Understanding Cost of Goods Sold (COGS) is important for businesses that want to maximize profits while maintaining accurate financial records. COGS refers to the direct costs of producing goods or services, which include raw materials, direct labor, and manufacturing costs.

Managing these costs effectively can have a significant impact on a company’s bottom line. According to IBISWorld, the manufacturing sector in the US has experienced a compound annual growth rate (CAGR) decline of 0.4% over the past five years, reaching an estimated $7.0 trillion in 2024.

Proper COGS calculation and analysis assist companies in setting competitive prices, managing inventory efficiently, and making sound financial decisions.

This article will focus on the fundamentals of COGS, including its definition, essential components, and distinctions from other financial indicators, offering significant insights for business owners and financial managers.

- Cost of Goods Sold (COGS) is an important financial indicator that indicates the direct costs associated with producing the goods or services that a company sells.

- COGS is calculated using the formula COGS = Beginning Inventory + Purchases – Ending Inventory, which helps businesses determine the direct costs associated with producing goods sold.

- Key elements of COGS include direct materials, labor, manufacturing overhead, and freight/storage costs, all crucial for assessing profitability and financial management.”

- ScaleOcean Manufacturing Software is designed to streamline this process by automating cost calculations, ensuring real-time tracking of material, labor, and overhead expenses.

What is Cost of Goods Sold (COGS)?

Cost of Goods Sold (COGS) is an important financial indicator that indicates the direct costs associated with producing the goods or services that a company sells. It comprises expenses such as raw materials, labor, and production overhead.

Overhead costs, unlike COGS, are necessary to run the business but are not directly tied to production. COGS is critical for calculating gross profit because it is deducted from revenue to determine profitability.

Businesses can utilize COGS analysis to optimize pricing strategies, manage production costs effectively, and enhance operational efficiency. Accurate COGS tracking is crucial for maintaining financial health, as it enables better decision-making and ultimately leads to business success.

Why Is Cost of Goods Sold (COGS) Important?

The Cost of Goods Sold (COGS) is important because it directly impacts a company’s profitability by determining the cost to produce or acquire the goods sold. COGS helps businesses calculate gross profit by subtracting it from total revenue, giving insights into overall financial health.

A clear understanding of COGS enables companies to set competitive pricing, manage production costs, and optimize operational efficiency. Using Singapore manufacturing accounting tools helps track COGS accurately, identify cost-saving opportunities, and maintain healthy profit margins for long-term sustainability.

What Is the Cost of Goods Sold (COGS) Formula?

The Cost of Goods offered (COGS) formula is a simple calculation used to quantify the direct expenses of manufacturing goods or services offered by a company. The formula is:

COGS = Beginning Inventory + P – Ending Inventory

Additional information for the formula:

P = Purchases during the period

Beginning inventory represents the value of goods available at the start of a period, while purchases account for additional inventory acquired. Ending inventory reflects unsold goods at the period’s close. To determine production costs, start with beginning inventory, add purchases, and subtract ending inventory.

This calculation offers a clear view of production expenses, enabling businesses to assess profitability, optimize inventory management, and make informed financial decisions. By maintaining accurate records, companies can improve cost control, streamline operations, and ensure a more efficient approach to financial planning.

How Do You Analyze the Cost of Goods Sold?

Understanding the Cost of Goods Sold (COGS) is essential for determining a business’s profitability. An accurate analysis enables businesses to control costs, fine-tune pricing tactics, and improve financial planning. The following points explain the important processes for assessing COGS.

1. Understanding the Components of COGS

COGS includes direct costs like raw materials, labor, and manufacturing expenses, excluding indirect costs like marketing and distribution for accuracy.

A clear breakdown helps businesses track spending and identify areas for cost reduction. Additionally, understanding the advantages of absorption costing aids in more accurate cost allocation.

2. Calculating COGS Using the Right Formula

The Cost of Goods Sold is calculated by adding the beginning inventory to purchases made during the period and then subtracting the ending inventory. This calculation reveals the actual cost of production for a specific time frame.

To ensure accuracy, it’s important to apply proper inventory valuation methods, such as FIFO or LIFO, which help prevent financial discrepancies and support better decision-making.

3. Identifying Cost Trends and Variations

COGS trends are analyzed regularly to uncover inefficiencies, pricing fluctuations, and seasonal changes in manufacturing costs.

By comparing historical data to current information, organizations may improve supplier contracts and production processes. Identifying cost fluctuations allows for better budget control and improved profit margins.

4. Enhancing COGS Efficiency Through Cost Management

Reducing COGS requires efficient supplier negotiations, lean inventory management, and process automation. Businesses should implement cost-saving strategies without compromising product quality.

A streamlined supply chain, machine availability, and waste reduction initiatives help maintain competitive pricing while improving overall profitability.

What Are the Various Accounting Methods for COGS?

When it comes to understanding the cost of doing business, knowing your Cost of Goods Sold (COGS) is crucial. Different accounting methods help businesses calculate COGS in various ways, each impacting financial results and taxes differently.

Here are some of the most commonly used accounting methods for COGS:

FIFO (First-In, First-Out) Method

The FIFO method assumes that the oldest inventory is sold first. This works out well when prices are rising, as it allows you to use older, cheaper stock for sales. This results in a lower COGS and higher profits, which in turn could reduce taxes during times of inflation.

What’s interesting about FIFO is that the inventory left over is valued at current market prices, giving it a more up-to-date valuation on the balance sheet. While this method is widely used, it may not reflect the actual flow of goods in businesses where prices fluctuate or for products that expire quickly.

LIFO (Last-In, First-Out) Method

In contrast, the LIFO method assumes the last goods purchased are the first ones sold. During inflation, this means that more expensive, newer inventory is sold first, leading to a higher COGS. This reduces profits and taxes in the short run, which can be beneficial in some situations.

However, using LIFO often means that the inventory listed on the balance sheet will be valued lower than the market price. It’s important for businesses using this method to understand the long-term tax implications, especially if they need to switch methods or meet regulatory requirements.

Weighted Average Cost Method

The weighted average cost method works by averaging out the cost of all inventory items. This method is straightforward, especially for companies with large inventories of similar products, like raw materials. It smooths out price fluctuations, giving a consistent approach to COGS over time.

This method is great for businesses that don’t have specific tracking of individual items. It helps in providing steady financial results, especially when the cost of inventory items varies, making it a solid choice for companies with fluctuating prices.

Specific Identification Method

The specific identification method is used when each product is unique, like cars, high-end jewelry, or custom-made items. Each product’s cost is tracked individually, giving an accurate reflection of how much each specific item costs to produce or purchase.

While this method is great for precision, it can be a bit tedious for businesses that handle large volumes of similar products. It’s best for companies that deal with high-value items that need to be tracked individually, providing a clear and accurate picture of their COGS.

To streamline COGS calculations and enhance financial management, ScaleOcean’s manufacturing software offers robust tools to track inventory, manage production costs, and automate reporting. Real-time data integration, it helps businesses make informed decisions and improve profitability.

What Is Included in the Cost of Goods Sold (COGS)?

All direct expenses associated with producing goods or services are included in the Cost of Goods Sold (COGS). Recognizing its components allows businesses to monitor profitability, refine pricing strategies, and efficiently manage financial performance.

The following are the key elements that constitute COGS and their impact on a company’s financial results:

- Direct Materials: Direct materials are raw materials used in production. These costs depend on product type and supplier pricing. Tracking material costs accurately ensures proper inventory valuation and helps avoid wasteful spending, supporting profitability and quality.

- Direct Labor: Direct labor costs include wages and benefits for employees involved in production. Proper tracking helps optimize workforce efficiency, control payroll expenses, and improve overall cost management without compromising productivity.

- Manufacturing Overhead: Manufacturing overhead covers indirect production costs like utilities, equipment depreciation, and factory maintenance. Accurate allocation allows businesses to determine actual production costs and adjust pricing strategies for better financial planning.

- Freight and Storage Costs: Freight and storage costs affect COGS by adding expenses related to raw materials and finished goods transport. Optimizing logistics and inventory management can reduce unnecessary shipping and storage costs while maintaining efficient supply chain operations.

Which Types of Companies Are Excluded from a COGS Deduction?

Certain businesses are not able to claim a COGS deduction because of how their operations are structured. For the most part, businesses that don’t sell physical products, like those in the service industry, are excluded. This mainly affects companies that don’t have inventory to account for.

Expenses related to selling and marketing, such as advertising and sales commissions, are not part of COGS. Likewise, administrative costs like management salaries, office rent, and utilities are excluded from COGS. These are necessary for running the business but aren’t directly tied to the production or sale of goods.

Service-based businesses, such as accounting firms, law offices, and consultants, don’t typically report COGS. Since they don’t have inventory to manage, their financial statements show “cost of services” instead. This helps clarify their financial reporting, as these costs don’t count toward a COGS deduction.

Is the Cost of Goods Sold the Same as Production Costs?

While closely related, production costs and COGS are not the same. COGS accounts for direct expenses such as raw materials, labor, and manufacturing overhead for goods sold during a particular period, whereas production costs encompass all expenses incurred during manufacturing, including those for unsold goods.

This means production costs may include inventory still in stock, while COGS reflects only sold items. Understanding the distinction helps businesses manage expenses, optimize pricing, and improve financial reporting. Using top manufacturing cost estimating tools ensures accurate profit margins and better decision-making.

What’s the Difference Between Cost of Goods Sold and Cost of Sales?

Although often used interchangeably, Cost of Goods Sold (COGS) and Cost of Sales (COS) have different meanings in financial reporting. COGS refers to the direct costs involved in producing tangible goods, such as raw materials, direct labor, and manufacturing expenses. It applies to businesses that manufacture or sell physical products.

In contrast, Cost of Sales is a broader term that applies to both product-based and service-based businesses. It includes all direct costs associated with delivering goods or services, such as mass production, distribution, and operational expenses.

While COGS focuses on physical inventory, Cost of Sales accounts for various business models, including service industries where labor and operational costs play a crucial role.

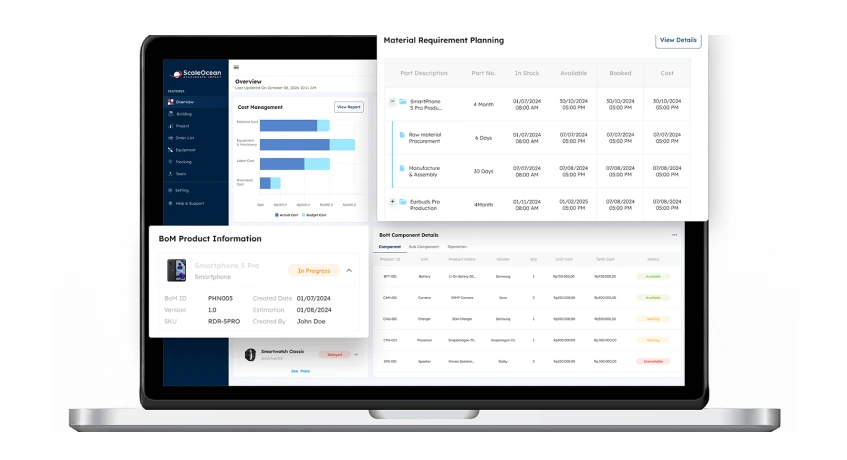

Calculate COGS Automatically with ScaleOcean Manufacturing Software

Managing manufacturing costs is a complex task, especially when it comes to calculating the Cost of Goods Sold (COGS) accurately. ScaleOcean Manufacturing Software is designed to streamline this process by automating cost calculations, ensuring real-time tracking of material, labor, and overhead expenses.

By integrating with inventory and production systems, it eliminates manual errors and provides precise cost breakdowns for each product.

With an intuitive interface and robust automation, ScaleOcean empowers manufacturers to optimize their cost structures and improve profitability. To experience how ScaleOcean can enhance your manufacturing operations, request a free demo today.

Key Features of ScaleOcean Manufacturing Software:

- Automated COGS Calculation: Automatically calculates COGS based on real-time inventory movement, production costs, and overhead expenses.

- Bill of Materials (BOM) Management: Tracks raw materials and components, linking them to production processes to ensure accurate cost tracking.

- Real-Time Production Tracking: Monitors work-in-progress, machine efficiency, and labor costs to maintain visibility into manufacturing operations.

- Integrated Inventory Management: Synchronizes inventory with production, preventing stock shortages and overstocking while reducing holding costs.

- Comprehensive Reporting & Analytics: Provides detailed reports on production costs, efficiency, and profitability, enabling data-driven decision-making.

The software reduces human error in cost calculation, improves inventory control, and ensures transparency in manufacturing expenses. Manufacturers can use real-time insights to make strategic pricing and production decisions, resulting in higher profit margins and greater business scalability.

Whether you’re managing a small-scale production line or a large manufacturing facility, ScaleOcean provides the tools needed to stay competitive in today’s market.

Conclusion

Tracking your Cost of Goods Sold (COGS) accurately is key to boosting profits and making smarter financial moves. By understanding your costs and using solid control strategies, you can sharpen your efficiency and grow steadily. It’s the best way to keep your pricing and inventory on track.

Calculating COGS manually can be time-consuming and prone to errors. ScaleOcean Manufacturing Software simplifies cost tracking, integrates inventory management, and offers real-time production insights.

With features such as automated COGS calculation and BOM management, businesses can enhance operations and boost profitability. If you’re interested in improving your manufacturing process, feel free to explore a demo at your convenience.

FAQ:

1. Is COGS an expense or an asset?

COGS is considered an expense because it represents the costs directly tied to producing the goods or services a company sells. These costs are deducted from revenue to calculate gross profit. Unlike assets, which are things a business owns, COGS doesn’t have long-term value.

2. What are the 4 costs of production?

The main costs involved in production include labor, raw materials, overhead, and consumables. These are the fundamental expenses a company incurs while producing goods or services. These costs are essential for creating products that generate revenue for the business.

3. Are COGS the same as inventory?

COGS and inventory aren’t the same thing. Inventory refers to the goods a company still has in stock for sale, while COGS accounts for the cost of items that have already been sold. Inventory is listed as an asset, while COGS is an expense on the income statement.

4. Is a high or low COGS better?

A lower COGS is usually a good sign because it means a business is efficiently managing its production costs, leading to higher profit margins. However, certain industries naturally have higher COGS, and that doesn’t necessarily mean they’re less profitable.

PTE LTD..png)

.png)

.png)

.png)

.png)