Managing company expenses efficiently can be a significant challenge, especially when relying on manual processes like sorting receipts and spreadsheets. Without a streamlined system, errors can pile up, causing unnecessary delays and inefficiencies that hinder business operations.

Expense management software offers a solution by automating and simplifying the tracking, approval, and reimbursement processes. According to the Ken Research, a report from the World Bank said companies that implement effective cost control measures can reduce travel-related expenses by up to 20%, resulting in significant savings.

So in this article, we’re going to dive deep into what expense management software is, its importance, and also review the top expense management software Singapore options, including ScaleOcean, SAP Concur, Expensify, and more, to help you find the best fit for your business.

- Expense management software is a digital solution that simplifies and streamlines the entire process of tracking company expenses.

- Discover the top 10 expense management software in Singapore, which includes ScaleOcean, SAP Concur Expense, Expensify, Webexpenses, and more.

- Steps for the expense management workflow are Digital Capture & Submit the Expense Report, Automatic Policy Enforcement, and so on.

- ScaleOcean’s expense software links up perfectly with your accounting, HR, and purchasing modules. Also, with real-time visibility, ScaleOcean makes it easy to track expenses openly.

What is Expense Management Software?

Expense management software is a digital solution that simplifies and streamlines the entire process of tracking company expenses, from employee submissions and approvals to reimbursements, including bills, corporate card transactions, and more.

Rather than chasing paperwork or digging through emails, companies use it to automate the expense tracking process. It’s not perfect, but it definitely helps cut down on mistakes and gives everyone better visibility into what’s being spent and why.

Why Does Business Need Expense Management Software?

When there’s no system in place, tracking employee expenses can get out of hand fast. Finance teams often end up stuck sorting through receipts and spreadsheets, where even small mistakes can lead to unexpected issues in budgeting.

With expense management software, companies finally get a better grip on how spending happens. It’s not just about keeping tabs, but it also helps tighten up policy use, cut down on unnecessary claims, and makes reimbursement a whole lot quicker.

As the demand for streamlined expense management continues to rise, according to Cognitive Market Research, the Travel & Expense Management Software market is projected to grow at a CAGR of 14.8% from 2025 to 2033.

This growth highlights the increasing need for businesses to adopt efficient systems to manage spending and improve financial oversight.

What are the Top 10 Expense Management Software for Singapore Businesses?

In this section, we’re looking at some of the more popular tools that businesses in Singapore are using to get a handle on their company spend. These aren’t one-size-fits-all. Each platform has its own thing it does best, depending on what you’re dealing with day to day.

Whether it’s getting reimbursements processed quicker, pulling up reports that actually make sense, or staying in line with local tax rules, these 10 expense software such as ScaleOcean, SAP, and Expensify offer solid ways to simplify business expenses.

Here are the top 10 expense management software in Singapore:

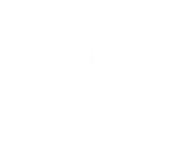

1. ScaleOcean Expense Management Software

ScaleOcean’s expense software links up perfectly with your accounting, HR, and purchasing modules. This connection lets you keep an eye on spending as it happens and simplifies financial tasks across all your departments, making your daily operations a whole lot smoother.

With real-time visibility, ScaleOcean makes it easy to track expenses openly, helping managers make smart, data-backed choices. You get a crystal-clear view of how costs are spread out, which keeps everyone accountable and ensures your business stays as efficient as possible.

ScaleOcean also fits the bill for Singapore’s CTC Grant claims. Our built-in training helps your team level up their skills and productivity, and you can claim this as part of the grant. Why not book a ScaleOcean free demo today to see how much easier your expense management can be?

Key Features:

- Flexibility and Customization: Tailor the software to your company’s needs, including approval workflows and expense categories, for seamless integration into internal processes.

- Automated Expense Approval: Automate approval workflows to reduce delays, streamline processes, and enhance operational efficiency across departments.

- Strong Data Security: Ensure the protection of financial data with robust security measures, including data encryption and role-based access controls.

- Expense Documentation: Use digital technology to upload receipts, ensuring accurate expense tracking and automatic report generation tailored to your business needs.

- Multi-Currency Support: Automatically calculate exchange rates for international transactions, ensuring smooth financial management across borders.

| Pros | Cons |

|---|---|

|

|

Pricing: ScaleOcean offers flat pricing with no hidden costs, ensuring transparency and predictable expenses for businesses. The pricing structure is aligned with the software’s customization, allowing companies to pay for the features and services they truly need, without unexpected fees.

Best For: ScaleOcean is best for medium to large enterprises that require a fully customizable solution for all business processes. It adapts seamlessly across various industries, offering tailored features that enhance operational efficiency, compliance, and financial management at scale.

2. SAP Concur Expense Platform

SAP Concur is a robust expense management platform built for large enterprises, designed to handle a high volume of transactions and compliance requirements. Its mobile tools allow employees to easily submit expenses from anywhere, streamlining the process.

However, it can be challenging for smaller companies due to its complex setup. The platform’s extensive features and enterprise-grade controls are tailored more towards businesses with multi-regional operations and strict internal policies.

Key Features:

- Mobile app for on-the-go expense submission

- Multi-currency and multi-region support

- Automated compliance management

- Integration with ERP systems

- Customizable approval workflows

| Pros | Cons |

|---|---|

|

|

Pricing: SAP Concur’s pricing varies based on company size and needs, with reports estimating around $8 per report. For larger enterprises, annual costs can reach approximately $110,000, reflecting their scale and enterprise-grade features.

Best For: SAP Concur is best suited for large enterprises with complex compliance needs, multiple regions, and intricate internal policies. It provides scalability for businesses that require robust expense management tools.

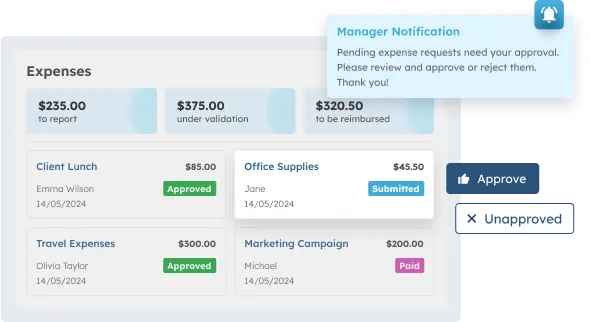

3. Expensify Software

Expensify is a simple and efficient tool that streamlines the expense management process. It offers quick receipt scanning, submission, and reimbursement features that reduce manual effort, allowing employees to manage expenses with minimal hassle.

While it’s easy to use, it may not integrate well with larger ERP systems, which can be a limitation for organizations with more complex infrastructure. Nevertheless, it is an effective solution for teams that prioritize speed and simplicity.

Key Features:

- Receipt scanning and automatic data extraction

- Real-time expense tracking

- Customizable approval workflows

- Integration with accounting tools

- Mobile app for easy expense management

| Pros | Cons |

|---|---|

|

|

Pricing: Expensify offers a tiered pricing model, starting at $5 per user/month for the Collect plan and $9 per user/month for the Control plan. This flexible pricing allows businesses of all sizes to choose the plan that suits their expense management needs.

Best For: Expensify is ideal for small to medium-sized businesses that need a straightforward expense management solution. It’s especially effective for teams that want fast, hassle-free reimbursement processes with minimal setup.

4. Webexpenses Expense Management

Webexpenses is a flexible expense management solution designed to adapt to various business setups. With cloud-based capabilities, it can handle multiple currencies and compliance requirements, making it suitable for global businesses.

The platform also provides finance teams with enhanced reporting capabilities, helping them analyze spending trends while reducing administrative tasks. It’s a good option for companies looking for a balance of flexibility and control.

Key Features:

- Cloud-based for remote access

- Multi-currency and compliance support

- Customizable reporting tools

- Real-time expense tracking

- Mobile app for expense submissions

| Pros | Cons |

|---|---|

|

|

Pricing: Webexpenses’ pricing typically ranges from $8.50 to $15.50 per active user per month, depending on features and usage. The platform offers flexibility for businesses of varying sizes, particularly those with global operations.

Best For: Webexpenses is well-suited for medium to large businesses that need a flexible, scalable expense management solution. It works well for businesses with global operations requiring multi-currency support and detailed reporting.

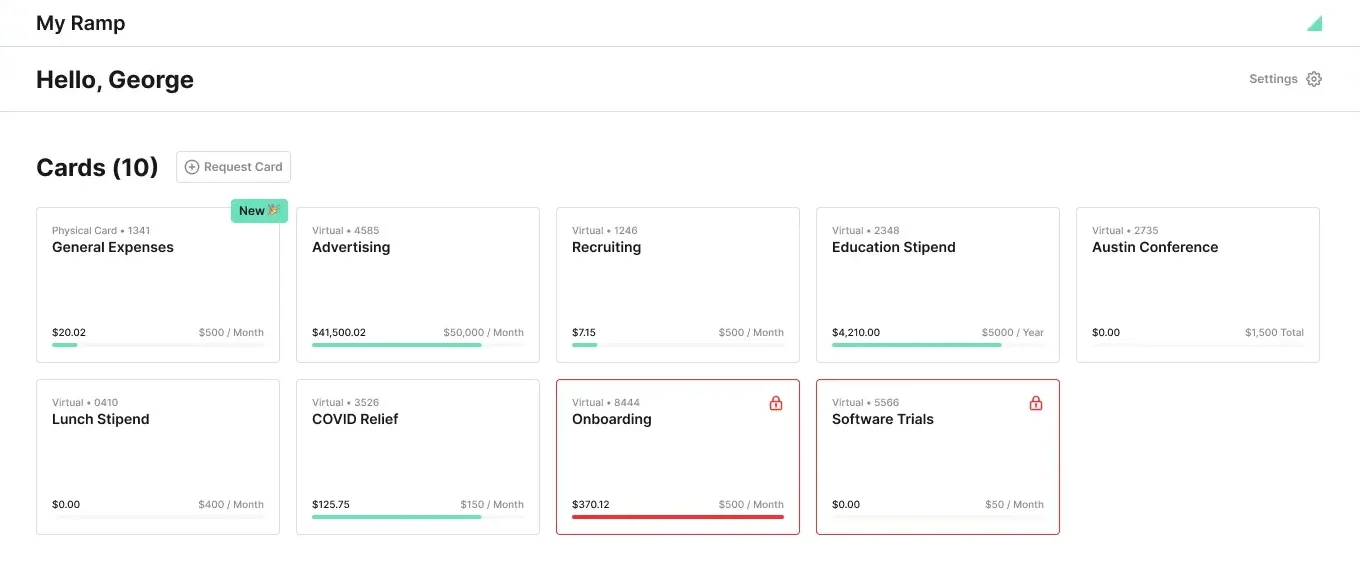

5. Ramp Expense Management System

Ramp combines expense management with corporate card features, automating receipt uploads and spend tracking. This solution helps companies streamline expense processes, with built-in analytics and cost-saving suggestions.

Ramp is designed for newer companies focused on rapid growth, offering analytics to help businesses make smarter decisions. It’s a practical choice for companies looking to optimize their spending while maintaining efficiency.

Key Features:

- Corporate card integration for expense tracking

- Automated receipt uploads

- Built-in analytics for cost-saving insights

- Real-time expense tracking

- Integration with accounting software

| Pros | Cons |

|---|---|

|

|

Pricing: Ramp’s pricing starts at $15 per user/month for the Ramp Plus plan, which includes advanced automation features. Custom-priced Enterprise options are available for businesses with more complex needs and larger teams.

Best For: Ramp is ideal for small to medium-sized businesses looking to streamline both their expense management and corporate card functions. It’s best for fast-growing companies seeking efficiency and automated cost-saving insights.

6. Zoho Expense Software

Zoho Expense seamlessly integrates with other Zoho tools like CRM and Books. It’s a budget-friendly expense management solution that provides essential features like mileage tracking, approval workflows, and policy settings for smaller teams.

While not feature-rich compared to other platforms, it works well for businesses that need basic automation without requiring extensive configuration. It’s best suited for businesses that need a simple solution for managing expenses.

Key Features:

- Integration with Zoho CRM and Books

- Mileage tracking and reporting

- Customizable approval workflows

- Mobile app for expense management

- Basic policy and compliance settings

| Pros | Cons |

|---|---|

|

|

Pricing: Zoho Expense offers affordable plans starting at $3-$4 per user/month, with higher tiers like Premium priced at $5-$6 per user/month. This flexible pricing is ideal for small businesses seeking a straightforward expense management solution.

Best For: Zoho Expense is best for small businesses that already use Zoho products and need a straightforward, budget-friendly solution for expense management. It’s ideal for companies that don’t require complex features or integrations.

7. Rydoo Expense System

Rydoo is a mobile-first expense management tool designed for remote teams and those who need real-time visibility into their spending. It integrates with local tax compliance rules to ensure expenses are always compliant with regional regulations.

Rydoo’s simple interface and fast approval workflows help teams save time on administrative tasks. It’s a suitable option for businesses that need a mobile-friendly solution for managing expenses and speeding up reimbursements.

Key Features:

- Mobile-first design for remote teams

- Real-time expense tracking

- Integration with tax compliance rules

- Fast approval workflows

- Multi-currency support

| Pros | Cons |

|---|---|

|

|

Pricing: Rydoo’s pricing starts at approximately €10–€12 per user/month, with tiered subscription plans suited for different business sizes. This pricing structure provides flexibility for businesses of varying scales, from small to mid-sized teams.

Best For: Rydoo is ideal for small to medium-sized businesses with remote teams that need a simple, mobile-friendly solution for managing expenses and staying compliant with local tax regulations.

8. Naven Expense Management System

Naven focuses on simplifying cross-border expense management while ensuring compliance with regional rules. The platform’s straightforward design allows for frictionless claims and clear approval workflows.

Naven is particularly suited for businesses operating across Southeast Asia, where managing expenses in various regions can often be complicated. The system is a practical choice for teams that need an easy-to-use, cross-border solution.

Key Features:

- Cross-border expense management

- Easy-to-use interface

- Streamlined approval workflows

- Regional compliance support

- Automated data entry

| Pros | Cons |

|---|---|

|

|

Pricing: Naven offers free access for the first 5 active users, with a cost of $15 per user per month for additional users. This straightforward pricing model is ideal for small teams and businesses in Southeast Asia with cross-border expense needs.

Best For: Naven is best for businesses operating in Southeast Asia that need a simple and effective solution for managing cross-border expenses. It’s particularly useful for teams with straightforward needs and limited complex requirements.

9. Coupa Expense Management Solution

Coupa is a comprehensive expense management tool designed for large teams and enterprises. It offers advanced features for procurement and expense management, providing visibility into spending from various perspectives.

Though it’s an enterprise-grade solution, it may be too complex for smaller businesses. However, for large organizations, its AI-driven analytics and procurement capabilities offer deep insights into spending and budgeting.

Key Features:

- Procurement and expense management integration

- AI-driven analytics

- Multi-department spending visibility

- Cloud-based platform

- Advanced reporting tools

| Pros | Cons |

|---|---|

|

|

Pricing: Coupa’s pricing is typically around $2,500 per month, with custom pricing for larger enterprises. The platform’s advanced features cater to large organizations with complex procurement and expense management needs.

Best For: Coupa is ideal for large enterprises with complex procurement and expense management needs. It’s best for companies that require comprehensive financial oversight and detailed spending analysis.

10. Sage Expense Management Platform

Sage’s expense management platform integrates seamlessly with its accounting tools, making reconciliation easier for businesses that already use Sage for accounting. It’s a good fit for mid-sized businesses that want reliable financial accuracy.

The platform strikes a balance between structure and flexibility, making it suitable for companies looking to scale steadily. It’s ideal for organizations that want efficient expense management with minimal complexity.

Key Features:

- Integration with Sage accounting tools

- Real-time expense tracking

- Cloud-based platform

- Customizable approval workflows

- Multi-currency support

| Pros | Cons |

|---|---|

|

|

Pricing: Sage’s expense management platform starts at $14.99 per active user per month, with a 10-user minimum for the Business plan. This pricing includes AI-powered tracking and seamless integration with Sage’s accounting tools.

Best For: Sage’s expense management platform is best for mid-sized companies already using Sage accounting tools. It’s suitable for businesses seeking reliable, efficient expense management with minimal complexity.

Comparing the Best Expense Management Software in Singapore

Managing company expenses doesn’t have to be a hassle. The right software can make a big difference by streamlining financial tasks, improving visibility, and ensuring accuracy across teams. In Singapore, there are plenty of options tailored to meet various business needs.

Check out our comparison of the best expense management software in Singapore:

| Vendor | Best For | Price |

|---|---|---|

| ScaleOcean | Medium to large enterprises need customizable solutions for business processes across industries. | Flat pricing with no hidden costs. Pricing based on customization and services needed. |

| SAP Concur | Large enterprises with complex compliance needs, multiple regions, and intricate internal policies. | $8 per report, around $110,000 annually for large enterprises. |

| Expensify | Small to medium-sized businesses seeking a simple solution with minimal setup. | $5 per user/month for the Collect plan, $9 per user/month for the Control plan. |

| Webexpenses | Medium to large businesses needing flexible, scalable expense management with multi-currency and global compliance. | $8.50 – $15.50 per user/month. |

| Ramp | Small to medium-sized businesses looking to streamline expense management and corporate card functions. | $15 per user/month for Ramp Plus, custom pricing for Enterprise. |

| Zoho Expense | Small businesses using Zoho products need a simple, budget-friendly solution. | $3-$4 per user/month for basic plans, $5-$6 for higher tiers. |

| Rydoo | Small to medium-sized businesses with remote teams need a mobile-friendly solution. | €10–€12 per user/month. |

| Naven | Businesses in Southeast Asia with cross-border expense management needs and straightforward processes. | Free for 5 users, $15 per user/month for additional users. |

| Coupa | Large enterprises need advanced analytics and comprehensive financial oversight. | $2,500 per month, custom pricing for larger enterprises. |

| Sage | Mid-sized companies using Sage accounting tools are seeking efficient expense management with minimal complexity. | $14.99 per user/month, with a 10-user minimum. |

How Does Expense Management System Solution Work?

Most companies break the process down into a few manageable steps that start from when an expense is submitted, all the way to when it gets reconciled. The idea is to cut down on the back-and-forth by bringing in automation where it actually makes a difference.

We’ll walk through six main stages that make up a dependable expense management system. It’s a good way to see how each part plays into a smoother process, especially when speed and accuracy are on the line.

Here are the six steps for a dependable expense management process:

Step 1: Digital Capture & Submit the Expense Report

Most employees usually begin by snapping a photo of their receipt through a mobile app, or sometimes they’ll just upload it from their desktop. The system picks it up instantly, and OCR takes care of pulling out the details so they don’t have to.

That alone cuts down on time spent doing data entry, which is often the part people drag their feet on. It’s also the moment where accuracy and ease first start to show up in the process.

Step 2: Automatic Policy Enforcement

After someone submits their expense report, the system automatically runs it through the company’s policy rules. If anything looks off or doesn’t match what’s allowed, it just gets flagged right away, so no need for anyone to dig through it manually.

That kind of setup really helps cut down the back-and-forth for approvers, while still keeping everything in check. Real-time policy enforcement means fewer delays and a smoother flow for everyone involved.

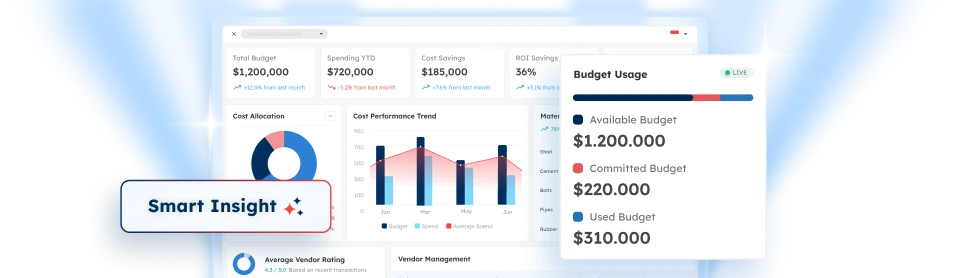

Step 3: Assigned Approvers Receive and Review

Once the report’s ready, it gets sent straight to the right managers or finance folks, who are usually the ones who need to give it a quick look. They’re notified almost immediately, so there’s not much lag time.

This part helps keep things accountable and traceable across teams, especially when more than one department is involved. Most of the time, approvals happen right from a centralised dashboard, which just makes things easier for everyone.

Step 4: Expense Gets Paid or Reimbursed

After the green light’s given, the money usually goes out, which is either folded into payroll or sent through direct deposit. Exactly when did it hit the account? That’s mostly up to how the company sets things up.

Speed matters here more than people realize. The longer it drags, the less likely folks are to comply with reporting.

Step 5: Accounting Reconciliation

Once expenses are reviewed and approved, they’re pushed into the accounting system and usually automatically. This keeps financial records aligned and saves teams from chasing after mismatched numbers later on.

On top of that, it becomes much easier to track things like the expense ratio, which is often used in internal reviews or reports. Compared to doing it all by hand, the reconciliation process here is far less error-prone and, honestly, just less of a headache overall.

Step 6: Real-Time Sync and Expense Analytics

Every bit of data gets updated the moment it’s entered, so you’re always working with the latest version, and nothing lags. Over time, this builds up a full audit trail, which can really help when you need to look back and make sense of what happened and when.

Dashboards do more than just look nice because they actually highlight patterns, show you where things are off, and give a quick sense of how budgets are being used. With expense analytics in place, finance teams don’t have to guess as much, so they can plan and respond more confidently when something shifts.

A well-structured expense management system can make all the difference in streamlining processes and improving efficiency. ScaleOcean ERP integrates all these steps, from automated expense capture to real-time analytics, ensuring your team stays on top of expenses with ease and accuracy.

What to Look For in Expense Management Software

When choosing the right expense management software, it’s important to select a solution that simplifies your workflow, reduces errors, and keeps everything consistent. A good system will make it easier to handle your expenses and ensure that data remains accurate across all teams.

Here’s a closer look at what to consider when evaluating expense management software:

1. Automation Features

Automation can save you time by categorizing expenses and reconciling accounts automatically. It helps reduce manual work and errors, so your financial reports are more accurate and efficient.

Plus, with automated approval workflows, the process speeds up, making it easier for managers to approve claims without unnecessary delays. This is particularly helpful when you have a large team or frequent approvals to manage.

2. Mobile Accessibility

Having mobile access to your software means your employees can submit claims and track their expenses even when they’re on the move. This is super helpful for teams that travel or work remotely.

Mobile access makes it easier for employees to snap photos of receipts and submit claims right away, so nothing gets lost or delayed. It simplifies the reimbursement process and makes it more convenient for everyone involved.

3. Seamless Integration

It’s crucial that your expense management software can integrate smoothly with your existing accounting system. This way, data flows naturally between platforms, eliminating the need for extra data entry.

With easy integration, you get a more complete view of your finances. This helps improve decision-making since all your expense data is consolidated and up-to-date, providing a clearer picture of your financial health.

4. Multi-Currency Support

If your business works internationally, you’ll need a system that can handle multiple currencies. This feature helps manage expenses across different countries and automatically converts currencies, making tracking much easier.

With real-time exchange rate updates, multi-currency support ensures accurate reporting of your expenses, regardless of where the transaction happens. This eliminates errors from manual conversions and keeps your financial records precise.

5. Compliance and Security

Your expense management software should meet local compliance standards to make sure all transactions are handled according to regulations. This helps avoid any legal issues or fines that could arise from non-compliance.

On top of that, security is key. With encryption and role-based access, the software keeps sensitive financial data safe. Ensuring top-notch security means that both your company’s and employees’ personal information stays protected.

6. Customizable Reporting

Customizable reporting tools allow you to create reports tailored to specific needs, such as by department, project, or individual employee. This helps you better understand your spending patterns and stay on top of budgeting.

With customizable reports, you can highlight key metrics like total spending, trends over time, or even budget discrepancies. This flexibility gives you the insights you need to manage your finances more effectively and make smarter decisions for your business.

How Do I Choose the Best Expense Management Software for Business?

When choosing the best expense management software for your business, it’s important to start by taking a closer look at your current expense management process. Identify where things might be slowing down or where mistakes tend to pop up. This way, you can find a solution that fixes those problems and matches your specific needs.

Here are some key questions to ask when evaluating the right software for your business:

1. Is the Software Adaptable to Your Company’s Future Growth?

Look for software that can grow with your business. What works well for a small team might not be enough for a larger organization as you expand. Opt for a solution that can easily handle more transactions and users as your business grows.

As your company evolves, it’s essential to ensure the software can grow with you. Choose platforms that offer flexible pricing options, so you’re only paying for what your business needs now, and avoid paying for features you won’t use.

2. Does the Software Align with the Specific Needs of Your Industry?

Different industries have different needs, so it’s important to choose software that’s built for your business type. For example, businesses in e-commerce may need multi-currency features, while service-based businesses may prioritize easier invoicing processes.

Understanding your industry’s specific needs will help you choose the right expense management solution. Picking software designed to tackle the common challenges of your industry will make your work more efficient and your team more productive.

3. What Type of Pricing Structure Does the Software Offer?

Expense management software comes in different pricing models like flat-rate subscriptions, pay-per-use, or tiered plans based on volume. It’s important to understand how each pricing model works to ensure you’re getting the most cost-effective solution.

By understanding the pricing structure, you can avoid unexpected expenses and ensure that your software fits your company’s budget. A well-suited pricing model will grow with your business without putting unnecessary strain on your finances.

4. What Integrations Does the Software Support?

Make sure the software integrates easily with the tools you’re already using, such as your accounting or ERP systems. Integration with platforms like QuickBooks or Xero can save you a lot of time by automatically syncing expense data for accurate reporting.

Integration capabilities are key to streamlining your financial processes. When your expense management system integrates seamlessly with your existing tools, it reduces manual data entry, minimizing errors and keeping your financial records consistent.

5. How Does the Software Handle Multi-Currency Transactions and Payments?

If your business works with international vendors or customers, it’s important to choose software that can handle multi-currency expenses. The platform should automatically convert currencies, apply exchange rates, and manage cross-border payments without any hassle.

Check if there are additional fees or limitations for international transactions, as these could affect your cost efficiency. Managing multi-currency transactions smoothly is especially important for businesses with a global presence, making this feature essential.

6. Can the Software Provide Additional Financial Services?

Consider using an all-in-one platform that offers more than just expense management. Solutions like Airwallex, for example, offer international transfers and other financial services that can simplify your operations by reducing the need to use multiple platforms.

A comprehensive platform gives you a full view of your business expenses, bringing all your financial tasks into one tool. This reduces the time spent switching between different systems and ensures that your financial data is always in sync and up to date.

Conclusion

Expense management isn’t just a finance task anymore because it’s a business-wide concern that touches productivity, compliance, and employee morale. The right software can take you from spreadsheet chaos to streamlined efficiency in just a few clicks. What matters is choosing a tool that fits your team, your goals, and your growth stage.

There’s no one-size-fits-all here, but solutions like ScaleOcean expense software are built to adapt and scale with you. If you’ve been putting off the switch, now’s the time. Your future finance team will thank you. So, try the ScaleOcean free demo now, so you can try it firsthand.

FAQ:

1. How do I keep track of expenses?

1. Record expenses regularly to avoid missing any items

2. Categorize spending to understand where money goes

3. Keep receipts or digital records for documentation

4. Compare actual spending with your budget

5. Review expense summaries for trends or discrepancies

2. How to track expenses with Excel?

1. Set up columns like Date, Description, Category, and Amount

2. Enter income and expenses under relevant headings

3. Use SUM formulas for automatic totals

4. Visualize spending with charts or summaries

5. Regularly update entries for accuracy

3. Can an app track expenses automatically?

Yes, many apps can automatically track expenses by syncing with bank accounts or credit cards, pulling transactions in real-time, categorizing them, and updating your spending without manual input

4. How do I choose an expense tracker?

1. Look for apps that sync with bank accounts

2. Choose tools with clear categories and reports

3. Opt for platforms with mobile and desktop access

4. Ensure strong security features

5. Pick software that meets your needs, personal or business

PTE LTD..png)

.png)

.png)

.png)

.png)