Inventory accounting is crucial for addressing financial challenges in a business. It ensures accurate reporting and decision-making by monitoring and valuing inventory. Effective inventory tracking helps businesses manage cash flow, determine the cost of goods sold (COGS), and avoid financial issues. It also enhances profitability by reducing waste and improving operational efficiency. Accurate inventory management is key to a company’s financial stability and success. According to IMDA Singapore, on 9 November 2023, the refreshed Retail Industry Digital Plan (IDP) was launched by Enterprise Singapore and IMDA to help businesses optimize operations, including inventory management, through digital tools.

This article explores the importance of inventory accounting and its role in addressing key business challenges. It highlights how accurate tracking and valuing of inventory contribute to better decision-making, enhanced profitability, and streamlined operations. The article also delves into the different inventory valuation methods and their impact on financial statements, cash flow, and taxes. Additionally, it discusses the benefits of integrating automated inventory management systems to reduce discrepancies and improve efficiency. The problem-solving focus is on how businesses can overcome common inventory challenges like stockouts, overstocking, and discrepancies by adopting digital tools and best practices for more accurate, efficient inventory management.

- Inventory accounting is the practice of tracking and valuing a company’s inventory for financial reporting purposes, ensuring accurate reporting on the balance sheet.

- Common inventory valuation methods, such as FIFO, LIFO, weighted average cost, and specific identification, significantly impact financial statements and tax liabilities by influencing inventory valuation and cost recognition.

- Best practices for inventory accounting include regular audits, real-time tracking, and integrating inventory data with financial systems to enhance accuracy and decision-making.

- ScaleOcean’s Inventory Management Software automates inventory tracking, integrates with financial systems, and ensures accurate, real-time reporting to support informed business decisions.

1. What Is Inventory Accounting?

Inventory accounting is the practice of tracking and valuing a company’s inventory for financial reporting reasons. The goal of inventory accounting is to ensure that inventory is appropriately reported on the balance sheet, which impacts both the company’s financial health and decision-making processes. Inventory is classified as a current asset since it is expected to be sold or used within a year, influencing a company’s overall assets and profitability. In Singapore, inventory accounting is critical for the retail, industrial, and wholesale industries, which rely on accurate inventory to meet demand while controlling expenses. As these industries grow, businesses require dependable tracking systems to ensure inventory is effectively managed, supporting financial stability and operational efficiency.

There are three forms of inventory: raw materials, work-in-process (WIP), and finished goods. Raw materials are the primary components utilized in production, whereas work in progress (WIP) refers to goods that are in the production process but have not yet been completed. Finished goods are products that are ready to sell. Accurate inventory valuation is critical for financial reporting since it directly affects cost of goods sold (COGS), profit margins, and overall company success. Proper valuation helps organizations make informed decisions and keep accurate financial records.

2. Common Inventory Valuation Methods

Inventory valuation methodologies play a key role in establishing the financial health of a corporation. The method adopted can have a substantial impact on the company’s financial statements, including the balance sheet and income statement, as well as its tax liabilities. Different methods influence how inventory is valued and costs are recognized, which affects profit margins, taxable income, and overall business performance.

a. FIFO (First In, First Out)

This strategy is based on the assumption that the first products acquired will be the first to sell. FIFO is appropriate for sectors where inventory items have a short shelf life, such as perishables, or when inventory costs tend to rise over time. This strategy ensures that older inventory is sold first, lowering the risk of obsolete inventory and valuing inventory on hand at more current market pricing.

b. LIFO (Last In, First Out)

According to GoBusiness Singapore, the Inventory Management and Sales Management System is supported by Enterprise Singapore, offering up to 50% support for SMEs. This solution helps businesses streamline inventory and sales management. In industries like oil, gas, and building supplies, LIFO assumes that the most recently purchased goods are sold first. This approach is beneficial in periods of inflation, as it can reduce taxable revenue by selling more expensive inventory, thereby lowering reported earnings.

c. Weighted Average Cost

This method keeps track of the real cost of each item of inventory and assigns that cost when it is sold. It is typically used for high-value or one-of-a-kind things such as automobiles, real estate, and custom-made products. This method provides the most exact cost reflection, but it can be more difficult to administer and is not suitable for firms with significant inventories.

d. Specific Identification

This method calculates the average cost of all inventory items, regardless of when they were purchased. Each unit sold is then priced according to the average cost. It is widely used in industries where objects are not easily identified, such as bulk products. This technique reduces cost volatility and simplifies inventory control by adopting a single average price for all items.

3. The Role of Inventory in Financial Statements

Inventory is an important component of both the balance sheet and income statement. On the balance sheet, inventory is classified as a current asset, and its value has a direct impact on a company’s total assets. Inventory levels have an impact on the cost of goods sold (COGS) on the income statement since larger inventory might result in reduced COGS and thus increased profitability.

The relationship between inventory and COGS is critical since it influences a company’s profitability and tax liabilities. A careful balance is essential to guarantee ideal inventory levels that support smooth operations while avoiding needless costs. Understanding capital expenditure definition can help businesses manage their investments in inventory effectively, ensuring that it supports long-term financial stability and growth. Additionally, it’s important to define financial instruments properly, as they can impact how inventory and related investments are managed in the financial statements.

Inventory turnover ratio is another important indicator for determining business efficiency. This ratio calculates how frequently inventory is sold and supplied in a particular period, providing information on how successfully a company maintains its stock. A high turnover rate indicates good inventory management and robust sales, whereas a low turnover rate could imply overstocking or slow-moving products. Businesses can improve their cash flow and profitability by regularly monitoring inventory levels and turnover rates. Efficient inventory management reduces surplus stock, improves sales cycles, and frees up money for other business needs, resulting in increased profitability.

4. Inventory Accounting Systems: Manual vs. Automated

Many organizations have traditionally relied on manual inventory tracking, particularly in the early phases of operations. However, as organizations expand and inventory grows more sophisticated, this strategy begins to show its limitations. Physical counts and manual record-keeping are prone to human errors and inefficiencies, resulting in discrepancies and a delayed response time in inventory management. As a result, organizations frequently want a more efficient solution to keep up with their growing operational demands.

As firms face these issues, computerized inventory management solutions have become critical to modern operations. The transition from manual tracking to automated solutions has numerous advantages, including real-time updates, fewer errors, and more efficient procedures. Software solutions provide quick insights into inventory status, enabling faster, more informed decisions. Automation improves efficiency by ensuring accurate tracking and reducing manual work. This enhances overall business performance. To further optimize operations, businesses in Singapore can explore accounting software Singapore to integrate with their inventory management systems for seamless financial tracking.

This is where ScaleOcean SG’s inventory management software comes in, offering a comprehensive solution for automating inventory tracking and reporting. ScaleOcean SG’s software keeps inventory levels up to date and accurately reflected in financial records with real-time data integration. This automation eliminates manual inefficiencies and enables data-driven decisions, ensuring smooth and accurate operations.

5. Challenges in Inventory Accounting

Effective inventory accounting is not without obstacles. Businesses frequently encounter stockouts, overstocking, and inventory anomalies, all of which can dramatically interrupt operations and affect the financial control in business. These issues are ubiquitous throughout businesses, although their impact varies according to the size of operations and the industry in question. Addressing these difficulties successfully is critical for guaranteeing smooth operations and long-term financial stability. The primary issues that firms experience in inventory accounting are listed below, along with techniques for mitigating them.

a. Stockouts

Stockouts happen when a business runs out of popular or essential items, leading to lost sales opportunities. This issue extends beyond revenue loss, as it also significantly affects customer satisfaction and loyalty. As customers experience delays or unavailability, their trust in the business can decline, potentially resulting in long-term negative effects. Furthermore, frequent stockouts can harm a company’s reputation, particularly in competitive sectors. To avoid stockouts, firms should develop automated inventory systems that track real-time stock levels, precisely estimate demand, and restock products on time.

b. Overstocking

Overstocking occurs when organizations keep excessive inventory levels, which is generally due to faulty demand projections or inadequate inventory management. While overstocking may appear to be a safe strategy to ensure availability, it really holds up precious capital that could be employed elsewhere. Furthermore, excess inventory increases storage expenses and may lead to product obsolescence. To combat overstocking, businesses can use demand-driven models, JIT inventory systems, and control measures like safety stock and audits.

c. Inventory Discrepancies

Inventory discrepancies can harm a financial management in company, leading to inaccurate reports, potential losses, and reconciliation issues. These discrepancies often result from mismatches between physical stock and recorded levels, caused by human error, theft, or tracking problems. Businesses can reduce inventory discrepancies by implementing automated inventory systems and conducting regular physical

6. Best Practices for Effective Inventory Accounting

Effective inventory accounting is critical for organizations to keep accurate financial records, maximize cash flow, and ensure operational efficiency. By following best practices, organizations can reduce typical inventory difficulties and ensure proper valuation, which has a direct impact on the company’s financial health.

Additionally, implementing methods such as accrual accounting ensures that inventory costs are matched with the revenues they generate, further enhancing financial accuracy and decision-making. Listed below are many recommended practices that organizations should implement to improve their inventory accounting operations.

a. Regular Inventory Audits and Reconciliations

Frequent inventory audits and reconciliations are critical for detecting inconsistencies early and ensuring that inventory records match actual stock. This technique helps detect issues like misplaced items, theft, and data entry errors, which affect financial reporting accuracy.

Similarly, performing regular bank reconciliation ensures that cash records are aligned with bank statements, preventing discrepancies in financial reporting. Regular audits, such as monthly, quarterly, or annual, can help businesses maintain accurate inventory records, minimize errors, and resolve discrepancies quickly.

b. Implement Inventory Control Measures

Implementing effective inventory control systems is critical for aligning stock levels with actual demand. Businesses can use technology and forecasting methodologies to better plan inventory levels, lowering the risk of overstocking or stockouts.

By optimizing inventory management, companies can work toward achieving their financial goals in business, ensuring that resources are used efficiently and capital is not tied up in excess inventory.

Demand forecasting software, safety stock levels, and reorder points help refill inventory on time, avoiding excess stock. Proper inventory control streamlines operations, reduces storage costs, and boosts cash flow by aligning stock with sales.

c. Leverage Technology

Integrating automated solutions into inventory management is a highly effective technique to eliminate errors while increasing performance. Automated systems give real-time data, allowing firms to monitor stock levels, perform financial audits, track orders, and manage inventory in numerous locations.

These solutions reduce manual errors, accelerate procedures, and provide vital insights to improve decision-making. Businesses that automate typical processes can optimize workflows, obtain improved inventory control, and increase reporting and financial management accuracy.

7. ScaleOcean SG’s Solutions for Inventory Accounting

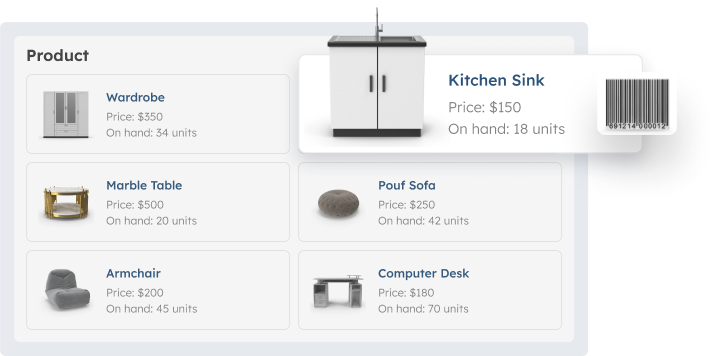

ScaleOcean SG provides a comprehensive software solution designed specifically for inventory management. It enables organizations to streamline processes and have greater control over operations. ScaleOcean offers an all-in-one platform that combines inventory accounting, sales, procurement, and accounting. This improves efficiency, lowers errors, and ensures accurate financial reporting. The platform provides real-time tracking, automated adjustments, and seamless connection, allowing firms to eliminate stock discrepancies and optimize cash flow. For Singapore enterprises, this technology improves inventory management and decision-making.

Many Singaporean firms have benefited from ScaleOcean’s inventory management services. Companies such as PT Sinarmas and Dekkson have reported increased inventory accuracy, efficiency, and cost savings. Businesses can also use government funds, such as the CTC Grant, to help cover ERP implementation costs. ScaleOcean provides a free demo, allowing organizations to test the platform and evaluate if it meets their needs. Below are the key advantages of ScaleOcean’s software:

- Integrated Features Across Modules, ScaleOcean’s ERP system integrates inventory management seamlessly with accounting, sales, and procurement modules, ensuring smooth data flow between departments.

- Real-time Inventory Tracking, The software allows businesses to monitor stock levels across multiple locations in real time, improving accuracy and reducing the risk of stockouts.

- Automated Low-Stock Notifications, ScaleOcean sends automatic notifications when stock reaches predefined thresholds, allowing businesses to reorder products before they run out.

- Inventory Adjustment Flexibility, The system supports automated inventory adjustments, enabling finance teams to manage product values in the warehouse with ease and accuracy.

- Barcode and Lot Tracking, With barcode scanning and lot tracking, ScaleOcean ensures accurate stock counting and precise tracking, especially for perishable goods, improving inventory management efficiency.

8. Conclusion

Inventory accounting is critical to business success. Accurate inventory tracking and management improve cash flow and profitability. As businesses grow, effective inventory accounting becomes even more important. It impacts decisions across departments and affects the bottom line. With proper inventory management, businesses can reduce discrepancies, improve financial reporting, and make informed decisions.

To stay competitive, businesses must adopt best practices and embrace automation. Modern inventory management technologies can streamline procedures and eliminate errors. Automation tools that incorporate inventory accounting enhance data accuracy and decision-making. Contact ScaleOcean’s accounting software to schedule a consultation or learn more about our solutions and how they can benefit your business.

FAQ:

1. What are the 4 types of inventory?

There are four main types of inventory:

– Raw materials: Basic materials used in manufacturing products.

– Work-in-progress (WIP): Items that are in the manufacturing process but have not yet been completed.

– Finished goods: Fully completed products ready for sale.

– MRO (Maintenance, Repair, and Overhaul): Items used for the upkeep and maintenance of equipment.

2. What is the inventory accounting method?

Inventory accounting methods are approaches used by companies to determine the value of their inventory for financial reporting. These methods impact the cost of goods sold and the company’s overall profitability. The most common methods are FIFO (First In, First Out), LIFO (Last In, First Out), Weighted Average Cost, and Specific Identification.

3. How is inventory recorded in accounting?

Inventory is listed as a current asset on the balance sheet and is recorded at its cost of acquisition or production. It is adjusted for any changes in its value over time. Since inventory is expected to be sold or used within one year, it plays a key role in determining the financial health of a company and directly affects both the balance sheet and income statement.

4. What are the 4 inventory methods in accounting?

The four primary inventory methods are:

– FIFO (First In, First Out): Assumes that the first items purchased are the first to be sold.

– LIFO (Last In, First Out): Assumes that the most recently purchased items are sold first.

– Weighted Average Cost: This method averages the cost of all inventory items.

– Specific Identification: Tracks and assigns the actual cost to each individual item in inventory.

PTE LTD..png)

.png)

.png)

.png)

.png)