Cash flow is crucial in a business, especially in a dynamic market like Singapore. Accounts receivable, or money owed to your organisation, is a significant factor in this regard. Understanding AR is more than just an accounting responsibility. It is a strategic necessity for CEOs and decision-makers who seek to accelerate growth.

According to Enterprise Singapore, banks frequently request a personal guarantee (PG) from business owners or directors for unsecured SME loans, emphasising the necessity of effectively managing financial responsibilities.

This tutorial will cover everything, from fundamental accounts receivable definitions to advanced optimisation tactics. We’ll go over the AR lifecycle, management practices, and how technology can transform your AR into a valuable asset, improving cash flow and promoting corporate success in the long term.

- Accounts receivable represent the money owed to your business for goods or services delivered but not yet paid for by your customers.

- The AR cycle involves four key stages: credit granting, invoicing, collections, and cash application, each of which is critical for maintaining healthy cash flow.

- How to analyse AR performance by examining key metrics like DSO and turnover ratio is crucial for understanding and improving your AR performance and financial health.

- ScaleOcean’s revenue software provides robust tools to automate and streamline your entire AR process, reducing errors and accelerating payments.

What is Accounts Receivable (AR)?

Accounts receivable refers to the money owing to a corporation for goods or services delivered but not yet paid. Once the invoice is sent, the amount is represented on the balance sheet as future cash flow, representing the expected payment from consumers. This is frequently seen in B2B deals where payment is not prompt.

Managing accounts receivable is critical to a company’s liquidity and its financial health in the short term. While it represents future inflows rather than current cash, good AR management ensures timely collections, promotes healthy cash flow, and minimizes disruptions to normal business operations.

Example of Accounts Receivable in Singapore Businesses

Accounts receivable are a crucial aspect of financial management for businesses across Singapore’s diverse industries. It is critical for managing cash flow and working capital. The following are examples of how different sectors manage accounts receivable:

- Creative Agencies: A local firm completes a S$10,000 digital marketing project under net 30 terms. The sum is recorded as AR until payment is received, which ensures consistent cash flow for ongoing projects.

- Construction: A construction firm bills S$200,000 for a completed project with terms of 45 days. Managing AR helps cover project costs while waiting for reimbursement.

- Retail: A retail store sells inventory for S$5,000 on net 30 terms, resulting in AR. This helps to manage cash flow and stock replenishment.

- Manufacturing: A manufacturer delivers S$50,000 worth of products on 60-day terms, which are marked as AR. Efficient AR management leads to smoother production and delivery cycles.

- IT Services: an IT service provider, invoices S$15,000 for system installation, which is payable within 30 days. This helps to track payments and manage cash flow for ongoing services.

- Consulting: A consulting firm invoices S$8,000 for business assistance, which is payable in 30 days. Managing these receivables ensures that services are delivered continuously.

- Education: A private education center, invoices S$2,500 for a course, which is due within 30 days. This ensures that the center can pay its financial responsibilities while continuing to operate.

- Hospitality: A hotel invoices S$10,000 for event space, with payment due in 45 days. Tracking AR helps to keep funds flowing for ongoing operations and improvements.

Pros and Cons of Offering Credit (Managing AR)

Offering credit can be a strategic move to attract customers and enhance sales, but it is not without obstacles. When managing accounts receivable, it is critical to weigh the benefits against the dangers. Here are the advantages and disadvantages of extending credit:

1. Pros

Credit can be an effective instrument for businesses to drive growth and build long-term relationships with their customers. However, it is crucial to examine the full range of benefits it offers. Here are the primary benefits of providing credit to customers:

- Increased Sales: Credit can boost sales, especially for larger clients that want credit terms.

- Stronger Customer Relationships: increase trust and build long-term partnerships, resulting in recurring business.

- Improved Competitiveness: Offering various payment alternatives can help you gain a competitive advantage.

- Loyalty Building: Credit programs make customers feel valued, which increases their likelihood of returning.

- Attract Larger Clients: Target larger clients who require credit terms to complete commercial transactions.

- Flexible Payment Options: allow clients to better manage their cash flow, encouraging larger or more regular orders.

2. Cons

While providing credit can be beneficial, it also has drawbacks that must be carefully managed to avoid potential traps. The following are the main drawbacks to consider when granting credit:

- Cash Flow Impact: Providing credit might restrict cash flow due to late payments.

- Bad Debt Risk: The likelihood of customers defaulting on payments creates a financial risk.

- Resource-intensive: Constant tracking, follow-up, and management of delinquent invoices are required.

- Operational Distraction: Accounts receivable administration can draw focus away from other vital business operations.

- Credit Risk Exposure: Increased risk of financial instability if customers fail to pay on time.

- Complexity in tracking and managing: Many credit accounts complicate the accounting process.

The Accounts Receivable Cycle

The accounts receivable cycle, often known as the order-to-cash cycle, is the process of making a credit sale and receiving payment. A seamless AR cycle provides speedier cash flow, decreases bad debt, and increases financial stability, all of which benefit the business’s health. Understanding each phase increases efficiency. We will now look at the four key stages of this process.

1. Credit Granting

Credit granting is the first and most important stage in risk management. Before granting credit, determine whether you are comfortable offering it and establish clear standards for who qualifies and what payment conditions they will have. Establishing a well-defined credit policy is critical at this time.

This process also includes screening new clients by reviewing their credit history, financial statements, and utilizing credit rating agencies. The idea is to mitigate nonpayment risk by providing credit only to individuals with a proven track record of timely payments.

2. Invoicing

After making a credit sale, the following step is to generate and deliver the invoice as soon as possible. This invoice is the formal payment request. Thus, it must have a unique number, date, clear item description, total due, and payment terms such as net 30 or net 60 to assure correctness.

Timely invoicing is critical because delays might lead to late payments. The quicker you send the invoice, the sooner payment is due. Using a clear and professional structure reduces confusion and disagreements, streamlines the process, and improves payment efficiency for the team.

3. Collections

The collection stage begins the day after an invoice becomes due. It is about following up on unpaid debts to guarantee that payment is received. It is critical to have a proactive collection process. Waiting too long might cause payments to be delayed and impair cash flow. Starting early improves the chances of speedy recovery.

A common technique involves escalating steps, beginning with gentle reminders on or before the due date. If payment is still pending, follow-ups could include phone calls or formal letters. Persistence is essential, but you must maintain professionalism and good customer relations while being tough about payment needs.

4. Cash Application

Cash application is the final stage of the accounts receivable cycle, in which incoming payments are matched to their corresponding invoices and marked as paid in the accounting system. When consumers make partial payments or utilize a single payment to cover many invoices, the process becomes more complicated.

Accurate and timely cash applications are critical for keeping clean financial records. It keeps client accounts up to date, eliminating the need to chase previously completed payments. Furthermore, it provides a comprehensive picture of outstanding receivables, which is critical for financial reporting and cash flow forecasting.

Key Differences Between Accounts Receivable vs Accounts Payable

Understanding the fundamental differences between accounts receivable (AR) and accounts payable (AP) is critical for efficiently managing your company’s finances. Both play important roles in cash flow management and financial decision-making. Here are the major differences between AR and AP:

- Definition: Accounts receivable (AR) refers to money due to a business by its customers, whereas accounts payable (AP) relates to money owed to suppliers.

- Nature: AR is an asset since it reflects future financial inflows, whereas AP is a liability that represents possible cash withdrawals.

- Impact on Cash Flow: AR increases cash flow through consumer payments, but AP reduces cash flow through supplier payments.

- Management Focus: Efficient AR management seeks to shorten collection times and boost cash flow, whereas successful AP management seeks to balance timely payments with solid supplier connections.

- Financial Statement: AR is shown as an asset on the balance sheet, while AP is listed as a liability.

- Goal: AR’s goal is to collect payments immediately, but AP’s goal is to proactively manage and delay payments to maximize cash flow.

Account Receivable Management Process

Effective accounts Receivable management assures on-time invoice payments, improves cash flow, reduces bad debt, and fosters solid partnerships. This includes establishing clear credit rules, managing credit sales, and being proactive from beginning to end, including account reconciliation. Let’s look at the seven important steps in a complete AR management procedure.

1. Establishing a Clear Credit Policy

A clear credit policy is required for effective accounts receivable administration, as it defines eligibility, limitations, and payment conditions. According to the MAS, on February 14, 2017, the maximum on uncollateralized business loans for financing businesses was increased from 10% to 25% of capital funds, highlighting the necessity of precise financial norms.

The policy should be consistent with your industry, risk tolerance, and the financial soundness of your clients. Having it documented from the beginning reduces risk and establishes clear expectations. This promotes trust and transparency, ensuring that everyone, including your team and customers, is on the same page.

2. Accurate and Timely Invoicing

Accurate invoicing is required for prompt payment. Any inaccuracies or delays in invoicing can cause considerable delays in payment processing. Ensuring that invoices are sent out promptly once products or services are provided helps to preserve cash flow and avoid unnecessary delays.

A decent invoice should be straightforward, with a precise breakdown of charges, a due date, and payment instructions. Electronic invoicing solutions can automate this process, minimizing human error and increasing invoice delivery speed, resulting in faster payments and more efficient operations.

3. Monitoring Accounts Receivable

Consistently keeping an eye on your AR is crucial for staying on top of any outstanding payments. This means regularly checking key metrics and reviewing reports, like the accounts receivable aging report, which neatly sorts invoices by how long they’ve been overdue, helping you quickly spot accounts needing immediate attention.

This consistent monitoring lets you catch negative payment trends early. For instance, if a customer suddenly starts paying later and later, you can address it before it snowballs into a bigger issue. This proactive stance is genuinely key to maintaining a healthy AR balance and ensuring financial stability.

4. Streamlining the Collections Process

The collection procedure should be systematic and rising, beginning with automated reminders before the due date. Follow up with direct contact after the due date to ensure payment efficiency while maintaining a great client connection.

Clearly describe each step in the procedure, such as when to write an email, make a phone call, or escalate the problem. A structured collections system ensures consistency and professionalism, allowing outstanding debts to be properly managed without falling through the cracks.

5. Offering Multiple Payment Options

Making it easier for your consumers to pay can greatly accelerate collections. In today’s fast-paced digital world, depending just on bank transfers or checks is insufficient. It is critical to provide a wide range of payment methods, including credit cards, internet payment gateways, and mobile payment choices.

The more convenient the payment process, the fewer reasons clients have for paying late. This consumer-centric approach increases cash flow and improves the overall customer experience. It’s a small tweak that has a significant influence on payment schedules.

6. Creating a Dunning Management Plan

Dunning management is a systematic technique of engaging with customers regarding outstanding invoices. It entails sending automatic reminder letters at regular intervals, with the tone gradually growing tougher as the invoice ages. This strategy enables timely payment collection while remaining professional.

Automating invoicing saves administrative burdens while also ensuring communication consistency. It enables teams to focus on more difficult accounts while successfully recovering outstanding payments. A well-crafted dunning strategy helps to sustain customer connections while protecting commercial ties.

In addition to this, businesses can improve their financial analysis by applying earnings per share techniques, which provide valuable insights into a company’s profitability and help assess how effectively payments and revenue are contributing to overall earnings.

7. Reconciling Accounts Receivable Regularly

Accounts receivable should be reconciled on a regular basis. This entails verifying payments made to your bank account with outstanding invoices in your system. This assures accurate financial accounts and a clear insight into your cash position, allowing you to manage your finances more effectively.

This allows you to swiftly discover and fix inconsistencies, such as overpayments or unreported cash. This final stage completes the AR process by preserving correct financial data, which is critical for making educated business decisions and running smoothly.

How to Record Accounts Receivable on the Balance Sheet

Accounts receivable are recorded using the double-entry bookkeeping method. When a credit sale is performed, the accounts receivable account is debited to reflect the amount owed by the customer, and the sales revenue account is credited to record earned income. This recognition occurs at the point of sale, in line with accrual accounting standards.

When a consumer pays, a journal entry is created to reflect the transaction. The Cash account is debited to increase the cash balance, while the accounts receivable account is credited to reduce the outstanding sum. This phase completes the transaction in the general ledger by changing receivables to cash.

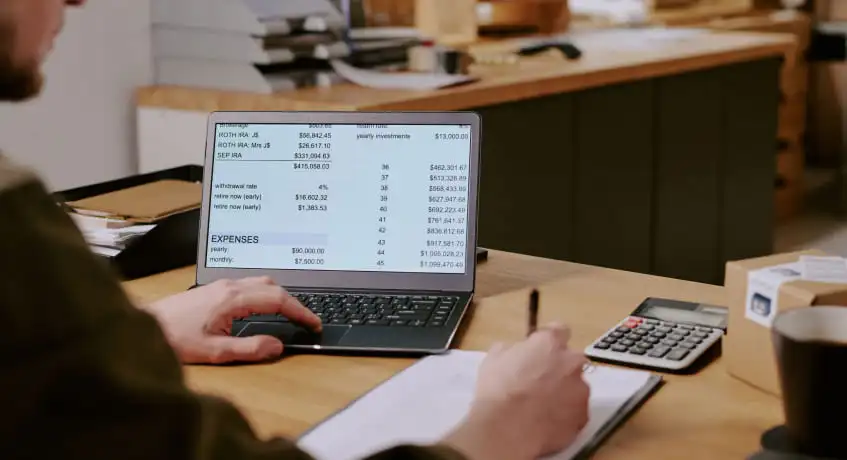

How to Analyze AR Performance

Analyzing AR performance entails more than simply tracking total receivables. It entails utilizing financial ratios and statistics to detect patterns, identify problems early on, and make data-driven decisions. Regularly monitoring these indicators allows you to measure cash conversion speed and collection effectiveness. So, to help you get a better hold on things, here are five of the most significant tools and indicators for monitoring AR success.

1. Accounts Receivable Turnover Ratio

The accounts receivable turnover Ratio measures how efficiently your organization collects receivables. It is determined by dividing net credit sales by the average accounts receivable over time. A higher percentage shows that your organization collects receivables rapidly, which is good for cash flow.

A low ratio indicates a poor collection strategy, flexible credit practices, or customers experiencing financial troubles. Tracking this percentage over time allows you to assess the impact of changes to your credit and collection techniques, hence increasing overall AR efficiency.

Furthermore, improving profit margin management by reducing overdue receivables can lead to better profitability by ensuring that more revenue is retained as profit, ultimately improving financial performance.

2. Days Sales Outstanding (DSO)

Days Sales Outstanding (DSO) is an important measure for examining accounts receivable. It calculates the average number of days it takes a corporation to collect payment following a sale. To compute DSO, divide the average accounts receivable by total credit sales and multiply by the number of days in the period.

The idea is to keep your DSO as low as possible, as a high DSO signals late payments, which might restrict cash flow. When you compare your DSO to industry averages and payment conditions, such as net 30, you can gain useful insight regarding your collection efficiency.

3. Bad Debt to Sales Ratio

This ratio calculates the percentage of sales written off as bad debt, which is a common issue in accounts receivable. You compute it by dividing bad debt expenditure by total credit sales over a given time. It immediately reflects the efficacy of your credit-giving policies and aids in credit risk assessment.

While some bad debt is unavoidable, a high or rising ratio raises red flags. It shows that your credit policy may be overly permissive, resulting in high-risk customers. Monitoring this ratio helps to create a balance between generating sales and reducing credit risk, ensuring long-term business success.

4. Collection Effectiveness Index (CEI)

The Collection Effectiveness Index (CEI) is an important indicator for determining how effective your collection activities are. It compares the amount you gathered over a given period to the total amount available for collection. Unlike DSO, it focuses purely on collection performance without regard for credit terms, providing a more accurate picture.

A CEI close to 100% implies strong performance, implying that you are collecting virtually all receivables available. On the other hand, a lower CEI indicates inefficiencies in the collection process. This indicator is quite valuable in determining the efficacy of your collections team and methods.

5. The Accounts Receivable Aging Report

The accounts receivable Aging Report is a valuable tool for assessing AR performance. It categorizes outstanding receivables into periods depending on due dates, such as 0-30 days, 31-60 days, and 90+ days. This provides a clear visual overview of your receivables’ status, which is critical for effective accounting.

This report assists in determining which clients are current on their payments and which are behind. If there are significant sums in older categories, it indicates probable cash flow concerns and an elevated risk of bad debt. It’s an essential tool for prioritizing collection operations and managing customer accounts effectively.

By improving accounts receivable management, companies can enhance their profitability ratio by ensuring faster cash conversion and reducing the risk of uncollectible revenue, ultimately contributing to better financial health.

Strategies to Optimize Your AR Process

Optimizing your AR process involves more than just getting paid faster. It also entails optimizing the entire cycle, lowering administrative costs, and boosting customer relationships. A smooth AR process improves financial health and operational efficiency. You may make a significant difference by implementing clear regulations, communicating effectively, and using appropriate technology. So, here are eleven ways to help you fully improve your AR process.

1. Set Clear Credit Policies

Honestly, everything starts right here. Having a clear, written credit policy, and one that’s followed consistently, is your primary defense against late payments and the dreaded bad debt. Everyone on your sales and finance teams needs to understand and stick to it.

It’s a good idea to regularly review and update this policy too, just to make sure it still fits market changes or your company’s current risk comfort level. A solid policy does set clear expectations from the very beginning, and that’s just so important for a smooth AR process.

2. Invoice Promptly and Accurately

Seriously, don’t let invoices just sit around on someone’s desk. The quicker you get that invoice out, the quicker you can get paid. You should really put a process in place to make sure invoices are created and sent off the moment goods are delivered or services are done, because timely invoicing is key.

Always, always double-check every invoice for accuracy before it goes out the door. Little errors, like in pricing, quantities, or even just customer details, can easily lead to disputes and big payment delays, so this really simple step can honestly prevent many common AR headaches.

3. Make Invoices Easy to Understand

Use a clean, professional invoice template that clearly shows the invoice number, date, due date, total amount, and comprehensive charge breakdown. Avoid jargon and intricate layouts. A basic design is easier for clients to understand and provides a more efficient payment procedure.

A clean and concise invoice is less likely to cause confusion or be overlooked. The goal is to make it easy for customers to understand what they’re paying for and to execute their payment swiftly. This improves cash flow and decreases payment delays.

4. Offer Multiple Payment Options

Providing different payment alternatives can greatly improve the consumer experience. Customers will find it easier to pay if you offer options such as bank transfers, credit cards, internet portals, or direct debit. The more convenient the process, the faster you can receive payments, which improves cash flow.

Ensure that all payment methods are prominently displayed on your bills and website. Reducing friction in the payment process speeds up collections and encourages timely payments. This basic method has a significant influence on encouraging clients to settle their accounts quickly.

5. Use Automated Reminders

Manually tracking and sending reminders for each invoice is time-consuming and error-prone. Accounting software is a significantly more effective way to automate the process. You may schedule reminders to go out before, on, and after the due date, which simplifies the accounts receivable procedure.

Automated reminders ensure that no invoices are neglected while also maintaining constant, professional communication with customers. This technique allows your AR team to focus on more complicated collection challenges and strategic responsibilities, increasing overall accounts receivable management efficiency.

6. Offer Early Payment Discounts

Offering early payment incentives, such as 1% or 2% on bills paid within 10 days of a net 30 due date, can help to accelerate cash flow. This incentive is widespread in accounts receivable, encouraging clients to pay sooner and helping your firm by bringing cash in faster.

While the discount may result in slightly lower revenue, the benefits of speedier cash flow usually exceed this. It’s a strategic trade-off that improves your working capital position, making it a beneficial strategy for many organizations looking to increase their financial flexibility.

7. Implement Late Payment Penalties

Your credit conditions should clearly state the consequences for late payments, whether they are a fixed fee or interest on the balance. The purpose is not to earn more money, but to provide a strong deterrent to late payments, which is critical for maintaining a good accounts receivable process.

Enforcing these late payment fines continuously indicates your commitment to your payment conditions. It encourages clients to prioritize their invoices, which aids in payment discipline and promotes a smoother cash flow for your company.

8. Maintain Regular Communication with Customers

Developing a relationship with your customer’s accounts payable personnel is critical. Don’t limit your interaction to late payments. A brief, courteous call to confirm receipt of your invoice can go a long way. This simple check-in keeps communication open and ensures bills flow easily through their system.

When it comes to payment concerns, strong relationships can make a big difference. Customers are more inclined to collaborate on problem solutions if they have a positive relationship with your organization. This human aspect is critical to ensuring that transactions go smoothly and consistently.

9. Create a Formal Collections Process

When an account gets substantially delinquent, a formal collection process is required. This strategy should detail every step your team will take, from internal follow-ups to enlisting a third-party collection agency or legal action. A precise approach guarantees that collections are handled systematically and professionally.

A formal process ensures consistency and fairness, which are required to maintain effective company practices. It also provides legal protection for your firm by demonstrating that you made a sincere effort to collect the debt before taking more drastic measures.

10. Leverage Technology and Automation

Modern accounting software can automate several aspects of the accounts receivable process, including invoicing and reminders, payment processing, and report preparation. This technology lowers human labor, reduces errors, and offers real-time information about AR performance, making the process more efficient and dependable.

Investing in the appropriate tools, such as Singapore’s best invoicing software, can help you turn AR management from a reactive activity to a strategic, data-driven one. This investment improves AR efficiency and delivers useful insights, making your financial management more efficient and successful.

11. Regularly Review and Analyze AR Performance

Make AR analysis a regular element of your financial review process, utilizing key metrics such as DSO, turnover ratio, and aging reports. This allows you to discover trends, highlight areas for growth, and celebrate accomplishments. Maintaining a sustainable cash flow requires constant performance monitoring.

True optimization is a continuous process, not a one-time activity. By keeping an eye on AR data, you can make informed decisions that increase cash flow and promote corporate growth. Continuous refinement guarantees that your processes remain successful and adaptable to changes in the business environment.

Compliance and Best Practices for AR in Singapore

Managing accounts receivable in Singapore takes more than just excellent business acumen. It also necessitates compliance with local financial regulations. Compliance ensures accurate reports, fosters investor trust, and facilitates the implementation of government objectives. Now, let’s look at key compliance considerations and best practices for AR management in Singapore.

1. Adhering to Singapore Financial Reporting Standards (SFRS)

Companies in Singapore must prepare financial statements under the Singapore Financial Reporting Standards (SFRS). Accounts receivable require correct recognition, measurement, and disclosure on the balance sheet. Additionally, organizations must examine receivables for potential impairment owing to bad loans.

Under SFRS(I) 9, firms must use the “expected credit loss” model for bad debts. This forward-thinking strategy necessitates calculating future losses rather than waiting for defaults to materialize. Following SFRS guarantees that financial statements accurately represent the company’s genuine financial situation.

2. Leveraging InvoiceNow for Faster E-Invoicing

InvoiceNow is a statewide e-invoicing network operated by Singapore’s IMDA that enables businesses to submit invoices directly and securely between accounting systems. It is based on the international Peppol network and eliminates the need for paper or PDF invoices, streamlining the invoicing process.

Businesses that use InvoiceNow can shorten their invoicing and payment cycles significantly. The structured digital format avoids errors and enables customers’ systems to process invoices more quickly. This government-backed effort is an excellent best practice for companies trying to update and streamline their AR operations.

3. Understanding Goods and Services Tax (GST) Implications

If your company is GST-registered, it’s critical to accurately account for GST on sales invoices following IFRS guidelines. The GST collected from clients is owed to the Inland Revenue Authority of Singapore (IRAS), so your AR records must clearly distinguish between revenue and GST for clarity and accuracy.

You may also be entitled to claim relief for the GST share of bad debts, subject to certain IRAS restrictions. Proper management and documentation of your AR is essential for correct GST reporting and claiming any appropriate relief. This is critical since it immediately affects your tax liabilities.

Optimize Your Accounts Receivable Process with ScaleOcean’s Revenue Software

ScaleOcean’s revenue software optimizes accounts receivable, hence increasing business efficiency. It streamlines financial management, increases cash flow, lowers overhead, and improves financial accuracy by providing features such as real-time tracking, automated invoicing, and seamless connection.

ScaleOcean provides a free demo of its software, allowing you to fully explore its capabilities. Additionally, firms can use the CTC grant to improve their accounting operations. The following are the primary features of ScaleOcean’s software.

- Automated Invoicing & Reminders: ScaleOcean automates invoicing and payment reminders, ensuring timely payments with minimal manual effort.

- Real-Time AR Dashboard: provides real-time visibility into AR data, helping businesses monitor aging invoices and optimize cash flow.

- Compliance with Financial Regulations: ensures full compliance with Singapore’s financial regulations, keeping your AR processes legally sound.

- Streamlined Credit Management: enables efficient credit policy management to reduce bad debt and maintain a predictable AR cycle.

- Seamless Integration: integrates AR with other business functions for smoother data flow and better collaboration across departments.

Conclusion

Accounts receivable is an important part of your company’s financial engine, affecting cash flow and overall profitability. Establishing clear credit standards and leveraging technology for automation enables firms to efficiently transform revenues into cash, maintaining liquidity for growth and investment. For Singaporean business executives, mastering AR management is a competitive need.

Businesses can transform their accounts receivable into a valuable strategic asset by employing efficient AR practices and using current solutions like ScaleOcean’s revenue software. This increases financial stability, lowers risks, and positions firms for long-term growth, making proactive AR management critical to success.

FAQ:

1. What do you mean by accounts receivable?

Accounts receivable refers to the amounts a company is entitled to receive from customers for goods or services provided. It is considered a future cash inflow and is listed as a current asset on the balance sheet, playing a key role in maintaining a company’s operational cash flow.

2. Is accounts receivable an asset or a liability?

Accounts receivable is classified as an asset, as it represents amounts due to a business for products or services rendered. Since it results in future cash inflows, it is listed as a current asset on the balance sheet, contributing to the company’s short-term liquidity and financial health.

3. Is accounts receivable a hard job?

The accounts receivable job can be demanding, as it requires precision, strong time management, and constant communication with clients. Duties include tracking payments, issuing reminders, and resolving overdue accounts. Proper AR management is essential for smooth financial operations and healthy cash flow.

4. What does an accounts receivable role do?

An accounts receivable role focuses on overseeing payments due from customers for goods or services. Key responsibilities include invoicing, monitoring payments, sending reminders for overdue amounts, and ensuring financial accuracy. This role is vital for managing cash flow and supporting the company’s financial health.

PTE LTD..png)

.png)

.png)

.png)

.png)