In today’s fast-paced business world, managing accounts payable (AP) efficiently is essential. Without the right tools, manual AP processes can lead to errors, delayed payments, and strained vendor relationships. As businesses grow, these inefficiencies become more pronounced, disrupting cash flow and hindering growth. This makes implementing AP automation software crucial for businesses looking to optimize their financial processes.

AP automation software solves these challenges by streamlining invoice processing, reducing human error, and speeding up payments. It ensures timely payments, enhances cash flow management, and strengthens vendor relationships. With numerous options available, it’s vital to choose the right software that aligns with your business needs. This article will help you select the best AP automation software to improve efficiency and financial operations.

- Accounts payable automation streamlines the entire AP process, from invoice receipt to payment, reducing manual labor and errors while improving efficiency and accuracy in financial operations.

- Key features of AP automation software include invoice data capture, customizable approval workflows, payment processing, ERP integration, and compliance and security, which together optimize financial management.

- Choosing the right AP automation software is vital for businesses, with essential factors like business needs, integration capabilities, ease of use, and vendor support playing a key role in maximizing efficiency and streamlining AP processes.

- Top accounts payable automation solutions like ScaleOcean, NetSuite, and Tipalti provide essential features such as seamless ERP integration and user-friendly interfaces, enabling businesses to improve invoice processing, accuracy, and cash flow management.

What Is Accounts Payable Automation?

Accounts payable automation automates the entire AP process, from invoice receipt to payment. By automating these tasks, businesses can reduce manual labor, minimize errors, and speed up processing. The goal is to improve efficiency and accuracy for a smoother workflow. AP automation uses technologies like OCR and AI for invoice capture, customizable approval workflows, payment processing through ACH or wire transfers, and integrates seamlessly with ERP systems.

The technologies used in AP automation, like OCR, AI, and Robotic Process Automation (RPA), allow enterprises to automate tedious activities, reduce errors, and guarantee accurate data extraction. According to Tungsten Automation, digitization is driving this change, with the AP automation market growing at an annual rate of 10%. Businesses can use these modern technologies to optimize their accounting procedures, cut operating expenses, and increase the overall accuracy and speed of their financial operations.

Key Features to Consider

When choosing accounts payable automation software, it’s critical to grasp the essential elements that might determine its effectiveness for your company. These capabilities help to simplify your workflow, eliminate manual involvement, and improve financial management efficiency. With the proper technology, you can speed invoice processing, optimize approval workflows, and ensure on-time payments. Here are some important features to consider:

1. Invoice Data Capture

The best accounts payable automation software uses OCR and AI to capture and extract invoice data accurately, reducing manual input, errors, and processing time. By automating data gathering, businesses can speed up bill processing, improve accuracy, and minimize human error. For businesses in Singapore, exploring invoicing software in Singapore can significantly enhance efficiency and reduce manual workload.

2. Approval Workflows

Many AP automation solutions have configurable approval workflows. These workflows enable firms to develop multi-level approval processes, which ensure compliance and prevent fraudulent payments.

By automating these processes, businesses can also track important financial metrics, such as Days Payable Outstanding (DPO), which provides insights into the efficiency of the company’s payment cycle.

Customization guarantees that the approval procedures are tailored to a company’s specific needs, thereby speeding the overall approval process. Additionally, integrating proforma invoices into the approval workflow ensures that estimates and terms are validated before moving forward with the payment process.

3. Payment Processing

A good AP automation solution accepts several payment methods, including ACH, wire transfers, and virtual cards. The modules of best accounting software are flexible, allowing firms to improve their payment processes and reduce the risk of late payments.

Businesses that provide several payment choices can also improve cash flow and cut transaction fees, increasing financial flexibility.

4. ERP Integration

ERP integration is essential for ensuring your accounts payable automation software works seamlessly with existing financial systems. According to IBTEKR, the IAEA began automating processes like payroll, finance, and procurement in 2017, equipping staff with the skills to implement new software. This highlights the importance of smooth integration. To prevent disruptions, choose software that easily integrates with your current ERP solution, reducing errors, saving time, and ensuring accurate financial data across platforms.

5. Compliance and Security

A reliable AP automation solution should adhere to local tax legislation and data protection standards, ensuring that your company remains in compliance with Singaporean financial accounting standards and laws.

Furthermore, security measures such as encryption and secure payment processing are required to protect sensitive financial information. Compliance with rules helps to avoid penalties, and security guarantees that business data is protected from cyber threats.

10 Best Accounts Payable Software Solutions

When evaluating accounts payable software, it’s important to consider features, pricing, and performance to find the best solution for your business. The right AP automation software can streamline invoice processing, improve financial reporting accuracy, and enhance cash flow management.

Businesses should seek solutions that integrate easily with existing systems, offer user-friendly interfaces, and provide scalability. Below, we present a comparison of some of the top AP automation solutions, highlighting key features and capabilities of each:

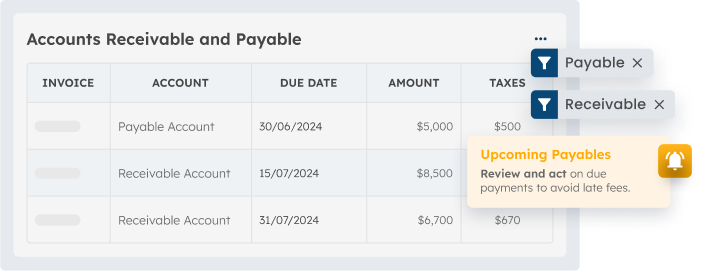

1. ScaleOcean AP Accounting Software

ScaleOcean’s AP accounting software simplifies the accounts payable process for businesses in Singapore. It offers features like automated invoice processing, customizable approval workflows, and seamless ERP integration, boosting efficiency and reducing errors for better cash flow management.

ScaleOcean also provides a free demo to showcase its capabilities, allowing businesses to explore its features. Plus, businesses can benefit from the CTC (Capability Transfer Grant), which helps subsidize the cost of implementing new technologies.

Key Features:

- Automated invoice processing, This feature uses technology like OCR and AI to automatically capture and process invoice data, reducing manual data entry and errors, and speeding up invoice approval.

- Customizable approval workflows, Businesses can design approval workflows that match their specific needs, ensuring invoices go through the right review processes before being paid, ensuring compliance and control.

- Vendor management portals, These portals allow businesses to manage vendor relationships easily, providing a space for vendors to submit invoices, track payments, and update their information directly.

- Payment processing and scheduling, This feature automates the payment process, enabling businesses to schedule payments and make them via multiple methods like ACH, wire transfers, or virtual cards, ensuring timely payments.

- Integration capabilities with other financial systems, AP automation software integrates seamlessly with existing financial systems (e.g., ERP or accounting software), ensuring smooth data flow and minimizing errors between systems.

| Pros | Cons |

|---|---|

|

|

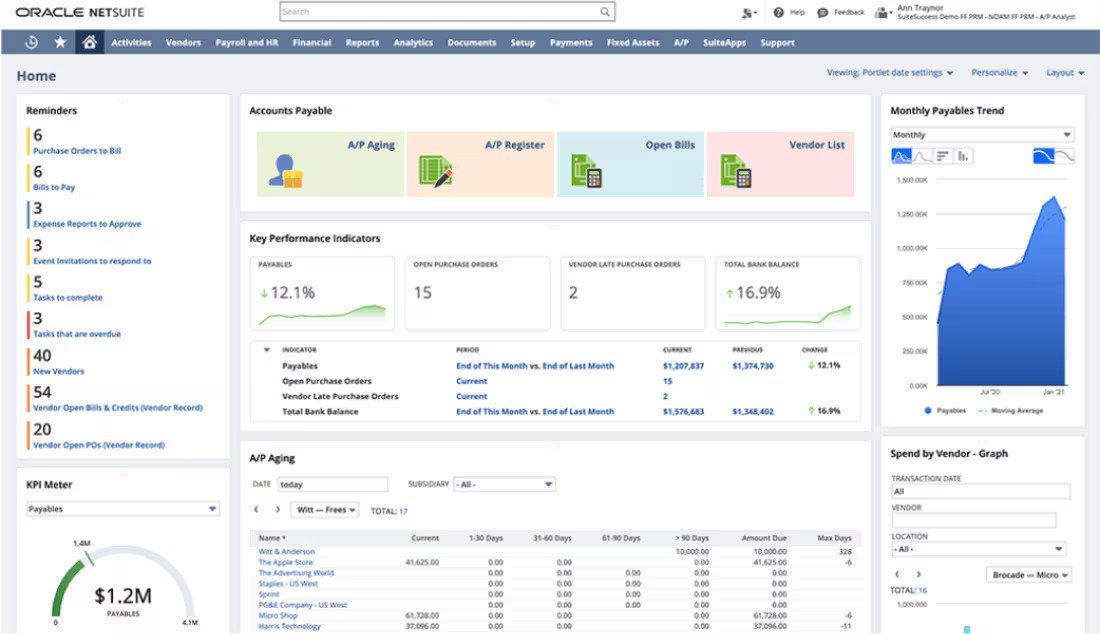

2. NetSuite Accounts Payable Software

NetSuite is a robust cloud-based ERP solution that offers comprehensive AP automation. It provides a fully integrated system for managing invoices, payments, and vendor relationships. NetSuite’s strong reporting features and real-time visibility enable businesses to track key financial metrics, making it an ideal solution for larger enterprises seeking scalability and global financial management.

Key Features:

- End-to-end AP automation

- Real-time reporting and visibility

- Integration with CRM and other business systems

| Pros | Cons |

|---|---|

|

|

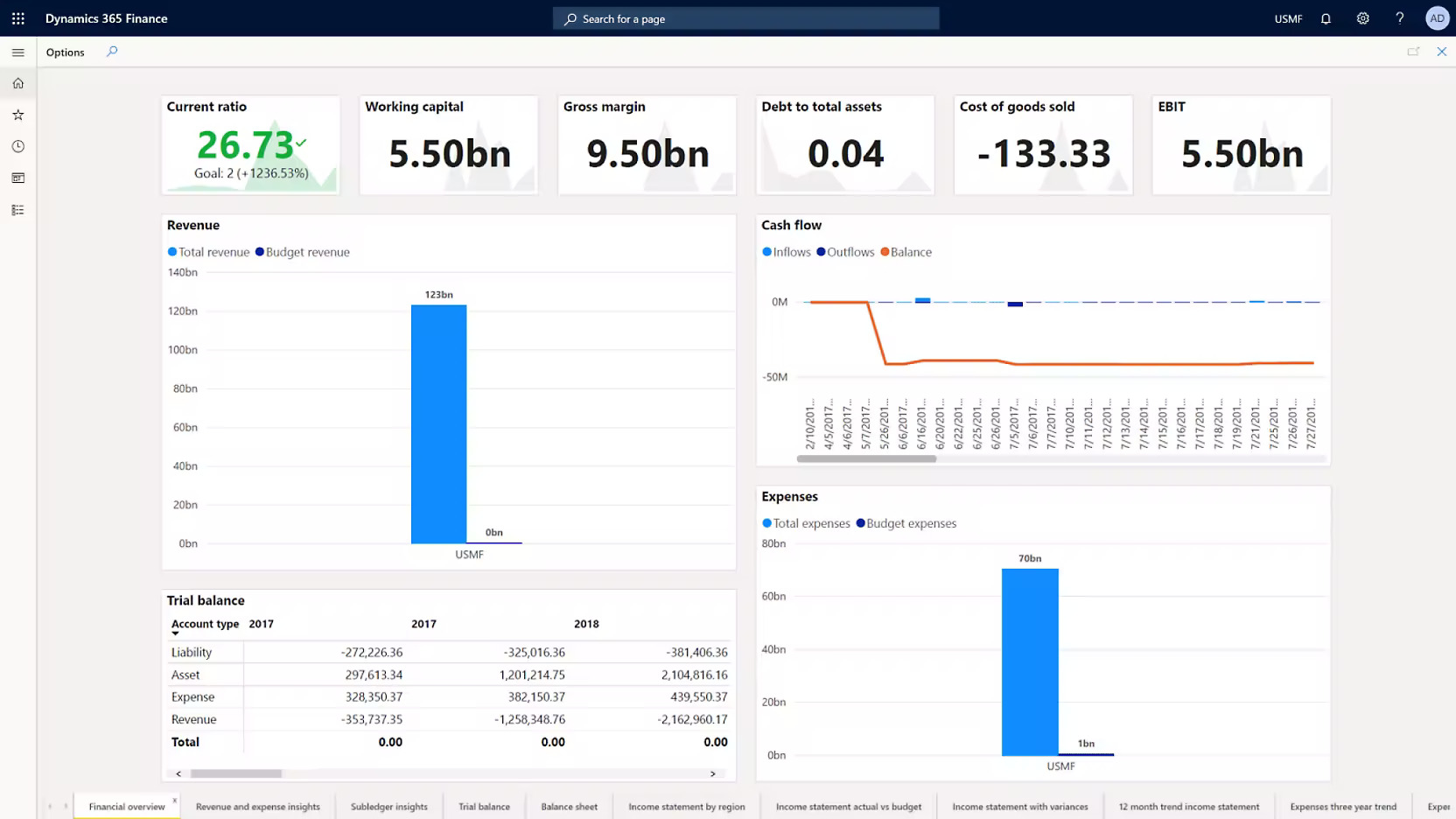

3. Microsoft Dynamics 365

Microsoft Dynamics 365 combines ERP and CRM capabilities, offering a comprehensive solution for AP automation. It provides end-to-end management of the AP process, from invoice capture to payment scheduling. With its powerful integration capabilities, Dynamics 365 is ideal for businesses already using Microsoft products and looking for seamless integration across various business functions.

Key Features:

- Automated invoice capture and processing

- Customizable approval workflows

- Integration with Microsoft products (Office 365, Azure, etc.)

| Pros | Cons |

|---|---|

|

|

4. Tipalti AP Automation Solution Software

Tipalti is a cloud-based accounts payable automation platform that focuses on global payment processing and compliance. Its comprehensive solution includes invoice processing, supplier management, and multi-currency support, making it ideal for businesses with international operations.

Key Features:

- Invoice capture and processing

- Global payment processing (multi-currency support)

- Supplier management and onboarding

| Pros | Cons |

|---|---|

|

|

5. ExFlow

ExFlow is a cloud-based accounts payable automation solution designed specifically for Microsoft Dynamics 365 users. It offers invoice automation, approval workflows, and seamless integration with Dynamics 365, making it ideal for businesses that already use Microsoft’s ERP system.

Key Features:

- Automated invoice processing

- Integration with Microsoft Dynamics 365

- Multi-level approval workflows

| Pros | Cons |

|---|---|

|

|

6. QuickBooks Online

QuickBooks Online is a widely-used accounting software that also offers accounts payable automation features. It is ideal for small to mid-sized businesses looking for an affordable, easy-to-use solution to manage invoices, payments, and vendor relationships.

Key Features:

- Automated invoice creation and payment scheduling

- Integration with bank accounts for payment tracking

- Customizable approval workflows

| Pros | Cons |

|---|---|

|

|

7. Sage Intacct Accounts Payable Software

Sage Intacct is a cloud-based financial management solution designed for growing businesses. Its AP automation features include invoice capture, approval workflows, and payment scheduling, while its real-time financial management and insights help businesses make informed decisions.

Key Features:

- Invoice capture and automated processing

- Multi-currency and multi-subsidiary management

- Integration with CRM and ERP systems

| Pros | Cons |

|---|---|

|

|

8. SAP Concur

SAP Concur is an integrated solution that automates AP, travel, and expense management. It helps businesses streamline their invoicing and payment processes while providing real-time expense reporting and ensuring compliance with company policies.

Key Features:

- Invoice and expense capture and processing

- Travel and expense management integration

- Payment scheduling and tracking

| Pros | Cons |

|---|---|

|

|

9. Xero Accounts Payable Automation Software

Xero is an easy-to-use accounting software that also offers accounts payable automation features. It is ideal for small businesses and accountants looking for a simple solution to manage invoices, payments, and vendor relationships.

Key Features:

- Invoice creation and approval workflows

- Integration with bank accounts for payment tracking

- Cloud-based for remote access

| Pros | Cons |

|---|---|

|

|

10. Libeo AP Automation Solution

Libeo is a simple accounts payable solution that helps businesses manage payments and invoices. With a focus on simplicity and ease of use, Libeo is ideal for small businesses looking for a straightforward platform to handle payments.

Key Features:

- Invoice capture and payment scheduling

- Direct bank payment integration

- Simple user interface

| Pros | Cons |

|---|---|

|

|

How to Choose the Right AP Automation Software

Choosing the right and best accounting software with an accounts payable automation module is crucial for businesses in Singapore. With many options available, it’s essential to evaluate your business needs, integration capabilities, and ease of use.

The right solution will optimize your AP processes, improve efficiency, and positively affect metrics like the accounts payable turnover ratio. To make an informed selection, consider these crucial factors:

1. Assessing Business Needs

Before choosing an AP automation software, Singapore enterprises should consider their transaction volume, complexity, and functional needs. For example, large firms with significant transaction volumes will benefit from solutions that provide scalability and advanced reporting capabilities. Understanding your specific requirements can assist you in identifying a software solution that is appropriate for your current operations and future growth.

2. Integration Capabilities

Make sure that the AP automation software works properly with your current financial systems, such as financial accounting ERP software.

This connection helps to streamline your AP operations and guarantees that all systems are linked. A well-integrated system lowers errors, improves efficiency, and makes financial data more accessible across departments.

3. User Experience

A user-friendly interface is required to ensure that staff can quickly learn the software without extensive training. Look for systems with user-friendly dashboards and functionality. A positive user experience boosts employee productivity and speeds up the onboarding process, making it easier for teams to transition to the new system.

4. Vendor Support

When selecting an AP automation system, think about the availability of customer service and technical support. The finest providers provide ongoing support to resolve any difficulties and guarantee the program runs smoothly.

A rapid support team guarantees that any issues are fixed swiftly, reducing delays to your AP activities and ensuring system uptime. With the best tax software for corporations, companies can also rely on consistent, effective support for seamless tax management.

Conclusion

Accounts payable automation software is essential for firms that want to increase the efficiency and accuracy of their financial procedures. Businesses in Singapore can improve their cash flow management, maintain payment accuracy, and streamline invoice processing by choosing the correct solution. With capabilities such as automated invoice capture, configurable approval workflows, and smooth payment processing, AP automation reduces errors and delays while optimizing overall financial operations.

When selecting AP automation software, it is critical to consider your business requirements, integration capabilities, and user experience. ScaleOcean’s accounting system and easy connection make it the top choice for enterprises in Singapore. This solution guarantees that AP operations are improved, allowing organizations to improve operational efficiency, cut expenses, and maintain financial correctness.

FAQ:

1. What is the best accounts payable automation software?

The ideal accounts payable automation software varies based on your business needs. Some of the top choices include ScaleOcean, Tipalti, NetSuite, and AvidXchange. These platforms offer features like automated invoice processing, customizable approval workflows, and easy ERP integration. ScaleOcean AP Software is a strong recommendation as it offers seamless ERP integration, real-time data insights, and an intuitive interface, making it a great choice for businesses seeking enhanced efficiency, accuracy, and scalability in their AP processes.

2. Can accounts payable be automated?

Yes, accounts payable can be entirely automated. AP automation software uses technologies like Optical Character Recognition (OCR), Artificial Intelligence (AI), and Robotic Process Automation (RPA) to handle tasks such as invoice capture, approvals, and payments. This automation reduces manual effort, minimizes errors, and speeds up the process.

3. Which software is used for accounts payable?

Common software used for accounts payable includes ScaleOcean Accounting Software, QuickBooks Online, Tipalti, SAP Concur, and Microsoft Dynamics 365. These solutions automate various AP functions, such as invoice processing, payment scheduling, and vendor management, improving efficiency and accuracy in financial operations.

4. How much does AP automation software cost?

The price of AP automation software varies depending on the software provider, your business size, and the features required. Small businesses typically spend around $50 to $150 per month, while larger companies may pay between $500 to $2,000 or more monthly. Additional charges for setup, integration, and training may also apply, depending on the level of customization needed.

PTE LTD..png)

.png)

.png)

.png)

.png)