What if you could borrow money to boost your business growth, with the expectation that the returns would far outweigh the cost? That’s the power of financial leverage, using debt strategically to amplify your potential gains and unlock new opportunities.

According to MoneySense, Daily Leverage Certificates (DLCs) offer traders 3x to 7x amplification based on the underlying asset’s daily performance. While leverage allows for potentially higher returns, it is important to note that it also significantly increases the risk of greater losses.

This strategy can be a powerful engine for growth, but it’s not without its risks. This article will break down the financial leverage definition, how it works, how to calculate the financial leverage formula, and how you can manage it effectively.

- Financial leverage involves using borrowed funds to acquire assets, expecting asset profits to surpass debt costs.

- The primary advantages of financial leverage include magnified profits and tax benefits, but they come with the substantial disadvantages of increased financial risk and potential bankruptcy.

- How to effectively analyze financial leverage involves a deep dive into your company’s financial statements to ensure debt levels are sustainable and support strategic goals.

- ScaleOcean’s accounting software makes managing financial leverage easier by giving you real-time data and insightful analytics, so you can make smarter, faster decisions for your business.

What Is Financial Leverage?

Financial leverage involves using borrowed funds to acquire assets, expecting asset profits to surpass debt costs. This strategy aims to boost shareholder returns but simultaneously increases the risk and volatility of earnings, as small operational changes impact earnings per share significantly.

Understanding leverage is crucial for shaping capital structure and investment choices. Effective leverage management relies heavily on accurate financial reporting, often utilizing principles like double-entry accounting to balance assets, liabilities, and risks for optimal returns.

How Financial Leverage Works

Financial leverage is the difference between asset returns and borrowing costs. For instance, earning 10% while borrowing at 5% boosts equity, enabling faster growth and major investments. Effective leverage requires meticulous bookkeeping and accrual accounting to accurately track profitability. Here’s how financial leverage works:

1. Amplified Returns

When a company’s operating income is strong, leverage really starts to shine for shareholders. Since interest payments on debt are generally fixed, any profit made beyond that fixed cost flows straight to the shareholders, which often results in a magnified return on equity (ROE). It’s a key reason why financial leverage can be so attractive.

To illustrate, even a modest 10% jump in operating profit could easily mean a 20% or 30% surge in earnings per share for a company using leverage. This amplification is actually the core reason many businesses choose to take on debt initially. The allure of outsized shareholder gains is undeniably a powerful motivator.

2. Amplified Losses

Now, it’s crucial to remember that leverage is a bit of a double-edged sword, and it can cut hard the other way too. If operating income takes a hit, those fixed interest payments don’t just disappear, which means profits can be quickly eaten away or even completely wiped out.

This is really where the significant risk factors come into play. If a company’s earnings aren’t enough to cover its interest obligations, it could easily face a serious liquidity crisis. For instance, a mere 10% drop in operating profit has the potential to wipe out earnings completely, truly showcasing the inherent danger of high leverage.

3. Tax Shield

A major upside to employing debt, which is often overlooked, is the tax shield it brings along. Those interest payments on debt are generally tax-deductible, which, in turn, cuts down on a company’s taxable income. This effectively lowers the real cost of borrowing money, a pretty nice perk for businesses.

This tax benefit often makes debt financing a more attractive and frankly, cheaper option compared to equity financing, mainly because dividends paid to shareholders don’t offer that same tax break. The tax shield really gives companies a direct financial nudge to include a specific amount of debt in their overall capital structure.

Key Ratio and How to Calculate Financial Leverage

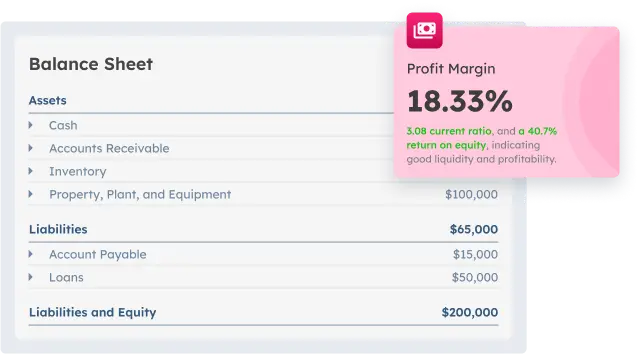

Key financial metrics, like the financial leverage ratio, are essential for effective leverage management. These ratios clearly reveal debt levels and repayment capacity. Monitoring this data, sourced from the income statement and balance sheets, ensures informed financial decisions. Here’s a closer look at important financial leverage ratios:

1. Debt-to-Equity (D/E) Ratio

The Debt-to-Equity ratio is one of those core indicators for financial leverage, and you get it by just dividing total liabilities by what the shareholders own. What it really tells you is how much of the company’s funding comes from borrowed money compared to what its owners have put in, and a high D/E ratio usually points to more risk.

Investors and creditors closely monitor this ratio to gauge a company’s risk exposure. Though industry benchmarks vary, a ratio significantly higher than peers often signals risk. It’s a simple, powerful metric for measuring reliance on borrowed capital.

2. Debt-to-Assets Ratio

You calculate this ratio by taking total debt and dividing it by total assets, which then shows you the percentage of a company’s assets that are actually paid for with debt. If this ratio goes above 1.0, it essentially means the company has more debt than assets, giving you a quick snapshot of the overall debt burden.

Similar to the D/E ratio, what’s considered a “good” number here really shifts depending on the industry you’re looking at. Generally speaking, a lower ratio suggests a business that’s more stable and less risky, offering a pretty clear picture of how leveraged the asset base truly is.

3. Interest Coverage Ratio

The Interest Coverage Ratio assesses a company’s ability to manage its interest payments by dividing Earnings Before Interest and Taxes (EBIT) by the interest expense. A higher figure is preferred, signaling that the company can comfortably and reliably cover its debt obligations.

Now, if this ratio is on the low side, it often signals that the company is really struggling with debt expenses and could be in trouble if earnings start to dip. Lenders usually want to see a ratio of at least 1.5 to 2.0. It’s a vital metric for understanding a company’s short-term financial stability, giving you a quick read on how secure things are.

4. Degree of Financial Leverage (DFL)

The Degree of Financial Leverage, or DFL, essentially tells you how sensitive a company’s earnings per share (EPS) are to changes in its operating income. You calculate it by dividing the percentage change in EPS by the percentage change in EBIT, and it really helps quantify the magnification effect of leverage.

For example, a DFL of 2.0 means that if EBIT goes up by 10%, EPS will jump by 20%, which sounds great in good times. However, while a high DFL can bring fantastic returns when things are going well, it also points to significant risk during downturns, so it’s a double-edged sword, really.

5. Debt-to-EBITDA Ratio

This key metric compares a company’s total debt to its EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), signaling its debt repayment capacity. A ratio below 3.0 is often considered healthy, though industry standards vary. Key data is sourced from the profit and loss statement.

Lenders, for instance, lean heavily on this metric in loan agreements to make sure a borrower isn’t getting too far over their skis with debt. It’s a favorite because EBITDA often acts as a good stand-in for the cash flow available to service debt, providing a solid indicator of a company’s long-term repayment capacity.

6. Equity Multiplier

The Equity Multiplier offers yet another angle on leverage, simply calculated by dividing total assets by the total shareholder equity. A higher number here means a higher level of financial leverage, showing you pretty clearly how many dollars of assets a company has for every single dollar of equity, which is a key insight into its financial architecture.

This ratio actually plays a big part in DuPont analysis, which breaks down Return on Equity (ROE) into profitability, asset efficiency, and, of course, financial leverage. It really brings into focus just how much of a company’s asset base is financed by debt, giving you a solid understanding of its overall capital structure strategy.

Advantages and Disadvantages of Financial Leverage

While financial leverage can drive substantial growth and value, mismanagement can lead to severe distress. Business leaders must carefully weigh these pros and cons, tailoring their approach to their specific industry, the current business cycle, and the organization’s tolerance for risk. Here’s a look at the advantages and disadvantages:

1. Advantages

Financial leverage offers the chance for significant growth by using borrowed funds to amplify returns. When used well, it lets businesses invest in more assets without depleting their own capital, effectively driving higher profits and increasing shareholder value.

By utilizing debt, companies can capitalize on lower interest rates and valuable tax deductions, strengthening their overall financial position. This leads to better resource allocation, higher returns on equity (ROE), and the ability to scale operations more rapidly. Here are the key advantages:

- Magnified Profits: Financial leverage can significantly boost returns on equity, which is appealing for businesses. When investments generate more than the interest paid, the extra profit increases shareholder wealth, making leverage a core strategy for growth.

- Access to Larger Investment: Leverage enables companies to pursue investments they couldn’t afford with only their own capital. This includes acquisitions, new factories, or more R&D, expanding a company’s strategic options and growth potential.

- Increased Buying Power: Borrowed funds increase a company’s capital, enhancing its buying power in the market. This can lead to better deals with suppliers and larger, more impactful investments, giving companies a stronger financial position.

- Higher Potential Returns: Using leverage allows investors to control a larger asset base with a smaller initial investment, increasing the potential for higher returns on equity. The primary goal is to maximize return and leverage investment efficiently.

- Tax Benefits: Interest paid on debt is tax-deductible, reducing a company’s tax liability. This creates a “tax shield,” making debt financing more cost-effective than equity and offering a direct financial incentive for using leverage.

2. Disadvantages

While financial leverage offers substantial rewards, it carries significant risks that impact stability. Borrowing can amplify profits from increased investment, but it also magnifies losses if the company fails to generate sufficient returns, creating a precarious balance.

Leverage fundamentally increases a company’s vulnerability to market changes and economic downturns. Should the business underperform, debt costs, especially interest payments, can become overwhelming, significantly raising the risk of severe financial distress. Here are the key disadvantages:

- Magnified Losses: Just as leverage can amplify profits, it can also magnify losses. A downturn in business or a rough patch can escalate into a crisis for companies carrying significant debt, with fixed debt costs accelerating financial decline much faster than expected.

- Increased Financial Risk: More debt increases financial risk. Companies are legally obligated to make debt payments regardless of financial performance, which strains cash flow and can put significant pressure on a company, making it harder to manage and grow.

- Potential for Bankruptcy: If a company fails to meet its debt obligations, it risks bankruptcy. High leverage can lead to this worst-case scenario, where a company loses everything, making it a critical risk when borrowing excessively for growth.

- Reduced Financial Flexibility: High debt levels limit a company’s ability to seize new opportunities or address unexpected challenges. Restrictive covenants from lenders can prevent further financing, leading to strategic paralysis and stifling business flexibility.

What are the Risks of Financial Leverage?

The primary risk of financial leverage is heightened financial distress, making debt obligations difficult to meet. Should cash flow falter, fixed interest and principal payments become a heavy burden, often forcing asset sales or costly emergency financing to cover immediate obligations.

Leverage also reduces operational flexibility, as lenders typically impose restrictive covenants that limit key actions like capital expenditures or dividend payouts. Diligent monitoring of the cash flow statement and leverage ratio is critical, particularly during economic downturns.

Type of Financial Leverage and What is the Difference

Financial leverage extends beyond corporate debt, applying to various contexts from business to personal finance. The underlying principle involves utilizing fixed costs, such as interest expenses, to amplify outcomes, which can be either significantly positive or highly negative. Here are the key types of financial leverage:

1. Operating Leverage

Operating leverage measures how sensitive a company’s operating income is to changes in sales volume. It occurs when a business commits a large share of its production costs to fixed expenses (like rent or machinery), creating a cost structure characterized by high risk and high reward.

A small increase in sales can lead to a large jump in operating profit. Conversely, a small sales dip can be devastating to the bottom line. Unlike financial leverage (which concerns financing costs), this is operational risk, although both often combine to compound the overall risk profile.

2. Combined Leverage

Combined leverage is the total risk profile from integrating both operating and financial leverage. It measures how sensitive a company’s Earnings Per Share (EPS) are to fluctuations in sales revenue, illustrating the full magnification effect from the top-line sales down to the bottom-line EPS.

A company with both high operating and financial leverage faces an extremely precarious position due to highly volatile earnings. Management often seeks balance. For instance, a firm with high business risk (operating leverage) might aim for lower financial leverage to offset the overall exposure.

3. Leveraged Investing

Leveraged investing is the practice of utilizing borrowed capital to acquire securities, such as buying stocks on margin. The primary goal is to amplify profit potential by generating investment returns that exceed the interest costs paid on the borrowed funds. InvestmentTrade said, Notably, leverage remains a key factor for 41% of traders.

But, you know, this strategy doesn’t just amplify the gains. It amplifies losses, too. If your investment’s value dives, you’re not just losing your own money, but you still have to pay back that loan, making it quite a high-stakes game for individual investors who really need to understand their financial leverage ratio here.

4. Leverage for Personal Finances

Individuals frequently use leverage without conscious financial labeling. Mortgages, auto loans, and student debt are classic examples, enabling people to acquire valuable assets or earning potential that far outweighs the immediate cost of the debt over time.

Like corporate finance, personal leverage is a powerful tool for wealth building, yet excessive borrowing risks financial distress. Smart debt management is crucial for financial health, making it essential to maintain a sustainable, balanced level of personal borrowing.

5. Leverage in Professional Trading

In professional trading, leverage is intrinsic to derivatives like futures and options. These instruments allow traders to control a large market position with minimal capital. This structure can lead to either massive profits or catastrophic losses in a surprisingly short timeframe.

This specific type of financial leverage is typically extremely high and generally only suits highly sophisticated, experienced traders who fully grasp the inherent risks. It differs significantly from strategic corporate debt, where the magnification of risk is orders of magnitude higher, making it a distinct financial tool.

Example of Financial Leverage

To grasp financial leverage, consider a firm buying $100,000 in equipment with a projected 15% return ($15,000). We examine two options: 100% equity financing versus borrowing $80,000 at 5% interest, highlighting how debt financing impacts final returns and how these transactions are recorded in the general ledger reporting.

In the equity-only scenario, Option A (investing $20k) yields a 75% return. However, in Option B (leveraged), the $15,000 profit is reduced by $4,000 interest, leaving $11,000. This results in a 55% return on the same equity, demonstrating leverage’s ability to amplify shareholder returns.

What is a Good Financial Leverage Ratio?

There’s no universally “good” financial leverage ratio. What’s optimal depends on the industry, cash flow stability, and company stage. Capital-intensive sectors, such as utilities, often sustain higher leverage than service or tech firms. Benchmarking against industry peers is key to determining the right level.

It is important for companies to understand the difference between bookkeeping and accounting also helps ensure leverage-related data is recorded and interpreted correctly. Benchmarking against industry peers is key to determining the right level.

Generally, a Debt-to-Equity ratio below 1.0 is considered safe, while a ratio above 2.0 may signal risk. The critical factor is a company’s ability to service its debt, often demonstrated by a strong interest coverage ratio. Adhering to IFRS (International Financial Reporting Standards) ensures consistency in all ratio calculations.

How to Analyze Financial Leverage

Analyzing financial leverage means understanding a company’s strategic financial reporting and health, not just calculating ratios. Begin with a trend analysis, examining leverage ratios over time to assess if debt is increasing or decreasing, which can signal potential risk changes.

Next, conduct a peer group analysis to compare leverage ratios against industry competitors, clarifying the company’s capital structure relative to norms. Finally, perform a scenario analysis or stress test to evaluate the firm’s ability to manage debt under various economic conditions.

Financial Leverage vs. Margin: Key Differences

Though both involve borrowing, financial leverage and margin differ significantly. Leverage is a broad corporate finance concept detailing how firms use debt to fund assets, strategically impacting their overall capital structure and long-term growth objectives.

Margin, conversely, is a specific term in trading where an investor borrows from a broker to buy securities, using their portfolio as collateral. Both aim to amplify returns, but leverage affects the company’s balance sheet, while margin applies to individual investors.

Manage Financial Leverage Integrated with Scaleocean Accounting Software

ScaleOcean’s accounting software centralizes financial data for real-time tracking of key leverage ratios (e.g., Debt-to-Equity). With unlimited users, no hidden costs, and scalable, industry-specific solutions, it enables easy monitoring of debt covenants and cash flow, minimizing surprises.

ScaleOcean assists in managing financial leverage with powerful scenario analysis, allowing you to model the impact of new debt or rate changes. Furthermore, the system aligns with the CTC grant, simplifying the adoption of this essential digital solution for your business. Here are the key features for ScaleOcean’s software:

- Comprehensive Accounts Payable Management: Track short- and long-term liabilities in real-time, ensuring accurate monitoring of debts through the General Ledger.

- Automatic Financial Leverage Ratio Calculation: Automatically generate financial reports, calculating leverage ratios like Debt-to-Equity in real-time.

- Real-Time Financial Reporting Integration: Changes in purchasing, sales, and assets are instantly reflected, providing accurate real-time financial risk insights.

- Scenario Analysis for Debt Management: Model the impact of new debt or rate changes to assess effects on financial leverage and risk.

- Integrated Cash Flow Monitoring: Seamlessly monitor cash flow alongside liabilities, enabling better management of financial leverage and liquidity.

Conclusion

Financial leverage is a powerful tool capable of enhancing shareholder value, but it requires strategic management. The key is ensuring that the benefits of debt consistently surpass its costs, allowing the firm to find the optimal capital structure and avoid excessive risk.

Effective financial leverage management is possible with the right strategy and tools, such as ScaleOcean’s integrated accounting software. Vendor solutions like ScaleOcean provide real-time monitoring and scenario analysis, enabling informed business decisions, and ScaleOcean offers a free demo so you can explore its features and benefits firsthand.

FAQ:

1. What is a good example of leverage?

An example of leverage is borrowing money to fund business growth. For example, a company may take out a loan to invest in new technology or acquire assets, enabling expansion without depleting its own capital, thus maximizing potential returns.

2. What if financial leverage is high?

A high level of financial leverage increases a company’s exposure to risk. While it can enhance returns, it also magnifies losses if business performance falters. Heavy reliance on debt means the company is more vulnerable to financial difficulties if income falls short.

3. What are the 5 financial ratios?

1. Debt-to-Equity Ratio

2. Liquidity Ratio

3. Acid-Test Ratio

4. Asset Return (ROA)

5. Equity Return (ROE)

4. What is leverage ratio analysis?

Leverage ratio analysis is used to evaluate a company’s risk by comparing its debt level to its equity or assets. This ratio shows how much debt the company uses to finance its operations, helping to determine if the company is at risk of insolvency.

PTE LTD..png)

.png)

.png)

.png)

.png)