Net sales are an important financial indicator because they indicate a company’s actual revenue performance after accounting for discounts, returns, and allowances. By focusing on net sales, firms acquire a more accurate knowledge of their actual income, which is critical for determining profit.

This measure gives information about how well a corporation converts sales into actual revenue after modifications. It aids in assessing overall business health and pinpointing areas for improvement.

In Singapore, net sales are especially important for firms in industries such as retail, manufacturing, and services, where profitability is dependent on accurate revenue tracking. It reporting promotes openness in various areas, allowing businesses to maintain competitive pricing and enhance their sales strategy.

Accurate data facilitates better decision-making, forecasting, and financial planning, allowing businesses to efficiently allocate resources and prepare for future growth. Here’s a complete explanation of net sales, from how to calculate it, the formula, to how it differs from various metrics. Learn more here!

- Net sales represent the actual revenue a company generates after subtracting returns, allowances, and discounts, offering a clearer picture of financial performance compared to gross sales.

- The importance of net sales is in financial reporting, performance evaluation, and easy decision-making

- To calculate net sales, you can use this formula: Net Sales = Gross Sales – (Sales Returns + Allowances + Discounts)

- Cost affecting net sales is sales returns, allowances, and discounts

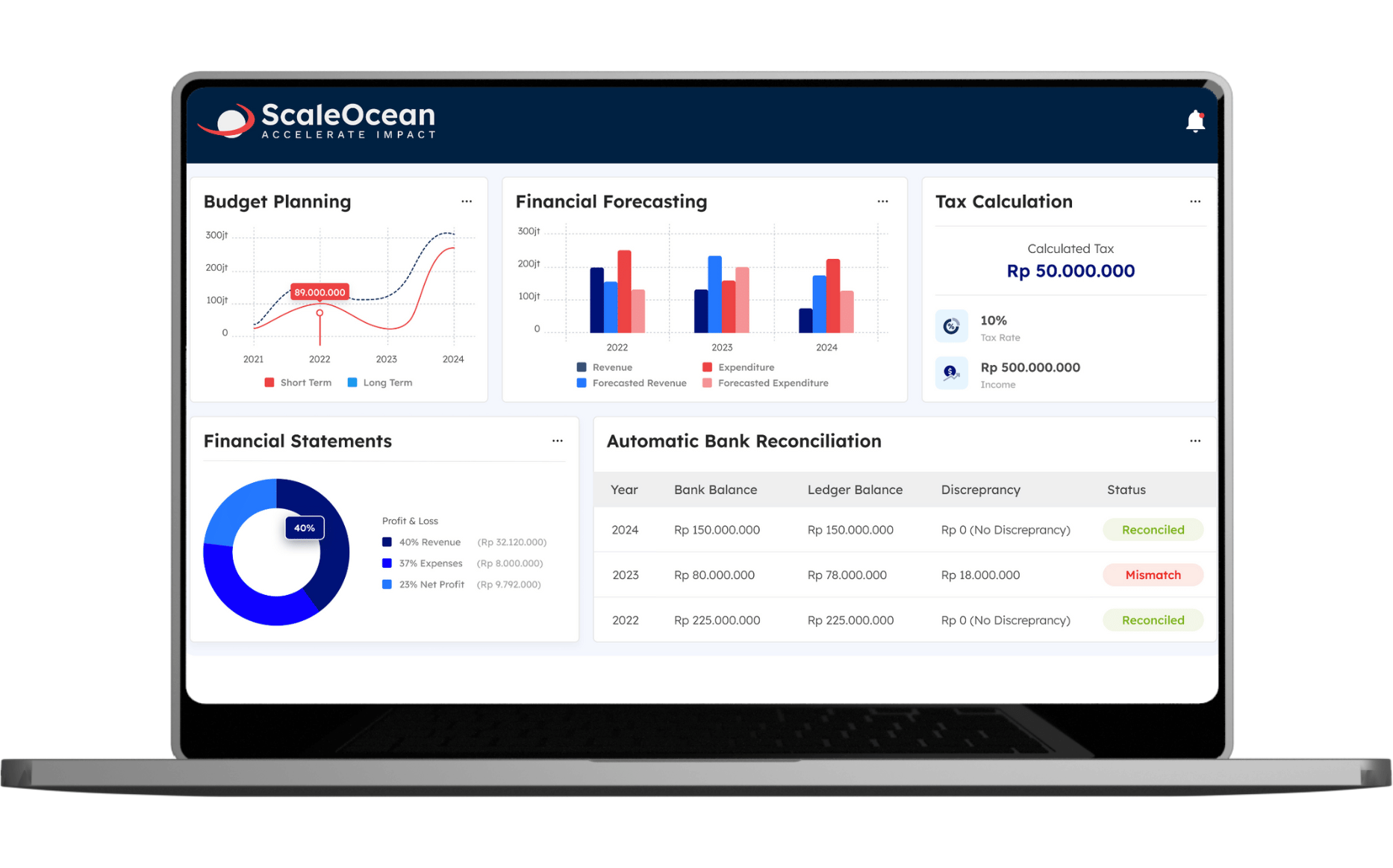

- ScaleOcean’s Accounting Software automates net sales tracking for businesses, providing real-time financial insights, ensuring accuracy, and simplifying reporting by integrating key business functions.

What Is Net Sales?

Net sales are the actual revenue a company generates from its sales activities after subtracting deductions like customer returns, allowances (partial refunds for damaged products), and discounts. This figure is considered a more precise indicator of a company’s real sales performance compared to gross sales.

It also represents the actual amount made by the company from its sales activities, which provides a more accurate view of financial performance than total sales.

Calculating revenue enables organizations to make informed decisions regarding sales strategies and pricing. This metric is critical for analyzing a company’s effectiveness as well as its financial health.

Why are Net Sales Important?

Net sales are a key indicator of a company’s real revenue, accounting for returns, discounts, and allowances. This figure is crucial for financial reporting and estimating profitability.

According to SSO, the Financial Reporting Standard FRS 25, Accounting for Investments, became effective for financial statements from 1st January 1988. This metric plays a vital role in ensuring consistency and transparency in financial reporting.

It is important in investor relations because it allows investors to understand how a company generates revenue. Furthermore, it affects loan applications and business valuations since it represents a company’s financial health and ability to generate continuous income.

Accurately calculating net sales is crucial in determining key metrics such as the profit margin formula, which is essential for analyzing the overall profitability of a business.

How to Calculate Net Sales

Net sales provide a clearer view of a company’s actual revenue after accounting for returns, allowances, and discounts. Calculating it involves a few straightforward steps, ensuring a more accurate representation of the sales performance.

1. Calculate the Gross Sales for the Company

Gross sales refer to the total revenue generated from sales transactions without any deductions. It includes the full value of all goods and services sold, regardless of returns or discounts. To calculate gross sales, simply sum up all invoices or sales transactions made during the period.

2. Deduct Sales Discounts

Sales discounts are reductions offered to customers for early payment or promotions. To calculate it, you need to subtract any sales discounts provided during the period. These discounts decrease the total revenue but incentivize timely payments, making them essential for improving cash flow.

3. Deduct Sales Allowances and Returns

Sales allowances and returns occur when customers are dissatisfied with products and request a partial refund or return. To calculate it, subtract these amounts from the gross sales. Allowances and returns can impact the revenue significantly, so it’s important to track them accurately.

4. Calculate the Net Sales

Finally, after deducting sales discounts, allowances, and returns from the gross sales, you arrive at net sales. It represent the actual revenue the company can expect to retain and are used for further analysis of profitability and financial performance.

Net Sales Formula Calculating

Calculating net sales is crucial for understanding the true revenue a company retains after accounting for returns, discounts, and allowances. It figure offers a more accurate representation of a company’s financial health by reflecting the actual income generated from its sales activities.

Here’s a breakdown of how to calculate it accurately.

Net Sales = Gross Sales – (Sales Returns + Allowances + Discounts)

The following is a complete explanation of this net sales formula:

- Gross Sales: The complete, unmodified value of all sales transactions during a designated time period.

- Sales Returns: The total value of goods returned by customers for either a full or partial refund.

- Sales Allowances: Price adjustments or partial refunds provided to customers, usually due to a product being damaged or defective, but still retained by the customer.

- Discounts: Price reductions offered to customers, typically for early payment, bulk purchases, or as part of a promotional offer.

Example of Calculating Net Sales

Let’s break it down with an example.

Suppose a company has gross sales of $100,000. After accounting for returns of $5,000, allowances of $2,000, and discounts of $3,000, the calculation for net sales would be as follows: Net Sales = $100,000 – ($5,000 + $2,000 + $3,000).

This results in a net sales total of $90,000, reflecting the actual revenue earned after deductions. Here’s the formula applied:

Net Sales = $100,000 – ($5,000 + $2,000 + $3,000) = $90,000

For example, in a service business, let’s say the gross sales amount to $50,000.

After accounting for returns of $1,000, allowances of $500 for client complaints, and discounts of $2,000 offered for early payment, the net sales calculation would be: Net Sales = $50,000 – ($1,000 + $500 + $2,000).

This results in a net sales total of $46,500, reflecting the actual revenue earned after all deductions.

Costs Affecting Net Sales

Understanding the costs affecting net sales is essential for evaluating a company’s actual revenue. Several factors, such as sales returns, allowances, and discounts, can significantly impact the final figure.

These adjustments reduce the overall sales revenue, making it crucial to account for them when calculating net sales.

1. Sales Returns

Sales returns occur when customers return products due to dissatisfaction or other reasons. The value of these returned goods is deducted from gross sales to calculate it.

This reduction reflects the products that were not successfully sold, impacting the total revenue a company can retain.

2. Allowances

Sales allowances are price reductions offered to customers, often due to product defects or issues. Unlike returns, customers typically keep the product but receive a partial refund.

These allowances reduce the overall sales value, affecting the net sales and offering businesses a way to maintain customer satisfaction despite product shortcomings.

3. Discounts

Discounts are price reductions given to customers as incentives for actions like early payments, bulk purchases, or participation in promotional campaigns.

These discounts directly lower the sales revenue and must be factored into the calculation of net sales to give a true picture of the income the business retains.

Net Sales vs. Gross Sales

Gross sales represent the unadjusted total of all sales transactions made during a specific period, without considering returns or discounts.

In contrast, net sales account for these factors, providing a more accurate measure of the company’s retained revenue after adjustments. While gross sales show the overall sales volume, it offers a clearer picture of actual income.

Net Sales vs. Income Statement

Net sales are often considered one of the first line items on an income statement, representing the total revenue after adjusting for returns, allowances, and discounts.

The income statement, however, includes other expenses like cost of goods sold (COGS), operating expenses, and taxes. Net sales contribute to the larger picture of profitability seen on the income statement.

Net Sales vs. Profits

Net sales are not the same as profits, though they contribute to calculating profits. Net sales refer to the revenue left after adjusting for returns, allowances, and discounts.

Profits reflect the earnings after deducting all operating expenses, taxes, and other costs. Net sales are a precursor to profit calculations, but do not account for all business expenses.

How Net Sales Appear on Financial Statements

On the income statement, this adjusted revenue figure appears prominently in the revenue section. It is an important parameter that directly influences the calculation of other major financial metrics like cost of goods sold, gross profit, and operating income.

Its strategic location emphasizes its critical importance in determining a company’s financial performance. Understanding the placement and relevance of net sales on financial statements is critical for firms seeking to appropriately estimate profitability and control operating costs.

This straightforward presentation enables stakeholders to rapidly grasp the genuine sales performance after accounting for various reductions, delivering a more realistic view of the money generated by core businesses.

To manage and track these figures effectively, businesses can use a sales account, which helps in organizing and monitoring all sales-related data, ensuring clarity and accuracy in financial reporting.

Common Mistakes to Avoid When Calculating Net Sales

When computing net sales, precision is critical, as even little errors can lead to erroneous financial reporting. These inaccuracies can influence decision-making, mislead stakeholders, and harm overall business success.

Avoiding frequent mistakes provides firms with a comprehensive picture of their actual revenue, which is critical for financial management, budgeting, forecasting, and performance review. The following are some major faults to watch out for:

1. Misclassifying Discounts or Allowances

Discounts and allowances should be properly classified to avoid inflating or underreporting revenue. If not correctly accounted for, they might alter the true net sales figure, resulting in misleading financial statements.

Proper classification ensures that the business’s financial health is appropriately represented and that choices are made using credible data.

2. Confusing Gross Sales with Net Sales

It’s critical to distinguish between gross sales and revenue after adjustments. Gross sales are total sales before adjustments such as returns, discounts, and allowances, whereas this adjusted figure represents the actual earned revenue after these adjustments.

Mistaking the two might result in a misunderstanding of a company’s genuine financial status and profitability.

3. Omitting Returns from Deductions

Returns should always be considered when computing net sales. Failure to subtract the value of returned goods might increase sales figures, creating an inaccurate picture of the company’s revenue. Returns are properly factored in, ensuring a more realistic portrayal of actual sales success and profitability.

How Net Sales Impact Business Decisions

Net sales play an important role in determining essential company choices because they provide a more realistic picture of actual revenue. Understanding this figure allows businesses to make more educated decisions about pricing, performance evaluation, and financial planning.

Businesses can use net sales data to improve their strategies and overall financial health. The following are the primary areas touched by this metric:

1. Pricing Strategy Adjustments

Businesses can make more educated pricing decisions by evaluating actual revenue. This could include raising or lowering prices based on market demand and sales results. With precise data, businesses can find the proper balance between competitiveness and profitability, resulting in higher revenue outcomes.

Understanding standard costing in business further helps to ensure that pricing decisions align with cost structures, improving overall financial performance.

2. Sales Performance Evaluation

Tracking real income allows companies to measure the effectiveness of their sales methods. It gives information about which items or services generate revenue and where changes are required.

According to IRAS.GOV.SG, business income must be reported using a 2-Line or 4-Line Statement. You should use the 4-Line Statement when your revenue exceeds $200,000. Understanding this allows businesses to better optimize their sales efforts and allocate resources to achieve growth.

3. Financial Forecasting and Budgeting Accuracy

Knowing the true revenue from sales allows you to create more realistic financial projections and budgets.

This allows for improved cash flow management, ensuring that the company has the finances to meet operating expenses and invest in growth. Accurate revenue data facilitates strategic planning by aligning goals with available resources.

Simplify Net Sales Tracking & Reporting with ScaleOcean’s Accounting Software

Ideal for Singapore businesses aiming for reliable, streamlined reporting, ScaleOcean’s Sales Software simplifies the process of tracking net sales. The software offers real-time visibility into financial data, enabling businesses to make timely decisions.

With seamless integration across various financial modules, it ensures a smooth workflow while reducing errors and inconsistencies in reporting.

These benefits help businesses maintain accurate financial records, improving overall operational efficiency and profitability. ScaleOcean also offers a free demo to showcase how the software can meet your business needs.

Additionally, businesses may qualify for the CTC Grant for software adoption, making it even more accessible. Here is the list of key features of ScaleOcean’s software:

- Automated Sales Tracking & Reporting: ScaleOcean ERP automates sales tracking and report generation, ensuring real-time accuracy and reducing manual errors.

- Seamless Module Integration: The system integrates financial modules like Accounting, Sales, and Inventory, streamlining workflows and minimizing discrepancies.

- Real-Time Financial Visibility: Provides businesses with real-time access to financial data for informed decision-making and accurate net sales tracking.

- Customizable Reports & Analytics: Offers tailored reporting options, allowing businesses to generate detailed, relevant sales and financial reports.

- Error Reduction in Reporting: Automates processes to reduce human errors in sales tracking and reporting, ensuring reliable and accurate net sales data.

Conclusion

Understanding and correctly calculating net sales is critical for firms to determine their genuine revenue. Proper net sales management guarantees that all adjustments, including returns, discounts, and allowances, are properly accounted for.

Without reliable tracking, businesses may misread their financial health, resulting in poor decision-making. Therefore, it is critical to have a clear and exact grasp of net sales statistics.

To accomplish accurate financial reporting and educated decision-making, organizations should use innovative technology such as ScaleOcean’s Accounting Software. The program streamlines the sales tracking process and connects multiple financial elements to ensure seamless reporting.

This reduces errors and delivers real-time insights, allowing businesses to make quick, data-driven decisions. Request a free demo and consultation with the ScaleOcean team to get this solution for your business.

FAQ:

1. What does net sales mean?

Net sales refer to the revenue a company retains after subtracting returns, allowances, and discounts. This amount represents the actual income generated from sales activities. Unlike gross sales, net sales provide a more accurate understanding of financial performance. It is a key metric in assessing the profitability of a business’s core sales.

2. How do you calculate net sales?

Net sales are calculated by deducting sales returns, allowances, and discounts from gross sales. The formula is:

Net Sales = Gross Sales – (Sales Returns + Allowances + Discounts). This calculation gives a more precise figure of the revenue earned after all necessary adjustments. It helps businesses assess their real income from sales activities.

3. Is net sales before or after VAT?

Net sales are typically calculated after VAT (Value Added Tax) is excluded. VAT is considered a pass-through item, as businesses collect it on behalf of the government. Since it is not part of the company’s income, it is not factored into the net sales figure. This ensures a clear picture of the actual revenue generated from sales.

4. What is the total sales vs net sales?

Total sales represent the full revenue generated from all sales before any deductions, such as returns or discounts. Net sales, however, reflect the revenue after these deductions are subtracted. Net sales provide a more realistic view of the income the company actually retains. Total sales can be misleading as it doesn’t account for adjustments that reduce revenue.

PTE LTD..png)

.png)

.png)

.png)

.png)