Operating leverage might feel complex, but the real difficulty is grasping how your cost structure impacts profits, especially during sales fluctuations. Gaining clarity on this concept may be the solution for you. It transforms a common business challenge into a powerful tool for strategic success.

In this article, we’ll clearly explain the definition of operating leverage, review its formula, and show you exactly how to calculate it. Mastering these elements will equip you to make smarter decisions and better manage both the risks and rewards as your business naturally evolves.

- Operating leverage is the balance between fixed and variable costs, amplifying the impact of sales changes on a company’s operating income.

- Operating leverage works by measuring how a company’s operating income changes in response to a change in sales, driven by its cost structure.

- One way to calculate operating leverage is by using the cost structure method with the formula DOL = [Q x (P – V)] / [Q x (P – V) – F], or you can use other methods, like using a margin ratio

- ScaleOcean’s accounting software automates these complex calculations, providing clear insights to help you manage and leverage them effectively.

What Is Operating Leverage?

Operating leverage simply describes the balance between a company’s fixed and variable costs. It’s a key metric that clearly shows how changes in sales revenue can amplify the impact on operating income, giving you deep insight into the business’s profit potential.

A company relying heavily on fixed costs has high operating leverage, making its profit highly sensitive to sales shifts. This means small changes in revenue can lead to much larger profit swings, representing both significant risk and considerable reward potential.

How Operating Leverage Impacts Business Strategy

Understanding your operating leverage is crucial for sound strategic decision-making. It strongly influences choices like pricing and production levels because it helps predict exactly how changes in sales will impact the bottom line. This knowledge is a powerful strategic tool for any CEO.

A business with high operating leverage often pursues aggressive sales strategies, as new sales significantly boost profit after fixed costs are met. However, this also highlights the dangers of a sales downturn, potentially leading the company toward a more cautious approach. It’s always about balancing risk and reward.

How Operating Leverage Works?

Operating leverage works by thoughtfully balancing fixed and variable costs within your company’s structure. Grasping these cost types is essential for assessing a firm’s financial health and predicting how sales changes will affect profitability. Let’s explore the key elements influencing operating leverage:

1. Fixed Costs

Fixed costs are those expenses that just don’t budge, no matter how much you produce or sell. Think of your monthly office rent or the salaries for your core administrative team. These are costs you’re on the hook for even if you don’t move a single product, essentially making them a foundational expense that’s always there.

Fixed costs remain constant, regardless of whether your company has an exceptional or quiet sales month. This inherent stability creates leverage. Once your revenue exceeds these set costs, any subsequent money earned flows directly into profit, potentially leading to what we call explosive profit growth.

2. Variable Costs

Now, variable costs are different. They are directly linked to how much your company actually produces. So, as you make more, these costs naturally climb, and if you produce less, they drop, with good examples being raw materials or sales commissions, things that are all part of your cost of goods sold, really.

These costs offer a lot more flexibility compared to fixed ones, giving a business a bit of a safety net during slower times. If sales take a dip, these expenses will also drop right along with them, and this direct connection to production is exactly what defines a variable cost structure.

3. High Operating Leverage

A company shows high operating leverage when fixed costs make up a large portion of its cost structure, common in sectors like software or airlines. Similarly, a report from the Monetary Authority of Singapore, Singapore’s banks drive growth and mobility, reinforcing its position as a hub for trade, investment, and talent in Asia.

With high leverage, a small sales bump causes a significant jump in operating income because fixed costs are already covered. However, the reverse is also true: a slight sales drop can cause a disproportionate fall in profits, making the model rewarding but inherently riskier.

4. Low Operating Leverage

Conversely, low operating leverage occurs when variable costs dominate the company’s cost structure. Businesses such as typical retail stores or consulting firms often follow this model. They have fewer fixed costs, but their costs per sale are generally higher, which provides a much more stable earnings profile overall.

These kinds of companies aren’t going to see those dramatic profit surges during a sales boom, for sure. But the upside is they’re much better protected when there’s a downturn, as their costs pretty much fall right along with their revenue, making it a less volatile, more predictable way to operate a business, a practical approach for many.

What Is the Degree of Operating Leverage (DOL)?

The Degree of Operating Leverage (DOL) is a specific ratio that quantifies the actual effect of leverage. It acts as a multiplier, indicating exactly how much operating income will shift for every one percent change in sales, turning a general idea into a concrete, measurable business insight.

If a company has a DOL of 2.5, a 10% sales increase would result in a 25% increase in operating income, a significant jump. This leverage calculation is incredibly useful for financial forecasting and understanding the company’s risk exposure, making it a critical tool in management analysis.

Degree of Operating Leverage (DOL) Formula

The most common way to grasp the Degree of Operating Leverage (DOL) involves looking at percentage changes. The formula, which measures this key accounting sensitivity, is calculated by dividing the Percentage Change in Operating Income (EBIT) by the Percentage Change in Sales. This shows the direct impact clearly.

Another highly practical way to calculate DOL uses direct financial data from the income statement. For this accounting approach, you divide the Contribution Margin by the Operating Income. Since the Contribution Margin is simply sales revenue minus variable costs, this method is quite straightforward with solid data.

How to Calculate Operating Leverage

Figuring out your operating leverage formula can be done in a few different ways, depending on what kind of data you happen to have available. All these methods really do give you the same core insight into how your company’s cost structure works, so let’s check out these three common ways to calculate operating leverage:

1. Using the Cost Structure

This first method really gets into the nitty-gritty, breaking down your costs into their core components, which is pretty detailed. The formula you’d use here is DOL = [Q x (P – V)] / [Q x (P – V) – F], where Q is units, P is price per unit, V is variable cost per unit, and F represents your total fixed costs, giving you a very precise DOL for a specific sales level.

This method does ask for a pretty solid understanding of your per-unit economics, which makes sense. But honestly, it’s a super powerful way to really visualize how even small shifts in your pricing or costs can directly affect your profits, which is great for driving smarter business decisions.

2. Using Percentage Changes

This particular method is probably the most intuitive one for really grasping what this concept is all about. You just take the percentage change in your operating income over a specific period, and then you divide that by the percentage change in sales from that same period, which makes the magnification effect of leverage super clear to see.

So, as an example, if your sales happened to grow by 10% and your operating profit went up by 30%, then your DOL would actually come out to 3. It’s a really straightforward calculation, giving you a quick, actionable measure of your company’s current operating risk.

3. Using a Margin Ratio

The margin ratio method uses numbers taken straight from the income statement. You calculate the Contribution Margin (Sales minus Variable Costs), then divide that by Operating Income. This offers a reliable way to calculate operating leverage without relying on specific per-unit data.

This approach is often a go-to for analysts because it relies on readily available financial statement information. It makes it much simpler to compare the leverage of different companies or track your own business’s progress, offering a solid snapshot of operational efficiency.

Comparing High vs. Low Operating Leverage in Businesses

When comparing businesses, the difference between high and low operating leverage becomes clear. A high-leverage company is built for aggressive growth; its profit margins expand significantly once those high fixed costs are covered. This setup presents a classic high-risk, high-reward scenario.

Conversely, a low-leverage company typically offers a more stable and predictable earnings stream. While its profits may not soar dramatically during booms, it is also much more resilient during economic downturns, representing a generally lower-risk, lower-reward model in accounting.

What Are Examples of High and Low Operating Leverage?

To truly grasp operating leverage, looking at actual industries helps. Businesses with high leverage typically have massive upfront costs for equipment or infrastructure. Classic examples include airlines (huge plane costs) or software companies (high R&D, low production costs).

On the flip side, low-leverage industries are usually service-based or have high variable costs. Think retail, where the cost of goods sold dominates, or consulting firms, where expenses scale with consultant salaries. Their expenses mirror income closely.

Real Businesses Example of Operating Leverage

To truly grasp operating leverage, consider a car manufacturer. They face enormous fixed costs for factories, robotics, and R&D. Once enough cars are sold to cover those vast upfront expenses, each additional unit sold becomes highly profitable, illustrating the potential for explosive growth.

Grocery stores typically run on lower leverage, with low fixed costs but high variable costs (inventory) per item. While this keeps profits stable, they won’t see the same profit surge as a carmaker during a boom. So because of that, ScaleOcean makes managing inventory and costs easier, helping these businesses secure consistent growth.

What Does Operating Leverage Tell You?

Operating leverage, when you really get down to it, gives us a good look into a company’s cost structure and just how much business risk they’re carrying. It really shows you how much a company needs to sell, you know, to cover all its fixed costs, something we often talk about as the break-even point.

But it isn’t just about risk. It also clues you into a company’s potential for growing profits, which is pretty useful in accounting. A high degree of leverage really highlights that if sales pick up, the effect on their net profit is going to be quite substantial. It’s a strong signal for potential profitability going forward.

The Importance of Operating Leverage

When it comes to strategic management, the importance of operating leverage cannot be overstated. It’s a foundational metric, essential for accurate forecasting, aligned budgeting, and setting realistic business goals. Without understanding the calculation, you’re flying blind on how sales shifts affect profitability.

This knowledge is key when managers address cost control and investment decisions. For example, investing in automation raises fixed costs and lowers variable costs, boosting leverage. Similarly, according to FTI Consulting, commercial real estate in the Asia Pacific rose 23% to $131B in 2024, but the traditional model is outdated.

How to Interpret Operating Leverage in Real Life

In business, the Degree of Operating Leverage (DOL) acts as a quick check for market sensitivity. For example, a DOL of 4 means you can expect a small 5% drop in sales to translate into a painful 20% drop in operating profit. This insight is crucial for navigating various market situations.

Beyond risk assessment, this concept is highly useful for setting sales targets. It allows you to clearly show your team how even a modest revenue increase can have a much bigger, amplified positive effect on the company’s financial health, highlighting the link between growth and profitability.

What is the Difference Between Operating Leverage and Financial Leverage?

Operating leverage is tied to fixed operating costs, like rent and salaries, which directly affect production and profitability. It shows how a company’s cost structure influences its operating income in response to shifts in sales, essentially measuring business risk.

Financial leverage, conversely, arises from fixed financing costs, such as debt interest. While it can amplify returns for shareholders, it also significantly increases financial risk, having an impact on both the company’s overall capital structure and its operating leverage.

Calculate and Manage Operating Leverage Automatically with ScaleOcean

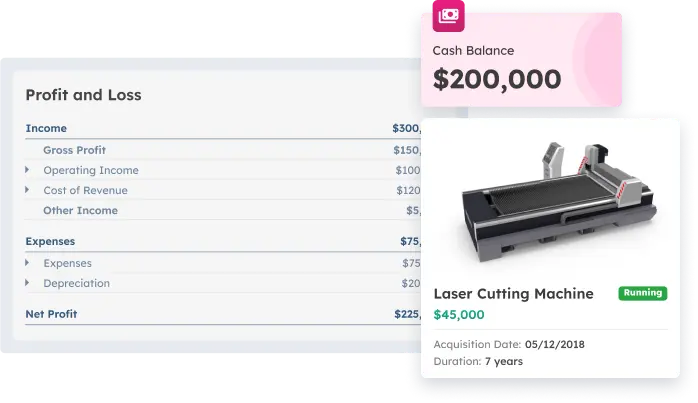

ScaleOcean’s accounting software simplifies calculating and tracking operating leverage. It automates cost categorization, which eliminates manual errors and provides a clear, real-time view of your cost structure. This streamlines operations, ensuring everything runs smoothly and efficiently.

With ScaleOcean, making data-driven decisions becomes effortless. The software effectively supports businesses in managing their costs and provides the added benefit of access to the CTC grant. You can find the key features of ScaleOcean’s software detailed below:

- Real-Time Budget vs. Actual Comparison: Track budget vs. actual expenses in real-time, ensuring accurate operating leverage and financial decisions.

- Long-Term and Short-Term Budget Planning: Plan both short and long-term budgets, managing fixed and variable costs to assess operating leverage.

- Fixed and Variable Cost Management: Categorize and track fixed and variable costs for better assessment and profitability optimization.

- Cash Flow Forecasting: Predict cash inflows and outflows to manage fixed and variable costs, maintaining a healthy cash flow balance.

- Expense Control for Improved Profitability: Control fixed and variable expenses efficiently, improving profitability while managing operating leverage.

Conclusion

Operating leverage is a truly crucial concept for every business leader. It has the power to boost profits when sales increase, but it can just as easily amplify losses when sales decline. Managing it effectively transforms it from a potential risk into a strategic tool.

Knowing your degree of leverage allows you to make far more informed pricing and production decisions. Vendor ScaleOcean’s accounting software is designed to help you manage both operating leverage and financial planning effectively. If you want to try all of its features firsthand, they are offering a free demo too.

FAQ:

1. Is higher or lower operating leverage better?

The best level of operating leverage depends on a company’s operational needs and risk appetite. A higher operating leverage with more fixed costs boosts profits when sales increase, but adds risk during downturns. Lower leverage reduces risk but limits profit growth potential.

2. What does the degree of operating leverage tell you?

The degree of operating leverage (DOL) indicates how much a company’s operating income changes in response to changes in sales. A higher DOL means even small changes in sales can cause larger fluctuations in profit, revealing potential growth and risk levels.

3. What’s a good operating leverage ratio?

An ideal operating leverage ratio varies depending on the company and industry. Typically, a ratio between 2 and 3 indicates effective use of fixed costs to drive profitability, though the appropriate ratio depends on a company’s risk strategy and industry benchmarks.

4. Is high DOL good or bad?

High DOL can be advantageous for companies experiencing consistent sales growth, as it amplifies profitability. However, it also increases vulnerability during sales declines. Balancing fixed and variable costs is essential to ensure high leverage benefits without excessive risk.

PTE LTD..png)

.png)

.png)

.png)

.png)