In today’s competitive business landscape, efficiency and transparency are essential, especially in international transactions. According to Ask Gov, when exporting goods from Singapore, the value declared for the shipment should be based on the commercial invoice, not a proforma invoice.

Proper use of proforma invoices allows businesses to clearly communicate anticipated costs and terms, helping Singapore businesses streamline their operations and build stronger client relationships.

This article discusses the essential features of proforma invoices, such as their components, benefits, and comparison to other forms of invoices. Business leaders will get vital insights into using proforma invoices to increase communication, secure funding, and manage foreign transactions more efficiently.

- A proforma invoice is a preliminary document sent by a vendor to a customer to estimate the cost of goods or services before delivery or shipment.

- Issuing a proforma invoice involves key steps like initiation, review, confirmation, and final invoice issuance, ensuring clarity and agreement before completing the sale.

- To create an effective proforma invoice, focus on clarity, consistent format, relevant information, and utilize software tools for accuracy and efficiency.

- ScaleOcean accounting software automates proforma invoicing, reducing errors, ensuring compliance, and supporting scalability to simplify financial management for businesses.

What Is a Proforma Invoice?

A proforma invoice is a preliminary document sent by a vendor to a customer to estimate the cost of goods or services before delivery or shipment. It includes estimated expenses, terms of sale, and delivery schedules, but does not require payment. It ensures both parties align before order confirmation.

A pro forma invoice’s primary aim is to provide a detailed breakdown of expenses, allowing the buyer to better understand the pricing and terms. It also helps businesses secure finance and gives the essential information for customs clearance, resulting in smoother international transactions and eliminating any delays.

How Does a Proforma Invoice Work?

A pro forma invoice functions as an initial document that outlines the terms of the sale, providing a detailed estimate of costs, including shipping fees, taxes, and other charges. This helps the buyer understand the financial commitment involved before the final agreement, although the shipping costs may change based on external factors.

In many industries, businesses use pro forma invoices to gain internal approval for purchases. It helps clarify the terms of the sale early in the process, reducing delays caused by follow-up questions or misunderstandings. This allows both the buyer and seller to align expectations before proceeding with the transaction.

Pro forma invoices also provide essential details for Customs authorities to calculate tariffs. They outline the sale price, estimate shipping weight, and include any potential taxes or additional costs. Unlike commercial invoices, pro forma invoices do not demand immediate payment, ensuring the transaction remains in the preliminary stage.

Key Components of a Proforma Invoice

A proforma invoice is an important document in commercial operations, particularly those involving international trade. It gives a clear description of costs and terms before the shipment or delivery of products. A proforma invoice has several critical components that outline the transaction and guarantee that both the buyer and seller are on the same page. The key elements are:

1. Seller and Buyer Information

This section includes essential details such as the names, addresses, and contact information of both parties. Having accurate information helps avoid misunderstandings and establishes a clear line of communication, crucial for successful business relationships.

Including transaction dates and customer or seller specifications also plays a vital role. These details help track the invoice for future reference and assist in smooth invoice and receipt management, ensuring both parties stay on the same page throughout the process.

2. Description of Goods or Services

The proforma invoice clearly lists the items or services being exchanged, including quantities and specifications. It also ensures that both parties have a mutual understanding of what is being offered, minimizing the risk of disputes or confusion later on.

Adding any specific customer or seller requirements is important for further clarity. This thorough description helps to define expectations, making sure that all parties involved know exactly what’s being provided, and it can also support operating costs management down the line.

3. Estimated Costs

In this section, the proforma invoice provides a detailed breakdown of costs, including unit prices, total amounts, taxes, shipping costs, and handling fees. Transparency here ensures that the buyer is well-prepared for the financial commitment involved in the transaction.

Accurate cost estimates not only help the buyer plan but also prevent potential conflicts during the final billing process. This level of detail helps build trust between the buyer and seller, reducing the chances of misunderstandings and ensuring smooth payments when the time comes.

4. Terms and Conditions

The terms and conditions section outlines important details like payment terms, delivery timelines, and validity periods. It helps both parties understand when payments are due and when goods or services are expected, ensuring there are no surprises down the line.

Specifying a clear delivery date is crucial for both buyer and seller. It sets expectations on when the transaction will be completed, providing a firm deadline that ensures timely delivery and helps avoid delays that could affect the overall transaction or project.

5. Customs Information

For international transactions, the proforma invoice includes customs details like HS codes, country of origin, and destination. These details are crucial to facilitate smooth customs clearance, ensuring the goods travel across borders without unnecessary delays or fines.

By including all necessary customs information, both parties can avoid complications during shipping. This also ensures that the transaction complies with local regulations, making cross-border trade easier and more efficient for businesses engaged in international commerce.

Key Advantages of Using a Proforma Invoice

A proforma invoice offers numerous benefits in business transactions, particularly in international trade. It provides an early overview of costs, terms, and conditions before any goods or services are delivered, helping both parties stay aligned on expectations. This topic serves several key purposes, each of which can positively impact the process:

1. Provides Clarity

A proforma invoice gives both the buyer and seller a clear view of what the transaction will entail. It lists estimated costs, including taxes, shipping, and handling fees, ensuring that there are no surprises later. This clarity prevents misunderstandings during the process.

It also helps the buyer prepare financially by providing a detailed breakdown of the expected charges. Knowing the cost in advance ensures that both parties are on the same page, making it easier to plan budgets and negotiate any changes before the final invoice is issued.

2. Serves as a Preliminary Agreement

The proforma invoice acts as an informal agreement between the buyer and seller. It allows both sides to review the key terms before committing to the sale. By clearly stating the costs and conditions, it ensures that both parties are aware of the financial implications.

While not legally binding, the document sets the framework for the transaction. It offers the buyer an opportunity to assess the deal and request any changes before a formal contract is signed, helping reduce the risk of disputes later in the process.

3. Facilitates Cross-Border Transactions

For international transactions, a proforma invoice is essential for customs clearance. It includes important details like the goods’ value, shipping costs, and origin, ensuring compliance with import/export regulations. This speeds up the border clearance process.

Moreover, it helps avoid delays in shipping by providing customs authorities with the necessary documentation. Having this information upfront ensures that both parties can meet their obligations efficiently, making cross-border trade smoother and less prone to complications.

4. Demonstrates Professionalism

Issuing a proforma invoice reflects a professional approach to business. It shows the buyer that the seller is organized and transparent about the costs and terms of the transaction. This builds trust and fosters a more reliable business relationship.

By providing a detailed, clear document before the final sale, the seller demonstrates an understanding of business best practices. It reassures the buyer that they are dealing with a professional, increasing the likelihood of a smooth and successful transaction.

The Process of Issuing a Proforma Invoice

Issuing a proforma invoice is a simple process with several critical components. It begins with document preparation and ends with the final invoice issuance. Throughout the process, both the buyer and seller make certain that all agreements are agreed upon and that expectations are clear. Here’s how it works in a few easy steps:

1. Initiation

The seller begins by generating a proforma invoice based on the buyer’s request or order. This document describes the anticipated pricing, delivery information, and terms of sale. The vendor obtains the essential information, such as product or service descriptions, quantities, and prices. Once prepared, the proforma invoice is forwarded to the buyer for review.

2. Review and Negotiation

After receiving the proforma invoice, the buyer reviews all of the information given. This may entail reviewing the price, payment terms, and delivery timetables. If any problems or revisions are discovered, the buyer may request changes to the conditions or expenses.

Negotiations take place to formalize the agreement, ensuring that all sides are satisfied with the specifics before proceeding. The clarity in invoicing software can help streamline this process by automating adjustments and ensuring both parties are on the same page.

3. Confirmation

Following all necessary conversations, the buyer confirms the order, accepting the parameters indicated in the proforma invoice. This confirmation usually includes a formal acceptance of the document, and the buyer may place an official order with the seller. Once the buyer has agreed to the terms, the transaction will proceed to delivery.

4. Issuance of Final Invoice

When the products or services are delivered, the seller generates the final commercial invoice. This is a formal bill requesting payment for the goods or services rendered. Unlike the proforma invoice, which is an estimate, the commercial invoice indicates the total amount due for payment, bringing the transaction to a close. The tax invoice also ensures compliance with tax regulations and can be used for accurate financial reporting.

Difference Between a Proforma Invoice and Other Types of Invoices

Understanding the many sorts of invoices is critical in the corporate sector for payment management and transparency. Each invoice type serves a distinct purpose, based on the stage of the transaction and the legal obligations involved. The following is an overview of the significant distinctions between a proforma invoice and other types of invoices:

1. Proforma Invoice

A proforma invoice is primarily used to outline estimated costs before goods or services are delivered, offering a preview of the financial commitment. It is often used to secure financing, facilitate customs clearance, or inform the buyer about expected charges before finalizing the deal.

While a proforma invoice does not require payment, it sets the tone for future transactions, ensuring that the buyer and seller align on costs. Since it’s not legally binding, no formal cancellation is needed, and it allows the seller to adjust estimates before issuing a final, binding invoice.

2. Commercial Invoice

A commercial invoice is generated once the transaction has been completed. While a proforma invoice provides an estimated breakdown, a commercial invoice includes the actual costs, making it legally binding. This document marks the completion of a sale and officially requests payment from the buyer.

Unlike the proforma invoice, which offers only an estimate and is typically used for planning purposes, the commercial invoice serves as the final record of the transaction. It includes comprehensive details on the products delivered, payment terms, and any additional charges, ensuring clarity and legal compliance.

3. Sales Invoice

A sales invoice is issued after the sale is concluded, confirming the final amounts due for the goods or services provided. In contrast to the proforma invoice, which is a pre-transaction estimate, a sales invoice serves as the official document for payment collection and serves as proof of the completed sale.

Whereas a proforma invoice serves to outline anticipated costs and secure early agreements, a sales invoice demands payment for the completed transaction. This final invoice ensures both the buyer and seller are on the same page regarding what has been exchanged, reducing ambiguity once the goods or services are provided.

4. Credit/Debit Note

Credit or debit notes come into play after a commercial or sales invoice has been issued, typically used to adjust the amount due if there’s an error or change in the transaction. While the proforma invoice focuses on estimations before delivery, these notes are reactive, correcting figures once goods or services have been delivered.

Unlike a proforma invoice, which is issued before any payment or delivery takes place, credit or debit notes modify the agreed-upon transaction amounts post-sale. These adjustments ensure that both parties are financially aligned after the goods or services have been exchanged, providing a more accurate final financial record.

When Should Businesses Use Proforma Invoices?

A proforma invoice is an effective tool for businesses to streamline the many phases of a transaction. It is usually used to highlight important facts such as pricing, terms, and delivery information before the actual sale.

Understanding when to utilize a proforma invoice can help organizations make better decisions and prevent misunderstandings. Here are some serious situations where a proforma invoice should be used:

1. Pre-Sale Stage

A proforma invoice allows potential purchasers to understand the expected cost before committing to a purchase. It breaks down prices, quantities, and other terms. This clarity enables purchasers to determine whether the item fits within their budget. It also promotes trust and helps decision-making.

2. Securing Financing

When seeking trade finance, businesses are frequently required to submit a proforma invoice to banks or financial institutions. This document provides proof of the transaction’s details, including projected costs. It strengthens the legitimacy of the deal and aids in securing the necessary finance, playing a crucial role in financial management, particularly for large-scale, multinational transactions.

3. Customs Procedures

A proforma invoice is critical for foreign transactions because it includes important details that help with customs clearance. It specifies product descriptions, quantities, and pricing, assisting customs authorities in determining duties and taxes. The proforma invoice speeds up shipments by streamlining the customs process and lowering the possibility of delays or unexpected charges.

4. Negotiations

A proforma invoice outlines issues such as pricing, delivery, and payment prior to closing a sale. It allows both parties to confirm that they are on the same page regarding essential parts of the transaction. If there are any inconsistencies, they can be used as a point of discussion. This clarity promotes a more efficient transaction and reduces misunderstandings.

How to Create an Effective Proforma Invoice

Creating an effective proforma invoice is critical to ensure clear communication and easy company operations. By offering a thorough estimate prior to delivery, both the buyer and seller may better align their expectations. To ensure that your proforma invoice is both accurate and professional, there are a few key factors to consider:

1. Clarity

Ensure that all facts, including descriptions, quantities, and costs, are stated clearly and accurately. Ambiguous statements might lead to future misunderstandings or disagreements. Providing a full breakdown not only increases openness but also helps to avoid errors when closing the sale. Clear details are required for a seamless transaction process.

2. Format

To minimize confusion with other forms of invoices, properly label the paper “Proforma Invoice”. This easy step guarantees that both the buyer and seller understand the document’s purpose. It’s also beneficial to use a standard structure for all of your proforma invoices, which improves clarity and decreases the possibility of errors in future transactions.

3. Include All Relevant Information

Include critical data such as payment conditions, delivery timelines, and customs information, particularly for overseas transactions. These elements are critical to ensuring that the buyer understands the transaction’s terms, from payment schedules to customs clearance details. The thorough inclusion of these facts ensures that all parties are on the same page.

4. Use Software Tools

Using invoicing software can automate and streamline the billing process, allowing you to create accurate and professional proforma bills with ease.

ScaleOcean can be the best option to automate, lowering the risk of human error, saving time, and guaranteeing that your bills are consistently prepared and comprehensive. Businesses that use dependable software can focus on higher-level responsibilities while ensuring their billing is precise.

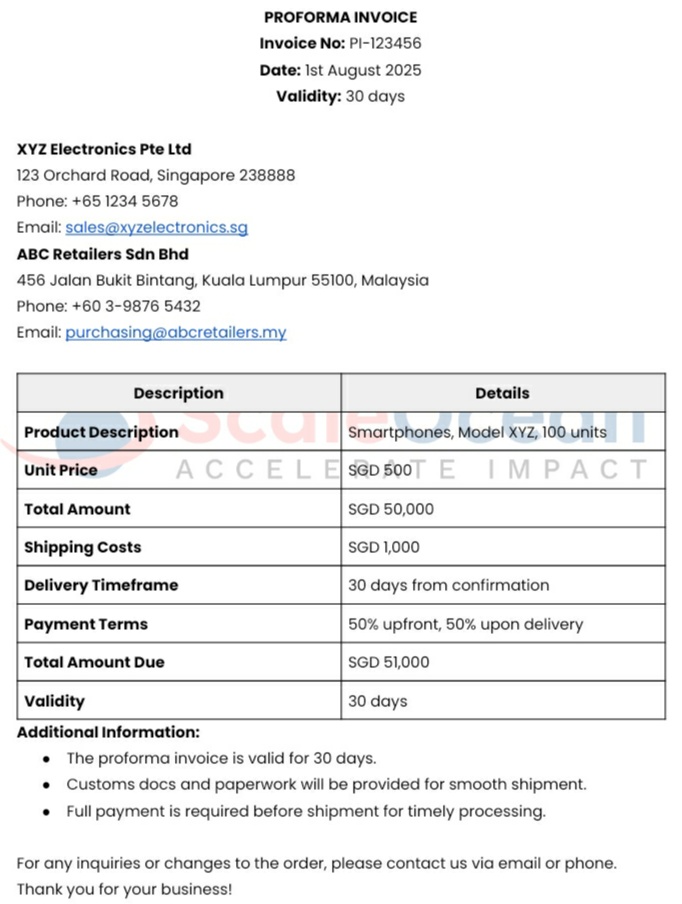

Example of a Proforma Invoice

A proforma invoice is a preliminary document that details the projected prices and terms of a transaction before actual shipment or delivery. It is often used in international trade to verify that all sides comprehend the agreement.

For example, a Singapore-based electronics supplier sends a proforma invoice to a Malaysian shop for a large order of smartphones, outlining the goods, pricing, shipping expenses, payment terms, and other critical details, ensuring transparency and clarity before the final sale. Here’s how the example might look:

Best Practices for Creating Proforma Invoices

When producing a proforma invoice, make sure that all details are correct, legible, and in accordance with applicable requirements. This reduces misconceptions and facilitates seamless transactions. By adhering to standard practices, you can ensure that your proforma invoice is effective for both local and foreign commerce. Here are some important best practices to follow:

1. Accuracy

Ensure that all details, including product descriptions, quantities, and costs, are precise and correct. This includes verifying unit prices, totals, and any taxes. Any inaccuracies in these facts can cause confusion, delays, and even disputes. Ensuring accuracy helps to preserve confidence between buyer and seller, making the transaction go more smoothly.

2. Clarity

Use basic and unambiguous language to ensure that all people involved understand what is happening. Avoid jargon and sophisticated terminology that may generate confusion. Clearly state the conditions of sale, payment schedules, and any other pertinent information. This will allow both parties to agree on the terms without ambiguity, eliminating the possibility of misunderstandings.

3. Compliance

According to Singapore Customs, importers may face penalties for non-compliance with the Customs Act, the Regulation of Imports and Exports Act (RIEA), and related regulations. This highlights the importance of ensuring your proforma invoice meets international trade standards, including necessary customs details such as HS codes, country of origin, and destination information, to avoid delays and penalties.

4. Consistency

Maintain a uniform structure for all of your invoices to make record-keeping easier and more professional. Consistent formatting ensures that all necessary information is included each time. It also establishes a consistent standard for your company, making it easier for customers to interpret and process information swiftly.

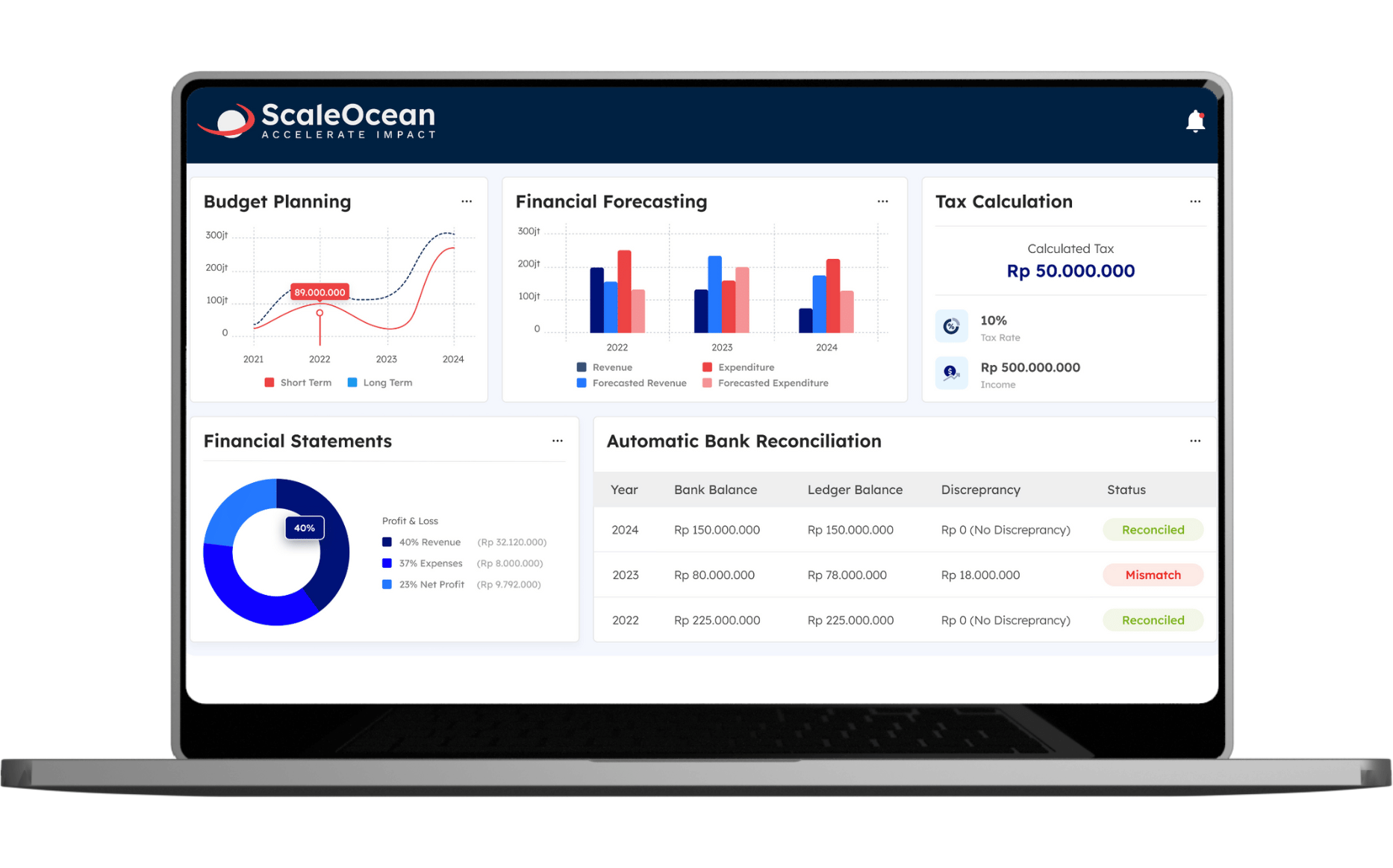

Streamlining Proforma Invoice Management with ScaleOcean Accounting Software

ScaleOcean accounting software is a complete software solution that simplifies and automates invoicing operations, allowing businesses to better manage their financial activities. ScaleOcean helps organizations decrease the stress of manual invoicing and streamline operations.

The program increases efficiency by reducing errors, guarantees compliance with changing rules, and allows for scalability to accommodate corporate expansion without the headache of human invoicing.

We provide a free demo to help you see how ScaleOcean can revolutionize your billing process and discover its capabilities firsthand. Furthermore, ScaleOcean is qualified for the CTC grant, which assists firms in implementing digital solutions. The following are the main features of ScaleOcean software:

- Automated Invoice Creation: Quickly generate accurate proforma and commercial invoices, streamlining your invoicing process.

- Customizable Templates: Easily tailor invoices to your business requirements for consistent, professional documentation.

- Integration with Inventory Management: Automatically update stock levels in real-time, ensuring invoices reflect accurate inventory data.

- Multi-Currency Support: Facilitate global transactions by handling multiple currencies effortlessly.

- IFRS Compliance: Ensure adherence to international financial reporting standards for consistent and reliable accounting.

Conclusion

Proforma invoices play an important role in the pre-sale process, allowing businesses to provide clarity to clients and establish clear expectations for both sides. These invoices, which outline expected costs, terms, and delivery deadlines, aid in the smooth operation of businesses, particularly in international trade. They ensure that all relevant details are conveyed up front, eliminating the possibility of misunderstandings or disputes later on.

The effective use of proforma invoices can greatly increase corporate efficiency by streamlining transactions and fostering openness, which promotes client trust. When managed appropriately, they result in smoother transactions and stronger relationships. ScaleOcean accounting software makes it easy to create precise and efficient proforma invoices, allowing businesses to retain smooth financial management while increasing client satisfaction.

FAQ:

1. What is a proforma invoice?

A proforma invoice is a document that outlines the estimated cost, terms of sale, and delivery information for goods or services before they are shipped or provided. It is essentially a preliminary bill and is not intended to request payment, but rather to inform both parties about the expected charges and conditions.

2. What is the difference between an invoice and a proforma invoice?

The primary distinction is that a proforma invoice serves as an estimate and is not legally binding, typically issued before the actual delivery of goods or services. In contrast, a commercial invoice is the final document sent after the delivery, which is legally binding and requests payment from the buyer.

3. Should you pay on a proforma invoice?

No, payment should not be made based on a proforma invoice. Since it is an estimate and not an official request for payment, payment should only be made when the commercial invoice is issued, which reflects the actual charges after delivery.

4. Why do people issue pro forma invoices?

Proforma invoices are issued to provide buyers with an early estimate of costs, terms, and delivery schedules before an order is confirmed. They are particularly useful for securing financing, assisting with customs processes in international trade, and ensuring both parties are aligned on the transaction details before proceeding.

PTE LTD..png)

.png)

.png)

.png)

.png)