Corporate tax in Singapore has played a significant role in establishing the country as a global business hub. With its strategic position, stable economy, and pro-business legislation, Singapore attracts companies looking for growth opportunities.

A key aspect contributing to this reputation is its competitive and open corporate tax system, designed to promote business expansion while remaining fiscally responsible.

According to World Bank data, Singapore’s Gross Domestic Product (GDP) will be roughly 501.43 billion USD in 2023, confirming its reputation as a high-income economy with a robust commercial sector.

In this article, we will dive into the key elements of corporate tax in Singapore, such as the corporate income tax rate, available tax exemptions, and incentives for businesses. We will also cover tax filing requirements, common mistakes, and how accounting software can streamline tax reporting and efficiency.

- For Singapore, Corporate Income Tax Rate for firms locally formed or foreign corporations with activities in the nation, pay a flat corporate income tax rate of 17% on chargeable revenue.

- Key tax relief measures in Singapore include partial tax exemptions, start-up tax exemptions, and industry-specific incentives that reduce tax liabilities for businesses.

- Filing Obligations require businesses to submit ECI within three months after the fiscal year ends and Form C-S or C by November 30th to ensure compliance with IRAS and avoid penalties.

- ScaleOcean accounting software can improve tax management efficiency by automating calculations, tracking data in real-time, and ensuring full tax compliance.

Singapore Corporate Income Tax Rate

All firms in Singapore, whether locally formed or foreign corporations with activities in the nation, pay a flat corporate income tax rate of 17% on chargeable revenue. Unlike progressive tax regimes, this single-tier structure ensures that businesses only pay taxes on profits, with no additional charges on dividends paid to shareholders.

This competitive tax rate, along with Singapore’s large network of double taxation agreements (DTAs), makes the country an appealing choice for enterprises looking for tax savings.

Tax Exemptions and Incentives

Singapore offers a range of tax exemptions and incentives to support business growth, particularly for small enterprises, startups, and key industries. These schemes help reduce the overall tax burden, making it easier for businesses to reinvest in expansion, innovation, and operational improvements.

Below are some of the key tax relief measures available to companies in Singapore:

- Partial Tax Exemption (PTE): Singapore grants a partial tax exemption to SMEs. This exempts 75% of the first SGD 10,000 of chargeable income and 50% of the next SGD 190,000 from tax, resulting in a total exclusion of SGD 102,500 per year.

- Start-Up Tax Exemption (SUTE): Eligible startups receive a 75% exemption on the first SGD 100,000 of chargeable income and 50% exemption on the next SGD 100,000 for the first three years of assessment, totaling an exempt income of SGD 125,000 per year.

- Industry-Specific Tax Incentives: Singapore offers tax breaks for businesses in industries like financial services, research and development, and worldwide trade, encouraging investment and innovation to enhance Singapore’s competitiveness globally.

- YA 2025 Tax Rebate: Businesses can benefit from a 50% rebate on their corporate tax payable, up to a maximum of SGD 40,000, with a guaranteed cash grant of at least SGD 2,000 for companies employing one or more local employees.

Filing Obligations

Businesses in Singapore must meet tight tax filing dates to maintain compliance with the Inland Revenue Authority of Singapore (IRAS). Companies must file crucial tax documents, such as an Estimated Chargeable Income (ECI) declaration and yearly tax returns, and tax invoice records, within specified times.

Timely and accurate filing not only avoids penalties but also helps firms retain good standing with tax authorities. The following are the main tax filing requirements for Singapore firms:

Estimated Chargeable Income (ECI)

Companies must submit an ECI to IRAS within three months after the end of their fiscal year. The ECI is an estimate of the company’s taxable income for the year that helps IRAS determine the company’s projected tax obligations.

Even if a corporation has no chargeable income, it must file the ECI unless specifically exempted. Businesses that file their corporate taxes early might take advantage of installment payment alternatives.

Form C-S/Form C Filing

Every year, corporations must submit Form C-S or Form C by November 30th to indicate their actual income for the year of assessment. Form C-S is a reduced form offered to small businesses that meet certain conditions, which reduces the reporting load.

Form C is the regular form required by larger businesses or those who do not qualify for Form C-S. To avoid penalties and compliance difficulties, ensure that you submit the correct form with accurate financial data.

Record-Keeping Requirements

In Singapore, businesses are required to keep clear and accurate financial records to meet tax regulations and simplify audits. This includes retaining important documents such as invoices, receipts, bank statements, and detailed accounting records.

All records must be kept for at least five years after the relevant Year of Assessment (YA), even if the business is no longer active. Having proper documentation helps ensure accurate tax filings and supports claims for deductions during audits.

If businesses fail to maintain accurate records, they may face penalties or complications during tax audits conducted by the Inland Revenue Authority of Singapore (IRAS). It is essential to comply with these record-keeping requirements.

Role of the Inland Revenue Authority of Singapore (IRAS) in Tax Compliance

The Inland Revenue Authority of Singapore (IRAS) plays a key role in ensuring businesses comply with tax regulations. It is responsible for enforcing corporate tax laws, conducting tax audits, and implementing penalties for businesses that do not follow the rules.

IRAS also supports businesses by offering useful resources, workshops, and clear guidelines to help them understand their tax obligations. With these tools, businesses can navigate the tax process more confidently and avoid mistakes.

To make things easier, IRAS provides digital services, such as e-filing systems. These tools allow businesses to file tax returns, make payments, and access tax-related information quickly and conveniently, ensuring a fair and transparent tax system.

Importance of Accounting Software in Tax Management

Accounting software is essential for simplifying tax management in businesses. It automates tax calculations, reporting, and tracking, helping reduce errors and ensuring compliance with local tax laws. With the right tools, businesses can easily stay on top of their tax responsibilities.

Here are some of the key advantages accounting software offers in managing taxes:

Automation of Tax Calculations

Accounting software automates tax computations by applying the appropriate tax rates, deductions, and exemptions depending on Singapore’s corporate tax legislation. This decreases the likelihood of errors and noncompliance.

Additionally, automated tax functions assist organizations in producing correct tax filings and maintaining uniformity across financial statements.

Integration with Financial Records

The seamless link with financial records ensures that tax reporting is based on current, correct data. This eliminates the need for manual data entry, lowering mistake rates and saving time.

Integrated accounting systems also make it easy for firms to track tax-deductible expenses, income streams, payslip templates, and capital allowances, ensuring that all qualifying deductions are recorded correctly.

Real-Time Updates

Real-time insights into tax requirements enable firms to remain ahead of deadlines and avoid penalties. Companies can ensure timely HR compliance by setting up automated reminders for ECI files, Form C-S/Form C submissions, and tax payments.

Furthermore, tax forecasting tools help firms plan their cash flow properly by anticipating future tax liabilities using real-time financial data.

Common Tax Filing Mistakes to Avoid

Filing corporate taxes correctly and on time is critical for Singapore businesses to avoid penalties and follow IRAS regulations. According to Singapore Incorporation Services, the Inland Revenue Authority of Singapore (IRAS) allows corporations between 11 and 22 months to file their corporate tax reports, depending on their accounting cycle.

However, many firms continue to make basic mistakes, such as missing deadlines or filing incorrectly, which can have serious financial and legal consequences. Here are the common risks to avoid:

Late Filing

Missing tax filing deadlines might result in financial penalties and enforcement measures by the IRS. Companies must submit their Estimated Chargeable Income (ECI) within three months of the end of the fiscal year, as well as Form C-S or Form C, by November 30 of each year.

Late files can result in fines and interrupt business operations, so it’s critical to set reminders or use accounting software for automated deadline tracking.

Inaccurate Reporting

Incorrect financial data, miscalculations, or missing income declarations can lead to tax inconsistencies and compliance concerns. To prevent unwanted audits or penalties, businesses must accurately disclose all revenue, deductible expenses, and exemptions.

Before submitting financial statements, companies can improve their human resource management process by considering using professional accounting services or tax software to ensure their accuracy.

Non-Compliance with Record-Keeping

Singapore law requires enterprises to keep financial records for at least five years following the applicable Year of Assessment (YA). Failure to retain source papers, accounting records, and tax schedules can complicate audits and result in fines.

Proper digital and physical record-keeping systems help organizations stay compliant while also ensuring that all important financial information is readily available when needed.

In addition, a robust human resource strategy ensures that employee records, payroll data, and compliance with labor laws are effectively managed, supporting overall organizational efficiency.

What is the Process for Paying Corporate Tax in Singapore?

Paying corporate tax in Singapore is a clear and structured process that begins with filing your tax returns. Companies need to submit their returns using Form C-S or Form C by November 30th each year, providing detailed information on income and expenses.

After submitting the tax return, the Inland Revenue Authority of Singapore (IRAS) reviews the information and sends out a Notice of Assessment (NOA). This document tells businesses how much tax they owe, and they have one month from the date of the NOA to pay.

Companies can make payments in several ways, such as through GIRO, online banking, or a credit card. For example, if a company owes SGD 10,000, they can easily make the payment online using the reference provided by IRAS.

It’s important to stay on top of deadlines and make payments promptly to avoid additional fees or penalties. For instance, missing the payment deadline could lead to late fees, which can add unnecessary costs and disrupt the company’s finances.

Strategies for Efficient Tax Reporting

Efficient tax reporting is key to running a successful business, helping you stay compliant while reducing your tax liabilities. By implementing smart strategies, businesses can avoid penalties and improve financial performance.

Here are a few effective strategies to enhance your tax reporting:

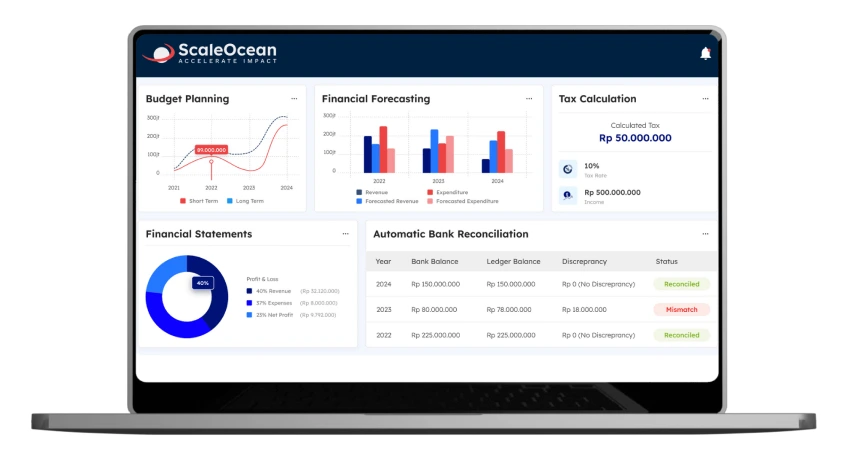

Leverage ScaleOcean Accounting Software for Tax Efficiency

ScaleOcean accounting software manages corporate tax effectively and offers a solution that’s both scalable and affordable, helping businesses streamline tax management and reduce errors while saving time on manual tasks.

With automated tax calculations, real-time tracking of finances, and smooth integration, ScaleOcean ensures accurate reporting and on-time filings while staying fully compliant with IRAS requirements. Businesses can manage their deductions, exemptions, and tax liabilities easily on one platform.

ScaleOcean’s real-time insights reduce financial risks, improve cash flow, and help businesses effectively track and manage CTC grants. To see how ScaleOcean can boost tax efficiency, businesses can try a free demo and experience the benefits of automation and real-time integration firsthand.

Key benefits of ScaleOcean accounting software include:

- Unlimited Users Without Additional Fees: Businesses may scale their operations without incurring additional fees per user, making it suitable for expanding enterprises.

- All-in-One Solution With Comprehensive Modules: Provides 200+ specific modules tailored to corporate needs, ensuring that tax calculations are consistent with financial operations.

- Flat and Transparent price: Fixed price with no hidden fees, making it a dependable option for midsize to enterprise-level businesses.

- Advanced Customization and Smart Configuration: Businesses can tailor dashboards and tax workflows to their own financial structures and compliance demands.

Maximize Tax Deductions

To reduce your taxable income, make sure you take advantage of allowable deductions like office rent, employee salaries, staff training, travel costs, and professional fees. These deductions help lower your tax burden while improving cash flow.

Keeping accurate financial records is crucial to support your claims and avoid issues during audits. Staying updated on the HR latest trends can also help you spot areas where you can cut costs and take advantage of tax-saving deductions.

Utilize Capital Allowances

Capital allowances help businesses reduce their taxable revenue by claiming relief on qualifying assets such as machinery, office equipment, and vehicles. These allowances encourage investment in productive assets and technology to fuel growth.

In Singapore, businesses can benefit from programs like the Productivity and Innovation Credit (PIC) and Writing Down Allowance (WDA), which promote investment in technology and productivity tools. Properly using these allowances can reduce taxes while supporting your growth strategy.

Engage Professional Tax Services

Singapore’s corporate tax laws can be complex, especially for businesses with diverse revenue or international transactions. By hiring accredited tax professionals, you ensure accurate tax filings while making the most of exemptions and deductions.

Tax specialists offer strategic advice on tax planning, compliance, and risk management. Just like human resource planning, engaging tax experts helps businesses stay compliant while optimizing tax strategies for better financial outcomes.

Conclusion

Understanding the corporate tax system in Singapore is crucial for businesses to maximize tax benefits, minimize liabilities, and remain compliant with IRAS regulations. By applying strategies such as tax exemptions, accurate record-keeping, and proactive tax planning, businesses can avoid common issues like late filings and mistakes.

Accounting software can make tax management much easier by automating calculations, tracking finances in real time, and integrating financial records. ScaleOcean’s accounting software simplifies tax filings, reduces errors, and ensures full compliance with Singapore’s tax laws. Experience its benefits and features with a free demo.

FAQ:

1. Are GST and corporate tax the same?

GST is an indirect tax applied to the supply of goods and services, while corporate tax is a direct tax imposed on a company’s profits. How these two taxes interact can either reduce or increase a business’s overall tax burden, depending on the planning strategies used.

2. Who is required to file corporate taxes?

Any business considered a taxable entity, including Free Zone entities, must register for corporate tax and obtain a registration number. In some cases, even businesses that are usually exempt may be required to register for corporate tax if asked by the Federal Tax Authority.

3. Who is exempt from corporation tax?

Typically, charities do not have to pay corporate or income tax. However, certain situations may require tax payments, especially when the charity engages in non-charitable activities or incurs expenses unrelated to its charitable purposes.

4. How much is the minimum corporate income tax?

The Minimum Corporate Income Tax (MCIT) is a 2% tax on gross income that applies starting from the fourth taxable year of business operations. Companies will pay whichever tax is higher: the regular corporate income tax or the MCIT.

PTE LTD..png)

.png)

.png)

.png)

.png)