Managing production costs is critical for firms to remain competitive. Standard costing is a successful strategy for controlling expenses because it establishes unambiguous, predicted cost targets.

According to MTI in Singapore, the manufacturing sector’s unit business cost index increased by only 0.2 percent in 2024, demonstrating effective cost control. This makes understanding standard costing extremely important for organizations today.

This article covers major subjects such as explaining what standard costing is, how to calculate it, highlighting its benefits, walking you through real-world examples and standard cost estimates, addressing common obstacles, and comparing it to other costing systems.

Each component is intended to provide organizations with clear, practical insights and tools for better financial decision-making.

- Standard costing is a method where businesses set expected costs for materials, labor, and overhead. These preset costs help track performance by comparing actual expenses.

- Standard costing provides various benefits, such as improved budgeting, cost control, and performance evaluation.

- Calculating standard costs involves estimating expenses for materials, labor, and overhead, adding all cost elements together, and then consistently monitoring and updating costs.

- ScaleOcean’s expense software guarantees consistent financial tracking and reporting. The solution automates variance analysis, allowing organizations to quickly detect and resolve cost disparities.

What is Standard Costing?

Standard costing is a method where businesses set expected costs for materials, labor, and overhead. These preset costs help track performance by comparing actual expenses, allowing businesses to identify inefficiencies and make improvements.

It also provides a uniform structure for tracking and managing production expenses, allowing organizations to remain competitive and profitable. Standard costing is constructed on a few fundamental components that serve as the foundation for proper cost planning, including:

- Direct Materials: The expected cost of raw materials required for production, including purchase price, transportation, and handling fees. Accurate estimates help avoid shortages and plan budgets effectively.

- Direct Labor: The projected cost of employees directly involved in manufacturing, covering pay, overtime, and benefits. Proper planning ensures fair wages while controlling production costs.

- Manufacturing Overhead: Includes indirect manufacturing costs like utilities, equipment depreciation, maintenance, and rent. Tracking these helps in setting precise pricing, profitability analysis, and managing overall business expenses.

Benefits of Standard Costing

Standard costing provides several benefits for financial planning, operational control, and decision-making. It not only helps Singapore businesses create clearer goals, but it also ensures better long-term cost management. The primary benefits include:

Enhanced Budgeting and Planning

Standard costing helps businesses create strong budgets and financial forecasts by providing clear benchmarks. With predefined costs, companies can set more realistic goals and plan for upcoming expenses. This process ensures smoother operations in the long run.

By establishing fixed cost expectations, businesses can align budgetary goals with operational capacity. This enables companies to plan strategically and ensure they stay within financial limits. The result is a more streamlined and efficient budgeting process.

Improved Cost Control

Standard costing makes it easier for managers to identify discrepancies by comparing actual costs with expected costs. This helps spot problems early, allowing businesses to take corrective measures before costs escalate. It promotes effective cost control and ensures profitability.

Early detection of cost variances also helps companies avoid excessive spending. With cost control in place, businesses can reduce waste and maintain more accurate financial reporting. This results in better decision-making and enhanced operational efficiency.

Performance Evaluation

Variance analysis can assist in determining how well resources are used. Companies can find opportunities for development by analyzing deviations from the standard. This information contributes to better decision-making and long-term operational efficiency.

Additionally, performing a cost-benefit analysis can help assess whether the benefits of addressing these variances outweigh the costs, providing a clear picture of the potential return on investment for improvement initiatives.

Simplified Inventory Valuation

Standard costing simplifies inventory valuation by using preset costs for materials, labor, and overhead. This method streamlines the calculation of inventory values, making it easier to track changes in stock prices. It enhances financial consistency and accuracy.

When prices fluctuate, standard costing helps maintain updated inventory records. This simplifies reporting and reduces the time spent on adjustments. Financial statements are produced more quickly, ensuring better visibility and accuracy in inventory management.

Cost Reduction

Standard costing identifies areas where resources may be underused or wasted, providing insights into inefficiencies. By highlighting these areas, businesses can implement improvements and cut unnecessary costs. This leads to a more cost-efficient operation.

With regular monitoring of cost variances, businesses can make data-driven decisions to reduce waste. Over time, this approach helps improve operational sustainability. Standard costing enables companies to optimize resource use and achieve long-term cost reduction goals.

How to Calculate Standard Costs

Calculating standard costs assists organizations in estimating the expected costs associated with producing goods or services. This technique establishes a baseline for budgeting and expense management control. Understanding how to appropriately calculate these expenses is critical for successful financial planning.

We will break it down into smaller tasks, making it easier to understand and calculate. Here are the key steps to calculate standard costs:

1. Calculate the Cost of Direct Materials

Start by listing all the materials needed for production. For example, if manufacturing a custom furniture piece, you’ll need wood, fabric, nails, and varnish. Use supplier quotes or historical data to estimate the cost of each material, and multiply the cost by the quantity needed for each unit.

For instance, if wood costs $10 per meter and you need 3 meters for each chair, the direct material cost for wood would be $30. Do this for all materials to determine your total direct material costs.

| Material | Quantity per Unit | Cost per Unit | Total |

|---|---|---|---|

| Wood | 3 meters | $10/meter | $30 |

| Fabric | 2 meters | $12/meter | $24 |

| Nails | 10 pieces | $0.50 each | $5 |

| Varnish | 1 liter | $15/liter | $15 |

| Total Direct Material Cost | $74 | ||

2. Assess the Costs of Direct Labor

Next, calculate the labor costs by determining the time it takes for employees to complete one unit of production. For example, if it takes a carpenter 4 hours to build a chair and their hourly wage is $20, the labor cost for that chair would be $80.

Multiply the hours worked by the hourly rate for each labor type involved. If an assistant takes 1 hour to help with sanding at $15 per hour, their cost would be $15. Add the labor costs for all roles to determine your total direct labor costs.

| Labor Type | Time per Unit | Hourly Rate | Total |

|---|---|---|---|

| Carpenter | 4 hours | $20/hour | $80 |

| Assistant (Sanding) | 1 hour | $15/hour | $15 |

| Total Direct Labor Cost | $95 | ||

3. Evaluate Your Overhead Expenses

Overhead costs include indirect costs like electricity, equipment depreciation, and rent. To standardize these costs, choose a base, such as the number of units produced. If monthly overhead is $1,000 and you produce 100 chairs a month, the overhead per chair would be $10.

Alternatively, if overhead is based on machine hours, and each chair takes 2 machine hours to produce, with an overhead rate of $8 per hour, the overhead cost per unit would be $16.

| Overhead Type | Time per Unit | Overhead Rate | Total |

|---|---|---|---|

| Manufacturing Overhead | 2 hours | $8/hour | $16 |

| Total Overhead Cost | $16 | ||

4. Bring Together All Cost Elements

Once you’ve calculated the direct material costs, direct labor costs, and overhead costs, add them together to find the total standard cost. For example, if direct materials cost $74, direct labor costs are $95, and overhead is $16, the total standard cost for producing one chair would be $185.

This combined total represents the expected cost of producing one unit of your product. This total serves as a benchmark for performance and helps businesses identify inefficiencies in their production process.

| Cost Element | Standard Cost |

|---|---|

| Direct Materials | $74.00 |

| Direct Labor | $95.00 |

| Manufacturing Overhead | $16.00 |

| Total Standard Cost | $185.00 |

5. Consistently Monitor and Update Costs

Standard costs need to be periodically reviewed to ensure they remain accurate. As material prices, labor rates, and overhead costs change, these updates help keep benchmarks relevant. Regular reviews help businesses adapt to external changes in the market or their operations.

By adjusting standard costs, companies can maintain better control over budgeting and ensure their pricing remains competitive. Ignoring these adjustments may lead to outdated data, affecting the company’s ability to make informed financial decisions.

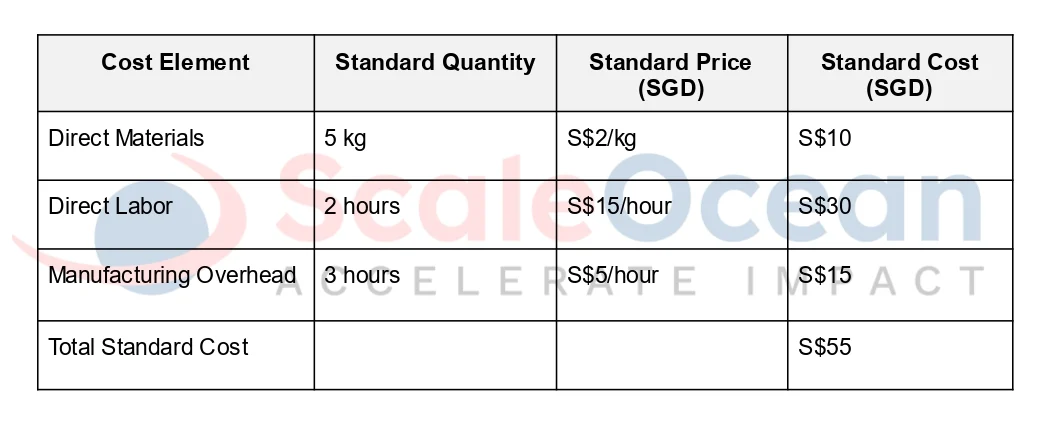

Simplified Example of a Standard Cost Calculation

To further grasp conventional costing, consider a simple calculation. This example divides the cost of making a product into its major components. Below is a sample table that shows the computation in detail:

In this example, producing one unit requires 5 kg of raw materials at SGD 2 per kg, resulting in SGD 10 for materials. Direct labor takes 2 hours at a rate of SGD 15 per hour, contributing SGD 30 to the total. Manufacturing overhead is calculated using 3 hours at SGD 5 per hour, adding SGD 15. When combined, these costs bring the total standard cost to SGD 55.

Disadvantages of Standard Costing

While standard pricing has numerous benefits, it is not without restrictions. Businesses may face challenges that impair accuracy, adaptability, and overall efficiency. Understanding these potential hurdles is vital for sustaining successful cost management. Examples include:

Setting Accurate Standards

Setting accurate cost standards can be challenging due to market volatility and changing prices. Small fluctuations in material or labor costs can lead to significant variances, making it difficult to establish reliable guidelines. Continuous market analysis is key.

To maintain accurate standards, businesses must adapt regularly to market shifts. Without frequent updates, preset standards may no longer reflect true production costs. This requires companies to invest in constant monitoring to keep standards relevant and achievable.

Maintaining Relevance

If cost standards aren’t reviewed periodically, they risk becoming outdated. Technological advancements, changes in production processes, or new suppliers can all affect the accuracy of established standards. A proactive review process ensures relevance and accuracy.

Failing to adjust cost standards can result in inefficiencies and poor decision-making. As business environments evolve, companies need to ensure that cost guidelines align with the latest trends. A structured review process helps maintain the accuracy and applicability of standards over time.

Employee Morale

Standard costing can negatively affect employee morale when too much focus is placed on cost variances. Workers may feel discouraged if targets seem unrealistic or unachievable. Balancing the emphasis on costs with recognition of achievements can help improve morale.

Employees may perceive strict cost control measures as a lack of appreciation for their efforts. By recognizing accomplishments and addressing discrepancies constructively, businesses can foster a more positive work environment. A balanced approach is essential to maintaining motivation.

Complexity in Implementation

Standard costing needs comprehensive data collection, meticulous analysis, and, in some cases, modern computing tools. For small enterprises, this process might be resource-intensive.

Adequate training and the appropriate tools are required to guarantee a successful and efficient deployment. Similarly, understanding the prepaid expenses process is essential for businesses, as it helps manage payments made in advance for goods or services, ensuring accurate financial planning and resource allocation.

Standard Costing in Custom or Non-Repetitive Manufacturing

Standard costing faces challenges in custom or non-repetitive manufacturing, where each project can have unique costs. The rigid nature of standard costing may not reflect the complexities and variations in custom jobs, leading to inaccurate financial assessments.

In industries with one-off or highly specialized products, applying standard costing can be inefficient. The method assumes consistency in production, which doesn’t apply to custom or non-repetitive processes. This limits its effectiveness and may result in inaccurate cost allocation.

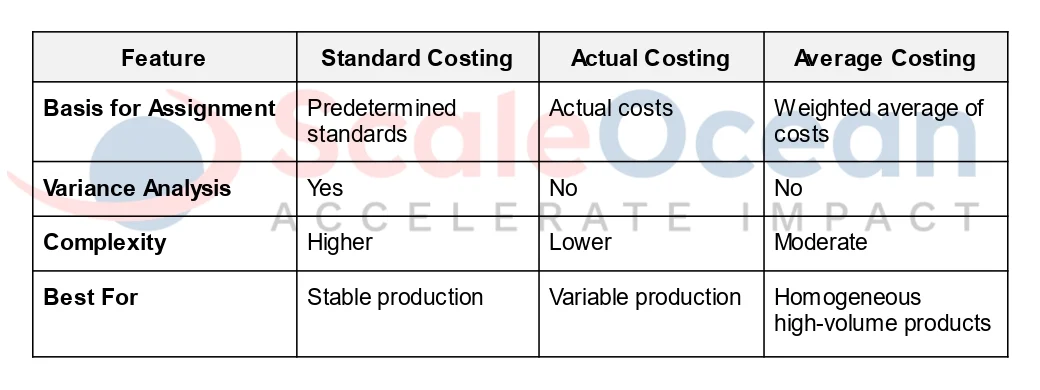

Standard Costing vs. Other Types of Costing Methods

Standard costing is a method where companies set expected costs for production. It helps establish clear goals for efficiency, but it has its pros and cons when compared to other costing methods. Each method has its unique way of managing and tracking expenses.

Let’s dive into how standard costing compares to other methods:

Standard Costing vs. Actual Costing

Standard costing uses predetermined standards to assign costs, offering a clear benchmark for measuring performance. It allows businesses to track variances between expected and actual costs. Actual costing, however, assigns costs based on real data, offering greater accuracy but lacking the foresight of standards.

When it comes to complexity, standard costing is more involved, requiring detailed variance analysis to identify discrepancies. In contrast, actual costing is simpler to manage, as it directly reflects the actual costs incurred, making it better suited for environments with fluctuating production.

Standard Costing vs. Activity-Based Costing

Standard costing allocates costs based on predetermined standards and averages, focusing on materials, labor, and overhead. Activity-based costing (ABC), however, assigns costs to specific activities, providing a more detailed picture of resource consumption by linking costs to activities that drive them.

While standard costing is great for stable and predictable environments, ABC is better for businesses with complex processes where different activities consume resources at varying rates. ABC gives a clearer understanding of where inefficiencies may be occurring, but it’s more complex and resource-intensive to implement.

Standard Costing vs. Target Costing

Standard costing focuses on predetermined estimates and variances, providing a clear benchmark for performance. Target costing, on the other hand, focuses on setting a desired cost for a product based on market competition and profit goals. Companies then work backward to reduce costs to meet this target.

Target costing is more market-driven and proactive, aiming to achieve a cost that allows the product to remain competitive in the market while still providing profit. It is more suitable for businesses facing tight competition and cost pressures, whereas standard costing works better in stable, established production environments.

Standard Costing vs. Average Costing

Standard costing assigns specific costs to materials, labor, and overhead, focusing on planned expectations. Average costing, however, takes a weighted average of all costs, which helps smooth out fluctuations in prices. This method is more generalized but easier to implement across large volumes of products.

While standard costing is more complex and better for stable production, average costing is ideal for high-volume, homogeneous products where tracking each cost precisely is less necessary. This simplicity makes average costing a practical choice for companies with straightforward, consistent production processes.

Different costing methods offer unique ways to assign and track production costs. Each method has its own strengths, weaknesses, and ideal use cases depending on business needs. So, we gather all of the differences above into the table below, which highlights the key differences between these three approaches:

When to Use Standard Costing

Standard costing is not appropriate for all types of businesses. It performs best in contexts where expenses and processes are largely consistent across time. Companies can maximize their benefits by knowing the best conditions for their application, which include:

Stable Production Processes

This strategy is best suited for industries where production methods are constant and changes are rare. Process variability is low, which means that cost standards can remain accurate for longer. It decreases the need for frequent revisions and minimizes the gap between projected and actual expenditures.

Such stability increases the reliability of variance analysis. Additionally, incorporating opportunity cost management into the analysis helps businesses identify potential benefits lost when one option is chosen over another, ensuring that resources are being allocated most effectively.

Mass Production

Standard pricing is ideal for industrial situations with huge volumes of identical items. Because the manufacturing process is repeated, calculating costs becomes easier and more precise.

This enables firms to streamline budgeting, track performance, and ensure consistent quality. The predictability of mass production increases the accuracy of cost control.

Budgeting and Planning

Standard costing can assist firms in establishing clear financial targets and measuring performance against them. By comparing actual expenses to specified norms, management may discover and correct deviations promptly.

This strategy also increases forecast accuracy and resource allocation, ultimately helping improve net sales through better cost management. Additionally, businesses can enhance their financial planning by integrating capital expenditure strategies, which help in managing large investments and assessing their long-term financial impact.

Considerations for Company Size and Resources

Standard costing is more suitable for larger companies with established production processes. These businesses typically have the resources and infrastructure needed to maintain accurate standards. Small companies may find the method too complex and resource-intensive.

For smaller businesses, simpler costing methods might be more efficient due to limited resources. Larger companies benefit from the detailed control that standard costing offers, which helps track costs more effectively and aligns with their scale of operations.

Aligning Business Objectives with Standard Costing

Standard costing is most effective when a company’s business objectives focus on cost control and efficiency. Businesses aiming to reduce waste and improve operational performance can leverage standard costing to set clear cost expectations and track progress.

However, if a company prioritizes flexibility or innovation, standard costing may not be the best fit. The rigid nature of predefined costs can limit adaptability, making it less suitable for businesses focused on rapid change or custom production processes.

How to Implement Standard Costing

Standard costing demands an organized method to assure accuracy and effectiveness. Each phase is intended to connect cost criteria with real-world operations and keep them relevant over time. The method typically includes the following stages:

Establish Standards

Begin by obtaining historical cost data and comparing it to industry benchmarks to determine achievable targets. To ensure accuracy, critical departments such as production, procurement, and finance should work together throughout this process. Standards should be based on current market conditions and production capability.

A well-defined standard serves as the baseline for performance measurement. Additionally, incorporating capital budgeting techniques in this process can help ensure that investments are aligned with long-term financial goals and that resources are allocated efficiently for maximum return.

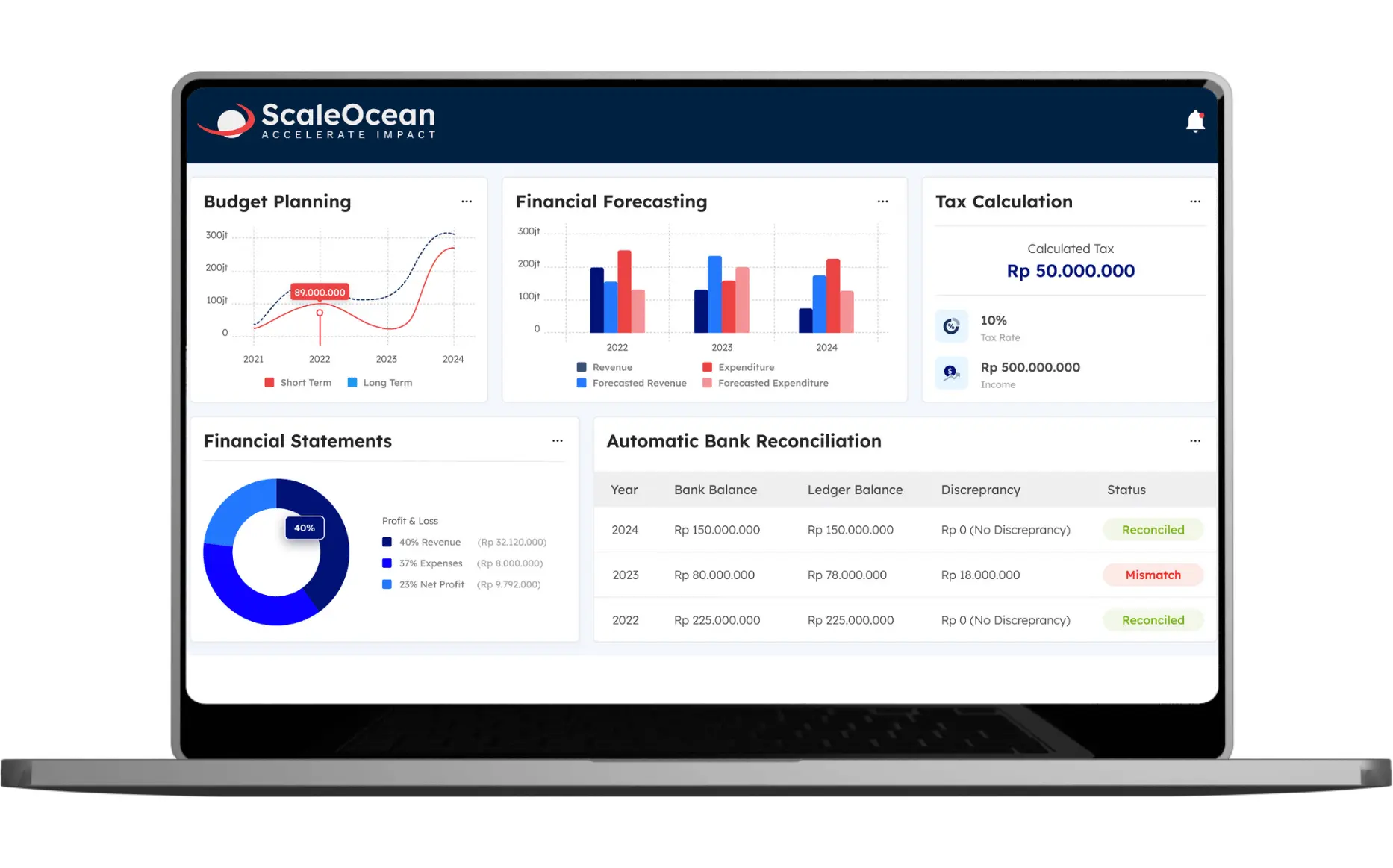

Integrate with ScaleOcean Accounting Software

Once standard expenses have been established, including them in ScaleOcean’s best expense software guarantees consistent financial tracking and reporting. The solution automates variance analysis, allowing organizations to quickly detect and resolve cost disparities.

With real-time data availability, managers can quickly compare performance against benchmarks, ensuring cost control is accurate and efficient.

ScaleOcean’s accounting software incorporates conventional costing into processes such as procurement, inventory, and payroll, assuring accuracy and data consistency. This automation eliminates manual labor, minimizes errors, and simplifies reporting.

Singapore enterprises can take advantage of the CTC award to reduce adoption expenses and request a free demo from our software to witness the real-time benefits.

The following is a list of main features from ScaleOcean software:

- All-in-One Solution: Complete modules ensure accurate, automated standard costing across all processes.

- Auto-Pilot Operations: Automates cost calculations and variance analysis for faster insights.

- Multi-Branch Integration: Synchronizes costing data across all branches for consistent reporting.

- Custom Integration: Connects with existing systems to match specific costing workflows.

- Industry Best Practices: Implements standard costing using proven, industry-tested methods.

Monitor and Review

Regularly compare actual prices to established benchmarks to find variations or variances. We should address significant differences to determine the underlying causes, whether operational inefficiencies or market shifts.

This ongoing monitoring ensures that costs remain under control. It also offers vital insights into process improvement and resource allocation.

Update Standards

Cost criteria should be revised on a regular basis to reflect changes in pricing, wages, and production methods. Updating these metrics ensures that they are still relevant and achievable in the current business context.

Ignoring updates may result in outdated benchmarks that misguide decision-making. Timely adjustments maintain the costing system accurate and efficient.

Implementing Standard Costing: Practical Examples

Standard costing can be used across industries to improve financial management and operational efficiency. These real-world examples demonstrate how various industries benefit from setting preset expenses and analyzing deviations. Here are two practical examples:

Manufacturing Sector

A car manufacturer sets standard costs for key components like engines, tires, and electronics before starting production. These predefined costs act as benchmarks, and the company compares them to actual spending to spot any discrepancies.

By identifying inefficiencies, the company can adjust its purchasing strategies, optimize assembly line processes, and improve cost control, leading to more efficient production and better profit margins for future vehicle models.

Service Industry

A hotel chain establishes regular pricing for products such as room amenities, housekeeping services, and maintenance activities. Variance analysis allows management to track expenses and identify variances that may have an impact on profitability.

According to Credence Research, with the hospitality market in Singapore projected to grow at 5.2% annually through 2032, such practices help hotels better allocate resources, maintain quality service, and keep financial performance on track.

Conclusion

Standard costing is a method that helps businesses set expected costs for materials, labor, and overhead. This approach ensures that budgets are more accurate and helps identify inefficiencies by comparing real costs with the set benchmarks, giving businesses better control over finances.

Though standard costing is a great tool, it’s important to keep it updated to reflect changes in the market. With ScaleOcean’s expense software, you can automate cost tracking and variance analysis to ensure your data stays current. Experience it yourself with a free demo of ScaleOcean’s solution.

FAQ:

1. What are the 4 methods of costing?

The four primary costing methods include process costing, job costing, direct costing, and throughput costing. Each method is suited for different production environments and helps businesses allocate costs for more informed decision-making.

2. What are the 7 types of cost?

1. Direct Costs

2. Indirect Costs

3. Fixed Costs

4. Variable Costs

5. Semi-Variable Costs (Hybrid)

6. Opportunity Costs

7. Sunk Costs

3. What are the 4 cost principles?

The four essential cost principles for sponsored projects are: costs must be reasonable, allocable, allowable, and consistently treated. These principles apply to sponsored funds as well as any related cost-sharing or in-kind contributions linked to the project.

4. What is the cost accounting standard 7?

CAS-7 or Cost Accounting Standard on Employee Costs. This standard applies to cost statements that require the classification, measurement, allocation, presentation, and disclosure of employee costs, including those that need attestation.

PTE LTD..png)

.png)

.png)

.png)

.png)