The accounting cycle is a systematic method used by firms to record, classify, and summarize financial transactions over a set time period. This cycle assures accurate financial reporting, aids in compliance with accounting rules, and provides vital insights into a company’s financial health.

In Singapore, businesses benefit from the flexibility in choosing their fiscal year-end (FYE) date. According to InCorp Global, companies can select their own FYE date, as long as it complies with legal requirements and remains consistent year after year.

This flexibility allows businesses to align their accounting cycle with their operational cycles, making financial planning and reporting more effective. This article will look at the accounting cycle, its essential components, and how they play an important role in a firm’s financial management, particularly in Singapore.

We will go over each 8 phases of the accounting cycle, from transaction identification and analysis to financial statement generation, and we will highlight effective practices for increasing accounting cycle efficiency. We will also look at how excellent accounting software can help to speed up this process and ensure accuracy.

- The accounting cycle is a multistep process used by firms to record, categorize, and summarize financial statements.

- For business owners, understanding the importance of the accounting cycle helps ensure financial records are accurate and up-to-date, leading to better financial performance monitoring.

- The accounting cycle consists of several key steps, from identifying transactions to generating financial statements, each critical for ensuring financial transparency and compliance.

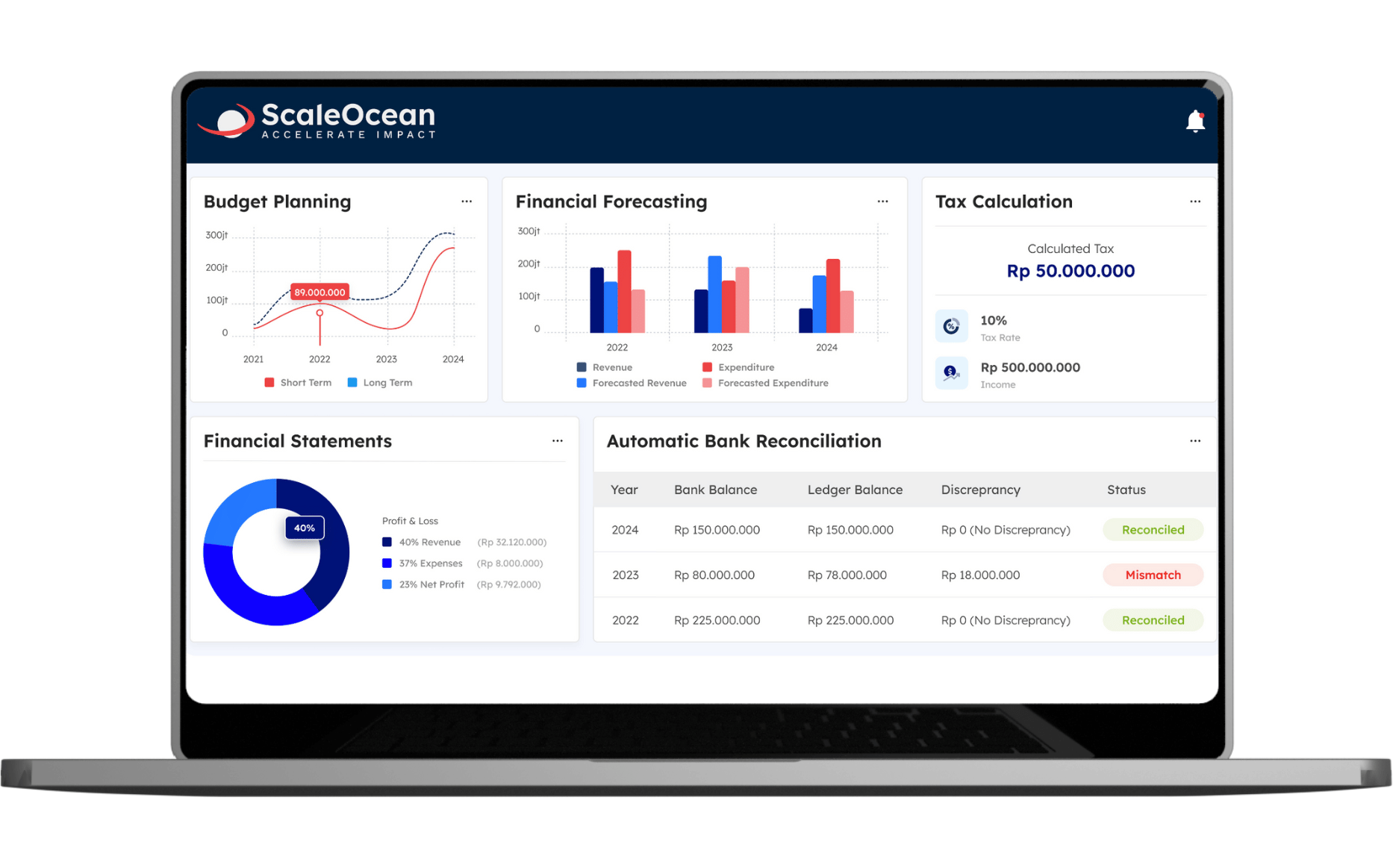

- ScaleOcean’s best accounting software provides a comprehensive accounting solution that maximizes corporate efficiency through automation and seamless connectivity.

What Is the Accounting Cycle?

The accounting cycle is a repeatable process used by firms to record, categorize, and summarize financial statements. This eight cycle guarantees that all financial actions are carefully tracked, allowing organizations to assess their financial success over time.

By following a structured approach, businesses can keep their financial records organized, which is key for transparency, reporting, and staying compliant with regulations. It helps track revenues, expenses, assets, and liabilities while ensuring accuracy and gaining stakeholder trust.

The goal of the accounting cycle is to provide clear and precise financial reports, which are essential for making smart business decisions. It lets companies generate reliable reports at the end of each period, helping owners, managers, and investors make better-informed choices.

The Importance of the Accounting Cycle for Business Owners

For business owners, understanding the accounting cycle is key to keeping financial records clear, accurate, and up to date. By following the steps from recording transactions to preparing financial statements, owners can track performance and make smarter decisions.

Accrual accounting helps by recognizing revenues and expenses when they happen, not just when cash is exchanged. This approach allows owners to better manage resources, maintain control over finances, and support their business’s growth and long-term stability.

Following the accounting cycle also ensures that businesses stay on top of financial regulations and avoid penalties. Regularly reviewing financial data helps owners spot trends, make better decisions, and reduce financial surprises, keeping the company on track for success.

The Steps in the Accounting Cycle

Below is a explantation of how the accounting cycle works and its significance for financial management:

1. Identifying and Analyzing Business Transactions

The first phase in the accounting cycle is to identify and analyze financial transactions that are important to the firm. These transactions could involve sales, purchases, investments, or expenses.

For purchases on credit, businesses commonly use a purchase journal to record and track these transactions accurately. Understanding these transactions allows organizations to appropriately categorize them in future accounting processes. This phase is crucial because it lays the groundwork for all later accounting activities.

2. Recording Journal Entries

Businesses use the double-entry approach to record transactions after they are identified. Every transaction has two sides, which are a debit and a credit, which keep the accounting equation (Assets = Liabilities + Equity) balanced.

This technique generates a clear and chronological record of financial transactions. Businesses maintain these journal entries to verify the accuracy and completeness of their financial data.

3. Posting to the General Ledger

When journal entries are completed, they are submitted to the general ledger, which acts as a summary of all accounts. The general ledger consolidates transactions from numerous accounts, offering a complete picture of the company’s financial situation.

This facilitates the tracking and monitoring of financial operations across many categories, ensuring that they are structured.

4. Preparing an Unadjusted Trial Balance

The unadjusted trial balance is created to check that the total debits and credits are balanced prior to making modifications.

This stage assists in identifying any inaccuracies in the recording process and provides a summary of the company’s current financial situation. It serves as an early check to ensure the accuracy of the records before any additional alterations are performed.

5. Making Adjusting Entries

Adjusting entries are performed to ensure that the company’s financial records accurately represent its financial status. These adjustments may include accruals, deferrals, or corrections to previously recorded transactions.

The correctness of these entries guarantees that the financial statements are precise and reflect the actual business performance.

6. Preparing Adjusted Trial Balance

After making the appropriate adjustments, firms create an adjusted trial balance. This phase guarantees that all accounts are properly updated and that the books are balanced.

It serves as a foundation for creating accurate financial statements and acts as a final check before publishing reports.

7. Generating Financial Statements

The next step in the accounting cycle is to prepare financial statements. These include the income statement, balance sheet, and cash flow statement, which provide important information on the company’s profit margin formula, assets, liabilities, and cash flow.

These reports are critical for making decisions and reporting the company’s financial situation to stakeholders.

8. Closing the Books

Finally, the accounting team closes the books at the conclusion of each accounting period. Temporary accounts, such as revenue and expense accounts, are reset to zero in preparation for the new accounting period.

This guarantees that the financial reporting process begins over for the next cycle, providing a clean slate for the upcoming period’s transactions.

Key Benefits of the Accounting Cycle

The accounting cycle is a key part of keeping your financial records accurate and trustworthy. By following a clear and organized approach, businesses can ensure transparency, timely reporting, and stay compliant with all regulations, which are essential for success.

Here are the key benefits of the accounting cycle:

- Enhanced Accuracy and Reliability: The accounting cycle ensures that all financial transactions are recorded properly, leading to more accurate and dependable financial statements. This helps reduce errors and ensures your financial data truly reflects the company’s actual position.

- Boosted Efficiency: With automated processes and a streamlined approach, the accounting cycle saves time and reduces manual work. It speeds up data entry, lowers the chance of errors, and allows your team to focus on strategic activities while keeping financial records accurate.

- Improved Compliance and Consistency: The accounting cycle helps businesses stay on top of local laws and international standards. It ensures that financial reports are consistently accurate and up-to-date, reducing the risk of fines and fostering trust through transparency in reporting.

- Greater Insight into Financial Performance: By following a structured accounting cycle, businesses can get real-time insights into their financial performance. This lets them track revenue, expenses, and profitability, which are crucial for understanding how well the business is doing.

- Facilitates Better Decision-Making: The accounting cycle provides decision-makers with accurate and timely financial data. This helps them make smarter choices about budgeting, resource allocation, and long-term strategies, ensuring the business stays on the right track.

- Consistency in Financial Planning and Analysis: The accounting cycle ensures you have reliable, consistent data for planning and analysis. It makes it easier to set realistic goals, forecast future performance, and align financial strategies with the company’s overall objectives.

By following the accounting cycle, businesses can ensure accuracy, efficiency, compliance, and insightful decision-making. ScaleOcean ERP streamlines this process by automating key tasks, providing real-time data, and ensuring consistency, helping your business thrive with ease.

Accounting Cycle vs. Budget Cycle

The Accounting Cycle and the Budget Cycle are both essential for managing a business’s finances. While they each have different focuses, they work together to support financial stability and long-term growth. Understanding their roles helps businesses make smarter decisions.

Here’s a comparison table to help you see the key differences between the Accounting Cycle and the Budget Cycle:

| Feature | Accounting Cycle | Budget Cycle |

|---|---|---|

| Purpose | Tracks and records past financial activities. | Prepares and projects future financial needs. |

| Focus | Reflects actual performance (revenue, expenses, obligations). | Assists in resource allocation, setting goals, and forecasting. |

| Timeframe | Reflects the past (historical data). | Looks ahead (future planning and forecasting). |

| Function | Ensures accurate reporting and compliance. | Enables financial development and future planning. |

| Key Activity | Recording revenue, expenses, and obligations. | Allocating resources, setting goals, and forecasting spending. |

When Do You Time the Accounting Cycle Correctly?

To keep consistent and accurate financial records, organizations must time their accounting cycles correctly. Typically, the accounting cycle corresponds to the business’s fiscal period, which might be monthly, quarterly, or annual.

According to Osome, a fiscal year is a 12-month period that a company selects to report its financial information. Each cycle provides a defined timeframe for tracking transactions, making adjustments, and preparing financial statements that appropriately reflect the company’s performance.

The accounting cycle starts and finishes within an accounting period, which is when financial statements are prepared. The length of the period varies, with the most common being an annual period, although businesses with complex processes may opt for quarterly cycles.

Regardless of the frequency, completing the cycle within the specified timeframe ensures timely and trustworthy financial reporting, allowing businesses to make educated decisions based on current information.

How to Enhance Efficiency in Your Business’s Accounting Cycle?

Long-term business performance and improved financial management depend on your accounting cycle being more efficient. In addition to guaranteeing accuracy, a streamlined accounting procedure saves your business money and time.

Businesses can reduce human errors, enhance decision-making, and streamline their financial operations by implementing best practices and utilizing the appropriate tools.

Timely, accurate financial data enables businesses to react faster to market fluctuations and make better-informed decisions through an effective accounting cycle. The following recommended practices will help you streamline and improve the effectiveness of your accounting process:

Automate Key Accounting Processes

Automating journal entry recording and ledger posting helps increase accuracy and reduce human error. The entire process is accelerated by automation, freeing up your team to concentrate on strategic decision-making rather than mundane duties.

This guarantees a more efficient accounting process and lessens the requirement for ongoing human supervision.

Implement a Centralized Accounting System

A centralized accounting system consolidates all financial data onto a single platform, enhancing communication and removing silos. ScaleOcean’s cloud-based platform makes financial data tracking easier, saves duplication, and improves transparency.

ScaleOcean improves real-time decision-making, cooperation, and compliance by centralizing financial activities, resulting in an optimized accounting cycle.

Regularly Review Financial Statements

Conduct regular checks of your financial statements to ensure accuracy and catch any irregularities early on. This approach aids in making educated decisions, spotting trends, and ensuring that your company remains financially stable.

Staying proactive with these reviews allows you to address possible issues before they become serious difficulties.

Utilize Cloud-Based Accounting Software

Cloud-based accounting software, such as ScaleOcean, connects effortlessly with your current business systems. It improves financial transparency, lowers manual errors, and accelerates the accounting cycle, giving you real-time financial data.

ERP financial accounting software also provides remote access, allowing you to manage your funds from anywhere and at any time.

Ensure Compliance and Accuracy

Update your accounting processes on a regular basis to ensure that you are in compliance with the current financial requirements and standards. Using software that automatically updates regulations ensures accuracy and prevents penalties for noncompliance.

This helps your company stay compliant with local and international regulations, reducing the risks connected with financial reporting.

Streamlining Your Accounting Cycle Process with ScaleOcean

With ScaleOcean’s powerful capabilities, businesses can easily shorten their accounting cycles, improve financial decision-making, and maintain regulatory compliance. ScaleOcean, with its flexibility and agility, is a reliable option for enterprises of all sizes.

Request a free demo of ScaleOcean’s accounting software today and discover how it can transform your financial management. ScaleOcean is also qualified for Singapore’s CTC grant, offering businesses the opportunity to reduce implementation costs while streamlining accounting processes.

The following is a list of ScaleOcean’s primary unique features:

- Customizable Accounting Solutions: ScaleOcean lets you personalize accounting systems, including automated entries and department-specific settings for better efficiency.

- Effortless Integration Across Branches: ScaleOcean seamlessly integrates accounting functions across branches, centralizing data for smooth collaboration.

- Automated Journal Entries and Ledger Posting: ScaleOcean automates journal entries and ledger postings, reducing human error and ensuring timely, accurate financial updates while freeing up time for strategic tasks.

- Real-Time Financial Reporting: ScaleOcean provides real-time financial reporting, giving businesses up-to-date insights to make smarter decisions and quickly respond to market changes.

- Ensuring Compliance and Accuracy: ScaleOcean ensures compliance with local laws like Singapore Accounting Standards (SFRS) and keeps financial reporting accurate to avoid regulatory fines.

Conclusion

The accounting cycle is essential for ensuring accuracy and efficiency in financial management. By following each phase, from transaction recognition to financial statement preparation, businesses can maintain reliable records, make informed decisions, and comply with regulations.

ScaleOcean accounting software offers a comprehensive solution that enhances every stage of the accounting cycle. Its cloud-based software automates key processes, ensures compliance, and provides real-time financial insights, all on a single platform tailored to your company’s needs.

Request a free demo today to explore how ScaleOcean can improve your accounting operations and help your business thrive.

FAQ:

1. What are the 5 basic accounting cycles?

The five essential stages in the accounting cycle are recording transactions, posting them to the ledger, preparing an unadjusted trial balance, making necessary adjustments, and generating financial statements. These steps ensure thorough and accurate financial reporting.

2. What is the big 5 in accounting?

Though now referred to as the Big Four, there was once a “Big Five.” Arthur Andersen, once a leader in the accounting industry, was a prominent member of this group, alongside PwC, Deloitte, EY, and KPMG, known for their excellence in the field.

3. What is the IAS 10 in accounting?

IAS 10 outlines guidelines for adjusting financial statements based on events that occur after the reporting period. It also specifies the disclosures businesses must make about the authorization date of the financial statements and any subsequent events.

4. What is the 4 4 5 accounting system?

The 4–4–5 system is a method of structuring accounting periods, commonly used in industries like retail and manufacturing. It divides the year into four quarters of 13 weeks, with each quarter consisting of two 4-week months and one 5-week month.

PTE LTD..png)

.png)

.png)

.png)

.png)