Struggling with managing cash flow and supplier payments? Days Payable Outstanding (DPO) can help. This key financial metric measures how efficiently your company handles accounts payable by calculating the time it takes to pay suppliers, offering insights into your cash flow management.

This calculation indicates the average time it takes for a company to pay its suppliers. DPO reflects cash flow management and overall financial health. According to a recent article from Allianz Trade, DPO measures the time taken to pay suppliers after purchasing goods or services.

In Singapore, where efficiency is critical, managing DPO is vital for maintaining cash flow and strong supplier relationships. This article will explore the importance of calculating DPO, how to measure it, and factors affecting it, such as COGS, accounts payable, and the calculation period.

- Days Payable Outstanding (DPO) is a financial metric that shows the average time it takes for a company to pay its bills and invoices to trade creditors, including suppliers, vendors, or financiers.

- To calculate DPO, the formula is: DPO = (Accounts Payable / Number of Days) × Cost of Goods Sold, which helps businesses assess their payment cycle.

- There are Steps and factors to improve DPO, including optimizing accounts payable, adjusting the number of days, monitoring and controlling COGS, and more.

- ScaleOcean’s accounting software automates the calculation of DPO, streamlining financial processes and improving cash flow management for businesses.

What is the Days Payable Outstanding Formula (DPO)?

Days Payable Outstanding (DPO) is a financial metric that shows the average time it takes for a company to pay its bills and invoices to trade creditors, including suppliers, vendors, or financiers. It reveals how well a company manages its short-term liabilities and cash flow.

A high DPO means delayed payments, benefiting cash flow but potentially harming supplier relationships. A low DPO indicates quick payments, which can improve cash flow but may limit liquidity. Monitoring DPO helps businesses improve working capital, much like how a payslip template ensures smooth management of financial obligations.

How to Calculate Days Payable Outstanding (DPO)

Understanding how to calculate DPO is crucial for businesses aiming to maximize working capital and maintain strong supplier relationships. The DPO calculation provides a straightforward method to assess the payment cycle and its impact on financial performance. The formula to calculate Days Payable Outstanding (DPO) is as follows:

DPO = (Accounts Payable × Number of Days) / Cost of Goods Sold

Days Payable Outstanding (DPO) is calculated using three components: Accounts Payable, which is the amount owed to suppliers, Cost of Goods Sold (COGS), representing direct production costs, and the number of days in the period, such as a quarter or year, to measure payment time.

To calculate DPO, use the formula: DPO = (Accounts Payable × Number of Days) / COGS. By dividing total accounts payable by the cost of goods sold and multiplying by 365, you determine the average number of days it takes the company to pay invoices, reflecting its cash flow and financial efficiency.

There are two variations of the DPO formula based on accounting methods. One version uses the accounts payable figure at the end of the period (e.g., fiscal year/quarter ending September 30), while the other calculates DPO using the average of beginning and ending accounts payable. COGS remains consistent in both.

Why DPO is Crucial for Your Business?

Days Payable Outstanding (DPO) is an important metric for managing your company’s cash flow, supplier relationships, and operational efficiency. By optimizing DPO, businesses can improve liquidity, build stronger partnerships with suppliers, and make smarter financial decisions.

Here are the key factors or advantages that show why DPO is crucial for your business:

1. Managing Cash Flow Effectively

Effective cash flow management is essential for maintaining the day-to-day operations of a business. A high DPO allows businesses to hold on to cash longer, improving liquidity and ensuring funds are available for other critical operations or investments.

However, it’s important to balance cash flow with supplier relationships. Extended payment periods can improve cash flow, but delaying payments too long can create financial strain on suppliers and hinder the company’s ability to negotiate favorable terms in the future.

2. Building Strong Supplier Partnerships

Strong supplier relationships are crucial for maintaining a reliable supply chain. By managing DPO carefully, companies can ensure timely payments that strengthen trust and cooperation with suppliers, which can result in better deals and favorable credit terms.

A balanced DPO shows that the company values its suppliers, enhancing communication and fostering long-term relationships. When suppliers are paid on time, they are more likely to prioritize the company’s needs, leading to smoother operations and more reliable deliveries.

3. Enhancing Operational Performance

Managing DPO effectively contributes to better operational performance by ensuring that the company’s resources are allocated efficiently. Delaying payments can free up cash for operational investments, such as technology or inventory, improving overall performance.

However, it’s important not to stretch DPO too far, as it can create friction in the supply chain and delay critical supplies. A well-balanced DPO helps maintain smooth operations, avoiding disruptions while also allowing for the reinvestment of capital into the business.

4. Strengthening Negotiation Leverage

A strong DPO gives a company greater negotiating power with suppliers. By paying on time or even negotiating extended payment terms, businesses can build a reputation for being reliable partners, which can lead to better pricing or credit conditions.

Having a favorable DPO allows companies to use their liquidity to negotiate more favorable contracts, such as discounts for early payments or extended credit terms. This can result in cost savings and improved supplier relationships, benefiting the business in the long run.

What is a Good Day Payable Outstanding?

A decent Days Payable Outstanding (DPO) depends on the industry and the company’s cash flow needs. A lower DPO means the company pays off creditors quickly, reflecting strong cash flow and financial health, though it may indicate underutilized supplier credit terms.

On the other hand, a higher DPO allows a company to hold funds longer, aiding liquidity. However, delayed payments beyond agreed terms can harm supplier relationships. According to Kolleno, average DPO varies by industry, such as retail (30-45 days) and manufacturing (50-70 days).

To determine whether a DPO is healthy, companies compare it with industry averages. For instance, a DPO of 20 means paying suppliers every 20 days. If much higher or lower than the industry norm, it may suggest the company is either slower or faster than competitors.

What Does High or Low DPO Reveal About Your Business?

Companies often acquire inventory and services on credit, creating accounts payable. DPO measures the time taken to pay off these short-term debts, reflecting the period from receiving the bill to actual payment, which impacts overall cash flow management.

Balancing DPO with cash inflows is crucial. If a company offers customers 90 days to pay but has only 30 days to settle supplier debts, it can face cash flow problems. Managing DPO carefully prevents these mismatches, ensuring smoother financial operations. Now, let’s explore the impact of both high and low DPO:

1. High Days Payable Outstanding (DPO)

A high Days Payable Outstanding (DPO) indicates that a company is taking longer to pay its suppliers. This can improve cash flow by keeping funds within the business longer, but it may also suggest the company is not fully utilizing supplier credit terms.

While a higher DPO can aid liquidity, it can harm supplier relationships if payments are consistently delayed. Suppliers may impose stricter terms or reduce credit limits, which could hurt the company’s ability to maintain smooth operations and negotiate favorable terms.

2. Low Days Payable Outstanding (DPO)

A low Days Payable Outstanding (DPO) means that a company is paying its suppliers quickly, which can improve supplier relationships and enhance the company’s reputation. It suggests that the company is managing its cash flow efficiently.

However, a low DPO may indicate that the company is not making the most of its supplier credit terms, potentially limiting its liquidity. This accounts payable turnover ratio could lead to cash flow challenges, especially if the company faces delays in customer payments or unforeseen expenses.

Steps and Factors for Improving DPO

Improving Days Payable Outstanding (DPO) is essential for maintaining healthy cash flow while ensuring strong supplier relationships. By optimizing payment processes, managing expenses, and using technology, businesses can strike the right balance between liquidity and operational efficiency.

Here are the key steps and factors to focus on for improving DPO:

1. Optimize Accounts Payable

Efficient management of accounts payable is crucial for improving DPO. Timely and accurate processing of invoices ensures that payments are made within agreed terms, avoiding penalties and optimizing cash flow. Businesses should aim to process bills quickly without rushing payments.

Using an accounts payable automation system can streamline invoicing and payment approval, reducing errors and delays. Implementing a centralized payment system can also help monitor outstanding invoices, enabling businesses to manage their cash flow more effectively and optimize DPO over time.

2. Adjust the Number of Days

The number of days used in the DPO calculation impacts the result. While 365 days is the standard for annual DPO measurement, businesses can adjust this figure to better reflect their operational needs, especially if they have a specific payment cycle or seasonal patterns.

By adapting the number of days, businesses can align their DPO with industry practices or internal goals. Regular evaluation of this figure helps optimize payment terms, ensuring a balance between liquidity and timely supplier payments.

3. Monitor and Control COGS

The Cost of Goods Sold (COGS) plays a significant role in DPO management. Higher COGS can lead to longer payment periods as businesses may delay payments to maintain cash flow. Companies must keep a close eye on COGS and adjust their payment strategies accordingly.

A balance is required between minimizing COGS and ensuring timely payments to suppliers. By controlling production costs, businesses can free up cash flow, allowing for efficient management of accounts payable and preventing delays that could impact supplier relationships.

4. Negotiate Supplier Payment Terms

Negotiating favorable payment terms with suppliers can improve DPO by extending payment deadlines. Companies can ask for longer payment periods or discounts for early payments, improving liquidity while ensuring suppliers are paid on time.

However, extending payment terms should be done strategically to avoid harming supplier relationships. Maintaining open communication with suppliers and negotiating terms that benefit both parties ensures that businesses can optimize cash flow without jeopardizing trust.

5. Utilize Automation and Technology

Implementing automation in accounts payable processes can significantly improve DPO management. By automating invoice processing, approval workflows, and payment schedules, businesses can reduce human error, speed up payment cycles, and ensure timely settlements.

Technology also provides real-time insights into outstanding payments, helping companies monitor DPO and manage cash flow more effectively. Automated systems streamline reporting, making it easier to identify inefficiencies and improve payment strategies over time.

6. Evaluate Industry Benchmarks

Comparing your company’s DPO with industry benchmarks is an effective way to assess performance. By understanding the average DPO for your industry, you can determine if your business is paying suppliers too quickly or too slowly compared to competitors.

This comparison helps identify areas for improvement in cash flow management and supplier relations. By staying within industry norms, businesses can enhance operational efficiency while ensuring that their payment practices are competitive and sustainable.

Challenges Associated with DPO

Days Payable Outstanding (DPO) can provide valuable insights into a company’s financial health, but it also comes with certain disadvantages. While a high DPO might offer short-term cash flow benefits, it can negatively impact supplier relationships and cash management.

Here are some key challenges of DPO:

1. Potential Strain on Supplier Relationships

A high DPO means that a company delays paying its suppliers, which could lead to strain in relationships. Suppliers may become frustrated with delayed payments, which can affect future deals, lead to stricter payment terms, or even threaten to stop supplying.

To avoid damaging relationships, businesses can negotiate extended terms proactively rather than waiting until the last moment. Communicating openly with suppliers and ensuring timely partial payments can help preserve trust and foster long-term partnerships.

2. Risk of Damaging Supplier Trust

Consistently delaying payments can damage the trust between a company and its suppliers. Suppliers rely on timely payments to maintain their operations, and a company’s failure to meet payment terms may lead to reduced credit limits or lost supplier confidence.

To maintain trust, businesses should focus on clear, honest communication regarding payment schedules and consider offering early payments where possible. This demonstrates financial responsibility and builds stronger, mutually beneficial supplier relationships.

3. May Indicate Poor Cash Flow Management

A high DPO may signal poor cash flow management, as it could indicate that a company is holding on to cash longer than necessary. This can lead to missed opportunities for reinvestment or could affect the company’s ability to cover its operational costs promptly.

To improve cash flow management, companies should regularly review their DPO alongside cash inflows to ensure that payments are not being delayed unnecessarily. Developing a more balanced payment cycle and streamlining accounts payable processes can help prevent this issue.

4. Can Lead to Missed Discount Opportunities

A longer DPO may result in missed early payment discounts, as suppliers often offer discounts for quicker payments. By holding off on payments to improve short-term cash flow, companies may miss opportunities to reduce costs and improve their overall profitability.

Companies can mitigate this by negotiating with suppliers for extended payment terms that still allow them to benefit from discounts. Alternatively, businesses should prioritize paying certain invoices early to take advantage of these discounts without affecting their cash flow.

Example of Days Payable Outstanding (DPO)

Days Payable Outstanding (DPO) is a key financial metric that helps businesses manage accounts payable and optimize cash flow. To calculate DPO, companies need to identify their total accounts payable, cost of goods sold (COGS), and the number of days in the period, typically 365 for a year.

Once the components are gathered, use the formula: DPO = (Accounts Payable × Number of Days) / COGS. For instance, if ABC Electronics has $1,200,000 in accounts payable and $6,000,000 in COGS, with 365 days, the DPO is 73 days, showing how long it takes the company to pay suppliers.

For ABC Electronics, a DPO of 73 days means the company takes an average of 73 days to settle its supplier invoices after receiving goods or services. This gives the company more time to manage its cash flow and maintain liquidity, which is beneficial for overall financial health.

Calculate Days Payable Outstanding Automatically with ScaleOcean Accounting Software

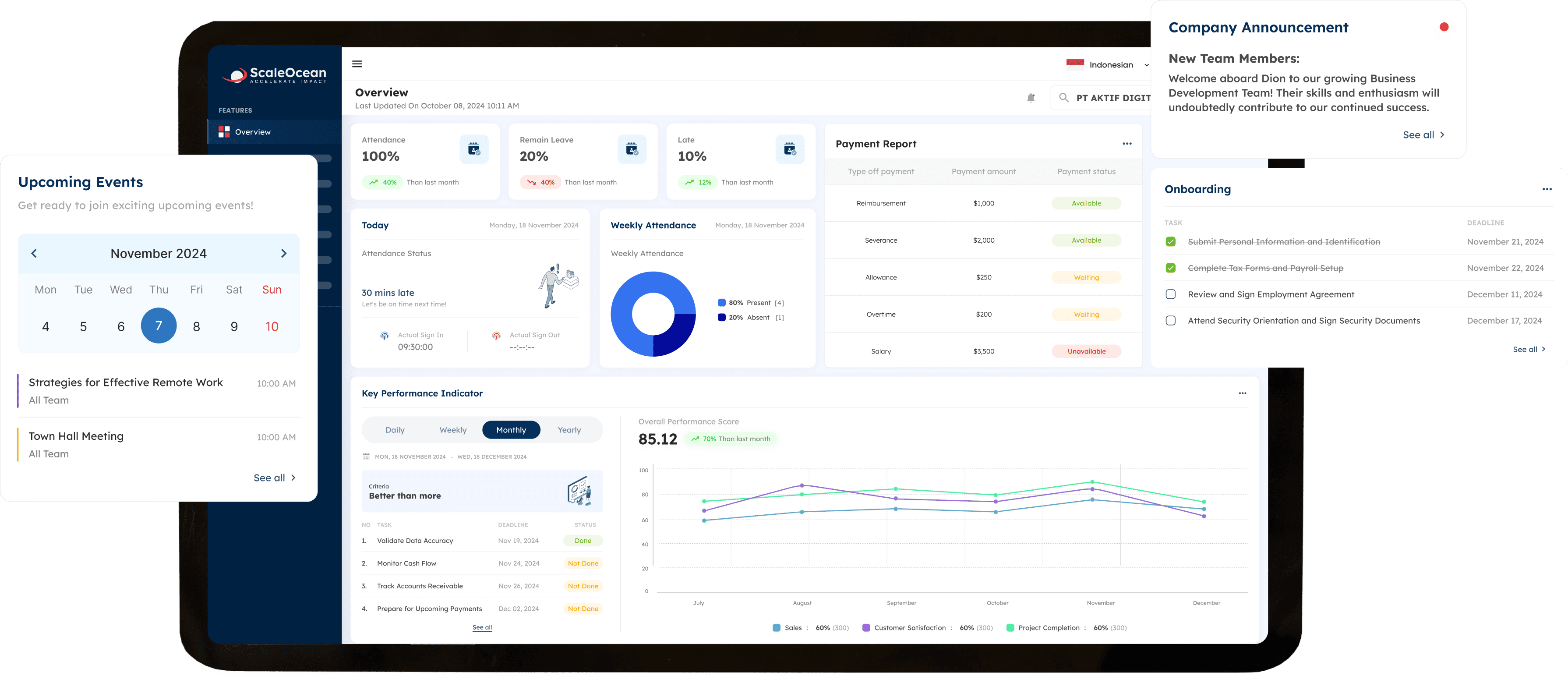

ScaleOcean’s accounting software automates and optimizes financial processes, including Days Payable Outstanding (DPO) calculation. It helps businesses manage accounts payable, ensuring accurate payments and healthy cash flow. The software provides real-time data for better decision-making and improved management.

With seamless integration and customizable features, ScaleOcean simplifies DPO tracking, enhancing cash flow efficiency. Eligible for a CTC grant, this software offers an affordable solution to streamline financial operations, improve cash flow, and boost productivity without exceeding budget constraints.

The following are the unique characteristics of ScaleOcean’s software:

- All-in-One Accounting Solution, Complete Modules for Financial Management and Beyond: ScaleOcean’s accounting software offers a comprehensive suite of over 200 modules designed to meet specific business needs, including modules for accounts payable and DPO management.

- Built from Best Business Practices: ScaleOcean’s software is developed with industry-leading practices, addressing challenges in financial management, operational efficiency, and automation.

- Customizable Solution for Your Company’s Unique Needs: ScaleOcean allows businesses to tailor the system to fit their specific workflows, providing advanced customization options like personalized dashboards and smart configurations.

- Auto-Pilot for Streamlined Business Operations: ScaleOcean’s software is designed to automate various aspects of business operations, including DPO management

Conclusion

Days Payable Outstanding (DPO) is a key financial metric that helps firms manage accounts payable and cash flow. By understanding its drivers and using solutions like ScaleOcean’s Accounting software, companies can optimize DPO. This leads to better financial management and stronger supplier relationships. Accurate DPO calculations enable businesses to make informed cash flow decisions and improve operational efficiency.

ScaleOcean provides a free demo to assist organizations in streamlining DPO calculations and optimizing their financial procedures. This demo allows you to see how the software’s automated capabilities may simplify accounts payable and improve cash flow management. Companies can use ScaleOcean’s solution to manage DPO effectively and benefit from a range of capabilities tailored to their needs.

FAQ:

1. How do you calculate days payable outstanding?

To calculate Days Payable Outstanding (DPO), divide the average accounts payable by the cost of goods sold (COGS), then multiply the result by the number of days in the period, typically 365. This gives you the average time it takes for a company to settle payments with its suppliers.

2. How do you calculate DPO and DSO?

DPO (Days Payable Outstanding) is calculated by dividing the average accounts payable by the cost of goods sold (COGS) and multiplying by 365. DSO (Days Sales Outstanding) is calculated by dividing accounts receivable by total sales and multiplying by 365.

3. What is the formula for AP days?

The formula for Accounts Payable (AP) days is calculated by dividing the average accounts payable by the cost of goods sold (COGS) and multiplying by 365. This gives the average number of days it takes a company to pay its creditors.

4. What is the formula for outstanding days?

The formula for calculating outstanding days is similar to DPO. It involves dividing accounts payable by the cost of goods sold (COGS) and multiplying by 365. This provides the average number of days a company takes to pay its outstanding debts.

PTE LTD..png)

.png)

.png)

.png)

.png)