Payroll software automates the management of employee remuneration, including payroll processing, tax deductions, and benefit management. By optimizing these processes, firms may decrease errors, save time, and increase efficiency. Payroll software helps businesses in Singapore comply with tight tax and labor standards.

According to Singapore Business Review, 40% of businesses find AI and automation in payroll processing “extremely appealing,” and over the next year, 70% of payroll providers expect increased use of AI and automation, though the impact will vary.

This article discusses various payroll software packages, emphasizing their essential features, benefits, and applicability for varied corporate requirements. We will look at key criteria for picking the proper system and provide insights into the leading systems on the market.

Continue reading to find out how you select the best payroll software for streamlining operations and maintaining compliance.

- Payroll software is a comprehensive solution that automates and simplifies the complex process of handling employee compensation.

- Payroll software provides numerous benefits, such as improving efficiency, accuracy, compliance, cost savings, and security in payroll management.

- Best payroll software includes: ScaleOcean, Gusto, Rippling, Onpay, and Deel, each offering unique features tailored to businesses of different sizes and needs.

- ScaleOcean’s HRIS software is best for businesses seeking an all-in-one ERP solution. ScaleOcean software automates payroll and other business processes, such as HR and accounting.

What is Payroll Software?

Payroll software is a complete solution that automates and simplifies the complex process of handling employee compensation. It integrates multiple components, such as calculating employee wages, tax deductions, benefits, and statutory contributions, to ensure that all payroll-related operations are completed quickly.

This form of software decreases the manual burden involved in payroll processing, lowering the chance of human error and improving overall accuracy. It also guarantees that firms stay compliant with ever-changing tax rules and labor requirements, making it a valuable resource for enterprises of all sizes.

In addition to fundamental payroll activities, payroll software includes capabilities such as tax filing, payslips, and employee record management. It can also automate leave management and employee onboarding, making it a flexible solution for human resource departments.

Payroll software automates these activities, saving critical time while also improving overall payroll process efficiency. This enables firms to focus on strategic activities while ensuring that their payroll is handled correctly and in accordance with all regulatory standards.

Benefits of Payroll Software

Payroll software provides numerous benefits that can dramatically improve the efficiency, accuracy, and general management of payroll procedures within a business. Automating multiple procedures reduces manual work and guarantees that operations run smoothly and without errors.

Let’s look at some of the important benefits that payroll software provides to businesses:

- Efficiency: Payroll software automates repetitive tasks, speeding up processing and freeing HR staff to focus on other duties, increasing overall productivity.

- Compliance: Payroll software ensures businesses stay compliant with tax rates, deductions, and benefits by automatically updating with changes, avoiding penalties, and ensuring employees get the correct benefits.

- Accuracy: Automated payroll software eliminates manual calculations, reducing errors and ensuring employees are paid correctly, improving satisfaction and reducing wage discrepancies.

- Cost Savings: Automating payroll reduces the need for large payroll teams, lowering administrative costs and allowing the saved time to be spent on more strategic business areas, improving financial efficiency.

- Security: Payroll software enhances data security through strong encryption and secure access procedures, protecting sensitive employee information and preventing unauthorized access to ensure privacy and financial stability.

Payroll automation offers numerous benefits, including improved efficiency, compliance, accuracy, cost savings, and security. However, according to HRM Asia, 35% of businesses still face challenges with payroll errors and data security concerns, despite its positive outlook. So you gotta search for the perfect and the right payroll software for your business in Singapore.

How Payroll Software Works

Payroll software combines several critical components, including employee attendance, tax codes, benefits, and salary, into a single, simplified system. This interface enables the software to automatically calculate gross pay based on work hours or wage agreements, while accounting for varied pay structures.

In cases where employees work part of a pay period, the software can also calculate a prorated salary based on the days worked, ensuring fair compensation. It then calculates the appropriate deductions, such as taxes, perks, and insurance premiums, to determine the net pay.

By automating these procedures, the software ensures that the payroll process is speedy and accurate, removing the need for manual calculations and reducing errors. Payroll software also serves an important role in ensuring compliance with local labor rules.

It computes and applies statutory deductions, such as contributions to social security, pension funds, and other government-mandated programs. This guarantees that firms are up to date on ever-changing legislation, lowering the chance of penalties or legal complications.

Furthermore, the program can generate pay stubs and other pertinent reports, making it easier for businesses to give employees transparent and accurate compensation information.

Why This Is Especially Important in Singapore?

In Singapore, payroll software is crucial due to the country’s strict compliance requirements and the need for accuracy in tax calculations, deductions, and benefits. Businesses must stay updated with regulations from various authorities to avoid penalties.

Below are the key regulatory bodies that payroll systems must align with in Singapore:

- Ministry of Manpower (MOM): Ensures compliance with labor laws, including foreign worker policies and employee rights.

- Central Provident Fund Board (CPFB): Manages mandatory employee savings and contributions for retirement, healthcare, and housing.

- Inland Revenue Authority of Singapore (IRAS): Oversees tax collection, ensuring correct payroll tax computations and timely submissions.

12 Recommended Payroll Software

Choosing the correct payroll software for your organization can help to speed payroll procedures, enhance accuracy, and ensure compliance with local rules. The following is a list of recommended payroll software solutions, each tailored to unique needs for organizations of varying sizes and industries.

These software solutions include a variety of capabilities that can automate activities, increase efficiency, and help manage employee compensation effectively.

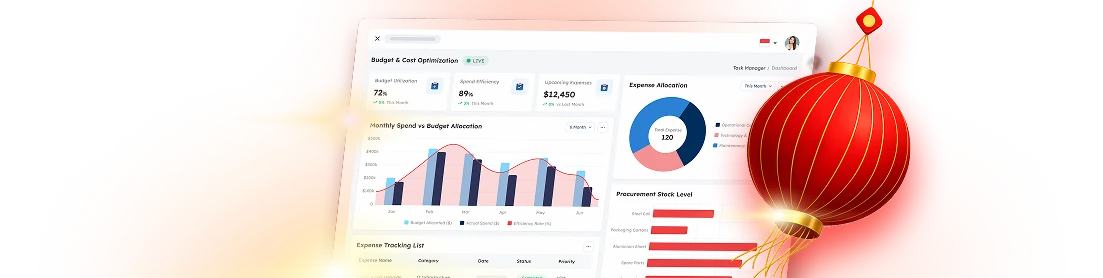

1. ScaleOcean Payroll Software

Best for businesses seeking an all-in-one ERP solution, ScaleOcean’s HRIS software automates payroll and other business processes, such as HR and accounting. It is ideal for companies of all sizes, offering smooth connectivity, accurate payroll processing, and data security, while also supporting growth.

Its user-friendly interface and automation features make operations more efficient, allowing businesses to focus on strategic goals. ScaleOcean enhances payroll and operations across departments with unlimited user access and customizable options.

The software integrates well with existing systems, improving data flow between functions. Businesses can experience its benefits through a free demo, simplifying payroll and other core functions. Singapore-based enterprises can also leverage the CTC grant to reduce ERP implementation costs.

Key Features:

- Automated Payroll Processing: ScaleOcean automated payroll calculations, ensuring that salaries are paid correctly and on schedule, reducing manual errors and saving time for HR departments.

- Payroll Reporting: This tool enables organizations to create complete payroll reports for analysis and compliance, providing transparency and ease of use.

- Data Security: ScaleOcean uses extensive security methods to safeguard sensitive payroll and employee information, assuring complete compliance with data protection standards.

- Payroll Auditing and Error Reporting: ScaleOcean’s built-in auditing and error-reporting capabilities enable organizations to spot inconsistencies and address payroll concerns before they become problems.

| Pros | Cons |

|---|---|

|

|

Price: ScaleOcean offers a flat pricing structure with no hidden costs, based on customization complexity. Prices vary depending on the specific business needs and the level of customization required.

Best For: ScaleOcean is ideal for medium to large enterprises looking for a customizable solution that can integrate across all business processes, ensuring smooth operations and growth across industries.

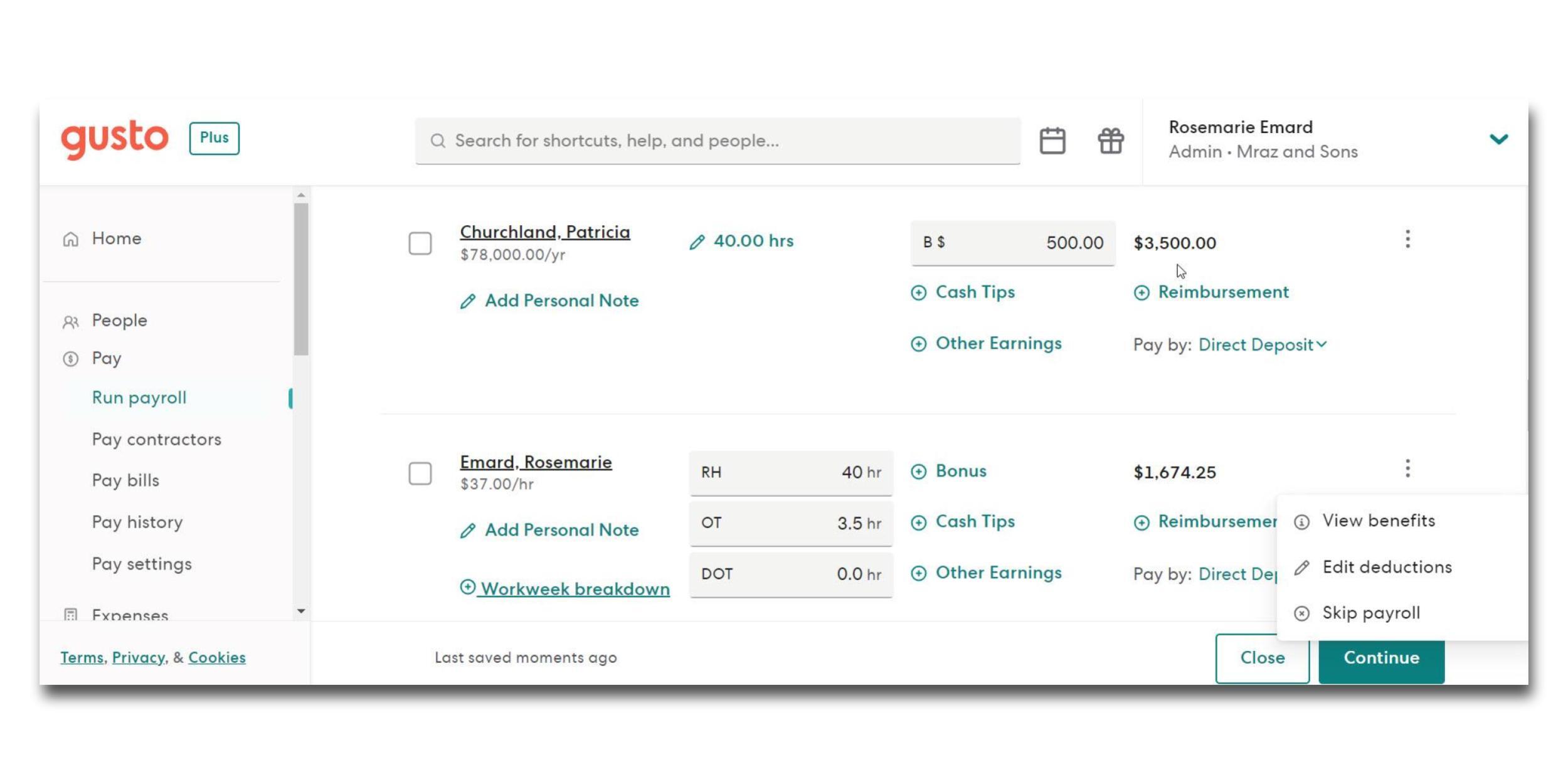

2. Gusto

Gusto is a comprehensive payroll software that simplifies payroll management for small to medium-sized businesses. It offers a variety of features to handle payroll, benefits, tax filing, and HR management all in one platform.

Gusto is ideal for companies that need an easy-to-use payroll solution with additional HR features, such as hiring and onboarding. It’s especially well-suited for businesses looking for a fully integrated solution to manage both payroll and employee benefits efficiently.

Key Features:

- Automated payroll processing

- Benefits management

- Tax filing and compliance

- Employee self-service portal

| Pros | Cons |

|---|---|

|

|

Price: Gusto has tiered pricing starting at $49/month for the Simple plan, with additional charges of $6 per employee. The Premium plan costs $180/month plus $22 per employee. A contractor-only plan is also available for $35/month.

Best For: Gusto is well-suited for small to medium-sized businesses that need an easy-to-use payroll solution with integrated HR features such as hiring, onboarding, and benefits management.

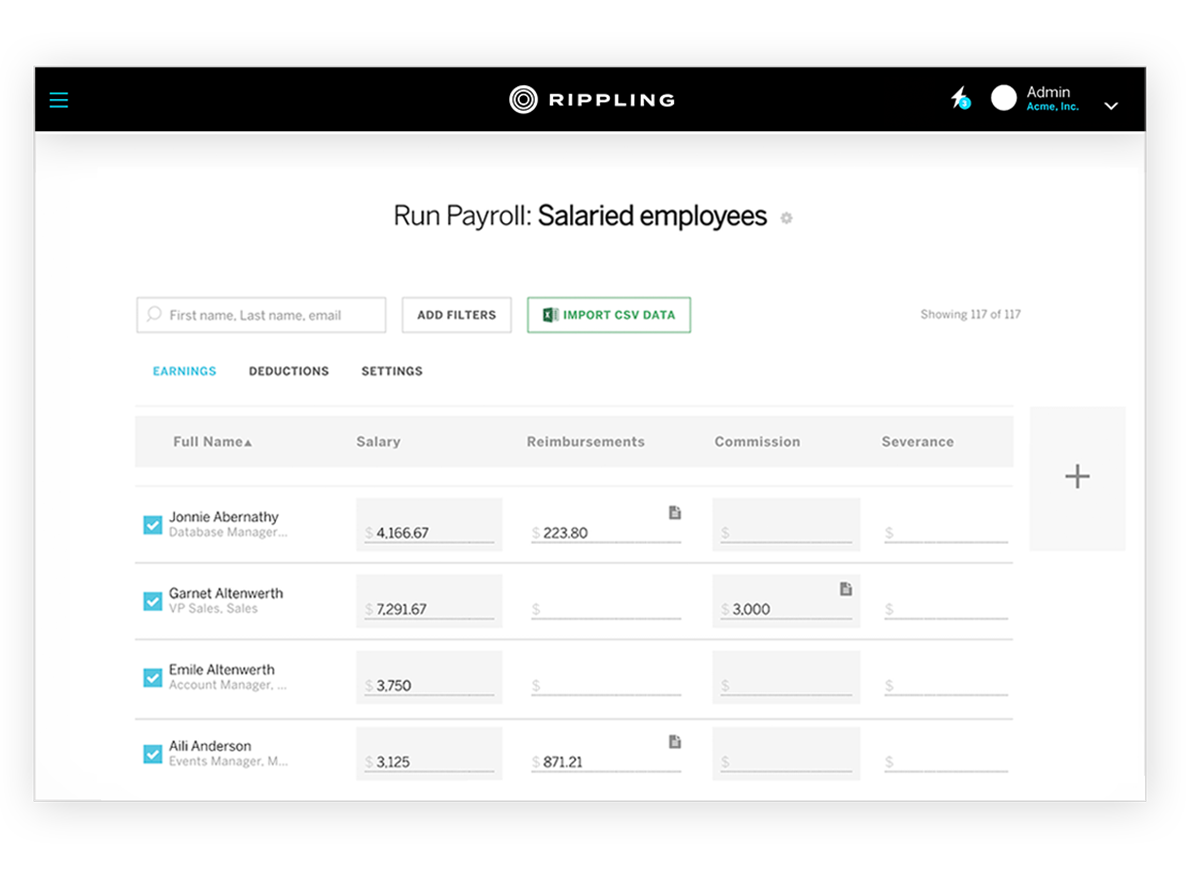

3. Rippling

Rippling is great for firms that require a unified platform to manage a wide range of employee-related functions, including onboarding, benefits, payroll, and more.

Key Features:

- Payroll processing automation

- Benefits management

- Employee data management

- Time and attendance tracking

| Pros | Cons |

|---|---|

|

|

Price: Rippling’s payroll solution starts at around $35 per month, with an additional $8 per employee for its core HRIS platform.

Best For: Rippling is best for businesses that need an all-in-one platform to manage payroll, HR tasks, and employee benefits seamlessly across different departments.

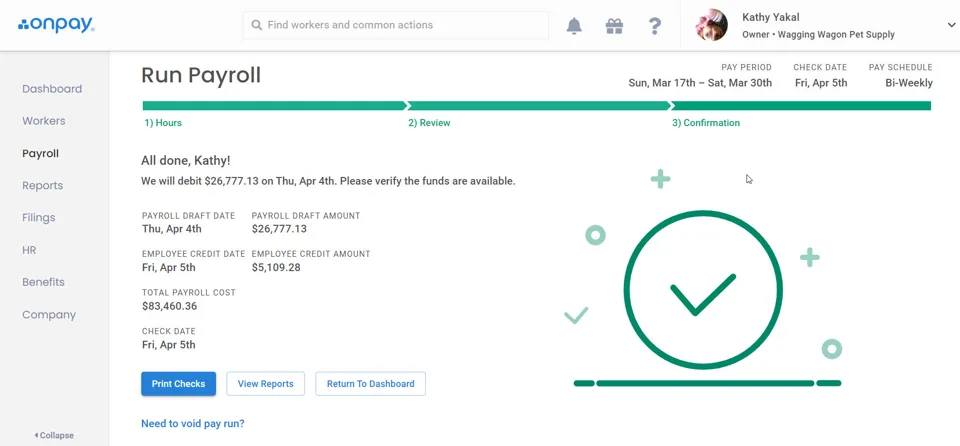

4. Onpay HR Software

Onpay is a user-friendly payroll software for small to medium-sized enterprises that includes faster payroll processing and critical HR functions. It is especially useful for businesses searching for an economical, user-friendly solution that automates payroll computations and tax filings, saving them time.

Onpay is suitable for organizations that require dependable payroll processing without complicated features or a lengthy learning curve. For businesses looking for a comprehensive solution, pairing Onpay with advanced HR software in Singapore can help streamline all HR and payroll operations effectively.

Key Features:

- Payroll management

- Tax filing automation

- Employee self-service portal

- Customizable reports

| Pros | Cons |

|---|---|

|

|

Price: OnPay offers transparent pricing, with a base fee of $49 per month, plus $6 per employee or contractor per month.

Best For: OnPay is ideal for small to medium-sized businesses that need an affordable, user-friendly payroll solution that automates payroll computations and tax filings.

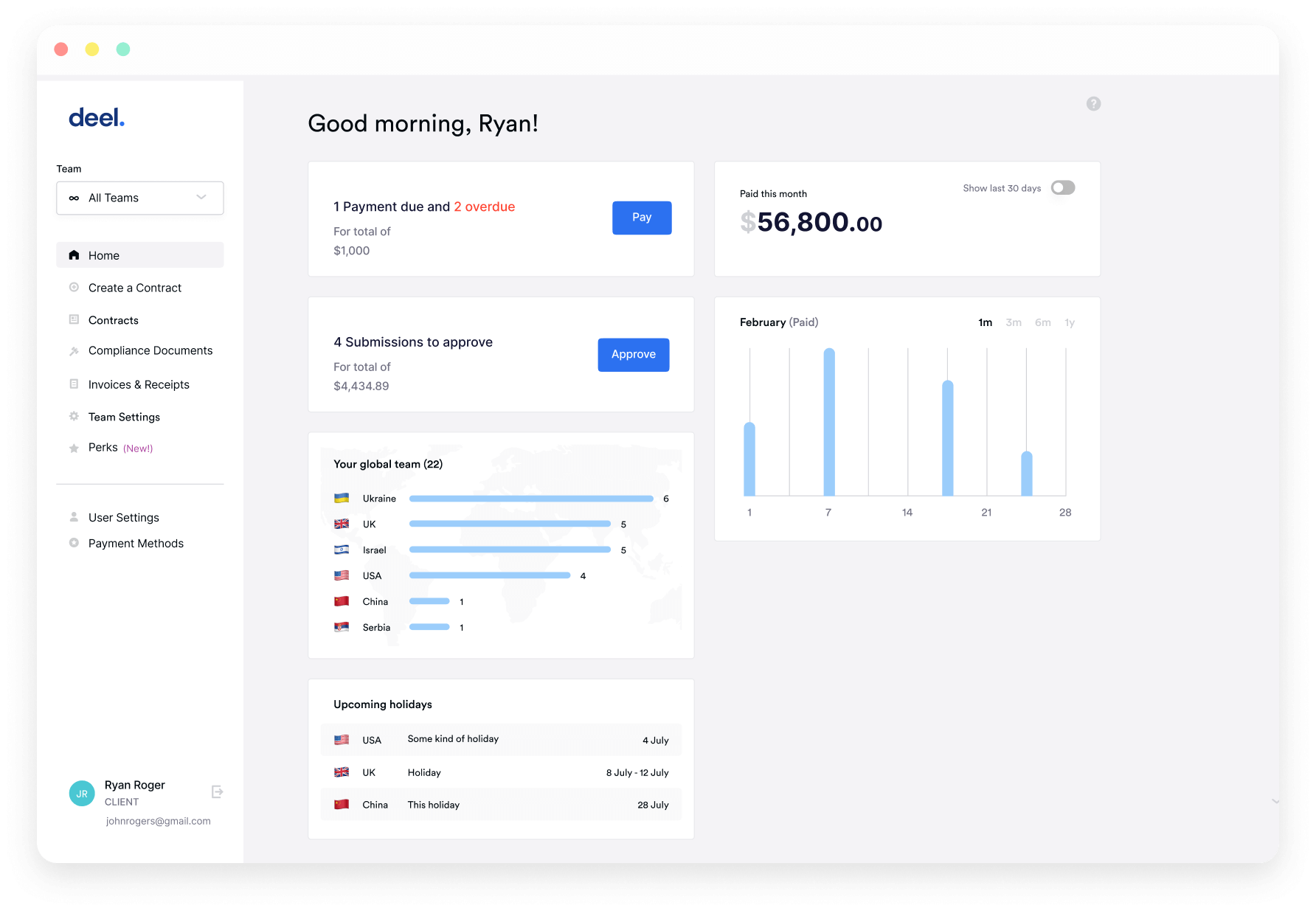

5. Deel

Deel is a worldwide payroll software that simplifies payroll management for remote teams and foreign employees. It provides a seamless solution for enterprises with a scattered workforce, allowing them to handle payments, contracts, and compliance across many nations.

Deel allows businesses to quickly pay employees and contractors in several currencies while following local tax rules and regulations. It’s ideal for businesses that operate abroad or have remote workers and need flexible payroll solutions and compliance management.

Key Features:

- Global payroll processing

- Contractor payments and management

- Compliance with local tax laws

- Automated contract generation

| Pros | Cons |

|---|---|

|

|

Price: Deel offers modular pricing starting at $49/month for contractors, $29/employee/month for Global Payroll, and $599/employee/month for Employer of Record services, covering 150+ countries.

Best For: Deel is perfect for businesses with remote teams or international employees, providing flexible payroll solutions and compliance management across multiple countries.

6. Paycor Payroll System

Paycor provides a comprehensive payroll software system that addresses payroll processing, tax compliance, and employee self-service.

It is great for organizations of all sizes, especially those looking for a reliable solution to manage employee payroll, track time, and simplify tax filing. Paycor stands out for its emphasis on offering accurate payroll management while smoothly integrating HR and time monitoring capabilities.

Key Features:

- Payroll processing

- Tax compliance automation

- Time tracking and scheduling

- Employee self-service portal

| Pros | Cons |

|---|---|

|

|

Price: Paycor’s pricing ranges between $99 and $199+ per month, plus $5–$14 per employee, depending on the tier chosen.

Best For: Paycor is best for medium to large businesses that need comprehensive payroll and HR features, with a strong focus on time tracking and tax compliance.

7. Paychex HR Software

Paychex offers a comprehensive payroll solution for organizations of all sizes, with an emphasis on ease of use and automation. It enables businesses to manage payroll processing, tax filings, and employee benefits while adhering to federal and state requirements.

Paychex is an excellent choice for firms searching for scalable payroll software that interacts seamlessly with HR management and provides advanced reporting features.

Key Features:

- Payroll processing and automation

- Tax filing and compliance management

- HR and benefits administration

- Employee self-service portal

| Pros | Cons |

|---|---|

|

|

Price: Paychex pricing starts at around $39 per month plus $5 per employee for the entry-level plan, with higher costs for additional services.

Best For: Paychex is great for businesses of all sizes, particularly those seeking a scalable solution with advanced payroll and HR features, along with 24/7 customer support.

8. Wave Payroll

Wave Payroll is a simple yet effective payroll solution for small businesses. It focuses on automating payroll procedures, tax calculations, and ensuring compliance with local tax laws.

Wave Payroll is ideal for businesses seeking an economical, user-friendly payroll solution that can be readily integrated with other Wave accounting products. Wave Payroll’s user-friendly design and easy features help small businesses save time and decrease administrative errors in payroll handling.

Key Features

- Payroll automation for new employees

- Integration with leave and expense claims

- Employee data transfer capabilities

- Easy payroll setup

| Pros | Cons |

|---|---|

|

|

Price: Wave Payroll is priced at $40/month for full-service payroll with automated tax filing or $20/month for a self-service option, plus $6 per employee or contractor.

Best For: Wave Payroll is ideal for small businesses seeking a straightforward and cost-effective payroll solution that integrates well with other Wave accounting products.

9. Paylocity Payroll Software

Paylocity is a comprehensive payroll software system that simplifies payroll processing, HR chores, and benefits management for businesses of all sizes.

Paylocity’s robust features reduce the complexity of payroll while assuring compliance with federal, state, and local standards. It is an excellent choice for businesses looking for a comprehensive solution that includes payroll, HR, and talent management.

Key Features:

- Payroll Automation

- Benefits Administration

- HR & Talent Management

- Real-Time Analytics

| Pros | Cons |

|---|---|

|

|

Price: Paylocity uses a per-employee-per-month pricing model, with costs ranging from $22–$32 per employee, plus potential base fees.

Best For: Paylocity is best for medium to large businesses that require a comprehensive payroll, HR, and talent management solution with advanced analytics capabilities.

10. ADP HR Software

ADP offers comprehensive payroll solutions, tax compliance, and reporting tools that are appropriate for businesses of all sizes.

With its broad collection of HR and payroll functions, ADP is a fantastic alternative for organizations that require a dependable and secure payroll solution. It is ideal for enterprises that want comprehensive payroll and HR solutions with sophisticated features.

Key Features:

- Payroll management

- Tax compliance automation

- Comprehensive reporting tools

- HR features integration

| Pros | Cons |

|---|---|

|

|

Price: ADP’s pricing starts at $39 per month for small business solutions like Roll by ADP, with larger enterprise solutions like Workforce Now ranging between $19-$28 PEPM.

Best For: ADP is suited for businesses of all sizes, particularly those requiring comprehensive payroll and HR management with extensive features and top-notch compliance tools.

11. SurePayroll

SurePayroll is a user-friendly payroll software that provides automatic payroll services and tax filing, making it a good option for small businesses.

It specializes in automating payroll computations, tax deductions, and report filing, allowing business owners to focus on other important activities. SurePayroll is excellent for small to medium-sized organizations that want a simple, low-cost payroll management solution.

Key Features:

- Automated payroll processing

- Tax filing and compliance management

- Employee self-service portal

- Payroll reminders and alerts

| Pros | Cons |

|---|---|

|

|

Price: SurePayroll’s Full Service payroll plan costs approximately $29–$29.99 per month, with an additional $4–$7 per employee.

Best For: SurePayroll is ideal for small to medium-sized businesses looking for a simple, affordable payroll management solution with reliable tax filing and compliance features.

12. BambooHR Software

BambooHR is an HR software solution that helps small and medium-sized organizations manage employee data, track performance, and streamline HR operations.

It offers a comprehensive platform for managing numerous HR operations, such as personnel data, performance management, and time off tracking. BambooHR is ideal for firms seeking an easy-to-use, scalable solution to improve HR productivity and employee engagement.

Key Features:

- Employee record management

- Performance tracking

- Time-off tracking

- Employee self-service portal

| Pros | Cons |

|---|---|

|

|

Price: BambooHR’s payroll, when bundled with HRIS, typically costs between $10 and $22 per employee per month, with pricing decreasing as the employee headcount grows, making it affordable for small and medium-sized businesses.

Best For: BambooHR is best for small to medium-sized businesses that need an intuitive HR and payroll solution with a strong focus on employee engagement and performance management.

Employer Responsibilities for Payroll Compliance

As an employer, it’s essential to stay on top of payroll compliance to maintain strong relationships with employees and avoid legal issues. Meeting obligations such as paying salaries on time, keeping accurate records, and reporting to the authorities helps ensure smooth operations.

Here are the key responsibilities employers need to take care of to stay compliant:

- Ensure timely salary payments: Make sure employees are paid on time as agreed in their contracts to build trust and stay compliant with labor laws.

- Provide detailed payslips: Provide payslips that clearly show wages, deductions, and benefits, helping employees understand their compensation.

- Keep accurate payroll records: Keep proper and detailed payroll records to ensure everything is in order and to easily handle audits when needed.

- Follow Employment Act guidelines: Follow the rules set by the Employment Act, including working hours, leave rights, and employee protection.

- Submit accurate CPF contributions on time: Ensure that monthly CPF contributions are made accurately and on time, as required by law.

- Report employee income to IRAS via IR8A annually: File the IR8A form with IRAS every year to report employees’ income details for tax purposes.

How to Choose Key Criteria for Good Payroll Software

Choosing the correct payroll software for your organization is critical to ensure that the payroll cycle runs smoothly and efficiently. The perfect software solution should be able to fit your organization’s specific needs, allowing payroll administrators and employees to easily manage compensation chores.

When assessing payroll software, several essential elements should be evaluated to ensure that it is in line with your company’s goals and meets all legal requirements. The following are the key criteria that will influence your decision-making process to choose the right payroll software:

Cost Considerations

When selecting payroll software, pricing plays a major role in your decision. It’s important to find the right balance between cost and features. A lower-priced option may seem attractive but might lack critical features or customer support.

Consider the long-term benefits the software can offer. Sometimes, paying a bit more for a solution with automation, compliance updates, and integrations can save you time and resources in the future, making it a worthwhile investment.

Ease of Use

Payroll software should be straightforward to use. A user-friendly interface allows payroll administrators to easily set up and execute payroll without requiring substantial training.

Employees should be able to easily access their payslips, examine benefits, and update personal information. The easier the system is to use, the more effective your payroll process will be, freeing up your team to focus on more vital responsibilities.

Customization

Every company has different payroll requirements based on its pay structures, perks, and deduction rules. The payroll software you use should be adaptable enough to meet these individual needs.

Whether you have different employee pay rates, commission schemes, or bonuses, the software should be easily customizable to suit your company’s specific payroll configuration.

Integration Capabilities

Payroll software should easily integrate with other systems, such as human resource management software, accounting platforms, and time tracking applications.

This interconnectedness, especially with Singapore’s HR software, ensures seamless data flow, reduces errors, and boosts efficiency.

Compliance Features

Compliance with local tax laws and labor rules is critical for any firm. Payroll software must include capabilities that keep it up to date with the newest regulatory standards. This includes automatic adjustments to tax codes, employee perks, and Social Security contributions.

It is also essential that payroll software accounts for mandatory deductions such as the foreign worker levy, ensuring that businesses remain compliant with government regulations. Compliance features can help firms avoid costly penalties and guarantee that payroll is completed properly in accordance with current requirements.

Calculation of CPF and SDL

In Singapore, accurate CPF and SDL calculations are key to staying compliant. Payroll software that automates these calculations ensures the right amounts are deducted and that your filings are always on time.

A system that handles this for you minimizes the chances of errors. It also keeps you in line with any changes in rates, so you don’t have to worry about manual updates or potential miscalculations.

Global Payroll Management Support

If your company operates across borders, payroll software with global payroll management support is a must. It allows you to handle employee payments, taxes, and benefits across different countries all in one system.

With global payroll support, compliance with local regulations becomes easier. The software ensures that you can manage multiple currencies, tax laws, and labor requirements smoothly, making it easier to expand and scale internationally.

Automated Payroll Tax Reporting

Automated payroll tax reporting is a game-changer for simplifying your tax filing process. With the right software, your taxes are calculated automatically, saving you time and reducing the chance of mistakes.

This feature helps you stay on track with tax deadlines and minimizes the risk of fines. Whether it’s local or international tax requirements, the software can generate accurate reports for every jurisdiction you need.

Security and Data Protection

Payroll data includes sensitive employee information such as salary, tax details, and personal identification. As a result, the security of your payroll software should be a key concern.

Ensure that the program provides high-level data protection through encryption, safe access controls, and frequent security updates. Protecting this data not only protects employee privacy but also helps to avoid potential security breaches that could harm your company’s reputation.

Scalability

As your firm expands, so will your payroll requirements. A flexible payroll software solution may expand with your business, accommodating an increased number of employees, new locations, or more complex payroll operations.

The software should be adaptable to these changes without requiring a major rebuild, allowing for seamless transitions as your organization grows.

Also Read: What is an HRIS Software and the Top 10 Recommendations

Conclusion

Choosing the appropriate payroll software is critical for businesses seeking to optimize payroll procedures, ensure compliance, and decrease administrative hassles. The payroll systems listed above provide a variety of capabilities, including tax filing automation, employee self-service portals, and multi-company support.

Each software solution is tailored to unique business requirements, whether you need a basic, low-cost solution for a small team or a complete system capable of managing complex payroll operations for a large enterprise.

ScaleOcean offers a comprehensive solution for businesses seeking an integrated payroll system that connects payroll management with HR, accounting, and other critical business operations. Designed for enterprises that prioritize efficiency, accuracy, and scalability, ScaleOcean ensures seamless workflows across departments.

Additionally, a free demo is available, allowing businesses to explore the full range of capabilities and see how it can enhance payroll and HR functions. Contact us today to see how ScaleOcean can help your business grow and improve your payroll management.

FAQ:

1. Which software is mostly used for payroll?

There are numerous payroll software alternatives available, each tailored to a certain purpose. ScaleOcean is a full HRIS system that includes payroll capabilities and might be an excellent fit for your company, effortlessly integrating with HR, accounting, and other critical operations.

2. What are the four types of payroll?

Let’s take a closer look at the four primary types of payroll solutions: manual payroll processing, outsourced payroll services, payroll software solutions, and Professional Employer Organisations (PEO). Each option offers distinct advantages depending on your company’s size and requirements.

3. What is ADP software in payroll?

ADP is a well-known provider of payroll and HR solutions, with a diverse set of features for payroll processing and compliance. However, ADP can be fairly costly for small firms. ScaleOcean payroll software is a more economical, integrated option that includes a wide range of functions to help with payroll and human resource management.

4. What is ERP payroll software?

ERP payroll software incorporates payroll processing into a wider Enterprise Resource Planning (ERP) system, which includes HR, accounting, and other company functions. This integrated strategy simplifies operations and improves data consistency across departments.

PTE LTD..png)

.png)

.png)

.png)

.png)