Understanding manufacturing overhead is important for any company involved in production. While direct expenses such as raw materials and labor are easy to calculate, overhead costs are frequently overlooked, despite playing an important role in determining the true cost of goods.

Manufacturing overhead, often referred to as factory overhead or production overhead, encompasses the indirect expenses associated with the manufacturing process that cannot be directly linked to individual products. However, these costs are vital for the overall functioning of a manufacturing facility.

These costs cannot be directly attributed to any single product, but they are required for the production process to function properly. Calculating manufacturing overhead is essential for accurate pricing, budgeting, and profit.

In this article, we will explain manufacturing overhead and walk you through the steps to accurately calculate it for your company.

- Manufacturing overhead encompasses the indirect expenses associated with the production process that cannot be directly linked to individual products.

- Examples of manufacturing overhead include depreciation of machinery and buildings, utility costs, factory supplies, indirect labor expenses, and property taxes and insurance.

- The importance of manufacturing overhead is establishing actual production costs, setting competitive prices, giving you choices of production methods, and improving your cost management.

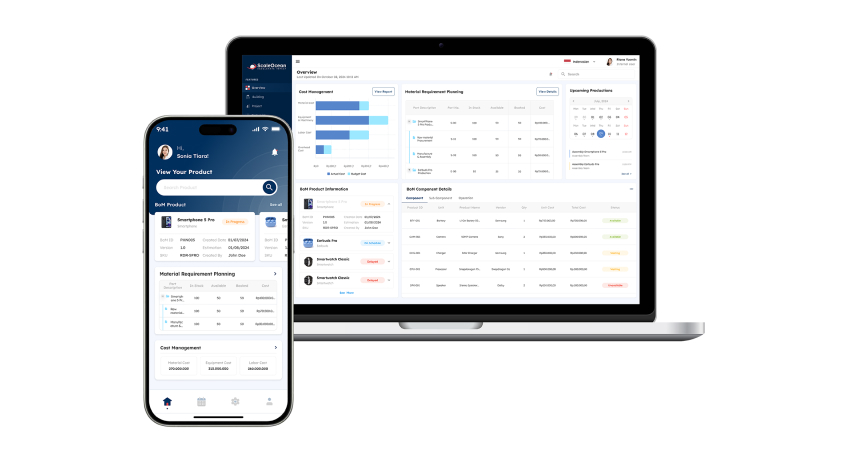

- You can manage these costs automatically with ScaleOcean manufacturing software, which provides accurate calculations and analysis, and increases profitability by up to 50%.

What Is the Manufacturing Overhead?

Manufacturing overhead refers to the various indirect costs that come with the production process but can’t be directly linked to specific products. This includes things like utilities, rent, insurance, indirect labor, and materials used in the factory.

These expenses are essential for keeping a manufacturing facility running smoothly, even though they aren’t directly involved in creating a product. Effectively managing overhead cost manufacturing is key to proper budgeting, resource allocation, and ensuring the company remains profitable.

Accurately calculating the true cost of production allows businesses to set competitive prices and make informed decisions about optimizing production processes and allocating resources effectively.

Examples of Manufacturing Overhead

Manufacturing overhead includes various indirect costs that are necessary to run a factory but cannot be directly attributed to specific products. These costs ensure smooth operations, including expenses like utilities, insurance, and property taxes.

Understanding these overhead costs helps businesses make informed decisions on budgeting, resource allocation, and pricing. The following are quick examples of manufacturing overhead that impact a company’s production costs:

- Depreciation of machinery and buildings

- Rent, leases, and mortgages

- Factory supplies

- Indirect labor expenses

- Maintenance and repair expenses

- Utility costs

- Property taxes and insurance

- Regulatory expenses

The Importance of Managing Manufacturing Overhead

Understanding and accurately calculating manufacturing overhead costs is important for several reasons, as it helps businesses gain a clear picture of production costs and improve operational efficiency. Using tools like Singapore manufacturing cost software can streamline this process, ensuring better cost control.

Here are the reasons why managing overhead costs in the manufacturing process is important:

- Establishing Actual Production Costs: By including overhead costs in the cost assessment, companies can account for all production-related expenses. This helps in effective financial planning and ensures accurate profitability evaluations for informed decision-making.

- Setting Competitive Prices: Factoring in overhead costs ensures that product pricing covers all expenses while staying competitive in the market. Underestimating or overestimating these costs can lead to incorrect pricing, resulting in either losses or missed profits.

- Optimizing Production Methods and Resource Allocation: Examining manufacturing overhead helps identify areas for cost reduction or optimization. This analysis allows businesses to allocate resources efficiently, whether by investing in technology, adjusting workforce levels, or improving energy efficiency.

- Improving Cost Management and Budgeting: Tracking manufacturing overhead allows companies to spot inefficiencies or fluctuations in expenses. With this data, businesses can implement better control strategies and forecast future costs, ensuring they stay within budget and avoid unexpected financial issues.

What Factors Affect Manufacturing Overhead?

Manufacturing overhead costs include indirect costs required to operate a production operation. These costs are useful in supporting industrial operations and establishing accurate prices, even though they are not directly related to the production of goods. Here are the major components of manufacturing overhead costs:

- Rent, leases, and mortgages: The cost of renting or owning a factory building is a significant overhead expense. For example, a business that rents warehouse space for storage or production will pay a monthly lease as part of its overhead.

- Utility Costs: Electricity and water usage for the production facility, such as the power consumed by machines, lighting, and cooling systems.

- Equipment Maintenance: Regular servicing of machines, like oil changes for factory equipment or calibrating machines to ensure efficiency and prevent breakdowns.

- Asset Depreciation: The gradual reduction in value of machinery or factory buildings over time, which impacts costs for businesses. For example, a machine that depreciates $2,000 annually.

- Workforce Expenses: Salaries for non-production workers such as supervisors, quality control, or maintenance staff who are essential for the factory’s operations but don’t directly make products. Also, these are considered key components of absorption costing, as they contribute to overall production costs.

- Operational Supplies: Items like cleaning products, lubricants, or tools used in the daily operation of the factory, which support production without being part of the finished product.

- Insurance Premiums: The cost of insuring the factory building, equipment, or workers against potential risks, such as fire or accidents, which are necessary for business protection.

- Tax Obligations: Property taxes on the factory building or local taxes associated with operating the manufacturing business, which are often fixed annual costs.

- Professional Fees: Costs for accounting, legal services, or consultation fees necessary to maintain compliance or optimize business operations.

Manufacturing Overhead Formula

Manufacturing overhead is determined by summing all indirect expenses associated with the production process. By precisely identifying these costs, companies can achieve more accurate estimations and allocations of manufacturing expenses, leading to improved pricing strategies.

Here are the formulas and calculations that you can use:

Total manufacturing overhead = Sum of fixed + variable + semi-variable indirect expenses

Total manufacturing overhead is the sum of fixed, variable, and semi-variable indirect expenses. Fixed costs are constant, regardless of production volume. Examples include rent, insurance, and salaried employee wages. These costs do not change with production fluctuations.

Variable costs change with the level of production. These include utility bills, raw material costs, and direct labor costs for hourly workers. Semi-variable costs have both fixed and variable components, such as phone bills with a fixed fee and usage-based charges.

How to Calculate Manufacturing Overhead

Calculating manufacturing overhead is crucial for understanding the indirect costs associated with production. It helps businesses allocate expenses efficiently, set appropriate prices, and make informed decisions to improve profitability. Here’s how to calculate it step by step:

Identify and List All Overhead Costs

The first step in calculating manufacturing overhead is to identify all indirect costs involved in production. These can include indirect labor, indirect materials, utilities, depreciation, insurance, maintenance, and compliance costs.

For example, ABC Electronics identifies costs like indirect labor for workers not directly involved in product creation and indirect materials such as packaging and cleaning supplies. This list should cover all expenses that are necessary but not directly tied to manufacturing products.

Sum Up All Overhead Costs

After identifying all relevant costs, the next step is to sum them up to determine the total manufacturing overhead. This includes combining the costs of labor, materials, utilities, and other associated costs.

In the case of ABC Electronics, the total manufacturing overhead for March is calculated by adding up the various expenses, which are indirect labor ($30,000), indirect materials ($18,000), utilities ($6,000), and so on. The total is $82,000.

Divide Total Overhead by Number of Units Produced

Once the total manufacturing overhead is determined, divide it by the number of units produced during that period to find the overhead cost per unit. The formula for this calculation is:

Manufacturing overhead per unit = Total manufacturing overhead / Number of units produced

For ABC Electronics, the company produced 15,000 Bluetooth speakers in March. To find the manufacturing overhead per unit, the total overhead ($82,000) is divided by the number of units produced (15,000). This results in an overhead cost of $5.47 per unit.

Adjust for Any Cost Reduction or Changes

If any overhead costs are reduced or adjusted, recalculate the overhead per unit to see how these changes impact production costs. For example, reducing maintenance costs can lower overall overhead.

ABC Electronics reduces its maintenance costs by $2,000. After recalculating, the new overhead per unit becomes $5.33, reflecting the savings from maintenance cost reductions. This improved cost structure can lead to better profitability or more competitive pricing.

The Types of Manufacturing Overhead Cost

Overhead costs are the silent driving force behind every business operation, often overlooked but essential to smooth functioning. There are several types of manufacturing overhead, such as fixed costs, variable costs, and semi-variable costs, that are essential for effective budgeting and cost control.

Let’s examine each category to uncover how they impact a business and why they matter, including:

Fixed Overheads

This cost is consistent expenses that remain unchanged regardless of production volume, including costs such as rent, salaries, insurance, and depreciation of assets. For instance, a manufacturing facility incurs the same rental expense whether it produces 100 units or 1,000 units.

These costs are both predictable and stable, which facilitates budgeting; however, they can exert financial pressure during periods of reduced production. Efficient management is crucial for sustaining profitability, particularly in sectors characterized by varying demand.

Variable Overheads

Variable overheads are costs that change with production levels, such as raw materials, utilities, packaging, and shipping. For example, a bakery uses more flour and electricity for 500 loaves than for 100.

While flexible, these costs can be challenging to manage during high production. Businesses must monitor them closely to avoid overspending and align expenses with output.

Semi-variable overheads

Semi-variable overheads consist of both fixed and variable expenses, featuring a stable base alongside a variable element that varies according to production levels or usage.

For instance, a delivery service incurs fixed monthly maintenance costs while experiencing variable repair costs that depend on the distance traveled. Evaluating these expenses enables organizations to enhance their cost management and financial forecasting.

Applied Overhead

Applied Manufacturing Overhead is a method used to allocate factory overhead to specific production orders, products, or departments. This approach is valuable for understanding how overhead costs are distributed across different areas of a business. Using the formula for applied overhead:

Applied overhead = Estimated amount of overhead costs / Estimated activity of the base unit

This calculation helps businesses assign overhead costs more accurately and identify which processes or products incur the most indirect costs. It provides a clearer picture of cost management and improves resource allocation.

How Is Manufacturing Overhead Used?

Manufacturing overhead is crucial for cost management, pricing, and profitability, as it includes indirect costs like rent, utilities, and maintenance. By learning how to analyze Cost of Goods Sold (COGS), businesses can allocate overhead costs effectively, ensuring accurate financial reporting and manufacturing efficiency.

Here is how manufacturing overhead is used:

Cost Allocation for Accurate Pricing

Cost Allocation for Accurate Pricing is essential for businesses to determine the true production cost of their products. Manufacturing overhead is distributed across various products, ensuring that all indirect costs are included in the final price calculation.

Accurate cost allocation allows companies to set competitive and profitable prices. If overhead costs are not properly allocated, products may be underpriced or overpriced, which can negatively impact profitability and long-term business success.

Financial Reporting and Compliance

Accurate tracking of manufacturing overhead is important for financial statements and tax compliance. Companies must report indirect costs correctly to meet accounting standards and regulatory requirements.

Proper overhead accounting ensures transparency, helping businesses make informed financial decisions and avoid discrepancies in audits or financial evaluations.

Budgeting and Cost Control

Manufacturing overhead analysis is essential for identifying areas where businesses can cut costs without compromising quality. By regularly reviewing expenses like utilities, equipment depreciation, and maintenance, companies can uncover opportunities for savings.

Effective cost control strategies allow manufacturers to optimize their budgets, improve operational efficiency, and allocate resources wisely. This approach helps maintain profitability while keeping production costs in check, leading to a more sustainable business model.

Production Efficiency and Process Improvement

Manufacturing overhead plays a crucial role in identifying inefficiencies within production. By closely monitoring overhead costs, businesses can spot areas of waste or underutilized resources, helping to streamline operations and improve process efficiency throughout the production cycle.

For example, high energy costs may indicate that equipment is not running efficiently. This signals the need to invest in more energy-efficient machinery, reducing long-term costs and boosting overall production efficiency. Such proactive steps ensure better cost control and productivity improvements.

Decision-Making in Manufacturing Strategy

Manufacturing overhead data plays a key role in strategic decision-making within a company. By analyzing cost trends, businesses can make informed choices about pricing adjustments, automation, or facility upgrades to stay competitive.

This information helps companies decide whether outsourcing production, investing in new technology, or optimizing workforce planning will benefit long-term growth. By using manufacturing overhead data, businesses can make decisions that ensure continued success in a constantly evolving market.

Incorporating manufacturing overhead analysis into business operations ensures effective cost management, strategic decision-making, and long-term success. With ScaleOcean’s manufacturing software, businesses can easily track overhead costs, optimize resources, and improve profitability.

How to Reduce Your Manufacturing Overhead

Companies in Singapore must implement the right strategies to reduce production overhead costs, which can significantly increase efficiency and overall profits. By cutting unnecessary costs and optimizing the use of resources, you can lower their production costs.

Here are some strategies to consider:

- Optimize Manufacturing Workflow: Streamlining operations involves optimizing production workflows to eliminate bottlenecks and enhance efficiency. Several of the recommendations for manufacturing accounting software can support this by automating processes, cutting overhead, and improving overall product flow.

- Implement Regular Preventive Maintenance: Regular preventive maintenance helps prevent equipment breakdowns and costly repairs. Routine checks allow issues to be addressed early, saving time and money.

- Repurpose Components from Existing Equipment: Repurposing old equipment parts can save money on new purchases. Instead of discarding outdated parts, businesses can find new uses in other processes or equipment.

- Employ an In-House Maintenance Specialist: Hiring an in-house maintenance expert reduces reliance on external contractors. Internal staff can ensure equipment stays in top condition with timely repairs and upkeep.

- Align Employees with Cost-Saving Objectives: Educating employees about cost-saving goals helps create an efficient culture. When employees understand the need to cut costs, they contribute to finding and implementing savings.

- Strengthen Partnerships with Suppliers: According to Investopedia, a survey by Ernst & Young of 200 senior supply chain executives found that 72% saw a deep negative impact from the pandemic, emphasizing that reliable partnerships can lead to better pricing and improved cash flow management.

- Minimize Dependency on Office Supplies: Cutting back on office supplies and going digital lowers costs. Switching to electronic documents and communication increases productivity and promotes sustainability.

- Lease Out Unused Workspace: Leasing unused space generates additional income to offset overhead costs. Businesses can utilize underused areas to improve financial stability and maximize resource efficiency.

Track Manufacturing Costs with ScaleOcean Software

Efficient cost management is crucial for manufacturers to maintain profitability and competitiveness. ScaleOcean Manufacturing Software streamlines cost tracking with an integrated, data-driven approach that connects production and financial metrics.

It provides real-time insights, ensuring every stage, from raw material procurement to final product costing, is closely monitored. This enables businesses to identify cost-saving opportunities, optimize production, and minimize inefficiencies to stay competitive.

Additionally, the software enhances forecasting and budgeting by leveraging accurate historical data and trends. ScaleOcean also offers free demos and consultations with team professionals for 100% optimal system implementation that suits your needs.

Features of ScaleOcean Manufacturing Software for Tracking Costs:

- Real-time Cost Monitoring: Track labor, material, and overhead costs in real time, providing instant insights into cost structures.

- Bill of Materials (BOM) Management: Link raw materials, components, and processes to calculate accurate manufacturing costs.

- Cost Variance Analysis: Compare budgeted vs. actual costs to pinpoint areas for cost control.

- Work Order Cost Tracking: Monitor the cost of individual work orders and batches to identify inefficiencies.

- Integration with Financial Systems: Integrate seamlessly with accounting systems for a unified view of financials and cost reporting.

ScaleOcean manufacturing software provides manufacturers with real-time, accurate data throughout the production lifecycle, allowing for better decision-making to reduce costs and increase profitability. Its comprehensive cost management tools account for all expenses, including materials, labor, and overhead.

Seamless integration with other business systems improves visibility and communication, thereby increasing operational efficiency. Furthermore, the software provides valuable insights into cost variances, helping manufacturers refine processes and minimize waste.

Conclusion

Manufacturing overhead is necessary for estimating genuine production costs, although it is frequently underestimated. Managing indirect expenses such as rent, utilities, and maintenance leads to more precise pricing, better planning, and increased profitability.

Proper tracking helps companies in properly allocating resources, enhancing output, and improving financial planning, all while eliminating inefficiencies that undermine competitiveness. With the right tools, overhead management becomes more efficient.

ScaleOcean Manufacturing Software offers real-time cost tracking, variance analysis, and financial integration, providing clear visibility into expenses. These insights help businesses refine processes, reduce waste, and boost profitability.

Explore how ScaleOcean can support your manufacturing operations with a free demo and discover smarter ways to manage costs.

FAQ:

1. What are the 4 types of overhead?

Overhead costs are usually divided into four key types, which are production overhead, administrative overhead, selling overhead, and financial overhead. These types represent various indirect costs, which can include fixed, variable, or semi-variable costs.

2. Is manufacturing overhead an asset or expense?

Manufacturing overhead is considered an expense and is included in the cost of goods sold (COGS). It accounts for indirect production costs and is allocated to work-in-process (WIP) and finished goods inventory during production.

3. What does 40% overhead mean?

For instance, if your overhead costs amount to $70,000 and direct labor costs are $175,000, the overhead rate is 40%. This indicates that for every dollar spent on direct labor, you are spending 40 cents on overhead costs.

4. What is factory overhead with an example?

Factory overhead includes indirect costs like utilities (electricity, water, gas), maintenance, and rent. For example, electricity to power machinery is an overhead cost. Businesses may reduce these by negotiating long-term supplier deals.

PTE LTD..png)

.png)

.png)

.png)

.png)