Managing finances in manufacturing is complex, requiring precision and efficiency to ensure business success. Manufacturing accounting systems are specialized tools designed to meet the unique financial needs of the industry. They can be a solution for companies to manage their finances comprehensively and gain full visibility into their operations.

Manufacturing accounting systems are software solutions designed to help manufacturers oversee their financial and accounting operations. They facilitate inventory management, cost accounting, and financial reporting.

For Singaporean businesses, adopting manufacturing accounting systems is crucial to maintaining a competitive edge in this fast-paced market. These systems help maximize profitability by streamlining financial processes while ensuring compliance with stringent regulatory standards.

Companies implementing the right framework can make informed decisions and secure their position ahead of the competition. This article delves into the essential role of manufacturing accounting systems in Singapore, their key features, and how they can transform your business operations.

- A manufacturing accounting system tracks, monitors, and oversees all financial elements of the production process, encompassing materials, labor, and overhead expenses.

- Methods of Manufacturing accounting systems include: absorption costing, variable costing, actual costing, job order costing, process costing, and Activity-based costing

- Benefits of A Manufacturing Accounting System include: accurate costing, improved inventory management, better production planning, enhanced financial reporting, and also costing control.

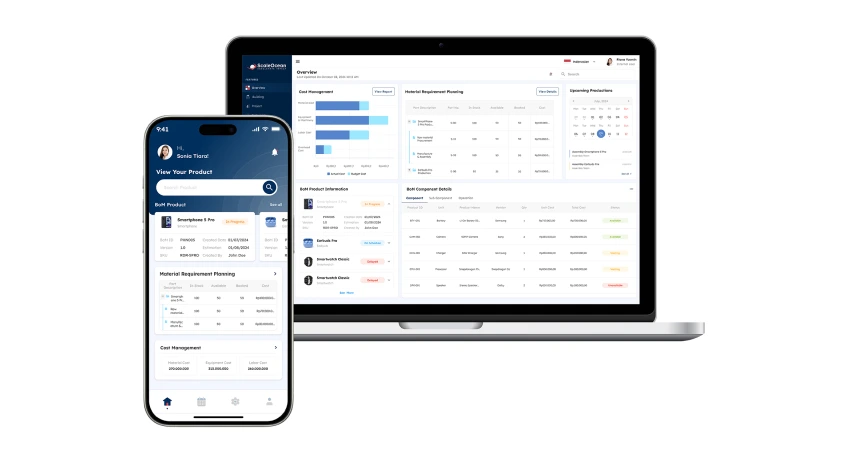

- You can easily manage your manufacturing financial accounting with ScaleOcean Manufacturing Software which offers more than 100+ best integrated and customizable modules.

What Is a Manufacturing Accounting System?

A manufacturing accounting system monitors and oversees all financial elements of the production process, encompassing materials, labor, and overhead expenses. It employs various costing methodologies, such as job order or process costing, tailored to the specific manufacturing approach.

Key components of a manufacturing accounting system include cost accounting for precise expense tracking, inventory management for optimized stock control, production planning and control for meeting production targets, and process costing for continuous manufacturing. These components work together to provide comprehensive financial insights, ensuring operational efficiency and profitability.

Also Read: Custom vs. Off the Shelf ERP: Know the Differences

The Manufacturing Landscape in Singapore

Manufacturing plays a crucial role in Singapore’s economy, significantly contributing to both GDP and employment. As of the third quarter of 2024, the manufacturing sector’s GDP reached 29,503.70 SGD million, marking a notable increase from previous quarters. This highlights the sector’s importance as a cornerstone of economic stability and growth in the nation.

The manufacturing sector in Singapore has demonstrated resilience and growth, with an 8.5% year-on-year increase in output reported in November 2024. This growth reflects the sector’s ability to adapt and thrive despite challenges, driven by strong performances in electronics and precision engineering.

What Kind of Accounting System Is Used in Manufacturing?

Manufacturing firms utilize cost accounting to monitor production costs and enhance operational efficiency. This encompasses the assessment of direct costs, including raw materials and labor, alongside indirect costs such as factory overhead. Through the evaluation of these expenditures, manufacturers can accurately establish product pricing and assess profitability.

Additionally, management accounting plays a crucial role by enabling businesses to make informed decisions based on data analysis related to production efficiency, budgeting, and cost management. This methodology offers valuable insights into inventory accounting, cost distribution, and financial forecasting, thereby assisting manufacturers in optimizing their resources and sustaining profitability.

What Is the Difference Between General Accounting and Manufacturing Accounting System?

In managing finances, the use of an accurate accounting system is important for the company. Especially if the manufacturing company has complex processes and extensive financial management. But what is the difference between a manufacturing accounting system and a general accounting system? Understand more here

1. Focus

- General Accounting: Monitors financial transactions, income, and expenditures associated with all business operations.

- Manufacturing Accounting: Concentrates on monitoring expenses associated with production, encompassing materials, labor, and overhead costs.

2. Purpose

- General Accounting: Offers a comprehensive summary of financial performance to aid in decision-making.

- Manufacturing Accounting: Offers comprehensive analysis of production efficiency, cost management, and pricing strategies for products.

3. Inventory Tracking

- General Accounting: Monitors inventory of finished goods exclusively (for instance, items prepared for sale).

- Manufacturing Accounting: Monitors various categories of inventory, including raw materials, work-in-progress (WIP), and finished products.

4. Cost Allocation

- General Accounting: Expenses are categorized into general groups such as operating costs or Cost of Goods Sold (COGS).

- Manufacturing Accounting: Expenses are assigned to particular products or manufacturing processes, encompassing both direct and indirect costs.

5. Work in Progress

- General Accounting: Tracks and values partially completed products, requiring estimation of completion percentages.

- Manufacturing Accounting: Monitors and assesses partially finished products, necessitating the estimation of their completion percentages.

6. Cost of Goods Sold

- General Accounting: COGS is determined by the inventory that has been acquired.

- Manufacturing Accounting: COGS is determined by the inventory that has been acquired.

7. Reporting

- General Accounting: Financial statements emphasize the overall profitability and financial well-being of an entity.

- Manufacturing Accounting: Comprises comprehensive reports on production costs, including Cost of Goods Manufactured (COGM) and variance analysis to assess efficiency.

Methods in Manufacturing Accounting Systems for Singapore Companies

An accounting system for manufacturing is essential for tracking and managing the various costs associated with production. By integrating key components such as cost accounting, inventory management, and production control, businesses can optimize their operations and ensure accurate financial oversight.

Here are the explanations for each method in the manufacturing accounting system, includes:

1. Absorption Costing

All costs associated with manufacturing, both fixed and variable, are incorporated into the product costs. This practice is consistent with Generally Accepted Accounting Principles (GAAP) for external reporting purposes. While it guarantees that inventory valuation reflects the total production costs, it may complicate the understanding of cost behavior for internal decision-making.

2. Variable Costing

This approach incorporates solely variable costs—namely direct materials, direct labor, and variable overhead—into product costs. Fixed overhead is classified as a period cost. By emphasizing the contribution margin, this method facilitates short-term decision-making and enhances profitability analysis.

3. Standard Costing

Involves the use of predetermined costs for materials, labor, and overhead expenses. Discrepancies between the standard costs and actual costs are examined to manage expenses, boost efficiency, and refine budgeting and performance assessment.

4. Actual Costing

This approach allocates costs according to the actual expenses associated with materials, labor, and overhead. While it offers accurate tracking of costs, it can become complicated due to variations in actual costs over time.

5. Weighted Average Costing

This method calculates the average cost of all units available for sale within a specific timeframe. It mitigates the impact of price variations, thereby facilitating the valuation of inventory. This approach is frequently employed in process costing systems for products that are uniform.

6. Job Order Costing

Job order costing is used for batch manufacturing, where costs are tracked for each specific job or batch of products. This method ensures that all costs associated with a particular batch are accounted for, providing clear insights into the profitability of each batch. It is especially useful for customized or small-scale production runs.

7. Process Costing

Process costing is used in continuous manufacturing, where products are produced in a steady flow. Costs are averaged over the production period and assigned to units produced, which is helpful when individual units are indistinguishable. This method ensures that cost distribution is fair and accurate, even in high-volume production environments.

8. Activity-Based Costing (ABC)

Involves the allocation of overhead expenses according to the activities that incur these costs, rather than relying on volume metrics. This approach enhances the precision of product costing by associating costs with particular activities, thereby facilitating better cost management and analysis of profitability.

9. Cost Control

Assists in recognizing and managing expenses during the production process, thereby enhancing efficiency and increasing profitability. This is essential for understanding the profitability of each product and making informed business decisions. By providing accurate cost data, it helps businesses identify areas for cost-saving and efficiency improvements.

10. Inventory Management

Inventory management involves accurately tracking raw materials, Work-in-Progress (WIP) items, and finished products to maintain precise inventory levels, thereby avoiding both shortages and excess stock.

It ensures that materials are available when needed for production and helps avoid stockouts that could halt operations. Effective inventory management also optimizes stock levels, reducing waste and storage costs.

11. Production Planning and Control

Assists in recognizing and managing expenses during the production process, thereby enhancing efficiency and increasing profitability. Production planning and control is responsible for forecasting demand and scheduling production to meet targets.

It involves managing resources, such as labor and materials, to ensure efficient manufacturing. This component helps align production with customer demand, preventing delays and ensuring timely deliveries.

12. Cost Allocation

Cost allocation ensures that both direct costs (like raw materials and labor) and indirect costs (such as rent and utilities) are accurately assigned to the relevant products or processes. This helps businesses understand the true cost of production. Proper cost allocation leads to better pricing decisions and cost management.

Challenges in Manufacturing Accounting

In implementing a manufacturing accounting system, companies face many problems and obstacles that can hinder the management of business finances. Starting from challenges in tracking costs, managing inventory, and meeting compliance standards must be addressed properly.

Here are the challenges and obstacles that must be overcome in the manufacturing accounting process

1. Cost Management

Accurate cost tracking is crucial for profitability, but it is challenging at times due to fluctuations in raw material prices, labor costs, and manufacture overheads. Without precise allocation of costs, businesses risk inaccurate pricing strategies, which can erode profit margins and market competitiveness.

2. Inventory Control

Ineffective inventory control disrupts operations and increases holding costs. Managing raw materials, work-in-progress, and finished goods requires efficient procedures to avoid overstocking or shortages, ensure smooth production, and satisfy customer demand without incurring unnecessary costs.

3. Regulatory Compliance

Manufacturing companies must navigate complex regulatory frameworks, including tax laws, environmental policies, and labor regulations. Failure to comply can result in penalties, legal responsibilities, and damage to the reputation, highlighting the importance of comprehensive accounting solutions to assure compliance.

4. Data Integration and Accuracy

The manufacturing accounting process generates vast amounts of data across departments. Ensuring accurate and integrated financial data, including updates to the general ledger, is critical to informed decision-making. Disconnected systems or manual entries increase errors, delay reporting, and hinder strategic planning efforts for long-term growth.

Also Read: Understanding Cloud ERP and Its Benefits for Business

Benefits of A Manufacturing Accounting System

Accounting for manufacturing streamlines complex financial operations increases accuracy, and allows for seamless departmental collaboration. These tools enable producers to optimize operations, improve decision-making, and maintain a competitive advantage in a demanding market.

1. Accurate Costing

An accounting for manufacturing system accurately tracks all production costs, including raw materials, labor, and overhead. By integrating this data, the system determines the true cost of production, enabling businesses to make informed pricing decisions. This accuracy allows companies to evaluate profitability and adjust their pricing strategies as needed.

2. Improved Inventory Management

The system enables real-time tracking of inventory, ensuring accurate data on raw materials, work-in-progress, machine availability, and finished goods. This minimizes the risk of stockouts or overstocking, leading to better resource utilization. It enhances inventory efficiency by linking directly to procurement processes, reducing waste and unnecessary costs.

3. Better Production Planning

By tracking costs and production data, a manufacturing accounting system helps businesses forecast demand and plan production schedules more effectively. The system integrates financial and production data, allowing managers to optimize resource allocation. This ensures that production targets are met without delays and that resources are used efficiently.

4. Enhanced Financial Reporting

With integrated financial tracking, the manufacturing accounting system provides real-time and accurate reports, offering insights into the business’s financial health. It helps businesses analyze profitability, cash flow, and other key financial metrics, supporting informed decision-making. These reports ensure that management can make timely adjustments to meet financial goals and maintain growth.

5. Cost Control

The system continuously monitors and tracks production-related expenses, helping businesses identify areas where costs can be reduced. By analyzing spending patterns, companies can make informed decisions to optimize resource use and minimize waste. This level of control improves overall profitability by ensuring that only necessary expenses are incurred.

Best Practices in Manufacturing Accounting System for Singapore Companies

Best practices streamline financial processes by improving cost tracking, accuracy, and decision-making. They ensure manufacturers achieve profitability, enhance efficiency, and stay competitive in a dynamic market through effective accounting strategies. Here are the Best Practices that you can use:

1. Implementing Standard Costing

Standard costing allocates predetermined costs to production processes, allowing producers to track variances and control costs. Businesses can increase financial performance and operational efficiency by comparing real costs to standards, identifying inefficiencies, improving cost management, and developing appropriate pricing strategies.

2. Utilizing Activity-Based Costing (ABC)

Activity-Based Costing (ABC) allocates costs based on specific activities, providing a detailed understanding of overhead expenses. This method ensures that resources are appropriately assigned, helping manufacturers identify unprofitable products or processes and focus on high-value activities for improved profitability and sustainability.

3. Regular Financial Analysis

Regular financial analysis enables manufacturers to evaluate performance, identify trends, and handle potential difficulties. This technique offers data-driven insights for strategic decision-making, ensuring that firms are financially healthy and responsive to market shifts or operational issues.

4. Integrating Technology in Accounting

Utilizing the best accounting software and automation tools improves accuracy, minimizes manual errors, and provides real-time access to critical data. By integrating with manufacturing systems, these tools simplify reporting, ensure regulatory compliance, and equip businesses with valuable insights to make informed decisions and drive sustainable growth.

What to Look for in Manufacturing Accounting System?

In the fast-paced world of manufacturing, especially in Singapore, the right accounting system can be the difference between thriving and just surviving. From scalability to real-time insights, here are the things to look for in a manufacturing accounting system to ensure your operations run smoothly and profitably.

1. Scalability

As your business expands, your requirements evolve accordingly. The appropriate system must scale seamlessly, supporting higher production levels, a growing number of users, and increasingly intricate processes.

Whether you are broadening your product offerings or venturing into new markets, scalable software guarantees that your system will remain adequate, thereby preventing expensive upgrades or migrations in the future.

2. Integration Capabilities

Your accounting system should not function independently. Seek solutions that integrate effortlessly with your current ERP, CRM, and supply chain systems. This approach guarantees a seamless flow of data between departments, reduces the likelihood of manual data entry errors, and offers a comprehensive perspective of your operations, thereby improving both efficiency and accuracy.

3. Real-Time Data Access

A system that offers real-time visibility into production costs, inventory levels, and financial performance supports quick and informed decision-making. With invoicing software Singapore integrated into the system, businesses can instantly track financial transactions and manage invoices, enabling them to identify bottlenecks and optimize workflows. This access to real-time data helps companies respond swiftly to market changes, ensuring they stay competitive.

4. Cost Tracking and Analysis

Effective cost management is essential in the manufacturing sector. Select software that accurately monitors variable, fixed, and overhead costs. Utilizing advanced tools for variance analysis can assist in identifying inefficiencies, managing expenses, and enhancing profitability. Precise cost tracking guarantees that you remain informed about your financial status.

5. Compliance and Reporting

Adhering to accounting standards such as GAAP or IFRS is essential. Your software must produce precise financial reports, which encompass profit and loss statements, balance sheets, and cash flow statements. Comprehensive reporting capabilities not only guarantee compliance but also offer critical insights for strategic decision-making.

6. User-Friendly Interface

A complex system may hinder productivity. It is advisable to choose software that features an intuitive and easily navigable interface, which helps to reduce the learning curve for your team.

A design that prioritizes user-friendliness decreases training time, lowers the likelihood of errors, and allows employees to concentrate on their primary responsibilities instead of grappling with the software.

ScaleOcean: Tailored Accounting Solutions for Manufacturers

In today’s fast-paced market, managing a manufacturing company requires a solution that can improve efficiency and streamline operations. ScaleOcean offers a comprehensive ERP solution tailored specifically to meet the unique demands of manufacturing businesses in Singapore.

To help you experience its potential, ScaleOcean invites you to explore its capabilities through a free demo offer, allowing you to see firsthand how it can transform your business processes through our features.

Key Features of ScaleOcean ERP:

- Manufacturing Module: Simplifies production planning, scheduling, and inventory management to ensure optimal resource allocation and seamless workflow.

- Financial Management: Automates essential accounting tasks, including invoicing, payroll, and financial reporting, saving time and reducing errors.

- Integration: Seamlessly connects with your existing business systems, creating a cohesive operational environment and improving overall efficiency.

Benefits for Your Manufacturing Business:

- Enhanced Efficiency: Automating routine tasks enables your staff to focus on strategic activities that drive growth and innovation.

- Improved Accuracy: Minimizes manual data entry errors, ensuring that your financial data is precise and reliable.

- Scalability: Designed to grow alongside your business, ScaleOcean ERP adapts to your expanding needs without disruptions.

ScaleOcean is a reliable ERP solution trusted by numerous companies to streamline their operations and improve efficiency. One satisfied user shared how managing inventory, shipments, and logistics used to be a challenging and time-intensive process before adopting the software.

They stated, “Before we started using ERP software, tracking our inventory, shipments, and logistics was a complex and time-consuming task. Now, everything runs efficiently and accurately, making our work much simpler.” With ScaleOcean, businesses can simplify complex workflows, boost productivity, and focus on achieving their strategic goals.

Conclusion

Manufacturing accounting systems are important for maintaining efficiency and profitability in Singapore’s competitive manufacturing sector. Businesses can significantly improve their financial management and overall operational performance by implementing best practices and leveraging advanced accounting solutions such as ScaleOcean.

These tools address the industry’s unique challenges while ensuring compliance and scalability. Manufacturers are encouraged to embrace integrated accounting solutions to simplify complex processes, reduce errors, and enable data-driven decision-making.

With streamlined operations and real-time insights, businesses can focus on innovation and growth, maintaining a strong foothold in the market. Leveraging tailored solutions such as ScaleOcean Manufacturing Software not only improves accuracy but also empowers companies to adapt to changing demands, ensuring long-term success. The right system can be a game-changer for driving efficiency and achieving sustainable growth.

FAQ:

1. What is a manufacturing accounting system?

A manufacturing accounting system is a specialized accounting software that tracks and records financial information related to the production process. It primarily involves monitoring all expenses tied to manufacturing goods, such as raw materials and labor costs.

2. What are the two types of manufacturing accounting?

Cost accounting and managerial accounting are both crucial type of accounting that are key in managing expenses and supporting decision-making in manufacturing settings. Cost accounting specifically concentrates on recording all expenses associated with the production process.

3. What are the 3 manufacturing systems?

The three types of manufacturing systems are manual work systems, worker-machine systems, and automated systems. These systems are classified based on the level of worker involvement in the production process.

4. What is the best accounting software for manufacturing?

When choosing the best accounting software for manufacturing, it’s important to consider the specific needs of your business. Here are some top options to help streamline your accounting processes in manufacturing:

1. ScaleOcean Accounting Software

2. Fishbowl Software

3. Katana Software

4. QuickBooks Enterprise

PTE LTD..png)

.png)

.png)

.png)

.png)