Capital expenditure (Capex) refers to the cash used by a firm to buy, improve, or maintain physical and intangible assets that enable long-term growth. Proper capital expenditure management is critical for firms because it has a direct impact on asset value, financial health, and operational scale. In Singapore’s competitive business environment, where companies continually invest in innovation and infrastructure, understanding Capex and its ramifications can have a big impact on sustainability and success.

This article discusses major features of capital expenditure management, such as its definition, types, distinctions from operational expenses, and impact on financial statements. It also looks at planning and budgeting strategies, financing choices, and Singapore-specific regulatory considerations. By learning about these subjects, business leaders may make more educated investment decisions, enhance cash flow management, and align Capex strategies with their growth goals.

- Capital expenditure (Capex) refers to funds spent on acquiring or improving long-term assets that support sustained business growth, distinct from regular operating expenses.

- Capex includes tangible assets like equipment and buildings, as well as intangible assets such as software and patents, both essential for maintaining competitiveness.

- Effective planning and budgeting of capital expenditure, often involving formal approval and feasibility assessments, ensure alignment with strategic goals and financial stability.

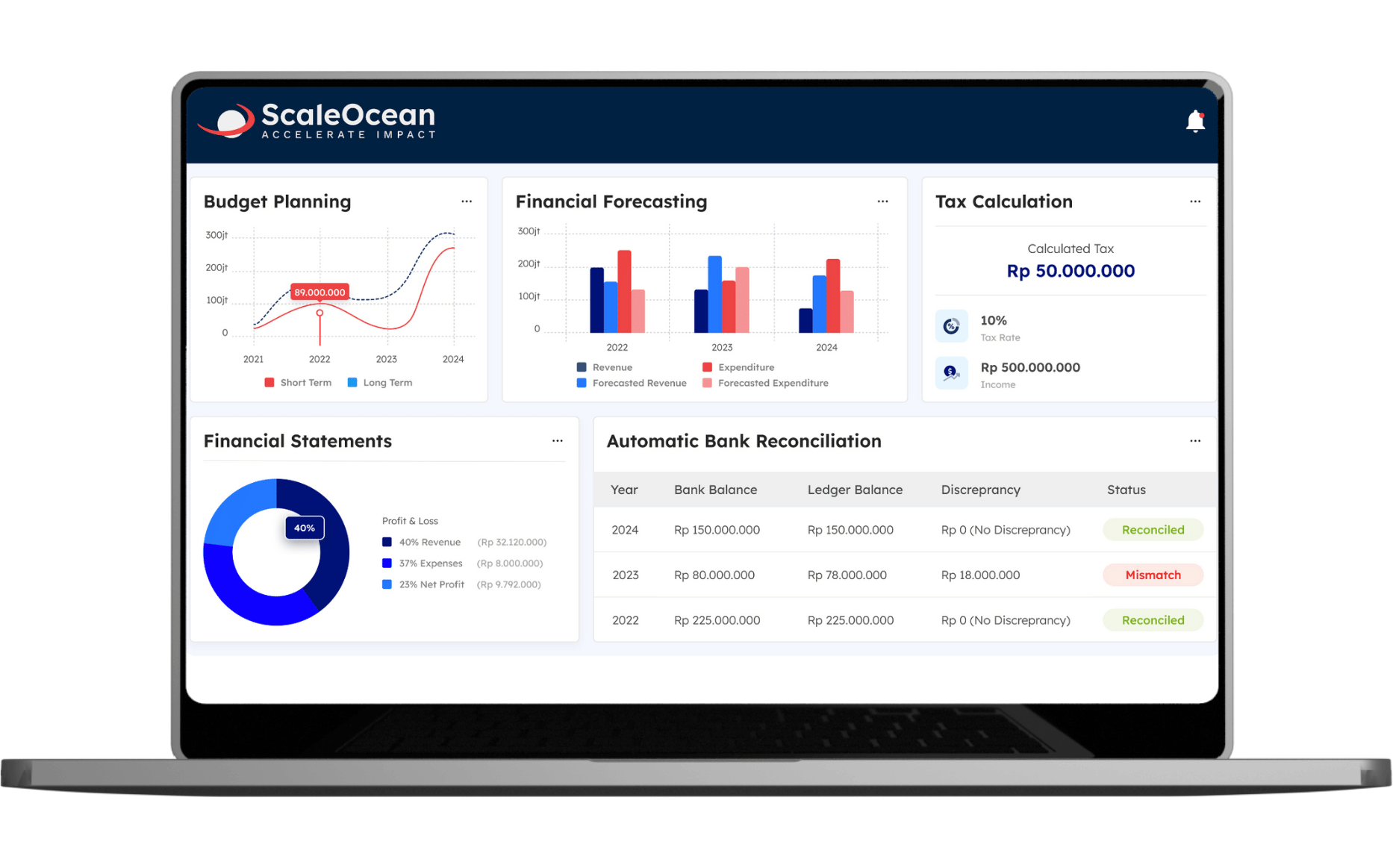

- Modern ERP and financial software, like ScaleOcean, streamline Capex management by automating processes, providing real-time insights, and integrating with accounting systems to improve accuracy and efficiency.

1. What Is Capital Expenditure?

Capital expenditure is the money a company spends to purchase, improve, or maintain long-term assets. The business uses premises, equipment, cars, and technology to drive long-term growth. It separates capital spending from day-to-day operational spending, which businesses usually classify as operating expenses. Companies typically allocate larger amounts for capital spending to support long-term goals rather than short-term needs.

Understanding capital spending allows organizations to plan more effectively for long-term growth. These investments are critical for growing operations or replacing old instruments and systems.

A good CapEx plan keeps your business productive, efficient cost control management, and future-ready. Over time, well-managed capital spending creates actual value and promotes long-term profit.

2. Types of Capital Expenditure

Capital expenditure takes several forms, depending on what a company needs to spend on for long-term value. While all Capex attempts to increase or maintain corporate performance, it can be broadly classified into two types: tangible Capex and intangible Capex. Each type serves a distinct purpose, yet both are critical to promoting business growth and competitiveness.

a. Tangible Capex

Tangible Capex is defined as expenditure on physical, touchable assets such as land, buildings, machinery, and vehicles. For example, when a logistics company buys new delivery trucks or modifies its warehouse facilities, it is incurring actual capital investment. These investments serve to increase operational efficiency, enhance capacity, and support everyday production or service delivery.

b. Intangible Capex

Intangible Capex refers to non-physical assets such as software licensing, patents, trademarks, and R&D expenses. For example, when a technology company invests in a new cloud software system or acquires intellectual property rights, the costs are recorded as intangible capital expenditures. These investments promote innovation, enhance digital capabilities, and generate long-term competitive benefits.

c. Example in Various Industries

Different industries apply tangible and intangible CapEx in unique ways to support growth. Manufacturing firms invest heavily in machinery and plant upgrades to improve production. Technology companies focus more on intangible assets like software and patents to drive innovation.

Retail businesses spend on physical stores and point-of-sale systems to enhance customer experience. Logistics companies allocate capital for vehicles and warehouse improvements to boost efficiency. These diverse investments help companies maintain competitiveness in their respective markets.

To track and manage these costs effectively, companies often use methods like standard costing process, which helps set benchmarks for expenses and compare actual costs against the expected ones, ensuring efficient capital allocation.

3. Capital Expenditure vs Operating Expenditure (Opex)

The primary distinction between capital expenditure and operating expenditure is its utilization inside the firm. Capital expenditure is used to acquire or upgrade long-term assets such as property, equipment, or machinery. These assets help to drive corporate growth and remain valuable for many years after purchase. Operating expenditure, on the other hand, pays for the company’s day-to-day expenses, such as salaries, rent, utilities, and office supplies. These costs keep the business functioning smoothly, but they do not generate long-term assets.

In accounting, companies record capital expenditure as an asset and apply depreciation throughout its useful life. This approach spreads the expense across several years and matches it to the asset’s economic benefit. In contrast, companies expense management costs fully within the accounting period in which they incur them. This immediate deduction has a direct impact on the profit and loss statement for that year. Understanding capex vs. opex is critical for accurate financial planning, reporting, and budget management.

4. How Capital Expenditure Affects Financial Statements

When a corporation incurs capital expenditures, the transaction is reflected on the balance sheet as a fixed asset. This asset contributes to the company’s overall assets and enhances its long-term resource basis. The asset’s value decreases over time due to depreciation or amortization expenditures. These non-cash expenses are recorded on the income statement to align costs with revenue.

Depreciation spreads the asset’s cost throughout its useful life, increasing the accuracy of profit reporting. This entire process relies on the principles of double-entry accounting, ensuring every transaction is accurately recorded in both debit and credit accounts, maintaining the integrity of the financial statements.

In the cash flow statement, capital expenditure is shown under cash flows from investment activities. This section monitors the outflow of funds used to acquire long-term investments. While capital expenditures diminish available cash in the immediate term, they are intended to generate future profits.

Investors and analysts closely track Capex to better understand its influence on liquidity and growth prospects. Strong capital expenditure selections can boost long-term profitability and provide competitive advantages in the market.

5. Planning and Budgeting for Capital Expenditure

Proper capital expenditure management requires careful planning because it affects both corporate growth and long-term financial stability. Businesses in Singapore often go through a formal approval process before committing finances to big capital initiatives. These processes include determining feasibility, forecasting cash flows, and ensuring alignment with strategic goals. Companies build defined frameworks to guarantee that each Capex choice is financially viable and promotes long-term business performance.

Capex budgeting uses techniques such as capex calculation methods to effectively assess costs, benefits, and potential investment risks. ROI predictions assist organizations in determining whether anticipated capital expenditures will deliver sufficient returns over time.

One effective approach is conducting a cost-benefit analysis process, which helps assess whether the benefits of a particular investment justify its costs. Aligning Capex decisions with overall strategy ensures that financial resources are allocated efficiently and effectively. Strong capital expenditure planning methods increase financial management, accountability, and the company’s investment decision-making process.

6. Financing Capital Expenditure

Capital expenditures are generally huge sums, therefore organizations must carefully plan how to fund these investments. Companies can fund capital investment through two main channels: internal and external. Understanding both funding options enables businesses to balance financial risks and select the appropriate approach for each case.

a. Internal Source

Internal sources include retained earnings, company reserves, and income set aside for future investments. This strategy eliminates interest charges and maintains ownership, making it a low-risk option. According to Sleek, business owners, especially SMEs, can claim tax deductions for renovation or refurbishment work on their premises, with a deductible cap of $300,000 every three years. However, this may limit the amount a company can invest, depending on its internal resources. Companies must strike a balance between using savings properly and maintaining enough cash for day-to-day operations.

b. External Source

External sources include funding possibilities such as bank loans, leasing agreements, and issuing new equity to raise money. Bank loans offer scheduled payments, whereas leasing allows you to use assets without having to pay for them up front.

Issuing equity attracts investors but may weaken ownership control. Although these strategies enhance accessible capital, they also result in new financial commitments or shareholder duties.

To assess the best option, businesses can apply the opportunity cost process to evaluate the trade-offs between each funding source, considering not only the financial commitments but also the potential benefits of alternative investments or financing opportunities.

7. Depreciation and Amortization of Capital Assets

When a business purchases an asset, it must record depreciation or amortization, depending on the asset type. Depreciation applies to real assets, such as machinery, whereas amortization applies to intangible assets, such as software. This approach spreads the asset’s cost over its estimated useful life. The salvage value plays a key role in this process, as it is subtracted from the initial cost to calculate total depreciation, influencing tax deductions and financial reporting.

Many Singaporean businesses profit financially from depreciation and amortization. The recorded business expense process reduces taxable income, resulting in decreased overall tax requirements. Proper management of these entries assures compliance with local tax legislation and accounting standards. Businesses frequently utilize specialized methodologies, such as straight-line or falling balance, to compute annual depreciation. Accurate estimates promote financial transparency and long-term planning.

8. Monitoring and Controlling Capital Expenditure

Monitoring capital expenditure extends beyond approval; organizations must constantly compare actual expenditures to approved budgets. Regular tracking allows management to detect early aberrations and take remedial action before they escalate.

Financial controllers use variance analysis to determine why expenses deviate from forecasts and to evaluate potential risks. This technique improves accountability by ensuring project managers remain accountable for expenditure decisions and stay on track with company goals.

To enhance decision-making, businesses can implement capital budgeting techniques, which provide a structured approach to evaluating investment options and aligning them with long-term financial goals.

Capex management software helps to improve financial monitoring and data quality across different projects. These solutions combine real-time data, enabling finance teams to create intelligent reports and dashboards.

Automated systems eliminate manual errors, save time, and boost confidence in reported data. With increased insight, executives can make more informed decisions, protect profitability, and efficiently optimize future investment initiatives.

9. Regulatory and Tax Considerations in Singapore

In Singapore, the Inland Revenue Authority of Singapore (IRAS) has established defined standards for capital expenditure and tax treatment. Businesses must understand which Capex items qualify for tax deductions under current IRAS rules. According to IRAS, capital allowances are no longer granted on expenditure funded by government or statutory board capital grants approved from 1 January 2021 onwards.

Not all capital expenditures are deductible, especially those classified as private or non-qualifying. To ensure accurate reporting, financial teams must carefully document and classify these expenses. Misclassification can lead to compliance issues or denied deductions, which may negatively impact the company’s financial results.

Furthermore, Singapore provides different subsidies and incentives for enterprises who invest in innovation or sustainable energy initiatives. To receive these incentives, businesses must first analyze their eligibility and then apply within the regulation deadline.

Financial planning teams should coordinate Capex plans with available government programs to maximize savings. Keeping up with regulatory developments helps organizations maintain compliance and avoid costly penalties. The proper integration of these incentives into financial strategy improves long-term profitability and competitiveness.

10. Challenges and Risks in Managing Capital Expenditure

There are various hazards associated with managing capital spending in a company setting. Spending too much on Capex can stymie cash flow. Underinvestment in Capex, on the other side, can stifle critical corporate growth. Poorly produced Capex forecasts frequently cause budgeting challenges, compromising overall financial stability.

Unexpected cost overruns on significant Capex projects might jeopardize long-term corporate goals and cash flow. Businesses must carefully consider these risks while making investments in new assets or expanding operations.

To avoid risk, organizations should examine their Capex plans and allocations on a regular basis. Using realistic estimates based on reliable financial data increases Capex accuracy and planning confidence. Applying established decision-making frameworks improves Capex prioritizing and resource allocation.

A well-defined Capex formula enables organizations to better analyze return on investment (ROI). Strong Capex planning mechanisms minimize the possibility of project overruns or underperformance. With adequate financial monitoring, businesses may balance growth capital expenditures against available finance and operating requirements.

To complement this, implementing a prepaid expenses method can help businesses manage upfront payments more effectively, ensuring that financial resources are optimized and expenses are recognized over time, supporting better cash flow management during capital-intensive projects.

11. How ERP and Financial Software Support Capex Management

Managing capital expenditure effectively is a critical part of any business strategy, and modern ERP-integrated software plays a vital role in supporting this process. ScaleOcean’s Expense Software is a comprehensive solution designed specifically to streamline capital expenditure management along with other business operations.

By automating Capex procedures, offering real-time monitoring and reporting, and integrating seamlessly with accounting and asset management modules, ScaleOcean helps businesses save time and reduce errors.

These features empower companies to make faster, more informed decisions while maintaining accurate financial records and improving overall operational efficiency. Using one of the best expense software, such as ScaleOcean, is critical for effective capital expenditure management. It not only makes tracking and budgeting easier, but it also helps people comply with financial grants like Singapore’s CTC Grant. ScaleOcean provides a free demo to firms wishing to optimize their Capex planning and control. The following is a list of key features from ScaleOcean software:

- Comprehensive Financial and Budget Control, ScaleOcean ERP enables businesses to monitor capital spending closely by comparing actual expenses to budgets.

- Integrated Financial Management with Real-Time Reporting, The system provides real-time financial data and analytics, giving managers up-to-date insights into Capex costs and commitments.

- Automated Workflow and Approval Processes, By automating purchase requests and approval workflows, ScaleOcean ERP speeds up Capex approvals while reducing errors and ensuring compliance with company policies.

- Strong Integration Across Modules, ScaleOcean seamlessly connects finance, purchasing, asset management, and project modules. This integration offers full visibility over Capex activities, from procurement through asset tracking and depreciation, enabling better control and coordination.

- No Hidden Costs with Unlimited User Licensing, With unlimited user access and no extra fees, ScaleOcean allows broad involvement across departments in Capex management without increasing costs.

12. Conclusion

Effective capital expenditure management is vital for long-term corporate growth. Companies that carefully plan, manage, and monitor Capex can invest wisely in assets that promote long-term performance. Balancing expansion expenditure with operating demands allows organizations to retain healthy cash flow and respond to changing market conditions, resulting in consistent growth over time.

ScaleOcean provides complete ERP solutions that simplify CapEx management by seamlessly linking finance, accounting, and asset procedures. Its expense software solution enables organizations to keep accurate records and maximize financial reporting. Together, these technologies enable businesses to make more informed investment decisions and promote continuous growth with confidence.

FAQ:

1. What is capital expenditure with an example?

Capital expenditure, or Capex, refers to funds spent by a company to buy, improve, or maintain long-term assets that support its business activities. These assets can be physical, like machinery or buildings, or intangible, such as software licenses. For example, when a factory purchases new equipment to increase production capacity, this spending is considered a capital expenditure because the asset will be used over many years.

2. What is considered a capital expenditure?

Capital expenditure involves spending on assets that benefit a business for multiple years beyond the current accounting cycle. This includes investments in fixed assets like land, buildings, machinery, and intangible assets such as software or patents. Routine expenses like utility bills or employee wages are excluded. For instance, acquiring a new office space or buying long-term software licenses counts as capital expenditure.

3. What is CapEx vs Opex?

Capital expenditure (Capex) relates to money spent on purchasing or upgrading assets that a business uses over the long term, while operating expenditure (Opex) refers to the regular costs necessary to run daily operations, such as rent, wages, and utilities. In accounting terms, Capex costs are recorded as assets and depreciated over time, whereas Opex costs are fully charged as expenses in the period they occur, immediately impacting profits.

4. What are the three types of capital expenditures?

Capital expenditures are commonly categorized into three groups:

1. Tangible Capex: Physical items like buildings, machinery, and equipment.

2. Intangible Capex: Non-physical assets including patents, trademarks, and software.

3. Growth Capex: Investments aimed at expanding the company’s production capacity or market reach, such as adding new facilities or upgrading technology.

Each category serves a specific purpose in supporting a company’s operational and strategic goals.

PTE LTD..png)

.png)

.png)

.png)

.png)