In today’s fast-paced business environment, managing finances efficiently is no longer optional; it’s a necessity. According to MTI (Ministry of Trade and Industry), Singapore’s economy is projected to grow between 1.0% and 3.0% in 2025.

Companies are increasingly turning to advanced ERP software for financial and accounting management to streamline operations, enhance accuracy, and drive growth. These tools are revolutionizing how companies handle accounting, budgeting, and compliance, ensuring they stay competitive in a dynamic market.

However, with so many options accessible, it might be difficult to choose the best answer. In this article, we have compiled a list of the 12 ERPs for financial accounting in Singapore for 2026, each tailored to the unique needs of businesses ranging from startups to enterprises.

Whether you’re seeking scalability, automation, or real-time analytics, this guide will help you make an informed selection to future-proof your financial planning. Learn more here.

- An ERP for finance and accounting is a software system that integrates a company’s financial processes with other essential business functions into one platform.

- The benefits of ERP for finance and accounting are increased efficiency, improved accuracy, gain real-time visibility, accelerate financial close cycles, strengthen compliance, and more

- Key ERP modules for financial accounting are general ledger management, accounts payable and receivable, cash and bank management, financial reporting and analysis, and more

- Top ERPs for financial accounting are ScaleOcean ERP, Oracle NetSuite, SAP S/4 HANA, Microsoft Dynamics 365 Finance, Sage Intacct, and more

- ScaleOcean is the recommended ERP for financial accounting that provides comprehensive integration to all business functions and customization according to your financial needs in businesses.

What Is Accounting and Finance in ERP?

An ERP for finance and accounting is a software system that integrates a company’s financial processes with other essential business functions into one platform. It streamlines tasks, centralizes data, and offers real-time insights for areas.

ERP for financial accounting goes beyond basic accounting to include functionalities like general ledger, accounts payable/receivable, financial forecasting, and budget control, enhancing accuracy, efficiency, and compliance.

Benefits of ERP in Finance and Accounting

Enterprise Resource Planning (ERP) software offers numerous benefits for finance and accounting departments by integrating key processes and streamlining operations. By automating and centralizing data, ERPs provide businesses with the tools to enhance efficiency, improve accuracy, and make informed financial decisions.

Here are the benefits of using ERP software for financial services and accounting, including:

- Automate Daily Tasks. Routine financial tasks such as data entry, invoice processing, and payroll management are automated by ERP systems. This reduces the workload on finance teams, increases productivity, and frees up time for more value-added activities. ScaleOcean’s accounting ERP software can integrate with invoicing software, enabling businesses to sync billing data automatically, minimize duplicate entries, and maintain accurate, real-time financial records across departments. This integration ensures smoother workflows and supports faster, more reliable decision-making.

- Accelerate Financial Close Cycles. ERP systems in finance and accounting streamline the financial close process by automating tasks like journal entries, account reconciliations, and report generation. This reduces the time spent on manual reconciliations, enabling companies to close their books faster and with greater accuracy.

- Centralized Data. An ERP system in financial accounting centralizes financial data from various departments, making it easier to manage and access. This eliminates the need for manual data transfers between systems, ensuring that all teams work with consistent, up-to-date financial information.

- Forecasting and Analysis. ERP tools support financial forecasting and analysis by utilizing historical data and trends. Businesses can use powerful analytics to forecast future financial performance, identify risks, and make informed decisions that align with long-term goals.

- Reporting Speed and Effectiveness. With automated data collection and reporting features, ERP systems enable faster and more accurate financial reporting. Whether for internal analysis or regulatory reporting, businesses can rely on ERP to produce comprehensive, error-free reports quickly, improving decision-making and strategic planning.

- Improve Accuracy. By integrating data from various business functions, ERP in financial services ensures consistent and accurate financial information. This reduces the risk of human error and discrepancies, ensuring that all monetary transactions and accounting cycles are properly recorded and reported, leading to reliable financial statements.

- Strengthen Compliance. ERP solutions come with built-in compliance features that ensure financial processes meet industry regulations and standards. By automating tax calculations, reporting, and audits, businesses can reduce the risk of non-compliance and penalties.

- Scalability. As businesses grow, ERP accounting and financial systems can scale to accommodate additional financial operations, transactions, and regulatory requirements. This scalability ensures that the finance and accounting functions can expand seamlessly without losing efficiency or accuracy.

Key ERP Modules for Finance and Accounting

ERP systems streamline accounting and financial processes by offering specialized modules that help businesses manage their finances more efficiently. These modules integrate various financial tasks, from transaction tracking to budgeting and forecasting, ensuring accuracy, transparency, and real-time insights into financial health.

Below are key ERP modules that support accounting and finance functions:

- General Ledger Management. It is the foundation of accounting in ERP for financial accounting. It centralizes all financial transactions, consolidating information from various departments. This module ensures accurate record-keeping, enabling businesses to create comprehensive financial statements, manage entries, and provide a clear picture of their financial standing. Real-time updates and automation simplify the reconciliation process and improve financial metrics.

- Accounts Payable (AP) and Receivable (AR). The AP and AR modules manage all transactions related to money owed by and to the business. The AP module helps track invoices from suppliers, ensuring timely payments and avoiding late fees. The AR module tracks customer payments, manages overdue accounts, and helps optimize cash flow. Together, these modules ensure efficient cash management, improve vendor relationships, and ensure timely collections for a more stable financial position.

- Cash and Banking Management. This module provides an integrated solution for managing a company’s cash flow, including bank account management, cash forecasting, and reconciliations. It allows businesses to track all financial transactions related to banking, such as deposits, withdrawals, and transfers. With real-time banking data through ERP for finance and accounting, businesses can ensure proper cash flow management, avoid liquidity issues, and make informed decisions based on their cash position.

- Financial Reporting and Analytics. Financial reporting and analytics modules provide businesses with automated, real-time financial insights. They generate financial reports, such as balance sheets, income statements, and cash flow statements, all of which can be customized based on the company’s needs and aligned with Singapore financial accounting standards. These ERP modules for financial accounting management offer data visualization tools that help management understand trends and performance metrics, allowing for better strategic planning and decision-making.

- Budgeting and Forecasting. The module helps businesses plan and predict their financial future by creating budgets, forecasts, and financial projections. By analyzing historical data and trends, this module enables accurate forecasting, providing a roadmap for financial decision-making. It also helps businesses manage costs, optimize cash flow, and stay aligned with their financial goals, ensuring they can meet long-term objectives and adjust strategies as needed.

- Fixed Asset Management. This modules track the lifecycle of a company’s physical assets, from acquisition to disposal. This includes managing depreciation, performing asset valuations, and tracking repairs and maintenance. By automating asset tracking and calculating depreciation, this module provides accurate financial reporting, ensuring that assets are accounted for and that the company complies with accounting standards.

- Compliance and Audit Management. This module helps businesses ensure they adhere to legal and regulatory requirements, maintaining compliance across all financial processes. It simplifies audit trails by keeping detailed records of all transactions, enabling easier audits. It also helps companies to ensure that financial operations meet international accounting standards and local tax laws, reducing the risk of non-compliance and associated penalties.

- Multi-Currency and Multi-Entity Support. For businesses operating globally, the multi-currency and multi-entity support module provides the ability to manage financial transactions in different currencies and across multiple subsidiaries. It automates currency conversion, ensuring accurate financial reporting and compliance with international accounting standards. This module also consolidates financial data from various entities, making it easier to manage and report on a global scale.

- Cloud Deployment. Cloud-based ERP systems for financial accounting enable businesses to manage their accounting and finance functions remotely, offering flexibility and scalability. The cloud deployment module provides easy access to financial data from any location, ensuring real-time collaboration and data sharing. It reduces IT infrastructure costs, provides automatic software updates, and offers enhanced security, making it an ideal solution for growing businesses.

- Tax Management. The module simplifies the process of managing taxes by automating tax calculations, ensuring compliance with local and international tax laws. It tracks tax liabilities, generates tax reports, and helps businesses calculate and file taxes more efficiently. By integrating tax management into the ERP system in financial services and using tax software in Singapore, companies can minimize errors, ensure accurate reporting, and stay up to date with changing tax regulations.

12 Top ERP Software for Financial Accounting

After reviewing the key ERP modules for finance, selecting the right software is essential for financial management. Here are the top financial ERP solutions in Singapore that provide advanced ERP features and seamless connectivity, boosting efficiency and performance.

1. ScaleOcean ERP

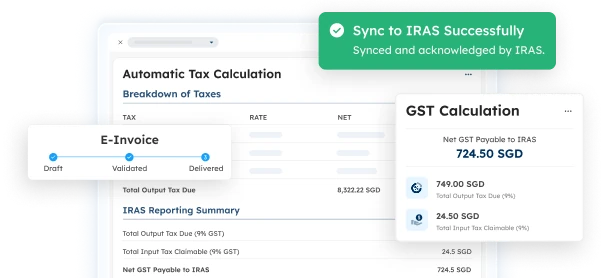

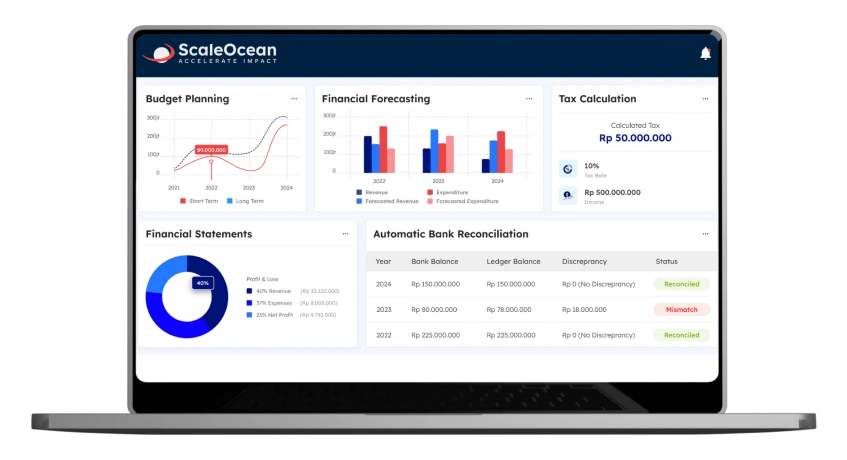

ScaleOcean’s Accounting Software is a comprehensive enterprise resource planning (ERP) solution designed to streamline financial management processes within businesses. It consolidates accounting, budgeting, reporting, and cash flow management into one platform.

The system automates financial transactions, enhances real-time data visibility, and ensures compliance with regulatory requirements. With cloud-based and on-premise options, ScaleOcean Financial ERP offers a flexible, scalable solution for businesses of all sizes. Plus, a free demo lets you experience its capabilities firsthand.

ScaleOcean Financial ERP offers a scalable, cost-effective financial management solution for Singaporean businesses. Unlike traditional ERPs, it provides unlimited user access at no extra cost, making it ideal for growth.

It’s an all-in-one system that integrates accounting, budgeting, reporting, and compliance, enabling seamless multi-branch operations with real-time insights. With strong security, AI-driven analytics, and cloud-on-premise flexibility, ScaleOcean ensures efficiency, financial oversight, and future-ready compliance management.

Additionally, businesses may leverage the CTC Grant to offset implementation costs, making it even more accessible for companies looking to enhance their financial systems without heavy upfront investment. Here are the features offered by Scaleocean ERP for financial accounting.

Key Features:

- Automated Financial Reconciliation: Automatically matches bank transactions with internal records, ensuring accuracy and reducing manual workload.

- Multi-Level Financial Analysis: Enables in-depth financial comparisons across projects, branches, and cost centers for better decision-making.

- Integrated Budget & Forecasting: Tracks real-time budget performance versus financial forecasts, helping businesses stay within financial targets.

- Unlimited Users Without Extra Fees: Unlike many competitors, ScaleOcean allows unlimited users at a fixed price, reducing operational costs.

- Seamless ERP Integration: Connects finance with inventory, procurement, and sales modules to create a fully automated and accurate financial system.

Many companies have successfully used ScaleOcean as a business solution, including PT Bukaka Inti Aircon. They implemented ScaleOcean’s finance ERP software to simplify and accelerate various business processes, including order management, work scheduling, costing, and integrated accounting/finance.

Furthermore, with ScaleOcean’s integrated job costing module, PT Bukaka can calculate project costs automatically and in real time, making it easier to manage profit margins efficiently and understand the financial position of each project.

With ScaleOcean’s financial accounting ERP, PT Bukaka has successfully optimized its financial operations, which in turn supports business growth and increased profitability. To see the process in action, watch the following video.

| Pros | Cons |

|---|---|

|

|

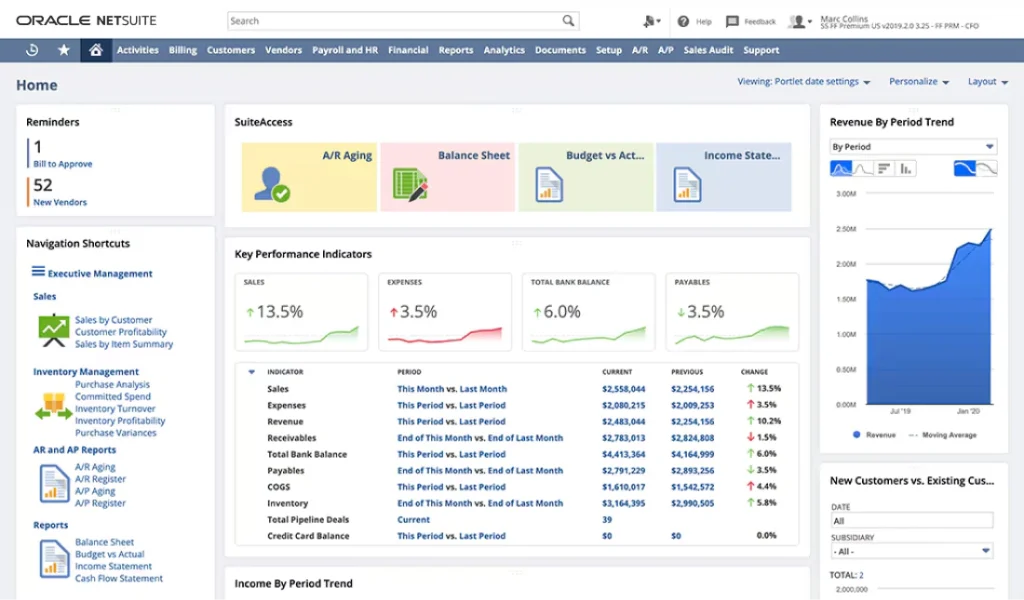

2. Oracle NetSuite

Oracle NetSuite is an ERP for financial accounting with features, including inventory accounting and customer relationship management. It also optimizes and automates various business operations, including financial management, inventory tracking, and order processing.

It provides real-time insights into both operational and financial performance, empowering businesses to make data-driven decisions and support growth.

Key Features:

- Financial management

- Order management

- Inventory management

| Pros | Cons |

|---|---|

|

|

3. SAP S/4 HANA

SAP ERP Financial Software is a leading ERP system with a range of modules, including finance and accounting applications. It’s what unifies and optimizes financial operations. It provides real-time data processing and sophisticated analytics, helping businesses enhance accounting, financial planning, and reporting workflows.

By consolidating financial data in a single platform, it ensures accuracy, supports informed decision-making, and improves resource management efficiency.

Key Features:

- Supply chain management

- Customer relationship management

- Automated reporting

| Pros | Cons |

|---|---|

|

|

4. Microsoft Dynamics 365 Finance

Microsoft Dynamics NAV is a financial management program (ERP system) offered by Microsoft as part of its Dynamics package. It streamlines essential business operations, including finance, supply chain management, and customer relations.

Built upon the foundation of Microsoft Dynamics NAV, it provides a unified platform that easily connects with other Microsoft applications, offering real-time insights and facilitating data-driven decision-making.

Key Features:

- Real-time financial reporting

- General ledger

- Cash flow management

| Pros | Cons |

|---|---|

|

|

5. Sage Intacct

Sage Intacct is a cloud-based ERP for finance services in small to medium-sized businesses. It streamlines and automates complex financial processes, providing real-time insights into financial data to facilitate informed decision-making.

The platform encompasses core financials, purchasing, order management, and financial reporting, all within an intuitive and user-friendly interface.

Key Features:

- Cash management

- Order management

- Purchasing

| Pros | Cons |

|---|---|

|

|

6. Acumatica Cloud ERP

Acumatica Accounting ERP is a cloud-based ERP solution featuring a financial management module with currency management, deferred revenue accounting, and advanced expense management.

It integrates various processes, including accounting, procurement, inventory management, and sales, into a unified platform, enhancing efficiency and providing real-time insights.

Key Features:

- Production management

- Stock management

- Multi-subsidiary tracking

| Pros | Cons |

|---|---|

|

|

7. Odoo

Odoo is a business management software that provides apps, including accounting modules, to assist various businesses with financial procedures. It also offers a comprehensive suite of integrated applications to manage business functions, including accounting, inventory, sales, and human resources.

Its modular design allows businesses to customize and scale the system according to their specific needs, ensuring seamless management of financial operations and other critical processes.

Key Features:

- Multi-currency support

- Customizable workflow

- Sales and CRM

| Pros | Cons |

|---|---|

|

|

8. QuickBooks

QuickBooks is a powerful accounting software designed specifically for finance and accounting tasks in small to medium-sized businesses. It offers robust financial management tools, including accounts payable and receivable, inventory management, and payroll processing.

The platform provides ERP features for financial accounting, real-time financial reporting, and integrates seamlessly with various third-party applications, facilitating efficient business operations.

Key Features:

- Reporting and analytics

- Payroll processing

- Financial management

| Pros | Cons |

|---|---|

|

|

9. FreshBooks

FreshBooks is an ERP for finance and accounting systems designed for small and medium-sized business owners to build natively on the Salesforce platform. It integrates various business functions, including financial management, human resources, and supply chain operations, into a unified system.

This integration facilitates real-time data access and streamlines processes, enhancing overall operational efficiency.

Key Features:

- Multi-entity and global consolidations

- Project accounting

- Integration capabilities

| Pros | Cons |

|---|---|

|

|

10. Xero

Xero Financial ERP for finance services in small businesses that gives businesses better insight with tools for managing invoicing, bank reconciliation, inventory, purchasing, expenses, bookkeeping, and more.

It also combines different financial processes like accounting, procurement, reporting, forecasting, and payroll into one platform, simplifying workflows and making them more efficient.

Key Features:

- Procurement management

- Multi-currency support

- General ledger

| Pros | Cons |

|---|---|

|

|

11. Epicor

Epicor is an ERP for financial management suite to enable manufacturers and distributors to withstand these challenges. It provides a centralized platform that integrates essential financial functions like accounting, procurement, and revenue management, allowing for real-time insights and more informed decision-making.

Key Features:

- Data analysis and reporting

- Asset management

- Supply chain management

| Pros | Cons |

|---|---|

|

|

12. FinancialForce

FinancialForce is a comprehensive ERP system that offers financial management, and it is designed to streamline financial and operational processes. It enables businesses to monitor performance in real-time, predict future outcomes, and make data-driven decisions to drive growth.

The platform integrates various modules, including financial management, supply chain operations, and project management, providing a unified system for managing diverse business functions.

Key Features:

- Inventory management

- Financial planning

- Accounting

| Pros | Cons |

|---|---|

|

|

What Is the Difference Between ERP and Accounting Software?

While both ERP and accounting software are designed to streamline financial processes, they differ in scope and functionality. Accounting software focuses primarily on managing a company’s financial transactions, including bookkeeping, invoicing, payroll, and financial reporting.

It is specialized for financial data and offers in-depth tools for managing accounts. On the other hand, ERP (Enterprise Resource Planning) systems are comprehensive platforms that integrate various business functions, such as finance, inventory management, HR, procurement, and sales.

An ERP system centralizes all operational data across departments, offering a unified business view that goes beyond just accounting. Meanwhile, accounting software is suitable for businesses focused on financial tasks.

You can use ScaleOcean’s financial accounting ERP software, which not only covers accounting processes but also integrates comprehensive business functions and can be accessed on one platform.

With modules covering inventory management, procurement, production, and human resource management, ScaleOcean ERP enables businesses to manage their entire financial management and workflow more efficiently.

Scaleocean offers customization services, allowing you to tailor various features and modules based on your business specifications and needs. This is ideal for those with complex business processes and requiring a system that significantly supports optimal operation. Do a free demo to get this solution

7 Things to Consider When Choosing the Right ERP for Financial Accounting

Choosing the right financial ERP software is vital for streamlining operations and accurate reporting. With many options available, it’s important to evaluate factors to ensure the software meets your company’s specific needs. Here are key considerations to guide your decision and promote long-term success in choosing an accounting and financial ERP:

1. Scalability and Flexibility

When choosing financial ERP software for financial accounting, select a solution that can grow with your business. It should handle increasing transaction volumes and adapt to evolving needs.

Look for the best accounting ERP software that easily integrates additional features like HR, procurement, or inventory management without a complete system overhaul. Scalability ensures the software meets your long-term requirements.

2. User-Friendliness and Training

The usability of ERP for finance and accounting is vital for adoption within your organization. A user-friendly interface simplifies navigation, reducing the need for extensive training.

The software should feature intuitive dashboards, streamlined workflows, and accessible support, along with comprehensive training resources to help users adapt quickly and boost productivity.

3. Integration with Existing Systems

Your financial ERP software should integrate smoothly with existing systems like CRM, accounts payable automation software, and supply chain management. A well-integrated system reduces data silos, minimizes errors, and ensures accurate data flow.

Choose ERP software for financial services with strong API capabilities and pre-built connectors for popular third-party systems to enhance efficiency and alignment with your operations.

4. Customization and Reporting Capabilities

Choose ERP software for finance that can be customized to fit your business processes, including a chart of accounts, tax structures, and reporting needs.

Ensure custom ERP software has advanced reporting and analytics tools for real-time financial reports, dashboards, and forecasts, supporting strategic decision-making and regulatory compliance.

5. Security and Compliance

Security is crucial when selecting financial ERP software due to the sensitivity of financial data. Ensure the provider meets industry standards for data protection, encryption, and access control, and complies with local and international regulations, including tax laws.

Regular updates and audits are vital for maintaining data integrity and safeguarding against cyber threats.

6. Cost of Implementation and Maintenance

When choosing financial ERP software, consider both initial implementation costs and ongoing maintenance expenses. Some systems may have lower upfront costs but could entail expensive customization later.

Also, weigh subscription models against one-time license fees, as this can affect your budget. Evaluate the total cost of ownership, including training, updates, and support services, to ensure the software offers value within your financial plan.

7. Vendor Support and Reputation

When choosing financial ERP software, prioritize customer support quality and the vendor’s reputation. Look for providers with a strong track record in customer service and issue resolution.

Research user reviews and industry ratings to assess reliability. A vendor offering responsive support and regular updates will facilitate a smoother implementation and minimize disruptions.

Conclusion

As businesses in Singapore gear up for a projected 3.2% economic growth in 2025, the right financial ERP software can be the cornerstone of their success. Investing in a robust system not only streamlines operations but also empowers organizations to make data-driven decisions, ensuring long-term sustainability.

The 12 best financial ERP software options highlighted in this article cater to a wide range of business needs, from startups to large enterprises, offering scalability, automation, and real-time insights.

Choosing ScaleOcean’s Financial ERP as a solution can transform how you manage finances, improve efficiency, and stay ahead in a competitive market. As technology continues to evolve, adopting the right tools today will position your business for growth tomorrow. Take the next step and explore these top-tier solutions and unlock your organization’s full potential.

FAQ:

1. What is ERP financial software?

ERP financial software is part of an integrated system that streamlines core business processes such as finance, HR, manufacturing, and supply chain management. It provides a unified platform for financial data management, offering real-time insights and a single source of truth for improved decision-making.

2. Which ERP is used by KPMG?

KPMG utilizes ERP systems such as ScaleOcean ERP, SAP, Microsoft Dynamics, and Oracle to manage business operations. They also provide ongoing technical and legal compliance support for these platforms, ensuring clients’ systems remain aligned with industry standards and regulations.

3. What is financial management in ERP?

Financial management in ERP integrates financial processes within the broader enterprise system, consolidating both financial and operational data. This provides teams with a comprehensive view of the business, enabling efficient decision-making, accurate reporting, and streamlined management of financial activities.

4. Do accountants use ERP?

Yes, accountants use ERP systems to streamline the accounting cycle and processes by integrating financial data. This accelerates tasks like accounts payable, receivable, and reporting, saving time and money. ERPs enable faster, more informed decision-making, improving overall financial management and efficiency for accounting teams.

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)

.webp)