In Singapore, the preparation of an accurate balance sheet is not merely a matter of financial prudence but also a legal obligation. The Accounting and Corporate Regulatory Authority (ACRA) mandates that all companies submit annual financial statements, including balance sheets, to ensure transparency and uphold financial integrity.

Non-compliance with these requirements can lead to significant penalties, as outlined by ACRA’s penalty framework. According to ACRA, companies that fail to file their financial statements on time can face fines, with late fees starting at $300 for submissions made within three months of the deadline and increasing to $600 for those filed after more than three months.

Furthermore, recent research from Fidelity International highlighted the prospect of a ‘balance sheet recession,’ where a global focus on deleveraging could impact economic growth. For businesses in Singapore, this backdrop underscores the critical importance of having a strong and well-managed balance sheet. An accurate balance sheet is not only a tool for understanding a company’s financial standing but also a key to successfully navigating potential economic headwinds.

Understanding and accurately preparing balance sheets are crucial for businesses to comply with regulatory standards and avoid such penalties. This article will delve into the importance of balance sheets, explore the consequences of non-compliance, and discuss how tools like accounting software can assist businesses in maintaining accurate financial records.

- A balance sheet is a key financial statement that details a company’s assets, liabilities, and equity, helping businesses assess their financial health and stability.

- How to read and analyzing balance sheets involves using financial ratios like debt-to-equity and current ratios to assess liquidity, solvency, and operational efficiency.

- Limitations of the balance sheet include its snapshot nature, reliance on historical cost, and inability to capture intangible assets or cash flow dynamics, requiring complementary data.

- ScaleOcean accounting software is an all-in-one solution that automates balance sheet creation, integrates real-time data, and provides AI-powered insights for better financial decision-making.

What Is A Balance Sheet?

A balance sheet is a statement of financial position that shows what a company owns (assets), owes (liabilities), and what’s left for the owners (equity) at a specific point in time. It helps business owners and investors understand how a company is financed through debt, equity, or both.

Beyond just tracking numbers, the balance sheet format also reveals how efficiently a business is managing its resources. Unlike other reports that cover a period, the balance sheet reflects a company’s financial position right now.

Components of A Balance Sheet

The structure of the balance sheet is typically divided into three main sections such as assets, liabilities, and equity. A balance sheet is built on a simple formula: Assets = Liabilities + Equity. This equation serves as the foundation for understanding a company’s financial position, showing how its resources are funded. Each component plays a key role in showing a business’s health, from daily operations to long-term stability.

1. Assets

Assets are everything a company owns that holds value and can support business operations. They are divided into current assets such as cash, accounts receivable, and inventory that are expected to be used or converted into cash within a year. And non-current assets like equipment, property, or long-term investments that support the business over time. The concept of double entry accounting ensures that these assets are accurately recorded.

2. Liabilities

Liabilities are the financial obligations a company has to external parties, such as suppliers, lenders, or employees. Current liabilities include debts due within a year, like accounts payable, short-term loans, or unpaid salaries, and are often recorded using accrual accounting to match expenses with the correct period.

Meanwhile, non-current liabilities refer to longer-term commitments such as bonds payable or mortgages. Understanding liabilities helps reveal how much risk a company carries and how dependent it is on external financing.

3. Equity

Equity is what’s left for the owners after all liabilities are subtracted from the company’s assets. It includes items such as common stock, retained earnings, and additional paid-in capital. This number essentially reflects the true value that belongs to shareholders. Salvage value in business plays a role in this, as the estimated value of assets at the end of their useful life can affect the overall equity value. Equity grows as the business generates profit and reinvests it, making it a key indicator of long-term sustainability.

How The Balance Sheet Works

The balance sheet sample presents a company’s financial position at a specific point in time, showing the value of its assets, liabilities, and equity. However, it does not reflect financial performance or trends over a longer period.

To gain accurate insights, you should compare balance sheets from previous periods, which can be done easily by referencing the general ledger for detailed financial data.

For example, if a company’s cash reserves appear strong this month but were significantly higher three months ago, it could signal rising expenses or poor cash flow. In this way, the statement of financial position becomes a critical tool for evaluating business stability, planning growth strategies, and making informed financial decisions.

Balance Sheet Example

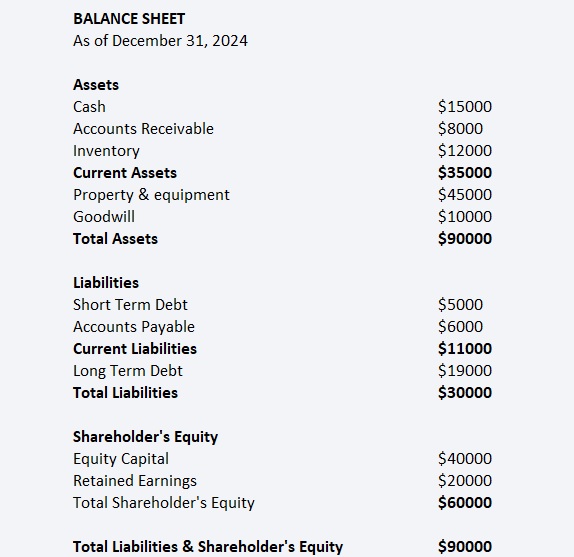

Below is a balance sheet example for a company as of December 31, 2024. This report provides an overview of the company’s assets, liabilities, and equity, offering insight into its financial reporting, health, and stability.

This balance sheet example provides a clear view of the company’s financial standing as of December 31, 2024. With $90,000 in total assets, the business has $35,000 in current assets that can easily be converted into cash, which is crucial for day-to-day operations and covering short-term liabilities.

Companies should understand how these figures are recorded is a key part of bookkeeping and accounting, helping businesses maintain accurate financial records.

The $45,000 in property and equipment represents the company’s long-term investments that help support its operations. On the liabilities side, the company has $30,000 in total liabilities, with $11,000 being due in the short term, meaning the company needs to ensure sufficient liquidity to meet these obligations.

The $60,000 in shareholders’ equity indicates the company’s strong financial foundation, with enough capital to support growth and absorb potential financial shocks. In practice, this balance sheet example shows the company’s ability to meet its immediate obligations while also providing a solid base for future investments or expansion.

How to Read and Analyze The Balance Sheet

When reading and analyzing a balance sheet, one of the most insightful methods is financial ratio analysis. This involves using specific formulas to assess a company’s performance and financial health. Key ratios like the debt-to-equity (D/E) ratio help business owners and investors understand how much debt the company is using about equity. A higher D/E ratio may indicate higher risk, suggesting the company relies more on borrowing than equity financing.

Break even point analysis can complement your financial review by helping you understand the minimum sales volume needed to cover costs, linking operational performance to financial position. Now, let’s break down how financial ratios can be used to analyze a previous balance sheet.

D/E Ratio = Total Liabilities / Shareholder’s Equity = $30,000 / $60,000 = 0.5

This means that for every dollar of equity, the company has 50 cents of debt. A lower D/E ratio generally indicates less risk, as the company is less reliant on borrowing to finance its operations.

Other ratios, such as the current ratio and quick ratio, focus on liquidity, showing the company’s ability to meet short-term obligations with current assets. These ratios offer insight into the company’s operational efficiency and its ability to convert assets into cash when necessary.

Using the balance sheet, we have:

Current Ratio = $35,000 / $11,000 = 3.18

A current ratio of 3.18 suggests the company has more than enough short-term assets to cover its short-term liabilities, indicating strong liquidity.

These ratios provide valuable insights into how well the company manages debt and liquidity. However, keep in mind that some ratios, like profitability ratios, will require information from other financial statements, such as the income statement. By comparing these ratios to industry standards or past performance, business owners can make more informed decisions, whether it’s for securing financing, budgeting, or strategic planning.

Usage of the Balance Sheet in Financial Modeling

In financial modeling, the balance sheet sample plays a vital role in creating a complete and accurate picture of a company’s financial health. It serves as the foundation for forecasting future performance, as key figures like working capital, fixed assets, and equity help define how a business might grow or require financing. Without this foundation, your projections risk becoming assumptions rather than informed estimates.

Think about how your business plans to grow. Will you need more inventory, hire additional staff, or invest in new equipment? Each of these decisions affects the balance sheet, and financial ERP software allows you to simulate these changes within a comprehensive financial model. For example, an increase in projected sales might raise accounts receivable and inventory levels, which in turn affects cash flow and funding needs. A well-structured model ensures that your growth strategy remains realistic and financially sound.

Additionally, this report is crucial in evaluating financial ratios employed in models, including financial leverage, debt-to-equity, return on assets, and current ratio. These ratios not only help evaluate business efficiency and solvency but also allow stakeholders to benchmark performance against industry standards.

Linking The Balance Sheet to Other Financial Statements

A balance sheet does not stand alone in a financial model. It is deeply connected to other financial statements, providing a complete picture of a company’s performance. Understanding how this report links to the profit and loss (P&L) statement, cash flow statement, and the three-statement model is crucial for making informed financial decisions.

1. Income Statement

The income statement reflects a company’s profitability over a period, showing revenues, expenses, and net income. The balance sheet connects with the income statement through net income. This relationship helps business owners track how profits from the income statement impact their overall financial position and increase equity. For example, higher profits lead to higher retained earnings, directly influencing the balance sheet’s equity section.

2. Cash Flow Statement

The cash flow statement shows the movement of cash in and out of the business, detailing operating, investing, and financing activities. For a clearer understanding, a cash flow statement example can illustrate how these activities are represented. The link between the cash flow statement and the balance sheet lies in cash changes, which affect the “cash” line under assets. When analyzing a company’s cash flow, it’s important to track how cash movements, whether from operations, financing, or investments, alter the cash balance and, in turn, impact liquidity on the balance sheet.

3. Three-Statement Model

The three-statement model integrates the income statement, cash flow statement, and balance sheet into a single framework, providing a comprehensive view of a company’s financial performance. This model ensures that all financial statements are interconnected. For instance, changes in net income from the income statement affect the equity on the balance sheet, while cash flow impacts both the cash section of assets and financing activities.

Limitations of the Balance Sheet

While the balance sheet is a fundamental financial report, the company must be aware that it also has certain limitations. It’s important to recognize these limitations so you can complement this report with other financial data and avoid drawing conclusions that may not reflect your company’s actual condition.

Here are some key limitations of the balance sheet:

- Snapshot in time: The balance sheet captures financial data at one specific date, not over a period. This means it cannot reflect daily operational changes or ongoing trends.

- Historical cost basis: Most assets are recorded based on their original purchase price, not current market value. As a result, the actual worth of assets may be understated or outdated.

- Omission of intangible factors: Important factors like brand reputation, employee expertise, or customer loyalty are not reflected. These intangibles can significantly influence a company’s true value and long-term success.

- Subject to estimates and judgments: Several items, such as depreciation, bad debts, or inventory valuation, are based on management’s assumptions. These estimates may vary and affect the accuracy of the financial snapshot.

- Potential liquidity misrepresentation: Not all current assets can be converted to cash quickly or without loss in value. This can give a misleading impression of how easily the business can meet short-term obligations.

- Limited view of cash flow dynamics: The balance sheet shows what a company owns and owes but not how cash moves through the business. For a complete picture, it must be analyzed alongside the cash flow statement.

Common Mistakes When Making Balance Sheets

Although preparing a balance sheet may seem straightforward, many businesses still encounter avoidable errors in the process. These mistakes, while often unintentional, can distort financial insights and lead to poor decision-making. These common mistakes are:

1. Misclassifying Assets and Liabilities

One of the most frequent mistakes is placing items under the wrong category. For example, recording long-term debt as a current liability, or classifying inventory as a non-current asset. Misclassification can distort key financial ratios and lead to incorrect assumptions about liquidity and solvency. For business owners, this error can affect both internal planning and external reporting accuracy.

2. Failing to Update Balances Regularly

Using outdated figures, especially for accounts like receivables, payables, or inventory, can lead to a balance sheet that no longer reflects the company’s true financial position. Regular updates are essential to ensure the data remains relevant for informed decision-making. With the best accounting system in Singapore, businesses can automate these updates, ensuring that financial information is always accurate and up-to-date.

3. Ignoring Depreciation and Asset Valuation

Not recording depreciation properly or neglecting asset revaluation can overstate the value of assets. This creates a false impression of a company’s net worth and may lead to poor investment or lending decisions. Depreciation is not just an accounting formality, it reflects the real-world decline in asset value.

4. Overlooking Accruals and Prepayments

Businesses often forget to account for accrued expenses or prepaid income, especially at the end of a reporting period. These items may seem minor, but they can significantly affect reported liabilities and assets. The accurate treatment of accruals ensures that the financial statements reflect obligations and resources that truly belong to the period.

5. Not Balancing the Equation

Every balance sheet must satisfy the fundamental equation: Assets = Liabilities + Equity. When totals don’t match, it signals missing entries, calculation errors, or incorrect classifications. Even small discrepancies can undermine the credibility of financial reports and make audits more difficult.

Enhancing Balance Sheet Efficiency with ScaleOcean’s Accounting Software

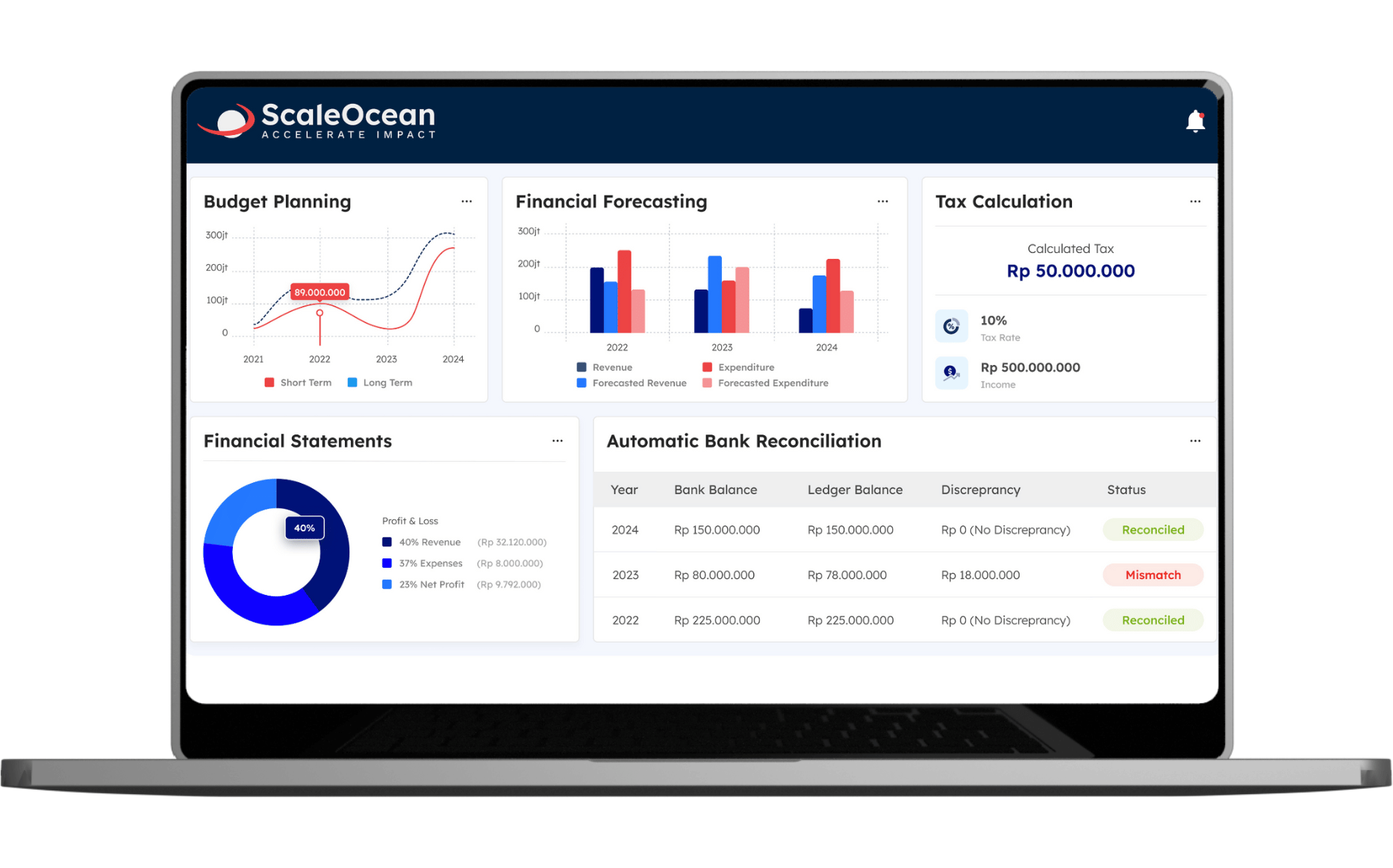

ScaleOcean’s accounting software is an all-in-one solution designed to simplify financial management for businesses. ScaleOcean does not only streamline your accounting processes but also provides a comprehensive system that integrates seamlessly with the entire business. This enables accurate, real-time financial data that empowers you to make informed decisions, improve cash flow, and ensure better financial planning.

ScaleOcean offers a free demo, allowing you to explore its full functionality and see how it can transform your financial management. Whether you’re managing a growing business or optimizing your existing processes, ScaleOcean equips you with the tools to stay ahead.

One of the core benefits of using ScaleOcean is its ability to automatically generate and update your balance sheet. It offers you a clear, up-to-date view of your assets, liabilities, and equity at any given moment. The integration of Artificial Intelligence (AI) enhances this by analyzing your financial data for trends and providing predictive insights. This means that, as you generate balance sheets, the system can highlight areas of concern, like rising liabilities or decreasing equity, and suggest actionable strategies.

Key features of ScaleOcean’s accounting software:

- Automated Balance Sheet Generation: ScaleOcean automatically creates and updates your balance sheet in real-time, ensuring accuracy and timeliness.

- Real-Time Data Integration: All your financial data, such as sales, expenses, and assets, are interconnected, offering a unified view of your company’s financial health.

- Customizable Financial Reports: Tailor your balance sheet reports to suit specific needs, including segmenting by department, project, or time period.

- Advanced Financial Analysis: Built-in financial ratios and forecasting tools to analyze liquidity, solvency, and overall financial performance.

- AI-Powered Insights: With integrated AI, the system analyzes financial data to highlight trends, identify risks, and recommend strategies.

Conclusion

A balance sheet is a vital statement of financial position that provides a snapshot of a company’s financial health by detailing its assets, liabilities, and equity. It serves as a crucial tool for business owners and investors, helping them assess the company’s stability and operational efficiency. However, to make the most of this financial report, it is important to have accurate, real-time data and the right tools for analysis.

With ScaleOcean, your company will not only manage its balance sheet more effectively but will also gain actionable insights that drive better decision-making. If you’re ready to streamline your financial operations and take control of your company’s future, start with ScaleOcean’s free demo today.

FAQ:

1. What is the formula for the balance sheet?

The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity. This equation helps determine how a company’s resources are financed, either through debt or ownership.

2. What are some common mistakes when creating a balance sheet?

Common mistakes include misclassifying assets and liabilities, using outdated data, and failing to account for depreciation. These errors can lead to inaccurate financial reports and poor business decisions.

3. What does a debt-to-equity ratio indicate on the balance sheet?

The debt-to-equity ratio compares total liabilities to shareholder’s equity, indicating how much debt a company uses to finance operations. A high ratio could signal higher financial risk due to reliance on borrowed funds.

PTE LTD..png)

.png)

.png)

.png)

.png)