Keeping financial reports clear and consistent is a struggle for many, often hurting trust. The best fix is following Singapore’s accounting standards, which keep you compliant and ensure your financial statements are truly reliable.

These standards provide a structured framework aligned with international accounting principles, enabling organizations to enhance financial management and bolster investor confidence.

According to the PWC Tax Summaries on Foreign Account Tax Compliance Act (FATCA) Model 1 agreement, all Singapore-based financial institutions must submit specified returns about U.S. reportable accounts to ensure compliance with international tax information sharing requirements.

This article digs into the key components of Singapore Accounting Standards, including their regulatory framework, the benefits of compliance, and the challenges that businesses face when adhering to them.

- Singapore Accounting Standards (SFRS) align closely with IFRS. SFRS mandates IFRS compliance for listed companies and offers it as an option for others.

- Key Singapore accounting standards like SFRS for Small Entities and Charities provide simplified reporting for different sectors, reducing complexity while ensuring regulatory adherence.

- Benefits of compliance with SFRS include enhancing investor confidence, supporting informed decision-making, and helping businesses avoid penalties, ensuring long-term financial stability.

- ScaleOcean accounting simplifies financial management, automating accounting processes, ensuring SFRS compliance, and providing real-time financial insights for businesses in Singapore.

What are Accounting Standards in Singapore

Singapore’s accounting standards, known as SFRS, align closely with IFRS. SFRS mandates IFRS compliance for listed companies and offers it as an option for others. Key standards like FRS 1 (Presentation) and FRS 115 (Revenue) ensure transparent financial reporting.

These rules follow the accrual method, recording deals when they happen, not just when cash moves. Governed by the ASC and Companies Act, they make sure financial reports stay reliable and consistent across the board.

Picking the best accounting software in Singapore makes following these standards much easier. Sticking to SFRS ensures your business stays compliant with international systems while meeting all local regulatory requirements smoothly.

Key Singapore Accounting Standards

Singapore’s business landscape thrives on financial transparency and accuracy, making compliance with accounting standards essential. Key accounting standards in Singapore ensure that financial reporting remains reliable, comparable, and aligned with global practices. Here’s the full explanation:

1. Singapore Financial Reporting Standards (SFRS)

SFRS is Singapore’s primary accounting framework, closely aligned with International Financial Reporting Standards (IFRS). It ensures consistency, transparency, and comparability in financial reporting across industries.

Companies must adhere to SFRS to accurately record transactions, including using tools like a purchase journal, to ensure their financial statements are reliable. These standards cover revenue recognition, financial instruments, and lease accounting. Compliance with SFRS, required under the Companies Act, enhances credibility and supports smooth cross-border business operations in the global financial landscape.

2. SFRS for Small Entities (SFRS for SE)

SFRS for Small Entities (SFRS for SE) is a simplified financial reporting framework for small and medium-sized enterprises (SMEs) without public accountability. It reduces complexity while maintaining essential principles like fair value measurement and accrual-based accounting.

This allows SMEs to efficiently prepare financial statements, minimizing compliance burdens and ensuring their reports are credible and aligned with Singapore’s regulatory requirements.

3. SFRS for Charities

The SFRS for Charities is designed for non-profit organizations to enhance transparency in financial reporting. Since charities primarily rely on donations and grants, this framework guides income recognition, fund management, and accountability in financial statements.

By following the SFRS for Charities, non-profits can build trust, improve governance, and demonstrate responsible financial management, ensuring resources are used effectively for their communities.

4. Financial Reporting Standard (FRS) – Financial Instruments

This standard outlines how to recognize, measure, and disclose financial instruments such as loans, bonds, and derivatives in financial statements. It provides guidelines for classifying assets and liabilities, assessing fair value, and accounting for hedges.

Accurate accounting of financial instruments is essential for reflecting a company’s financial position and managing investment risks. Compliance with this standard ensures transparency, helping investors assess financial health and risk exposure effectively while strengthening corporate governance and improving investment decisions.

To ensure precision in these processes, businesses can leverage accounts payable software

that automates transaction tracking and ensures compliance with financial reporting standards, strengthening corporate governance and improving investment decisions.

5. Financial Reporting Standard (FRS) – Revenue from Contracts with Customers

This standard provides a framework for recognizing revenue from customer contracts, ensuring consistency across industries. Revenue should be recognized when control of goods or services is transferred to customers, not when payment is made.

Companies follow a five-step model: identifying the contract, determining performance obligations, setting transaction prices, allocating those prices, and recognizing revenue as obligations are fulfilled.

This helps businesses produce accurate financial statements, reduce inconsistencies in reporting, and enhance transparency, allowing investors and stakeholders to better assess a company’s revenue activities and financial sustainability.

6. Financial Reporting Standard (FRS) – Leases

The FRS on leases standardizes how businesses account for lease agreements, requiring lessees to record most leases on their balance sheets as a right-of-use asset and a corresponding lease liability. This change improves transparency by accurately reflecting lease obligations in financial statements.

Companies must also disclose detailed lease information, including future commitments and expenses. Overall, the standard provides a clearer financial picture and enhances comparability for investors assessing a company’s financial commitments.

7. Financial Reporting Standard (FRS) – Inventories

The Financial Reporting Standard (FRS) for inventories provides guidance on measuring and reporting inventory costs to ensure accurate stock valuation. Companies must measure inventories at the lower of cost or net realizable value to avoid overstatement of assets.

The standard also allows for cost formulas like First-In, First-Out (FIFO), and weighted average cost for consistency in valuation. By following this standard, businesses can maintain accurate records, optimize inventory management, and offer reliable information to stakeholders, thereby enhancing cost control and ensuring regulatory compliance.

Key Principles of SFRS

Financial transparency is the backbone of Singapore’s economy, and the Singapore Financial Reporting Standards ensure that businesses maintain consistency and accuracy in their financial reporting. Here are the key principles that shape financial management examples and reporting under the Singapore accounting standard:

1. Accrual Accounting

With accrual accounting, we record financial activities the moment they actually happen. It doesn’t matter when the cash physically moves, but what counts is capturing the transaction right when the deal is made.

This method gives a much clearer picture of a company’s true financial health. It allows everyone involved to see exactly how the business is performing in real-time, making it far more accurate than just tracking bank balances.

2. Comparability

The financial information of an entity should be consistent and comparable with that of similar organizations. This principle ensures that accounting data remains useful for analysis and decision-making.

SFRS ensures consistent analysis of financial statements across companies, industries, and periods. This principle requires businesses to apply uniform accounting policies, allowing stakeholders to assess financial metrics examples over time and in comparison to competitors.

3. Relevance

Financial reports should contain information that is meaningful and can impact decision-making. The data should provide both predictive insights and confirm past performance to support informed choices.

Under the Singapore Financial Reporting Standards (SFRS), financial reports must include important information that affects stakeholders’ economic decisions. By customizing reports to meet the needs of investors and regulators, businesses enhance financial communication and build trust with key stakeholders.

4. Verification

Verification ensures that financial statements provide reliable information that helps stakeholders assess a company’s financial condition. This principle requires financial reports to contain data that can confirm past expectations or predict future financial outcomes.

By applying this principle, companies enhance accountability, enabling regulators, auditors, and investors to validate financial performance accurately. A well-verified financial statement provides a clear picture of a company’s stability and prospects, supporting better financial decision-making.

5. Faithful Representation

SFRS means that financial statements must accurately depict a company’s financial position, performance, and cash flows. This principle ensures that information is complete, neutral, and free from material errors, allowing stakeholders to make informed decisions.

Companies need to report every transaction truthfully. By avoiding bias or errors, they ensure their financial stories are accurate, helping build trust and making sure there are no misleading misstatements in the final report.

6. Prudence

This principle requires businesses to exercise caution when recognizing revenues and expenses, ensuring that financial statements do not overstate profits or assets. Prepaid expenses are a good example, as businesses must carefully account for them and recognize them only when the benefit is received.

Additionally, the principle encourages companies to account for potential losses and liabilities as soon as they are foreseeable. Revenues, on the other hand, should only be recognized when they are assured, helping to maintain accuracy and prevent premature financial reporting.

7. Fair Value Measurement

SFRS also ensures that financial assets and liabilities are recorded at their current market value rather than historical cost. This principle allows businesses to reflect the true worth of their financial instruments, investments, and assets in financial statements.

Under SFRS, fair value is calculated using current market conditions, independent appraisals, or valuation models. This approach makes sure that the numbers reflect reality and provide a transparent view of a company’s value.

8. Going Concern

The going concern principle assumes that a business will continue operating for the foreseeable future unless there is evidence to the contrary. By adhering to the going concern principle, businesses build confidence among creditors and investors, reinforcing trust in their financial sustainability and ability to meet future obligations.

Additionally, businesses that prioritize ESG (Environmental, Social, and Governance) criteria demonstrate a commitment to long-term sustainability, further enhancing trust and credibility with stakeholders.

9. Clarity and Comprehensibility

SFRS’s focus on understandability ensures financial statements are clear for everyone, especially investors. Information should be shared in a straightforward way, keeping things simple and avoiding any confusing or vague language.

This principle is all about transparency. By keeping figures and notes clear, even those with basic financial knowledge can easily grasp the data. It helps users reliably check a company’s health and make much smarter decisions.

Benefits of Compliance with Accounting Standards

Compliance with SFRS regulation is critical for firms seeking financial stability and long-term viability. Compliance promotes stakeholder trust and long-term corporate growth in addition to meeting legal requirements. Here are the primary benefits of conforming to Singapore accounting standards:

1. Transparency and Investor Confidence

Adhering to Singapore Accounting Standards increases financial transparency, which makes businesses more appealing to investors. Accurate financial reporting fosters trust and facilitates access to investment possibilities, while also supporting environmental, social, and governance initiatives that enhance long-term sustainability.

Investors and stakeholders use standardized financial statements to assess a company’s profitability and risks. Compliance also assures consistency in reporting, allowing organizations to compete effectively in both domestic and international markets.

2. Regulatory Compliance and Avoidance of Sanctions

Following financial reporting standards helps businesses meet regulatory requirements, so avoiding penalties or legal action from authorities. Singapore’s Accounting Standards Council (ASC) imposes tight requirements to ensure that all organizations comply with financial regulations.

Noncompliance can lead to financial penalties, reputational loss, and operational disruptions. Businesses that obey regulations can run effectively and avoid unnecessary legal issues.

3. Improved Business Decision-Making

A well-structured accounting system allows organizations to monitor financial performance, plan future investments, and improve operational efficiency. Compliance with financial reporting standards provides management with reliable data for identifying revenue patterns, cost-cutting options, and investment opportunities.

Businesses can use trustworthy financial information to accomplish strategic planning, optimize resource allocation, and efficiently minimize financial risks.

Compliance and Regulatory Framework in Accounting Standards in Singapore

Singapore’s strong financial ecosystem relies on a well-structured compliance and regulatory framework to uphold transparency, accuracy, and credibility in accounting practices. Below are the crucial elements of the Singapore accounting standard regulatory framework that businesses must adhere to.

1. The Accounting Standards Council Singapore (ASC)

Regulatory ACS serves as the main authority for the creation and upkeep of SFRS. Formed under the Accounting Standards Act, ASC guarantees that financial reporting adheres to global best practices, particularly the International Financial Reporting Standards (IFRS).

The council frequently updates and amends standards to stay aligned with international financial trends and changing business landscapes. Adhering to ASC standards is compulsory for all businesses in Singapore, fostering transparency and uniformity in financial statements across various sectors.

2. Companies Act and Financial Reporting Obligations

The Companies Act, overseen by the Accounting and Corporate Regulatory Authority (ACRA), requires all companies in Singapore to adhere to SFRS when preparing their financial statements. Businesses must keep precise records, file annual financial reports, and guarantee that their statements accurately reflect their financial position.

Certain entities, including publicly traded companies and large private firms, are also required to undergo independent audits to verify their compliance. Noncompliance with financial reporting requirements may lead to penalties, fines, or legal repercussions.

3. Role of the Accounting and Corporate Regulatory Authority (ACRA)

ACRA is the regulatory authority responsible for corporate governance and financial compliance in Singapore. It upholds the Companies Act and ensures that companies follow SFRS in their financial statements, including the accurate reporting of accounts receivable. ACRA performs audits, investigations, and compliance assessments to identify any errors or fraudulent actions in corporate financial statements.

The companies also offer guidelines and resources to assist businesses in meeting regulatory obligations. By enforcing accounting standards and imposing penalties for non-compliance, ACRA is essential in preserving the integrity and credibility of Singapore’s financial environment. Businesses must remain informed about ACRA’s regulations to maintain compliance.

4. Singapore Exchange (SGX) Financial Reporting Requirements

Companies that are publicly listed in Singapore are obligated to adhere to additional reporting standards established by the Singapore Exchange (SGX). SGX requires that these listed entities submit regular financial statements that align with SFRS and disclose significant financial information to their investors.

These firms are also required to comply with stringent corporate governance practices, promoting transparency and accountability in their financial reporting. Furthermore, SGX mandates that listed companies engage external auditors for independent evaluations of their financial status.

5. Audit and Assurance Requirements

Auditing plays a vital role in Singapore’s framework for accounting compliance. Companies that surpass certain revenue or asset limits are required to undergo statutory audits carried out by licensed auditors registered with ACRA.

The audit process verifies that financial statements are accurate, dependable, and aligned with SFRS. Using tax preparation software can streamline the audit process by ensuring accurate tax data and simplifying the preparation of financial statements for review.

Singapore companies that are publicly traded, large private enterprises, and financial institutions face strict audit regulations. External auditors evaluate financial documents for errors, fraud, or discrepancies. By following audit regulations, companies boost transparency, enhance financial credibility, and build investor trust in their operations.

6. Tax Compliance and Reporting under the Inland Revenue Authority of Singapore (IRAS)

The IRAS oversees corporate tax compliance, ensuring that businesses accurately report their financial information for tax evaluation. Companies are required to prepare their financial statements following SFRS guidelines to appropriately calculate their taxable income.

Additionally, IRAS enforces regulations related to Goods and Services Tax (GST), withholding tax, and transfer pricing to deter tax evasion. Companies that do not adhere to tax reporting regulations may be subjected to audits, fines, or legal proceedings.

7. Enforcement Actions and Penalties for Non-Compliance

Robust enforcement measures ensure that companies comply with SFRS and regulatory standards. Organizations that do not meet these requirements may incur fines, face legal action, or encounter operational restrictions. ACRA, IRAS, and SGX perform regular compliance assessments to detect financial inaccuracies, fraudulent behaviors, or governance issues.

In extreme situations, companies that are not compliant could face monetary penalties, revocation of business licenses, or removal from the stock market. By implementing compliance through audits and investigations, Singapore’s regulatory bodies maintain financial integrity and corporate responsibility.

To support compliance and regulators in the accounting process, businesses can implement ERP software for financial accounting that helps standardise reporting, maintain accurate records, and ensure ongoing compliance.

8. Annual General Meeting (AGM) Requirements

In Singapore, holding an AGM is a must to stay compliant with the Companies Act. It’s a great chance for shareholders to get together, review how the business is doing, and look over the latest financial statements and key decisions.

You’ll need to hold your AGM within six months of your financial year-end. This keeps your governance on track, giving stakeholders a clear space to discuss the company’s health and make smart, informed choices for the future.

9. Maintenance of Statutory Records

Under Singapore’s accounting standards, businesses need to keep official records like shareholder and director registers. These files must be kept accurate and ready for inspection by authorized people whenever they need to check them.

Keeping these records updated is a big part of good corporate governance. It’s not just about rules, but it’s also about being transparent and proving that your company meets its legal obligations to regulators and stakeholders alike.

10. Filing of Annual Returns

Filing annual returns is a must for Singapore companies to stay in the clear. These filings share fresh updates on directors, shareholders, and finances, making sure everything is transparent and easy for everyone to see.

You’ll need to file your returns with ACRA within a month of your AGM. Using ScaleOcean ERP software can streamline this process by automating data management, ensuring accurate and timely filings, and helping you stay compliant with local standards for enhanced business transparency.

Challenges in Adhering to Accounting Standards

Compliance with accounting standards is an essential part of a Singaporean company’s financial transparency and compliance. However, this process often raises some issues that can make it difficult for businesses to stay on track. Here are some of the major issues that companies face:

1. Complexity of Regulations and Periodic Updates

Singapore Financial Reporting Standards are frequently updated, requiring organizations to keep educated and modify their accounting practices accordingly. These upgrades can be complex, making it difficult for businesses to completely comprehend and implement changes successfully.

Because of this, many firms find it tough to make sure their statements match the latest rules. This can lead to a gap in their reporting, which unfortunately puts the business at risk of falling out of compliance.

2. Resource and Expertise Limitations

Many organizations lack the in-house ability to handle complex financial reporting standards, which leads to compliance issues. This shortage of trained specialists can lead to inefficiencies and missing deadlines for submissions.

Small to medium-sized businesses (SMEs), in particular, may lack the resources to hire expert accountants, raising the risk of financial reporting errors or delays.

3. Risk of Human Error in Manual Processes

Manual accounting processes increase the risk of errors, which can lead to noncompliance and financial discrepancies. Relying on spreadsheets and paper records can make it challenging to track real-time updates or changes.

Without the best invoicing software, businesses are more prone to inconsistencies in financial reporting, which can result in compliance issues or missed tax deadlines. Automating these processes helps ensure accuracy and timely reporting, reducing the risk of violations.

Adhering to Singapore’s Accounting Standards With ScaleOcean Accounting Software

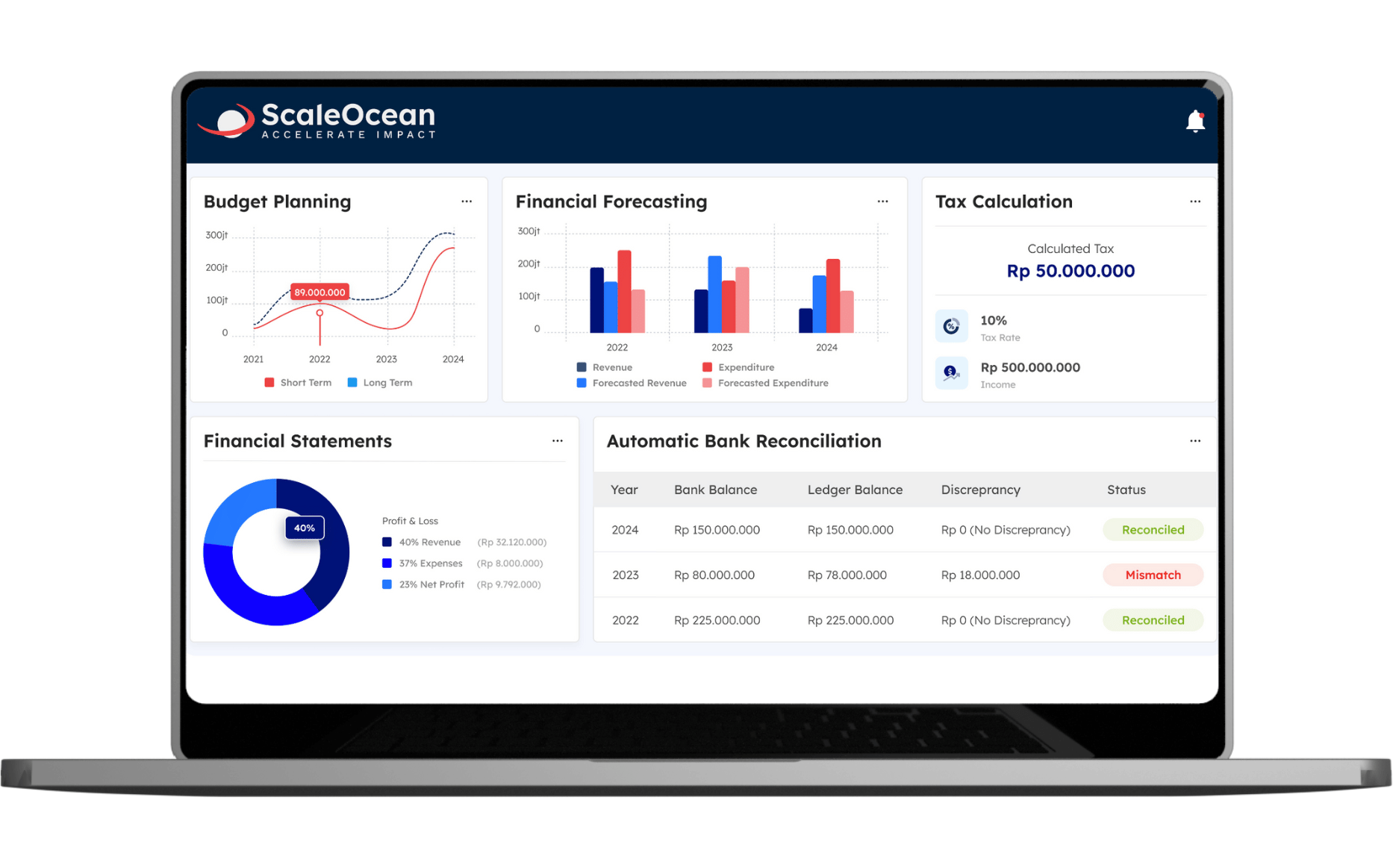

ScaleOcean Accounting Software offers a comprehensive accounting software solution that streamlines financial processes and improves compliance for Singapore enterprises. With its user-friendly interface and sophisticated functionality, it reduces accounting difficulties while assuring firms fulfill regulatory compliance.

ScaleOcean offers comprehensive ERP solutions that are fully eligible for the CTC grant, helping businesses streamline their financial management procedures. With its user-friendly interface and advanced features, ScaleOcean enhances efficiency and ensures seamless project and cost management.

So here are the key features for ScaleOcean software:

- Compliance with SFRS: ScaleOcean ensures compliance with Singapore Accounting Standards, making it easier for businesses to meet financial regulations.

- Automation of Accounting Processes: Automated financial reporting reduces errors and enhances accuracy, improving overall efficiency.

- Real-Time Financial Reporting: With real-time analytics, businesses gain better insights into financial performance, enabling data-driven decision-making.

- Scalability and Flexibility: ScaleOcean’s platform adapts to the needs of both small businesses and large enterprises, offering scalable solutions.

- Integration with Other Business Systems: Seamless integration with ERP, HR, and inventory management systems enhances operational efficiency.

- Local Customer Support: With dedicated Singapore-based support, businesses receive timely assistance in managing their accounting needs.

Case Studies: Implementation of ScaleOcean in Singaporean Companies

To better understand the practical impact of ScaleOcean, let’s explore how it has been successfully implemented in different types of businesses in Singapore. These case studies showcase the software’s ability to address specific challenges and improve financial management across various industries.

1. Case Study 1: Manufacturing Company

A Singapore-based manufacturing company used ScaleOcean to automate financial reporting, saving substantial time and effort on human data entry. By automating their accounting operations, they reduced errors caused by human input, resulting in better accuracy and reliability in their financial reports.

The solution also allowed the company to retain complete compliance with Singapore’s demanding accounting standards, easing regulatory reporting and assuring timely financial statement submission. This resulted in increased transparency and better decision-making throughout the company, particularly in their manufacturing processes.

2. Case Study 2: Retail Business

A retail company used ScaleOcean to seamlessly combine its financial data and inventory management system, resulting in a unified view of its operations. This integration improved the company’s cash flow by offering real-time visibility into financial and inventory data, allowing for more informed purchasing decisions and better stock management.

Furthermore, the automation of financial operations resulted in less manual work, allowing the retail sector to function more efficiently and focus on development prospects. ScaleOcean’s real-time reporting also enabled the company to respond rapidly to market developments while improving operational efficiency.

Conclusion

Understanding and adhering to Singapore Accounting Standards is critical for organizations to ensure financial transparency and regulatory compliance. Compliance enables firms to make educated, strategic decisions, which are critical for long-term success. Companies that remain compliant can avoid costly penalties while also increasing their market trust.

ScaleOcean simplifies accounting operations, ensuring organizations fulfill compliance standards while enhancing overall productivity. The software provides vital financial data to firms, allowing them to streamline their operations and reduce compliance concerns.

ScaleOcean provides a free demo to businesses in Singapore wishing to improve their accounting practices, allowing you to see how its solutions may streamline your processes and help your business grow.

FAQ:

1. What is the difference between SFRS and IFRS?

SFRS and IFRS are highly aligned, with SFRS(I) being nearly identical to IFRS. Issued by Singapore’s ACRA, SFRS(I) follows IFRS set by the IASB but includes local adaptations for compliance with Singapore’s corporate and tax regulations. These adjustments ensure relevance to the country’s financial reporting landscape.

2. What are Singapore Financial Reporting Standards (SFRS)?

Singapore Financial Reporting Standards (SFRS) set the guidelines for financial reporting, ensuring transparency and consistency. Based on IFRS with local modifications, SFRS follows the accrual accounting method, where transactions are recorded when they occur, not when payment is received, providing a more accurate financial position of businesses.

3. Who sets accounting standards in Singapore?

The Accounting Standards Council (ASC) sets accounting standards in Singapore. Established under the Accounting Standards Act 2007, it replaced the Council on Corporate Disclosure and Governance (CCDG) in developing SFRS and SFRS(I). ASC ensures alignment with international standards while adapting to Singapore’s regulatory and business environment.

4. Is IFRS 17 an accounting standard?

Yes, IFRS 17 is the global accounting standard for insurance contracts, replacing IFRS 4 in January 2023. Issued by the IASB, it enhances financial transparency by standardizing how insurers recognize obligations. This transition accounting system ensures consistency, improves comparability, and reduces variations in financial reporting across the industry.

PTE LTD..png)

.png)

.png)

.png)

.png)