Singapore has a strong and well-organized tax system that plays an important part in preserving the country’s business climate. According to the Ministry of Finance in Singapore, the Goods and Services Tax (GST) was introduced in 1994 as a broad-based consumption tax. It is currently set at 8% (as of 2023).

GST applies to the majority of goods and services, ensuring businesses contribute to the economy fairly while promoting transparency and efficiency in the marketplace. At the center of this framework is Singapore’s Inland Revenue Authority (IRAS). It manages tax regulations and ensures GST compliance.

IRAS enforces tight criteria. It provides businesses with tools and resources to meet their tax duties, such as properly issuing and managing tax invoices. Their work is critical in upholding Singapore’s tax compliance requirements and ensuring seamless tax filing for firms across all industries.

- A tax invoice is an official document issued by a GST-registered supplier to a GST-registered customer, detailing the sale and GST charged, serving as proof for accurate tax record-keeping.

- Key requirements of a tax invoice include the phrase “Tax Invoice,” supplier and customer details, invoice number and date, and more components that will ensure clarity and compliance.

- Tax invoice formats must comply with IRAS rules to ensure compliance and avoid issues, with key types being E-Invoicing and Digital Invoices.

- ScaleOcean accounting software are gonna assist organizations in reducing manual errors and administrative workload, resulting in increased operational efficiency.

What Is a Tax Invoice?

A tax invoice is an official document sent by a GST-registered provider to a GST-registered consumer for taxable goods or services. It describes the sale of goods or services, including a breakdown of the Goods and Services Tax (GST) charged. This document acts as proof of the transaction and is essential for maintaining accurate tax records.

The provider must include critical information, such as a description of the products or services. This includes quantities, prices, and GST amounts to ensure compliance with GST requirements. Customers rely on tax invoices to obtain input tax credits. These credits can be utilized to offset GST paid on purchases with GST earned on their own sales.

This method is critical for firms to successfully manage their tax liabilities. Both suppliers and customers can ensure accurate GST filings. By following proper invoicing guidelines, they can comply with the Inland Revenue Authority of Singapore (IRAS).

Key Requirements of a Tax Invoice

A tax invoice must include key details to comply with GST regulations. These include the term “Tax Invoice,” supplier and customer info, invoice number, date, description, quantity, unit price, and amounts before and after GST.

These components contribute to a clear understanding of the transaction and tax responsibilities. The key components of a tax invoice are:

- The Phrase “Tax Invoice” Displayed: “Tax Invoice” should be visible to distinguish it from proforma invoices, ensuring compliance with GST laws and indicating that the transaction is subject to tax.

- The Supplier’s Name, Address, and GST Registration Number: The supplier’s name, address, and GST number must appear on the invoice to confirm GST registration and allow IRAS tracking.

- The Customer’s Name and Address: The customer’s name and address define the relationship and ensure proper allocation of input tax credits and monitoring of tax transactions.

- An Invoice Number and the Date of Issue: A unique invoice number helps organize records. The issue date is crucial for meeting GST obligations within the 30-day invoicing requirement.

- A Description of the Goods or Services Supplied: The invoice must clearly describe the goods or services provided, aiding clarity and accurate GST reporting for both parties.

- The Quantity and Price per Unit: The invoice must display the quantity and unit price to calculate the pre-GST total and provide transparency for financial records.

- The Total Amount Payable, Excluding GST: The invoice should list the base price before GST to help the customer understand the pre-tax cost, which is necessary for calculating GST.

- The GST Amount Charged: The GST amount must be clearly shown, based on the pre-GST amount, ensuring transparency and making tax claim tracking easier.

- The Total Amount Payable, Including GST: You must list the total amount, including GST, to reflect the complete financial obligation and ensure clarity on the full transaction cost.

- Signature: A digital or physical signature can be included on the invoice to confirm the transaction’s legitimacy and provide official acknowledgment from the supplier.

Simplified Tax Invoices

In some cases, firms can send a simplified tax invoice. This option is available for transactions in which the total amount payable, including GST, is less than $1,000.

For zero-rated or exempt supplies, issuing a tax invoice is not mandatory but can be done voluntarily. While the reduced version is less thorough than a full tax invoice, some crucial components must be present:

- Supplier’s Name and GST Registration Number: The simplified tax invoice must include the supplier’s name and GST registration number to confirm GST registration and ensure the transaction is compliant with Singapore’s tax regulations.

- Date of Supply: The tax invoice should display the date of supply, which shows when the supplier provided the products or services. This helps document the transaction properly for timely GST filings and input tax returns.

- A Description of Goods or Services Supplied: A description of the goods or services provided must be included, ensuring both parties understand the transaction. This helps with tax reporting and reduces uncertainty about the supplied items or services.

- The Total Amount Payable, Including GST: The invoice should show the total amount payable, including GST, helping the consumer understand the full cost of the transaction and how GST impacts the overall payment. This promotes transparency in the financial obligation.

Methods for calculating GST on tax invoices

When calculating GST on tax invoices, businesses in Singapore have two acceptable methods. Each method has its advantages, and it’s important to choose one that suits your needs while maintaining consistency to avoid discrepancies.

Here are the methods to calculate GST on tax invoices:

- Itemized GST Calculation: Apply 9% GST to the value of each item (excluding GST) and then sum the GST amounts for each item. This method provides a detailed breakdown of the tax for each product or service.

- Total Value GST Calculation: Apply 9% GST to the total sum of all items’ values (excluding GST). This method calculates the tax based on the total value of the goods or services before you add GST.

When to Issue a Tax Invoice

As per IRAS guidelines, a tax invoice must be issued within 30 days of supply. This guarantees that businesses meet GST reporting deadlines, allowing for accurate and timely tax returns.

Meeting this criterion enables organizations to keep organized financial records. This is critical for operational efficiency, corporate tax compliance, and regulatory adherence. Remember that you only need tax invoices when you sell products or services to GST-registered consumers.

Customers who are not GST-registered can receive a normal invoice or receipt instead. This distinction simplifies the invoicing process and reduces administrative burdens for firms dealing with non-GST-registered clientele.

According to IRAS, from 1 April 2026, businesses applying for voluntary GST registration must adopt the GST InvoiceNow Requirement. This ensures compliance with the new regulations and helps maintain organized financial records for accurate tax reporting and adherence to GST laws.

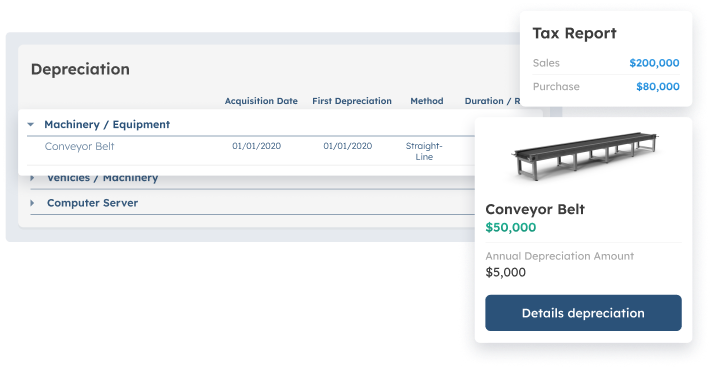

Formats for Tax Invoices

Tax invoice formats must comply with local tax laws, including IRAS requirements in Singapore. Using the correct format ensures compliance. It reduces issues during audits or tax filings, making it essential for businesses to follow precise guidelines.

Formats vary based on transaction type and jurisdiction. Some formats cater to GST compliance, while others are needed for international transactions. Let’s explore key subcategories of tax invoices for a better understanding:

E-Invoicing

E-invoicing simplifies the process, ensuring compliance with IRAS regulations by electronically generating and sending invoices. Also, the best invoice software in Singapore can help businesses create accurate e-invoices, reducing manual errors and improving efficiency.

E-invoicing also enables faster processing and secure storage. Businesses can easily retrieve records when needed. Integration with accounting software ensures correct formatting, minimizing discrepancies in tax reporting and simplifying audits.

Digital Invoices

Digital invoices streamline transactions by offering quick creation and management. When submitted via the proper channels, they ensure IRAS compliance. Digital invoices make tracking simpler and enhance operational efficiency, reducing errors in the invoicing process.

While e-invoicing uses a more automated and integrated approach, businesses typically generate digital invoices manually and store them electronically. This distinction is important, especially when comparing “invoice vs receipt,” as both serve different functions in tax reporting.

The Importance of Accurate Tax Invoicing

Accurate tax invoicing is critical for ensuring tax compliance and avoiding fines. Incorrect or missing information on a tax invoice may result in fines or audits by IRAS, disrupting business operations. Furthermore, firms need these invoices to obtain input tax credits, which ensures they do not overpay GST.

Here are the functions of tax invoicing and why accurate tax invoicing is so important:

- Tax Savings: Accurate tax invoices help businesses claim all eligible deductions, minimizing tax burdens and avoiding GST overpayment, leading to significant tax savings.

- Financial Documentation: Proper tax invoices ensure clear, organized financial records, aiding bookkeeping, financial analysis, and transparency for accurate reporting.

- Regulatory Inspections and Compliance: Correctly issued tax invoices help businesses comply with tax laws, reducing penalties and easing the audit process by maintaining accurate records.

- Allows Customers to Claim Input Tax Credits: Accurate invoices enable businesses to claim input tax credits, reducing GST overpayment and streamlining tax liabilities for better efficiency.

- Business Operations: Tax invoices assist in tracking sales, managing inventory, and maintaining cash flow while resolving customer disputes and supporting smooth operations.

- Time Efficiency: Accurate tax invoices save time by automating tax filings and financial tracking, allowing businesses to streamline the invoicing process and avoid delays or mistakes.

- Enhanced Control and Insights: Accurate tax invoices provide insight into transactions, helping businesses manage sales, inventory, and expenses for better decision-making and smoother operations.

- Cost Savings: Proper tax invoices prevent GST overpayment and errors, ensuring businesses can claim deductions and avoid penalties, leading to long-term cost savings.

- Strategic Advantage: Maintaining accurate invoices ensures compliance, boosts efficiency, and provides businesses with a competitive edge, helping them navigate audits and attract reliable clients.

Streamlining Tax Invoice Management with ScaleOcean

One of ScaleOcean’s key advantages is its capacity to improve tax compliance. It also ensures the issuance of tax bills that fulfill the Inland Revenue Authority of Singapore (IRAS) standards. By leveraging IRAS invoicing software in Singapore, businesses can streamline their invoicing processes and ensure compliance with GST regulations efficiently.

The technology reduces human error. It also guarantees firms remain compliant with regulations, resulting in smoother financial administration and tax reporting.

ScaleOcean offers a free demo for businesses to explore how the software can enhance operations. It also provides the opportunity to access the CTC (Cost-to-Company) grant for software implementation support. The following are the primary features of ScaleOcean’s software:

- Automated Tax Invoice Generation Compliant with IRAS Standards: ScaleOcean ensures automated generation of tax invoices that adhere to the Inland Revenue Authority of Singapore (IRAS) standards.

- Seamless Integration with Accounting Systems: The software seamlessly integrates with existing accounting systems, allowing tax-related data to flow smoothly between invoice generation and accounting records.

- Real-time GST Tracking and Reporting: ScaleOcean offers real-time tracking and reporting of GST transactions, providing businesses with an up-to-date view of their tax liabilities.

- Efficient Invoice Customization: With customizable invoice formats, ScaleOcean allows businesses to tailor invoices to their specific needs while ensuring compliance with tax regulations.

- Automatic Reconciliation and Payment Tracking: The platform simplifies payment reconciliation and invoice tracking by automating these processes.

Conclusion

Understanding and complying with tax invoice standards in Singapore is critical for firms to follow IRAS laws. Proper tax invoicing ensures businesses meet tax requirements and keep financial records organized.

This reduces the chance of errors and fines. As Singapore’s GST framework evolves, businesses must remain aware and comply with the requirements. Businesses can consider using digital solutions like ScaleOcean accounting software to ease the tax invoicing process while remaining compliant.

ScaleOcean’s automatic billing and seamless connectivity expedite the invoicing process. Real-time tracking reduces administrative tasks, helping businesses manage their tax obligations effectively. ScaleOcean offers a more efficient and compliant invoicing method.

FAQ:

1. What is a tax invoice in Singapore?

A GST-registered supplier issues a tax invoice to a GST-registered customer in Singapore, detailing the GST amount on goods or services. It allows customers to claim input tax credits and ensures compliance with IRAS regulations.

2. Is a tax invoice a receipt?

No, a tax invoice is not the same as a receipt. A tax invoice includes GST details and is essential for tax reporting. A receipt serves only as proof of payment, lacking the tax-related information needed for GST filings.

3. What is the difference between an invoice and a tax invoice?

A tax invoice includes GST details like the amount charged, issued by a GST-registered supplier for tax reporting. A business may not include tax details in a general invoice. It can use it for basic payment requests without needing to comply with GST regulations.

4. What is the difference between a tax invoice and a proforma invoice?

A tax invoice is an official document that includes GST details for tax reporting, in compliance with IRAS rules. A proforma invoice is a preliminary quote without GST. It is used for proposed transactions and is not legally binding or for tax purposes.

PTE LTD..png)

.png)

.png)

.png)

.png)