Managing prepaid expenses is an important aspect of company accounting, especially for enterprises in Singapore. Prepaid expenses refer to paying for products or services in advance, such as insurance or rent.

Accurately tracking and recording these expenses is critical for keeping correct financial records and managing cash flow effectively. This article discusses the importance of prepaid expenses, how they are documented, and how they affect the balance sheet.

It also discusses the main differences between prepaid and accrued expenses, giving business owners useful insights into how to successfully manage their finances and ensure correct financial reporting. Learn more here!

- Prepaid expenses are advance payments for future goods or services, recorded as assets on the balance sheet until used. Common examples include insurance, rent, and subscriptions.

- Steps for recording prepaid expenses are as assets and gradually recognized as expenses. Monthly adjustments ensure that expenses are aligned with the benefits received over time.

- Examples of prepaid expenses are prepaid rent, prepaid assurance, software subscriptions, legal retainers, office supplies, and taxes and interest

- ScaleOcean Expenses Software automates the update of prepaid expenses on the balance sheet, improving accuracy and streamlining financial processes for better cash flow management.

What are Prepaid Expenses?

Prepaid expenses refer to payments made in advance for goods or services that will be received in the future, typically within a year. These are initially listed as current assets on the balance sheet.

Over time, as the benefit is utilized, a portion of the payment is recognized as an expense on the income statement, in accordance with the matching principle of accounting. Common examples include prepaid rent, insurance, and software subscriptions.

A company pays in advance for goods or services it will receive later, and these are its prepaid expenses. The company reports these expenses as assets on the balance sheet until it depletes them over time.

Common instances of prepaid expenses include insurance premiums, rent, and subscriptions. The company usually makes these payments in advance for services it expects to receive in the future.

For example, if a company pays for a year’s worth of insurance upfront, it has prepaid that expense. The prepaid sum becomes an expense as the company uses the coverage over time.

This guarantees that the company matches expenses to the actual time in which it incurs them, in accordance with accrual accounting rules. Businesses in Singapore must ensure that their accounting system properly tracks and record these payments for accurate financial reporting.

Accounting for Prepaid Expenses

Accounting for prepaid expenses ensures that expenses are recognized in the correct period, aligning with the matching principle. Prepaid expenses are payments made in advance for goods or services that will benefit the business in the future.

This process involves recognizing the initial payment, making periodic adjustments, and understanding the differences between accrual and cash basis accounting.

1. Initial Payment

When a company makes an advance payment for goods or services to be received in the future, the payment is initially recorded as an asset. This reflects the future economic benefit the business will receive.

The journal entry debits the specific prepaid asset account, such as Prepaid Insurance, and credits the Cash account, recognizing that the payment is made but not yet consumed.

2. Periodic Adjustment (Amortization)

As time progresses and the benefit from the prepaid item is consumed, periodic adjustments are necessary. The company makes an adjusting entry at regular intervals to reflect the expense.

This entry debits the appropriate Expense account, such as Insurance Expense, and credits the prepaid asset account. This process gradually reduces the asset’s balance while recognizing the expense incurred in each accounting period.

3. Accrual Basis vs. Cash Basis

Under accrual accounting, prepaid expenses are recorded as assets initially and expensed over time as the benefit is received, adhering to the matching principle.

In contrast, cash basis accounting records expenses when the payment is made, which may result in the expense being recognized earlier than it is consumed. Accrual accounting provides a more accurate reflection of expenses in the period they relate to.

When Do Prepaid Expenses Hit the Income Statement?

Prepaid expenses hit the income statement over time as the benefits of the prepaid goods or services are consumed. Initially, these expenses are recorded as assets on the balance sheet. However, as the service is provided or the good is used up, the asset is gradually amortized.

The corresponding expense is recognized on the income statement at each accounting period, aligning with the matching principle, which ensures expenses are reported in the same period as the related revenue.

Examples include insurance premiums, rent, and software subscriptions, where each month a portion of the prepaid amount is expensed. Companies can implement standard costing method allows businesses to allocate costs accurately, ensuring that expenses, like prepaid ones, are matched with the correct revenue for more effective financial management.

Examples include insurance premiums, rent, and software subscriptions, where each month a portion of the prepaid amount is expensed.

Record Prepaid Expenses

Recording prepaid expenses is critical for accurate financial reporting and compliance with accounting standards. The practice ensures that companies properly match expenses to the period in which the service is provided, which aligns with Singapore financial accounting standards.

Without proper documentation, companies risk misstating their financial performance. Businesses that initially recognize these payments as assets can spread the expense recognition over time when they consume the service.

Businesses risk misrepresenting their financial situation by failing to appropriately register prepaid expenses. This can result in overstating expenses in the period when they make the payment, while understating them later when they actually use the service.

Proper recordkeeping allows organizations to connect expenses to the periods in which they incur them, resulting in a more accurate picture of financial performance.

How to Record Prepaid Expenses?

When a company pays for products or services that it will receive in the future, it must properly record the payment as a prepaid expense. These payments are initially classified as assets, indicating the company’s right to a future benefit.

The practice of registering prepaid expenses is critical for accurate financial reporting. The following are the major steps in registering prepaid expenses:

1. Initial Recording as an Asset

This type of business expense is recognized as an asset on the balance sheet when paid. This is because the corporation paid for future advantages but hasn’t yet received the service or product.

The payment is normally classified as a current asset because the business will use it during its operational cycle, which is usually one year. This process is handled efficiently with the help of accounting software in Singapore that tracks all prepaid transactions.

2. Gradual Expense Recognition

As the advantage of the prepaid expense is realized, the corporation gradually recognizes it in the income statement. For example, if the prepaid expense is for a year of service, the company will recognize a portion of the cost each month.

This approach guarantees that the corporation proportionally recognizes expenses during the time it consumes the services or items.

3. Example of Insurance Payment

When a company pays for a one-year insurance policy in advance, prepaid expenses records the entire amount as a prepaid expense under current assets.

Over the course of the year, as the company uses the insurance coverage, it will transfer a portion of the prepaid amount from the asset to expense accounts. This guarantees that the company recognizes the expense progressively and consistently throughout the coverage period.

4. Monthly Expense Adjustment

Each month, a portion of prepaid funds is transferred from the asset to the expense account, reflecting the cost of services used. This ensures expenses align with the benefit received.

According to IRAS, the 2023 budget offers a 300% tax deduction on the first $400,000 of qualifying training expenses for SSG-funded courses from YA 2024 to YA 2028, helping businesses manage training costs more effectively.

Example of a Prepaid Expense

Let’s say a corporation pays $1,200 in advance for a 12-month insurance policy. At the moment of payment, the company records the entire $1,200 as a prepaid expense in assets.

This indicates that the service, insurance coverage, will be provided throughout the course of the following year. The company uses a general ledger to track these transactions and ensure proper financial reporting.

The corporation will record $100 as an expense each month, which is a fraction of the prepaid amount ($1,200 ÷ 12 months).

This process continues until the policy expires, ensuring that the expense management in business matches the time period during which the company provides the service, in accordance with the accrual accounting technique. To better understand this, here are some common examples in several business processes, including:

1. Prepaid Rent

Prepaid rent occurs when a company pays several months’ or even a year’s worth of office rent in advance. The payment is initially recorded as a prepaid expense under current assets on the balance sheet.

Over time, as the rental period progresses, a portion of the prepaid amount is expensed on the income statement, typically monthly, reflecting the use of the rented space.

2. Prepaid Insurance

Prepaid insurance refers to payments made for insurance coverage for an extended period, such as an annual premium.

This payment is recorded as an asset on the balance sheet. Each month, as the coverage is provided, a portion of the prepaid amount is expensed, which aligns the expense with the period the coverage is actually benefiting the business.

3. Software Subscriptions

Software subscriptions are often paid upfront for a year or more of access to a service or software. For example, paying for a year-long software license in advance results in a prepaid expense.

The prepaid amount is gradually expensed as the software is used over the subscription period, ensuring the expense aligns with the period in which the service is utilized.

4. Legal Retainers

Legal retainers are advance payments made to secure the services of an attorney or law firm for future legal work. These payments are recorded as prepaid expenses until the services are rendered.

As legal work is performed, the retainer is expensed, reflecting the usage of the legal services over time, often on a monthly or case-by-case basis.

5. Office Supplies

Office supplies may be purchased in bulk and paid for upfront, but not immediately used. For example, a company might buy a large quantity of paper or printer ink that will be used over several months.

The cost control process is initially recorded as a prepaid expense, and over time, as the supplies are consumed, the corresponding amount is moved to the expense account, reflecting the actual usage.

6. Taxes and Interest

Certain taxes or interest expenses are paid in advance of the period they cover. For instance, property taxes or interest on loans might be paid in advance for the upcoming period.

These are recorded as prepaid expenses initially, and then expensed gradually as the applicable period for the taxes or interest occurs, ensuring that the expense is matched to the right accounting period.

How to Find Prepaid Expenses on the Balance Sheet?

Prepaid expenses appear on the balance sheet under the “Current Assets” section. Companies classify them differently from other assets because they project these expenses to deplete within a year or within the company’s operational cycle.

This distinction promotes accurate financial reporting and reflects the short-term nature of these assets. Businesses can leverage cloud accounting tools to track prepaid expenses effectively and maintain clear financial statements.

To better understand the impact of these expenses on overall financial decision-making, companies can apply opportunity cost methods to assess the potential benefits lost by allocating funds to prepaid expenses instead of other potentially more profitable investments.

Look for a line item titled “Prepaid Expenses” or “Prepaid Insurance” in the assets section, depending on the payment type. This line item will show the amount of money you paid in advance for services. You will use these services over time, and the cost will progressively become an expense.

How to Forecast Prepaid Expenses?

To accurately predict prepaid expenses, companies must consider the services and items that they have already committed to paying for in advance. A cost-benefit analysis example can help businesses evaluate the financial advantages of these advance payments.

This approach helps businesses manage their budgets and cash flow more efficiently by anticipating costs. Proper forecasting ensures that organizations are financially prepared to cover future expenses. Here are some critical strategies to help you forecast prepaid expenses:

1. Review Upcoming Contracts and Payments

Businesses should start by examining upcoming contracts and payments. This covers recurrent expenses like insurance payments, rent, and software subscriptions, which are usually paid in advance.

Identifying these predictable costs enables organizations to forecast future financial outflows. The regular evaluation of these contracts guarantees that organizations can anticipate and manage their financial responsibilities.

2. Examine Agreement Terms

Businesses can anticipate the amount they will have to pay in advance for each service by reviewing the conditions of these agreements. The payment schedules, contract lengths, and rate fluctuations should all be carefully evaluated.

This phase assists in establishing the timing and amount of prepaid expenses. A good understanding of these words can help you avoid surprises and ensure proper financial planning.

To enhance this process, businesses can also use capital budgeting techniques to forecast and allocate funds for long-term investments, ensuring that cash flow is efficiently managed and that resources are allocated to the most profitable initiatives.

3. Estimate Future Prepaid Expenses

Businesses can use the information acquired to anticipate how much will be necessary for prepaid expenses in the following months or years. This includes calculating the overall cost of monthly payments as well as any one-time service advances.

With this information, firms may forecast future prepaid expenses and alter their budgets accordingly. Proper estimation helps to minimize underfunding expenses during critical periods.

4. Plan Cash Flow and Budget

Forecasting prepaid expenses enables firms to manage their cash flow and set aside enough funds in advance to cover these expenses when they emerge.

Businesses can ensure adequate liquidity at the appropriate moment by precisely predicting these payments. This phase is critical for ensuring smooth operations and preventing cash shortages. Effective cash flow planning also contributes to better financial decision-making.

Impact of Prepaid Expenses on Liquidity Ratios

Prepaid expenses impact liquidity ratios by affecting the classification of current assets. Liquidity ratios, such as the current ratio and quick ratio, measure a company’s ability to meet short-term obligations.

Since prepaid expenses are initially recorded as assets, they influence the calculation of these ratios, potentially skewing the real-time liquidity picture.

1. Current Ratio

The current ratio, calculated by dividing current assets by current liabilities, measures a company’s ability to cover short-term obligations with its assets. Prepaid expenses increase current assets, which can lead to a higher current ratio.

While this might appear to improve liquidity, prepaid expenses don’t represent cash or liquid assets, so the ratio may not fully reflect the company’s actual ability to meet short-term liabilities.

2. Quick Ratio

The quick ratio, also known as the acid-test ratio, excludes less liquid assets such as inventories and prepaid expenses to give a more accurate picture of liquidity.

Since prepaid expenses are excluded from the quick ratio, their impact is less significant compared to the current ratio. This provides a clearer view of a company’s short-term financial health by focusing on more liquid assets like cash, receivables, and marketable securities.

When assessing the financial health of a company, it’s also important to consider CapEx, as capital expenditures can significantly impact cash flow and liquidity, especially for companies making large investments in assets for long-term growth.

Are Prepaid Expenses a Current Asset?

Yes, prepaid expenses are considered current assets as they are expected to be used within one year and are reported in the balance sheet’s current assets section.

According to SSO, for YA 2021, 2022, or 2024, individuals can elect a 75% annual allowance on capital expenditure for machinery or plant, which can also be reflected as assets in the financial statements.

Prepaid expenses, as opposed to fixed assets such as property or equipment, provide benefits in the short term. Over time, they gradually turn them into expenses, in accordance with the accrual accounting technique, to ensure that expenses correspond to the periods to which they belong.

Difference Between Prepaid Expense vs. Accrued Expense

Prepaid and accrued expenses are both important in accounting, although they differ in terms of payment timing. A prepaid expense arises when a corporation pays in advance for goods or services that it will receive later.

Accountants first record these expenses as an asset on the balance sheet and then expense them as they realize the benefit over time. Accrued expenses occur when a corporation obtains a service or product but has yet to pay for it.

Companies recognize these expenses in the accounting period when they receive the service, even if they make the payment later. Both prepaid and accrued expenses are critical for keeping accurate financial records and managing cash flow effectively.

Manage Prepaid Expenses Integrated with ScaleOcean

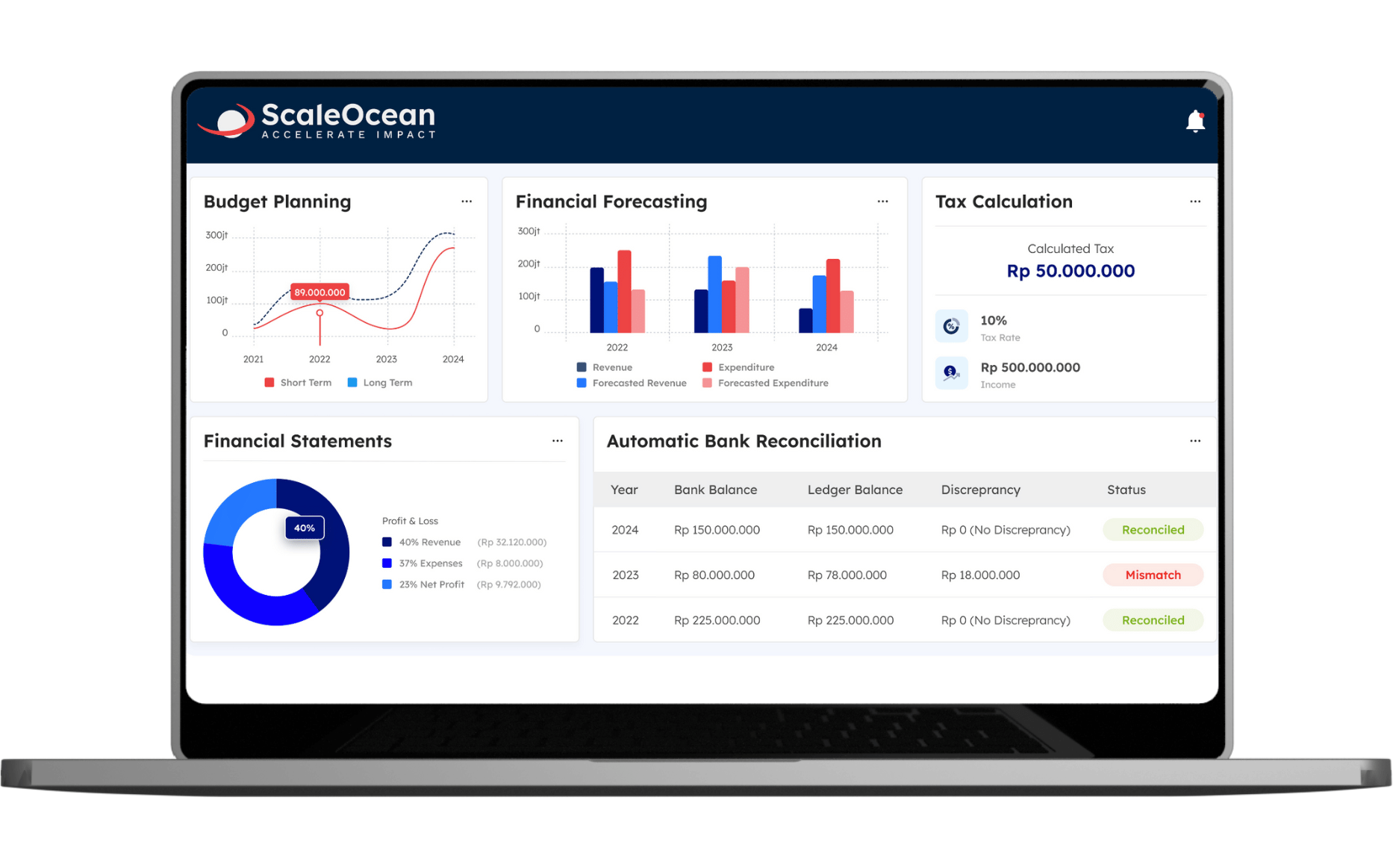

ScaleOcean Expenses Software is an ERP-based solution designed to streamline financial processes for businesses of all sizes. With its intuitive interface and robust functionality, ScaleOcean allows businesses to manage accounting tasks efficiently, including automatically updating prepaid expenses on the balance sheet.

This software not only saves time but also ensures accuracy, offering a comprehensive suite of tools that help businesses stay on top of their financial data, optimize cash flow, and make informed decisions.

ScaleOcean’s expense management module can be integrated with other modules in the ERP system, such as budget management, sales, and accounting, to facilitate overall cost monitoring and ensure that prepaid expenses are calculated correctly in the context of the company’s overall expenses.

ScaleOcean offers a free demo to showcase how its software can elevate your business’s accounting and financial management. Plus, businesses that qualify can take advantage of the CTC grant to further reduce costs while implementing ScaleOcean’s solution.

Below are the key features of ScaleOcean software:

- Automatic Recording and Allocation: Prepaid expenses are automatically recorded when payment is made. These expenses are then allocated and recognized according to the specified period automatically and in real time.

- Amortization Schedule Management: Supports the amortization of prepaid expenses according to the specified period, ensuring that expenses are not recorded entirely in the payment period, but are instead distributed according to usage or benefits received.

- Real-time Reporting: Easily monitor the remaining balance of prepaid expenses and see how the costs are allocated each month with high visibility.

- Accurate Financial Reporting: Generates reports that separate prepaid expenses from other expenses and ensure reports are accurate and compliant with applicable accounting principles (actual vs. cash basis).

- Expense Analysis and Optimization: Provides analysis of expenses related to prepaid expenses, making it easier to identify trends and optimize future spending.

Conclusion

Prepaid expenses are essential for accurate financial reporting, as they ensure that organizations appropriately account for payments made in advance. Properly recording and managing these expenses enables businesses to represent their genuine financial status while remaining compliant with accounting requirements.

Expense software, for example, can help to ease this procedure while also ensuring accuracy. ScaleOcean’s Expense Software provides a variety of software products to help organizations improve their financial processes.

Solutions by ScaleOcean Expenses Software streamlines chores like tracking prepaid spending while also supporting other critical services like financial reporting, invoicing, and inventory management. ScaleOcean’s adaptable and user-friendly platform is ideal for organizations aiming to increase financial efficiency and accuracy.

Request a free demo to provide this integration solution for your business.

FAQ:

1. What is the entry of prepaid expenses?

The purpose of the break-even point (BEP) is to help businesses calculate the number of units or sales dollars needed to cover both fixed and variable costs. Once the BEP is reached, any additional sales will generate profit, as they surpass the company’s expenses.

2. Where do prepaid expenses fall under?

Prepaid expenses are classified under the current assets section of the balance sheet. When a company makes an advance payment for a product or service, it is recorded as a “Prepaid Expense” in this section.

3. How do I post a prepaid expense?

To record a prepaid expense, follow these steps:

1. Make the payment for the prepaid item.

2. Record the payment in the accounting journal.

3. Debit the asset account.

4. Recognize a portion of the expense on the income statement.

5. Continue the process as the benefit is consumed over time.

4. Where do we put prepaid expenses?

Prepaid expenses are classified as assets on a company’s balance sheet since they represent future value, similar to store credit that will be used later. Most prepaid expenses are converted into regular expenses within 12 months, so they are typically listed as current assets, alongside cash and inventory.

PTE LTD..png)

.png)

.png)

.png)

.png)