In today’s fast-paced business world, making sound investment selections is more critical than ever. Companies require a clear plan for allocating resources efficiently and prioritizing projects that promote growth. In Singapore’s competitive economy, good capital budgeting optimizes investment and supports long-term growth. The city-state’s robust economy emphasizes the importance of this necessity. According to the World Bank Group, Singapore’s GDP has averaged 7% since independence, with over 9% in its first 25 years, demonstrating the dynamic environment for capital allocation decisions.

This article explores the fundamentals and best practices of capital budgeting, including key techniques, evaluation methods, and risk management strategies. It covers how businesses can prioritize projects, assess financial viability, and monitor performance to make data-driven decisions. By reading through the discussion, business leaders will gain practical insights into structuring capital budgets, using accounting tools effectively, and ensuring that investment choices align with long-term growth objectives.

- Capital budgeting is the process by which businesses evaluate and select long-term investments that align with their objectives, ensuring efficient fund allocation to maximize returns over time.

- Capital budgeting techniques, including non-discounted and discounted methods (such as NPV, IRR, and PI), provide various approaches to assess the financial viability of projects and ensure they fit the company’s strategic goals.

- Best practices in capital budgeting, such as using multiple evaluation methods, incorporating sensitivity analysis, and leveraging real options reasoning, enable businesses to make more informed, strategic investment decisions.

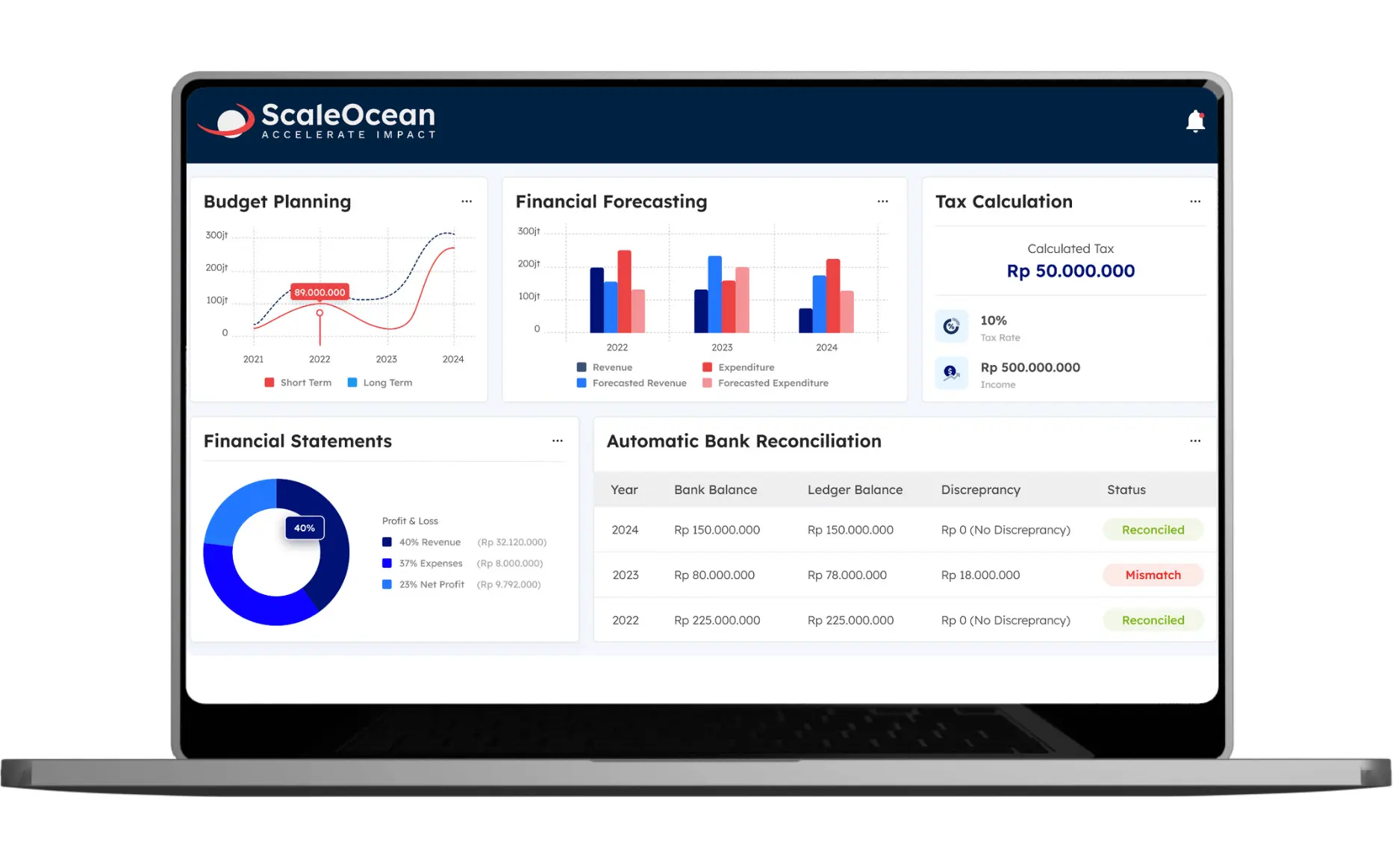

- ScaleOcean accounting software simplifies capital budgeting by automating processes, integrating real-time data, and improving transparency, helping businesses achieve higher ROI and more accurate financial planning.

What is Capital Budgeting?

Capital budgeting is the process by which firms examine and select long term investments. It involves planning and managing enormous budgets, ensuring that they allocate funds efficiently to initiatives that will yield the maximum results. This strategy helps businesses determine which investments align with their long term objectives and will add value over time.

Capital budgeting is not just for the building industry. It is vital in a variety of industries, from technology to manufacturing, where organizations must make large scale investment decisions. Whether investing in new equipment, expanding facilities, or entering new markets, capital budgeting ensures that the right projects are chosen, allowing firms to achieve long term success.

Why Capital Budgeting Matters?

Capital budgeting enables organizations to make informed investment decisions, particularly when resources are constrained. By carefully picking the most promising projects, businesses may route cash to ventures with the highest return on investment, ensuring that every dollar is spent wisely. This technique is critical for increasing business growth and ensuring financial stability.

Furthermore, good capital budgeting promotes long-term success by allowing businesses to maintain a competitive advantage. It promotes more effective planning, allowing organizations to connect their investments with strategic objectives. This strategic resource allocation is critical to determining the company’s future financial health and guaranteeing long-term growth.

In addition to these considerations, understanding the opportunity cost of each investment helps ensure that resources are allocated to projects that offer the highest potential benefits, maximizing long-term growth and financial health. This strategic resource allocation is critical to determining the company’s future financial health and guaranteeing long-term growth.

Key Elements in Capital Budgeting

Capital budgeting entails a series of strategic decisions that guarantee resources are directed toward the most valuable initiatives. Businesses that focus on long-term goals can maximize their revenues and make prudent investments. Effective capital budgeting is critical for accelerating growth, mitigating risks, and retaining a competitive edge. In this section, we will look at the important factors that influence the capital budgeting process:

1. Project Identification & Strategic Alignment

The first step in capital budgeting is to identify investment opportunities that are consistent with the company’s long-term objectives. Businesses can focus on long-term growth by ensuring that projects contribute to overarching strategic objectives. This alignment is critical for obtaining intended results and ensuring consistency in the cost control process and financial planning.

2. Cash Flow Estimation

Estimating the cash flows from a project is critical for determining its financial sustainability. This includes estimating both the initial investment and continuing costs over the project’s existence. Furthermore, firms must forecast prospective revenue streams and prepare a detailed cash flow statement to see whether the project will yield enough returns to justify the expenditure.

3. Evaluation Techniques

After estimating cash flows, businesses use several financial indicators such as Net Present Value (NPV), Internal Rate of Return (IRR), and Profitability Index (PI) to evaluate the project’s viability.

These strategies assist firms in identifying the most profitable initiatives, allowing them to select investments that deliver the highest financial returns while still aligning with their strategic objectives.

In addition to these methods, companies can also apply the standard costing method to set cost benchmarks and measure actual performance, ensuring that the financial projections are accurate and helping manage costs effectively throughout the project lifecycle.

4. Risk & Scenario Analysis

Managing uncertainty is an important component of capital budgeting. Businesses can use sensitivity, scenario, or probabilistic assessments, such as Monte Carlo simulations, to better understand the risks associated with new initiatives. Companies can make better decisions and reduce the likelihood of unexpected losses by evaluating various risk variables and their potential effects on cash flows.

5. Implementation & Monitoring

After selecting a project, execution and ongoing monitoring keep it on track. Monitoring actual performance against projections helps firms spot anomalies early and make changes accordingly. This ensures the project stays on track with its budgetary objectives and allows adjustments to address unexpected obstacles.

Factors Affecting Capital Budgeting

A variety of factors influence capital budgeting decisions, determining how a corporation invests its resources. Understanding these aspects leads to improved financial planning and more educated investing decisions. Capital budgeting decisions are heavily influenced by a number of factors, including capital structure, the economic environment, and management priorities.

1. Company’s Capital Structure

A company’s capital structure defines how it finances projects through a mix of loans and equity. Strong capital structure provides flexibility in selecting feasible projects, allowing companies to invest without compromising stability. According to MA Singapore, The Register is a public record of individuals conducting regulated financial activities under the SFA and offering advisory services under the FAA, ensuring businesses rely on certified professionals for investment decisions.

2. Economic Environment & Tax Policies

The broader economic environment and current tax policies have a considerable impact on capital budgeting decisions. Interest rates, inflation, and economic growth all have an impact on capital costs and returns. Tax regulations, such as tax incentives and deductions, can either increase or decrease the profitability of specific projects. When making financial decisions, keep fluctuations in these areas in mind.

3. Management Priorities

Management’s strategic goals and willingness to accept risks are critical factors in capital budgeting decisions. Projects that align with the company’s long-term vision, such as entering new markets or enhancing infrastructure, often receive preference.

Furthermore, a company’s risk appetite determines which initiatives the company accepts, reflecting its overall approach to financial management, with higher risk potentially leading to larger rewards or greater scrutiny.

To help manage these financial commitments, companies can use prepaid expenses examples to better forecast and allocate funds for long-term projects, ensuring that cash flow remains steady while pursuing strategic growth opportunities.

Capital Budgeting Techniques & Metrics

Capital budgeting strategies and indicators are critical for assessing investment opportunities and making sound financial decisions. These strategies assist in determining if a project will provide good returns and fit the company’s strategic objectives. The methodologies range from simple to more complex approaches, providing many ways to assess a project’s financial viability.

1. Non-Discounted Methods

One of the most basic non-discounted strategies is the Payback Period. This technique calculates the time required to recoup the initial expenditure, providing a clear and transparent assessment of how quickly a project can return invested resources. However, the payback period method ignores the time value of money, which can result in erroneous appraisals of long-term investments. As a result, it is best suited to short-term initiatives with a modest influence on future cash flows.

2. Discounted & Ratio-Based Methods

Discounted and ratio-based methodologies provide more exact evaluations of capital budgeting projects by considering the time value of money. These strategies help businesses understand how the value of cash flows changes over time, making them more reliable for long-term investment decisions. The primary techniques utilized in this category are as follows:

a. Discounted Payback Period

This strategy improves on the usual payback period by accounting for the time worth of money. It discounts future cash flows, providing a more accurate picture of how long it will take to recoup the initial investment. It is especially important for long-term projects, when the time value of money has a considerable impact on profitability.

b. Net Present Value (NPV)

NPV is the difference between the present value of a project’s cash inflows and outflows. A positive Net Present Value indicates that the project will generate more value than it costs, resulting in a profitable investment. A negative net present value (NPV) suggests that the project should be evaluated because it will result in a loss for the company.

c. Internal Rate of Return (IRR)

IRR is the discount rate at which a project’s net present value (NPV) is zero. It makes it easier to compare projects by providing a percentage return on investment. However, if the project includes non-conventional cash flows, IRR might be misleading because it may yield several values or fail to account for the underlying risk.

d. Profitability Index (PI)

The Profitability Index is calculated as the present value of cash inflows divided by the present value of cash outflows. A PI larger than one suggests that the project is financially viable and likely to yield a return. If the PI is less than one, it indicates that the project will not produce sufficient returns to justify the expenditure.

3. Advanced Methods

Advanced capital budgeting approaches provide more in-depth insights into project evaluation, particularly when comparing investments with different lifespans or unknown future conditions. These strategies go beyond typical measures to provide a more detailed picture of prospective returns and dangers. Let’s investigate two important advanced techniques:

a. Equivalent Annual Cost (EAC)

EAC is used to convert a project’s Net Present Value (NPV) to an annual sum. Businesses can now compare projects of varying lengths on an equal basis. EAC is especially effective for analyzing long-term projects with varied lifespans since it standardizes costs to an annual value, making it easy to compare alternative investment options.

b. Real Options Analysis

Real Options Analysis assesses the importance of managerial flexibility while making future decisions, such as expanding, postponing, or terminating a project. This technique takes into account the uncertainties and potential opportunities that may develop over the project’s existence.

It is especially useful for projects with a high degree of uncertainty since it enables firms to make decisions that maximize long-term value by taking into account future options.

To complement this approach, businesses can integrate effective expense management strategies to track and control costs throughout the project lifecycle, ensuring that financial resources are efficiently allocated and aligned with evolving opportunities.

Common Challenges in Capital Budgeting

Capital budgeting is not without obstacles. Despite its importance, organizations frequently confront numerous challenges when making long-term investment decisions. These problems can have an impact on the accuracy and reliability of capital budgeting, as well as the overall success of projects. The key challenges are as follows:

1. Forecast Uncertainty

Long-term projections are inherently unpredictable, as current assumptions may alter over time. These changes can have a substantial impact on the reliability of investment decisions, making it impossible to forecast future cash flows or market circumstances accurately. As a result, the expected outcomes may no longer match reality, posing possible dangers.

2. Bias & Inaccuracy

Bias, particularly optimism bias, influences investment decisions by underestimating projected business expenses and overestimating expected profits. This can result in overly optimistic projections that may not be true in fact. Such mistakes might alter the financial sustainability of a project, resulting in unwise decisions.

3. Method Limitations

Certain capital budgeting techniques, such as IRR, can produce various results, particularly when cash flows are erratic or unconventional. Furthermore, measures like the payback period do not account for profitability after the break-even point. This constraint renders these strategies less reliable for long-term investments in which profitability is critical.

4. Irreversibility

Capital budgeting decisions frequently require considerable investments, and once made, they are difficult to reverse. Incorrect or poorly considered investments can have long-term financial consequences, affecting the company’s resources for years. This irreversibility makes the decision-making process important, emphasizing the importance of comprehensive analysis.

Key Report Types & Their Use Cases

Key reports in capital budgeting are critical for monitoring, managing, and assessing investment decisions. They assist firms in keeping stakeholders informed and projects on schedule. These reports also include information about financial performance, risks, and strategic alignment. The following are some of the important report kinds and their use cases:

1. Capital Expenditure (CAPEX) Proposal Reports

Capital expenditure reports are generated before project approval to determine the feasibility of an investment. They often include a project summary that explains the project’s goal, scope, and strategic alignment.

Financial criteria such as NPV and IRR, risk assessments, an implementation timeframe, and a cost-benefit analysis are all included to ensure that the project is financially viable and in line with the company’s goals.

2. Project Monitoring & Progress Reports

During project execution, these reports give regular updates on the project’s status. They display the percentage of completion, budget spent, cash flow status, and any variations. These reports are critical for keeping stakeholders informed about the project’s progress and identifying deviations from the original plan, allowing adjustments to be made in real time.

3. Periodic Capital Expenditure Review Reports

These reports are usually published weekly or annually to evaluate long-term investment performance. They compare the actual capital expenditures report to planned budgets to determine whether projects are reaching financial and strategic objectives. These assessments assist firms in ensuring that capital investments are providing the intended returns and remain consistent with the overall business strategy.

4. Capital Budget Presentations

Capital budget presentations provide a visual depiction of funding sources, asset categories, and project objectives. They employ infographics and charts to display complex financial data in an understandable style, allowing executives or boards to make better decisions about future investments.

Best Practices & Strategic Insights in Capital Budgeting

Capital budgeting is an important practice for businesses to make the best use of resources and achieve long-term success. Businesses can make better investment decisions by adhering to best practices and strategic insights. Here are essential recommendations for improving your capital budgeting process:

1. Use Multiple Evaluation Methods

To assure the dependability of your investment selections, employ a variety of evaluation tools such as NPV, IRR, and Payback Period. Each approach provides unique insights, such as cross-checking data will assist in validating consistency and reducing the likelihood of decision-making errors.

2. Incorporate Sensitivity and Scenario Testing

Anticipating risk variations is critical to good capital budgeting. Businesses can examine the impact of uncertainties such as fluctuating costs or changes in market circumstances on project outcomes by testing various scenarios. This enables more effective planning and risk management.

3. Rank Projects Using Metrics

Businesses should prioritize investments by ranking them according to key financial criteria like NPV or Profitability Index (PI). Allocating funds to projects with the highest returns ensures that existing resources are used efficiently and strategic goals are met.

4. Leverage Real Options Reasoning

Real options reasoning can be extremely useful when projects allow for strategic flexibility. This strategy assists firms in evaluating the potential for future development, changes in scope, or expansion, allowing them to make investments that can adapt to changing market conditions.

5. Ensure Ongoing Monitoring and Periodic Reviews

After a project has begun, continual monitoring is required to ensure its success. Regularly comparing actual performance to planned goals allows organizations to make required adjustments, keeping the project on track and aligned with long-term goals.

Enabling Smarter Capital Budgeting with ScaleOcean Accounting Software

Traditional spreadsheet budgeting lacks teamwork and is prone to complications. ScaleOcean’s expense software overcomes these difficulties with automation, real-time tracking, and seamless bank connectivity. It streamlines financial reporting, increases transparency, and promotes data-driven decision-making. ScaleOcean improves financial control and post-implementation performance, resulting in higher ROI and more accurate capital budgeting outcomes.

ScaleOcean is a strong solution for streamlining capital budgeting, allowing firms to make strategic and informed decisions. With a free demo, businesses can see how the program helps improve budgeting and financial planning. Additionally, ScaleOcean is qualified for the CTC grant, which will help enterprises improve their capital management. Below is a list of key features of the ScaleOcean software:

- Integrated Financial Platform for Accurate Budgeting: ScaleOcean integrates project-level budgeting, forecasting, and cash flow analysis for accurate, strategic financial decisions.

- Real Time Collaboration & Customizable Reporting: The cloud-based solution enables real-time teamwork and customizable reports tailored to capital budgeting needs.

- Multi-Level Financial Analysis for Capital Decisions: Advanced financial tools offer in-depth analysis for informed and strategic capital project decisions.

- Automated Reconciliation & Unlimited User Access: Automates financial reconciliation and offers unlimited user access at a fixed price, ideal for growing businesses.

- Cloud-Based Flexibility & Enhanced Financial Control: Provides flexible, real-time financial management, improving capital budget control and optimizing ROI.

Conclusion

Capital budgeting is vital for making sound, strategic investment decisions. It enables businesses to deploy capital more efficiently, directing resources toward projects that promote long-term growth. A structured approach to budgeting assists firms in prioritizing investments and optimizing financial results.

Businesses that use sound procedures and risk-aware practices can balance profitability with long-term resilience. ScaleOcean’s expense system improves upon this by offering real-time tracking, automatic reporting, and data-driven insights. This ensures optimal budgeting and promotes both immediate and long-term success.

FAQ:

1. What is meant by capital budgeting?

Capital budgeting refers to the process of evaluating potential long-term investments or projects. Companies assess these investments by predicting future cash flows and comparing them to the initial investment, ensuring that chosen projects align with business goals and offer the best return on investment.

2. What is a capital budgeting method?

A capital budgeting method is a tool used to determine the financial viability of a proposed investment. These methods help in assessing costs, expected returns, and the timing of cash flows, ensuring that businesses make informed, strategic decisions that support long-term growth and financial success.

3. What is an example of capital budgeting?

A typical example of capital budgeting is a company evaluating whether to expand its operations by building a new facility. This involves calculating the upfront construction costs, expected revenue increase, and long-term operational savings, using methods like NPV or IRR to decide if the investment is worth pursuing.

4. What are the three methods of capital budgeting?

The three primary methods of capital budgeting are Payback Period, Net Present Value (NPV), and Internal Rate of Return (IRR). The Payback Period measures how quickly an investment recovers its initial cost, while NPV and IRR assess the potential profitability and financial returns over time, considering time value.

PTE LTD..png)

.png)

.png)

.png)

.png)