Net Present Value (NPV) is a financial metric used to assess investment profitability by calculating the present value of future cash flows, considering the time value of money. It compares the initial investment to discounted future profits.

According to MOF Singapore, advanced countries spend about 2% of their GDP on debt servicing, highlighting the importance of investments that generate sufficient returns to cover both initial costs and future financial obligations.

In decision-making, NPV is a critical instrument for determining project viability. It allows organizations to prioritize investments with the best prospective returns, ensuring that resources are deployed efficiently. Companies that calculate NPV may reliably select which initiatives are worth pursuing and which should be reconsidered.

So, in this article, we will cover what Net Present Value (NPV) is, how to calculate it using its formula, and provide examples to help you understand its practical application. Let’s dive in and explore how NPV can guide your investment decisions.

- Net Present Value (NPV) helps assess investments by comparing future returns to costs, factoring in the time value of money. A positive NPV indicates a profitable investment.

- The NPV formula (NPV = Cash flow / (1 + i)t – Initial investment) is key to determining whether future cash flows justify the initial cost of a project.

- Calculating NPV involves the NPV of the Initial Investment, NPV of Future Cash Flows, selecting a discount rate, and Full Calculation of Present Value to determine whether the NPV is positive or negative.

- Accounting software like ScaleOcean simplifies NPV calculations, enhancing accuracy and real-time data integration for better-informed investment decisions.

What is Net Present Value (NPV)?

Net Present Value (NPV) is a way of calculating the value of all future cash flows, both positive and negative, by bringing them back to their present value. It’s a key tool used in finance and accounting to determine how profitable an investment might be.

This approach is essential for figuring out the worth of various financial opportunities, such as businesses, investment securities, capital projects, and new ventures. It’s especially helpful for evaluating any project that involves cash flow, including cost-saving initiatives and long-term investments.

NPV allows businesses to make smarter decisions by providing a clearer understanding of an investment’s true value. By factoring in the time value of money, companies can better assess profitability and prioritize investments with the highest potential return.

Net Present Value (NPV) Formula

Understanding the Net Present Value (NPV) formula is critical in financial analysis for assessing investment opportunities. It assists firms in determining whether a project will add more value than its operating costs. This formula is an important tool for directing investment decisions since it takes into consideration the time value of money.

Here’s the NPV formula if there’s one cash flow from a project that will be paid one year from now:

NPV = Cash flow / (1 + i)t – Initial investment

Here are the detailed explanations of the formula:

- “i”: The discount rate (interest rate) applied to future cash flows.

- “t”: The time period (usually years) for which the discount rate is applied.

Here’s the NPV formula if you are analyzing a longer-term project with multiple cash flows:

NPV = ∑t=0n Rt / (1 + i)t

Here are the detailed explanations of the formula:

- “∑”: Summation symbol, representing the total of all cash flows over time.

- “t=0”: The starting time period, typically the present.

- “n”: The final time period in the calculation.

- “Rt”: Cash flow at time period t.

- “i”: Discount rate, reflecting the time value of money.

- “t”: The time period in which the cash flow occurs.

Example of NPV Calculation

Let’s consider a scenario where a business has the option to invest $500,000 in a new project expected to generate $10,000 monthly for four years. Alternatively, the business could place the same amount in real estate, with an expected return of 5% annually. The risks associated with both options are considered equivalent.

There are two key steps in calculating the NPV of the project:

Step 1: NPV of the Initial Investment

The investment in the project is made upfront, so this is the first cash flow to include in the calculation. Since it’s paid immediately, there’s no need to discount the $500,000 spent at the start of the investment.

Step 2: NPV of Future Cash Flows

In this step, you calculate the value of future cash flows by identifying the number of periods and the discount rate. Future cash flows are adjusted to reflect their value in today’s terms, considering the time value of money.

Here’s how to break it down:

- Identify the number of periods (t): The project will provide monthly cash flows for four years, which equals 48 periods (4 years × 12 months).

- Identify the discount rate (i): The alternative investment in real estate yields a 5% annual return. To account for monthly cash flows, the annual discount rate needs to be converted into a monthly compound rate. Using the formula, the monthly compound rate is approximately 0.407%.

Formula:

Periodic Rate = ((1 + 0.05)^(1/12)) – 1 = 0.407%

Assuming the monthly payments are made at the end of each month, the first cash flow happens one month after the project starts. These future cash flows must be adjusted for the time value of money. This can easily be done using a calculator or spreadsheet.

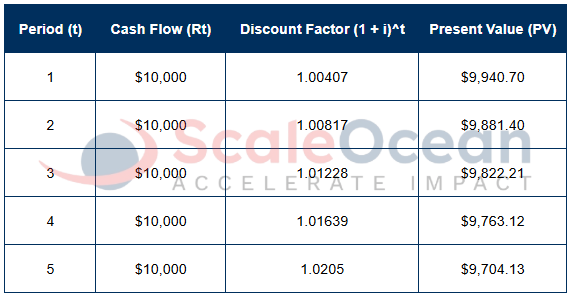

Here’s the table illustrating the first five payments based on the calculated periodic rate of 0.407%:

Full Calculation of Present Value

The full calculation involves adding up the present values of all 48 monthly cash flows, adjusted by the 0.407% monthly discount rate. Assuming the cash flows happen at the end of each month, the present value of each cash flow is calculated and summed.

The NPV formula can be expressed as:

NPV = -$500,000 + ∑(t=1 to 48) (10,000 / (1 + 0.00407)^t)

This formula sums the present value of each monthly cash flow over the 48 periods, discounted to the present.

In this case, the NPV is positive, indicating that the project will generate more value than its initial cost. If the NPV had been negative, it would mean the investment wasn’t worth pursuing. This shows that, based on this calculation, the project is a good investment.

How to Calculate Net Present Value (NPV) Using Excel

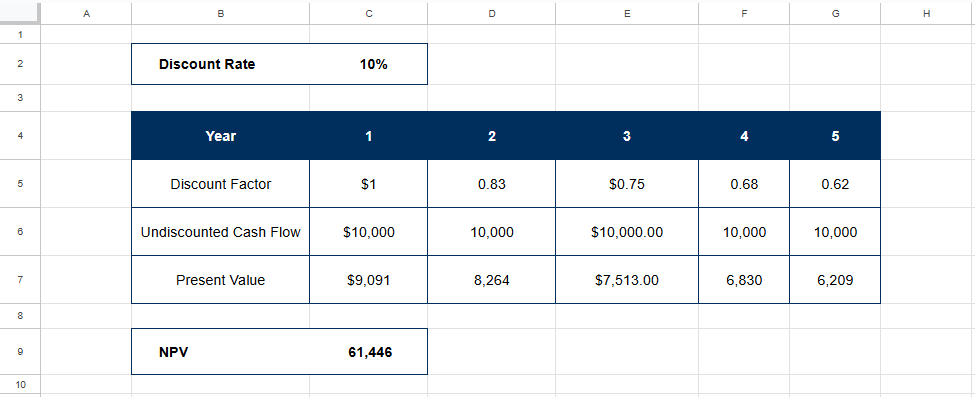

Calculating Net Present Value (NPV) using Excel is a straightforward process that helps businesses assess the profitability of investments. By applying a discount rate to future cash flows, NPV allows for a comparison of expected returns against initial costs.

Here’s how to calculate NPV using Excel with the example provided in the table below:

To calculate the NPV in Excel, start by applying the discount factor for each year’s cash flow. For Year 1, multiply the Undiscounted Cash Flow ($10,000) by the Discount Factor (0.91). Use the formula = C6 × C5, adjusting cell references for each year.

Once the present values are calculated, Excel will show them in the corresponding cells. Each year’s present value will reflect the cash flow discounted to today’s terms, considering the discount factor for each period in the investment’s timeline.

To find the total NPV, sum the present values for each year. Use the formula = NPV (B2, C7 / F7), where B2 contains the discount rate (10%), and C7:F7 contains the calculated present values. This gives you the total NPV, $61,446.

What is the Purpose of NPV?

Net Present Value (NPV) helps businesses figure out if an investment is worth it by comparing the present value of expected future cash flows with the initial cost. It’s a great way to see if a project will add value and generate profits in the long run.

NPV is essential for making smart decisions when evaluating new projects, mergers, or acquisitions. It gives businesses a clear picture of whether the potential returns are worth the costs, helping to prioritize the best opportunities.

NPV also takes the time value of money into account, making sure that future cash flows are properly adjusted. By considering the cost of capital and potential risks, NPV offers a realistic view of how successful an investment might be.

Negative vs Positive NPV

A positive NPV shows that the rewards on an investment exceed its costs. This indicates that the project or investment is projected to generate value over time. With this outcome, corporations should proceed with the investment to optimize profits. The positive NPV shows that the project will generate wealth for the company.

A negative net present value (NPV) indicates that the investment’s costs will surpass its rewards. This outcome frequently indicates that the project will incur a financial loss. In these circumstances, businesses should reconsider or even refuse the investment. The negative NPV emphasizes the risk of wasting resources.

Applications of NPV

Business decision-makers use Net Present Value (NPV) as a versatile measure to assess project profitability and financial sustainability. By evaluating NPV alongside key financial metrics, Businesses can calculate the present value of future cash flows to see whether their investments will yield sufficient returns.

Here are some of the primary applications of NPV in various business scenarios:

Capital Projects

In capital-intensive sectors, net present value (NPV) helps evaluate large investments like infrastructure or expansion projects by comparing long-term profits to high initial costs. It ensures businesses make informed decisions before committing to expensive projects.

According to IRAS, for assets acquired during the Years of Assessment (YAs) 2021, 2022, and 2024, companies have the option to write off the cost over two years, which can improve the financial evaluation and NPV of these projects.

Mergers and Acquisitions

When a corporation considers purchasing another business, net present value (NPV) is critical in determining the target company’s potential value. The calculation of NPV enables the acquiring business to forecast future cash flows from the purchase and compare them against the acquisition cost.

This helps to determine whether the merger or acquisition is financially beneficial and is an essential part of business capital budgeting, ensuring that investments align with long-term strategic goals.

New Product Development

Before introducing a new product line or service, firms utilize NPV to estimate the projected return on investment. The technique assesses prospective future sales and earnings, adjusted for current value, to assist firms in determining if a product development project would provide adequate value.

It enables businesses to determine whether the development expenses are worth the predicted cash streams.

Cost-Cutting Initiatives

NPV is also useful for determining the financial advantages of cost-cutting strategies within a corporation. Businesses can determine their current worth by estimating the future savings generated by these activities.

Utilizing financial software for business allows for more efficient tracking and analysis of cost-saving measures, ensuring that the savings are genuinely advantageous in the long run.

NPV vs Payback Period and IRR

The payback period measures how long it takes to repay the initial investment without taking into account the time value of money. Businesses commonly use it as a simple strategy in fast assessments. However, this statistic lacks depth because it does not account for future cash flows beyond the payback period or the time value of money.

IRR is the discount rate at which a project’s net present value (NPV) equals zero. It provides the estimated % return on an investment. The operating margin is often considered in the calculation of IRR as it reflects the company’s operational efficiency and profitability, which directly impacts the overall return on investment.

While the payback period is a straightforward measure of investment recovery, the net present value (NPV) gives a more thorough analysis by taking into account the time value of money and cash flows throughout the full investment life.

In contrast, IRR is a rate of return that does not directly evaluate profitability in monetary terms. NPV continues to be the most practical and comprehensive technique for determining a project’s overall financial viability.

Drawbacks of NPV

While NPV is an effective financial tool, it has some limits that organizations must consider. The accuracy of NPV depends greatly on the assumptions used during the calculation procedure. Understanding the potential downsides of any strategy aids in making more informed selections.

The following are some main issues that firms confront while employing NPV.

Requires Accurate Cash Flow Projections

Accurate cash flow projections are necessary when determining the net present value. However, forecasting future inflows and outflows is difficult due to market volatility.

A little inaccuracy in these projections can result in a substantial NPV underestimation. Businesses must rely on solid data and extensive analysis to mitigate this risk.

Sensitive to Discount Rate

The discount rate used in calculations can have a significant influence on the outcome. Even a modest adjustment in the discount rate can affect whether the result becomes positive or negative.

Selecting the appropriate discount rate is crucial, and businesses must carefully consider their cost of capital or required rate of return. Misjudging this rate can result in poor investment decisions.

Complex for Multi-Stage Projects

Calculating NPV for large or multi-stage projects can be complex and time-consuming. These projects frequently require many cash flows over several years, which can be difficult to forecast.

The model’s complexity increases as we adjust it for different stages and dangers. It calls for a thorough analysis of each phase’s possible impact on the entire investment.

How to Calculate NPV More Easily with Accounting Software

ScaleOcean accounting software can greatly automate NPV calculations, reducing manual errors and assuring more accurate results. Businesses that streamline the NPV calculation process can gain instant access to real-time financial data, tailor inputs, and simply adjust discount rates.

Software integration improves cash flow estimates and provides up-to-date financial measures, increasing the accuracy of investment decisions.

Learn how ScaleOcean can help you calculate NPV faster and more precisely, allowing your company to make more educated decisions. ScaleOcean’s free demo and access to the CTC grant allow you to see firsthand how the program simplifies financial analysis.

The ScaleOcean program has several essential characteristics, which are listed below:

- Automated Financial Analysis and Reporting: automates financial reports, ensuring quick, accurate insights for better investment decisions.

- Real-Time Cash Flow Tracking: tracks cash flow in real-time, providing businesses with up-to-date financial data for informed decisions.

- Seamless Integration for NPV Calculation: integrates financial data, simplifying NPV calculations and improving investment decision accuracy.

- Cash Flow Forecasting: automatically forecasts cash flow, helping businesses plan for future investments and operational needs.

- Comprehensive Financial Reporting with Customization: offers customizable financial reports to track performance and enhance strategic financial analysis.

Conclusion

NPV is an important metric for analyzing investment prospects since it provides a clear indication of profitability. It assists firms in determining if a project’s future cash flows justify the initial investment, making it critical for sound financial decision-making.

As a thorough financial analysis tool, NPV allows organizations to maximize their investment strategy. For a more streamlined approach to NPV calculations, look at ScaleOcean’s accounting software, which is meant to simplify financial analysis and increase overall decision-making efficiency.

FAQ:

1. What does the NPV tell you?

NPV helps determine if an investment is worthwhile by comparing the expected returns with the initial investment. A positive NPV indicates the project will be profitable, while a negative NPV signals a potential loss, guiding businesses in their decision-making process.

2. What is better, NPV or IRR?

NPV is often preferred over IRR as it provides a tangible monetary value for an investment’s profitability. While IRR offers a percentage return, NPV considers the time value of money and gives a clearer understanding of how much value the project will add.

3. What is the NPV of 10,000 at 7%?

To calculate the NPV of S$10,000 at a 7% discount rate for one year, the formula is 10,000 / (1 + 0.07), resulting in S$9,345. For multiple years, each year’s cash flow is discounted to present value and summed up for the total NPV.

4. Is a higher or lower NPV better?

A higher NPV is preferable as it indicates that the investment’s returns exceed its costs, making it a more profitable choice. Conversely, a lower or negative NPV means the project may not provide sufficient returns, suggesting it should be reconsidered or avoided.

PTE LTD..png)

.png)

.png)

.png)

.png)