A Cash Flow Statement is an important financial document that summarizes all cash inflows and outflows that a firm experiences over a given time period. It enables organizations and stakeholders to examine how cash is generated and spent, which is critical for operational efficiency, particularly in competitive markets such as Singapore. For businesses operating in fast-paced industries, having a clear understanding of cash flow is essential to ensuring timely payments, meeting operational needs, and managing working capital effectively.

The statement also provides vital information about a company’s financial health by summarizing cash flows from operations, investments, and financing. In Singapore’s fast-paced company environment, understanding and successfully managing cash flow is critical for sustaining growth and making sound financial decisions. With real-time insights into cash management, businesses can plan for future growth, invest in new opportunities, and maintain stability even during economic fluctuations.

- A cash flow statement is a key financial document that provides a comprehensive overview of a company’s cash inflows and outflows, helping businesses assess their financial performance over a specific period.

- There are two main methods for preparing a cash flow statement: the direct method, which categorizes cash receipts and payments, and the indirect method, which adjusts net income for changes in balance sheet items.

- The main components of a cash flow statement include net income, depreciation and amortization, changes in working capital, and investing and financing activities.

- System likeScaleOcean Accounting Software automates the creation of cash flow statements, improving efficiency and accuracy by integrating key financial data and reducing manual entry.

What Is a Cash Flow Statement?

A cash flow statement is one of the most important financial statements that businesses use to monitor their actual cash movements, offering a clear view of liquidity and its essential role in a company’s financial health.

Along with the income statement and balance sheet, it provides a comprehensive picture of the company’s cash inflows and outflows during a specific time period, helping to assess financial leverage and overall financial health.

This statement is critical for assessing a company’s liquidity, financial health, and ability to meet short-term obligations. It assists businesses, investors, and analysts in evaluating cash flow dynamics, ensuring that organizations can meet their current expenses without experiencing financial duress. The following are the primary components of a cash flow statement:

1. Operating Activities

Operating activities track the cash flow generated or used by a company’s normal day-to-day operations. This includes cash received from clients for sales and cash paid out for raw materials, wages, and other supplier costs, showing your business’s core financial performance.

These activities are critical for determining how well a company generates cash from its core business tasks, which affects its capacity to continue operations without external financing. The cash flow from operating activities is often compared with the profit and loss statement to assess how actual cash generation aligns with reported profitability.

2. Investing Activities

Investing activities involve cash flows from the purchase and sale of long-term assets used in a company’s operations. This includes all transactions involving property, plant, and equipment, as well as investments in securities or other businesses.

The general ledger is essential in accurately recording these transactions, ensuring that investments and asset purchases are properly tracked. The purpose of these actions is to help the company grow or adapt its asset base, which can have a substantial impact on future profitability and operations.

3. Financing Activities

Financing activities track cash flows related to a company’s capital structure, such as borrowing, repaying loans, issuing stock, or paying dividends to shareholders. These activities show how a company raises capital and provides value to investors, revealing its funding strategy.

The cash flow statement is essential for companies managing future financial needs. With tools like financial ERP software, businesses can easily analyze past flows to better estimate and budget for future expenses, ensuring they have enough cash to fund both growth and core operations.

Why Is the Cash Flow Statement Important?

A cash flow statement is essential for assessing a company’s financial health and how it manages cash for daily operations. It helps analyze liquidity, operational efficiency, and investment decisions, while also playing a key role in financial planning and forecasting future cash needs. In Singapore, businesses must follow Singapore accounting standards to ensure accurate financial statements.

According to ACRA Singapore, entities that comply with SFRS(I) can include a statement of compliance with IFRS Accounting Standards in their first and subsequent SFRS(I) financial statements, ensuring transparency in reporting. The following items demonstrate the special significance of a cash flow statement:

1. Liquidity Assessment

The cash flow statement evaluates a company’s capacity to satisfy its short-term obligations. It indicates whether the company has enough cash on hand to continue operations without relying on external finance, maintaining smooth day-to-day business operations.

2. Operational Efficiency

The cash flow statement demonstrates how efficiently a firm operates its operations by measuring the cash earned from core business activities. A positive cash flow from operations suggests a robust, sustainable business strategy, whereas a negative cash flow may indicate inefficiencies that must be rectified.

When combined with a clear accrual accounting process, businesses can better understand timing differences between cash movements and recorded revenues or expenses, leading to more accurate financial analysis.

3. Investment Decisions

Investors use the cash flow statement to assess a company’s financial stability and development prospects. It provides a clearer understanding of how a company makes and spends cash, which influences investment decisions like stock purchases or whether to give financing.

4. Financial Planning

The cash flow statement is essential for companies to manage their future financial needs. With the help of tools like financial ERP software, businesses can analyze previous cash flows and better estimate and budget for future expenses.

Optimizing the double-entry accounting process ensures that all transactions are accurately recorded, providing a clear view of financial health. Such software automates financial data processing, ensuring accuracy and efficiency in planning for capital expenditures and ensuring companies have enough cash to fund both growth and operations.

How to Prepare a Cash Flow Statement

Preparing a cash flow statement is crucial for truly understanding the movement of money within your business. It helps you track cash inflows and outflows easily, providing vital insights into your financial health. The process involves several key steps:

1. Gather Financial Information

To create an accurate cash flow statement, start by collecting key financial data. This includes net income, non-cash expenses (like depreciation), and changes in assets/liabilities from the balance sheet. Bank statements also help track actual cash movements.

Accurate data collection is absolutely essential to ensure the cash flow statement reflects a company’s true financial position. This information is the foundation for calculating cash flows and truly understanding how business activities affect cash reserves over time.

2. Select a Preparation Method

You can prepare a cash flow statement using two methods like direct or indirect. The indirect method starts with net income and adjusts for non-cash items, while the direct method records cash inflows and outflows directly from operating activities.

Choosing the right method simply depends on the available detail and the company’s preference. The indirect method is often preferred due to its simplicity, whereas the direct method gives you much more granular insights into all your cash transactions.

3. Calculate Cash Flow from Operating Activities

Operating activities cover your primary business operations, including cash from customers and payments to suppliers. Using the indirect method, you start with net income and adjust for changes in working capital, like accounts receivable or payable.

For the direct method, you simply record the actual cash inflows from customers and outflows for expenses. Both methods are great for measuring the cash generated or used by the company’s core operations, which is absolutely critical for financial health, especially when calculating the Net Present Value (NPV) of future cash flows.

4. Calculate Cash Flow from Investing Activities

Investing activities cover the purchase and sale of long-term assets, such as property or equipment. This section records cash spent on capital expenditures and cash received from asset sales, providing real insights into how the business is allocating resources for growth.

By analyzing these investing activities, businesses can evaluate their investments in future growth versus their current cash position. Significant spending suggests an effort to expand, while cash received from sales could simply indicate asset liquidation or a strategic change.

5. Calculate Cash Flow from Financing Activities

Financing activities cover transactions related to raising capital and managing debt. This section tracks cash coming in from issuing stock or borrowing funds, and cash flowing out for repaying debt, paying dividends, or repurchasing stock.

Understanding financing activities helps businesses assess their ability to raise funds and meet all financial obligations. For example, borrowing offers instant cash, but repayment obligations might impact future cash flows and profitability, which is crucial to know.

6. Reconcile and Confirm the Cash Flow Statement

After calculating cash flows from operating, investing, and financing activities, you add them up to find the net change in cash. Reconciliation is then crucial, ensuring the statement perfectly aligns with the actual cash balance shown on your balance sheet.

Verifying the cash flow statement helps you quickly catch any discrepancies or mistakes. By carefully cross-checking the ending cash balance, businesses can ensure the statement accurately reflects the company’s cash position and confirm that the financial data is completely correct.

7. Review and Evaluate

Once the cash flow statement is done, it’s vital to assess any negative trends, which often signal financial issues. Reviewing your cash inflows and outflows offers valuable insight into the company’s ability to generate sufficient cash for all daily operations.

Furthermore, evaluating cash flow helps businesses see if they have enough liquidity to fund investments and meet financing obligations. Spotting unusual patterns or discrepancies allows for timely adjustments and better financial planning as you move forward.

Different Methods of Preparing a Cash Flow Statement

There are two main approaches for preparing a cash flow statement: direct and indirect. The direct technique categorizes important cash inflows and outflows while directly reporting cash receipts and payments. This method provides a detailed perspective of cash flows, allowing users to better understand the sources and uses of cash in daily operations, which is crucial for capital budgeting in project management, ensuring that projects are funded effectively and efficiently.

In contrast, the indirect technique begins with net income and adjusts for changes in balance sheet items to calculate cash flow from operating activities. This method is more generally employed because it simplifies the process by focusing on reconciling net income with cash flows, and it is frequently preferred since it relies on easily accessible financial data from the income statement and balance sheet.

So if you are curious what the specific differences are between direct and indirect methods, here is the table for it:

| Direct Method | Indirect Method |

|---|---|

|

|

Key Components Explained

The cash flow statement has several critical components that aid in understanding how a business manages its cash. These components indicate a variety of financial operations, including a company’s profitability and the impact of its investment and financing decisions. Businesses and investors can improve their understanding of a company’s cash management and financial health by evaluating these factors. The following are the main components, discussed in greater detail:

1. Net Income

Net income serves as the foundation of the cash flow statement, indicating a company’s profitability. Since it is derived from the income statement, it must comply with Singapore accounting standards to ensure accurate reflection of earnings. This ensures that all calculations, including adjustments for non-cash items, are in line with local regulations, providing stakeholders with a true and fair view of the company’s financial performance.

2. Depreciation and Amortization

Depreciation and amortization are non-cash charges that lower net income but have no direct impact on cash flow. These expenses reflect the gradual cost allocation of assets over their useful lives, often calculated using the depreciation formula. Depreciation and amortization are frequently brought back into operating cash flow on the cash flow statement because they do not entail actual cash withdrawals.

3. Changes in Working Capital

Working capital adjustments are made to account for changes in current assets and liabilities such as accounts receivable, payable, and inventories. These adjustments reflect a company’s short-term cash needs and aid in understanding how much cash is tied up or freed up in operations, which influences the overall cash flow position.

4. Investing and Financing Activities

Investing and financing operations show how a company’s decisions about investments and financing affect its financial position. This covers cash flows generated by the purchase or sale of long-term assets, as well as cash raised or spent in debt and equity transactions. These parts help evaluate the company’s financial strategy and resource allocation by demonstrating how cash is invested for future growth or refunded to stakeholders.

Interpreting the Cash Flow Statement

Understanding a company’s financial health requires the ability to interpret its cash flow statements. It provides information about how successfully a firm manages its cash and if it has enough funds to maintain operations, invest in growth, or return value to shareholders. The following sections illustrate how various types of cash flow might affect a company’s financial position:

1. Positive Cash Flow

When a corporation makes more cash than it uses, it indicates good financial health. Positive cash flow enables the company to reinvest in growth possibilities, reduce debt, or pay dividends to shareholders. It demonstrates the company’s capacity to run smoothly and sustain long-term profitability.

2. Negative Cash Flow

A negative cash flow may indicate that the company is aggressively investing in its future, or that it is experiencing financial troubles. Negative cash flow may reflect a company’s growth phase, in which investment in assets and expansion outpaces current cash generation, but it may also imply underlying profitability or liquidity difficulties if not managed appropriately.

3. Free Cash Flow

Free cash flow is the cash remaining after capital expenditures, indicating a company’s ability to reinvest in its operations, pay dividends, or pay down debt. This indicator is crucial for determining a company’s ability to manage its financial obligations and pursue new prospects without relying on external finance.

Common Pitfalls in Cash Flow Statements

Companies frequently encounter issues while preparing a cash flow statement, which can result in erroneous financial reporting. These problems can distort an understanding of a company’s genuine financial state, making it difficult for entrepreneurs and investors to make sound decisions. Here are some frequent pitfalls to avoid when evaluating a cash flow statement:

1. Overlooking Non-Cash Items

Failure to account for non-cash expenses, such as depreciation and amortization, can result in an erroneous cash flow analysis. Since these expenses diminish net income but have no effect on cash, failing to include them in the statement might misrepresent the underlying cash position, making the company appear less liquid than it is.

2. Misclassifying Cash Flows

Misclassifying cash flows can cause severe distortions in the financial picture. For example, identifying financing activities as operating cash flows or vice versa can mislead stakeholders about the company’s financial health, influencing decision-making and perhaps leading to misunderstandings regarding cash flow sources and uses.

3. Ignoring Seasonal Variations

Failure to account for seasonal swings in cash flow can lead to poor financial planning. Many organizations face cash flow peaks and troughs throughout the year owing to fluctuations in client demand or operational cycles. Ignoring these variations can result in an imbalance between cash inflows and outflows, potentially producing liquidity problems during off-peak periods.

Example: Real-World Application

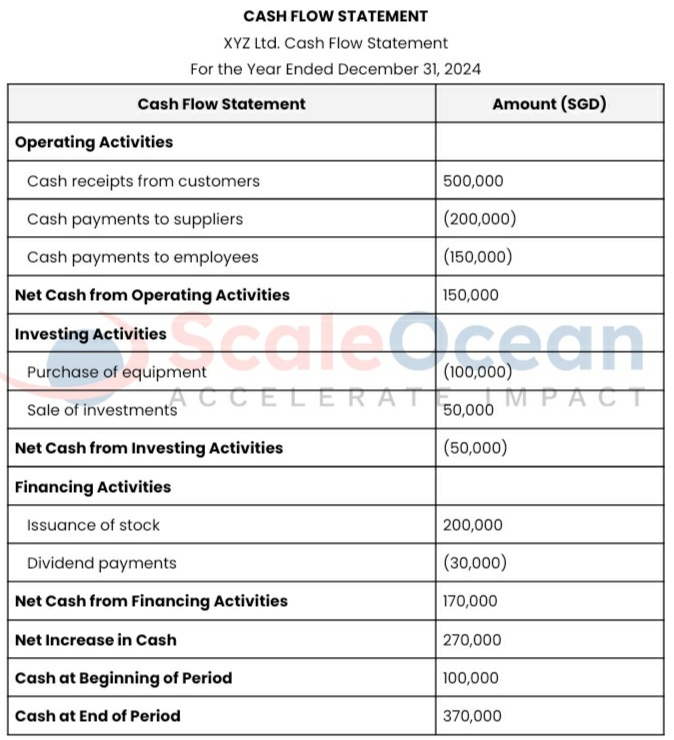

In this case study, XYZ Ltd. creates a cash flow statement that incorporates cash flows from operations, investments, and financing activities. Customer payments produce cash for the corporation, which then invests in new gear and raises capital through stock issuance and dividend payments. Analyzing these areas allows us to better understand how each activity affects the company’s cash condition. Below is an example of XYZ Ltd.’s cash flow statement that illustrates these activities in detail:

XYZ Ltd.’s operating activities show a strong cash inflow of SGD 500,000 from customer receipts, though cash outflows of SGD 200,000 to suppliers and SGD 150,000 to employees reduce the overall cash generated. Despite these outflows, the company maintains a positive net cash flow of SGD 150,000, indicating that its core operations are generating sufficient cash to support daily activities.

In investing and financing activities, the company shows a net cash outflow of SGD 50,000 from investments, indicating reinvestment in assets for future growth. Meanwhile, financing activities generated SGD 170,000 from stock issuance and dividend payments, reflecting successful capital raising and commitment to shareholder returns. Overall, XYZ Ltd. is financially stable, with sufficient liquidity for short-term obligations and growth.

According to the cash flow statement, XYZ Ltd. has a steady financial situation. Positive operating cash flow implies enough liquidity to satisfy short-term obligations, but negative investing cash flow indicates investments in future growth. The net positive cash flow from financing operations demonstrates effective capital raising. Overall, the company has adequate liquidity and financial flexibility to sustain operations and expansion.

Best Practices for Preparing a Cash Flow Statement

Creating an accurate and dependable cash flow statement is critical for good financial management. Following best practices ensures that the statement accurately represents the company’s true cash position and provides relevant information for decision-making. Here are some important principles to consider when creating a cash flow statement:

1. Regular Updates

The cash flow statement should be updated on a regular basis to ensure that it accurately reflects financial data. Regular updates enable organizations to analyze cash flows in real time, offering up-to-date liquidity insights and allowing for timely choices about cash management, investments, and financing requirements.

Reviewing these figures through clear bookkeeping and accounting reports also helps stakeholders understand how cash is moving through the business.

2. Accurate Classification

Cash flows must be properly classified into operating, investing, and financing activities to ensure accurate reporting. Misclassifying cash flows can distort the financial picture, making it harder to evaluate the company’s performance across all areas. Clear and accurate classification promotes transparency and improves decision-making based on reliable data.

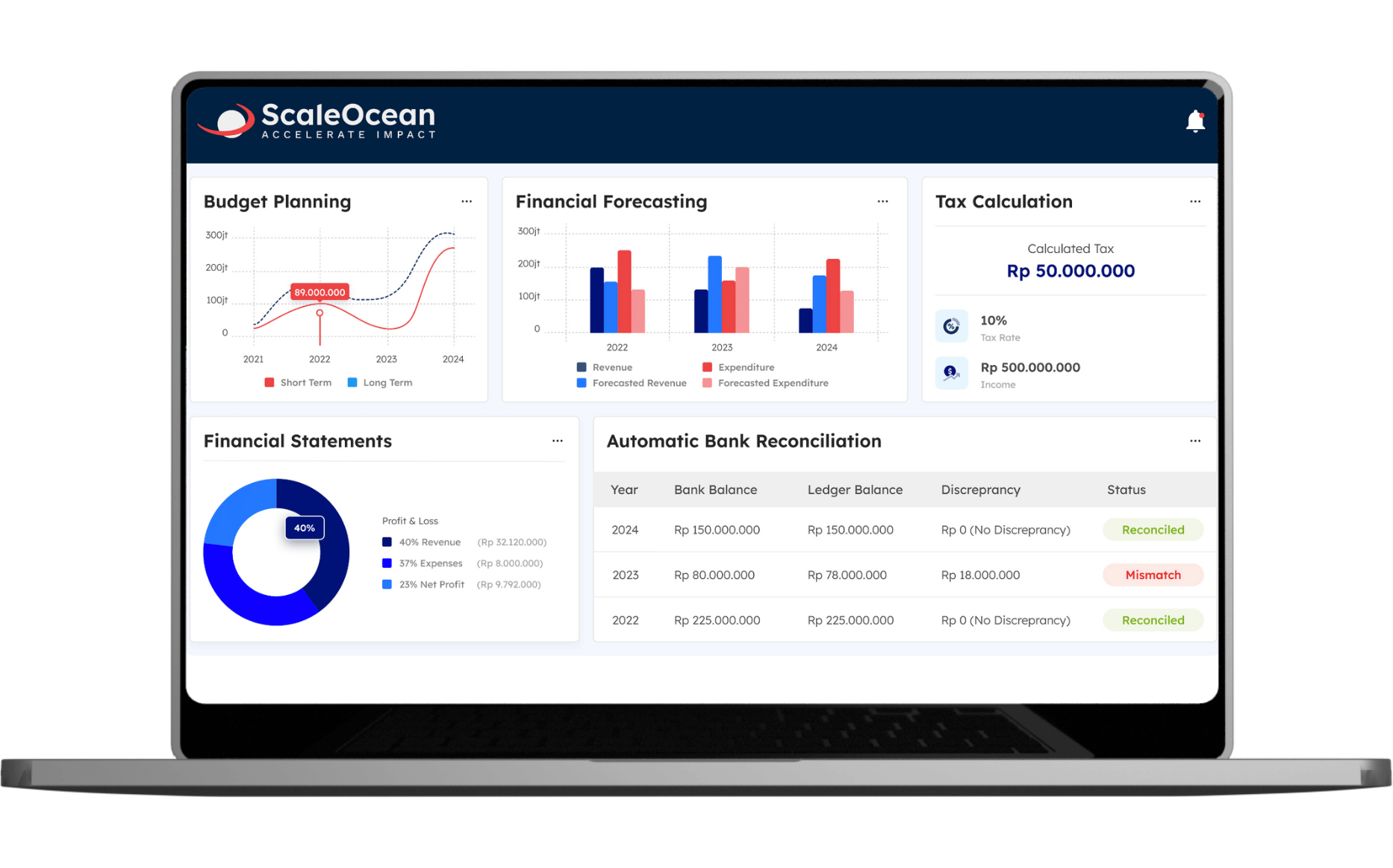

3. Use of Accounting Software Like ScaleOcean

Accounting software, such as ScaleOcean, can help automate and streamline the preparation of financial statements, including the cash flow statement. These software solutions automate operations like data entry, categorization, and report generation, allowing businesses to save time, decrease human error, and ensure more accurate data.

Accounting software provides increased efficiency, real-time financial insights, better cash flow management, and simpler compliance with financial requirements. If you want to discover how it works for your business, ScaleOcean provides a free demo where you can try out its impressive features firsthand. Furthermore, firms may be eligible for the CTC Grant to help with the expense of implementing this software. ScaleOcean’s software includes the following major features:

- Unlimited Users at No Extra Cost: ScaleOcean allows unlimited users without additional charges, supporting business growth.

- All-in-One Solution: Offers over 200 modules, covering a wide range of business needs in one system.

- Industry-Specific Customization: Tailored solutions for various industries like manufacturing, retail, and F&B.

- Business Process Automation: Automates key operations, reducing human error and improving efficiency.

- Flat and Transparent Pricing: Offers clear, cost-effective pricing without hidden fees or surprise costs.

Conclusion

A cash flow statement is critical for ensuring financial transparency, providing stakeholders with a clear picture of a company’s cash position. It enables investors, creditors, and management to evaluate how efficiently a firm generates cash to meet its obligations and fund its activities. This transparency fosters confidence and facilitates informed connections with all parties.

The cash flow statement is crucial for informed decision-making, providing insights into cash inflows and outflows to guide investments, funding, and daily operations. It also aids in business planning, helping companies manage cash and plan for future financial needs to ensure long-term growth. Accounting management software like ScaleOcean further streamlines this process by automating financial statement preparation, ensuring accuracy and timely insights for better financial decisions.

FAQ:

1. What is the cash flow statement?

A cash flow statement is a financial report that tracks the movement of cash into and out of a business over a defined period. It offers a clear picture of a company’s cash management, highlighting its ability to meet short-term liabilities and maintain ongoing operations.

2. What are the three types of cash flow statements?

The three key types of cash flow statements are:

1. Operating Activities: Cash flows that result from the company’s regular business operations, such as sales revenue and payments to suppliers or staff.

2. Investing Activities: Cash flows associated with the acquisition and disposal of long-term assets like property, equipment, or investments.

3. Financing Activities: Cash flows linked to the company’s capital, including borrowing, repaying loans, issuing shares, or paying dividends.

3. How do I calculate a cash flow statement?

To prepare a cash flow statement, begin with the net income shown on the income statement. Adjust for non-cash items like depreciation and changes in working capital, such as changes in receivables and payables. Then, determine cash flows from operating, investing, and financing activities, ensuring to account for both inflows and outflows in each section.

4. What is the purpose of the statement of cash flows?

The statement of cash flows serves to provide a comprehensive view of how cash is generated and used by a business. It is essential for evaluating a company’s liquidity, operational performance, and its capacity to fund future growth or meet financial obligations, offering valuable insights for both management and investors.

PTE LTD..png)

.png)

.png)

.png)

.png)