Between 2021 and 2023, the Ministry of Manpower (MOM) in Singapore received an average of 670 complaints annually regarding the issuance of payslips, according to Human Resource Directors News.

These complaints were primarily about delays in issuing itemized payslips or instances where no payslips were provided at all. This highlights the growing urgency for businesses in Singapore to ensure their payroll processes are compliant, timely, and transparent.

As businesses evolve and embrace digital transformation, adopting a digital approach to payslip issuance has become essential. A PWC survey revealed that 54% of HR leaders consider embedding a digital culture a high priority on their transformation agendas.

For companies in Singapore, digitalizing payroll or salary slips for employees ensures compliance with MOM regulations, enhances operational efficiency, and minimizes errors.

This article will delve into the critical need for accurate, itemized payslips, the advantages of digital payroll systems, and how businesses can adopt modern HR solutions to streamline payslip generation and distribution. Learn more here!

- A payslip is a document detailing salary, allowances, deductions, and net pay, ensuring financial transparency and clarity for employees.

- The importance of a payslip is transparency, verification, record-keeping, and legal compliance

- Key components of a payslip include: employee information, pay period, gross salary, deductions, net pay, employer information, year-to-date, and additional details

- To create a payslip can use payroll software, manual creation with payroll or salary slip template, or the legal requirement to comply with local labor laws

- ScaleOcean’s HRIS software is an all-in-one solution that simplifies payroll with features like real-time payslips, compliance, and automation.

What is a Payslip or Salary Slip?

A payslip or salary slip, also referred to as a pay stub or pay advice, is a document issued by an employer that outlines an employee’s earnings and deductions for a given pay period.

It typically includes details such as gross income, taxes, and other deductions like insurance or retirement contributions, culminating in the net pay, also the amount the employee actually receives. Payslips are essential for proof of income, maintaining records, budgeting, and filing taxes.

The Importance of a Payslip or Salary Slip

A payslip, or salary slip, plays a crucial role in both an employee’s financial management and an employer’s administrative processes. It provides a clear breakdown of an employee’s earnings, taxes, and deductions for a specific pay period, ensuring transparency and accuracy in salary disbursement.

Here are the reasons why a payslip is important, which are for employees, and also for companies, including:

1. Transparency

Payslips offer employees clear insight into their earnings, deductions, and taxes for each pay period. This transparency fosters trust between employers and employees by ensuring that both parties are aligned on compensation details.

Payslip, also known as a salary slip, can also help employees understand how their salary is calculated, promoting clarity and minimizing misunderstandings regarding pay.

2. Verification

A payslip is a valuable tool for verifying an employee’s income. It can be used for loan applications, renting a property, or verifying salary details for tax purposes.

When an employee needs to confirm their earnings or deductions, the payslip provides an official, easily accessible record that can be used for various verification processes, ensuring authenticity.

3. Record-keeping

Payslips play a critical role in maintaining accurate financial records. They help employees track their income and deductions over time, which is vital for budgeting and financial planning.

For employers, payslips serve as a necessary document for auditing, tax reporting, and internal accounting, ensuring that financial records are well-organized and up-to-date.

4. Legal Compliance

Payslips are crucial for ensuring legal compliance with labor laws and regulations. In many countries, employers are legally required to provide payslips to their employees.

These documents help ensure that wages are paid according to legal standards, and they also provide a record that can be used to resolve disputes over payment or employment terms.

Essential Components and Elements to Include on a Payslip

A payslip contains various components that ensure both employers and employees are on the same page regarding compensation. These essential elements provide a detailed breakdown of earnings, deductions, and other relevant information, making it a vital tool for record-keeping, verification, and financial planning.

Below are the key components that should appear on every payslip.

1. Employee Information

The payslip should include clear identification details of the employee, such as their full name, employee ID, and job position. This ensures the document is personalized and can be easily matched with the correct individual. Including this information prevents any confusion and helps in tracking multiple employees’ payments within an organization.

2. Pay Period

The pay period section on the payslip indicates the specific time frame for which the employee is being paid, whether weekly, bi-weekly, or monthly. For instance, in cases of employees who join mid-month or leave before the end of the month, a prorated salary is calculated based on the exact days worked.

This ensures both the employer and employee are aware of the exact period the earnings relate to, helping to avoid disputes about pay dates or missing payments.

3. Gross Salary

Gross salary is the total amount an employee earns before any deductions are made, including base salary and additional allowances such as bonuses or overtime pay.

This component provides an overview of the total compensation earned for the pay period, giving employees a clear understanding of their earnings before deductions are applied.

4. Deductions

Deductions refer to the amounts subtracted from an employee’s gross salary, such as tax contributions, pension or retirement fund contributions, insurance premiums, and other legal or voluntary deductions.

This section ensures transparency and helps employees understand the specific reasons their gross salary is reduced to arrive at the net pay.

5. Net Pay

Net pay represents the final amount an employee takes home after all deductions are made from the gross salary. This is the amount that is actually deposited into the employee’s bank account. The net pay section is crucial, as it indicates what the employee will receive after taxes and other contributions are accounted for.

6. Employer Information

The employer’s details, such as company name, address, and contact information, should also be included on the payslip. This provides a point of reference for employees in case they need to raise any concerns or queries about their salary. It also serves as an official record in case of disputes or audits.

7. Year-to-Date (YTD) Totals

YTD totals show the cumulative earnings and deductions for an employee over the course of the current year. This section is particularly helpful during tax season, as it gives employees a clear view of their total income and deductions to date. It helps in planning for tax filing and provides insight into overall earnings and deductions for the year.

8. Additional Details

Other relevant information may include overtime hours worked, bonuses, commissions, or any specific adjustments for the current pay period. In certain cases, employers may also need to account for deductions like the foreign worker levy in the payslip.

Including such details adds clarity and ensures employees are fully informed about all aspects of their earnings, allowing them to track any special payments or corrections in their pay.

Format of a Payslip or a Salary Slip

Following MOM regulations, a structured salary slip must detail salary components to ensure accuracy and compliance. Including all necessary information helps prevent payroll disputes, enhances financial transparency, and provides employees with a clear breakdown of their earnings.

Below are the key formats you should include in an itemized payslip sample for Singapore to support proper record-keeping and fair compensation, including:

- Employer’s Full Name: The official registered name of the company issuing the payslip. This ensures clarity in legal and financial records, especially for tax or compliance purposes.

- Employee’s Full Name: The complete name of the individual receiving the salary. This helps prevent confusion and ensures the employer correctly assigns the document to the intended employee.

- Payment Date: The specific date when the salary is disbursed, or multiple dates if the payslip template covers several payments. This allows employees to track when they receive their wages.

- Basic Salary Details: For employees paid hourly, daily, or based on output, the salary slip should show the rate of pay and the total hours, days, or pieces worked. This ensures transparency in how the basic salary is calculated.

- Salary Period Start and End Date: The timeframe for which the salary is being paid. This helps employees verify that they are being compensated correctly for the right period of work.

- Allowances for the Period: Includes both fixed and one-time allowances, such as transport stipends or uniform reimbursements. These additional payments contribute to the total earnings and should be clearly stated.

- Additional Payments: Any extra compensation beyond the basic salary, such as bonuses, public holiday wages, or rest day pay. This ensures employees have a clear understanding of all payments received.

- Salary Adjustments: Any reductions applied to the salary, including standard contributions like CPF and specific reductions such as unpaid leave or work absences. This helps employees track any salary modifications.

- Overtime Hours Worked: The total number of extra hours an employee has worked beyond regular hours. This ensures proper calculation of additional earnings for overtime.

- Overtime Pay Amount: The payment received for overtime hours, calculated based on company policies and labor laws. This ensures employees are fairly compensated for their extra work.

- Overtime Payment Period: If the overtime pay is based on a different timeframe from the regular salary period, the employer should state the exact start and end dates. This ensures employees understand which period their overtime compensation covers.

- Total Net Salary: The final amount received by the employee after all calculations, including earnings and adjustments. This is the take-home pay that the employee can expect in their bank account or cash payment.

To simplify documentation and pay slip creation, you can use ScaleOcean’s HRIS software. This system enables integrated employee data management, including payroll, attendance, and performance, making the payslip creation process automated and efficient.

With this seamless integration, this HRIS software can also provide accurate and timely reports. This will significantly simplify the payroll process, ensuring that every employee receives their entitlements without calculation errors.

Take a free demo now to discover this solution for your business.

How to Create a Payslip for Employees

Creating an accurate and detailed payslip is essential for both employers and employees, as it helps ensure transparency and proper documentation of earnings and deductions. There are various ways to create a payslip, ranging from using payroll software to manually generating one using templates.

Here are three common methods for creating payslips, including:

1. Using Payroll Software

Payroll software automates the process of creating payslips, allowing for the accurate and timely generation of documents for each employee. The software typically integrates with other HR systems, making it easy to track earnings, deductions, and tax information.

It also ensures compliance with local tax laws and regulations, reducing the risk of errors. Most payroll software also offers customization options to add company logos and specific employee details, making the payslip professional and comprehensive.

2. Manual Creation

If payroll software is not available, payslips can be manually created using templates. These templates often come with pre-set fields for employee information, pay period, gross salary, deductions, and net pay.

Templates can be found online or created using spreadsheet tools like Excel. While this method is more time-consuming and requires attention to detail, it allows employers to create personalized payslips without additional software costs. However, it is essential to double-check calculations for accuracy.

3. Legal Requirements

Payslips must comply with local labor laws, which may vary by country. In many jurisdictions, employers are legally required to provide employees with detailed payslips, including information such as gross salary, deductions, net pay, and employer details.

The payslip must also be provided on a regular basis, such as monthly or bi-weekly, depending on the employment agreement. Employers should familiarize themselves with these legal requirements to avoid potential fines or disputes.

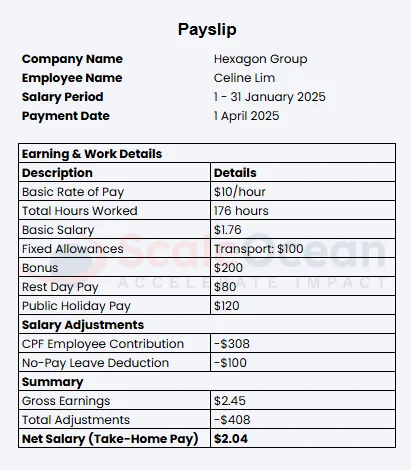

Example of Payslip and The Template

A payslip example provides a clear, practical illustration of how to present an employee’s earnings and deductions. It helps both employers and employees understand what to expect on an official payslip.

Along with a payslip template, which can be customized to fit specific needs, businesses can ensure that all necessary details are included while maintaining a professional format. Below is an example of a payslip and a template for easy reference.

To help streamline your payroll cycle, we’ve prepared a downloadable payslip template that you can easily customize to suit your company’s needs. The template includes all the key components discussed above, such as basic salary, allowances, overtime pay, CPF contributions, and net salary.

Whether you’re managing payroll for a small business or a growing company, this template is designed to be practical, professional, and compliant with MOM guidelines. Here is the template of a payslip or salary slip with Excel format that you can download:

Best Practices for Issuing Payslip

Issuing accurate and transparent payslips is a critical practice for any business. It ensures both compliance with regulations and maintains trust between employers and employees. To ensure that payslips serve their intended purpose effectively, it is important to follow a set of best practices.

Here are some key guidelines for issuing payslips.

1. Accuracy

Accuracy is the most important aspect when issuing payslips. Employers must ensure that all earnings, deductions, and taxes are calculated correctly. This includes verifying employee hours, overtime pay, and any bonuses.

Mistakes can lead to confusion, disputes, and legal issues, so double-checking calculations is crucial to maintaining trust and avoiding errors.

2. Clear Formatting

Payslips should be easy to read and understand. Using clear formatting with distinct sections for gross pay, deductions, net pay, and additional details helps employees quickly identify the key information.

A well-organized payslip reduces the chance of confusion and makes it easier for employees to track their earnings and deductions over time.

3. Confidentiality

Payslips contain sensitive financial information, and it is vital to maintain confidentiality when issuing them. Employers should ensure that payslips are delivered securely, either via encrypted email, a secure HR portal, or in physical form with adequate protection.

Only the relevant employee should have access to their payslip to avoid data breaches or unauthorized sharing of personal information.

4. Support and Clarification

Employers should be ready to provide support and clarification for any questions or concerns regarding a payslip or salary slip.

It’s essential to have a point of contact within the company, such as HR or payroll, for employees to reach out to if they don’t understand a deduction or need further explanation. Offering clear, accessible support helps resolve issues quickly and maintains employee satisfaction.

5. Timeliness

Payslips should be issued on time, whether it’s weekly, bi-weekly, or monthly, as outlined in the employment agreement. Delays in issuing payslips can create confusion and dissatisfaction among employees, and in some cases, could lead to legal issues.

Ensuring that payslips are delivered consistently on schedule helps reinforce an employer’s reliability and professionalism.

Difference Between Payslip vs. Pay Stub

Although often used interchangeably, a payslip template and a pay stub can differ in the type of information they present. A pay stub typically highlights an employee’s total earnings before taxes, along with employer contributions and any taxes or insurance premiums withheld.

It serves as a financial summary that focuses more on statutory deductions and contributions. This format is commonly used in regions where payroll details are tied closely to corporate tax documentation.

Meanwhile, a payslip usually includes details such as hours worked, hourly rates, and overtime payments. It provides a clearer picture of how wages are calculated based on time or performance.

In systems like those used in Singapore, an itemized payslip template also reflects specific allowances, CPF contributions, and net take-home pay. By offering this level of transparency, especially through digital payroll software, businesses can improve employee trust and support better financial awareness.

Difference Between Payslip vs. Paycheck

Many people mistakenly think a payslip and a paycheck are the same, but they serve different purposes. A payslip provides a breakdown of an employee’s salary details, such as earnings, allowances, and contributions, during a specific pay period.

Its main function is to inform the employee of how the employer calculated the final salary. Meanwhile, it has no monetary value, and the employee cannot use it for transactions.

A paycheck, on the other hand, is a physical or digital payment that an employee receives for their work. It represents the actual amount of money earned, which can be deposited or cashed at a bank. In some countries where paper checks are still used, a paycheck acts both as proof of payment and a means to access funds.

Are Employers Required to Provide a Payslip?

Employers in Singapore must issue itemised payslips under the Employment Act, a rule enforced by the Ministry of Manpower (MOM) since 1 April 2016. This requirement applies to all employees covered by the Act, including full-time, part-time, temporary, and contract workers.

Employers must issue payslips at least once a month and can provide them in soft copy, hard copy, or even handwritten, as long as they are complete and accurate. Beyond compliance, providing a payslip template is a best practice for payroll transparency and employee trust.

A detailed payslip helps staff clearly understand how their employer calculates their salary, including overtime, bonuses, prorated salary, and CPF contributions. This helps reduce confusion, prevent disputes, and ensure your business maintains good standing with local regulations.

The Importance of Using MOM-Approved Payslip Formats

A payslip that follows MOM’s approved format provides clarity on how employers calculate and pay salaries. When the structure is clear and the employer lists all required details, such as pay period, overtime, and CPF contributions, employees can easily understand their payment breakdown.

For example, if there’s a change in net salary, the payslip allows them to trace it back to specific adjustments like unpaid leave or bonuses, ensuring HR compliance. For businesses in Singapore, using the correct payslip format is a legal requirement under the Employment Act.

Non-compliance can lead to penalties, warnings, or employee complaints filed with the Ministry of Manpower. This is especially relevant for SMEs applying for government support such as the Productivity Solutions Grant (PSG) or Enterprise Development Grant (EDG).

A clear, MOM-compliant payslip can strengthen your audit preparedness and position your company as a responsible employer, ready for growth and funding opportunities.

Guide for Customizing Payslip Template for Singapore Employees

Customizing a payslip template that meets Singapore’s requirements is essential for ensuring accuracy, compliance, and employee clarity. Whether you’re using a manual system or HR software, following the right steps will help you create professional, MOM-compliant payslips.

Here’s a simple guide to help you through the process.

1. Gather Employee Information

Start by collecting essential employee details such as full name, job title, employee ID, and CPF number. These fields help identify the recipient and ensure accuracy in reporting.

It’s also important to record the start and end dates of the salary period, as required by MOM regulations. Consistent formatting across payslips helps maintain professionalism and clear record-keeping.

2. Determine Gross Earnings

Calculate the total income before any deductions. This includes basic salary, fixed and ad-hoc allowances, bonuses, public holiday pay, and rest day wages.

For hourly or daily-rated workers, remember to include the number of hours or days worked and the applicable rate. Accuracy at this stage ensures transparency and prevents confusion during verification.

3. Deduct Necessary Amounts

Subtract mandatory items such as the employee’s CPF contributions, no-pay leave, and any ad-hoc reductions like unpaid absences or late penalties. Employers must clearly state these deductions to comply with MOM’s requirement for an itemized payslip template.

Companies should also always double-check statutory contribution rates and ensure they update them according to the latest guidelines.

4. Calculate Net Pay

Once all earnings and deductions have been accounted for, calculate the final net salary. This is the actual amount the employee will receive. Presenting this clearly in the payslip helps employees understand how their take-home pay is derived. It’s best to highlight this section, either with bold text or a separate line, to avoid any confusion.

5. Save and Distribute

Save the finalized payslip securely, whether in Excel, PDF, or printed form, and distribute it to employees within the required timeframe.

In Singapore, employers must issue this document at least once a month and keep it on record for a minimum of two years. You can provide payslips via email, the HRIS system in Singapore, or printed hard copies, as long as the format remains clear and complete.

Trends in Creating Payslip or Salary Slip

As businesses evolve, so do the methods of issuing payslips. Traditional paper payslips are gradually being replaced by more efficient, secure, and convenient options. Two key trends in creating payslips today are the rise of digital payslips and mobile access.

These trends not only streamline payroll processes but also enhance the overall employee experience. Here’s a look at both trends.

1. Digital Payslips

Digital payslips are becoming increasingly popular due to their convenience and environmental benefits. Employers can issue payslips electronically via email or a secure HR portal, allowing employees to access them instantly.

Digital payslips also reduce administrative costs related to printing and mailing, while ensuring greater security with encryption and password protection.

2. Mobile Access

With the rise of mobile technology, employees now expect to access their payslips on their smartphones. Mobile access to payslips allows employees to view their earnings, deductions, and other important information from anywhere, at any time.

Many businesses are integrating mobile-friendly platforms or apps, improving accessibility and making it easier for employees to manage their financial records on the go.

Generate Precise Payslip Instantly Using ScaleOcean’s HRIS Software

ScaleOcean’s HRIS Software is an all-in-one and AI-powered solution designed to simplify HR processes, including generating accurate, compliant payslips for businesses in Singapore. With automation at its core, the system helps HR teams eliminate manual errors, stay aligned with MOM regulations, and speed up the payroll process.

By using ScaleOcean, companies can quickly generate detailed payslips, including full salary breakdowns such as CPF contributions, overtime pay, and allowances. The integrated AI engine checks the accuracy of data inputs, helps identify any potential issues in real-time, and offers valuable payroll insights, making the entire process more efficient and reliable.

ScaleOcean offers a free demo to help companies explore the system before committing. It also supports CTC grants in Singapore, assisting businesses in modernizing HR operations while reducing costs associated with implementation.

Below are key features of ScaleOcean’s HRIS software:

- Auto Calculation of CPF & Tax Contributions: The system automatically applies the latest CPF rates and tax rules to ensure compliance and accuracy.

- Real-Time Payslip Generation: The system generates payslips instantly after processing payroll with just one click.

- Customizable Payslip Template: Format and adjust templates to fit your company’s branding and structure while staying MOM-compliant.

- Integrated Attendance & Overtime Tracking: Pulls data directly from the system to calculate overtime pay and unpaid leave automatically.

- Secure Payslip Distribution: Automatically sends payslips to employees via email or employee self-service portal with password protection.

- Audit-Ready Payroll Records: Employers store and organize all payslips for easy access during audits or grant applications.

Conclusion

A payslip template is essential for both employees and employers in Singapore. It provides clarity and transparency in salary payments. The template outlines key details such as earnings, allowances, deductions, and net pay. This document helps employees manage their finances and ensure compliance with MOM regulations.

For companies seeking to simplify payroll management, ScaleOcean’s HRIS software offers a comprehensive, AI-powered solution. The system instantly generates accurate, compliant payslips, ensuring both efficiency and error-free processing.

Try ScaleOcean’s HRIS software with a free demo today and experience how easy it is to manage payroll accurately and efficiently.

FAQ:

1. How to get a pay slip?

Payslips are provided monthly by an employer, either as a printed hard copy or an electronic version. They are available only to salaried employees, and it is the employer’s responsibility to provide a copy of the payslip each month.

2. Is a payslip the same as a W-2?

A final pay stub displays the total earnings before taxes and deductions, as well as the net pay the employee takes home. In contrast, a W-2 form reports taxable wages after pre-tax deductions have been applied.

3. Who will provide a pay slip?

An employer issues a payslip to an employee every month, containing details related to the employee’s pay. This document includes information such as gross salary, deductions for taxes and contributions, and the net pay received.

4. What is a pay slip used for?

Payslips give employees a clear breakdown of their earnings and deductions, helping them understand how their pay is calculated. They also allow employees to spot any errors or discrepancies in their payments, ensuring they receive the correct amount for their work.

PTE LTD..png)

.png)

.png)

.png)

.png)