The accounts payable turnover ratio (APTR) is an important financial metric that indicates how well a company manages its short-term liabilities. It reflects how frequently a company pays off its accounts payable in a given year, providing insights into operational efficiency, cash flow, and the ability to satisfy financial obligations on time.

In Singapore’s competitive and fast-paced economy, keeping a good APTR is critical for firms seeking liquidity and operational stability. Efficient payables administration not only promotes positive supplier relationships, but it also assists firms in maintaining financial resilience and improving overall operational performance.

- The accounts payable turnover ratio (APTR) measures how often a company settles its payables within a year. A higher ratio indicates timely payments, while a lower ratio may suggest cash flow issues and slower payment cycles.

- To calculate APTR, gather financial data and use the formula: AP Turnover Ratio = Net Credit Purchases / Average Accounts Payable. This evaluates a company’s ability to meet short-term obligations and assess liquidity.

- Best practices for optimizing APTR include efficient accounts payable processes, leveraging automation, regular monitoring, and consulting with financial advisors. These strategies help improve supplier relationships and financial health.

- Financial automation with ScaleOcean SG’s ERP system enhances AP efficiency by automating the AP process, reducing errors, and speeding up payments. This boosts the APTR and strengthens supplier relationships.

What Is the Accounts Payable Turnover Ratio?

The accounts payable turnover ratio is a financial measure that helps companies figure out how well they handle their accounts payable. It counts the number of times a corporation settles its average accounts payable during a given time period, usually a year. This ratio is significant in determining how quickly a company can pay its suppliers and shows its short-term liquidity. A greater ratio indicates quicker payments, whilst a lower ratio indicates slower payment cycles. The AP turnover ratio is calculated using the formula below:

AP Turnover Ratio = Net Credit Purchases / Average Accounts Payable

Another method for calculating the accounts payable turnover ratio is to use the cost of goods sold (COGS). This strategy enables organizations to evaluate the ratio in terms of inventory and sales activities.

Another relevant indicator associated with the AP turnover ratio is days payable outstanding (DPO), which evaluates how long it takes a company, on average, to pay its suppliers. The formula to calculate DPO is:

DPO = 365 / AP Turnover Ratio

The accounts payable turnover ratio is computed as AP Turnover Ratio = Net Credit Purchases / Average Accounts Payable, and it shows how efficiently a company pays its suppliers. It can also be computed using COGS to account for inventories and sales. Furthermore, days payable outstanding (DPO), defined as DPO = 365 / AP Turnover Ratio, indicates the average time it takes to pay suppliers, offering insights into cash flow and payment cycles.

How to Calculate the Accounts Payable Turnover Ratio (APTR)

Calculating the accounts payable turnover ratio (APTR) is critical for organizations to evaluate their effectiveness in managing payables and cash flow. This ratio measures a company’s ability to meet its short-term obligations to suppliers, suggesting liquidity and operational performance. A high APTR indicates timely payments, but a low ratio could indicate cash flow problems. Here are the basic stages for calculating the AP turnover ratio:

1. Gather Financial Data

To calculate the accounts payable turnover ratio, collect the appropriate financial data, such as net credit purchases and average accounts payable. Net credit purchases are the total credit purchases made by the company during the period, excluding any cash purchases. This figure is critical because it shows the amount a company has purchased on credit and will be used to assess how well it has paid off these obligations.

2. Use the AP Turnover Formula

Once you have the necessary information, you can use the accounts payable turnover ratio method to evaluate your company’s efficiency in managing payables. The formula compares net credit purchases to average accounts payable for the period, indicating how frequently the business pays off its accounts payable in a year. This ratio is used to assess how quickly the company settles its debts with suppliers. The general ledger plays a crucial role in tracking the accounts payable and net credit purchases, ensuring that all financial data is recorded accurately for proper ratio calculation. The formula goes as follows:

AP Turnover Ratio = Net Credit Purchases / Average Accounts Payable

3. Calculate Average Accounts Payable

This formula allows you to determine the average amount the company owes to its suppliers throughout the period. By adding the beginning accounts payable balance to the ending balance and dividing by two, it provides a more accurate reflection of the company’s average payables over time, smoothing out any fluctuations that might occur during the period. This approach helps give a more realistic view of how much the company typically owes its suppliers during the course of the term. The formula goes as follows:

Average AP = (Beginning AP + Ending AP) / 2

4. Determine Days Payable Outstanding (DPO)

Once you have the AP turnover ratio, you can compute the Days Payable Outstanding (DPO), which represents the average number of days it takes a company to pay its suppliers. This statistic is used to assess the company’s payment procedures and liquidity. To compute DPO, divide 365 by the AP turnover ratio. The formula goes as follows:

DPO = 365 / AP Turnover Ratio

Interpreting the AP Turnover Ratio

The accounts payable turnover ratio is a useful indicator of how effectively a company manages its payables. It enables firms to assess their capacity to pay suppliers on schedule and sustain enough cash flow. This ratio is useful for determining a company’s financial health and operational efficiency. Understanding how to evaluate this ratio might help firms make better judgments about their payment strategy. The following are two major interpretations of the ratio:

1. High AP Turnover Ratio

A high AP turnover ratio shows that a corporation pays its suppliers on time. This shows that the company has a good cash flow. It may also indicate good credit arrangements with suppliers. Maintaining this high ratio may indicate good financial health and operational efficiency. Businesses with a high ratio frequently have positive connections with suppliers. These companies are regarded as dependable and financially secure. A track record of on-time payments may potentially lead to improved loan arrangements later on.

2. Low AP Turnover Ratio

A low AP turnover ratio could indicate that the corporation is waiting longer to pay its suppliers. This could suggest possible liquidity concerns in areas where cash flow is constrained. Extended payment terms may bring temporary comfort, but they can also pose complications. Suppliers may become suspicious of long delays and refuse to issue credit in the future. Furthermore, low ratios over time might strain supplier relationships. Over time, this might impede talks and limit the company’s credit term flexibility.

Factors Influencing AP Turnover Ratio

Several factors influence the accounts payable turnover ratio, and understanding them is critical for firms seeking to manage their financial health successfully. According to IRAS, from 1 January 2023, businesses must account for GST on low-value goods purchased, except those directly linked to taxable supplies. The following are the important elements that can influence this ratio:

1. Negotiated Credit Terms

Credit arrangements with suppliers have a substantial impact on a company’s AP turnover ratio. If a corporation negotiates longer payment terms, it may reduce its AP turnover ratio. On the other hand, shorter payment terms incentivize faster payments, resulting in a greater ratio. Suppliers and businesses frequently agree on these terms based on their respective financial situations.

2. Cash Flow and Liquidity

A company’s cash flow and liquidity are critical factors in influencing its AP turnover ratio. Companies having a large cash reserve can make payments more swiftly and efficiently. When cash flow is consistent, a company is more likely to satisfy its financial obligations on schedule, which leads to a greater AP turnover ratio. Liquidity guarantees that businesses can make consistent supplier payments.

3. Industry Standards

Payment procedures are influenced by industry standards, which in turn affect the payables turnover ratio. Payment timelines vary by sector. For example, the manufacturing industry may have longer payment cycles due to inventory management, whereas the service industry may settle accounts more quickly. These variances should be taken into account when examining a company’s AP ratio to ensure that context is preserved.

4. Economic Conditions

The broader economic situation can have a direct impact on how businesses manage their accounts payable. During times of economic instability or recession, firms may postpone payments to conserve cash, resulting in a lower AP turnover ratio. According to AInvest, the deadline for ceasing corporate cheque processing has been extended by one year to the end of 2026, allowing sufficient time for companies to adjust their financial processes. During such times, managing cash flow is even more important for businesses to ensure financial stability.

Strategic Implications of AP Turnover Ratio for Businesses

The payables turnover ratio is more than simply a financial metric; it is an effective tool for making strategic decisions. Businesses that closely monitor this ratio might acquire insights into their operational efficiency, financial stability, and supplier relationships. Optimizing the AP turnover ratio has significant benefits that can improve overall business performance. Here’s how firms can use it:

1. Supplier Relationships

A high AP turnover ratio implies that payments to suppliers are made on schedule, which promotes trust. Strong supplier ties can help you negotiate more effectively. Businesses might get better loan terms or discounts for making early payments. This creates long-term partnerships that benefit both parties.

2. Creditworthiness and Financing

A high accounts payable turnover ratio indicates financial stability and enhances a company’s reputation. Lenders and banks frequently regard enterprises with a high AP turnover as dependable. This greater trust can lead to easier access to funding and improved creditworthiness. It provides access to improved financing rates and financial prospects.

3. Cash Flow and Working Capital

Managing the AP turnover ratio ensures a consistent cash flow and maximizes working capital. A balanced ratio helps organizations avoid financial problems and preserve operational efficiency. Companies that improve their cash flow management can reinvest in growth possibilities, assuring long-term corporate sustainability.

Best Practices to Optimize AP Turnover Ratio

Improving the accounts payable turnover ratio necessitates a systematic approach that ensures timely payments and effective cash flow management. By managing this ratio, organizations can enhance supplier relationships, secure better loan terms, and improve their overall financial health through automation that streamlines payment processes.

Here are some excellent practices for firms to implement:

1. Efficient Accounts Payable Processes

Streamlining accounts payable operations ensures that payments are received on time. Timely payments contribute to a favorable AP turnover ratio. A smooth process also minimizes the possibility of late fees or penalties. This enhances vendor relationships and builds a positive reputation. Effective payables management requires efficient processing.

2. Leveraging Technology

The use of automation tools and financial software, like the best accounting software, enhances accounts payable accuracy and efficiency. Technology enables organizations to handle payments more quickly and accurately. Companies may easily manage high numbers of transactions thanks to automated procedures. It also offers real-time data, making it easier to track outstanding payables and improve the AP turnover ratio.

3. Regular Monitoring and Analysis

Businesses should routinely review their AP data for inefficiencies. Companies that watch the AP turnover ratio can identify trends and alter their strategies. Regular analysis improves decision-making and keeps the organization on track.

For easy monitoring and analysis, companies can use accounts payable software, which can automate the tracking of AP data, generate real-time reports, and provide actionable insights.

ScaleOcean can be the best option, which can help businesses easily monitor key metrics such as payment cycles, vendor performance, and cash flow. This allows for quicker identification of inefficiencies, better forecasting, and improved vendor relationships.

By streamlining the AP process, companies can reduce human errors, optimize payment schedules, and ensure timely and accurate reporting. Monitoring also aids in determining areas where payment terms might be modified for better cash flow management.

4. Engaging Financial Advisors

Consulting with financial experts can provide useful information for improving the AP turnover ratio. Experts can help you optimize your payment schedule and negotiate better terms with suppliers. Financial advisors assist businesses align their procedures with industry norms. Their experience guarantees that businesses make sound judgments for long-term financial success.

The Role of Financial Automation in Enhancing AP Efficiency

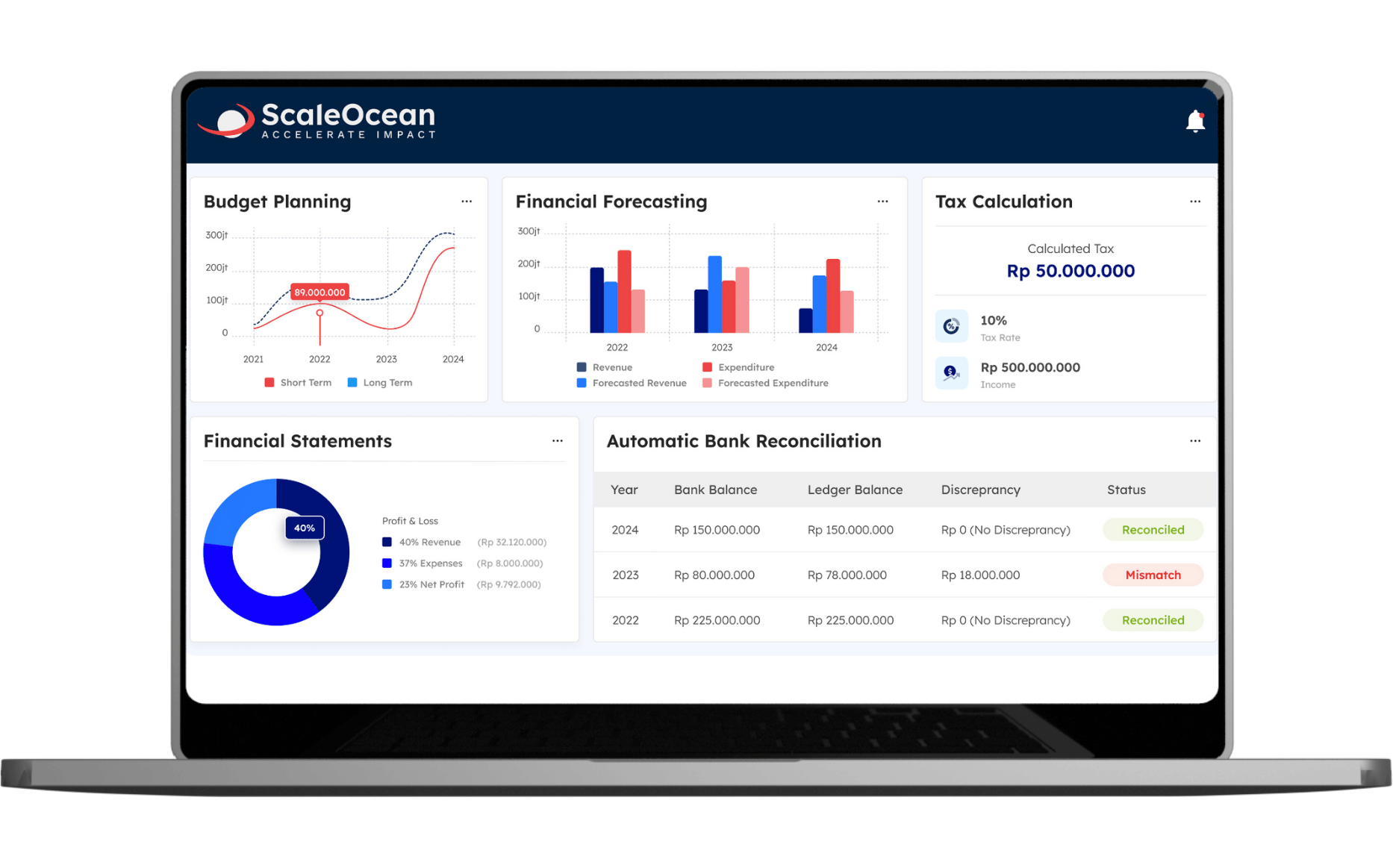

ScaleOcean SG’s financial automation solutions help organizations streamline their accounts payable (AP) processes. The innovative ERP system automates the entire AP workflow, eliminating manual effort, increasing accuracy, and speeding up payment processing. Automation improves AP efficiency and the accounts payable turnover ratio (APTR) by decreasing errors, late payment penalties, and improving supplier relationships.

Many firms have increased their AP efficiency by using financial automation with ScaleOcean, saving time and increasing accuracy. ScaleOcean also provides a free demo, and with the help of Singapore’s CTC (Cost to Company) grant, firms can get financial assistance to adopt the solution. ScaleOcean has the following key features:

- End-to-End Financial Automation, ScaleOcean ERP automates the entire accounts payable process, reducing manual effort, streamlining invoice management, and improving payment processing times.

- Real-Time Data Integration, The ERP system offers real-time data integration across all business operations, providing visibility into accounts payable, cash flow, and financial obligations.

- Customizable Workflow for Accounts Payable, ScaleOcean ERP provides the ability to customize workflows based on specific business needs.

- Smart Reporting and Analytics, With integrated reporting tools, ScaleOcean ERP offers actionable insights on financial operations, including accounts payable.

- Seamless Vendor Integration, The ERP system integrates with vendors’ platforms, ensuring seamless communication and faster processing of invoices.

Conclusion

The accounts payable turnover ratio (APTR) is an important indicator for determining how efficiently a company manages its financial commitments. A well-managed APTR not only provides continuous cash flow, but it also improves supplier relationships and demonstrates competent financial management, thereby boosting a company’s growth and sustainability.

Businesses can evaluate and streamline their accounts payable operations to improve their financial practices even further. ScaleOcean SG provides innovative financial automation solutions to assist businesses achieve financial success by streamlining AP procedures, increasing accuracy, and maximizing cash flow. Discover how ScaleOcean can help your organization achieve its financial goals through automation.

FAQ:

1. How do you calculate accounts payable turnover ratio?

To calculate the accounts payable turnover ratio, divide the total net credit purchases by the average accounts payable over a given period. This ratio helps determine how frequently a business settles its accounts payable annually. The formula is: AP Turnover Ratio = Net Credit Purchases / Average Accounts Payable

2. Is higher or lower accounts payable turnover better?

A higher accounts payable turnover ratio is typically preferred as it indicates that a business is paying its suppliers promptly. This reflects a healthy cash flow and effective management of payables. Conversely, a lower ratio could suggest slower payment to suppliers, which may signal cash flow issues or extended payment terms.

3. What is a good trade payables turnover ratio?

The ideal trade payables turnover ratio varies by industry, but a higher ratio generally signifies that a company is paying its suppliers efficiently and on time. To assess whether a ratio is good, it should be compared to industry standards and peer performance to ensure the company is operating optimally.

4. How to calculate receivables turnover ratio?

To calculate the receivables turnover ratio, divide the total net credit sales by the average accounts receivable for a given period. This ratio reflects how well a company manages and collects its receivables. The formula is: Receivables Turnover Ratio = Net Credit Sales / Average Accounts Receivable

PTE LTD..png)

.png)

.png)

.png)

.png)