You’ve likely heard the buzz about ESG lately, but what does it really mean for your business? From being a niche concept to a mainstream priority, ESG is now essential for assessing how companies handle their social and environmental responsibilities.

Starting in 2027, NLCos must report Scope 1 and 2 GHG emissions under enhanced disclosure standards. This mandate, highlighted by ASEAN Briefing, underscores ESG’s rising role in driving transparency and accountability in environmental practices across sectors.

We’ll explore its core principles, what ESG means, why it’s become so important for investors and stakeholders, and how you can build a strategy that works. Understanding the environmental, social, and governance ESG framework is the first step. It’s a critical factor for sustainable and responsible growth in today’s world.

- ESG, Environmental, Social, and Governance, represents key criteria for evaluating responsible corporate operation.

- The three core principles of ESG, Environmental, Social, and Governance, provide a holistic view of a company’s impact and corporate responsibility.

- ESG investing integrates environmental, social, and governance factors into financial decisions, driving sustainable growth and long-term returns.

- ScaleOcean’s accounting software brings all your business processes together, making it super easy to gather data and create reports, so you can hit your ESG goals faster and more effectively.

What Is ESG (Environmental, Social, and Governance)?

ESG, Environmental, Social, and Governance, represents key criteria for evaluating responsible corporate operation. It helps investors and stakeholders assess how effectively a business manages risks, opportunities, and ethical practices beyond traditional financial results.

ESG serves as a comprehensive scorecard, measuring a company’s environmental impact, social responsibility, and quality of governance. This provides a broader view of corporate performance, which is vital for guiding sustainable and ethical business decisions in the global economy.

ESG’s Three Core Principles

ESG concentrates on three core principles, Environmental, Social, and Governance, that define responsible organizational operations. Each pillar addresses crucial aspects of sustainability, ethics, and transparency, forming the essential basis of a robust ESG strategy. Here are the three ESG pillars:

1. Environmental

First up, the “E” in ESG, which pretty much covers how an organization impacts the environment around it. This means looking at things like energy usage, how waste is managed, dealing with pollution, and making sure natural resources are conserved.

Now, if we think about schools and other educational institutions, this environmental aspect might involve working to reduce the campus’s carbon footprint, or maybe putting in place really solid recycling programs. The main goal is to reduce environmental impact and promote sustainability throughout operations.

2. Social

Moving on, the “S” covers social criteria, and honestly, this one is all about people and the relationships an organization maintains. It shows how a company treats employees, suppliers, customers, and communities, focusing on labor practices and social impact.

For an educational setting, thinking about “what is ESG?” from a social angle might mean making sure staff have fair labor practices, actively promoting diversity and inclusion among the student body, and really engaging positively with the local community. It’s about building a fair, healthy, and inclusive social environment for everyone.

3. Governance

Finally, the “G” in ESG stands for governance, and this essentially dictates how an organization is actually run. It covers leadership, executive pay, audits, internal controls, and shareholder rights to ensure transparency and accountability.

Applying school governance means ensuring a diverse board, transparent financial reporting (e.g., following IFRS (International Financial Reporting Standards)), and clear ethical processes. It is fundamentally about building stakeholder trust in the educational setting through responsible and ethical institutional behavior.

History of ESG Investing, Regulations, and Standards

ESG investing began with the ethical focus of socially responsible investing (SRI) in the 1960s. Its formal evolution began in 2005 with the UN’s “Who Cares Wins” report, which first coined the term “ESG” and highlighted the financial link between sustainability and lasting business resilience.

Since 2005, ESG has become a key global standard. Organizations like SASB and TCFD have been instrumental in building a consistent, worldwide framework for reporting these issues. This collaboration helps ensure companies everywhere can adopt reliable and comparable sustainability practices.

Why is ESG Important for Businesses?

ESG is a core pillar of business strategy, driving resilience, profitability, and long-term growth. It helps with risk management, attracts capital, and enhances reputation. According to DBS, A survey of 800 SMEs in Asia found that over 80% of Singaporean SMEs prioritize ESG, leading the region. Here’s why ESG is important for businesses:

1. Risk Management

ESG, or environmental, social, and governance, really helps us spot and then reduce risks that traditional financial checks often just overlook. Think about it, environmental issues like climate change or even social concerns such as labor unrest can seriously impact a school’s financial health, for instance.

When a company or even an educational institution really integrates ESG into their operations, they just become so much better at anticipating and responding to new threats as they pop up. It creates stable operations and safeguards long-term shareholder value.

2. Investor Demand

Investors these days are more and more using ESG criteria to sift through their potential investments, you know? They just tend to view companies with a strong ESG performance as being, well, better managed and more sustainable overall. This shift has led to major capital moving into ESG-focused investments worldwide.

If a business, especially one looking for growth, just doesn’t bother with its ESG concerns, it can frankly make it a lot harder to attract new investment. A strong ESG profile attracts new investors and lowers borrowing costs, opening access to fresh capital for business growth.

3. Long-Term Value Creation

At its core, ESG is really about thinking for the long haul, focusing on what lasts, you know? When companies genuinely focus on sustainability and nurturing strong relationships with all their stakeholders, they’re truly building value that’s designed to stick around. It could mean advancing green tech or building loyal customers through ethics.

It’s often the case that businesses that really put ESG first tend to be more innovative and generally more efficient in their operations. They’re just so much better positioned to actually thrive in a world that’s becoming more and more centered on sustainability and social responsibility, and that’s a trend that’s clearly not going anywhere.

4. Enhanced Brand Reputation

A strong ESG commitment significantly elevates a company’s brand and reputation. Consumers and staff, particularly younger generations, seek organizations whose values align with their own. This alignment boosts customer loyalty and improves crucial talent retention.

Consider the education sector, A school known for its deep commitment to sustainability and social equity, guided by the ESG framework, gains a competitive edge. This powerful differentiator helps them attract more students and secure top-tier faculty in a challenging market.

5. Regulatory Compliance

Governments are increasingly regulating ESG areas like emissions and data privacy. Proactive compliance isn’t just common sense. It helps businesses stay ahead of the curve, avoiding costly fines and protracted legal challenges down the road.

When companies strategically embed ESG into their core operations, they future-proof themselves against evolving regulations.

Adhering to frameworks such as the Singapore Financial Accounting Standards (SFAS) ensures that companies maintain transparency and accountability in their reporting, further enhancing stakeholder trust. This approach not only drastically cuts potential risks but also signals a strong commitment to responsibility.

ESG Investing

ESG investing integrates environmental, social, and governance criteria into financial analysis to foster sustainable and ethical growth. Evidence shows that strong ESG performance correlates with superior, long-term returns for companies. Here are the main aspects of ESG investing:

1. Integration

Integration, you might find, is the most common way folks approach ESG investing, and it pretty much means bringing those ESG risks and opportunities directly into your financial analysis. This method really helps investors get much clearer, more informed, and holistic decisions when they’re looking at where to put their money.

Analysts actually spend time figuring out how things like a company’s environmental impact or social policies could affect its future earnings and even its stock price. It just provides a much more complete picture of a company’s overall investment potential, which is crucial for good long-term planning.

2. Screening

Screening is a clear ESG method to include or exclude companies based on defined criteria. Negative screening avoids sectors like tobacco, while positive screening focuses on businesses that are leaders in ESG performance.

This straightforward approach ensures portfolios align with investor values. It’s a non-negotiable way to avoid inadvertently supporting firms with weak ethical or environmental records, building greater trust and integrity.

3. Thematic Investing

Thematic investing targets specific ESG-driven sectors, like clean energy or education. It lets investors select companies actively tackling major social or environmental issues, offering a direct path to measurable, positive change.

This approach enables highly targeted investments in areas with significant growth potential. It is a proactive, forward-thinking strategy designed to achieve both solid financial returns and a measurable societal impact.

4. Impact Investing

Impact investing elevates the strategy by intentionally generating a specific, measurable social or environmental benefit alongside financial returns. The positive impact isn’t accidental. It’s a core goal to fund solutions to global challenges.

These investments are often seen in areas like affordable housing, sustainable farming, or essential community healthcare. The primary objective is always to create a direct, measurable positive outcome, making this a truly powerful vehicle for real change.

Challenges of ESG

Implementing ESG can be challenging due to issues like limited data, inconsistent frameworks, and risks of greenwashing. Overcoming these obstacles is vital for building a credible, impactful ESG strategy. Here are some common challenges faced in ESG implementation:

1. Lack of Standardization

Talking about what ESG is and how to report it, a big problem we run into is that there just isn’t one agreed-upon standard for ESG reporting. You see a lot of different ESG frameworks and various rating agencies, and each one kind of has its own way of doing things. It can cause confusion and inconsistent data.

Because of this, it’s pretty tough for investors to really compare different companies fairly, and frankly, companies themselves sometimes don’t quite know what they should be reporting. While people are definitely trying to get things more aligned, right now, it’s still a significant hurdle that needs more collaborative work.

2. Data Quality

Obtaining accurate ESG data remains a key hurdle in investing and performance assessment. Much of this data is self-reported and lacks rigorous, third-party auditing, raising valid concerns about its overall quality and reliability.

Companies must implement robust systems for collecting, managing, and verifying their ESG information. Without solid data, setting meaningful goals and tracking true progress becomes impossible, ultimately undermining the credibility and impact of the entire ESG effort.

3. Greenwashing

Greenwashing involves companies making misleading claims about their ESG impact to attract capital without real change. This tactic ultimately undermines the trust necessary for genuine and valuable ESG efforts across the market.

Regulators and investors are increasingly vigilant in detecting greenwashing. Companies, particularly in sectors like education, must support all ESG claims with transparent data and concrete, verifiable actions, not just rhetoric.

4. Risk vs. Impact

A key tension in ESG is balancing risk mitigation (minimizing negative impacts) with active, positive contribution. Clearly defining the primary goal of your ESG initiatives from the outset is crucial for strategic success.

Balancing financial returns, risk mitigation, and positive impact requires a thoughtful approach. Companies must clearly define what success means for their specific ESG strategy and communicate those targets transparently to all stakeholders.

How to Define ESG Goals

Defining clear ESG goals provides essential structure for your sustainability strategy, converting broad intentions into measurable actions. This approach aligns company efforts with long-term accountability and maximizes impact. Here’s how organizations can effectively set and define their ESG goals:

1. Establish ESG Needs

Begin by assessing what ESG truly means for your organization. Evaluating current performance and identifying issues most relevant to your industry and stakeholders helps you focus efforts where they matter most for meaningful direction.

For example, a school might prioritize campus energy efficiency or diversity. The key is to align ESG perfectly with your core mission and values, effectively weaving ESG into the fabric of your current business operations.

2. Identify Key Areas for ESG Frameworks

After assessing needs, pinpoint areas for maximum impact, whether in operations, the supply chain, or community engagement. Focusing on just a few key priorities makes the entire ESG endeavor more manageable and significantly more effective.

Adopting an ESG framework, like SASB or GRI, is a smart strategic choice for reporting. These frameworks provide essential structure, aligning your efforts with industry best practices and enhancing overall credibility.

3. Set Goals

After identifying key focus areas, set SMART goals (Specific, Measurable, etc.). Clear objectives, like “reduce landfill waste by 20% in three years,” enable easier progress tracking and maintain accountability across the team.

ESG goals should be ambitious enough to drive progress, yet grounded in reality. The ideal balance is to challenge your organization while ensuring the targets remain achievable through concerted, collective effort.

4. Determine Responsibility

Assigning clear ownership for each ESG goal is crucial, whether to a specific officer, committee, or department head. Without this clear responsibility, vital initiatives risk stalling, ensuring someone always champions the effort.

Accountability is key to driving real ESG progress. Every involved person must clearly understand their specific role and expectations, which simplifies execution, fosters a sense of shared purpose, and ensures consistent effort.

5. Create a Timeline

Putting together a realistic timeline for reaching your ESG goals is a must-do, and breaking down bigger goals into smaller, manageable milestones really helps. This approach makes the whole process feel much less daunting, plus it gives you chances to celebrate progress along the way, which is good for morale.

A well-defined timeline also really streamlines resource planning and keeps the entire organization laser-focused on the objectives. Essentially, it transforms your ESG strategy from just another document into a truly actionable plan, something you can actually work with. This is where the rubber meets the road.

6. Measure and Adjust

It’s really important to regularly measure how you’re performing against your established ESG goals, using data to get a clear picture of what’s hitting the mark and what isn’t. Be ready to tweak your strategy as needed, basing those adjustments on your findings and on changing stakeholder expectations, because things do evolve.

Remember, ESG is definitely an ongoing journey, not just a one-and-done project that you check off a list. Continuous improvement, always refining and growing, is truly key to building a truly sustainable organization that makes a lasting impact. It’s about evolving with the landscape.

ESG Strategy Checklist

A clear checklist simplifies ESG strategy development, converting ideas into measurable actions. It ensures all critical areas, governance, sustainability, and ethics are addressed for maximum impact and corporate accountability. Here’s an essential ESG strategy checklist:

1. Identify ESG Stakeholders

When you’re thinking about ESG, remember your stakeholders are everyone from investors and employees to your students, their parents, and the wider community. It’s super important to really dig in and understand what ESG issues resonate most with each group, because their perspective is what truly makes your strategy count.

Actually, talking with these stakeholders doesn’t just build trust. It also makes sure your ESG efforts are totally on track with what they expect. This engagement is a really foundational step if you’re aiming for long-term, sustainable success.

2. Build Your Team

Next up, you’ll want to pull together a cross-functional team, really bringing in folks from different departments like finance, operations, HR, and even academics for your school’s ESG initiatives. This mix of perspectives is incredibly valuable and typically leads to a much more robust and integrated strategy overall.

This group will really be the ones pushing the ESG strategy forward, so they must have the right resources and enough authority. Giving them that power is key if you expect them to actually make real, tangible change within the organization.

3. Research Peers’ ESG Reports

It’s always a good idea to peek at what other schools or organizations in your field are up to when it comes to ESG. Digging into their ESG reports offers some seriously valuable insights and benchmarks, helping you grasp industry best practices and spot places where you can truly lead and even innovate with your own ESG framework.

This kind of research also helps you steer clear of those common mistakes we often see. Frankly, learning from what worked (and what didn’t) for others is just a smart and incredibly efficient approach to things.

4. Determine ESG Materiality

Doing a materiality assessment is key. It helps pinpoint the ESG issues that really matter most to your organization and its stakeholders. This process lets you prioritize your efforts and zero in your resources on where they’ll make the biggest splash, which is absolutely critical for building a focused and truly effective ESG strategy.

Essentially, this step makes sure you aren’t pouring time into issues that just aren’t relevant to your school or business. It’s all about being strategic and really making every single effort count.

5. Build Your ESG Reporting Roadmap

You absolutely need to map out how you’ll gather data, keep tabs on progress, and eventually report on your ESG performance. Deciding on your chosen ESG frameworks and how often you’ll report is a big part of this, and a well-defined roadmap really ensures your reporting comes across as consistent, transparent, and credible.

This isn’t just a general idea. Your plan should clearly detail the specific metrics you’ll track for each and every one of your ESG goals. Think of it as the ultimate blueprint for your entire accountability process, which is pretty critical.

6. Leverage Technology for ESG Reporting

Let’s be real, trying to manually collect and report all this ESG data is usually pretty inefficient and just asks for mistakes. Using technology, maybe an ERP system for your school, to automate data collection and smooth out reporting, is a game-changer. It saves a ton of time and seriously boosts the accuracy and reliability of your data.

Honestly, getting the right technology in place can shift your ESG reporting from feeling like a chore to being a real strategic asset. It provides those crucial insights you need to make smarter decisions and really drive continuous improvement across the board.

What Types of Industries Can Benefit from ESG Initiatives?

Virtually every sector benefits from ESG efforts, fostering transparency, sustainability, and trust. Across industries, from finance to manufacturing, ESG boosts efficiency, ethical impact, and long-term compliance and growth. Here are industries that benefit most from ESG:

1. Energy

Given its significant environmental impact, the energy sector faces intense scrutiny. ESG initiatives are crucial for guiding this sector toward cleaner options and better managing its carbon footprint, which is vital for long-term viability and social license.

For energy companies, ESG is not optional. It is essential for their continued survival and operation. It acts as a powerful catalyst for innovation, driving necessary steps to successfully navigate the complex global energy transition.

2. Financial

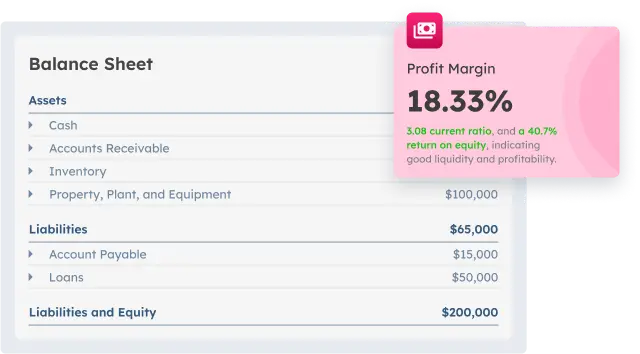

The financial industry has a powerful role in capital allocation. By integrating ESG, banks and firms can direct funding toward sustainable ventures, effectively manage risk, and meet the rising market demand for responsible investment products, all while ensuring transparency through a detailed cash flow statement.

The sector has a significant responsibility to ensure its own operations embody ethics and transparency. Strong governance (the ‘G’ in ESG) is especially critical here, as it upholds the public trust essential to managing vast sums of capital.

3. Information Technology (IT)

IT firms face distinct ESG challenges like data privacy, high data center energy use, and e-waste. A robust ESG strategy is crucial for managing these risks, fostering user trust, and demonstrating responsible stewardship of technology and data.

IT companies also have a significant opportunity to drive positive social impact. Technology, when leveraged effectively, becomes a powerful tool for advancing education, improving healthcare access, and contributing to broader community development.

4. Manufacturing

For manufacturers, ESG efforts often really center on how they manage their supply chains, ensuring worker safety, and improving resource efficiency, which makes a lot of sense. By focusing on these areas, they can actually cut costs, seriously boost their brand reputation, and build a much more resilient supply chain overall.

Having a genuine commitment to ESG can actually turn into a pretty significant competitive advantage for them. It helps them attract the kinds of customers and talent who truly value sustainability and ethical production, which is increasingly important.

5. Agriculture

The agriculture industry directly impacts land use, water conservation, and biodiversity. ESG initiatives promote sustainable farming to protect the environment while balancing productivity, ensuring food security, and supporting planetary health.

The sector has a significant social component. Prioritizing fair labor practices and engaging local communities are essential ESG efforts for agriculture, helping to build a truly sustainable and equitable food system from the farm to the consumer.

6. Retail

Retailers are prioritizing sustainable sourcing, ethical labor, and reduced packaging waste across their supply chains. These ESG efforts strongly resonate with value-driven consumers, effectively cultivating a loyal and deeply engaged customer base.

A robust commitment to ESG genuinely differentiates a retailer in today’s saturated market. It credibly demonstrates that the company values more than just transactions, a depth of care that consumers highly appreciate and that fosters deep trust.

7. Human Resources

Human Resources is central to the “S” in ESG. HR is tasked with building a diverse, inclusive workplace, ensuring fair labor practices, and promoting employee well-being. This focus is crucial for establishing a positive and productive company or educational culture.

Whether in business or education, prioritizing these social factors is key to attracting and retaining top talent. This strategic focus on the workforce and environment acts as a critical driver for long-term organizational success and a thriving ecosystem.

8. Supply Chain

Global supply chain complexity inherently raises numerous ESG risks. Companies face increasing accountability for supplier performance, making proactive risk management crucial to safeguard brand integrity and corporate reputation in a volatile environment.

A transparent and responsible supply chain is no longer optional. It’s a core strategic asset. It is fundamental to building a resilient and ethical business that can thrive in today’s interconnected world, much like any strong support system.

Alternatives to ESG Investing

ESG is just one approach within responsible investment. Other strategies exist to pursue ethical and sustainable goals, using different methods to balance impact and financial returns. Understanding them aligns investments with core values. Here are key alternatives to ESG investing:

1. Social Responsible Investing

Socially Responsible Investing (SRI) is considered the precursor to modern ESG. This approach primarily uses negative screening, actively excluding companies or sectors (like tobacco or weapons) to uphold the core principle of avoiding harm.

SRI is a straightforward, values-based investment method. It allows investors to ensure their capital avoids industries they find ethically objectionable, providing a simple yet powerful way for institutions, such as endowments, to align their money with their principles.

2. Impact Investing

Impact investing stands apart by actively seeking measurable, positive social or environmental returns alongside financial gains. This proactive strategy focuses capital on solutions for global issues, fundamentally prioritizing the creation of positive change.

Unlike ESG’s frequent focus on risk mitigation, impact investing clearly targets specific, positive outcomes with its capital. This approach is highly targeted and more hands-on, appealing greatly to those who prioritize achieving direct and verifiable results.

3. Conscious Capitalism

Conscious Capitalism is a comprehensive business philosophy, extending beyond investment. It asserts that businesses should pursue a higher purpose than just profit. Its foundation rests on four pillars like higher purpose, stakeholder orientation, conscious leadership, and culture.

This is a holistic business view where profit is the natural outcome of creating value for everyone involved. It’s about building an organization that is both highly profitable and a powerful force for good in the world, with a clear profit and loss statement reflecting its success, a powerful model for any institution.

What’s the Difference Between ESG and Sustainability Initiatives?

ESG and sustainability are often confused, but they are distinct. Sustainability is a broad, holistic concept, meeting today’s needs without compromising future generations. It’s about balancing environmental, social, and economic considerations broadly.

The ESG framework is the specific, detailed system used to measure and report a company’s non-financial performance. It serves as a practical tool to assess risk and return. Think of sustainability as the overarching goal, and ESG as the mechanism for measuring progress.

Integrate Business Processes to Achieve ESG Goals with ScaleOcean’s Accounting Software

ScaleOcean’s accounting software integrates seamlessly across all business functions, from procurement to supply chain, to support your ESG initiatives. With unlimited users and customized solutions, it streamlines financial management, delivering a faster ROI and enhancing reporting accuracy.

ScaleOcean boosts ESG management using automation, real-time dashboards, and compliance-ready reports. This CTC-grant-eligible system empowers businesses to measure sustainability goals, optimize operations, and maintain alignment with long-term strategic objectives effectively. Here are the key features for ScaleOcean’s accounting software:

- Integrated Financial and ESG Reporting: Combines financial and ESG data for easy reporting, ensuring compliance with global sustainability standards.

- Automation of ESG Data Tracking and Compliance: Automates ESG data collection, ensuring accurate and compliant reporting aligned with global frameworks like GRI.

- Supply Chain and Vendor Sustainability Integration: Assesses suppliers based on ESG criteria, promoting ethical and environmentally responsible procurement choices.

- Real-Time ESG Data Analysis: Provides real-time analytics to optimize ESG performance and predict future trends for better decision-making.

- Improved Internal Governance and Control: Enhances transparency and governance by integrating ESG data and maintaining an audit trail for compliance.

Conclusion

ESG is a key strategic framework, not just a trend, that is actively reshaping value creation. Integrating E, S, and G factors builds long-term resilience, boosts transparency, and attracts investment by aligning business growth with sustainability principles.

Vendor ScaleOcean supports this ESG transformation with ERP software that unifies data and automates performance tracking. The system helps institutions effectively achieve measurable sustainability goals. If you want to explore its features, ScaleOcean offers a free demo.

FAQ:

1. Is ESG reporting mandatory in Singapore?

In Singapore, all listed companies must publish annual sustainability reports under SGX requirements. These reports outline how businesses manage environmental, social, and governance factors, ensuring transparency and alignment with responsible corporate practices.

2. What is a good ESG score?

A strong ESG score generally falls between 70 and 100, depending on the evaluator. This rating shows that a company effectively controls sustainability risks while maintaining high ethical standards and governance to support long-term operational success.

3. What are the Big 4 ESG standards?

1. Global Reporting Initiative (GRI)

2. Sustainability Accounting Standards Board (SASB)

3. Task Force on Climate-related Financial Disclosures (TCFD)

4. Carbon Disclosure Project (CDP)

4. What is an ESG checklist?

An ESG checklist serves as a tool to evaluate how well organizations meet sustainability goals. It covers essential aspects such as environmental impact, labor practices, ethics, and compliance, guiding businesses toward stronger ESG performance.

PTE LTD..png)

.png)

.png)

.png)

.png)