Absorption costing, or full costing, allocates all manufacturing expenses — including direct materials, labor, and overheads — to the products being made. This method ensures each product reflects its total cost, offering a comprehensive view of profitability and compliance with financial reporting standards. Based on CEIC Data, Singapore’s manufacturing labor cost index was 103.00 in March 2018 (2010 base = 100). Implementing absorption costing is crucial for effective pricing, cost control, and long-term sustainability in Singapore’s vital manufacturing sector.

This article will go over the concept of absorption costs in detail, including its importance to manufacturers and how it works in practice. You’ll also learn about its components, how it differs from variable costing, and the benefits and drawbacks of employing this method. We’ll also look at instances and explain why absorption costing is important for organizations, particularly in Singapore’s competitive manufacturing landscape.

- Absorption costing is a method that allocates all manufacturing expenses, including direct materials, labor, and overheads, to each product, ensuring accurate cost allocation.

- Absorption costing works by systematically identifying direct costs, calculating overhead costs, allocating these overheads to products, and determining the full cost per unit.

- Absorption costing provides manufacturers with a complete picture of product costs, helping management make informed decisions based on comprehensive cost structures.

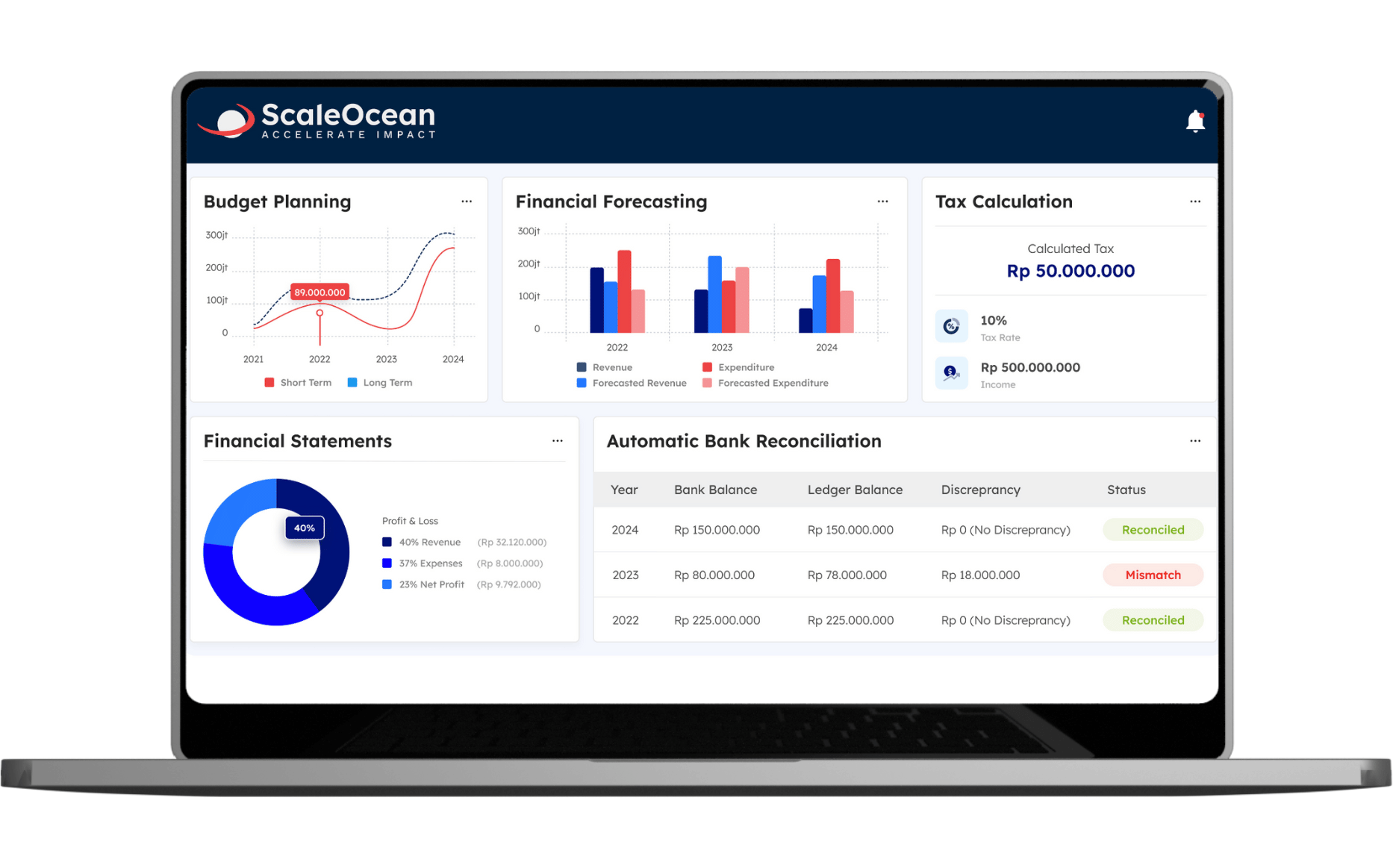

- ScaleOcean, a comprehensive accounting software, replaces inefficient spreadsheets by providing real-time financial visibility, automated processes, and cross-module interaction to improve financial management and decision-making.

What Is Absorption Costing?

Absorption costing, also known as full costing, is a system that allocates all manufacturing expenses to each product. This strategy incorporates direct materials, direct labor, and variable and fixed manufacturing overheads. By using this strategy, producers ensure that each unit produced bears the full burden of production expenses, resulting in a more accurate determination of profitability.

Unlike costing methods that simply include variable expenses, absorption costing includes all production-related costs, providing a complete financial picture. It guarantees that fixed overheads, such as factory rent and equipment depreciation, are considered in inventory valuation and price choices, which aids both financial reporting and internal cost control. Based on ACRA guidelines, this method aligns with the Singapore Financial Reporting Standards (International), ensuring transparent financial reporting and effective internal controls.

Why Use Absorption Costing

Manufacturers use absorption costing to meet financial reporting requirements such as GAAP and IFRS. This strategy ensures that all production-related costs, including fixed overhead, are factored into inventory valuation. As a result, financial statements provide a more accurate and comprehensive picture of industrial processes, in line with regulatory standards.

Absorption costing allows organizations to price products more strategically, safeguard profit margins, and manage total profitability. It prevents underestimating genuine production costs, which could mislead decision-makers. Reliable external financial reports are also easier to compile, which promotes transparency and credibility in industrial accounting. By integrating this method into your accounting system, manufacturers can ensure more accurate financial data and improve decision-making processes.

Components of Absorption Costing

Absorption costing includes all critical components contributing to the cost of manufacturing a product. Understanding each element is vital for accurate product pricing, inventory valuation, and financial reporting. A recommended manufacturing accounting system in Singapore can streamline these processes for better efficiency.

These components ensure that each unit produced accurately reflects the exact cost incurred, allowing for more informed operational and strategic decisions.

1. Direct Materials

Direct materials are all raw materials that are directly absorbed into the finished product during manufacture. These costs are clearly recognizable and change with production levels. Absorption costing treats direct materials as a major cost, guaranteeing that each unit produced carries the appropriate share of material expenses, which has a direct impact on overall inventory valuation.

2. Direct Labor

Direct labor refers to the salaries and benefits paid to workers who are directly involved in the transformation of raw materials into finished commodities. It captures the human work required to make each unit. Absorption costing allocates direct labor per unit produced, allowing producers to evaluate the labor cost contribution to the end product’s overall cost.

3. Variable Manufacturing Overhead

Variable manufacturing overhead refers to indirect production costs that vary with output volume, such as electricity, supplies, and maintenance. These expenses are distributed proportionally across all units. To understand this better, you must know the manufacturing overhead formula for accurate costing.

4. Fixed Manufacturing Overhead

Fixed manufacturing overhead covers expenses that do not vary with output volume, such as factory lease payments, equipment depreciation, and production supervisor salaries. These expenditures are spread over all units produced, lowering the per-unit fixed cost as output grows. Including fixed overhead in absorption costing is critical for completely capturing the overall resources employed in the manufacturing process. In the broader context of corporate expense management, these fixed costs need to be managed carefully to ensure that businesses maintain efficient cost structures and financial health.

How Absorption Costing Works

Absorption costing in manufacturing necessitates a methodical strategy to ensure that all costs are accurately recorded. This strategy assigns direct and indirect costs to products in a systematic manner, benefiting both internal management and external reporting. Manufacturers can fully allocate expenses to each unit produced by following a set of explicit steps, resulting in an accurate reflection of production costs.

1. Identify Direct Costs

The first stage is to identify all direct manufacturing costs, such as raw materials and wages for production workers. These charges are easily traceable to specific items, laying the groundwork for precise cost allocation under absorption costing.

2. Calculate Overhead Costs

Next, manufacturers calculate their variable and fixed production overheads for the accounting period. Variable overheads include indirect materials and factory utilities, while fixed overheads cover factory rent, equipment depreciation, and salaried production personnel. Also, you must Learn how to manage overhead costs for better budgeting.

3. Allocate Overheads to Products

Once overhead expenses are calculated, they must be assigned to products using a rational way. Manufacturers often distribute overhead based on machine hours, labor hours, or production units, ensuring that each unit bears its fair amount of indirect costs.

4. Compute Full Cost Per Unit

After determining direct expenses and allocated overheads, producers calculate the total cost per unit. This graph depicts the sum of direct materials, direct labor, variable overhead, and fixed overhead divided by total units produced throughout the time.

5. Value Inventory and Cost of Goods Sold

Finally, inventory and cost of goods sold (COGS) indicators are valued using the full absorption costing approach. This ensures all manufacturing costs are reflected on the balance sheet and income statement, aiding compliance with GAAP and IFRS.

Absorption Costing Formula

In manufacturing, determining the overall cost incurred by each product unit is crucial for accurate financial reporting and pricing strategies. The absorption costing formula provides a systematic method for capturing all relevant production costs—both direct and indirect—so that no expense is neglected. This strategy enables producers to more precisely allocate expenses among all units produced over a particular period.

Absorption Cost per Unit = (Direct Materials + Direct Labor + Variable Overhead + Fixed Overhead) ÷ Total Units Produced

Using this technique, manufacturers can determine the total cost of each unit, enabling better decisions on inventory, cost control, and profits. It ensures that each product reflects both variable and fixed costs, providing a solid foundation for setting prices and assessing operational efficiency.

Examples of Absorption Costing

To better understand how absorption costing works in manufacturing, consider a real-world example. The absorption costing formula is simple and effective: add direct and manufacturing overhead costs, then divide by units produced. This ensures each unit covers its fair share of production costs, leading to more accurate pricing and inventory valuation.

Absorption Costing Formula: (Direct Materials + Direct Labor + Variable Overhead + Fixed Overhead) ÷ Total Units Produced

For example, Consider a manufacturing company generating 1,000 units. The overall expenditures include $50,000 for direct supplies, $30,000 for direct labor, $20,000 for variable overhead, and $40,000 for fixed overhead. Applying the formula (50,000 + 30,000 + 20,000 + 40,000) ÷ 1,000 yields a unit cost of $140. This signifies that each product unit has fully absorbed costs of $140, which is used to calculate inventory valuation and pricing strategies.

Advantages of Absorption Costing

Absorption pricing gives manufacturers a complete view of product costs, including direct materials, labor, and overheads. This approach ensures each unit reflects the total resources required, offering a more accurate cost picture. As a result, management may make more informed operational decisions based on a comprehensive understanding of cost structures.

Absorption costing helps make better pricing decisions by accurately determining the total cost of production. Using manufacturing cost estimating tools from Singapore, producers can set prices that cover all expenses, achieve desired profit margins, and stay competitive without hidden overheads.

Full absorption costing aligns revenues with all associated expenditures in the same reporting period, which improves financial statement accuracy. This matching approach, similar to accrual accounting, ensures that stakeholders, including investors and auditors, get a clear and reliable picture of the company’s profitability. As a result, it builds stakeholder trust and promotes long-term corporate sustainability.

Disadvantages of Absorption Costing

Despite its benefits, absorption costing can cause manufacturers to misread cost behavior, particularly when examining internal efficiency. This misconception can make it difficult to discern between variable and fixed costs, thereby influencing strategic decisions in industrial operations. Over time, this can lead to inefficiencies that lower a company’s overall competitiveness.

Because fixed expenses are shared across all units, low production quantities might artificially raise unit costs. When production output declines, per-unit costs rise, distorting profitability calculations and leading to bad pricing strategies if not carefully handled. Manufacturers must regularly monitor seasonal demand swings to avoid pricing themselves out of the market.

Furthermore, depending entirely on full costing may mask cost management methods, making it difficult to discover waste or inefficiencies. Manufacturers may struggle to optimize processes and save costs without visibility into controllable expenses at different production stages. This lack of openness can stymie efforts to apply lean manufacturing principles successfully.

Absorption Costing vs. Variable Costing

The major difference between absorption costing and variable costing is how they handle fixed production overheads. Absorption costing assigns all fixed overhead costs to each unit produced, so including them into the product’s total cost. This method ensures that inventory values on the balance sheet reflect both variable and fixed manufacturing costs, as required for GAAP and IFRS reporting. These costs are also recorded in the general ledger, ensuring consistency in financial reporting across all accounting records.

Variable costing, on the other hand, treats fixed production overheads as period expenses, which are recognized promptly in the income statement. This strategy provides manufacturers with a clearer picture of how production quantities affect profitability by isolating variable expenses per unit. While absorption costing is useful in statutory reporting, variable costing is frequently chosen internally for operational analysis and short-term decision-making.

Use Comprehensive Accounting Software ScaleOcean Instead of Time-Washing Spreadsheets

ScaleOcean manufacturing ERP provides an accounting system that helps manufacturers streamline their financial processes. It provides real-time financial visibility, automated accounting processes, and seamless cross-module interaction, hence removing the inefficiencies of manual spreadsheets. ScaleOcean enables manufacturers to maintain accurate, timely, and audit-ready financial records, allowing them to make better business decisions faster.

If you want to increase financial accuracy, operational efficiency, and make faster, wiser decisions in your manufacturing business, ScaleOcean provides a free demo to help you discover its full potential. Furthermore, Singapore-based manufacturing enterprises can take advantage of the CTC grant to reduce implementation costs and increase ROI. The following are the primary USPs of ScaleOcean software:

- Real-Time Financial Visibility & Smooth Cashflow, ScaleOcean delivers up-to-date financial data, allowing businesses to track cash, payables, receivables, and inventory in real time.

- Efficiency in Calculation & Automated Accounting, Revenue, cost, profit, and tax calculations are fully automated, minimizing errors and speeding up transaction recording.

- Automated Bank Reconciliation, Bank reconciliation becomes faster and more accurate, significantly reducing manual matching errors.

- Comprehensive Financial Reporting with PSAK Compliance, Financial reports generated are PSAK-compliant, audit-ready, and support better strategic decisions.

- Strong Cross-Module Integration, The accounting module integrates with sales, inventory, asset, and revenue management systems, eliminating the need for double manual data entries.

Conclusion

Absorption costing helps manufacturers capture the total cost of production, improving inventory valuation and compliance with financial reporting rules. By understanding its workings and components, manufacturers can make better pricing and operational decisions. This leads to long-term profitability. While absorption costing has several benefits, maintaining it manually using spreadsheets can be time-consuming and error-prone.

ScaleOcean provides a comprehensive accounting system designed specifically for manufacturing to help you simplify and optimize your financial processes. Our solution automates real-time cash flow tracking and PSAK-compliant reporting, letting you focus on growing your business without the headache of spreadsheets. Request a free demo today and learn how ScaleOcean can improve your finance management efficiency and accuracy.

FAQ:

1. What is meant by absorption costing?

Absorption costing, or full costing, is a method where all manufacturing expenses, including direct materials, direct labor, and both variable and fixed overheads, are assigned to the products being made. This method ensures that each product’s cost includes the total production expenses, offering a comprehensive view of financial performance.

2. What is the difference between absorption costing and standard costing?

Absorption costing allocates actual production costs to products, incorporating both fixed and variable overheads. In contrast, standard costing uses predetermined estimates based on historical or projected data for direct materials, labor, and overheads. The key distinction is that standard costing relies on estimated costs, while absorption costing is based on actual expenses.

3. What is absorption costing and marginal costing?

Absorption costing includes all production-related expenses, both fixed and variable, in the product cost, making it a more complete costing method. Marginal costing, however, only considers variable production costs in the product’s cost, treating fixed expenses as period costs. The main difference lies in the treatment of fixed costs in the cost structure.

4. What is absorption pricing method?

The absorption pricing method involves setting a product’s price to cover the full production cost, which includes direct costs as well as variable and fixed overheads. This ensures that the product price reflects the total expenses involved in its production, helping businesses ensure their pricing covers all costs and generates profit.

PTE LTD..png)

.png)

.png)

.png)

.png)