based organizations.

- Accuracy, Using IRAS-approved accounting software considerably decreases the likelihood of financial data entry errors. Automated features ensure that computations and data inputs are constant, which helps firms avoid errors during tax filing. Companies can create confidence in IRAS by providing accurate data while preserving compliance and operational reliability.

- Efficiency, These solutions simplify the preparation and submission of tax returns, saving time and resources. Accounting software decreases inefficiencies and the workload of finance personnel by automating repeated tasks. Businesses can focus their resources on more strategic operations, increasing overall productivity and effectiveness.

- Compliance, IRAS-approved accounting software assures strict compliance with Singapore’s tax requirements. The systems are designed to meet all reporting requirements, reducing the possibility of penalties for noncompliance. With updated features that match the most recent tax laws, firms may keep ahead of regulatory changes and maintain a compliant financial environment.

2. ScaleOcean’s Best Accounting Software for Singapore Businesses

ScaleOcean Accounting Software is intended to meet IRAS tax compliance requirements by automating tax reporting and facilitating IRAS online tax payment. Automated tax calculations, real-time IRAS connection, and customizable reports improve efficiency and accuracy.

Businesses can improve financial accuracy and compliance by using IRAS-approved accounting software and benefiting from the CTC Grant to offset costs. Learn more and schedule a free demo today!

- Automated Tax Calculation, Reduces the need for manual calculations, resulting in more accurate GST and income tax returns. This function decreases the possibility of human error and improves the accuracy of financial records.

- Real-Time Integration with IRAS Systems, Allows for seamless data submission, which reduces delays and errors. Businesses may monitor submission status in real-time, assuring transparency and compliance.

- Customizable Financial Reports, Provides customizable reporting choices to meet specific business objectives. These reports give actionable information that allows businesses to make informed decisions.

- User-friendly interface, Simplifies navigation and reduces employee training time. Its simple design enables even non-technical people to easily manage complex financial activities.

- 24/7 Customer Support, Ensures that any technological issues are rectified swiftly, allowing operations to run smoothly. Dedicated support teams provide advice on how to maximize software capabilities and ensure continuous compliance.

Conclusion

Compliance with IRAS laws is critical for Singapore businesses seeking to avoid penalties, expedite processes, and contribute to economic development. Investing in IRAS-approved accounting software makes tax reporting easier, minimizes errors, and increases efficiency.

These solutions not only verify compliance but also provide useful information for making smarter financial decisions. To get started, businesses can request a free demo to discover how these solutions can be adjusted to their specific requirements while being fully compliant with Singapore’s tax rules.

FAQ:

1. What is the minimum salary to pay income tax in Singapore?

Individuals in Singapore must file personal income tax returns if their annual income reaches SGD 20,000. Tax residents earning below this amount are exempt from tax. Singapore follows a progressive tax system, with rates ranging from 0% to 24%, ensuring higher earners pay a larger portion of their income in taxes.

2. How do I check my annual income IRAS?

You can check your annual income with IRAS through myTax Portal by following these steps:

1. Log in to myTax Portal using your Singpass.

2. Go to the ‘Account’ section and select ‘View Account Summary’.

3. Click ‘View Details’ to access your Statement of Account (SOA).

4. Download your SOA for reference.

5. Alternatively, check your IR8A statement from your employer.

3. How long does IRAS take to process?

The processing time varies by submission type. 80% of e-filed Form IR21 is processed within 7 working days, while paper-filed forms take about 21 days. Delays may occur if information is incomplete or requires clarification. Other tax filings, such as income tax returns, typically take 7 days for e-filing and 3 weeks for paper submissions.

4. How do I contact IRAS customer service?

You can contact IRAS customer service through several channels:

1. Phone: Call 1800-356 8300 from Mondays to Fridays, 8:00 am to 5:00 pm (except Public Holidays).

2. Online: Chat with their support team through the IRAS tax website.

3. Email: Reach out to askiras@iras.gov.sg.

4. Mail: Address correspondence to IRAS, 55 Newton Road, Singapore 307987.

PTE LTD..png)

.png)

.png)

.png)

.png)