In today’s fast-paced business world, many companies struggle to optimize their revenue. Pricing, timing, and customer targeting can feel like a balancing act. The good news? With the right revenue management strategies, you can turn these challenges into opportunities for growth.

Because of that, we will explore everything from its core concepts and key performance indicators to the common challenges businesses face. The goal is to give you a clear roadmap for improving your own revenue outcomes. This is a deep dive into the systems that help companies achieve their dedicated goals for profitability.

- Revenue management is a strategy that uses data and analytics to optimize income from fixed, perishable inventory.

- The core concepts of revenue management include perishable inventory, variable demand, and strategic customer segmentation to inform pricing decisions.

- Businesses face many revenue management challenges, such as market volatility and technological limitations, that require robust solutions and adaptive planning.

- ScaleOcean’s revenue software provides an integrated solution to overcome these hurdles, offering powerful analytics and automation to streamline your revenue management process.

What Is Revenue Management?

Revenue management is a strategy that uses data and analytics to optimize income from fixed, perishable inventory. The main goal is to adjust pricing and availability based on predicted demand, ensuring businesses maximize the revenue generated from their products or services.

It’s fundamentally about effectively balancing supply with demand. For example, airlines and hotels constantly change prices based on factors like seasonality or local events. This approach helps companies avoid underselling during peak demand or overstocking when demand is low.

Why Is Revenue Management Important?

Revenue management is incredibly important for any company’s bottom line because it directly impacts profitability by ensuring you aren’t leaving money on the table. By optimizing prices, businesses can significantly increase revenue without needing more customers or inventory.

Beyond just the money, this practice offers valuable insights into customer behavior and market trends. This data-driven approach helps companies stay competitive, adapt to changes, and support long-term sustainable growth through a resilient, efficient operational model.

Key Concepts of Revenue Management

Grasping key concepts like perishable goods and customer segmentation is vital for building a robust revenue management strategy. These foundational ideas allow businesses to make data-driven decisions, which is essential for effective strategy development in industries like hospitality and air travel. Key concepts to explore further include:

1. Perishable Inventory

So, perishable inventory basically means any product or service that, well, just loses its value after a particular time period. Think of an unsold airline seat or that empty hotel room for a night, the chance to sell it, that opportunity, it’s just gone forever once that time passes, creating a really significant urgency to sell before it expires.

This particular concept really sits at the heart of revenue management, simply because it makes businesses truly think dynamically about their pricing. The whole point is to maximize the return you get on each unit of inventory, before that value just disappears, which means it’s all about expertly managing that time-sensitive value proposition.

2. High Fixed Costs, Low Variable Costs

Industries effectively using revenue management often share a unique cost structure. They typically have high fixed costs (like a hotel building) but very low variable costs (like one flight meal). This setup means that once fixed costs are met, nearly every extra sale contributes straight to profit, creating a powerful leverage point.

Because of this unique structure, it’s often much better to sell every single last unit of inventory, even if it’s at a bit of a discount, rather than just leaving it completely unsold. This makes pricing strategies incredibly, incredibly important for sure, as the entire focus really shifts to maximizing the total contribution for covering those high fixed costs.

3. Variable Demand

Demand for products and services is rarely constant. It naturally fluctuates based on factors like seasonality, day of the week, or special events. For example, a resort sees much higher demand in summer than in winter. This inherent variability is a primary challenge and opportunity that revenue management addresses.

By accurately forecasting these fluctuations, businesses can adjust their prices to match expected demand. They charge more during busy periods and offer discounts in slower, off-peak times. This dynamic pricing approach helps smooth out revenue and maximize profitability year-round.

4. Customer Segmentation

Since not all customers are willing to pay the same price, segmentation is key. This involves dividing the market into distinct groups based on factors like booking patterns or price sensitivity. This foundational concept in revenue management allows for much more targeted pricing strategies.

Consider the difference. A business traveler might pay a premium for a last-minute flight, while a leisure traveler books early for a lower price. By understanding these various segments, a company can smartly offer differentiated prices to capture the maximum possible revenue from each group.

5. Performance Management

Performance management here means continuously tracking and analyzing incoming results. This requires setting up key performance indicators (KPIs) to accurately measure the success of your revenue management strategies. It’s absolutely crucial for identifying what’s working well and what needs adjustment.

Regularly reviewing key metrics, like occupancy, average daily rates, and revenue per available room, keeps businesses on track. This process allows for quick course correction if a strategy underperforms. This constant analysis ensures the system is always optimized for continuous improvement.

6. Collaboration

Effective revenue management is truly not a siloed function. It demands collaboration across several departments. The revenue team absolutely needs to work closely with sales, marketing, and operations to ensure everyone is aligned on pricing, promotions, and inventory allocation for optimal revenue.

For example, marketing must grasp the pricing strategy to craft truly effective campaigns, while sales needs to know exactly which customer segments to target. This kind of seamless, cross-functional teamwork is simply essential for executing a cohesive and successful revenue strategy.

8 Revenue Management Steps

Implementing a Revenue Management System (RMS) follows a structured process with specific key steps needed for a robust strategy. These steps, from data gathering to tool investment, are crucial for success and continuous improvement, allowing businesses to truly refine their approach over time. Here are the 8 essential steps:

1. Data Collection

Everything pretty much starts with data, seriously, as it’s the absolute foundation for any decent revenue management strategy out there. So, this means you’re gathering historical stuff and current data too, looking at sales, bookings, cancellations, what your rivals are pricing things at, and market trends.

You’ll actually find this data coming from all sorts of places, you know, like your property management system, your central reservation system, and even those market intelligence tools. And getting a centralized system in place to gather and keep all this information organized is just so important, truly.

2. Customer Segmentation

Okay, so once you’ve got that data all sorted, the very next thing you’ll want to tackle is segmenting your customers, definitely. And what that really means, like we’ve talked about, is just grouping customers based on shared characteristics and how they tend to buy things.

You’ll often see segmentation criteria include stuff like booking lead time, length of stay, which channel they used to book, and even their purpose of travel. By really pinpointing these different segments, you can, like, totally tailor your pricing and marketing efforts way more effectively.

3. Forecasting

Now, forecasting, that’s essentially just predicting future demand, right, based on all your historical data and what the current market conditions look like. For revenue management, honestly, this step is probably one of the most critical you’re going to come across. It really is.

Your forecast absolutely needs to take into account factors like seasonality, any local events that pop up, what your competitors are up to, and just the overall economic trends, too. And it’s definitely not a “one and done” kind of thing. You really ought to be updating it regularly to reflect any new information.

4. Planning, Executing, and Setting Prices

With a solid forecast in hand, you can begin planning your comprehensive pricing strategy. This involves defining specific price points for various customer segments and time periods. The main goal is to align your pricing perfectly with the predicted demand patterns you have identified.

Executing the plan means putting those prices into action across all your distribution channels. You must do this carefully to maintain rate parity and avoid confusing customers. This step is where the strategic side of revenue management truly comes into play and makes a difference.

5. Choose a Long-Term Pricing Strategy

A solid, long-term pricing strategy provides a helpful framework for all your day-to-day decisions. Whether the goal is maximizing occupancy or capturing market share, a clear long-term aim ensures all your short-term tactics remain aligned with your overarching business vision, which is crucial for consistency.

You should revisit this strategy periodically to ensure it remains relevant to your goals and the current market landscape. It provides significant stability and clear direction for all your revenue management efforts. In essence, it serves as your true north star, guiding your entire pricing philosophy.

6. Execute on Plan

Execution is where strategy becomes reality. This means implementing your pricing and inventory controls across every relevant channel. It requires careful coordination between revenue management, sales, and marketing teams to guarantee a consistent message to the market.

This step also involves actively managing distribution channels to optimize for both reach and cost. The main goal is to ensure inventory is readily available where your target customers shop. Effective execution is truly what transforms a good plan into actual, tangible revenue growth.

7. Analyse and Refine

Revenue management is definitely not a “set it and forget it” function. It demands constant monitoring, deep analysis, and continuous refinement. You absolutely must track performance against your forecasts and KPIs to genuinely determine what strategies are working and what needs immediate attention.

Based on that analysis, you should be ready and willing to make strategic adjustments. This might involve simply tweaking pricing, altering inventory controls, or rolling out new promotions. This continuous feedback loop is what empowers your team to adapt and ensure ongoing success.

8. Invest in Technology

Manually juggling all the data in today’s complex market is nearly impossible. Investing in a dedicated Revenue Management System (RMS) automates these processes. This technology is highly effective for data collection, forecasting, and especially complex price optimization.

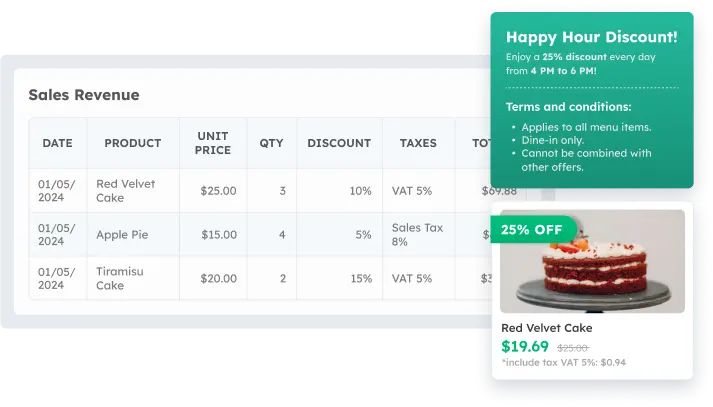

An RMS analyzes huge data sets in real-time, automating price adjustments and freeing your team to focus on high-value strategy. ScaleOcean’s revenue software optimizes pricing based on market demand and your strategy, helping you maximize revenue and easily stay ahead of competitors.

History of Revenue Management

Revenue management, initially called yield management, began in the airline industry after the 1978 US Airline Deregulation Act. This change gave airlines the freedom to set prices, fueling fierce competition and creating the urgent need for new pricing and capacity strategies.

American Airlines pioneered this approach with its DINAMO system, which allowed it to offer different prices for the same seat, effectively maximizing revenue. This strategy was so successful that it set the stage for revenue management to spread rapidly across hotels, car rentals, and cruises.

Revenue Management KPIs and Metrics

Measuring revenue is vital for successful management, and KPIs and metrics are essential for tracking strategy performance and finding improvement areas. These tools provide insights into profitability and efficiency, supporting data-driven decisions that ensure your strategies truly deliver results. Here are the key KPIs and metrics to track:

1. PRASM (Passenger Revenue per Available Seat Mile)

For airlines, PRASM, or Passenger Revenue per Available Seat Mile, is a pretty vital metric for seeing how efficiently they’re generating revenue. It’s essentially your total passenger revenue divided by the total available seat miles, giving airlines a clear idea of what they’re earning for every unit of capacity they have.

When PRASM is up, it generally means an airline is doing a solid job of filling seats and setting optimal fares, which is always a good sign for revenue management. This metric really covers a lot, factoring in both how full the planes are and what people are paying, making it a critical indicator of an airline’s financial health.

2. Profit per Unit

Profit per unit is a super straightforward but quite powerful metric, simply telling you how profitable each item you sell actually is. You calculate it by taking the selling price of a unit and subtracting its variable cost, which then helps businesses quickly grasp each sale’s direct contribution to their overall profit.

This KPI is particularly useful in industries with lots of different products, like retail, allowing you to easily spot your most profitable items versus those that might need some price tweaking. It truly gives you a clear view of your product-level performance, which is invaluable for revenue management strategies.

3. Occupancy

In hospitality, occupancy is a really fundamental metric, showing you the percentage of available rooms that actually got sold over a certain period. You figure it out by dividing the rooms sold by the total rooms available, giving you a direct measure of how well a hotel is doing at filling its capacity.

Now, while high occupancy is usually a positive thing, it’s important to remember it doesn’t tell you everything. You really need to look at it with other metrics, like the average daily rate. For instance, a hotel could be full but still not make money if rooms were sold at too low a price, which is a key consideration for revenue management.

4. Average Daily Rate

Average Daily Rate, or ADR, is another really important KPI for hotels, essentially measuring the average revenue brought in per occupied room each day. You get this by dividing your total room revenue by the number of rooms sold, offering a clear window into the pricing performance of a hotel.

When ADR is on the rise, that’s generally a good sign, meaning the hotel can ask for higher prices for its rooms. It’s really best looked at alongside occupancy to give you the full picture of your revenue performance, because the aim is always to strike that perfect balance between ADR and occupancy for maximum revenue.

5. Forecast vs. Actual Sales

This metric simply puts your sales forecasts head-to-head with your actual sales figures. It’s a direct way to gauge how accurate your demand forecasting truly is. A small difference between what you predicted and what actually happened usually means your forecasting model is performing well.

Keeping a close eye on this KPI consistently helps you fine-tune your forecasting methods as time goes on. It’ll clearly show you where your predictions might be a bit off, giving you a chance to dig in and make things better, which is why accurate forecasting is genuinely the cornerstone of effective revenue management, making this a vital metric to watch.

6. Annual Contract Value (ACV)

For subscription businesses, particularly in SaaS, Annual Contract Value (ACV) is a really key metric to keep an eye on. It basically shows you the average revenue you get from each customer contract every year, helping companies grasp the true value of their customer relationships on a normalized annual basis.

ACV is pretty handy for tracking overall growth, and it’s essential for your financial planning and forecasting, too. If you see your ACV going up, it often means you’re doing a good job of upselling or cross-selling to current customers, or even bringing in higher-value new ones, which is always a strong indicator of a healthy subscription business.

7. Average Sales Cycle Length

This metric is all about how long it takes, on average, to seal a deal, from that very first contact right through to the final sale. Generally, a shorter sales cycle is preferable because it signals you’re turning leads into customers more efficiently, and keeping an eye on this really helps pinpoint any holdups in your sales process.

Taking a close look at sales cycle lengths for various customer segments or lead sources can seriously help you optimize your sales and marketing strategies. Shortening this cycle isn’t just about faster deals; it can actually lower your customer acquisition costs and really speed up revenue growth, making it a key indicator of sales team efficiency.

8. Customer Retention and Churn Rate

Customer retention rate shows how many customers stick around, while the churn rate tracks those who leave. For any business relying on recurring revenue, holding onto existing customers is absolutely critical for long-term success. It’s nearly always cheaper than finding new ones.

A high retention rate coupled with a low churn rate is usually a clear sign of a truly healthy business, indicating strong product quality and solid customer relationships. These metrics are fundamental to gauging if your revenue streams are sustainable, directly reflecting loyalty.

9. Customer Acquisition Cost

Customer Acquisition Cost (CAC) totals all sales and marketing money spent just to land one new customer. You calculate it by dividing your total acquisition expenses by the number of new customers gained in a specific period, giving you a clear grasp of your efforts’ efficiency.

Ideally, a lower CAC is better, but it must always be viewed in context with a customer’s Lifetime Value (LTV). A truly healthy business model requires that LTV is significantly higher than CAC, confirming that you are acquiring customers profitably over the long term.

10. ARPA (Average Revenue per Account)

Average Revenue per Account (ARPA), or sometimes ARPU, basically measures how much revenue you’re pulling in from each account, usually looking at it monthly or yearly. You calculate this by simply dividing your total revenue by the number of active accounts, offering a straightforward way to track the average value of your customer accounts.

Seeing your ARPA go up is definitely a positive trend, suggesting you’re doing a good job of increasing the value of your current customer base, maybe through upselling, cross-selling, or even smart price adjustments. It serves as a key metric for grasping high-level revenue trends and really helps in assessing the overall health of the business.

11. RevPAR (Revenue per Available Room)

Revenue per Available Room, or RevPAR, is arguably the most important metric in the hotel industry. You calculate it by multiplying the Average Daily Rate (ADR) by the occupancy rate, offering a comprehensive view of how effectively a hotel is managing to fill rooms at a profitable rate.

RevPAR is key because it neatly combines occupancy and pricing, giving you a clear view of revenue performance. Hotels can easily boost it by increasing room fill rates or ADR. According to The Straits Times, in Singapore, the average room rate was $272.63, down 3.3% from $281.94 last year, reflecting the impact of pricing changes.

Revenue Management Pricing Strategies

Pricing is central to revenue management; the right strategy directly impacts your revenue potential. Different pricing models offer various strengths based on your industry and market goals. A skilled revenue manager must truly understand these strategies to adapt effectively to changing market dynamics. Let’s take a look at the key pricing strategies:

1. Open Pricing

Open Pricing is a highly flexible strategy that moves past rigid fixed tiers, allowing for far more granular price adjustments. Instead of being constrained by pre-set rates, you can set a unique price per day or room type based on real-time demand. This grants significant control over pricing decisions.

The key benefit is the speed with which you can react to market changes, avoiding a rigid rate structure. It truly empowers revenue managers to set the optimal price at virtually any given moment. This results in a much more dynamic and potentially profitable overall pricing model.

2. Forecast Pricing

Forecast Pricing is fundamentally about setting your prices based on predicted demand. By accurately understanding future demand levels, you can proactively adjust prices to match. This means raising prices for anticipated high-demand periods and lowering them to encourage bookings during expected lulls.

This proactive approach allows you to lead the market, not just react to it. While it heavily depends on the accuracy of your forecasting models, when executed correctly, it can truly and significantly boost your ability to capitalize on market demand.

3. Guest-Segment Pricing

Guest-Segment Pricing means you offer different prices based on distinct customer segments, such as corporate travelers, leisure guests, or loyalty members. This is a direct application of customer segmentation that ensures the price someone sees depends entirely on the specific group they belong to.

By tailoring prices to what each segment is willing to pay, you capture more value from less price-sensitive customers while still attracting budget-conscious ones. This requires a solid understanding of your customer base and is a truly powerful way to optimize revenue from diverse groups.

4. Competitive-Driven Pricing

Competitive-driven pricing means your rates are set largely by what your competitors charge. You constantly monitor their pricing, adjusting your own to match or counter them. The primary goal is to effectively position your offering within the broader competitive landscape.

While competitor awareness is crucial, this strategy requires real caution. Merely chasing the lowest price can rapidly spiral into a price war, which ultimately harms profitability for everyone involved. It should always be just one component of a much broader strategy.

5. Length of Stay (LOS) Controls

Length of Stay (LOS) controls are used to strategically manage booking durations, ensuring maximum revenue over time. This involves setting minimum or maximum stay requirements, especially during peak demand. The goal is to prevent short, lower-value bookings from consuming inventory best suited for longer, profitable stays.

For example, you might enforce a three-night minimum stay over a holiday weekend to ensure the entire period is filled. These controls are extremely helpful for shaping booking patterns to align perfectly with your revenue goals. It’s a strategic way to manage inventory for genuinely optimal results.

Revenue Management Strategies and Tips

Specific tactics and tips truly enhance revenue management alongside pricing strategies. Tools like dynamic pricing and efficient distribution management help you successfully execute your strategy and boost results. Implementing these methods can significantly enhance your overall revenue performance. Here are some strategies and tips:

1. Dynamic Pricing

Dynamic pricing, essentially, is all about constantly adjusting prices. It’s done frequently, reacting to real-time shifts in both supply and demand, which is quite different from a static pricing model where prices just stay fixed for ages. Truly, it’s a cornerstone of modern revenue management.

By leveraging algorithms and all that market data, you can actually automate these price changes, making sure you’re always hitting that optimal price point. This approach really lets you capitalize on demand surges, which is great, and also helps stimulate business during those slower times, proving to be a highly effective way to maximize revenue.

2. Inventory Controls

Inventory controls, at their core, are the rules you put in place for your available inventory to ensure you’re getting the most value out of it. This might mean tactics like holding back certain room types from lower-value segments or even setting capacity limits for particular distribution channels, ultimately helping you allocate your inventory most profitably.

By really getting strategic about who can book what and at what time, you can prioritize those higher-value customers, which is incredibly important when inventory is tight and demand is high. This approach makes sure you’re always getting the best possible return on what are often very perishable assets.

3. Channel Management

Channel management fundamentally involves closely monitoring all your distribution channels, like your website, OTAs, and GDS. The primary goal is to optimize your presence on each one to maximize reach while diligently minimizing distribution costs, as each channel carries unique trade-offs.

An effective channel strategy ensures consistent pricing and availability across every platform, which is crucial. It also means analyzing each channel’s performance to determine the best allocation of effort, helping you build a truly profitable and balanced distribution mix.

4. Promotions and Bundling

Promotions and bundling, when executed correctly, are powerful tools for boosting demand and increasing average transaction value. Limited-time discounts are excellent for stimulating quiet periods, while bundling multiple offerings for a single price encourages customers to spend more overall.

A prime example is a hotel bundling a room with breakfast and a spa treatment, significantly increasing the offer’s appeal and the total revenue per guest. These tactics should always be employed strategically to align perfectly with your broader revenue goals.

5. Incentivizing Direct Bookings

Direct bookings via your site or call center are the most profitable because they let you bypass costly OTA commissions. Offer special perks to incentivize direct business and boost your margins. (Remember, according to IRAS, the commission income submission deadline is March 1st yearly, starting January 2nd.)

Developing a solid direct booking strategy is crucial for reducing dependence on costly third-party channels. This approach gives you better control over both the customer relationship and your long-term profitability. It’s a strategic move designed for sustainable business growth.

6. Overbooking

Overbooking means selling more inventory than you technically possess, anticipating cancellations and no-shows. It’s a common strategy, especially in the hotel and airline sectors, aiming to maximize capacity and prevent revenue loss from those often-unavoidable last-minute cancellations.

Naturally, this strategy must be managed with extreme care to avoid situations where you cannot accommodate a confirmed customer, which could seriously harm your reputation. It relies heavily on accurate no-show forecasts, but when properly handled, it’s a very effective tool for maximizing utilization.

7. Ancillary Revenue Optimization

Ancillary revenue is essentially money earned from services outside your main offering, like baggage fees for airlines or spa services for hotels. Optimizing this particular revenue stream is becoming a critical component of your overall, modern revenue management strategy.

By analyzing customer data, you can easily spot opportunities to upsell and cross-sell relevant ancillary services. This approach can significantly boost the total revenue gained per customer. It’s a smart way to grow the top line without relying solely on core product pricing.

8. Distribution Channel Controls

This control is all about strategically deciding which inventory you make available on specific distribution channels. You could, for example, choose to list only your standard rooms on high-cost OTAs, while intentionally reserving your premium suites just for direct bookings, thereby allowing you to steer customers towards your more profitable channels.

These sorts of controls really hand you more power over your entire distribution mix and the associated costs, which is super helpful. Being quite selective about what you’re selling and where means you can significantly boost your overall profitability, making it a rather sophisticated way to manage your online presence.

9. Duration Controls

Duration controls, sometimes called length of stay controls, are put in place to manage exactly how long a customer is allowed to book for. This means you can set minimum or maximum stay requirements, with the main goal being to optimize your occupancy and revenue across a period of time, not just focusing on a single night.

Take a major conference, for instance. A hotel might decide to impose a minimum stay of three nights, preventing those one-night bookings from chopping up the availability, and ensuring they really capture the full value of that high-demand period. It’s a pretty key tactic for effectively managing peak demand periods.

10. Cost-Plus Pricing

Cost-plus pricing is a very straightforward method, though you can calculate production costs and simply add a percentage markup to determine the selling price. While certainly simple, it generally ignores demand and competitor pricing, so it isn’t usually considered a true revenue management strategy alone.

That said, it is a genuinely useful starting point, especially for establishing a basic price floor, ensuring that costs are covered with every sale. Think of it as a foundational concept that can easily be woven into a much more dynamic and sophisticated pricing model down the line.

11. Price Skimming

Price skimming means launching a new product at a high initial price, then gradually lowering it over time. This is common for innovative products lacking early competition. It allows a company to capture the maximum revenue from early adopters willing to pay a premium for novelty.

As the market matures and competition increases, the price is lowered to attract a broader, more price-sensitive customer base. This clever approach maximizes revenue across the product’s entire lifecycle and is frequently observed in the technology and electronics industries.

12. Penetration Pricing

Penetration pricing is essentially the inverse of price skimming; here, you launch a new product with a really low initial price point to quickly grab market share and pull in a large customer base. The goal is to build volume while creating barriers to entry for potential competitors.

Once you’ve established that strong market position, the price can then be slowly increased, which is a strategy often deployed when you’re jumping into an already highly competitive market. It’s a clear move that prioritizes gaining market share growth over immediate short-term profitability, you see.

Industries That Use Revenue Management

Revenue management began in airlines but is now effective across industries with perishable inventory, fluctuating demand, and high fixed costs. From hotels to healthcare, many businesses have successfully adopted these strategies, showing their widespread, powerful impact. Here are some industries that use revenue management:

1. Travel & Hospitality

This is likely what comes to mind when most of us talk about revenue management, the classic use case. Airlines, hotels, restaurants, and car rentals all rely on complex systems to manage pricing and inventory. Since their services are perishable, they must handle constant and serious demand fluctuations.

For travel and hospitality, revenue management isn’t just nice to have. It’s absolutely central for staying profitable and competitive in the market. The methods they’ve developed here often serve as a benchmark, showing others what’s possible, and honestly, it’s still where this practice feels the most advanced.

2. Media & Telecommunications

Media companies, especially broadcasters, heavily rely on revenue management when selling ad space. This makes sense because ad inventory on a specific platform is perishable. Once aired, it’s gone. They use forecasting to predict viewership and set dynamic rates to maximize advertising revenue.

Telecommunications companies cleverly apply similar principles to manage their network capacity. They frequently design different pricing plans, for instance, to encourage service use during off-peak times. This helps balance the load and extract the greatest value from their expensive fixed assets.

3. Retail

The retail sector, particularly e-commerce and fast fashion, is truly embracing revenue management. Retailers are smartly using dynamic pricing based on demand, inventory, and competitor actions. They also effectively optimize markdowns for seasonal or slow-moving items.

By using these methods, retailers are successfully boosting their profit margins and significantly reducing costly unsold inventory. This capability is helping them keep pace with fast-changing trends and customer tastes, marking it as a critical growth area for practical revenue management applications.

4. Healthcare

Healthcare might seem unusual, but revenue management (called revenue cycle management here) is vital for scheduling and billing. Like a flight seat, a doctor’s time is perishable like if an appointment is missed, the revenue is lost. Hospitals use clever scheduling to cut no-shows and optimize their valuable staff.

Beyond appointments, this also involves expertly navigating the complex world of insurance claims and patient billing, ensuring payments are received correctly and on time. Ultimately, it helps providers keep their financial house in order, which means they can invest more back into better patient care.

5. Software & SaaS

SaaS companies smartly apply revenue management to design their subscription tiers and pricing models. They segment customers based on specific needs, offering various packages at different price points. This lets them capture value from everyone, whether it’s a small startup or a large enterprise.

SaaS businesses also track metrics like ACV and churn rate closely to truly understand the health of their recurring revenue streams. Pricing and package structure are critical strategic levers for growth in this industry, showcasing a modern evolution of classic revenue management ideas.

6. Rental

The rental industry, covering cars, equipment, and even storage, is a natural fit for revenue management. These businesses rent a fixed number of assets, face changing demand, and always need to maximize asset utilization. It’s the perfect setup for strategic pricing.

Using dynamic pricing, these companies can adjust rental rates based on the season, day, or booking lead time. This is quite effective! It helps them boost both occupancy and overall profitability, essentially using the same proven principles that are so successful in the hotel industry.

Revenue Management Challenges and Solutions

Revenue management brings great benefits, but we face real challenges like unpredictable markets and tech limitations. Overcoming these hurdles with the right strategies and tools is the key to success. By tackling them head-on, you can ensure your strategy delivers results! Here are some common revenue management challenges and solutions:

1. Volatile Market Conditions and Forecasting

Market conditions can shift unexpectedly, especially after major global or economic events. This kind of volatility makes accurate demand forecasting incredibly difficult, since historical data often doesn’t match current trends, leaving businesses feeling uncertain about the future.

Simply relying on past data can lead to seriously inaccurate predictions, making it tough to quickly adjust pricing and demand strategies. Companies truly need more agile models to effectively keep pace with changing market dynamics and consistently make informed decisions.

Here are the solutions to address these challenges:

- Agile Forecasting Models: Use real-time market signals to enhance forecasting accuracy.

- Competitive Monitoring: Track competitor pricing and market conditions for better prediction.

- Predictive Analytics: Build resilient forecasts that adapt to market shifts using advanced analytics.

2. Technological Limitations

Outdated technology often creates serious inefficiencies when systems like PMS and CRS can’t communicate well. This results in data silos, making it tough for a business to get a clear, single, unified picture of its daily operations.

When systems aren’t integrated, it really limits a company’s ability to make fast, data-driven decisions. This ultimately hampers the effectiveness of their revenue management strategies and significantly drags down their overall operational efficiency.

Here are the solutions to address these challenges:

- Integrated RMS: Invest in a modern, centralized Revenue Management System.

- Automated Calculations: Automate complex calculations for quicker, data-driven decisions.

- Real-Time Synchronization: Ensure seamless data flow across all platforms for accurate insights.

3. Distribution Channel Complexity

Managing pricing and availability across various channels, each with its own rules, commissions, and costs, is tough. It’s genuinely difficult to maintain rate parity and keep distribution costs in check, which often leads to annoying inconsistencies and margin erosion.

The growing complexity of distribution channels demands constant oversight and management. Without a good centralized system, businesses really struggle to optimize their channels effectively, which sadly results in both missed revenue opportunities and unnecessarily higher costs.

Here are the solutions to address these challenges:

- Centralized Channel Management: Use an integrated system to manage all channels from one platform.

- Automated Updates: Automate price and availability adjustments across distribution channels.

- Rate Parity: Ensure consistent pricing and availability across all channels to maintain control.

4. Maintaining Price Integrity

Dynamic pricing is powerful, but it carries a real risk of alienating customers. Frequent price changes can make people feel the pricing is unfair, quickly eroding trust and damaging your brand reputation, especially if the changes feel inconsistent or deceptive to them.

Without a clear structure for price changes, customers might easily perceive the business as untrustworthy. This creates a delicate balance between optimizing revenue and keeping customers happy through pricing practices that feel transparent and easy to understand.

Here are the solutions to address these challenges:

- Clear Pricing Rules: Set specific guidelines for pricing across different customer segments.

- Pricing “Fences”: Implement restrictions like advance purchase or non-refundable rates.

- Transparent Communication: Clearly explain pricing strategies to customers to maintain trust.

5. Neglecting Ancillary Revenue

Many businesses miss a trick by focusing only on primary product pricing and overlooking ancillary revenue. By not optimizing upgrades, add-ons, or services, they’re missing out on valuable, easy-to-capture revenue streams that could significantly boost overall profitability.

When a company fails to prioritize ancillary revenue, it misses a huge chance to enhance customer value and dramatically increase overall earnings. This narrow focus on just the primary products limits a company’s potential to truly grow and maximize its financial returns.

Here are the solutions to address these challenges:

- Ancillary Revenue Strategy: Integrate upselling and cross-selling into your revenue management strategy.

- Customer Data Analysis: Leverage data to identify profitable ancillary products and services.

- Targeted Offers: Create personalized offers based on customer preferences to boost ancillary sales.

Revenue and Yield Management Key Differences

Yield management is all about maximizing revenue from fixed, perishable inventory by strategically managing price and capacity. It’s a tactical approach often applied to specific assets, like airline seats or hotel rooms, aiming to get the absolute best yield from what you already have.

Revenue management is a much broader strategy that includes yield management, but also covers channel management, ancillary revenue, and long-term planning. It focuses on maximizing overall profit by considering total revenue potential and costs across the entire business.

Use ScaleOcean for the Seamlessly Integrated Revenue Management Software

ScaleOcean’s revenue management software is built to handle the complexities of today’s pricing strategies. It offers a seamless, integrated system that combines powerful data analytics with real-time forecasting, helping businesses make smarter, more profitable decisions in volatile markets.

ScaleOcean simplifies channel management, integrates smoothly with your existing systems, and empowers your team to truly optimize revenue. Plus, the CTC grant is available to support your growth! Here are the key features for ScaleOcean’s software:

- Demand Forecasting: Analyzes historical data and market trends to predict customer behavior, helping businesses adjust strategies to meet demand.

- Dynamic Pricing Adjustment: Automatically adjusts prices based on seasonality, demand, customer segmentation, and availability to maximize revenue.

- Cross-Functional Integration: Integrates sales, inventory, production, CRM, supply chain, and accounting data, ensuring alignment for better decision-making.

- Profitability Optimization: Calculates margins, costs, and projected revenue automatically, helping avoid underpricing and boosting profitability.

- Real-Time Performance Reports: Provides up-to-date reports on actual revenue versus targets, enabling businesses to track and optimize performance.

Conclusion

Revenue management is more than just tweaking prices. It’s a smart, comprehensive strategy using data and technology to boost financial performance. By integrating concepts like perishable inventory and segmentation, it helps businesses can make smarter decisions for lasting success.

To truly succeed with revenue management, getting the right technology is essential. ScaleOcean, with its integrated revenue software, offers great tools for optimizing pricing and channel management. You can explore all its features and benefits firsthand by signing up for a free demo.

FAQ:

1. What are the 7 core principles of revenue management?

1. Sensitivity to Pricing

2. Demand Forecasting

3. Managing Overbooking

4. Customer Segmentation

5. Controlling Inventory

6. Flexible Pricing

7. Managing Capacity

2. What is an example of revenue management?

A common example of revenue management is a hotel adjusting its pricing based on demand. Prices rise during busy periods and are reduced during off-peak times to ensure rooms are sold at optimal rates, boosting profitability by aligning price with demand.

3. What is the difference between profit and revenue?

Revenue refers to the total income a business earns from selling products or services before any deductions. Profit, however, is what remains after all costs, such as expenses, taxes, and costs of goods sold, are subtracted from that revenue.

4. Is revenue management part of ERP?

Revenue management is not typically a core part of ERP systems, though some ERP solutions may offer tools that support it. ERP systems mainly focus on operational and financial tasks, with dedicated revenue management software needed for precise optimization.

PTE LTD..png)

.png)

.png)

.png)

.png)