Invoicing and receipt are two critical activities that enable organizations to track payments, manage finances, and maintain organization. Understanding the distinction between an invoice and vs receipt is critical since each document serves a specific purpose at various stages of a transaction.

For Singaporean enterprises, getting this correctly is extremely crucial because it has a direct impact on tax compliance, accounting correctness, and overall financial health in the country’s regulated business environment.

This article will walk you through the fundamental differences between invoices and receipts, including definitions, purposes, and legal roles. It also discusses when and why each document is required, the various sorts of invoices and receipts that organizations may encounter, and common mistakes to avoid.

By the conclusion, you’ll have a greater understanding of how good documentation, including the importance of invoices and receipts for financial management in Singapore, boosts cash flow, meets tax responsibilities, and strengthens your company’s financial operations.

- An invoice is a document issued by a seller requesting payment from a buyer, clearly stating the amount due and payment terms.

- A receipt serves as official proof that the buyer has completed payment, confirming the transaction is finalized.

- Key differences between an invoice and a receipt lie in their timing and functionality, like invoices request payment before funds are received, while receipts confirm payment after it occurs.

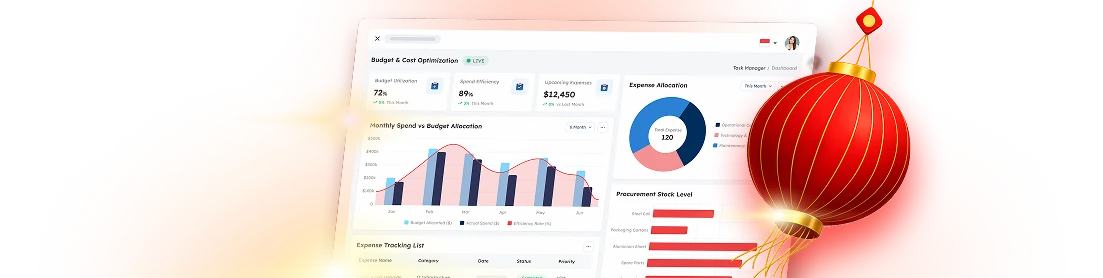

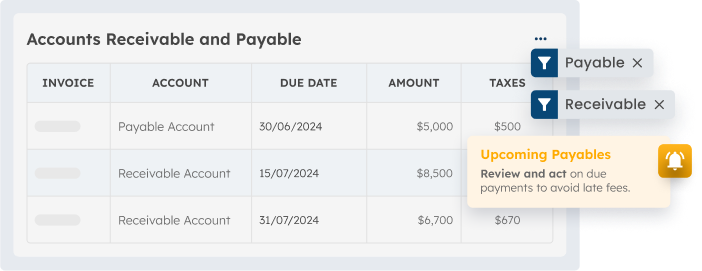

- ScaleOcean’s software simplifies invoice and receipt management by automating issuance, tracking payments in real time, and ensuring adherence to Singapore accounting standards, helping businesses save time and reduce errors.

What Is an Invoice?

An invoice is a document that a seller sends to a buyer requesting payment. It specifies the sum due for goods or services given. The primary aim of an invoice is to clearly express payment terms. This allows the buyer to understand when and how to pay the vendor. According to IRAS, a tax invoice must be issued within 30 days from the time of supply, ensuring timely documentation and compliance with tax regulations.

Typically, an invoice contains vital information such as the seller’s and buyer’s names. It also displays the invoice number and issue date. Payment terms describe deadlines and ways of payment. The invoice details each item or service sold, as well as the price. This paper serves as an official request to receive payment.

Also Read: Understanding a Tax Invoice in Singapore's Business Environment

What Is a Receipt?

A receipt is official confirmation that a buyer has paid for the products or services purchased. It indicates that the transaction has been completed and payment has been successfully received by the seller. This document verifies that the buyer’s obligation has been met and serves as proof of the purchase.

According to Singapore Statutes Online, an Accounting Officer is required to deposit any public money received daily into a designated public bank account or to the Accountant-General as per the Minister’s instructions, ensuring proper handling of public funds.

A receipt often includes the payment date, amount paid, and method of payment (such as cash, credit card, or bank transfer). It may also include information on the purchased things or services. In Singapore, receipts let customers authenticate their transactions and businesses preserve accurate financial records.

Invoice vs Receipt: What Are the Key Differences?

Invoices and receipts play distinct roles in business, such as invoices request payment upfront, while receipts confirm payment after it’s done, so because of that, you can’t have an invoice to be used for a receipt. Both documents are vital for financial transparency and tax compliance. Let’s break down exactly how they differ:

1. Functionality

An invoice specifies the products or services sold, the total amount due, and the payment terms. It’s a formal document that outlines the buyer’s obligation to pay, often including strict deadlines or penalties in case of late payment.

A receipt, conversely, confirms that the payment has already been made and the transaction is officially finished. It details the exact amount paid, the method of payment used, and the date, ensuring both parties have a clear, official record of the exchange.

2. Working Together

Invoices kick off the payment process by outlining the sale’s terms and expectations. Once the buyer completes the payment, a receipt is issued to finalize the transaction. Together, these two documents create a complete and traceable record of the entire transaction flow.

Without an invoice, the buyer won’t know the exact amount or payment terms. Conversely, without a receipt, the seller lacks the necessary proof of payment. Both documents truly complement each other, forming a comprehensive and complete transaction record.

3. Legal Significance

Invoices can be legally binding documents that clearly define the terms of a sale, including payment deadlines and agreed-upon amounts. If the buyer doesn’t pay, the invoice acts as a key reference point for enforcing that payment, ensuring business transactions are protected.

Receipts offer important legal protection to the buyer, unequivocally confirming that payment was made. In case of disputes or returns, a receipt serves as solid proof of transaction completion, which really helps resolve any claims that might arise after the sale.

4. Timing Difference

Invoices are issued before payment is made, acting as your formal request for funds. This document clearly informs the buyer of the exact amount due and the payment deadline, ensuring a clear, mutual understanding of the pending financial transaction.

Receipts are provided only after payment is fully received, officially marking the completion of the transaction. They serve as immediate proof that the buyer has settled the payment in full, giving assurance to both parties that the transaction is absolutely complete.

Why Are Invoices and Receipts Important for Businesses?

Invoices and receipts are critical components of any business’s bookkeeping and accounting. They properly track sales and cash flow. Businesses can create reliable financial reports by recording every transaction. These records also serve as proof of transactions, which is crucial for managing the firm’s finances.

In Singapore, invoices and receipts are required for tax compliance, particularly under GST legislation. They provide unambiguous proof during tax audits, ensuring transparency and correctness. Proper documentation prevents financial errors and builds trust with customers and tax authorities.

When Do You Need to Issue an Invoice or Receipt?

An invoice is necessary when a business requests payment before a transaction is complete. It helps track payment terms (like due dates and amounts owed), ensuring the buyer fully understands their financial obligation.

This formal request is common in service contracts or B2B deals. In some cases, businesses may also issue a proforma invoice to provide an estimate or outline of costs before finalizing the agreement.

A receipt should always be issued after payment, confirming the transaction is complete. It offers crucial proof of payment and summarizes the items purchased. Using a financial ERP system can greatly streamline receipt generation, ensuring accurate records and boosting operational efficiency.

Common Mistakes to Avoid with Invoices and Receipts

Missing or erroneous facts are frequently the source of invoice and receipt errors. For instance, incorrect buyer information or invoice numbers can cause misunderstanding. Such inaccuracies may cause payment delays or disagreements between businesses and customers. Ensuring precise and comprehensive information reduces misunderstandings and expedites the payment process.

Another common concern is the delayed sending of invoices or receipts. Late paperwork can interrupt cash flow and delay payments. Furthermore, failure to comply with Singapore’s tax requirements, particularly GST standards, may result in fines. Staying up to date on tax rules and providing documentation on time helps keep your firm compliant and financially healthy. Here are several solutions:

1. How to Handle Disputes Related to Invoices and Receipts

Disputes concerning payments can develop when invoices or receipts are confusing or absent. Keeping well-organized and accurate documents makes it easier to resolve such disagreements swiftly. Consider the following fundamental principles for efficiently managing disputes:

a. Prompt and Clear Communication

When payment issues emerge, it is critical to communicate with customers promptly and clearly. Responding promptly helps to avoid misunderstandings and demonstrates your commitment to resolving the issue properly. Timely communication promotes trust and indicates your commitment to client service.

b. Establish Clear Payment Terms

Before completing any transaction, carefully identify and communicate payment terms to your customers. This establishes expectations and avoids uncertainty, making it easier to manage payments and avoid future disagreements. Clear terminology also serves as a reference point if misunderstandings arise.

c. Organize Invoices and Receipts Efficiently

Keeping all invoices and receipts organized allows you to immediately locate critical documents when needed. Proper organization speeds up dispute settlement and facilitates smooth bookkeeping. Using digital file systems can improve this process by making retrieval faster and more consistent.

d. Document All Payment Communications

It is critical to keep records of all payment-related communications and agreements. Documented talks give evidence in the event of disagreements, making it easier to clarify the situation and achieve a fair resolution. This technique also serves to safeguard your company’s legal interests and encourage openness.

e. Handle Disputes Calmly and Professionally

Approach any payment disagreement calmly and professionally. Addressing problems respectfully protects customer connections and promotes cooperative problem solving, which benefits both parties in the long run. Staying collected also allows you to think clearly and identify the best answer.

2. Best Practices for Issuing Invoices and Receipts

In order for business operations to run smoothly, invoices and receipts must be issued precisely and on time. Using standard templates and accurate numbering promotes uniformity and professionalism. Furthermore, having both digital and physical versions allows simple access when necessary. Here are a few best practices to follow:

a. Issue Invoices and Receipts Promptly

Make sure to send out invoices and receipts as soon as the transaction or service is complete. Prompt issuance promotes clean financial records and accelerates payment collection. This also demonstrates professionalism and increases customer trust in your organization.

b. Use Standardized Templates

Use standardized templates that convey all relevant information clearly and consistently. Using consistent templates eliminates errors and makes documents easier to read for your team and customers. It also enhances your brand’s professional image.

c. Implement a Consistent Numbering System

Use a uniform numbering system to keep track of all invoices and receipts efficiently. This method improves document management by reducing duplication and missing records. It also makes audits and financial reviews easier by giving a clear structure.

d. Maintain Digital and Physical Records

Maintain both digital backups and physical copies of all invoices and receipts for secure record-keeping. Having different formats safeguards your organization in the event of data loss or technical challenges. It also accelerates document retrieval during audits and dispute resolutions.

e. Regularly Review and Update Systems

Check and update your top invoicing software on a regular basis to ensure that it is in accordance with current rules and company requirements. Staying up to date reduces the chance of errors or noncompliance with tax rules such as GST. Continuous improvement also increases operational efficiency.

Impact of Proper Invoice and Receipt Management on Cash Flow

Proper invoice and receipt management allows firms to receive payments more quickly by clearly reminding clients when to pay, particularly regarding Accounts Receivable (AR). Timely reminders decrease delays and encourage early payment, boosting the company’s cash flow and stability. When invoices and receipts are well-organized, it helps to avoid misconceptions, which are common causes of payment disputes. Avoiding these disagreements results in fewer delinquent invoices, which helps businesses maintain a better financial position.

Accurate records from invoices and receipts aid in financial forecasting by providing clear data on incoming payments. This enables businesses to plan budgets and investments more confidently and accurately. Businesses that track payments well can predict cash availability and utilize resources strategically. Overall, excellent invoice and receipt administration improves financial planning and facilitates long-term business growth.

How Software Solutions Simplify Invoice and Receipt Management

ScaleOcean provides a robust software solution to streamline financial operations, including invoicing and receipt management. This all-in-one platform automates invoicing and receipt issuance, tracks payments and outstanding invoices in real time, and ensures compliance with Singapore’s accounting standards and tax laws. By supporting key principles such as accrual accounting it enables organizations to generate precise financial reports, saving time and minimizing manual errors.

ScaleOcean provides enterprises with benefits such as shorter payment cycles, increased cash flow, and greater financial transparency, allowing teams to focus on growth rather than paperwork. If you want to see these benefits for yourself, ScaleOcean provides a free demo that allows you to examine the system in action. Furthermore, qualifying Singaporean enterprises can take advantage of the CTC Grant to reduce implementation costs and enhance value. ScaleOcean offers the following major features:

- Unlimited Users Without Extra Cost: ScaleOcean offers 100% unlimited users with no additional fees, allowing businesses to scale their invoicing and receipt management operations without worrying about per-user costs.

- All-in-One Solution with 200+ Specialized Modules: The platform provides over 200 specialized modules, including those for accounting and finance, designed to automate invoicing, manage receipts, and handle financial reporting efficiently, all within a single system.

- Built on Best Business & Industry Practices: ScaleOcean integrates best practices from various industries, ensuring that its invoicing and receipt automation features meet real-world operational needs, improving accuracy and reducing manual work.

- Advanced Customization & Smart Configuration: The system offers advanced smart configurations and dashboard personalization, enabling businesses to tailor invoice and receipt workflows according to their specific departmental metrics and operational needs.

- Seamless Integration Across Company Branches: ScaleOcean can integrate all company branches and subsidiaries into one unified platform, ensuring consistent and synchronized invoicing and receipt processes across the entire organization.

Conclusion

Understanding and properly handling invoices and receipts is the first step in optimizing financial procedures. Businesses that keep accurate and timely paperwork can enhance their accounting operations, ensure tax compliance, and manage cash flow more effectively. Avoiding typical blunders, such as missing details or delayed issuance, lowers the chance of conflicts and improves financial transparency, laying the groundwork for better-informed, confident business decisions.

ScaleOcean provides a robust accounting software solution that automates invoicing and receipt issuance, reducing human work and increasing operational efficiency. ScaleOcean provides enterprises with the tools they need to manage financial documents efficiently, including unlimited users, advanced customization, and seamless connection across branches. This not only improves day-to-day operations but also promotes long-term growth and financial stability at all levels of the company.

FAQ:

1. Is an invoice the same as a receipt?

No, an invoice requests payment before a transaction, while a receipt confirms payment after completion. Both documents are necessary for accurate accounting, tax reporting, and financial organization, especially for businesses in Singapore.

2. Can a receipt replace an invoice?

No, a receipt cannot replace an invoice. Invoices request payment, while receipts confirm it. Both are essential for proper bookkeeping and regulatory compliance, especially in Singapore for GST reporting and audits. Missing invoices can create record-keeping issues.

3. Does an invoice mean you owe money?

Yes, an invoice indicates an outstanding payment. It outlines the amount due, payment deadline, and services or products. Proper invoice management ensures timely payments, maintains good relationships, and helps businesses stay financially organized in Singapore.

4. Is an invoice a purchase receipt?

No, an invoice and a purchase receipt serve different purposes. An invoice requests payment, while a receipt confirms payment has been made. Both are required for accurate financial records, tax reports, and audits, helping businesses track unpaid bills.

PTE LTD..png)

.png)

.png)

.png)

.png)