Invoicing software is a digital tool designed to simplify the creation, distribution, and management of invoices. It optimizes billing processes, facilitates payment tracking, and minimizes errors, leading to more accurate financial records. As businesses continue their digital transformation, choosing the right invoicing solution is key to maintaining smooth and efficient financial operations.

This is especially relevant in Singapore, where businesses are rapidly digitizing financial processes to improve efficiency and remain competitive. However, despite the push for paperless operations, according to the Singapore Business Review, a survey by Sansan and Rakuten involving 400 professionals in operations, business planning, accounting, and finance revealed significant challenges in invoice processing.

The survey found that 52.8% of employees still print electronic invoices, while 66.3% scan paper invoices to convert them into digital files. Furthermore, nearly 80% of respondents identified invoices as a top priority for going paperless, highlighting the urgent need for a seamless digital invoicing solution.

Not all invoicing solutions offer the same level of integration, compliance, or scalability, which means businesses must carefully evaluate their options. To help with this decision, this article provides 15 recommended invoicing software solutions that can enhance efficiency, improve compliance, and support business growth in Singapore’s evolving digital landscape.

- Invoicing software automates invoice creation, payment tracking, and financial reporting, helping businesses streamline operations and reduce manual errors.

- The advantages of invoicing software include improved cash flow, enhanced financial accuracy, compliance support, and seamless integration with accounting tools.

- Top invoicing software includes ScaleOcean, Xero Invoice, QuickBooks, Sage, NetSuite, FreshBooks, Zoho, Wave, Square Invoices, and more.

- ScaleOcean invoicing system is one of the vendor that helps businesses streamline their billing processes and ensure compliance with relevant regulations.

What Is Invoicing Software?

Invoicing software is a digital solution that automates the creation, distribution, and management of invoices, including those related to blanket orders. It helps companies track payments, manage accounts receivable, and generate financial reports efficiently.

By reducing manual tasks and minimizing errors, e-invoicing software improves cash flow management and enhances overall financial accuracy. For businesses in Singapore, invoicing software is particularly crucial due to the country’s strong regulatory environment and fast-paced business ecosystem.

With the Goods and Services Tax (GST) system, companies need to issue IRAS tax invoice-compliant invoices accurately and promptly. Additionally, as Singapore encourages digital transformation, e-invoicing adoption under the Peppol framework is growing, making automated invoicing solutions and the best tax software increasingly important.

Advantages of Using Invoicing Software

Using invoice billing software helps companies streamline financial operations by automating billing, reducing errors, and improving cash flow management. Below are the key advantages of using this software and how it can benefit businesses.

1. Automated Billing Process

Quotation letter software streamlines repetitive tasks such as data entry, invoice creation, and payment reminders. By automating these processes, businesses can save valuable time and minimize administrative workload. It also reduces the likelihood of errors, ensuring invoices are sent accurately and on schedule.

2. Higher Accuracy in Financial Transactions

The software automates financial metrics, such as tax calculations, discount applications, and currency conversions, minimizing the chances of miscalculations.

Maintaining double-entry accounting principles ensures compliance with financial regulations and enhances the accuracy of accounting records. With precise invoicing, businesses can build trust and avoid disputes with clients.

3. Optimized Cash Flow Management

Real-time tracking of payments allows businesses to monitor outstanding invoices and overdue Accounts Receivable (AR) effectively. Automated reminders encourage timely payments, reducing cash flow disruptions. A well-managed invoice approval workflow software helps businesses maintain financial stability and plan for future growth.

4. Improved Client Interaction

Clients can access invoices, process payments, and review billing history through a dedicated online portal. This transparency simplifies the payment experience and enhances customer satisfaction.

It’s important to understand the distinction between an invoice and a receipt, as each serves a different purpose in the transaction process. Faster, more convenient transactions help strengthen relationships with clients and boost trust.

5. Actionable Financial Insights

Comprehensive reports and analytics provide businesses with a clear overview of revenue, pending payments, and financial trends. These insights support informed decision-making and help forecast future business performance. Real-time financial data allows businesses to identify areas for improvement and growth opportunities.

6. Effortless System Integration

This best accounting software seamlessly connects with accounting tools, project management systems, and CRM platforms. This integration eliminates redundant data entry and ensures consistency across financial records. A well-connected system enhances workflow efficiency and improves overall business operations.

Key Features of Invoicing Software

Invoicing software comes with a variety of features designed to simplify financial management and improve efficiency. These tools help companies generate invoices, track payments, and gain financial insights with minimal manual effort.

For businesses aiming to streamline invoicing and financial processes, accounts payable accounting software reduces administrative work by automating invoice creation, payment tracking, and reporting for a more efficient workflow. Below are the key features that make invoicing software an essential tool for modern businesses.

1. Payment tracking

The invoicing software tracks invoice status in real time, so finance teams can quickly see which bills are paid, partially settled, or still outstanding, reducing guesswork and manual checks across spreadsheets or chat messages every day for every customer…

Automated reminders nudge customers before and after due dates, reducing late payments and fees. Rather than chasing updates manually, teams trust scheduled alerts that keep invoices visible and help sustain healthier, more predictable cash flow over time, too.

2. Automated Invoice Creation

Customizable invoice templates let teams generate documents in minutes, not hours, while keeping layout, tax field, and line items consistent. Branding, such as logo and contact details, appears automatically, so every invoice looks professional and on brand too.

These templates can also be aligned with the financial accounting standards in Singapore, ensuring compliance with local regulations.

Teams can also issue a proforma invoice template to share clear cost estimates before work starts, so clients know what to expect. Once details are confirmed, the draft can be easily converted into a final invoice, reducing rework and speeding approval cycles.

3. Automated Recurring Invoicing

Recurring invoicing lets businesses schedule bills for subscriptions, retainers, or services, so invoices go out automatically each cycle. This reduces manual entry, prevents missed dates, and gives customers a consistent, predictable payment experience fast.

When recurring invoices are sent on a fixed schedule, finance teams gain clearer visibility into expected monthly cash inflows.

For new clients or when providing preliminary estimates, businesses can use a proforma invoice to outline expected charges before finalizing the sale. They can forecast revenue from long-term contracts, spot churn earlier, and spend more time analysing results than raising bills.

4. Seamless Payment Processing

Seamless payment processing connects invoices with different payment gateways, so customers can pay online by card, bank transfer, or digital wallet. Fewer steps at checkout mean fewer abandoned payments and a much smoother overall billing experience for the user.

Once a payment is confirmed, the software automatically marks the invoice as paid and updates ledgers, so records stay aligned. This cuts reconciliation work, reduces posting errors, and gives finance teams a clearer picture of real-time cash positions daily.

5. Comprehensive Financial Reporting

Comprehensive financial reporting pulls invoice, payment, and customer data into clear dashboards and reports, so finance and management teams spot trends faster. They can see overdue balances, slow-paying clients, and seasonal dips in revenue without extra spreadsheets.

With better visibility, leaders compare invoicing performance across periods or customer segments and make informed decisions. They can refine credit terms, plan cash needs carefully, and align sales targets with the real billing patterns shown in reporting, too.

Top 15 Invoicing Software Recommendations for Businesses in Singapore

Choosing the right e-invoicing software is crucial for businesses looking to automate billing, improve cash flow management, and ensure compliance. With various options available, it’s important to select a solution that aligns with your business needs and integrates seamlessly with existing systems.

To help you make an informed decision, here are 15 top invoicing software solutions in Singapore that offer powerful features for businesses of all sizes.

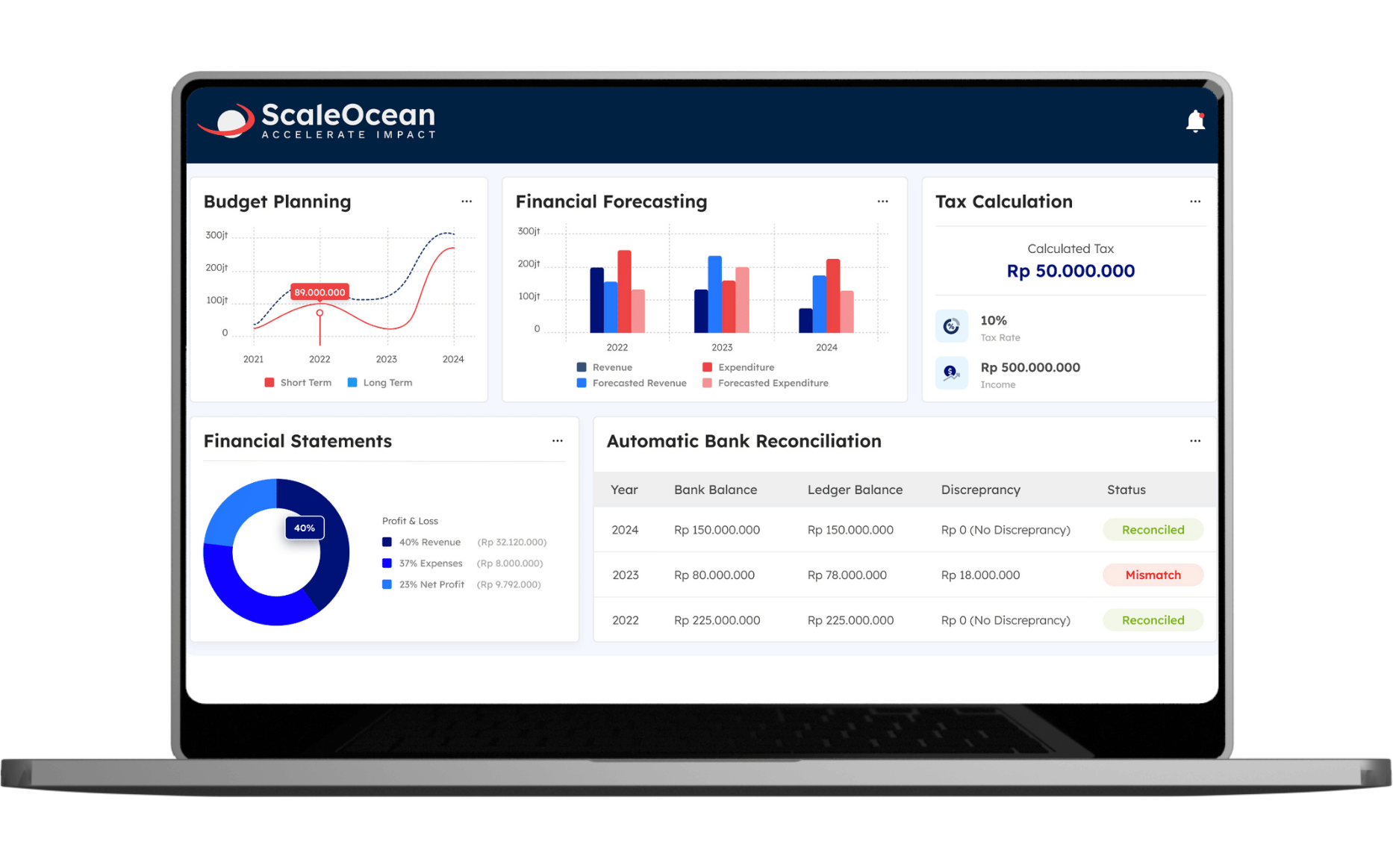

1. ScaleOcean’s Invoicing Software

ScaleOcean’s best accounting software is designed to automate every step, from invoice creation and tracking to seamless payment reconciliation. With smart AI-driven insights, businesses can optimize cash flow, predict payment trends, and reduce human errors that often slow down financial operations.

The system integrates effortlessly with accounting platforms, ensuring a smooth workflow across departments. Whether you’re handling local transactions or cross-border payments, ScaleOcean adapts to your financial needs, keeping your business compliant and efficient.

ScaleOcean also helps businesses simplify the CTC grant application process by ensuring the software meets eligibility requirements, helping businesses in Singapore maximize financial support for digital transformation. You can explore ScaleOcean’s full capabilities through a free demo, with dedicated assistance to understand how it fits their operational needs.

Key features of ScaleOcean invoicing software:

- Automated Recurring Billing: Easily set up recurring invoices for subscription-based or long-term clients, eliminating the need for manual invoicing each cycle.

- Multi-Payment Gateway Integration: Supports various payment methods, including bank transfers, credit cards, and digital wallets, streamlining collections.

- Invoice Approval Workflow: Customizable approval processes ensure compliance and accountability before invoices are sent out.

- Real-Time Invoice Tracking: Monitor invoice status, from issuance to payment, with live notifications and automated follow-ups for overdue payments.

- Bulk Invoice Generation & Scheduling: Issue multiple invoices simultaneously or schedule them for future delivery, saving time on administrative tasks.

| Pros | Cons |

|---|---|

|

|

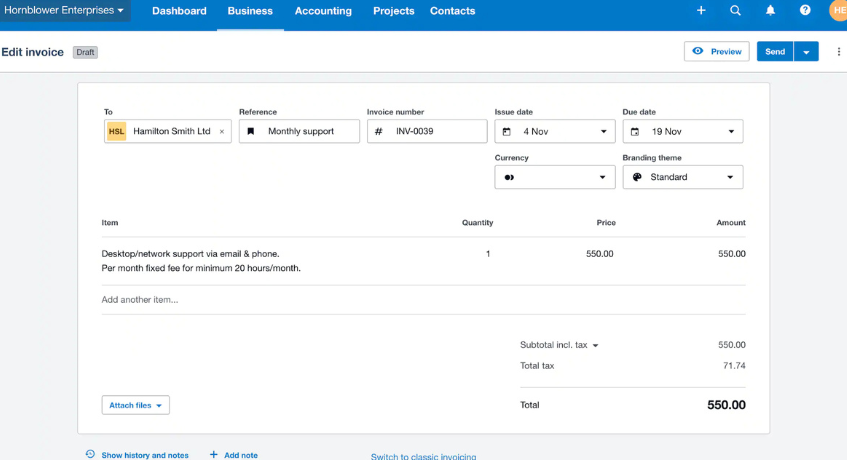

2. Xero Invoicing System

With built-in accounting features like bank reconciliation, inventory tracking, and numerous integrations, Xero is a scalable option for expanding businesses. Xero is primarily an accounting software, but it also offers invoicing features appropriate for small businesses. Its entry-level plan includes essential tools, but it limits users to 20 invoices per month. Businesses that require project and expense tracking must choose the highest-tier plan.

Key Features:

- Customizable Invoices

- Flexible Payment Processing

- Built-in Accounting Tools

- Extensive Integrations

| Pros | Cons |

|---|---|

|

|

3. QuickBooks Invoicing Processing Software

For companies that take payments in person or online, Square Invoices offers flexible invoicing processing software. It integrates with other business tools and accepts a wide range of payment methods. Users can send unlimited invoices, and recurring billing can be automated. The subscription plan offers more customization options.

Key Features:

- Multiple Payment Methods

- Business Tool Integration

- Client Portal & Automation

| Pros | Cons |

|---|---|

|

|

4. Sage Quotation Invoicing System

Sage is a quotation invoice software that provides comprehensive reporting for businesses needing detailed financial and inventory insights. It offers a wide range of reports, from summaries to in-depth analyses, with quick and easy generation, making it a reliable choice for businesses that prioritize financial reporting efficiency.

Key Features:

- Comprehensive Reporting

- Quick Report Generation

- Advanced Inventory Management

- Integrated Accounting Tools

| Pros | Cons |

|---|---|

|

|

5. NetSuite Financial ERP Software

Oracle NetSuite is a financial ERP software designed to automate accounting processes and track business finances efficiently. It provides a solution for businesses that need more than just traditional accounting software. As a well-established ERP provider, NetSuite supports businesses operating on a global scale, making it a suitable choice for companies looking to expand beyond basic accounting solutions.

Key Features:

- Comprehensive Financial Management

- Global Business Support

- Customizable Modules

- Scalable Solutions

| Pros | Cons |

|---|---|

|

|

6. FreshBooks Invoicing Software

FreshBooks is a user-friendly invoicing software designed for businesses of all sizes. It offers a clean interface with easy-to-understand terminology, making it accessible even for those without accounting experience. The software allows businesses to start with a basic plan and scale up as needed, adding features like unlimited proposals, bank reconciliation, and accountant access.

Key Features:

- Customizable Invoices

- Online Payment Support

- Client Portal

- Scalable Plans

| Pros | Cons |

|---|---|

|

|

7. Zoho Invoicing and Billing Software

Zoho is an invoicing and billing software designed for service-based businesses. It allows users to track projects and billable hours, generate estimates, and convert them into customized invoices upon approval.

The platform includes a client portal to streamline communication and approval processes. Depending on the chosen payment provider, businesses can accept payments online, via bank transfers, or in person using solutions like Square for credit card transactions.

Key Features:

- Customizable Invoices

- Client Portal

- Project & Estimate Management

- Multiple Payment Gateways

| Pros | Cons |

|---|---|

|

|

8. Wave Invoicing Software

Wave is e invoicing software designed for freelancers and service-based professionals. It offers essential features like income and expense tracking, invoicing, and reporting, making it a practical choice for small-scale operations. While the free plan includes unlimited invoicing, it lacks advanced functionalities such as inventory tracking and third-party integrations, which may be necessary for growing businesses in Singapore.

Key Features:

- Comprehensive Income & Expense Tracking

- Unlimited Invoicing

- Estimate Conversion

- Online Payment Acceptance

| Pros | Cons |

|---|---|

|

|

9. Square Invoices Software

Square Invoices streamlines the invoicing process with its intuitive app and automation features. The centralized Customer Directory simplifies invoicing by storing client details and payment information for quick transactions. Automated recurring invoices, milestone-based payment schedules, and invoice tracking enhance usability. Additionally, estimates can be converted into invoices automatically, and integrations with software like QuickBooks and Xero ensure a seamless workflow.

Key Features:

- Unlimited Invoicing & Estimates

- Automated Recurring Billing

- Third-Party Integrations

- Multiple Payment Options

| Pros | Cons |

|---|---|

|

|

10. Invoice2go Software

Invoice2go is a cloud-based invoicing solution with a user-friendly interface and a well-designed mobile app. It is suited for freelancers with basic invoicing needs, especially those not using accounting software for billing. While it offers convenience and customization, Invoice2go may not be the most cost-effective option.

Key Features:

- Customizable Invoices

- Mobile Invoicing

- Expense Tracking

- Payment Processing

| Pros | Cons |

|---|---|

|

|

11. Volopay Invoicing and Billing Software

Volopay is a Singapore-based invoicing and billing software established in 2019. It operates as a financial solutions provider with a major payment institution license from the Monetary Authority of Singapore (MAS).

Volopay offers a platform that enables businesses to manage expenses, process local and international payments, and oversee cash flow efficiently. Initially launched in Singapore and Australia, the company has expanded its presence to India, Indonesia, and the Philippines, serving a growing customer base.

Key Features:

- Multi-Currency Support

- Flexible Card Options

- Accounting Software Integration

| Pros | Cons |

|---|---|

|

|

12. Chargebee Cloud-Based Invoicing Software

Chargebee is a cloud-based invoicing software and subscription management platform designed for businesses across various industries, including telecommunications, media, e-commerce, and IoT.

It is PCI Level 1 certified and provides tools for managing subscriptions, invoices, and payments, along with generating customized reports. Additionally, the software supports Singapore accounting standards, ensuring compliance with local financial regulations for businesses operating in the region.

Key Features:

- Subscription Management

- Multi-Currency & Localization

- Integration with Payment Gateways

| Pros | Cons |

|---|---|

|

|

13. Invoicely Cloud-Based Software

Invoicely is a cloud accounting software that helps businesses manage financial operations efficiently. It offers tools for creating and customizing invoices, tracking payments, and generating financial reports.

With a centralized dashboard, users can monitor accounts payable and receivable, track financial performance, and access real-time insights. The platform also supports online payments and allows businesses to manage multiple entities within a single account.

Key Features:

- Customizable Invoices

- Multi-Business Management

- Real-Time Financial Reporting

| Pros | Cons |

|---|---|

|

|

14. Hiveage Quotation Invoice Software

Hiveage is a streamlined quotation invoice software and expense-tracking solution designed for businesses that don’t require complex software. It enables users to send invoices and estimates, accept online payments, track time and expenses, automate billing, and manage subscriptions. Hiveage also supports multi-currency transactions, tax management, and shipping and discount options.

Key Features:

- Simplified Invoicing & Billing

- Time & Expense Tracking

- Financial Insights & Reports

| Pros | Cons |

|---|---|

|

|

15. Invoice Ninja Software

Invoice Ninja is an open-source invoice processing software designed for businesses, offering a range of additional features beyond basic billing. It provides an affordable option for companies with a low client volume and supports multi-currency payments, making it suitable for international invoicing. Users can create and send invoices while tracking them in real time.

Key Features:

- Multiple Payment Gateways

- Automated Invoicing

- Multi-Currency Support

| Pros | Cons |

|---|---|

|

|

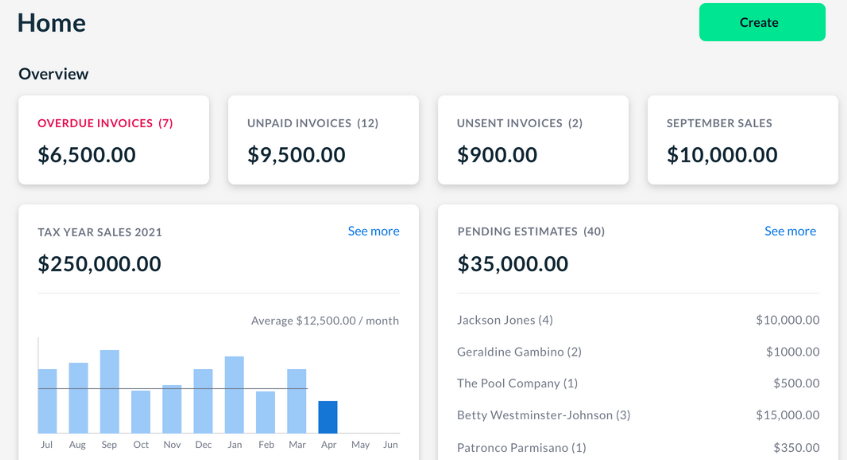

What does Invoicing Software do?

Invoicing software automates the financial management process by creating, delivering, and tracking invoices. Many systems also handle payment processing and update accounting records when transactions are completed.

Businesses can personalize invoices by adding their logo, modifying the design, and setting payment terms such as deadlines or discounts for early payments. Some platforms support recurring invoices, reducing manual input and ensuring consistent billing for ongoing services.

These e-invoicing software make it easier for businesses to receive payments by offering multiple payment options, including credit cards, bank transfers, and digital wallets. Automated tracking features provide real-time updates on invoice statuses and send reminders for overdue payments.

Once a payment is received, the quotation invoice software reconciles transactions and generates financial reports, offering insights into customer payment trends and cash flow. This helps businesses manage their finances efficiently while reducing administrative workload.

Factors to Consider When Choosing the Right Invoicing Software

Selecting the right invoice processing software depends on several factors, including business needs, budget, essential features, security measures, and customer support. The ideal solution should align with your invoicing volume, integration requirements, and scalability. Below are the key factors to consider before making a decision.

1. Business Needs and Requirements

Every business has unique invoicing needs based on transaction volume, complexity, and industry-specific requirements. If your company handles frequent invoices or requires recurring billing, choosing invoicing software in Singapore with automation features is important.

Additionally, businesses working across multiple industries may need specialized tools like time tracking or project-based invoicing. It is also important to assess whether the software can scale as your business grows.

2. Key Features

The value of invoicing processing software depends on its ability to simplify financial processes. Customization features enable businesses to incorporate logos, modify templates, and tailor invoice terms to their needs.

Connecting the software with financial ERP software, CRM systems, and payment gateways helps create a more seamless workflow. Additional key features include automated invoicing, financial reporting, expense tracking, and multi-currency support for companies managing global transactions.

3. Security and Compliance

Since quotation invoice software deals with sensitive financial data, strong security measures are essential. The system should offer encryption, secure storage, and compliance with industry regulations to protect business and client information.

Ensuring the software follows relevant financial and tax invoice laws prevents legal issues and maintains credibility. Companies should also check if the provider offers regular security updates to safeguard against cyber threats.

4. Customer Support

Reliable customer support can make a significant difference in handling invoicing issues efficiently. Companies should consider whether the software provider offers assistance through multiple channels, such as email, chat, or phone.

Availability is also crucial, especially for businesses operating across different time zones. Responsive and knowledgeable support ensures smooth operation and quick problem resolution.

5. Budget

The cost of e-invoicing software varies depending on features, scalability, and pricing models. Some platforms operate on a subscription basis, while others require a one-time purchase.

Businesses should assess whether the pricing fits their budget and if a free trial or demo is available for testing. Evaluating long-term costs, including potential add-ons or upgrades, helps in making a cost-effective decision.

Conclusion

Investing in the right invoice processing software is essential for businesses looking to streamline financial processes, enhance efficiency, and ensure compliance with Singapore’s regulatory landscape. As digital transformation accelerates, businesses can no longer rely on manual invoicing methods that lead to inefficiencies and errors.

Among the 15 recommended invoicing software solutions, ScaleOcean stands out as an all-in-one platform designed to meet the needs of modern businesses. With its automated invoicing, seamless accounting integrations, and compliance-ready features, ScaleOcean helps businesses reduce manual work, speed up payments, and maintain financial accuracy.

Whether you’re handling local or international transactions, ScaleOcean offers a scalable and intuitive solution that adapts to your business growth. Try ScaleOcean’s free demo today and experience how it can revolutionize your invoicing process.

FAQ:

1. Why should businesses in Singapore use invoicing software?

Invoicing software helps businesses automate billing, reduce manual errors, and ensure compliance with Singapore’s GST InvoiceNow requirements. It streamlines financial operations, improves cash flow management, and integrates with accounting systems, making it easier to manage transactions efficiently.

2. What features should I look for in an invoicing software?

Key features to consider include automated billing, invoice tracking, multi-currency support, seamless accounting integration, and compliance with local tax regulations. Businesses in Singapore should also prioritize solutions that support InvoiceNow and offer customization options for invoicing workflows.

3. Which invoicing software is best for businesses in Singapore?

There are many options, including ScaleOcean, Zoho Invoice, QuickBooks, Xero, and FreshBooks. ScaleOcean stands out with AI-powered automation, unlimited user access, full customization, and compliance with Singapore’s accounting standards, making it an ideal choice for businesses of all sizes.

PTE LTD..png)

.png)

.png)

.png)

.png)