The Foreign Worker Levy in Singapore is a fee paid by companies employing foreign workers, aimed at maintaining a balance between local and foreign workers in the labor market.

While it may sound simple, many companies encounter issues managing this levy, such as miscalculations, late payments, or difficulties complying with frequently changing regulations.

The impact can be devastating, ranging from fines to work permit disruptions that threaten company operations. Therefore, it is crucial for companies to fully understand the rules and how to manage this levy to avoid getting caught in these problems.

This article will provide a comprehensive guide to the Foreign Worker Levy in Singapore, from definition, basic regulations, how to calculate, and solutions to common management issues. Learn more here!

- The foreign worker levy is a mandatory monthly fee imposed by the Singapore government to regulate foreign labor and encourage local employment, supporting national economic and social goals.

- Calculated foreign worker levy should understand quotas and tiers, including: S Pass levy rates, and work permit levy rates

- Foreign worker levy bill factors include: quota utilization. skill level, nationality mix, types of work pass, sector of employment, and government policy changes

- The Foreign Worker Levy deadline in Singapore is due monthly, with payments required by the 14th of each month for the previous month’s levy

- ScaleOcean HRIS software solution offers streamlined foreign worker levy tracking and payment, improving labor management efficiency and compliance.

What Is the Foreign Worker Levy?

In Singapore, the Foreign Worker Levy (FWL) is a monthly fee employers must pay for each Work Permit or S Pass holder they employ. This levy serves as a pricing mechanism to regulate the number of foreign workers in the workforce.

This strategy promotes businesses to hire local personnel over international labor, hence promoting national employment goals. The government’s goal in establishing this charge is to strike a balance between economic and social stability.

The levy applies to a variety of industries, including construction, manufacturing, and services. It is an important element for companies that employ foreign workers to consider when developing their personnel plans.

Effective human resource management requires employers to budget for these monthly fees to remain compliant and avoid penalties. Understanding the foreign worker levy enables businesses to effectively manage costs and utilize labor resources.

How Is the Foreign Worker Levy Calculated?

The Foreign Worker Levy in Singapore is calculated based on several factors, including the type of work pass held by the foreign worker, the industry they are employed in, and their skill level. Here is how the levy is calculated to ensure compliance and avoid unnecessary costs for businesses.

Understanding Quotas and Tiers of Foreign Worker Levy

The government sets a quota that limits the number of foreign workers a company can hire based on its total workforce. This quota is meant to encourage businesses to hire local employees first, with a higher quota available for companies in sectors where foreign workers are more commonly employed, such as construction or manufacturing.

Each business sector in Singapore has a set quota that restricts the proportion of Work Permit (WP), Employment Pass, and S Pass holders a company can employ relative to its total workforce. Learn more here!

S Pass Levy Rates

The S Pass Levy Rates in Singapore are determined based on the sector in which a foreign worker is employed and the worker’s skill level. The S Pass is typically issued to mid-skilled workers, such as technicians or specialists, and the levy rates for S Pass holders vary accordingly.

| Sector | Quota | Levy Rate (SGD) |

|---|---|---|

| Manufacturing | 15% of total workforce | $330 – $650 |

| Process | 15% of total workforce | $330 – $650 |

| Construction | 15% of total workforce | $330 – $650 |

| Marine Shipyard | 15% of total workforce | $330 – $650 |

| Services | 10% of total workforce | $330 – $650 |

Work Permit Levy Rates

The Work Permit Levy Rates in Singapore are determined by the type of work pass and the sector in which a foreign worker is employed. The Work Permit is primarily issued to lower-skilled foreign workers in industries such as construction, manufacturing, and marine shipyards.

The levy rates for Work Permit holders depend on several factors:

| Sector | Quota | Tier | % Range | Levy Rate |

|---|---|---|---|---|

| Manufacturing | 60% | 1 (Lower) | 10-25% | $ 250 / $ 370 |

| 2 (Medium) | 25-50% | $ 350 / $ 470 | ||

| 3 (Higher) | 50-60% | $ 550 / $ 650 | ||

| Construction | 83.3% | Malaysians, NAS, PRC | <83.3% | $ 300 / $ 700 |

| NTS | <83.3% | $ 500 / $ 900 | ||

| Off-Site | <83.3% | $ 250 / $ 370 | ||

| Services | 35% | 1 (Lower) | 5-10% | $ 300 / $ 450 |

| 2 (Medium) | 10-25% | $ 400 – $ 600 | ||

| 3 (Higher) | 25-30% | $ 600 – $ 800 | ||

| Marine Shipyard | 8% | 1 (Lower) | 8-15% | $ 400 – $ 650 |

| 2 (Medium) | 15-30% | $ 400 – $ 650 | ||

| 3 (Higher) | 30-77.8% | $ 400 – $ 650 | ||

| Process | 83.3% | Lower | <83.3% | $ 200 – $ 450 |

| Malaysians, NAS, PRC | <83.3% | $ 200 – $ 450 | ||

| NTS | <83.3% | $ 300 – $ 400 |

Factors Affecting Foreign Worker Levy Bills

Several factors influence the amount that businesses must pay in Foreign Worker Levy bills. Understanding these factors is crucial for companies to manage costs and ensure compliance with government regulations. Here are the key factors that affect the foreign worker levy:

- Quota Utilization: Each business sector in Singapore has a quota that limits the proportion of foreign workers a company can employ compared to its total workforce. Companies that employ a greater percentage of foreign workers relative to local workers will incur higher levy charges.

- Skill Level of Workers: The levy rate for foreign workers is tiered based on their skill level. Higher-skilled workers, such as those with S Pass or Employment Pass, are subject to lower levies compared to lower-skilled workers who hold a Work Permit.

- Nationality Mix: Certain sectors may have varying levy rates depending on the mix of local and foreign workers, such as Non-Traditional Source (NTS) countries compared to those from Malaysia, NAS, or PRC.

- Type of Work Pass: The type of work pass held by the foreign worker significantly affects the levy amount. The levy rates are adjusted based on the skill level of the worker, with lower-skilled workers in sectors like construction and manufacturing typically facing higher levies.

- Sector of Employment: The industry or sector in which a foreign worker is employed also impacts the levy rates. Sectors that rely more on foreign workers, such as construction, marine, and manufacturing, generally have higher levy rates.

- Government Policy Changes: The Foreign Worker Levy rates and quotas can change over time as the government updates its policies to manage the labor market. Regular adjustments are made to the levy rates to reflect economic conditions, industry needs, and labor market trends.

How to Application Process of Foreign Worker Levy

The application process for the Foreign Worker Levy in Singapore involves several steps that employers must follow to ensure compliance with government regulations. Here’s an overview of the process:

- Registering for Work Passes: Before applying for the Foreign Worker Levy, employers must first apply for a work pass for their foreign workers. This includes obtaining a Work Permit, S Pass, or Employment Pass, depending on the worker’s qualifications and the type of job.

- Submitting the Levy Application: Employers must apply for the Foreign Worker Levy from the 1st of the month following the levy bill issue date. During the application, employers need to specify whether the worker held an existing work permit or employment pass during the claimed period. The application must be submitted within 1 year of the levy bill date.

- Levy Determination: After submitting the application, MOM will assess the levy rate based on the sector, skill level of the worker, and the company’s foreign worker quota. The levy rate will be set accordingly, and employers will be notified of the amount they need to pay each month.

- Payment Setup: Employers can set up payment methods, such as GIRO (for automatic deductions) or manual payment through MOM’s online system. Setting up GIRO is encouraged to ensure timely payments and reduce administrative efforts.

- Approval and Confirmation: Once the application is processed (which can take up to 12 working days, or longer if additional checks are needed), employers will receive confirmation from MOM. They must ensure the levy is paid by the required deadlines each month to avoid penalties.

You can optimize the application of the foreign worker levy process by using the best payroll software in Singapore, such as Scaleocean. It can automate key tasks such as tracking work pass types, ensuring compliance with sector quotas, and calculating the correct levy rates based on employee data.

ScaleOcean’s payroll software in Singapore also streamlines payment setup through GIRO integration, ensuring timely submissions and minimizing manual errors.

By providing real-time updates and notifications, ScaleOcean simplifies the entire process, reducing administrative workload and helping businesses stay compliant with MOM regulations. Request a free demo to provide this solution for your business.

How to Check Your Levy Bill

To properly manage payments, businesses must periodically review and pay foreign worker levy invoices on time. The Ministry of Manpower (MOM) provides a handy web platform for this purpose.

Employers can safely log in to access detailed levy statements at any time. These statements reflect the overall number of foreign workers employed as well as the amount of levy due. Employers who regularly monitor the levy bill can better organize their finances and prevent surprise charges.

Using MOM’s eService to examine the levy bill increases transparency in payment management. Employers can use this platform to track quota balances and payment histories. This avoids errors and missed payments, which could result in penalties.

To streamline payroll processes, employers can implement a reliable top payroll software in Singapore, such as ScaleOcean, that integrates levy payment tracking. The web system rapidly updates levy information upon each payment or worker status change.

Companies that stay informed through MOM’s site maintain compliance and ensure smooth workforce operations. You can request a free demo to get the customized solution that meets your business needs.

Levy Payment Schedule and Deadlines

The Foreign Worker Levy in Singapore is due monthly, with payments required by the 14th of each month for the previous month’s levy. Employers can pay via GIRO or online through MOM’s e-Services portal.

For example, the levy payment for February 2026 must be made by March 14th, 2026. If the 14th falls on a weekend or public holiday, the payment is due on the next working day.

Late payments incur penalties, including fines or work pass suspension, and can result in higher levy rates. Adjustments should be made for any changes in worker status, such as pass type or employment. Timely payments are essential to avoid penalties and maintain compliance with MOM regulations.

Companies that repeatedly fail to make payroll cycles may also face legal consequences. Such penalties impede corporate operations and potentially undermine the company’s reputation among authorities.

Payment Methods

Employers have numerous easy payment methods for the foreign worker tax, all of which are intended to make the procedure as smooth and fast as possible. To ensure accurate tracking of these deductions, it’s important to clearly outline them in the payslip.

Choosing the appropriate payment option reduces delays and fines while simplifying financial administration. Understanding these choices enables employers to choose the best manner to fulfill their levy obligations. The following summarizes the primary payment methods available to facilitate hassle-free transactions:

- GIRO: Employers are recommended to set up a GIRO arrangement with MOM to ensure automatic monthly withdrawals. This strategy streamlines payment handling and reduces the likelihood of late fees. GIRO also saves time by eliminating the need to make manual payments each month.

- PayNow QR: It can also be made via mobile banking apps for increased convenience. Customers of DBS/POSB, UOB, and OCBC can make payments quickly by scanning the MOM QR code. The process consists of logging in, scanning the QR code, entering the levy amount, and verifying the transaction.

Managing Levy Waivers and Refunds

Employers may be eligible for levy waivers or refunds if a foreign worker leaves before the tax period finishes. Special government initiatives also provide a levy reduction to qualifying employers under certain conditions.

Knowing when and how to apply allows businesses to avoid excessive levy payments and improve their cash flow. Clear MOM rules clarify the requirements and process for submitting waiver or refund applications.

To avoid delays in reimbursement or levy modifications, waiver or refund requests must be submitted on time. Employers should conduct regular worker reviews and retain the correct documents to support their applications.

Using MOM’s eServices platform improves the process of tracking and managing levy returns. Proactive levy management through waivers and refunds decreases financial risks while ensuring compliance with Singapore’s foreign worker legislation.

Understanding Sector-Specific Levy Requirements

The foreign worker levy varies per industry sector to suit specific manpower needs and government policy. Each sector has its own set of rules, including tax rates, foreign worker quotas, and employment standards.

Understanding these sector-specific levy duties enables firms to better organize their workforce and manage expenditures. The primary sectors with their levy frameworks are:

1. Construction Sector

The construction sector adheres to a Dependency Ratio Ceiling (DRC), which limits the number of foreign workers in comparison to locals. Levy rates change according to skill level, with lower-skilled workers paying greater levies.

Employers must also keep a minimum number of highly skilled local staff. This supports workforce skill development and balances foreign labor reliance. Adherence to these guidelines assures compliance and long-term labor management.

2. Manufacturing Sector

Manufacturing uses a similar DRC to control the proportion of foreign labor engaged. Levy rates are tiered based on the worker’s category and expertise. Employers must regularly check and pay foreign worker levy quotas to avoid exceeding them and incurring additional penalties.

Effective quota management supports seamless operations and adherence to government laws in this area.

3. Services Sector

To manage foreign worker employment levels, the services industry uses a tiered levy structure in conjunction with a DRC. Exceeding foreign worker quotas results in higher tax rates to promote employing more local workers.

This system promotes worker localization while balancing international labor demands. Employers must closely monitor quota consumption to optimize expenses and remain compliant.

4. Marine Shipyard and Process Sectors

Marine shipyards and process industries have unique levy laws that reflect their operational needs. These include levy rates that differ by industry.

According to MoM Singapore, the marine shipyard sector has a Dependency Ratio Ceiling (DRC) of about 77.8%. Quota limitations are designed to reflect the nature of labor in these industries. Understanding these specific needs enables firms to effectively plan and manage their foreign personnel.

Tips for Effective Levy Management

Effectively managing the foreign worker levy allows firms to control costs while remaining compliant with government rules. Proper levy management ensures that activities run smoothly and avoids disruptions caused by penalties or quota breaches.

Employers may improve their labor planning and save money by implementing best practices. Key ways for effectively handling the levy include:

Regular Monitoring

Employers should check and pay foreign worker levy bills and quota balances on a regular basis through the MOM’s online site. Frequent monitoring helps uncover differences early on and avoids unwanted expenditures.

Maintaining accurate timesheet records also supports better tracking of actual work hours, ensuring compliance with levy regulations. Keeping track of quota consumption provides for more effective workforce planning and resource allocation. This proactive approach eliminates the risks associated with over-deployment and payment problems.

Timely Payments

Meeting levy payment deadlines is critical to avoiding penalties and maintaining continuous work pass validity. To preserve compliance, employers must prioritize the prompt check and pay of the foreign worker levy. Delays in payments might result in fines or the suspension of foreign workers’ visas.

Additionally, when managing payroll, employers should also consider adjustments for prorated salary in cases of employees joining mid-month or leaving before the pay period ends. Setting reminders or automating payments helps to ensure transactions are completed on time as part of effective talent management practices.

Utilize MOM Tools

Employers should use MOM’s calculators and eServices to arrange levy payments appropriately. These tools estimate monthly levy costs based on workforce size and sector.

Using MOM’s digital services simplifies budgeting and helps you comply with levy requirements. These dependable tools can help employers maximize hiring decisions and financial planning.

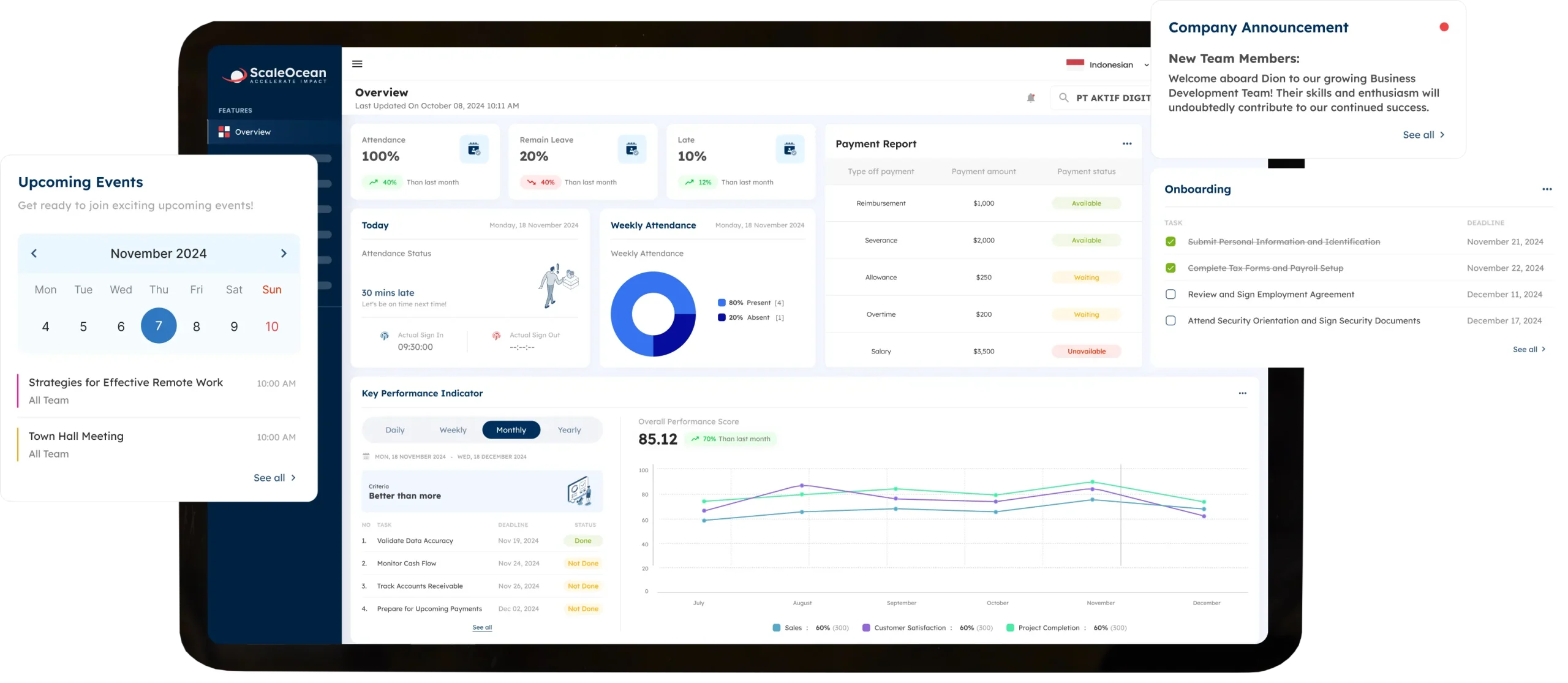

Manage Foreign Worker Levy Easily with ScaleOcean’s HRIS Software

ScaleOcean HRIS, a comprehensive and flexible ERP solution, optimizes Foreign Worker Levy (FWL) management in Singapore by providing an integrated and automated system.

With its integrated HRIS module, ScaleOcean helps companies monitor foreign worker attendance, salaries, and contract compliance in real-time, ensuring that all levy-related data is calculated accurately and complies with government regulations.

You can also customize the ScaleOcean system to your specific business needs, with its user-friendly interface. ScaleOcean is also suitable for those applying for a CTC grant for digital system development. Here are some specific features of ScaleOcean HRIS software for managing the foreign worker levy:

- Automatic Quota Calculator: ScaleOcean can calculate the local-to-foreign worker ratio in real-time and notify you if the number of foreign workers approaches the maximum limit to avoid penalties.

- Automatic Levy Waiver Tracking & Submission: You can request levy refunds and waivers under certain conditions, and ScaleOcean can track the process automatically.

- Payroll and Payment Integration (GIRO/PayNow): ScaleOcean can file relevant reports for billing on MOM’s Check and Pay Foreign Worker Levy portal.

- Analytics Dashboard and Cost Projection: The system can predict levy costs for the next 6-12 months based on your recruitment plan and show potential cost savings if your company increases the number of local workers.

With ScaleOcean’s solutions, your company can not only optimize foreign worker levy management but also improve overall operational efficiency and ensure compliance with updated government regulations.

To discover the best HRIS software solution, book a free demo and discuss your business needs with ScaleOcean’s professional team.

Conclusion

Understanding the foreign worker levy is critical for firms seeking to ensure compliance and control costs. Regular monitoring and timely payments help to avoid penalties and worker disruptions.

Knowing sector-specific restrictions can help organizations manage foreign worker quotas more effectively. Using government tools promotes precise levy planning and efficient operations. Overall, proper levy management ensures the stability of your firm and staff.

ScaleOcean provides a comprehensive ERP system that simplifies foreign worker levy management and payroll operations. Our program easily tracks levy payments, quotas, and compliance.

ScaleOcean’s HRIS Software allows organizations to automate payment reminders and eliminate administrative burdens. Request a free demo to improve your labor management and levy payments efficiently.

FAQ:

1. How much is the foreign worker levy?

The foreign worker levy ranges from S$300 to S$950 per month, depending on the worker’s skill level.

2. Who pays the foreign worker levy?

Employers are required to pay the Foreign Worker Levy (FWL) every month for each Work Permit holder they employ. This fee is part of Singapore’s framework to maintain a balanced labor market.

3. How to waive the foreign worker levy?

A levy waiver allows for a reduction or refund of the levy when an employee cannot work due to MOM-approved reasons such as overseas leave, hospitalization, quarantine, or police custody. Employers must submit a waiver application via myMOM or WP Online, along with supporting documents.

4. How do I calculate my levy?

The levy is calculated as 0.25% of an employee’s total monthly wages. For employees earning less than $800 a month, the minimum levy is $2, while the maximum is $11.25 for those earning over $4,500.

PTE LTD..png)

.png)

.png)

.png)

.png)