In Singapore’s competitive market, high operating costs can erode profits and hurt competitiveness. Rent, salaries, utilities, and supplies add up, and without effective management, even rising revenues may not keep a business profitable. Control operating costs wisely to ensure sustainable growth.

High operating costs significantly affect profitability and competitiveness. According to Reuters, Singapore Airlines’ net profit fell 48.5% from April to September 2024, totaling S$742 million. The increase in both gasoline and non-fuel prices contributed significantly to the company’s overall expenditures.

This article will look at the importance of managing operating costs in Singapore’s dynamic market. We will explore several cost-cutting measures that do not compromise quality, as well as ways for firms to improve their financial management processes.

- Operating costs are the daily expenses that a company must pay to carry out its day-to-day operations, such as maintaining and operating a business.

- Calculating operating costs is key to tracking expenses and profitability. They are calculated as: Operating Costs = COGS + Operating Expenses.

- Understanding the types of operating costs, such as fixed, variable, and semi-variable, is key to managing expenses and planning for future growth.

- ScaleOcean accounting software helps businesses streamline cost tracking, automate reporting, and align operations with industry best practices.

What Are Operating Costs?

Operating costs are the daily expenses that a company must pay to carry out its day-to-day operations, such as maintaining and operating a business. These costs are required to produce goods or services and keep the firm running successfully. They typically include rent, utilities, labor, and other administrative costs related to the primary business activity.

Operating costs include both direct and indirect expenses. Direct costs, like raw materials and labor, are tied to production, while indirect costs, such as rent and utilities, support overall business operations. Both are essential for calculating operating income on the income statement.

Understanding running costs is critical to corporate success. Businesses that effectively calculate and manage these costs can make more educated pricing, budgeting, and forecasting decisions. This aids in maintaining profitability, controlling cash flow, and discovering cost-cutting opportunities to improve overall financial performance.

Understand More About Operating Costs

Businesses track both operating and non-operating costs separately. Operating costs cover the daily expenses required to produce goods and run the business, while non-operating costs, such as interest on loans, are accounted for separately, helping businesses evaluate necessary expenses.

The goal of any business is to maximize profits, which are calculated by subtracting expenses from revenue. While increasing revenue boosts profits, rising costs can cut into them. Therefore, businesses often focus on lowering operating expenses, which is usually easier than increasing sales.

However, cutting costs too aggressively can harm a business. For instance, reducing the number of customer service staff may save money short term, but could hurt customer service, leading to lost customers and decreased revenue in the long term, negatively impacting profits.

Key Functions and Importances of Operating Costs in Business

Operating costs are critical for driving important company processes. Businesses that understand these costs can make better judgments, manage their processes, and increase profitability.

Monitoring and managing running costs effectively assists firms in identifying areas for improvement, allocating resources more efficiently, and setting achievable financial goals. As a result, the total business is more stable and grows. Here’s a deeper look into the important functions of operating costs:

1. Financial Planning

Operating costs are a critical component of a company’s financial plan. They provide insight into the daily expenses required to keep the firm functioning properly. Businesses that manage and forecast operating costs can anticipate future expenses and spend resources accordingly. This enables businesses to define realistic financial goals for a business, revise cash flow projections, and avoid overspending.

2. Pricing Strategies

Operating costs are important in defining the appropriate price approach for products or services. When setting prices, a corporation must consider its operating costs, such as labor, supplies, and overhead, to ensure that these expenses are covered while being profitable.

Businesses that fail to account for running costs may underprice their products or services, resulting in losses. Understanding the break-even point helps businesses set prices that cover costs and achieve profitability.

3. Performance Measurement

Operating costs are an important metric for determining a company’s operational efficiency. Businesses that regularly analyze their costs can find areas where they are overpaying or inefficient. If operating expenses are abnormally high, it indicates the need for internal improvements such as process optimization, improved resource allocation, or cost-cutting initiatives.

4. Analyzing Profitability

Operating costs are essential for assessing a company’s profitability. By subtracting these costs from revenue, businesses can determine operating income, a key indicator of financial health. Efficiently managing operating costs directly impacts the bottom line and helps improve profitability.

Reducing operating costs allows businesses to increase their margins and overall profitability. By focusing on controlling these expenses, companies can make more informed pricing decisions and better allocate resources, leading to sustainable financial growth and improved profit margins.

5. Engaging with Investors

For investors, operating costs are a critical factor in evaluating a company’s efficiency and potential for long-term success. A company that effectively manages its operating costs demonstrates its ability to sustain operations and generate consistent profits, which is attractive to investors.

Investors often review operating costs to assess whether a company is well-positioned for growth. By calculating metrics like NPV (Net Present Value), they can determine whether the company’s future cash flows justify its operating expenses and investments.

A strong track record of controlling expenses signals efficient management, while high operating costs may raise concerns about the company’s ability to scale or maintain profitability in the future.

Calculation of Operating Costs

Operating costs are critical for understanding the expenses that a company incurs when running its operations. This computation assists firms in tracking their financial performance and making educated decisions about budgeting and profitability.

Businesses assess operating costs using both the cost of goods sold (COGS) and other operational expenses. Understanding the operating margin calculation helps determine the impact of these costs on profitability. Here is the formula for calculating operating costs:

Operating Costs = Cost of Goods Sold (COGS) + Operating Expenses

Consider the following business expenses: $50,000 in cost of goods sold (COGS), and $30,000 in operating expenses, which include rent, utilities, and payroll. Applying the methodology for operating costs, COGS + running expenses, the total operating costs would be $80,000.

Operating costs fluctuate over time, and it’s important to monitor them over different periods, like monthly, quarterly, or annually. By tracking these costs, you gain valuable insights into your business expenses, helping you make informed decisions for better financial management.

Types of Operating Costs

Operating costs are divided into three categories, with each affecting businesses differently depending on output levels and other factors. Understanding these different categories is critical for effective cost management and financial planning:

1. Fixed Operating Costs

Fixed costs are expenses that remain constant no matter how much a company produces. These costs provide predictability, which is crucial for budgeting and financial planning. They include expenses like rent, salaries, and insurance premiums, which must be paid regularly.

For instance, rent is a fixed cost that a business must pay every month, regardless of how many products it sells. This predictable expense helps companies plan their finances more effectively and maintain stability in operations.

2. Variable Operating Costs

Variable costs are directly tied to production levels. As production increases, these costs grow, and when production decreases, they fall. Examples of variable costs include raw materials, wages for production workers, and packaging costs, which fluctuate with activity levels.

For example, the more products a factory manufactures, the higher its raw material and energy consumption will be. These expenses are flexible and can be adjusted by scaling production up or down, making them easier to manage than fixed costs.

3. Semi-Variable Operating Costs

Semi-variable costs contain both fixed and variable elements. These costs remain constant up to a certain level but rise once that threshold is exceeded. A good example is energy bills, which have a fixed base rate but increase with higher usage levels.

For instance, a business might pay a set fee for electricity each month, but if it uses more energy due to increased production, the bill will rise. Properly managing semi-variable costs requires careful monitoring of usage and staying within the set limits to avoid unexpected increases.

Operating Costs vs. SG&A

SG&A expenses are part of operating costs and cover a company’s management, advertising, sales, and delivery activities. These costs are necessary for running a business but do not include the direct expenses of producing goods or services, like raw materials or labor.

Operating costs, which include both SG&A and the cost of goods sold (COGS), are essential for calculating a company’s profitability. Effective management of operating costs ensures a business can sustain operations while maintaining financial stability, covering everything from rent to production costs.

How to Calculate Operating Costs

Calculating running costs is critical for any organization to track expenses and stay financially healthy. A detailed grasp of these costs enables organizations to make better educated decisions about budgeting, pricing, and financial planning. Incorporating Cost-Benefit Analysis (CBA) into this process helps businesses assess the potential benefits of cost reduction strategies and optimize resource allocation.

1. Step-by-Step Guide

To properly manage their finances, firms must have a clear and methodical approach to estimating operating costs. Businesses that break down the process into basic steps may effectively manage their spending, assess their financial health, and make well-informed decisions. Here’s a detailed step-by-step approach for calculating your running costs.

a. Identify Fixed Costs

The first step in estimating operating expenses is to determine fixed costs. These are costs that stay constant regardless of manufacturing volume. Examples include rent, salary, insurance, and other recurring expenses that do not change in response to business activity. These expenses are generally easy to estimate and budget for.

b. Identify Variable Costs

Next, identify variable costs, which vary with production or company activity. These expenses often include raw materials, utility bills, shipping fees, and commissions. Variable expenses rise or fall in direct proportion to how much you produce or sell, making them an important metric to track.

c. Add Semi-Variable Costs

Semi-variable costs have both fixed and variable components. For example, power bills may include both a fixed base rate and a variable cost based on usage. It is critical to consider these charges in order to gain a thorough knowledge of total operational expenses and to calculate overhead costs accurately when factoring these in.

d. Summing These Costs

Once you’ve identified all fixed, variable, and semi-variable costs, add them together to determine the overall operating costs. This gives you a realistic picture of how much it costs to run your firm and serves as a foundation for financial planning.

2. Tools and Resources

Accounting software Singapore, like ScaleOcean, can help organizations streamline the process. These technologies automatically track, categorize, and manage all expenses, resulting in accurate and up-to-date calculations.

Accounting software allows firms to minimize human errors, increase productivity, and obtain real-time insights into their financial health, resulting in a faster and more reliable cost calculation process.

Example of Operating Costs

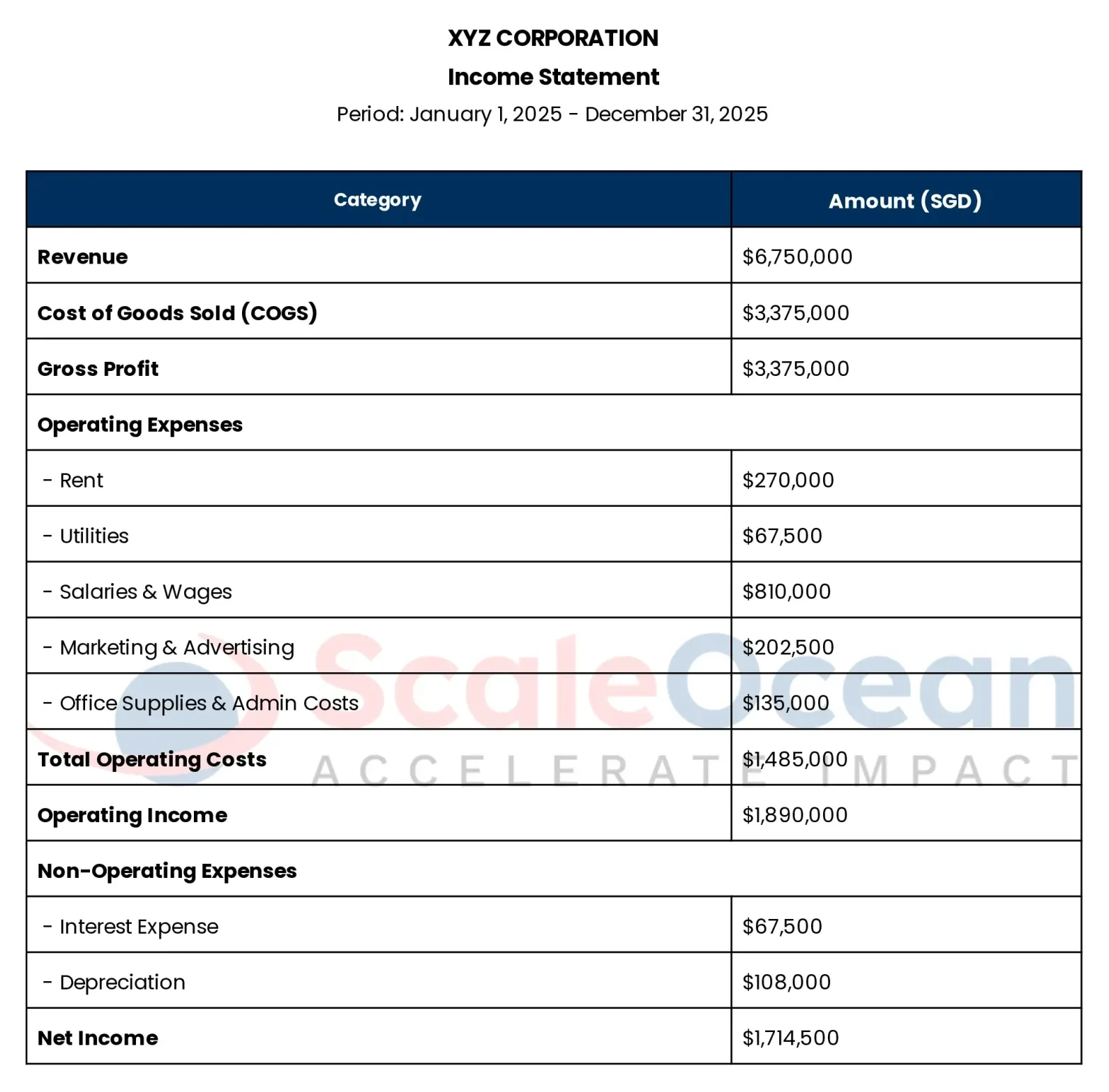

Operating costs are essential for any business to track as they reflect the daily expenses necessary for production and operations. These costs include rent, utilities, salaries, and other administrative expenses, all of which directly impact profitability. Below is a sample income statement for XYZ Corporation:

The income statement for XYZ Corporation outlines total operating costs of $1,485,000. This includes $270,000 for rent, $67,500 for utilities, $810,000 for salaries, $202,500 for marketing, and $135,000 for office supplies. These costs are essential for daily operations.

These operating costs support the company’s core activities, like production, marketing, and administration. By managing them effectively, XYZ Corporation ensures efficient operations and profitability. Monitoring costs helps identify savings and optimize financial performance.

Distinguishing Operating Costs from Other Expenses

It is critical to separate operating expenditures from other sorts of expenses that a company may incur. While operating expenditures are required for the day-to-day operation of the firm, other expenses may relate to long-term investments or activities that are not directly involved in core operations. Understanding these disparities allows organizations to better manage their budgets and allocate resources.

1. Capital Expenditures (CapEx)

Capital expenditures (CapEx) are investments in long-term assets like machinery or buildings, aimed at generating value over time. Unlike operating costs, which are recurring, CapEx focuses on acquiring or improving assets for future benefit. According to The Times, major tech companies are investing $340 billion in AI, driving innovation but raising concerns about a potential financial downturn.

2. Non-Operating Expenses

Non-operating expenses are expenses that are not directly related to the fundamental business operations. Examples include loan interest payments, investment losses, and non-core operation expenses. While these expenditures have an impact on the company’s financial health, they are not the same as operating costs, which are required to keep operations running.

3. Fixed Expenses

Fixed expenses are operating costs that do not change over time, regardless of business activity level. Rent, insurance, and salaried employee compensation are examples of non-variable expenses. Even if business activity declines, fixed expenses stay constant, making them predictable and easier to plan for.

Limitations of Operating Costs

While operating costs are necessary for understanding the ongoing expenses associated with running a firm, they do not provide a complete picture of a company’s financial situation. These expenditures are largely concerned with day-to-day operations; however, other financial considerations, such as non-cash expenses and non-operating items, also play an important part in determining overall profitability and financial health. Recognizing these limits is critical to conducting a thorough financial analysis.

1. Non-Cash Expenses

Depreciation and other non-cash expenses are not included in operating costs. Depreciation is the loss in the value of assets over time, yet it does not result in a direct cash outflow. Although it reduces taxable income, it has no direct influence on cash flow, making it important to include it when analyzing a company’s overall financial health.

2. Exclusion of Non-Operating Items

Non-operating expenses, such as interest and investment losses, are excluded from operating costs. These costs, while vital to the company’s financial performance, are not part of the main business operations. As a result, operating costs may not accurately reflect a company’s overall financial picture, especially if non-operating expenses are high.

How Do Operating Costs Affect Profit?

High operating costs have a substantial impact on a company’s profit margins. When operating expenses consume a greater portion of revenue, the amount left for profit decreases. To be profitable, firms must carefully manage and control their costs, ensuring that their expenses do not exceed their revenue. Tracking financial metric types is essential for assessing cost efficiency and profitability, helping businesses make informed decisions to maintain their margins while improving their financial performance.

Operating costs also play an important part in determining the break-even point, which is the amount of revenue required to cover all operating expenses. Understanding total operating costs allows firms to assess how much income is required to avoid losses. This study aids in the development of sales targets and price strategies, guaranteeing that the company can cover its costs and begin to generate profits. Additionally, evaluating opportunity cost helps businesses determine whether their resources are being used most effectively to maximize returns.

10 Strategies to Reduce Operating Costs

Reducing operating costs is critical to increasing profitability and sustaining financial health. Businesses can streamline processes and eliminate unnecessary costs by employing effective tactics that do not sacrifice quality or service. Here are some techniques for reducing operating costs:

1. Process Optimization

Streamlining procedures and eliminating inefficiencies can significantly save costs. Simplifying workflows and automating operations saves time and reduces errors. This results in more efficient resource utilization and improved overall performance. Standard costing plays a key role in this process by helping businesses set cost benchmarks and identify areas where optimization can lead to savings. Process optimization also promotes a culture of continual improvement, motivating teams to devise new ways to save costs and increase production.

2. Energy Efficiency

Implementing energy-saving measures, such as using LED lighting or upgrading HVAC systems, can help reduce power expenditures. Small modifications, such as turning off equipment while not in use, can help to minimize energy use. These measures help to save costs while also promoting environmental sustainability.

3. Outsourcing

Outsourcing non-core tasks such as customer service or IT support may result in cost reductions. This allows enterprises to focus on their core duties while harnessing the expertise of specialized firms. Outsourcing also minimizes the requirement for in-house workers and their associated costs. Furthermore, it gives enterprises flexibility by letting them scale services up or down as needed.

4. Technology Integration

Adopting automation and smart software solutions can help reduce manual labor. A cloud accounting system and data analytics improve decision-making and operational efficiencies. Technology integration can also help to increase communication efficiency and reduce delays. It also allows for real-time tracking and monitoring, which gives businesses more visibility into their operations.

5. Inventory Management

Optimizing inventory levels ensures that firms only keep what they need, lowering storage and handling expenses. Implementing just-in-time inventory or demand projections can help to prevent overstocking and understocking. This improves cash flow while minimizing waste. Furthermore, it enables organizations to better allocate resources, enhance cost control, and adapt swiftly to market developments.

6. Negotiate with Suppliers

Negotiating better pricing and payment terms with suppliers helps to lower purchase costs. Establishing long-term relationships through mechanisms like a blanket order often results in savings or favorable conditions. Regularly monitoring supplier contracts ensures that the company receives the best value. Furthermore, evaluating multiple suppliers can assist in uncovering the most cost-effective solutions for the company.

7. Employee Training

Employee training boosts productivity while reducing errors, which can lead to costly mistakes. Employees who have been properly trained are more productive and require less monitoring. This improves overall business performance and lowers operating costs. Furthermore, well-trained individuals have better confidence in their responsibilities, which leads to increased job satisfaction and retention.

8. Preventive Maintenance

Regular maintenance of equipment and machinery can help to prevent costly failures and repairs. Scheduled maintenance increases asset life and decreases downtime. This reduces unforeseen costs and ensures seamless operations. Preventive maintenance also helps to spot potential problems early on, allowing for prompt repairs before they become severe difficulties.

9. Telecommuting

Allowing employees to work remotely can help to save money on office space and utilities like power and water. Telecommuting also lowers transportation costs and allows employees more flexibility. This decreases costs while increasing employee satisfaction. Furthermore, it can help organizations attract and keep top personnel by providing more flexible working arrangements.

10. Review Subscriptions

Regularly reviewing and deleting unnecessary or redundant memberships can significantly save expenditures. Businesses frequently overlook subscriptions that are no longer necessary. Regular audits guarantee that only necessary services are paid for, resulting in lower expenses. Furthermore, combining services or opting for bundled packages can result in additional savings.

Optimize Your Operating Cost Management with ScaleOcean Accounting Software

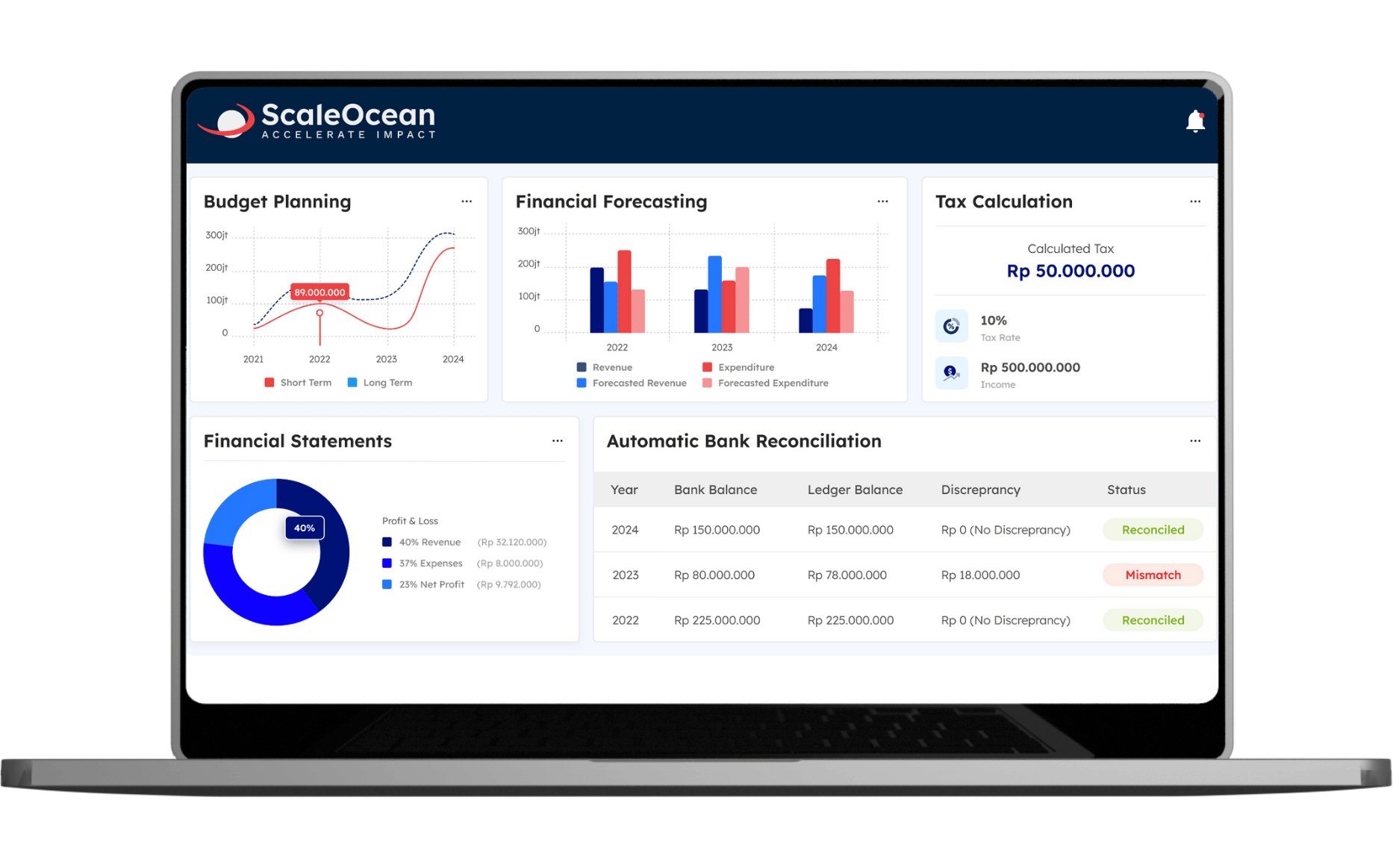

ScaleOcean accounting software provides sophisticated automation capabilities that dramatically improve business operations, particularly in terms of cost management and reporting.

ScaleOcean automates these operations, reducing manual oversight, saving time, and decreasing errors. This not only improves operational efficiency but also helps organizations to concentrate on their core activities while maintaining accurate, real-time financial data.

ScaleOcean delivers value by integrating seamlessly and aligning operations to fit the individual needs of each firm. It improves efficiency and streamlines operations by offering a wide range of features. Companies in Singapore can also benefit from the CTC grant, which helps support the implementation of digital solutions such as ERP systems.

The following are the main unique characteristics of ScaleOcean software that make it the best solution for your business:

- Auto-pilot All Business Operations: ScaleOcean automates processes like cost tracking and reporting, reducing the need for manual oversight.

- All-in-One Solution – Complete Modules According to Your Needs: With access to over 200 modules, ScaleOcean provides a comprehensive solution to manage all aspects of business operations, including real-time financial tracking.

- Built from Best Business & Industry Practices: ScaleOcean is designed based on industry best practices, ensuring that automation of cost tracking and reporting aligns with operational efficiency.

- Customizable to Your Company’s Needs: ScaleOcean offers customizable dashboards and smart configurations to align departments with key metrics for tailored cost tracking and reporting.

Conclusion

Understanding and managing operating costs is critical to the profitability and sustainability of any firm. Proper spending tracking and control enable firms to make more informed decisions, optimize operations, and increase profitability. Businesses can overcome financial issues and lay the groundwork for long-term growth by managing costs effectively.

Consider using the ideas presented to improve your financial management and operational efficiency. ScaleOcean’s accounting software can help automate cost tracking and reporting, revealing critical information about your company’s financial health. Try a free demo of ScaleOcean today to see how our software can help your business grow and run more efficiently.

FAQ:

1. What are examples of operating expenses?

Operating expenses are the costs businesses need to cover to keep things running daily. These include rent, utilities, employee salaries, office supplies, marketing efforts, insurance, and maintenance. These expenses are essential for smooth day-to-day operations and long-term success.

2. What are the 4 levels of cost?

There are four types of costs such as fixed costs that stay the same, variable costs that change with production, semi-variable costs that combine both fixed and variable elements, and step costs, which increase when production hits specific milestones. Each plays a role in managing expenses.

3. What is a good operating cost ratio?

A healthy operating cost ratio typically falls between 60% to 80%, depending on your industry. A lower ratio means you’re effectively managing costs and improving profits. The ideal figure can differ based on factors like company size and market environment, but lower is usually better.

4. What is another name for operating costs?

Operating costs are often referred to as operating expenses (OPEX) or selling, general, and administrative expenses (SG&A). These are the regular costs necessary for running a business day-to-day, like utilities, rent, and employee wages. They’re crucial for understanding your company’s financial health and efficiency.

PTE LTD..png)

.png)

.png)

.png)

.png)