In today’s environment, double-entry accounting is critical for increasing openness and reliability in financial reporting for organizations. Singapore’s strong economy, strategic location, and role as a global financial hub make it an appealing destination for enterprises globally.

According to The World Bank, Singapore’s city-state excels in financial services, scoring 78.7 out of 100, with notable strengths in operational efficiency (83.2) and public services (79.3). Its solid regulatory framework (73.7) supports transparency, making it one of the easiest places to do business.

In such a dynamic and highly regulated corporate environment, proper financial reporting is not only necessary but also vital to long-term success. Double-entry accounting is a cornerstone of financial precision, ensuring that each transaction is precisely recorded with the appropriate debits and credits.

This core principle assists firms in maintaining the integrity of their financial statements, ensuring that they satisfy regulatory criteria while providing clear insights into their financial health. As firms in Singapore expand and innovate, double-entry accounting remains critical to successful financial management and decision-making.

- Double-entry accounting is a bookkeeping approach in which each financial transaction impacts at least two accounts and records every financial transaction twice, one as a debit and one as a credit.

- The advantages of Double-entry accounting include ensuring accuracy, enhancing financial reporting, detecting errors, preventing fraud, and supporting informed decision-making.

- The disadvantages of Double-entry accounting include a complex system, resource-intensive, and requiring extensive training.

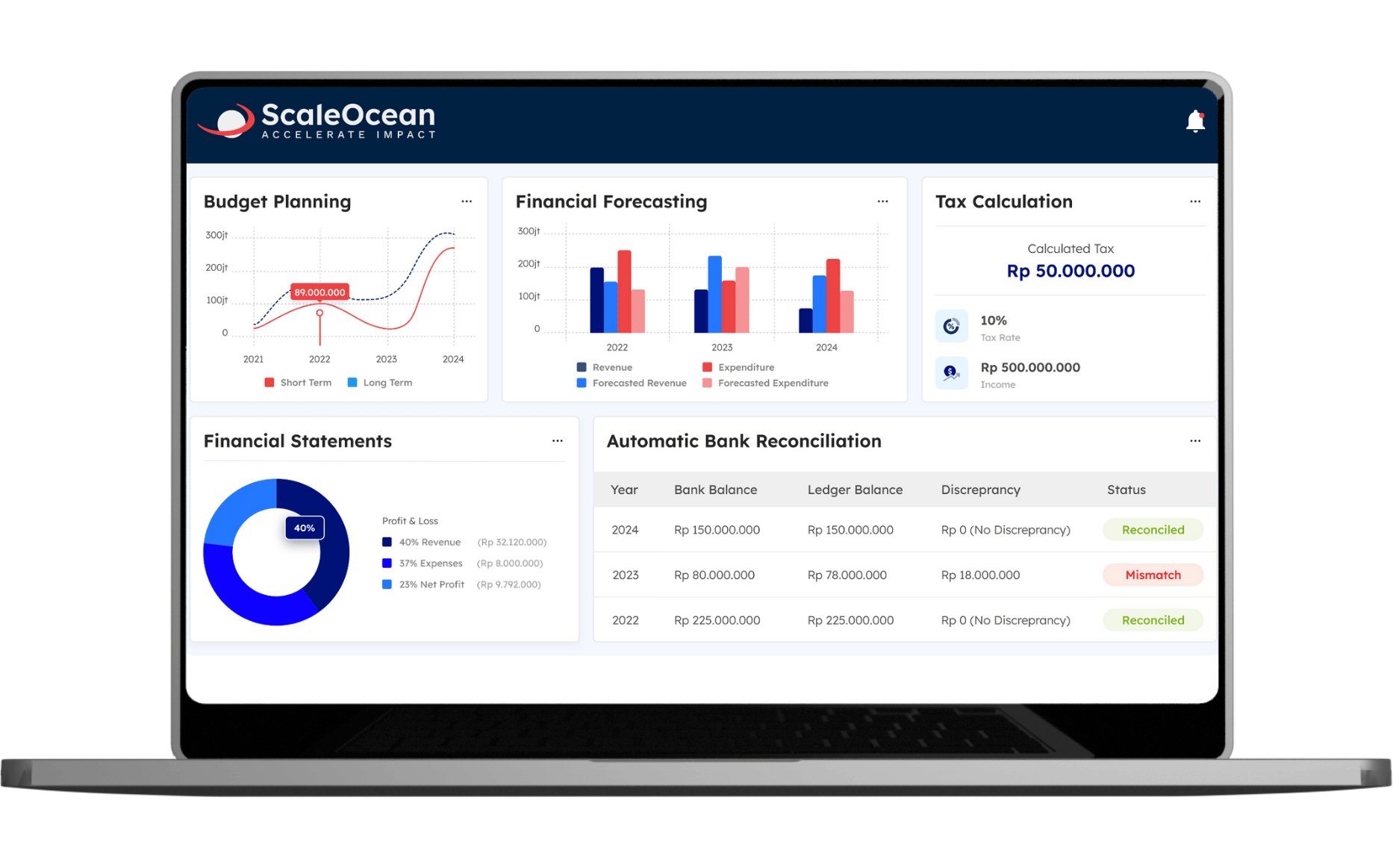

- ScaleOcean Accounting Software provides firms with an efficient, streamlined approach to financial administration, including strong automation and real-time reporting tools.

What is Double-Entry Accounting?

Double-entry accounting is a bookkeeping approach in which each financial transaction impacts at least two accounts and records every financial transaction twice, one as a debit and one as a credit. This keeps your books perfectly balanced, giving organizations an organized and reliable financial record. The golden rule for this whole system is the formula:

Assets = Liabilities + Equity

Using this system gives you a crystal-clear view of your finances. It cuts down on errors and ensures you stay compliant. Tracking assets, debts, and equity accurately makes your financial reporting much more reliable for long-term stability.

Advantages of Double-Entry Accounting

Double-entry accounting provides various benefits that assist organizations in keeping accurate and dependable financial records. Its organized architecture ensures that each transaction is recorded in two accounts, improving financial accuracy and transparency.

With the advancement of cloud accounting, businesses can now leverage digital platforms to automate and streamline this process, reducing errors and enhancing real-time financial oversight.

This strategy helps generate accurate financial reporting, identify discrepancies, and maintain efficient operations, supporting key metrics like the accounts payable turnover ratio to improve decision-making and risk management.

1. Accuracy and Error Detection

The double-entry system records each financial transaction twice, making it easier to identify anomalies between debit and credit entries.

This framework enables organizations to swiftly detect and remedy problems, ensuring the accuracy of financial records and increasing overall reliability. Furthermore, it assists firms in maintaining a clear audit trail, which is critical for internal controls and external audits.

2. Comprehensive Financial Reporting

Double-entry accounting, often used in accrual accounting, allows organizations to compile detailed financial statements such as balance sheets and income statements. These statements provide vital information on the company’s financial health, allowing decision-makers to measure profitability, liquidity, and overall financial performance.

This comprehensive reporting also offers stakeholders accurate financial data, which helps with strategic planning and investment decisions.

3. Fraud Prevention

The balance of the general ledger reporting in double-entry accounting serves as a precaution against fraud. Discrepancies between debits and credits are easier to spot, making it more difficult for fraudulent operations to go undetected.

This improves openness while lowering the danger of financial mismanagement. It also gives management the tools they need to constantly monitor financial activities and ensure that all transactions are correctly accounted for.

Disadvantages of Double-Entry Accounting

While double-entry accounting has many benefits, there are some drawbacks that organizations must consider. The system’s complexity and resource requirements might be challenging, especially for smaller businesses or people with insufficient accounting knowledge.

For these smaller businesses, adopting a double-entry accounting system may require additional time and expenditure in training or professional support, potentially diverting resources away from other vital aspects of the business.

1. Complexity

Double-entry accounting might be difficult to understand for persons with no accounting expertise. It demands a specific understanding of accounting principles as well as the ability to correctly apply the system’s rules. This complexity can overwhelm those unfamiliar with bookkeeping and accounting.

As a result, firms may need to spend on employee training or hire professional accountants to verify that the system is used correctly and regularly. This additional skill may pose a challenge for small enterprises and startups with limited resources.

2. Resource Intensive

Implementing and maintaining a double-entry accounting system can be time-consuming, particularly for companies with high transaction volumes or a small accounting team.

Small organizations, in particular, may struggle to dedicate enough resources to keep this system running regularly. This frequently necessitates hiring specialist accounting personnel or outsourcing to third-party companies, both of which can raise operating costs.

3. Training Requirements

Double-entry accounting requires extensive training for employees to fully grasp accounting principles. Staff must be equipped with the skills to accurately record debits and credits, understand the accounting equation, and maintain balance sheets. Without this knowledge, financial discrepancies may arise.

Lack of proper training can result in errors that distort financial reports, including profit loss statements, leading to inaccurate financial analysis. These mistakes can ultimately affect decision-making, compliance, and overall financial health. Businesses must invest in continuous training to minimize these risks.

Types of Business Accounts in Double-Entry Accounting

Double-entry accounting categorizes financial transactions using many types of business accounts. These accounts ensure that every transaction impacts at least two accounts, one as a debit and one as a credit, while preserving the accounting equation’s integrity.

Understanding these account types is critical to proper financial reporting and decision-making, especially in accordance with IFRS standards. Here are the various types of business accounts:

- Asset Accounts: Reflect the company’s resources, like cash, inventory, and property. They are split into current assets (convertible to cash within a year) and non-current assets (long-term investments). Proper management ensures liquidity and supports a strong cash flow statement report.

- Liability Accounts: Show the company’s financial obligations to third parties, such as loans and accounts payable. They are divided into current liabilities (due within a year) and non-current liabilities (due after a year), ensuring obligations are met without harming financial stability.

- Equity Accounts: Reflect the owner’s interest in the business, including capital investments, retained earnings, and other contributions. They indicate the company’s net value and are vital for stakeholders to assess the financial health and solvency of the company.

- Revenue Accounts: Track income generated from the company’s main operations, such as sales of products or services. They play a key role in income statement reporting, helping measure performance, calculate net income, and guide pricing strategies for growth and financial viability.

- Expense Accounts: Monitor the costs associated with running a business, including rent, payroll, utilities, and supplies. Effective management of expenses ensures profitability and operational efficiency, highlighting areas where costs can be optimized.

Basic Rules of Double-Entry Accounting

The link between debits and credits is central to double-entry accounting’s fundamental principles. Debits boost asset and expense accounts while lowering liabilities, equity, and revenue accounts.

Credits, on the other hand, have the reverse effect because they reduce assets and expenses while raising liabilities, equity, and revenue. This dual recording keeps the accounting equation balanced, resulting in a complete and accurate depiction of a company’s financial status, which is also crucial when analyzing a company’s financial leverage.

The accounting equation, which specifies that assets must always equal the total of liabilities and equity, is the basis for double-entry accounting. This equation ensures that all transactions are appropriately documented and the financial accounts are balanced.

Maintaining this balance allows firms to produce credible reports, track their financial health, and make educated decisions that promote long-term success.

Double-Entry vs. Single-Entry Accounting

Smaller shops often use single-entry accounting because it’s simple and focuses mostly on cash flow. While it’s easy to manage, it doesn’t give you the full story, making it a bit tough to see how the business is really doing over the long haul, especially when creating balance sheets.

Double-entry accounting gives you the big picture by recording every transaction as both a debit and a credit. This balanced approach creates super accurate financial reports, including balance sheets, giving you the transparency you need to make much smarter decisions.

How Double Entry Accounting Works With a Practical Example

Double-entry accounting works by recording every transaction in at least two accounts to maintain balance. For example, when a company purchases $1,000 in inventory on credit, the transaction affects both the asset and liability accounts. The inventory account is debited by $1,000, reflecting the growth in inventory as the company acquires more goods.

On the other side of the transaction, the accounts payable account is credited by $1,000, recording the company’s obligation to pay the supplier in the future. This credit entry ensures the company’s liabilities are accurately reflected in the financial records.

By recording both a debit and a credit, double-entry accounting maintains the integrity of the accounting equation (assets = liabilities + equity). This method ensures accuracy and transparency in financial reporting, making it easier to track financial health and make informed business decisions.

Enhancing Efficiency with ScaleOcean Accounting Software

ScaleOcean Accounting Software provides firms with an efficient, streamlined approach to financial administration, including strong automation and real-time reporting tools. The software’s unique features distinguish it from competing accounting solutions, giving firms the capabilities to manage financial activities seamlessly.

ScaleOcean’s user-friendly design and numerous capabilities help businesses simplify difficult accounting operations, ensure accuracy, and reduce manual effort.

This complete solution saves organizations time, reduces errors, and boosts productivity by combining financial activities into a single, coherent system. ScaleOcean also provides a free demo, which allows you to see firsthand how the program can assist your organization.

Businesses can also use the CTC (Cost to Company) grant to lower installation costs and ensure that the software provides the most value. The following are some of the key advantages of ScaleOcean’s accounting solution:

- Unlimited User Without Additional Costs: ScaleOcean offers unlimited users with no additional costs, allowing businesses to scale without worrying about user restrictions. This flexibility supports growth and eliminates the burden of managing extra charges as the team expands.

- All-in-One Solution – Complete Modules According to Needs: With over 200 specialized modules and 1,000+ features, ScaleOcean provides an all-in-one solution that adapts to the unique needs of any business, ensuring that every aspect of financial management is covered.

- Auto-pilot for Entire Business Operations: The software is equipped with automation features that handle routine operations, allowing businesses to focus on growth while ScaleOcean manages day-to-day financial tasks efficiently.

- Inter-Branch Integration: ScaleOcean facilitates seamless integration across multiple business branches, ensuring that all financial data is connected and easily accessible on one unified platform, which is ideal for businesses with multiple locations or subsidiaries.

10. Conclusion

Adapting to technology innovations is critical for organizations looking to remain competitive in today’s fast-paced marketplace. Embracing digital solutions such as ScaleOcean enables businesses to use cutting-edge technology to improve financial management.

Businesses can expedite their accounting procedures and receive a full view of their financial activity by leveraging capabilities such as real-time reporting and automation.

Building confidence with stakeholders and enabling long-term success requires a commitment to transparency and compliance. Businesses that invest in sophisticated financial reporting systems ensure that their financial data is accurate, accessible, and in line with industry standards.

ScaleOcean provides a free demo for anyone interested in seeing these benefits firsthand, allowing you to learn how the software may improve your financial operations and help your company succeed in the long run.

FAQ:

1. What is the golden rule of double-entry accounting?

The fundamental principles of accounting are (1) debit expenses and losses, credit incomes and gains, (2) debit the recipient, credit the provider, and (3) debit what comes in, credit what leaves. These principles, originating from Luca Pacioli, form the foundation of double-entry accounting.

2. What are common double-entry bookkeeping mistakes?

While double-entry bookkeeping ensures accurate financial tracking, errors such as confusing debits and credits, categorizing expenses incorrectly, typing mistakes, or neglecting bank reconciliation can lead to flawed financial records and potential compliance problems.

3. What are the 5 basic principles of bookkeeping?

Basic Principles of Bookkeeping:

1. Precision: The Core of Financial Reliability

2. Consistency: Building Confidence in Every Statement

3. Clarity: Trustworthy Transparency

4. Responsibility: Beyond Just Figures

5. Understanding: The Human Element Over AI

4. What are the 4 types of errors in accounting?

Accounting errors typically fall into data entry mistakes, errors of commission, errors of omission, and errors of principle. Among these, errors of principle are the most complex and can cause financial statements to fail to comply with Generally Accepted Accounting Principles (GAAP).

PTE LTD..png)

.png)

.png)

.png)

.png)