Prorated salary refers to modifying an employee’s pay based on the time worked within a certain period. Employees are compensated proportionally for the days, weeks, or months they work. This system ensures fair compensation for part-time employees, new hires, and those who leave in the middle of a pay period.

According to the Ministry of Manpower, employers must pay salaries at least once a month, within 7 days after the salary period ends. Proper payroll management is essential for companies to stay compliant.

In Singapore, prorated pay estimates are essential for legal and tax compliance. This article discusses the notion of prorated salary and its importance. We’ll go over how to calculate prorated compensation, covering months, weeks, and days. Employers will benefit from simple formulas for each technique, ensuring proper payroll management.

- A prorated salary is a payment adjustment made when an employee works part of a pay period rather than the entire period.

- Prorated pay impacts employee benefits such as retirement contributions, health insurance, paid time off (PTO), and bonuses, modifying them proportionally to the time worked.

- In Singapore, the formula to calculate prorated salary is: Prorated Pay = (Proportion of Time Worked) x (Full Monthly Salary).

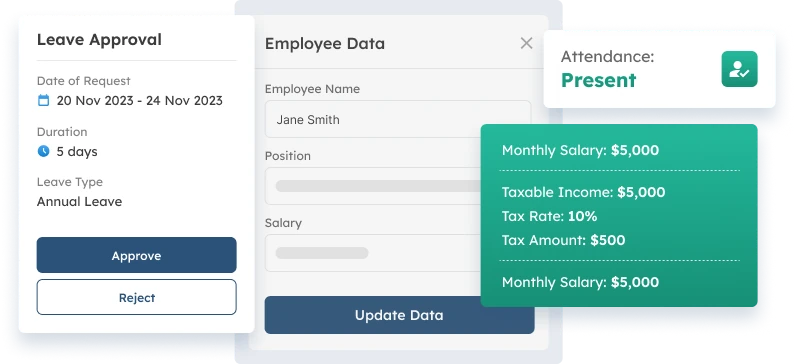

- ScaleOcean’s HRIS software streamlines the management of prorated salaries, ensuring accuracy and compliance by automating calculations and integrating with time tracking systems.

What is a Prorated Salary?

A prorated salary is an adjustment made when an employee works only part of a pay period. It ensures employees are paid fairly for the time they’ve worked, which is common for those who start or leave mid-month, work part-time, or take unpaid leave.

For example, if an employee joins a company halfway through the month or quits before the end of the month, their remuneration will be computed based on the number of days or hours worked.

Similarly, part-time employees or those who take unpaid leave would earn lower compensation to reflect their fewer working hours. This adjustment promotes pay equity and guarantees that employees are only compensated for the time they contribute to the firm.

Can All Employees Receive Prorated Pay?

Not all employees receive prorated pay, although it is widely used for those who work less than a complete pay period. This often comprises new hires, employees who end their contracts mid-month, part-time workers, and individuals with flexible work hours.

Prorated pay adjusts an employee’s income to match the actual time worked, ensuring appropriate compensation for the duration of their employment. Based on Hawksford, the Employment Act (EA) applies to employees working under a contract of service, excluding seamen, domestic workers, and government employees.

While prorated compensation is most commonly associated with salaried employees, hourly workers may also face comparable adjustments. Hourly employees receive prorated pay based on the number of hours worked in a given pay period.

This guarantees that compensation is in line with the actual time spent on the task, whether the person works full-time, part-time, or on a flexible schedule.

What are the Effects of Prorated Pay on Employee Benefits?

Prorated pay influences not only an employee’s income but also the benefits they receive. Because prorated compensation represents the amount of time worked, benefits like retirement contributions, health insurance, paid time off (PTO), and bonuses can be modified proportionally.

Prorated pay adjustments can affect human resource retention if employees feel their compensation or benefits are unfair, highlighting the need for careful management to reduce turnover. Here’s a closer look at how prorated pay can affect the following major areas of employee compensation:

Retirement Contributions

Retirement contributions are frequently linked to an employee’s earnings. When a person receives prorated pay, their payments to retirement accounts, such as pension plans, may be cut.

Because the compensation is lower for the period, the employer’s matching contribution (if applicable) will be proportional to the amount received, implying that employees on prorated pay will notice a loss in their retirement savings during that time.

Health Insurance

Health insurance benefits are typically offered on a full-time basis. Employers may lower coverage or premium rates for employees getting prorated pay to reflect the fact that they work fewer hours than full-time employees.

This reduction varies depending on corporate policies and the degree of benefits provided, and employees may find that their coverage is less complete while working on a prorated pay basis. Additionally, employers need to consider factors like corporate tax in Singapore when determining how benefits are adjusted for prorated pay.

Paid Time Off (PTO)

Paid time off is another benefit impacted by prorated pay. Employees who work fewer hours, such as part-time or temporary workers, often receive less paid time off (PTO), which is computed based on hours worked.

For example, if an employee earns a prorated wage and works part-time, their annual and sick leave will be modified accordingly, resulting in less PTO than a full-time employee.

Bonuses and Incentives

Bonuses and incentives are usually given based on performance and full-time work status. Employees on prorated pay may get a reduced bonus or incentive, depending on the company’s reward system.

These benefits are frequently prorated to match the actual number of days or hours worked during the period, so the total bonus that the employee receives is closely related to their work schedule for that specific period.

Additionally, employers must consider other mandatory deductions, such as the foreign worker levy, which may impact the overall compensation package. Beyond salary adjustments, companies should also strengthen their talent management and succession planning to ensure long-term workforce stability and leadership continuity.

What are the Legal Requirements for Prorated Salary in Singapore?

In Singapore, prorated salaries must follow specific legal guidelines to ensure employees are fairly compensated. Employers are required to comply with rules regarding minimum wage, overtime, pay equality, and employment contracts when calculating prorated amounts.

To streamline the calculation of prorated salaries and ensure compliance with legal requirements, businesses can benefit from using the best payroll software. Such software automates salary calculations, ensures accurate tax deductions, and helps maintain compliance with labor laws.

Here’s a breakdown of the key legal requirements for prorated salary:

- Minimum Salary Standards: Employers must ensure that prorated salaries meet minimum wage standards, guaranteeing employees are fairly paid for the time they work, even if their schedule is reduced.

- Overtime Compensation: If employees work overtime, their prorated salary must reflect the additional pay for extra hours worked, in compliance with the legal overtime rates.

- Pay Equity and Anti-Discrimination: Prorated salaries must follow pay equity laws, ensuring all employees, regardless of gender, race, or other protected factors, receive equal pay for equal work, even when working part-time or reduced hours.

- Employment Contracts and Negotiated Agreements: Prorated salary calculations should be clearly outlined in the employment contract or collective agreements. These documents specify how salaries are adjusted for part-time workers or those employed mid-period.

- Annual Wage Supplement (AWS) Eligibility: Employees with prorated salaries may still qualify for the AWS based on their contract terms. The AWS is usually calculated based on a full year’s salary, with the prorated amount applied as needed.

When Should You Pay Employees on a Pro-Rata Basis?

Prorated pay is required in many cases to ensure that employees are adequately reimbursed for the time they labor. There are various situations in which pro-rata compensation is required, and knowing when to utilize it helps maintain labor law compliance and assures equitable treatment for both employers and employees.

This is especially important when adjusting the payroll cycle to reflect the actual days worked within the period. Here are the situations where pro-rata pay applies:

- New Hires or Terminations Mid-Pay Period: Pay is prorated for employees who join or leave mid-period based on the days worked. This ensures fair compensation and accurate business expenses management.

- Part-Time Employees: Part-time employees are compensated based on hours worked. Their pay is prorated, ensuring fairness while also simplifying business expenses tracking. The payslip process reflects this adjustment for temporary or seasonal workers.

- Flexible Work Schedules: Employees with flexible schedules receive prorated pay for the hours worked. This ensures they are paid fairly while helping businesses manage expenses accurately.

- Unpaid Leaves of Absence: Employees on unpaid leave have their pay adjusted based on the days worked. This guarantees fair pay and ensures business expenses reflect the time off taken.

- Mid-cycle Salary Increase: Salary increases mid-period are prorated based on the new rate for days worked. This ensures employees are fairly compensated while keeping business expenses up to date.

How to Calculate Prorated Salary in Singapore?

Calculating prorated salary in Singapore varies depending on the payment system and length of employment. Employers often base their approach on the number of days or weeks an employee worked throughout the pay cycle, in line with guidelines set by the IRAS (Inland Revenue Authority of Singapore).

The following are three popular approaches for calculating prorated salaries:

1. Determine the Employee’s Monthly Salary

To calculate a prorated salary, you first need to know the employee’s monthly salary. This is typically the amount they earn for a full month of work, not including bonuses or commissions. If they’re paid hourly, you can convert their hourly rate to a monthly figure.

For example, if an employee’s monthly salary is $3,000, that’s the base amount. This figure is used as the starting point for prorating, where you adjust the amount based on how much time they actually worked during the period.

2. Establish the Reference Period

Next, define the reference period for prorating, which is usually the pay period, like a month or week, that the employee worked. If the employee worked part of the period, you need to figure out the number of days worked compared to the total number of days in that period.

For example, if an employee worked for 10 days out of a 30-day month, you’ll need to calculate the proportion of the month they worked. This helps in determining how much of their full salary they’re entitled to based on the time worked.

3. Calculate the Time Worked Proportion

To figure out the proportion of time worked, divide the number of days the employee worked by the total number of days in the reference period. This fraction tells you how much of the full pay they should receive for the days worked.

For instance, if the employee worked 10 days out of 30, the time worked proportion is 10/30, which equals 0.33. This means the employee worked 33% of the month, so they’ll receive 33% of their full monthly salary.

4. Compute the Prorated Salary

Now that you have the time worked proportion, multiply it by the employee’s monthly salary to determine the prorated pay. This gives you the amount they should be paid for the days they actually worked during the pay period.

For example, if the employee earns $3,000 per month and worked 33% of the month, their prorated salary would be $3,000 × 0.33, which equals $990. That’s the amount they should receive for the partial month worked.

And here is the formula:

Prorated Pay = (Proportion of Time Worked) x (Full Monthly Salary)

To calculate prorated pay, you first need to determine the proportion of time worked in a given pay period. For example, if an employee works 10 days in a 30-day month, the proportion would be 10/30, or 0.33, representing 33% of the month worked.

Once you have the proportion, multiply it by the employee’s full monthly salary to find the prorated pay. For example, if the monthly salary is $3,000, the prorated pay would be 0.33 × $3,000, which equals $990. This ensures fair compensation.

Examples of Prorated Salary Calculation

Calculating prorated salary is important for ensuring employees are fairly compensated when they work part of a pay period. Whether an employee is hired mid-month, works part-time, or takes unpaid leave, prorating ensures they are paid accurately for their time worked.

Here are some examples of how prorated salary can be calculated:

Converting Annual Salary to Weekly Pay

To convert an annual salary to weekly pay, divide the annual salary by the number of weeks in a year. For example, if the annual salary is SGD 52,000, dividing by 52 weeks gives a weekly pay of SGD 1,000.

If the employee works a portion of the year, multiply the weekly pay by the number of weeks worked. For instance, if they work 10 weeks, their prorated salary would be SGD 1,000 × 10, totaling SGD 10,000 for the period.

Converting Annual Salary to Daily Pay

To calculate the daily pay from an annual salary, divide the annual salary by the number of working days in a year. For example, if the annual salary is SGD 48,000 and there are 250 working days, the daily pay would be SGD 192.

If the employee works a partial period, multiply the daily rate by the number of days worked. For example, for 15 days worked, the prorated salary would be SGD 192 × 15, giving the employee SGD 2,880 for that period.

Prorated Salary with Deductions

When calculating prorated salary with deductions, first determine the prorated pay based on the time worked. Then, apply any deductions such as taxes, benefits, or other withholdings proportionally based on the prorated amount.

For instance, if an employee’s prorated salary is SGD 2,500 and the total deductions are SGD 500, the employee would receive SGD 2,000. This ensures that both the pay and deductions are adjusted fairly to reflect the actual time worked.

A Simple Guide on How to Calculate Prorated Deductions

Prorated deductions ensure employees are fairly compensated based on the time worked during a pay period. When calculating deductions for partial periods, businesses need to adjust statutory and pre-tax deductions accordingly to reflect the actual time worked.

Here are the key steps to calculate prorated deductions:

1. Identify the statutory deductions

Start by identifying mandatory statutory deductions such as CPF and taxes. These deductions must be calculated based on the employee’s salary and the applicable laws in the given period.

Ensure that you’re applying the correct percentages for statutory deductions. This is crucial to comply with legal requirements and ensure accurate deductions from the employee’s salary.

2. Determine pre-tax deductions

Next, identify any pre-tax deductions like insurance or retirement contributions. These are deducted before taxes and should be prorated based on the employee’s working days in the pay period.

Once you’ve identified pre-tax deductions, adjust them according to the time worked. This ensures the deductions align with the employee’s actual working period, maintaining accuracy and fairness.

3. Determine the deduction amount per day

To prorate the deductions, calculate the daily deduction by dividing the total deduction amount by the number of days in the full pay period. Then, multiply it by the days worked to get the prorated amount.

The prorated daily deduction helps ensure that employees only pay for the actual time they worked. This ensures fair deductions when the employee works part-time or for a partial period in the pay cycle.

4. Apply deductions to the salary

Finally, subtract the prorated deductions from the employee’s gross salary. This gives the net pay, ensuring all deductions are accurately applied based on the employee’s actual time worked during the period.

After applying the prorated deductions, the employee’s salary reflects their actual work period. This method ensures fairness in compensation and compliance with both statutory and pre-tax deduction rules.

How to Explain Prorated Salary Policy

It’s important to clearly explain the prorated salary policy so employees understand how their pay is calculated, especially when working part-time, starting mid-month, or taking unpaid leave. Clear communication helps avoid confusion and ensures everyone is on the same page.

Here’s how to effectively communicate the prorated salary policy:

1. Clarify Policies During Onboarding

During the onboarding process, take the time to explain how prorated salaries are calculated based on an employee’s start or end date. Make sure they understand how their pay will be adjusted for partial months, part-time work, or any time off.

By addressing this early on, you set clear expectations and avoid misunderstandings later. It also helps employees manage their finances better, knowing exactly how their pay will be determined from the start.

2. Offer Clear and Concise Examples

Providing easy-to-follow examples can make understanding prorated pay a lot simpler. Walk through scenarios where an employee works part of a pay period or takes time off, so they can see how their pay will be adjusted.

Real-life examples help employees see the concept in action, making it easier to grasp. This ensures they feel confident and informed about how their pay is calculated, especially if their situation involves partial periods or leave.

3. Include the Policy in the Employee Manual

Make sure the prorated salary policy is clearly stated in the employee manual. This way, employees can easily refer back to it whenever they need clarification, ensuring consistency and transparency in how the policy is applied.

Having the policy in the employee manual makes it accessible and official. It provides employees with a simple reference point for understanding how their prorated pay is determined, so they can always check if they have questions.

Manage Prorated Salary Easily and Stay Compliant with ScaleOcean HRIS Software

ScaleOcean’s HRIS software provides an efficient solution for handling prorated salaries, allowing organizations to conduct payroll with ease and precision. The software’s automatic functions prevent manual errors and save time by calculating prorated pay according to preset parameters.

The seamless interaction with time monitoring systems guarantees that salary calculations accurately reflect actual working hours. ScaleOcean offers a scalable solution for complex payroll situations and helps you keep up with changing legislation.

If you’re looking for a simple, compliant way to handle prorated salaries, ScaleOcean offers a free demo to get started. Additionally, ScaleOcean is eligible for the CTC (Cost to Company) grant, making it a more appealing solution for firms improving payroll management.

The following is a list of ScaleOcean software’s unique selling points (USPs):

- Automated calculation: Easily calculate prorated salary with automated tools, reducing errors and time spent on manual calculations.

- Time tracking integration: Seamlessly integrate time tracking with payroll systems to ensure accurate salary payments.

- Customizable rules: Tailor prorated pay rules to meet your company’s specific needs and adjust based on employee work schedules.

- Automatic updates: Stay up to date with any regulatory changes in salary calculations or tax rates.

- Compliance and reporting: Ensure compliance with local regulations and generate necessary reports for payroll audits.

- Self-service portals: Allow employees to access their pay details and track their work hours through a convenient self-service portal.

Conclusion

Understanding prorated salary calculations is critical for ensuring equitable compensation, particularly for employees who work half pay periods. Prorated pay guarantees that employees are equitably compensated, whether they are new hires, part-time workers, or operate on flexible schedules.

Prorating by months, weeks, or days ensures payroll accuracy and fairness. It is also critical to understand how prorated pay affects employee benefits and to comply with legal requirements, particularly in Singapore.

ScaleOcean HRIS software provides a comprehensive solution for firms looking to handle prorated salaries more efficiently. Features like automated calculations, time tracking integration, and customized rules ensure payroll accuracy. Compliance reporting enables firms to stay on track with rules.

ScaleOcean also offers self-service portals, making payment information conveniently accessible. Sign up for a free demo today to learn how ScaleOcean can enhance your payroll management.

FAQ:

1. Can you prorate a salaried employee?

You can prorate a salaried employee’s pay when they join or leave mid-cycle or receive a raise during the cycle. However, this practice is only allowed under specific circumstances and company policies.

2. What does prorated mean on a payslip?

“Pro rata” means “in proportion” in Latin. On a payslip, it refers to dividing pay and benefits fairly based on the actual time worked during the period, such as for part-time work or partial months.

3. What are the disadvantages of pro rata?

Disadvantages of Pro Rata:

1. No added benefit for early cancellation, unlike short rate cancellation.

2. Financial complications may arise from outstanding finance agreements.

3. Employees with reduced hours may receive lower pay.

4. Who is entitled to pro rata?

Employees with over 5 years but less than 10 years of continuous service are entitled to pro-rata long service payments if dismissed for reasons other than serious misconduct or in case of death.

PTE LTD..png)

.png)

.png)

.png)

.png)