Overhead costs are critical to a company’s day-to-day operations, yet they have no direct impact on the creation of goods or services. Rent, utilities, and administrative wages are examples of expenses that must be met in order for the firm to function properly. Overhead costs, while not directly related to production, have an impact on a company’s overall financial health and efficiency.

In Singapore, successfully controlling overhead costs is critical for SMEs to remain profitable and competitive in a continually changing market. With rising operating costs and the need to maximize resources, organizations must closely monitor and control these expenditures. By successfully recognizing and managing overhead, SMEs may ensure long-term success and growth while keeping a competitive advantage.

- Overhead costs are necessary expenses for daily operations, such as rent and utilities, that don’t directly contribute to production but are vital for profitability.

- Overhead costs include fixed, variable, and semi-variable categories, helping businesses optimize resource allocation and budget management.

- Overhead costs are calculated by adding indirect expenses over a period, helping businesses assess financial obligations and set accurate pricing.

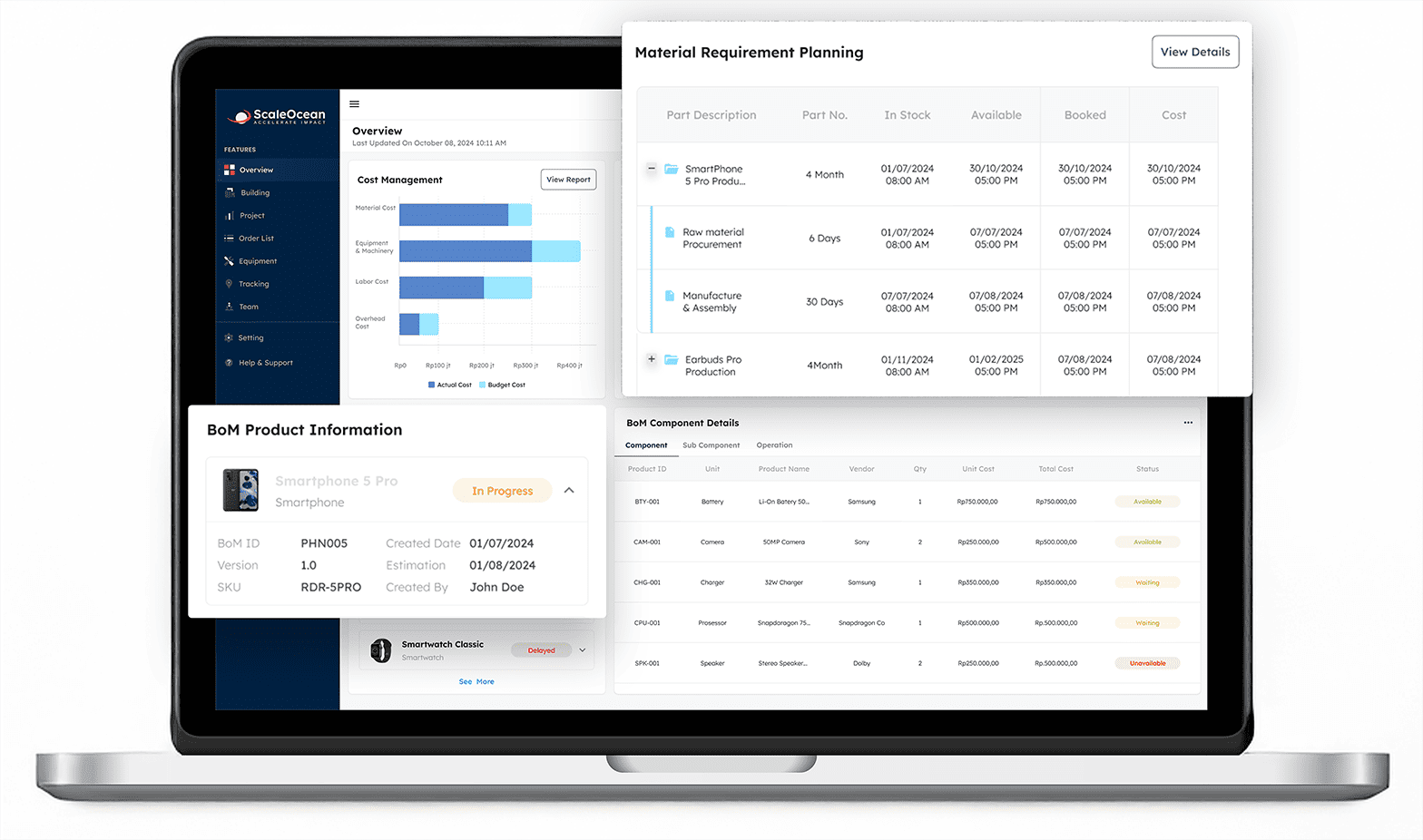

- ScaleOcean software automates overhead cost tracking, providing real-time financial data, improving efficiency, and reducing wasteful spending.

What Are Overhead Costs?

Overhead costs are ongoing expenses incurred by a firm to maintain its everyday operations but do not contribute directly to the production of goods or services. These costs are required for the firm to function but are not directly related to a specific product or service, making them critical to overall profitability and pricing strategies.

Understanding overhead expenses is critical for firms seeking to build successful pricing strategies and maintain profitability. Knowing these costs allows businesses to build realistic budgets, avoid overpaying, and make sound financial decisions. It also plays an important part in determining a company’s financial health because overhead costs affect the bottom line.

Types of Overhead Costs

Overhead costs are classified into several categories based on how they vary with corporate activities. These categories assist firms understand how their expenses behave and how to spend resources more effectively. Companies can improve budget management and operational efficiency by categorizing overhead costs. The primary forms of overhead costs are:

1. Fixed Overheads

Fixed overheads are consistent regardless of business activity level. These include expenses like rent, payroll, and insurance, which are unaffected by how many products or services a company creates. For example, a Singapore-based company may pay a predetermined sum of rent and employee salaries each month, regardless of how much business they create, including work in progress or ongoing projects.

2. Variable Overheads

Variable overheads vary according to the level of business activity. Typical expenses include utilities, office supplies, marketing fees, and COGS that may fluctuate depending on production volume. When a company expands and requires more resources, its costs will rise. On the other hand, as business slows, these costs tend to fall.

3. Semi-Variable Overheads

These are costs that have both fixed and variable components. Phone and internet bills, for example, usually include a fixed base charge that may grow depending on usage. These prices fluctuate, but there is a consistent baseline cost that firms can budget for.

How to Calculate Overhead Costs

Overhead costs must be calculated as part of the business financial management process. Understanding these expenses allows businesses to manage their financial obligations, find areas for improvement, and make more informed pricing decisions. The method entails adding up indirect charges over a particular time period.

Businesses determine overhead costs by adding up all indirect expenses over a given time period, such as monthly or annually. For example, according to Indeed, if a company produces 1,000 units of goods and spends a total of $50,000 on overhead, the unit overhead cost is $50. This technique helps firms evaluate financial obligations and identify cost-cutting options. The Steps include:

1. Add up all indirect expenses

To assess overhead costs, organizations must add all indirect expenses over a given time period, such as monthly or annually. These are expenses that are not directly related to production but are required for the business to function. Examples include recurring administrative expenses such as rent, utilities, payroll, and so on.

2. List your overhead expenses

The next stage in evaluating overhead costs is to list all of the recurring expenses that a Singapore-based enterprise incurs that are not directly related to the production of goods or services. These expenses can vary depending on the type of business and location, but they typically include costs associated with day-to-day operations. The following are some examples of common overhead expenses that businesses in Singapore may encounter:

- Rent: S$4,000

- Utilities: S$1,000

- Administrative salaries: S$2,250

- Foreign transaction fees: S$200

- Other miscellaneous expenses: S$300

3. Calculate total monthly overhead cost

After identifying all overhead expenses, firms should sum them up to get the overall monthly overhead cost. For example, if a company’s expenses include rent at S$4,000, utilities at S$1,000, salaries at S$2,250, international transaction fees at S$200, and miscellaneous expenses at S$300, the total monthly overhead cost is S$7,750. This enables firms to identify and manage their ongoing financial commitments.

4. Overhead Rate Calculation

To calculate the overhead rate, divide the total overhead costs by total sales and then multiply by 100 to get the percentage. This rate indicates how much of the business’s sales income is used to cover overhead expenses. For example, if the monthly sales are S$500,000 and the total overhead costs are S$7,750, here is the result of the calculation:

(S$7,750 / S$500,000) × 100 = 1.55%

Common Mistakes in Overhead Cost Management

Overhead cost management is critical for maintaining profitability, yet many firms fall into common traps that result in wasteful spending and financial inefficiencies. These mistakes are frequently the result of failing to closely monitor costs or relying on obsolete techniques. Avoiding such errors is critical for optimizing overhead management. The following sections illustrate some of the most common mistakes.

1. Overlooking Hidden Expenses

Small, regular costs, such as wasted software subscriptions or underutilized office supplies, can accumulate over time, resulting in wasteful expenses. These sometimes go unnoticed yet have a huge impact on the bottom line. Regular audits help to discover such inefficiencies and ensure that businesses only spend on required resources.

2. Inaccurate Tracking and Allocation

Inaccurate tracking of overhead costs can lead to poor financial decisions, reducing total profitability. Using outmoded or manual processes might result in spending allocation problems, skewing financial reporting. Implementing modern accounting tools and software streamlines spending tracking, providing real-time, reliable data to aid decision making.

3. Lack of Budgeting for Overhead Costs

Inaccurate tracking of overhead costs can lead to poor financial decisions, reducing total profitability. Using outmoded or manual processes might result in spending allocation problems, skewing financial reporting. Implementing modern accounting tools and software streamlines spending tracking, providing real-time, reliable data to aid decision making.

Overhead Cost Allocation Methods

Overhead cost allocation is critical to identifying the true cost of goods and services. Proper allocation enables firms to discover which departments or products spend the most resources, allowing for more effective financial planning. There are various techniques for allocating overhead costs, each having advantages and disadvantages. These methods include the following:

1. Direct Allocation

Direct allocation directs overhead expenditures to certain departments or goods. This strategy is simple and straightforward to apply, making it perfect for smaller firms. However, it may not be successful for larger firms where expenses are spread over numerous divisions, potentially resulting in erroneous cost distribution.

2. Step-Down Allocation

Step-down allocation is a sequential process in which overhead charges are assigned from one department to the next based on service demand. It provides a more methodical technique than direct allocation, guaranteeing that expenses are spread more evenly. This strategy is effective for firms with multiple departments or interdependent services.

3. Reciprocal Allocation

Reciprocal allocation takes into account the mutual services provided by departments before distributing costs. It is a more precise distribution strategy, particularly in businesses with complicated interdepartmental linkages. Reciprocal allocation provides a more accurate picture of cost consumption by taking into account these exchanges.

4. Activity-Based Costing (ABC)

Activity-Based Costing (ABC) allocates manufacturing overhead costs according to the activities that generate the expenses, providing more precise and accurate cost allocation. It is especially effective for complex firms that offer various products or services. ABC allows for more exact and accurate cost allocation by directly tying expenses to the individual activities that create them.

5. Absorption Costing

Absorption costing strategy assigns all manufacturing expenses, fixed and variable, to product units. This strategy provides compliance with financial reporting regulations while also providing an accurate picture of the exact cost of producing each unit. It is widely utilized in sectors where product cost allocation is critical for profit analysis. Understanding the types of standard costing helps businesses implement appropriate costing methods to align with their financial reporting and operational needs.

Managing Overhead Costs Effectively

Effectively controlling overhead costs is crucial for maintaining financial health and optimizing profits. By tracking these costs, businesses can allocate resources better, reduce wasteful spending, and make informed decisions. Regular reviews help identify areas for improvement. Just as the Singaporean government’s expenditure is projected to be 3.4% of GDP in 2025, by Data Gov Singapore, businesses must manage overhead efficiently to ensure financial sustainability. These strategies can help firms manage overhead costs effectively:

1. Regular Monitoring

It is critical for firms to regularly analyze and review their overhead expenses. By doing so, businesses can discover areas where they can cut costs and increase efficiency. Regular monitoring ensures that firms are aware of their financial status and may make changes before problems grow. This proactive approach allows businesses to maintain control over their spending.

2. Cost Allocation

Accurate overhead cost allocation is crucial for identifying appropriate product price and guaranteeing profitability. Proper cost breakdown structure allocation allows businesses to better understand their financial health and the true cost of each product or service. This technique enables businesses to establish competitive prices while preserving reasonable profit margins.

3. Utilizing Technology

Implementing accounting software for manufacturers in Singapore can help organizations manage overhead costs more efficiently by automating tracking and improving financial decision-making. These contemporary tools contribute to error reduction and data accuracy. Businesses that use technology obtain real-time insights into their overhead finances, allowing them to control expenditures more efficiently and effectively.

Streamlining Overhead Management with Integrated Software

To remain competitive and successful, firms must effectively manage their overhead costs. Integrating production and accounting systems simplifies overhead management, automates tasks, and enhances financial control. Integrated software simplifies operations, improves data accuracy, and allows for improved decision-making. Key features include:

1. Integrated Solutions

Integrated manufacturing and accounting software, like manufacturing cost estimating software, streamlines overhead cost management by automating critical processes and ensuring seamless data integration. This integration connects financial and operational data, which reduces manual errors and increases efficiency. Businesses can use such systems to more properly manage spending and make real-time choices.

2. Benefits

Integrated software optimizes overhead cost management by automating spend tracking and categorization, reducing the need for manual data entry and inaccuracies. It gives real-time financial analytics, enabling organizations to make informed decisions and adjustments. Furthermore, the program improves the accuracy of budgeting and forecasting, allowing firms to plan more effectively, maximize their resources, and efficiently manage overhead costs.

3. ScaleOcean’s Manufacturing Software for Efficient Overhead Cost Management

ScaleOcean provides a technology that merges production and accounting activities, allowing organizations to manage overhead costs more efficiently. It improves workflows and resource efficiency by automating spending tracking and giving real-time information. This lowers wasteful spending and increases profitability. Businesses have greater control over their financial operations by utilizing tools meant to track and manage overhead costs.

ScaleOcean also provides a free demo, allowing organizations to see the software’s functionality firsthand. ScaleOcean is also qualified for the CTC (Cost to Company) grant, which helps enterprises cut implementation costs. The following are the primary features of ScaleOcean’s software.

- Integrated Overhead Cost Tracking, ScaleOcean automates real-time tracking of overhead costs, reducing waste and ensuring accurate expense management.

- Comprehensive Reporting, It generates detailed cost reports, like the Cost of Goods Manufactured, for better financial decision-making.

- Automated Production Scheduling, ScaleOcean automates production schedules based on real-time data, minimizing production inefficiencies.

- Seamless Integration, It integrates production, financial, and inventory systems, providing a unified view of operations and costs.

- Customizable and Scalable, ScaleOcean is flexible and scalable, catering to businesses of all sizes with customizable solutions.

Conclusion

Understanding and managing overhead costs is critical to a company’s financial success. These costs have a direct impact on profitability and, if not managed properly, can stifle growth. Businesses that carefully manage and allocate overhead costs can preserve financial stability and make educated decisions.

Using integrated software solutions such as ScaleOcean can assist to streamline processes and enhance cost control. Automation, real-time data, and seamless connection enable firms to efficiently track expenses, optimize resources, and increase profitability, assuring long-term success.

FAQ:

1. What is overhead cost with example?

Overhead costs are the necessary ongoing expenses for running a business, which are not directly tied to producing products or providing services. These include expenses such as rent, utilities, employee salaries, and insurance. For example, if a company pays $2,000 for rent, $500 for utilities, and $1,000 for employee salaries each month, all of these are classified as overhead costs.

2. What does 30% overhead mean?

A 30% overhead rate means that for every dollar a company earns, 30 cents are spent on overhead expenses. This percentage shows how much of the business’s revenue goes towards operating costs that do not directly contribute to production. For instance, if a business generates $100,000 in revenue, a 30% overhead implies that $30,000 is spent on overhead costs.

3. How to calculate overhead cost?

1. List all overhead expenses, Identify all indirect costs that are essential for operating the business but aren’t tied to production. These include costs like rent, utilities, salaries, insurance, etc.

2. Add up the total overhead expenses, Calculate the total overhead by summing all related expenses over a certain period, whether monthly or annually.

3. Optional: Calculate the overhead rate, If you wish, you can calculate the overhead rate by dividing the total overhead costs by the total sales for that period, then multiplying by 100 to get the percentage.

4. Monitor and adjust regularly, Make it a habit to review your overhead expenses periodically to ensure they are accurate, and identify any opportunities to cut costs or improve efficiency.

4. What are the 5 overhead costs?

Here are five common examples of overhead costs:

1. Rent – The cost of leasing office or workspace.

2. Utilities – Expenses for services like electricity, water, and heating.

3. Salaries – Compensation for employees in non-production roles.

4. Insurance – The premiums paid for various business insurance policies.

5. Depreciation – The reduction in value of physical assets such as equipment and property over time.

PTE LTD..png)

.png)

.png)

.png)

.png)