Tax preparation in Singapore can be a challenging process for businesses, especially during the busy tax season. Managing the required documentation, ensuring accuracy, and staying updated on tax regulations can be overwhelming. Without proper systems in place, businesses risk missing crucial deductions or credits.

According to The Straits Times, the Ministry of Finance points out that Singapore has relatively low income inequality compared to other advanced economies. This highlights the importance of accurate tax filing, as it ensures the country’s overall economic fairness.

The impact of poor tax management is significant, as businesses may face costly fines, legal consequences, or damage to their reputation. So, using tax preparation software like ScaleOcean can simplify the process, improve efficiency, and ensure compliance with the local tax laws.

This article provides a deep review of the best corporate tax software options in 2026, including local favourites such as ScaleOcean, TurboTx, and H&R Block. We’ll also break down how these platforms actually work, what features matter most, and why tax preparation software is worth it.

- Tax software is a digital solution that simplifies the tax filing process for individuals and businesses.

- Takes a close look at the best 8 tax software reviews in Singapore, such as ScaleOcean, TurboTx, H&R Block, FreeTaxUSA, TaxSlayer, and more.

- Key features of tax software, like automation, audit trails, and local tax form support, are essential when choosing the right software for your team.

- ScaleOcean revenue software is built to be user-friendly, making tax preparation a hassle-free experience. Also, it connects directly to the IRAS software register.

What is Tax Software?

Tax software is a digital solution that simplifies the tax filing process for individuals and businesses. It automates the process of calculating, filing, and keeping track of income, corporate, and sales tax returns, saving time and reducing stress.

By pulling financial data from various sources like bank statements and accounting software, this tool minimizes errors in tax calculations. It also ensures that your tax filings are always in line with the latest regulations so that you can stay compliant without worry.

Top Tax Software Option in Singapore for 2026

In 2026, businesses in Singapore need reliable tax preparation software for accurate tax filings. Several software options stand out, providing varied features to suit different needs, ranging from individual returns to complex business taxes.

Here are the best corporate tax software to simplify the tax preparation season in Singapore 2026:

1. ScaleOcean Tax Software

The software seamlessly integrates with key business processes, including accounting, revenue, and expense management modules. This ensures tax data is accurately captured and prepared for filing, reducing the chances of manual errors and the time spent on tax-related tasks.

ScaleOcean places a strong emphasis on data security, complying with Singapore’s Personal Data Protection Act (PDPA). It stores data securely in line with local regulations, giving businesses confidence that they meet the requirements for the CTC grant in Singapore. So, try ScaleOcean’s free demo today to try its features firsthand.

Key Features:

- Integrating with IRAS Portal: Seamless filing of GST and income tax returns through API, sending data directly without manual downloads or uploads.

- Comprehensive GST Management: Adheres to the latest GST rate changes and supports multi-rate scenarios for efficient tax handling.

- Audit Trail with IAF: Generates audit files in the IRAS-required format, detailing all accounting transactions for audits.

- Automatic Reconciliation: Automatically matches input tax and output tax, streamlining the reconciliation process.

- Local Accounting Compliance (SFRS): Automatically converts financial reports into the XBRL format and handles multi-currency transactions.

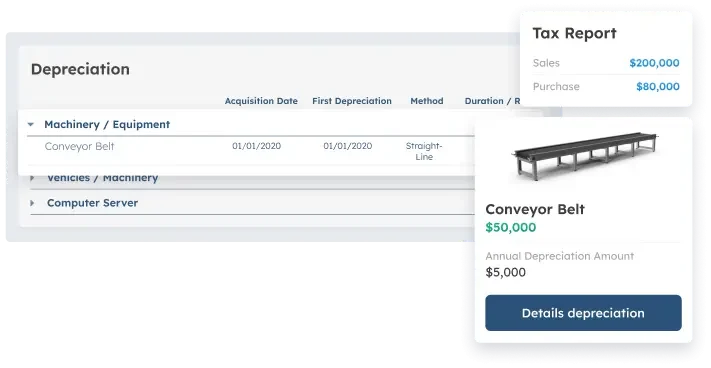

- Fixed Assets & Capital Allowance Module: Calculates tax depreciation and book depreciation separately, ensuring accurate corporate tax filings.

- PIC & Grants Tracking: Tracks assets and expenses that qualify for government tax incentives like the Productivity and Innovation Credit.

| Pros | Cons |

|---|---|

|

|

Price: ScaleOcean offers a flat price with no hidden costs. The cost is adjustable based on the level of customization needed, making it a flexible choice for medium to large enterprises.

Best For: ScaleOcean is ideal for medium to large enterprises that can fully be customized to integrate into their existing business processes, regardless of industry type.

2. TurboTx Software

TurboTx Software provides an intuitive platform for both simple and complex tax filings. It offers different options, including DIY and expert-assisted services, allowing users to select the best solution based on their needs, whether for individual or business returns.

TurboTx supports federal and state filings, with a range of service tiers designed to meet various filing requirements. Whether you are filing a simple return or require additional expert guidance, TurboTx adapts to your tax filing needs with flexibility and ease.

Key Features:

- DIY tax filing options for individuals and businesses

- Expert-assisted filing services for complex cases

- Supports a wide range of federal and state tax returns

- User-friendly interface with step-by-step guidance

- Flexible service tiers for different tax needs

| Pros | Cons |

|---|---|

|

|

Price: TurboTx’s pricing starts from free for basic federal filings, with options ranging from $0 to $159+ based on the complexity and assistance level required.

Best For: TurboTx is best for small to medium-sized businesses that need an adaptable tax solution for both simple and more complex federal filings. It works well for companies seeking flexibility with the option for expert assistance when needed.

3. H&R Block Tax Platform

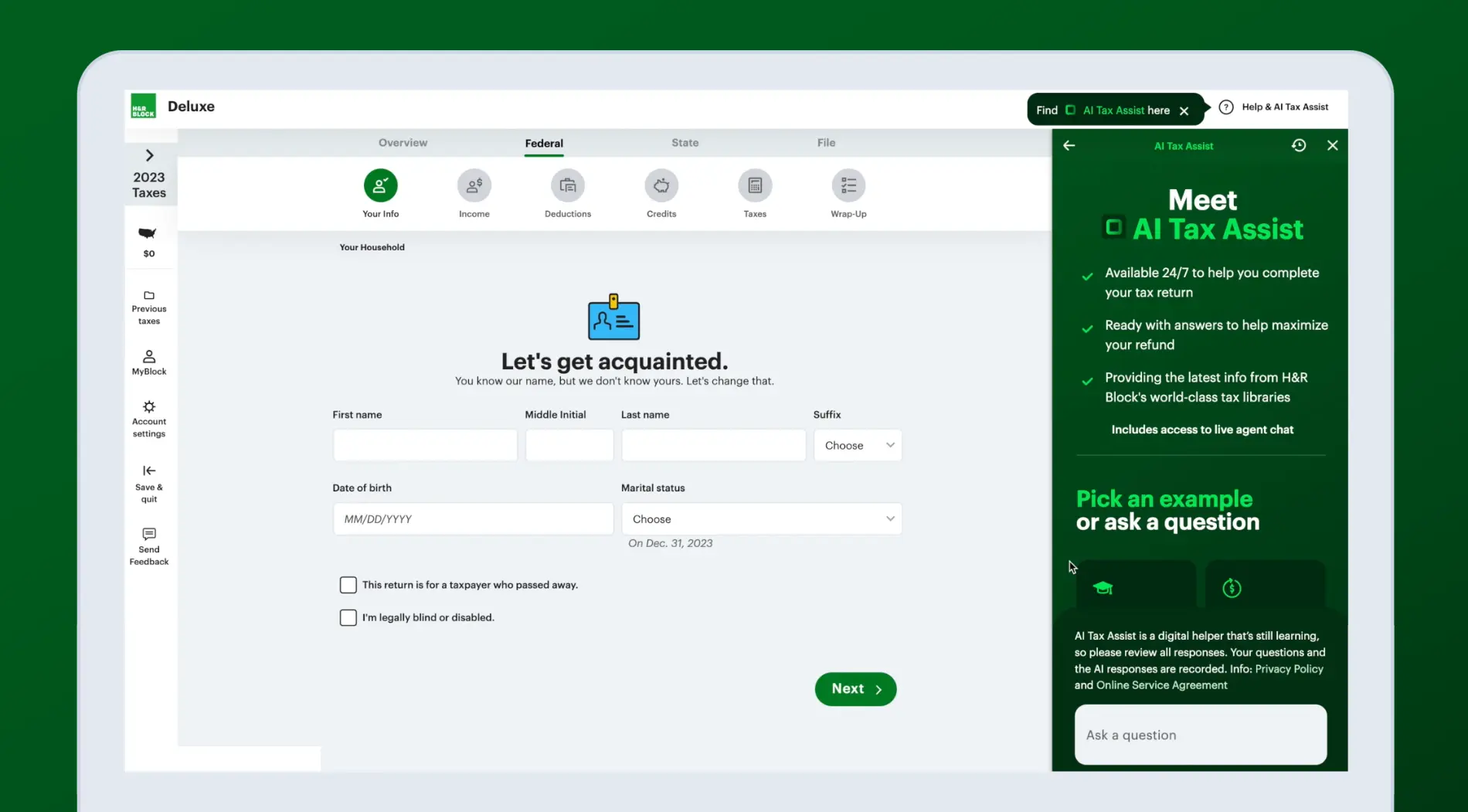

H&R Block Tax Platform offers a comprehensive solution for filing federal and state taxes, catering to both simple and complex tax situations. The platform includes a step-by-step guide, ensuring users are supported throughout the filing process.

It integrates multiple tax tools, providing options for filing personal and business taxes. The platform’s design makes it easy to navigate, allowing users to access additional support when needed. It also streamlines the financial management process, ensuring that tax returns are filed in compliance with up-to-date regulations.

Key Features:

- Options for simple to complex tax filings

- Free federal filing available for basic returns

- Step-by-step assistance throughout the filing process

- Access to tax professionals for support

- Federal e-filing is included with most packages

| Pros | Cons |

|---|---|

|

|

Price: H&R Block’s pricing typically ranges from $35 to $100+, depending on the complexity of the tax return and the package chosen.

Best For: H&R Block is best for small businesses looking for an intuitive and comprehensive tax filing platform. It is suitable for businesses that need support with moderate to complex tax filings, including payroll and deductions.

4. FreeTaxUSA Software

FreeTaxUSA Software is a budget-friendly tax solution, providing free federal tax filing and affordable state returns. It caters to users with standard tax situations but also offers optional upgrades for those who need extra support for more complex filings.

FreeTaxUSA simplifies the filing process by guiding users through each step, ensuring they are compliant with the latest tax rules. While it offers basic features for free, it also provides additional tools and support through its paid plans for more intricate tax returns.

Key Features:

- Free federal filing for basic tax returns

- Simple and easy-to-use interface

- Supports various tax forms for both individuals and businesses

- Offers premium features for more complex filings

- State filing is available for an additional fee

| Pros | Cons |

|---|---|

|

|

Price: FreeTaxUSA offers free federal filing and charges $15.99 per state return. Optional upgrades include a Deluxe edition for $7.99 and Pro Support for $44.99.

Best For: FreeTaxUSA is best for small businesses with straightforward tax filing needs. It is ideal for companies that only require basic federal and state filing and don’t need complex features or professional assistance.

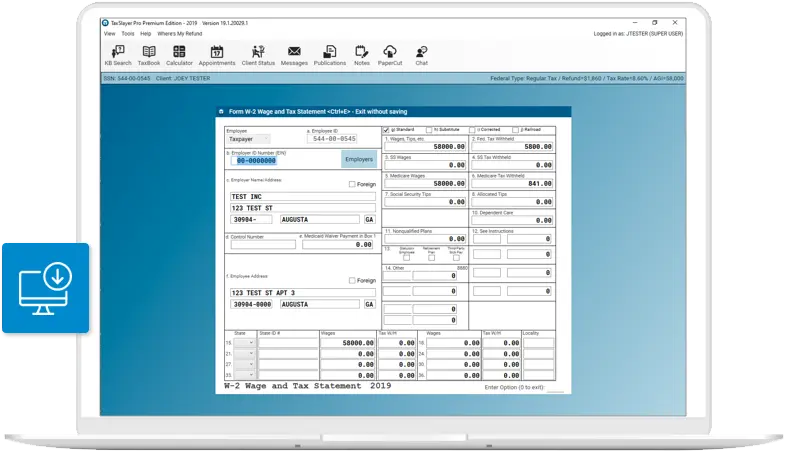

5. TaxSlayer System

TaxSlayer System is designed to provide an accessible platform for both individual and self-employed users. It supports federal and state tax filings, making it a versatile tool for those who need an efficient and straightforward tax solution.

With its range of features, TaxSlayer allows users to file both simple and more complicated returns. The platform provides a user-friendly interface, with additional tools available for advanced tax situations, ensuring that various tax requirements are met.

Key Features:

- Simple tax filing for self-employed users

- Federal and state tax filing support

- User-friendly interface for first-time users

- Basic and complex tax filing options are available

- Live customer support for premium users

| Pros | Cons |

|---|---|

|

|

Price: TaxSlayer offers a range of pricing options, from free filing for simple returns to $52.99 for self-employed users, with additional charges for state returns.

Best For: TaxSlayer is best for small to medium-sized businesses and freelancers who need a simple yet effective tax software Singapore for both personal and business tax filings. It is particularly useful for companies with straightforward filing needs and minimal tax complexities.

6. TaxAct Tax Preparation Software

TaxAct Platform offers a range of options to help users file their taxes, from simple returns to more complex scenarios. It supports both federal and state filing, with tools designed to ensure maximum deductions and accurate returns.

TaxAct’s platform includes easy-to-follow steps for individuals and small businesses, helping them navigate the filing process. It also provides access to expert assistance, ensuring users get the help they need when filing their tax returns.

Key Features:

- Federal and state tax filing support

- Tools for maximizing deductions

- Step-by-step filing process for individuals and businesses

- Access to live support for higher-tier plans

- Multiple filing options to suit various tax needs

| Pros | Cons |

|---|---|

|

|

Price: TaxAct’s pricing ranges from $29.99 to $164.99, with professional versions starting at $159.99. State filing fees are additional.

Best For: TaxAct is best for small to medium-sized businesses that need an affordable tax software solution. It is suitable for companies that want to maximize deductions and need both federal and state filing support with easy-to-navigate features.

7. Cash App Taxes Software

Cash App Taxes Software is an entirely free tax filing service, allowing users to file both federal and state returns without hidden fees. It supports various tax forms, including those for income from self-employment, investments, and cryptocurrency.

This software simplifies tax filing by offering a clean and straightforward interface. It integrates well with Cash App, enabling users to easily manage their financial metrics and ensure that their tax returns are filed correctly, with no additional costs involved.

Key Features:

- Free filing for both federal and state returns

- Supports a wide range of tax forms, including 1099s and W-2s

- User-friendly platform for quick and easy filing

- Cryptocurrency tax filing support

- No hidden fees or upsells

| Pros | Cons |

|---|---|

|

|

Price: Cash App Taxes is completely free for both federal and state income tax filing, with no hidden fees or premium upgrades required.

Best For: Cash App Taxes is best for small businesses with simple tax filing needs, particularly those with basic income sources and straightforward financial situations. It’s ideal for businesses that prioritize cost-effectiveness and ease of use in tax filing.

8. Jackson Hewitt Tax Service Software

Jackson Hewitt Tax Service Software provides a flat-rate, all-inclusive service for both federal and state tax filings. It is ideal for individuals with simple tax situations, offering a straightforward filing process that helps save time.

The software includes basic features for tax filing and ensures compliance with tax regulations. While it is suitable for personal use, it may not be ideal for those with complex tax needs, as it focuses on straightforward tax situations.

Key Features:

- Flat-rate pricing for both federal and state filings

- Easy-to-use platform with no hidden costs

- Supports basic tax filings for individuals

- Quick and convenient tax filing solution

- All-inclusive service without additional charges

| Pros | Cons |

|---|---|

|

|

Price: Jackson Hewitt offers a flat-rate price of $25 for both federal and state tax filing, regardless of the complexity of the return.

Best For: Jackson Hewitt is best for small businesses that need a straightforward and cost-effective solution for both federal and state tax filings. It is ideal for businesses with basic tax needs and no complicated tax scenarios, looking for a quick filing option.

To wrap things up, managing tax preparation doesn’t have to be a headache. With the right software, businesses can make the process much smoother. So, ScaleOcean ERP software provides a complete solution that easily integrates with tax filing, helping businesses stay compliant, efficient, and stress-free.

Compare the Best Tax Software

Using tax software simplifies the tax preparation season in Singapore by automating complex filing tasks, reducing errors, and ensuring compliance with local regulations. With various options available, businesses and individuals can find solutions that suit their unique needs.

Here’s a comparison table of the best tax software for corporations in Singapore:

| Vendor | Best For | Price |

|---|---|---|

| ScaleOcean | Ideal for medium to large enterprises with complex tax needs | Flat price with no hidden costs, adjustable for customizations |

| TurboTx | Best for small to medium-sized businesses with flexible tax needs | Starts free for basic filings, up to $159+ for complex returns |

| H&R Block | Great for small businesses needing a comprehensive tax solution | $35 to $100+, depending on tax complexity |

| FreeTaxUSA | Suitable for small businesses with straightforward tax needs | Free federal filing, $15.99 for state returns |

| TaxSlayer | Best for small to medium-sized businesses and freelancers | Free for simple returns, up to $52.99 for self-employed |

| TaxAct | Ideal for small to medium-sized businesses seeking easy filing | $29.99 to $164.99, with state filing fees |

| Cash App Taxes | Best for small businesses with basic tax filing needs | Completely free for federal and state filings |

| Jackson Hewitt Tax Service | Best for small businesses needing quick, simple filings | Flat-rate $25 for both federal and state filings |

How Does Tax Software Work?

Tax software starts by gathering your financial information, like income, expenses, and payroll details, from sources such as bank accounts and receipts. It sorts everything into the right categories, cutting down on manual data entry and minimizing mistakes, making tax prep simpler.

After collecting the data, the software organizes it into sections like income, deductions, and business expenses. This makes it easy to check everything and ensure nothing is missed or placed incorrectly, saving you time and avoiding errors when it’s time to file.

The software then calculates your tax liability using the latest tax laws, ensuring everything is accurate. It automatically generates the tax documents needed for submission and connects with your accounting software in Singapore for smooth syncing, making the entire process faster and more reliable.

Also Read: ERP for Finance and Accounting: These are the Best 12 Systems

Who Should Use Tax Software?

Tax software is essential for businesses when preparing taxes, as it simplifies the entire process. It helps ensure accuracy, saves time, and reduces the risk of costly mistakes. For businesses, especially SMEs with limited resources, tax software streamlines tax preparation and improves overall efficiency.

For bigger businesses, there’s still a lot to gain, too. With proper automation and linking up with tools like the best invoice software Singapore, the entire reporting process becomes far more efficient to handle and less prone to bottlenecks.

For larger businesses, using the best tax software for corporations can help streamline complex tax processes, too. By automating tasks and integrating with other tools, businesses can reduce errors, save time, and improve efficiency in managing their tax obligations.

Key Features to Look for in Tax Software

When choosing tax software, it’s important to look for features that will simplify the tax filing process and ensure accuracy. Key functionalities like automation, real-time syncing, and support for local tax codes can make a huge difference during tax season.

Here are the key features to look for in tax software:

- Automation: Automating tasks like tax filing saves time and reduces errors, especially with multiple reports or deadlines. Using accounts payable automation software can further streamline your financial processes, ensuring everything is accurate and efficient.

- Real-time Syncing: Choose software that syncs your data across devices in real-time. This feature lets you access your tax information wherever you are, keeping everything up-to-date without having to manually update your files.

- Support for Local Tax Codes: Ensure the software supports local tax codes to help you stay compliant with regional tax laws. This feature makes sure your filings are always accurate and reflect the latest regulations.

- Audit Trails: Audit trails are useful for tracking any changes made in the system. This is especially important for businesses in regulated industries, as it adds transparency and ensures you have a record of all actions during tax preparation.

- Easy Export Options: Look for software that makes it easy to export your tax reports. This feature is great for quickly generating necessary documents and ensures your business can meet financial reporting requirements with ease, including financial reporting examples that are commonly needed.

Is Tax Software Worth It?

Tax software doesn’t just save time, it actually helps avoid a lot of the back-and-forth that comes with manual entries and chasing errors. For most businesses, it leads to fewer compliance risks and makes things like audits way less stressful.

Even if there’s already a finance team handling things, using software keeps everything consistent across the board. With how sensitive tax work can be, that kind of built-in accuracy and structure is usually worth the spend.

Tax software helps save time, cut down on mistakes, and reduce compliance risks, making tax season a lot smoother. According to Medium, nearly half of working Singaporeans pay no personal income tax due to tax reliefs and CPF deductions, which shows how crucial it is to have accurate software.

Pros and Cons of Tax Software

Tax software can be a valuable tool for streamlining the tax filing process, making it easier to manage and file returns. However, like any tool, it comes with its own set of advantages and potential drawbacks. Understanding these pros and cons can help you decide if it’s the right choice for your needs.

Here’s a breakdown of the pros and cons of using tax software:

| Pros | Cons |

|---|---|

|

|

How to Choose the Best Tax Software

Choosing the best tax software can make a huge difference during tax season in Singapore, especially when it comes to ensuring accuracy and reducing stress. The right tool can simplify your workflow, save time, and ensure compliance with the latest tax regulations.

Here are some key factors to consider:

User-Friendly Interface

No one wants to waste time clicking around aimlessly, especially when it comes to taxes. A clean and intuitive interface is essential, especially for users who may not be well-versed in finance or accounting. A simple layout makes the process less overwhelming and more efficient.

An easy-to-navigate platform helps users quickly get to the information they need. Clear dashboards and straightforward navigation allow even those with minimal experience to feel confident in using the software. This minimizes the learning curve and helps you focus on getting the job done.

Compatibility with Tax Forms

For tax preparation software to be effective, it must support the necessary tax forms, especially for local filing requirements. Handling things like e-filing and ensuring your forms meet the standards of local tax authorities, including Singapore financial accounting standards, is crucial to avoid errors and delays.

Tax software Singapore that is constantly updated ensures you stay compliant with the latest regulations and tax codes. Automatic updates mean you don’t have to worry about manually adjusting the software every time a policy changes, making your filing process much smoother.

Cost Considerations

While the upfront price of tax software Singapore might seem affordable, it’s important to consider what’s included in the package. Look beyond the initial cost and consider the total cost of ownership, including any additional fees for reporting tools, support, or multi-user access.

The total cost will depend on the features you need and how many people will be using the software. Flexible pricing based on usage can help ensure you’re only paying for what you actually need. It’s important to balance functionality with affordability, especially as your business grows.

Customer Support Availability

During peak tax season, responsive customer support is more than just a nice-to-have. Delays can cause unnecessary stress, especially with tight filing deadlines. A support team that’s available when you need it can make all the difference.

Look for software that offers easily accessible support from experts who understand the local tax rules. Local support teams often provide faster and more relevant assistance, helping you navigate issues quickly and efficiently, rather than relying on remote teams that may not be available during crucial times.

Warranty and Guarantees

It’s always a good idea to check what service-level commitments the software provider offers. Guarantees such as accuracy warranties or refund options can provide peace of mind in case something goes wrong.

Having defined service-level agreements (SLAs) in place helps ensure you are supported if any issues arise during the tax preparation process. This backing can help reduce risks, especially when dealing with complex tax filings that need to be done right the first time.

Conclusion

Tax preparation software is a tool designed to make tax preparation easier by automating tasks like filing, calculations, and managing data. It ensures you comply with tax regulations while saving you time. This makes choosing the right and best tax software a must-have during tax season, especially for those with busy schedules.

So for that reason, ScaleOcean accounting software makes tax management smooth and straightforward, with a user-friendly interface that integrates well with your financial processes. It helps businesses automate tasks and stay compliant. To see how it works, try ScaleOcean’s free demo and experience its features firsthand.

FAQ:

1. Can I use AI for my taxes?

AI can certainly offer benefits for tax filing, such as making the process more efficient and providing real-time help. However, it’s not perfect. AI can sometimes make mistakes and pose security risks, especially when dealing with the sensitive nature of tax information.

2. Is AI replacing tax accountants?

AI won’t replace accountants, but it will change how they do their jobs. It’s handling repetitive tasks in accounts receivable, freeing up accountants to focus on more strategic areas like risk management and decision-making. The future of accounting is human working alongside AI.

3. How are taxes calculated?

The federal individual income tax is based on seven tax rates that range from 10 percent to 37 percent. These rates apply to taxable income, which is your adjusted gross income after subtracting either the standard deduction or itemized deductions. Income up to this amount is taxed at zero.

4. What is the one-tier corporate tax system in Singapore?

Singapore uses a one-tier corporate tax system. This means that the tax a company pays on its income is final. When the company pays dividends, these are not taxed again in the hands of the shareholders, making the process simpler and more efficient.

PTE LTD..png)

.png)

.png)

.png)

.png)