Understanding expense ratios is key to picking the right funds, even if they seem tricky at first. These costs directly affect your returns, so it’s vital for anyone investing to know how to calculate and manage them to protect their profits.

According to Anver, in 2024, the Global ODCE’s TGER stayed steady at 0.82% of GAV, while the NAV-based ratio rose slightly to 1.21%. This shift is a clear reminder for investors to keep a close eye on these ratios and how they might be impacting their final returns.

This article breaks down everything you need to know about expense ratios. We’ll explain the formula, look at different fund types, and share practical tips to help you optimize your financial strategy for much better long-term success.

- An expense ratio is the percentage of a fund’s assets used for its annual operating expenses, covering management and admin fees.

- Expense ratios are calculated by dividing a fund’s annual costs by its total assets (Expense Ratio = Total Fund Costs ÷ Total Fund Assets).

- A good expense ratio is generally below 0.30% for index funds/ETFs and ranges between 0.50%-1.50% for active equity funds, reflecting the level of management required.

- ScaleOcean expense software offers a great way to optimize your expense ratios through easy integration.

What Is an Expense Ratio?

An expense ratio is the percentage of a fund’s assets used for its annual operating expenses, covering management and admin fees. It’s a key metric to evaluate how efficiently a fund is managed. This annual fee, expressed as a percentage of the fund’s average assets, directly reduces investor returns.

Since this ratio is taken directly from the fund’s assets, it actually lowers your returns. Generally, a lower ratio means a more cost-efficient fund, so it’s vital to check this when guessing your potential profit over time.

In business, a good expense ratio means you’re managing costs effectively relative to your revenue. In Singapore, it’s a popular way to measure how well a company handles its daily spending compared to the money it brings in.

Why Is Expense Ratio Important?

The expense ratio is a big deal because it directly hits your wallet. High ratios can really bite into your potential profits over time. Understanding these costs helps you pick funds that are both profitable and truly cost-efficient for your future.

Keeping an eye on expense ratios makes comparing different funds much easier. By choosing a fund with fair and reasonable costs, you can maximize your total returns, which is especially vital for growing your wealth in long-term investments.

How Does an Expense Ratio Work?

An expense ratio works by taking a small slice of the fund’s assets to pay for its daily operations. This fee directly lowers the fund’s overall value, so it’s a big deal for any investor who wants to keep their returns as high as possible.

It covers things like management, admin, and distribution fees. Simply put, the lower the expense ratio is, the less money is taken out of your investment. This leaves more of your cash in the fund to grow and potentially earn you more over time.

How Is Expense Ratio Calculated?

This formula takes a fund’s annual costs and divides them by its total assets. The resulting percentage shows how efficiently the fund is managed relative to its size. You can calculate the Expense Ratio as:

Expense Ratio = Total Fund Costs ÷ Total Fund Assets

Total costs cover things like management and admin fees, usually found in the fund’s annual report. Total assets represent the average value of everything under management. You can easily find both figures in the fund’s financial statements.

For example, say a fund has $10 million in assets and $100k in annual costs, and that’s a 1% expense ratio. In simple terms, for every $1,000 you invest, $10 goes toward running the fund. It’s a really clear way to see exactly how much of your money is being spent on fees.

Types of Expense Ratios Across Fund Categories

Expense ratios aren’t the same for every fund, so knowing the differences is key to picking the right investment. In the next sections, we’ll break down specific fund types and the costs usually tied to them to help you make a smarter choice.

1. Mutual Funds

Mutual funds usually cost a bit more than ETFs, mostly because they are actively managed. These higher fees cover the expert research, portfolio management, and admin work needed to keep the fund running smoothly.

Active funds tend to have higher expenses because managers are always on the move. They are constantly buying and selling assets to chase the best possible returns, and that extra effort naturally comes with a higher price tag.

2. Exchange-Traded Funds (ETFs)

Generally, ETFs come with lower expense ratios than mutual funds. This is mainly because they’re passively managed and simply track a specific index, rather than having a team actively picking stocks, which helps keep the costs down for you.

The low cost of ETFs makes them a great pick for long-term investors. They’re a smart way to get market exposure while keeping your expenses as low as possible, helping you keep more of your hard-earned money over time.

3. Niche Funds (Sector-Specific)

Niche funds focusing on areas like tech or healthcare usually have higher expense ratios. This is because they use very specialized strategies and deal with smaller market segments, which naturally takes more effort and resources to manage.

Even with higher fees, these sector funds can be worth it if the industry booms. For some investors, the chance for bigger returns makes the extra cost much more justifiable, provided the specific sector performs well in the long run.

What is a Good Expense Ratio?

A good expense ratio means your costs are well-balanced against your revenue. In Singapore, businesses use this to see how efficiently they’re managing daily expenses compared to what they’re earning, showing how lean the operation really is.

Generally, a lower ratio is better because it shows costs are under control. This keeps profits and margins healthy, allowing a company to reinvest for the future without cutting corners on quality. Here is what makes an expense ratio “good”:

- Index Fund / ETF: Typically below 0.30% per year. These funds are passively managed, which leads to lower management costs due to minimal trading and fewer management decisions required.

- Equity Fund (Active Stock Fund): Ranges from 0.50% to 1.50% per year. Active management involves continuous decision-making by fund managers, which increases operational costs compared to passive funds.

- Bond Fund: Usually between 0.30% to 1.00% per year. Bond funds have relatively simple management, focusing on fixed income investments, which typically results in lower operating expenses compared to equities.

- Money Market Fund: Below 0.50% per year. These funds invest in short-term, low-risk instruments like deposits and government securities, which require minimal management, resulting in low costs.

- Lower Compared to Similar Funds: You should expect a low expense ratio when compared to funds with similar strategies, as it reflects a more efficient cost structure without sacrificing performance.

- Aligned with Historical Performance and Consistent Returns: Funds with low expense ratios should consistently perform in a way that justifies the fees, providing returns that match the costs incurred.

- No Hidden Fees: Ensure there are no additional costs, such as sales loads or redemption fees, as these can reduce the net returns for investors and offset the benefits of a low expense ratio.

ScaleOcean ERP helps you keep your expense ratios steady by tracking and analyzing your spending in real-time. By making cost management simpler and giving you clear, actionable insights, it ensures you have better control and stay truly cost-efficient.

Components of an Expense Ratio

An expense ratio is made up of a few key parts, such as management fees, operating costs, and distribution fees. Each of these covers the day-to-day expenses of running the fund, making sure everything operates smoothly behind the scenes.

Knowing what goes into these costs helps you make smarter investment choices. Management fees are usually the biggest chunk, especially in actively managed funds, so it’s always worth keeping a close eye on them before you commit.

Is the Expense Ratio the Same for All Funds?

Actually, expense ratios aren’t the same across the board. They vary based on the fund type like for instance, actively managed funds usually cost more than passive options like ETFs because of the extra research and hands-on management involved.

A fund’s unique structure also plays a big role in its price tag. If you’re looking at niche or sector-specific funds, you’ll likely see higher fees. This is simply because their specialized focus requires more expertise to manage well.

Expense Ratios of Passive vs. Active Funds

Passive funds, such as ETFs, usually come with lower fees because they simply follow market indices. Since they don’t need constant hands-on management, their operational costs stay low, which is great for keeping your expenses down.

Active funds are different because they need constant expert decision-making, which drives up the cost. When you invest in these, you’re paying for a manager’s expertise and active strategy, which naturally leads to a higher expense ratio.

How Expense Ratios Can Affect Returns

Expense ratios have a direct impact on your returns. A higher ratio means more of your money goes toward operating costs, which eats into your total profit. Over time, this can really slow down the growth of your investments and compounding power.

Even a tiny difference in costs can lead to very different results over the years. It’s easy to overlook a small ratio at first, but you should always factor it in when checking a fund’s performance. It becomes much more impactful as time goes on.

For example, think about a 1% fee versus 0.5%. It sounds small, but over 20 years, the gap is huge. The fund with the higher ratio will leave you with noticeably less money, showing how much those extra costs can hurt your long-term wealth building.

Strategies for Minimizing Expense Ratio Impact

To keep high costs from eating your returns, there are a few smart moves you can make. Opting for low-cost index funds or direct plans is a great way to lower fees. Next, we’ll walk through some simple strategies to help you minimize the impact of these ratios.

1. Prioritize Low-Cost Index Funds (ETFs)

Index funds, particularly ETFs, typically have much lower fees. They passively manage and track the market, providing you with broad exposure to various stocks without the high costs associated with active management.

Choosing low-cost index funds is one of the smartest ways to keep fees from eating your profits. It allows you to earn solid market returns while making sure you keep as much of your hard-earned money as possible.

2. Opt for Direct Plans

Choosing direct plans lets you skip the middleman, cutting out those extra fees from brokers or distributors. By going direct, you get to keep a bigger slice of your returns for yourself instead of handing them over in commissions.

Direct plans are a huge win for long-term investors. Since you aren’t paying those recurring fees, the savings really start to snowball over the years, leaving you with a much larger nest egg in the end.

3. Avoid Funds with Unnecessary Fees

It’s crucial to avoid funds that add high management or distribution fees. Many of these funds charge a premium that their performance doesn’t justify, which can cost you more than the value they offer.

By taking a close look at expense ratios, you can steer clear of funds that don’t offer good value. This simple check helps you avoid overpaying for poor results and puts you in a much better position to boost your long-term returns.

4. Consolidate Investments on Low-Fee Platform

Moving your investments onto a single, low-fee platform can really save you money over time. Many modern platforms provide budget-friendly options that make it easier to manage a diverse portfolio without high costs eating into your profits.

If you’re also looking to manage your expenses efficiently, finding the best expense management software in Singapore can help streamline your financial planning alongside your investments.

By picking the right platform, you can cut out those unnecessary expenses. It’s a great way to keep your costs down while still enjoying the benefits of a well-managed, balanced portfolio that works hard for your future.

5. Assess Performance Relative to Cost

It’s vital to look at a fund’s performance alongside its cost. Sometimes, a high-performing fund with a slightly higher fee actually offers better overall value than a cheaper fund that just isn’t delivering strong results.

For example, according to PWC, despite global AUM growing by 12%, with Singapore’s asset management industry advancing 10% to S$5.4 trillion, net inflows sharply dropped from S$435 billion to S$193 billion. This highlights the importance of evaluating returns relative to costs to ensure you’re getting optimal value.

6. Invest for the Long Term

Investing for the long haul helps soften the blow of expense ratios. As the years go by, the initial weight of those fees feels much smaller, especially if your fund is bringing in strong, steady returns that keep your portfolio growing.

Staying invested long-term also lets you fully benefit from compounding. This powerful growth can help balance out some of the costs from higher expense ratios, giving your wealth a better chance to build up over time despite the fees.

7. Use Expense Management Tools

Expense management tools are a lifesaver for tracking fees across your portfolios. They give you a clear look at where your money is going, making it easy to see how efficient your spending is and where you could be saving some extra cash.

With automated tracking, you can watch your expenses in real-time. This helps you stick to your budget and skip unnecessary costs. By cutting out hidden fees, you can make better decisions and set your portfolio up for much better returns.

8. Monitor Portfolio Annually

Checking your portfolio and its fees once a year is key to staying on track. By reviewing your expenses annually, you can make sure you aren’t overpaying for funds that aren’t performing well, helping you avoid costs and boost your efficiency.

An annual review is the perfect time to rethink your investments. By tracking both performance and costs, you can decide whether to stick with what you have or switch to more cost-effective options that might offer you better returns over time.

ScaleOcean’s Solutions for Consistent Expense Ratios

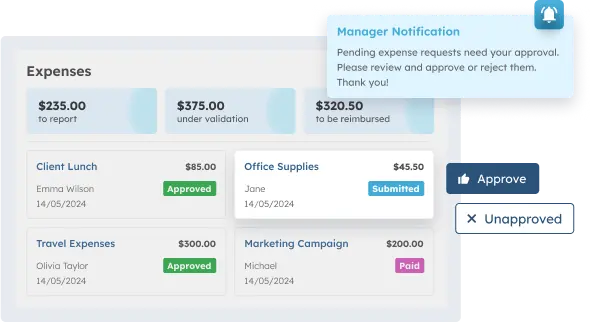

ScaleOcean expense software offers a great way to optimize your expense ratios through easy integration. The software helps you track spending in real-time, making it much simpler to make smart decisions and keep your financial management truly cost-effective.

Plus, ScaleOcean’s software is eligible for CTC grants, making it a very smart choice for businesses. It blends perfectly with your current systems to streamline how you manage expenses, helping you stay organized while maximizing your returns.

Here are the key features of ScaleOcean’s software:

- Automated Data Input and Duplication Detection: Automates data entry and detects duplicates, ensuring accurate financial records with minimal effort and errors.

- Real-Time Budget Control: View expenses in real-time, preventing overspending and maintaining optimal budget control.

- AI-Driven Expense Analysis: AI analyzes spending patterns and offers cost-saving insights, enhancing profitability and cost efficiency.

- Customizable Expense Policy Enforcement: Automatically blocks excessive spending, keeping operational costs within budget and balancing expense ratios.

- Dashboard for Tracking Trends: Provides an intuitive dashboard to track spending trends, making it easy to monitor financial health and adjust strategies.

ScaleOcean makes managing your expense ratios a breeze with real-time tracking and smart AI insights. It fits right into your current workflow, helping you make sharper financial calls. Also, ScaleOcean offers a free demo to help you explore these powerful features firsthand.

Conclusion

Keeping an eye on expense ratios is key to making sure your investments stay profitable. Once you understand how these costs are taken from your assets, it’s much easier to pick the right funds and make smarter moves with your money.

ScaleOcean makes tracking your spending simple with real-time updates and automation. It cleans up your financial workflow and helps you manage expenses better. You can even try a free demo to see exactly how it works for your team!

FAQ:

1. What does a 0.75 expense ratio mean?

A 0.75% expense ratio indicates that for every $1,000 invested, $7.50 is charged annually to cover operational expenses, such as management and administrative fees. This is a moderate fee, especially for actively managed funds, compared to passive funds.

2. Is a 0.9 expense ratio good?

A 0.9% expense ratio is on the higher end, especially when compared to low-cost index funds or ETFs. It may be acceptable for actively managed funds if their performance justifies the cost, but typically, a lower ratio is more desirable.

3. Is a .03 expense ratio good?

A 0.03% expense ratio is excellent because it remains extremely low. Large passive index funds or ETFs typically offer this ratio, meaning they charge minimal fees, which allows your money to grow without high costs reducing your returns.

4. Is the expense ratio charged every day?

Although the expense ratio is shown as an annual percentage, it is deducted daily from the fund’s NAV. This means the cost is spread out over the year, reducing the fund’s value slightly each day rather than all at once at the end of the year.

PTE LTD..png)

.png)

.png)

.png)

.png)